Why Nike Shares Are Trading Higher By Around 7%; Here Are 20 Stocks Moving Premarket

Shares of NIKE, Inc. NKE rose sharply in today’s pre-market trading after the company announced a CEO transition.

After the market close on Thursday, Nike announced that longtime Nike veteran Elliott Hill will become president and CEO of Nike, effective Oct. 14. Hill will also become a director on the board and a member of the executive committee.

NIKE shares gained 7% to $86.64 in the pre-market trading.

Here are some other stocks moving in pre-market trading.

Gainers

- Banzai International, Inc. BNZI gained 148.1% to $7.12 in pre-market trading. Banzai International shares fell around 18% on Thursday after the company announced a 1-for-50 reverse stock split.

- Battalion Oil Corporation BATL gained 119.4% to $6.45 in the pre-market trading session after the company announced it has amended its merger agreement with Fury Resources for the acquisition of all outstanding shares of Battalion at $7.00 per share in cash.

- Leafly Holdings, Inc. LFLY gained 76.7% to $3.18 in pre-market trading.

- SRIVARU Holding Limited SVMH rose 53.2% to $0.19 in pre-market trading after gaining 11% on Thursday. SRIVARU Holding, on Thursday, secured Nasdaq Panel approval for continued listing amid compliance efforts.

- Tenon Medical, Inc. TNON shares rose 41.2% to $7.10 in pre-market trading after the company announced the issuance of three notices of allowance for patent applications from the UPSTO.

- Alliance Entertainment Holding Corporation AENT gained 25.5% to $2.56 in pre-market trading after the company reported better-than-expected full-year 2024 adjusted EPS results.

- Genfit S.A. GNFT gained 13% to $4.88 in pre-market trading after posting H1 results.

- Kidpik Corp. PIK rose 10.4% to $2.66 in pre-market trading.

- Joint Stock Company Kaspi.kz KSPI shares gained 6.3% to $106.10 in pre-market trading. Joint Stock Company Kaspi.Kz shares fell 16% on Thursday after Culper Research issued a report on the company.

Losers

- Signing Day Sports, Inc. SGN fell 24.5% to $0.40 in pre-market trading. Signing Day Sports shares jumped 308% on Thursday after the company announced it will acquire sports gaming technology company Swifty Global.

- Society Pass Incorporated SOPA shares fell 17.4% to $0.85 in pre-market trading after gaining 22% on Thursday.

- Neo-Concept International Group Holdings Limited NCI shares dipped 16.7% to $0.70 in pre-market trading after surging 72% on Thursday.

- TOMI Environmental Solutions, Inc. TOMZ fell 15.8% to $0.6398 in pre-market trading.

- E-Home Household Service Holdings Limited EJH shares declined 14.1% to $0.0839 in pre-market trading after falling 8% on Thursday.

- Exicure, Inc. XCUR fell 13.2% to $3.41 in today’s pre-market trading after jumping 72% on Thursday. Exicure recently announced it received an extension from the Nasdaq Hearings Panel.

- FedEx Corporation FDX declined 13.1% to $260.92 in pre-market trading after the company reported weaker-than-expected results for the first quarter of fiscal 2025 and lowered its full-year guidance.

- Kopin Corporation KOPN shares declined 11.8% to $0.85 in pre-market trading after the company announced a public offering of common stock and pre-funded warrants.

- Rezolve AI Limited RZLV shares fell 11.3% to $6.21 in pre-market trading after jumping around 47% on Thursday.

- Veea Inc. VEEA shares fell 7.6% to $10.22 in pre-market trading after declining around 10% on Thursday. Veea recently announced a strategic partnership with Crowdkeep to integrate their respective technologies into a singular, tailored solution to track assets, people, and conditions across a variety of use cases.

Now Read This:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Solana-Based Memecoins Spike — Dogwifhat, Bonk Outshine Dogecoin, Shiba Inu In 24-Hour Gains

Memecoins on the Solana SOL/USD blockchain rallied sharply on Thursday as the broader cryptocurrency regained momentum following the Federal Reserve’s aggressive rate cut.

What happened: Canine-inspired token dogwifhat popped 6.55% in the last 24 hours, emerging as the market’s biggest gainer among memecoins exceeding billion-dollar valuation. The coin’s trading volume jumped 18.56% to $424 million.

Another dog-themed coin Bonk recorded gains of more than 6%, with trading volume more than doubling to $152 million.

Additionally, cat-themed cryptocurrency Popcat lifted 4.74%, extending its gravity-defying rally this year. The token was up an astounding 11130% year-to-date.

| Cryptocurrency | Gains +/- | Price (Recorded at 11:45 p.m. EDT) |

| dogwifhat WIF/USD | +6.55% | $1.79 |

| Bonk BONK/USD | +6.01% | $0.00001822 |

| Popcat (POPCAT) | +4.74% | $0.9046 |

Solana memecoins outperformed the more established Ethereum ETH/USD-based heavyweights like Dogecoin DOGE/USD and Shiba Inu SHIB/USD, which were up 2.66% and 4.39%, respectively.

The performance of memecoins rubbed on Solana’s native token SOL, which was up 3.60% in the last 24 hours.

Major cryptocurrencies were on the move following the Fed’s announcement of a 50 basis point cut in interest rates.

Bitcoin BTC/USD has rallied nearly 6% since the announcement, while Ethereum ETH/USD was up more than 10%.

Image via Shutterstock

Read Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Max Keiser Attacks Michael Saylor For Finding Fault With El Salvador's Bitcoin Strategy: 'You Owe Nayib Bukele An Apology'

Staunch Bitcoin BTC/USD advocate Max Keiser slammed MicroStrategy Inc. MSTR co-founder Michael Saylor for casting aspersions on the Bitcoin strategy adopted by the Nayib Bukele-led El Salvador administration.

What Happened: Keiser took to X on Thursday to respond to Saylor’s broader argument questioning investments in Bitcoin without any expectation of a yield on it.

During an interaction with Saifedean Ammous, the author of the famous book “The Bitcoin Standard,” Saylor asserted that El Salvador would eventually have to liquidate their Bitcoin stash to pay their expenses if they don’t get any yield on it.

“I put the question to you. What’s the point of El Salvador or your family accumulating all of your capital in Bitcoin if you expect zero yield forever and you’re never going to borrow against it,” the Bitcoin billionaire added.

Keiser, who serves as senior Bitcoin adviser to El Salvador President Nayib Bukele, did not take these observations well.

“Michael Saylor is unequivocally wrong while slandering El Salvador. El Salvador is reducing debt & growing GDP (and buying more Bitcoin every day) without exposing El Salvador to the counterparty risk that Saylor is exposing his shareholders to,” Keiser hit back. “You owe Nayib Bukele an apology, dude.”

Why It Matters: Keiser’s fiery response was noteworthy given his endorsement of Saylor’s Bitcoin strategy in the past.

In January, Keiser credited Saylor for taking Bitcoin “out of the shitcoin gutter” and setting the stage for Bitcoin ETF approvals.

Just last month, he heaped praise on MicroStrategy’s stock, underscoring its limitless growth potential.

As of this writing, the Central American nation holds 5,878.76 Bitcoins in its reserves, worth more than $372 million.

Price Action: As of this writing, Bitcoin was exchanging hands at $63,317.85, up 2.01% in the last 24 hours, according to data from Benzinga Pro.

Photo Courtesy: Shutterstock.com

Read Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Simon Property Group Announces $3.5 Billion Revolving Credit Facility

INDIANAPOLIS, Sept. 19, 2024 /PRNewswire/ — Simon®, a real estate investment trust engaged in the ownership of premier shopping, dining, entertainment and mixed-use destinations, announced today that its majority-owned operating partnership subsidiary, Simon Property Group, L.P. (the “Operating Partnership”), has amended, restated and extended its $3.5 billion multi-currency unsecured revolving credit facility.

“The closing of this facility is a continued endorsement of the strength of our Company. The amended, restated and extended $3.5 billion credit facility enhances our already strong financial flexibility, and when combined with our existing $5.0 billion senior unsecured credit facility provides us with $8.5 billion of total revolving credit capacity. We appreciate the long-standing support from our lender group,” said Brian McDade, Executive Vice President and Chief Financial Officer.

The amended, restated and extended facility will initially mature on January 31, 2029 and can be extended for an additional year to January 31, 2030 at the Operating Partnership’s sole option. Based upon the Operating Partnership’s current credit ratings, the interest rate for U.S. Dollar borrowings is unchanged from the prior facility at SOFR plus 82.5 basis points (inclusive of a 10 basis point SOFR spread adjustment). The facilities are supported by a globally diverse lender group composed of 28 banks.

About Simon

Simon® is a real estate investment trust engaged in the ownership of premier shopping, dining, entertainment and mixed-use destinations and an S&P 100 company ((Simon Property Group, NYSE:SPG). Our properties across North America, Europe and Asia provide community gathering places for millions of people every day and generate billions in annual sales.

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/simon-property-group-announces-3-5-billion-revolving-credit-facility-302253647.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/simon-property-group-announces-3-5-billion-revolving-credit-facility-302253647.html

SOURCE Simon

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

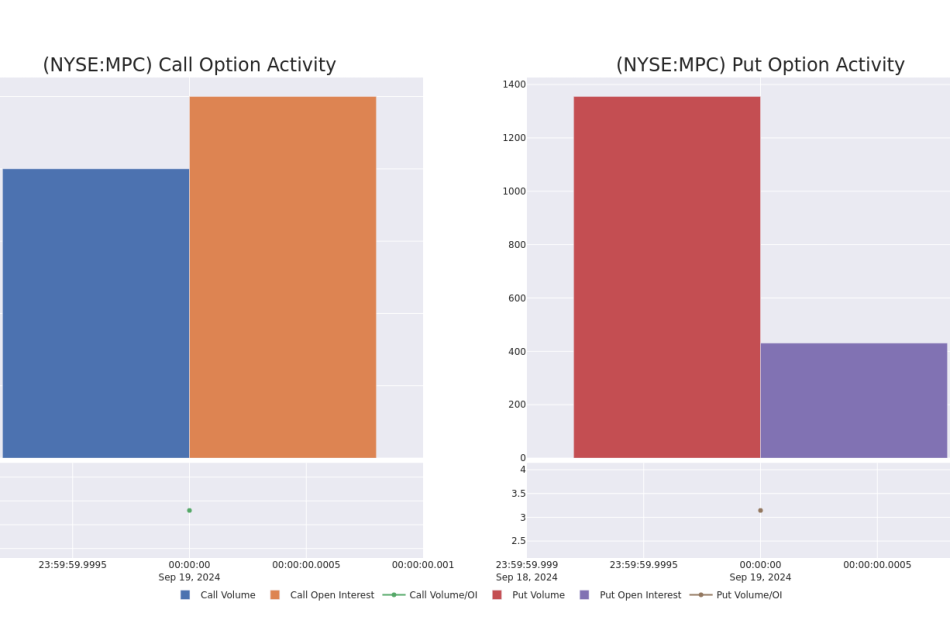

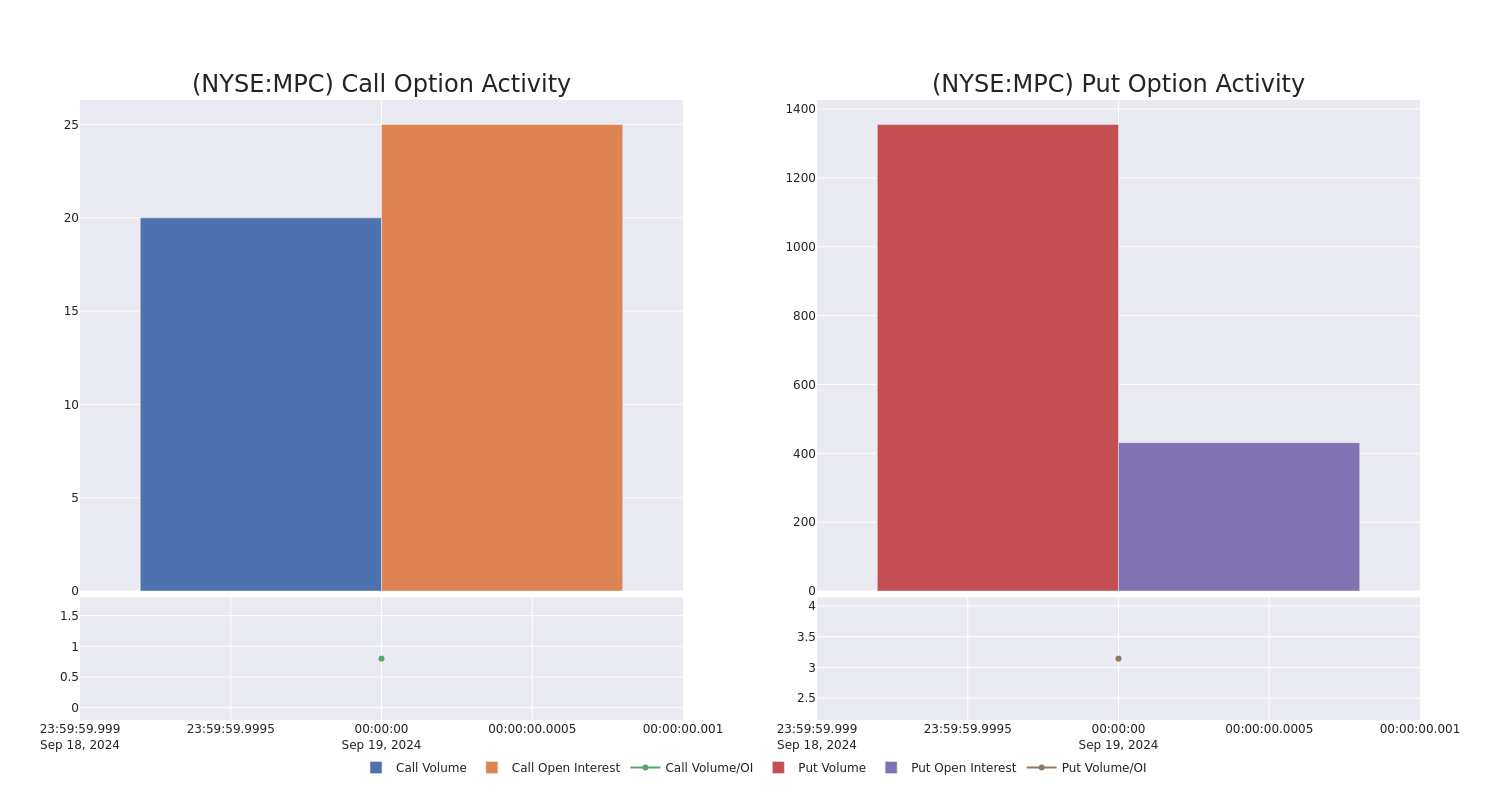

What the Options Market Tells Us About Marathon Petroleum

Deep-pocketed investors have adopted a bearish approach towards Marathon Petroleum MPC, and it’s something market players shouldn’t ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in MPC usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga’s options scanner highlighted 11 extraordinary options activities for Marathon Petroleum. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 36% leaning bullish and 54% bearish. Among these notable options, 9 are puts, totaling $484,470, and 2 are calls, amounting to $91,160.

Expected Price Movements

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $155.0 to $155.0 for Marathon Petroleum over the recent three months.

Insights into Volume & Open Interest

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Marathon Petroleum’s options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Marathon Petroleum’s substantial trades, within a strike price spectrum from $155.0 to $155.0 over the preceding 30 days.

Marathon Petroleum Option Volume And Open Interest Over Last 30 Days

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| MPC | PUT | TRADE | BEARISH | 12/18/26 | $21.6 | $20.85 | $21.6 | $155.00 | $105.8K | 431 | 200 |

| MPC | PUT | TRADE | BEARISH | 12/18/26 | $22.25 | $20.8 | $21.8 | $155.00 | $95.9K | 431 | 144 |

| MPC | PUT | TRADE | BEARISH | 12/18/26 | $21.9 | $20.6 | $21.9 | $155.00 | $61.3K | 431 | 48 |

| MPC | PUT | TRADE | BEARISH | 12/18/26 | $22.4 | $20.6 | $21.9 | $155.00 | $52.5K | 431 | 72 |

| MPC | CALL | TRADE | BULLISH | 06/20/25 | $24.8 | $24.25 | $24.8 | $155.00 | $49.6K | 4 | 20 |

About Marathon Petroleum

Marathon Petroleum is an independent refiner with 13 refineries in the midcontinent, West Coast, and Gulf Coast of the United States with total throughput capacity of 3.0 million barrels per day. Its Dickinson, North Dakota, facility produces 184 million gallons a year of renewable diesel. Its Martinez, California, facility will have the ability to produce 730 million gallons a year of renewable diesel once converted. The firm also owns and operates midstream assets primarily through its listed master limited partnership, MPLX.

Where Is Marathon Petroleum Standing Right Now?

- With a trading volume of 2,110,663, the price of MPC is up by 1.02%, reaching $166.35.

- Current RSI values indicate that the stock is is currently neutral between overbought and oversold.

- Next earnings report is scheduled for 47 days from now.

What The Experts Say On Marathon Petroleum

Over the past month, 2 industry analysts have shared their insights on this stock, proposing an average target price of $187.5.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* Maintaining their stance, an analyst from Morgan Stanley continues to hold a Overweight rating for Marathon Petroleum, targeting a price of $182.

* Maintaining their stance, an analyst from Mizuho continues to hold a Neutral rating for Marathon Petroleum, targeting a price of $193.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Marathon Petroleum, Benzinga Pro gives you real-time options trades alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Existing-Home Sales Dipped 2.5% in August

Key Highlights

- Existing-home sales retreated 2.5% in August to a seasonally adjusted annual rate of 3.86 million. Sales slid 4.2% from one year ago.

- The median existing-home sales price rose 3.1% from August 2023 to $416,700, the 14th consecutive month of year-over-year price increases.

- The inventory of unsold existing homes improved by 0.7% from the previous month to 1.35 million at the end of August, or the equivalent of 4.2 months’ supply at the current monthly sales pace.

Existing-home sales fell in August, according to the National Association of Realtors®. Three out of four major U.S. regions posted sales declines while the Midwest registered no change. Year-over-year, sales slipped in three regions but remained stable in the Northeast.

Total existing-home sales{1} – completed transactions that include single-family homes, townhomes, condominiums and co-ops – descended 2.5% from July to a seasonally adjusted annual rate of 3.86 million in August. Year-over-year, sales retracted 4.2% (down from 4.03 million in August 2023).

“Home sales were disappointing again in August, but the recent development of lower mortgage rates coupled with increasing inventory is a powerful combination that will provide the environment for sales to move higher in future months,” said NAR Chief Economist Lawrence Yun. “The home-buying process, from the initial search to getting the house keys, typically takes several months.”

Total housing inventory[2] registered at the end of August was 1.35 million units, up 0.7% from July and 22.7% from one year ago (1.1 million). Unsold inventory sits at a 4.2-month supply at the current sales pace, up from 4.1 months in July and 3.3 months in August 2023.

“The rise in inventory – and, more technically, the accompanying months’ supply – implies home buyers are in a much-improved position to find the right home and at more favorable prices,” Yun added. “However, in areas where supply remains limited, like many markets in the Northeast, sellers still appear to hold the upper hand.”

The median existing-home price[3] for all housing types in August was $416,700, up 3.1% from one year ago ($404,200). All four U.S. regions posted price increases.

REALTORS® Confidence Index

According to the monthly REALTORS® Confidence Index, properties typically remained on the market for 26 days in August, up from 24 days in July and 20 days in August 2023.

First-time buyers were responsible for 26% of sales in August – matching the all-time low last seen in November 2021 – and down from 29% in both July 2024 and August 2023. NAR’s 2023 Profile of Home Buyers and Sellers – released in November 2023[4] – found that the annual share of first-time buyers was 32%.

All-cash sales accounted for 26% of transactions in August, down from 27% in both July and one year ago.

Individual investors or second-home buyers, who make up many cash sales, purchased 19% of homes in August, down from 13% in July 2024 and 16% in August 2023.

Distressed sales[5] – foreclosures and short sales – represented 1% of sales in August, unchanged from last month and the previous year.

Mortgage Rates

According to Freddie Mac, the 30-year fixed-rate mortgage averaged 6.2% as of September 12. That’s down from 6.35% one week ago and 7.18% one year ago.

Single-family and Condo/Co-op Sales

Single-family home sales decreased 2.8% to a seasonally adjusted annual rate of 3.48 million in August, down 3.3% from the previous year. The median existing single-family home price was $422,100 in August, up 2.9% from August 2023.

Existing condominium and co-op sales in August were identical to July at a seasonally adjusted annual rate of 380,000 units, down 11.6% from one year ago (430,000 units). The median existing condo price was $366,500 in August, up 3.5% from the prior year ($354,200).

Regional Breakdown

Existing-home sales in the Northeast in August faded 2.0% from July to an annual rate of 480,000, which was identical to August 2023. The median price in the Northeast was $503,200, up 7.7% from last year.

In the Midwest, existing-home sales were unchanged in August at an annual rate of 920,000, down 5.2% from the previous year. The median price in the Midwest was $315,400, up 3.8% from August 2023.

Existing-home sales in the South waned 3.9% from July to an annual rate of 1.73 million in August, down 6.0% from one year before. The median price in the South was $367,000, up 1.6% from one year earlier.

In the West, existing-home sales declined 2.7% in August to an annual rate of 730,000, down 1.4% from a year ago. The median price in the West was $622,500, up 2.2% from August 2023.

About the National Association of Realtors®

The National Association of Realtors® is America’s largest trade association, representing 1.5 million members involved in all aspects of the residential and commercial real estate industries. The term Realtor® is a registered collective membership mark that identifies a real estate professional who is a member of the National Association of Realtors® and subscribes to its strict Code of Ethics.

# # #

For local information, please contact the local association of Realtors® for data from local multiple listing services (MLS). Local MLS data is the most accurate source of sales and price information in specific areas, although there may be differences in reporting methodology.

NOTE: NAR’s Pending Home Sales Index for August is scheduled for release on September 26, and Existing-Home Sales for September will be released on October 23. Release times are 10 a.m. Eastern.

Information about NAR is available at nar.realtor. This and other news releases are posted in the newsroom at nar.realtor/newsroom. Statistical data in this release, as well as other tables and surveys, are posted in the “Research and Statistics” tab.

[1] Existing-home sales, which include single-family, townhomes, condominiums and co-ops, are based on transaction closings from Multiple Listing Services. Changes in sales trends outside of MLSs are not captured in the monthly series. NAR benchmarks home sales periodically using other sources to assess overall home sales trends, including sales not reported by MLSs.

Existing-home sales, based on closings, differ from the U.S. Census Bureau’s series on new single-family home sales, which are based on contracts or the acceptance of a deposit. Because of these differences, it is not uncommon for each series to move in different directions in the same month. In addition, existing-home sales, which account for more than 90% of total home sales, are based on a much larger data sample – about 40% of multiple listing service data each month – and typically are not subject to large prior-month revisions.

The annual rate for a particular month represents what the total number of actual sales for a year would be if the relative pace for that month were maintained for 12 consecutive months. Seasonally adjusted annual rates are used in reporting monthly data to factor out seasonal variations in resale activity. For example, home sales volume is normally higher in the summer than in the winter, primarily because of differences in the weather and family buying patterns. However, seasonal factors cannot compensate for abnormal weather patterns.

Single-family data collection began monthly in 1968, while condo data collection began quarterly in 1981; the series were combined in 1999 when monthly collection of condo data began. Prior to this period, single-family homes accounted for more than nine out of 10 purchases. Historic comparisons for total home sales prior to 1999 are based on monthly single-family sales, combined with the corresponding quarterly sales rate for condos.

[2] Total inventory and month’s supply data are available back through 1999, while single-family inventory and month’s supply are available back to 1982 (prior to 1999, single-family sales accounted for more than 90% of transactions and condos were measured only on a quarterly basis).

[3] The median price is where half sold for more and half sold for less; medians are more typical of market conditions than average prices, which are skewed higher by a relatively small share of upper-end transactions. The only valid comparisons for median prices are with the same period a year earlier due to seasonality in buying patterns. Month-to-month comparisons do not compensate for seasonal changes, especially for the timing of family buying patterns. Changes in the composition of sales can distort median price data. Year-ago median and mean prices sometimes are revised in an automated process if additional data is received.

The national median condo/co-op price often is higher than the median single-family home price because condos are concentrated in higher-cost housing markets. However, in a given area, single-family homes typically sell for more than condos as seen in NAR’s quarterly metro area price reports.

[4] Survey results represent owner-occupants and differ from separately reported monthly findings from NAR’s REALTORS® Confidence Index, which include all types of buyers. The annual study only represents primary residence purchases, and does not include investor and vacation home buyers. Results include both new and existing homes.

[5] Distressed sales (foreclosures and short sales), days on market, first-time buyers, all-cash transactions and investors are from a monthly survey for the NAR’s REALTORS® Confidence Index, posted at nar.realtor.

Troy Green National Association of Realtors® tgreen@nar.realtor

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Hydrogen Combustion Engine Market to Hit $94.68 billion by 2031, at a CAGR of 9.8%, says Coherent Market Insights

Burlingame, Sept. 19, 2024 (GLOBE NEWSWIRE) — The global Hydrogen Combustion Engine Market Size to Grow from USD 49.23 Billion in 2024 to USD 94.68 Billion by 2031, at a Compound Annual Growth Rate (CAGR) of 9.8% during the forecast period, as highlighted in a new report published by Coherent Market Insights. Environmental concerns due to rising pollution levels from conventional internal combustion engines have become one of the primary factors fueling growth in the hydrogen combustion engine market. While hydrogen is touted as a clean fuel that emits only water vapor as a byproduct during combustion, widespread adoption of associated technologies has been relatively slow until now.

Request Sample Report: https://www.coherentmarketinsights.com/insight/request-sample/7235

Market Dynamics:

The hydrogen combustion engine market is primarily driven by the increasing demand for emission-free vehicles. Hydrogen combustion engines do not emit greenhouse gases such as carbon dioxide and have the potential to reduce dependence on fossil fuels. They utilize hydrogen as fuel and generate water and heat as by-products during operation. Furthermore, governments across regions are promoting the use of hydrogen-powered vehicles through incentives and supportive policies in order to meet greenhouse gas emission reduction targets.

An additional driver for the market growth is the focus of leading automotive OEMs on the development of hydrogen combustion engine-powered vehicles. For instance, in June 2021, Toyota Motor Corporation announced plans to commercialize solid oxide fuel cell systems for commercial vehicles by 2024.

Hydrogen Combustion Engine Market Report Coverage

| Report Coverage | Details |

| Market Revenue in 2024 | $49.23 billion |

| Estimated Value by 2031 | $94.68 billion |

| Growth Rate | Poised to grow at a CAGR of 9.8% |

| Historical Data | 2019–2023 |

| Forecast Period | 2024–2031 |

| Forecast Units | Value (USD Million/Billion) |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Segments Covered | By Engine Type, By Power Output, By Application |

| Geographies Covered | North America, Europe, Asia Pacific, and Rest of World |

| Growth Drivers | • Growing environmental concerns • Rise of Renewable Energy |

| Restraints & Challenges | • Limited infrastructure for hydrogen storage and distribution • Safety concerns and lack of standardization in hydrogen combustion engine technology |

Market Trends:

Electric hybrid hydrogen vehicles are gaining traction in the market. Such vehicles utilize both electric batteries and hydrogen fuel cells or combustion engines as the power source. They offer benefits such as zero emissions during electric-only operation and extended range capabilities through the use of hydrogen. Major automakers such as Hyundai Motor Company and Toyota Motor Corporation are launching electric hybrid hydrogen passenger vehicle models.

Countries worldwide are focusing on expanding their hydrogen refueling infrastructure in order to promote the adoption of hydrogen-powered vehicles. For example, in Europe, Germany and France have announced investments of over US$ 8.2 billion until 2030 to develop a network of at least 1,000 hydrogen refueling stations. Such initiatives are expected to fuel demand for hydrogen combustion engine vehicles during the forecast period.

Hydrogen combustion engines are increasingly being used in power generation applications as a clean alternative to diesel generators. The technology provides reliable baseload power with zero emissions. Several companies are developing hydrogen-fueled turbines and fuel cells for integrated energy solutions.

Hydrogen combustion engines are gaining traction in transportation sectors such as trucks, buses, marine vessels and railroads. Heavy-duty vehicles require high energy density fuels and hydrogen meets this need. Many countries are introducing hydrogen refueling infrastructure and offering incentives for fleet operators to adopt the technology.

Immediate Delivery Available | Buy This Premium Research Report: https://www.coherentmarketinsights.com/insight/buy-now/7235

Key Market Takeaways:

The global hydrogen combustion engine market is anticipated to witness a CAGR of 9.8% during the forecast period 2024-2031, owing to growing demand for clean and reliable power solutions. On the basis of engine type, reciprocating engines segment is expected to hold a dominant position, owing to higher efficiency and power density compared to rotary engines.

On the basis of power output, less than 500 KW power output segment is expected to hold a dominant position over the forecast period, due to widespread application in power generators, trucks and backup power systems.

On the basis of application, power generation segment is expected to be the key end-user, owing to increasing installation of hydrogen power plants and fuel cells.

By region, North America is expected to hold a dominant position over the forecast period, due to supportive government policies and investments in hydrogen infrastructure by top automakers.

Key players operating in the hydrogen combustion engine market include AGCO Corporation, Ballard Power Systems Inc., BMW Groups, Caterpillar Incorporated, Cummins Inc., Ford Motor Company, General Motors Company, Honda Motor Co., Ltd., JCB, Jaguar Land Rover Automotive plc., Mazda Motor Corporation, MAN Energy Solutions, Mitsubishi Heavy Industries, Renault SA, and Toyota Corporation. These players are engaging in new product development and partnerships with hydrogen technology companies.

Recent Developments:

In April 2021, Toyota Motor Corporation, announced the development of a hydrogen combustion engine specifically designed for sports cars.

In April 2021, Alstom, strengthened its hydrogen capabilities by acquiring Helion Hydrogen Power, a subsidiary of AREVA Energies Renouvelables.

Request For Customization: https://www.coherentmarketinsights.com/insight/request-customization/7235

Detailed Segmentation:

By Engine Type:

- Reciprocating Engines

- Rotary Engines

By Power Output:

- Less than 500 kW

- 500 kW to 1 MW

- Above 1 MW

By Application:

- Power Generation

- Transportation

- Industrial

- Others (Marine, Aerospace, etc.)

By Region:

North America:

Latin America:

- Brazil

- Argentina

- Mexico

- Rest of Latin America

Europe:

- Germany

- U.K.

- Spain

- France

- Italy

- Russia

- Rest of Europe

Asia Pacific:

- China

- India

- Japan

- Australia

- South Korea

- ASEAN

- Rest of Asia Pacific

Middle East:

- GCC Countries

- Israel

- Rest of Middle East

Africa:

- South Africa

- North Africa

- Central Africa

Have a Look at Trending Research Reports on Automotive and Transportation Domain:

Automotive VVT System Market is estimated to be valued at USD 68.46 Bn in 2024 and is expected to reach USD 102.14 Bn by 2031, exhibiting a compound annual growth rate (CAGR) of 5.9% from 2024 to 2031.

Hydrogen Trucks Market is estimated to be valued at US$ 4.98 Bn in 2024 and is expected to reach US$ 62.45 Bn by 2031, exhibiting a compound annual growth rate (CAGR) of 43.5% from 2024 to 2031.

Vehicle Subscription Market is estimated to be valued at USD 4.52 Bn in 2024 and is expected to reach USD 35.49 Bn by 2031, growing at a compound annual growth rate (CAGR) of 34.2% from 2024 to 2031.

Hydrogen Buses Market size is estimated to be valued at US$ 10.78 Bn in 2023 and is projected to reach US$ 165.34 Bn by 2030, exhibiting a compound annual growth rate (CAGR) of 47.7% during the forecast period (2023-2030).

Author Bio:

Ravina Pandya, PR Writer, has a strong foothold in the market research industry. She specializes in writing well-researched articles from different industries, including food and beverages, information and technology, healthcare, chemical and materials, etc. With an MBA in E-commerce, she has an expertise in SEO-optimized content that resonates with industry professionals.

About Us:

Coherent Market Insights is a global market intelligence and consulting organization that provides syndicated research reports, customized research reports, and consulting services. We are known for our actionable insights and authentic reports in various domains including aerospace and defense, agriculture, food and beverages, automotive, chemicals and materials, and virtually all domains and an exhaustive list of sub-domains under the sun. We create value for clients through our highly reliable and accurate reports. We are also committed in playing a leading role in offering insights in various sectors post-COVID-19 and continue to deliver measurable, sustainable results for our clients.

Mr. Shah Senior Client Partner – Business Development Coherent Market Insights Phone: US: +1-650-918-5898 UK: +44-020-8133-4027 AUS: +61-2-4786-0457 India: +91-848-285-0837 Email: sales@coherentmarketinsights.com Website: https://www.coherentmarketinsights.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

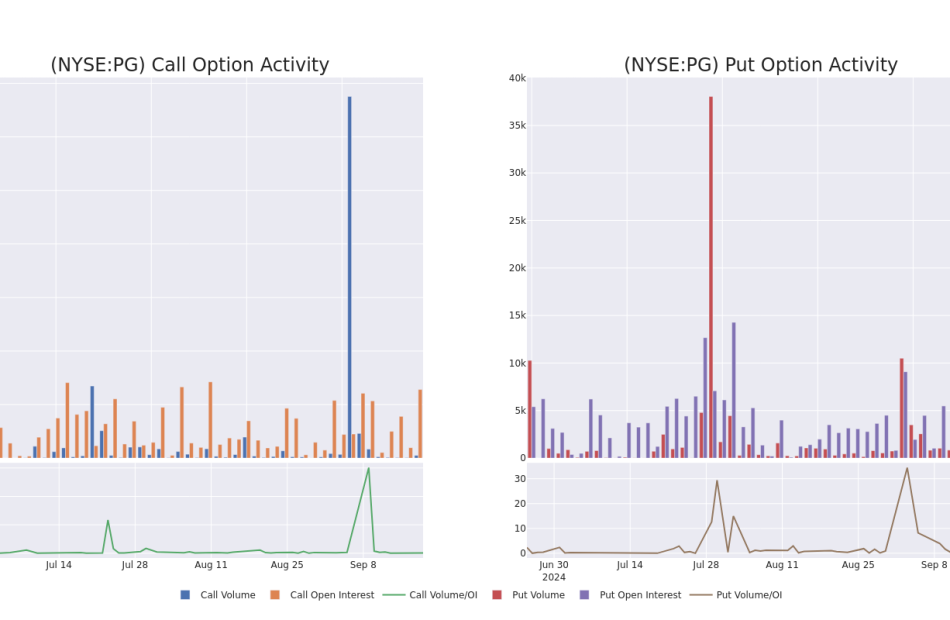

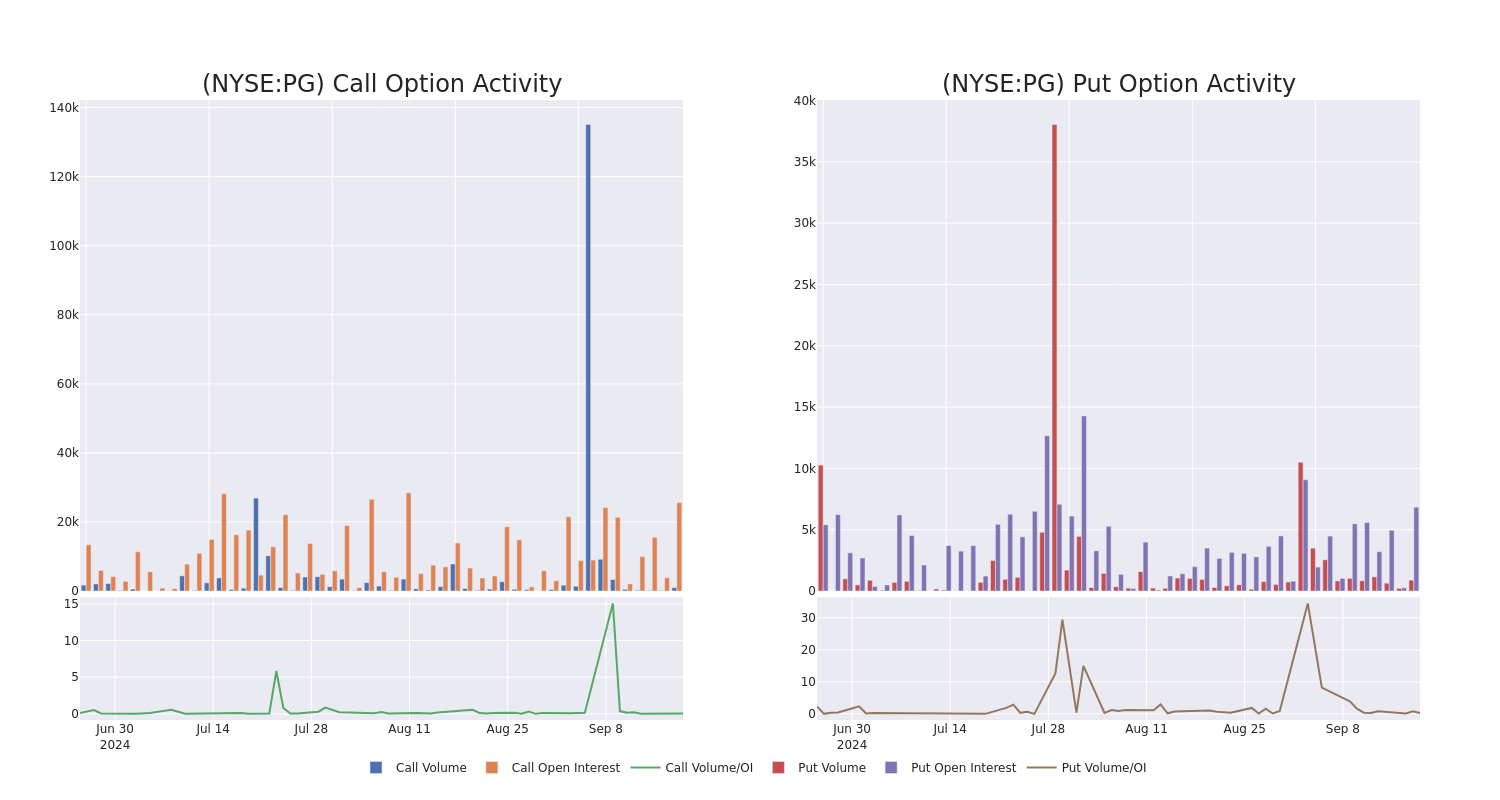

This Is What Whales Are Betting On Procter & Gamble

Financial giants have made a conspicuous bearish move on Procter & Gamble. Our analysis of options history for Procter & Gamble PG revealed 9 unusual trades.

Delving into the details, we found 33% of traders were bullish, while 55% showed bearish tendencies. Out of all the trades we spotted, 2 were puts, with a value of $215,436, and 7 were calls, valued at $548,283.

Expected Price Movements

After evaluating the trading volumes and Open Interest, it’s evident that the major market movers are focusing on a price band between $155.0 and $180.0 for Procter & Gamble, spanning the last three months.

Analyzing Volume & Open Interest

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Procter & Gamble’s options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Procter & Gamble’s whale trades within a strike price range from $155.0 to $180.0 in the last 30 days.

Procter & Gamble 30-Day Option Volume & Interest Snapshot

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| PG | CALL | SWEEP | BEARISH | 03/21/25 | $4.95 | $4.9 | $4.95 | $180.00 | $315.9K | 1.4K | 38 |

| PG | PUT | TRADE | BULLISH | 09/20/24 | $3.9 | $3.7 | $3.75 | $175.00 | $187.5K | 2.7K | 600 |

| PG | CALL | SWEEP | BEARISH | 10/18/24 | $1.95 | $1.94 | $1.95 | $175.00 | $55.6K | 14.8K | 611 |

| PG | CALL | SWEEP | BEARISH | 09/20/24 | $0.79 | $0.53 | $0.79 | $172.50 | $53.6K | 1.4K | 1 |

| PG | CALL | TRADE | BEARISH | 04/17/25 | $8.4 | $8.1 | $8.2 | $175.00 | $36.8K | 129 | 45 |

About Procter & Gamble

Since its founding in 1837, Procter & Gamble has become one of the world’s largest consumer product manufacturers, generating more than $80 billion in annual sales. It operates with a lineup of leading brands, including more than 20 that generate north of $1 billion each in annual global sales, such as Tide laundry detergent, Charmin toilet paper, Pantene shampoo, and Pampers diapers. Sales outside its home turf represent more than half of the firm’s consolidated total.

After a thorough review of the options trading surrounding Procter & Gamble, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Where Is Procter & Gamble Standing Right Now?

- With a trading volume of 8,632,563, the price of PG is down by -1.37%, reaching $171.54.

- Current RSI values indicate that the stock is is currently neutral between overbought and oversold.

- Next earnings report is scheduled for 27 days from now.

Expert Opinions on Procter & Gamble

A total of 2 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $188.0.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* Maintaining their stance, an analyst from JP Morgan continues to hold a Overweight rating for Procter & Gamble, targeting a price of $186.

* In a positive move, an analyst from DZ Bank has upgraded their rating to Buy and adjusted the price target to $190.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Procter & Gamble options trades with real-time alerts from Benzinga Pro.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Alliance Entertainment Reports Fourth Quarter and Fiscal Year 2024 Results

Operational efficiencies and margin improvements drive profitability turnaround

Higher-margin DTC sales increased to 36% of gross revenue in FY24

Strengthened balance sheet with 45% reduction in revolver debt and added new $120M credit facility

PLANTATION, Fla., Sept. 19, 2024 (GLOBE NEWSWIRE) — Alliance Entertainment Holding Corporation AENT, a global distributor and wholesaler specializing in music, movies, video games, electronics, arcades, toys, and collectibles, reported its financial and operational results for the fourth quarter and fiscal year ended June 30, 2024.

FY 2024 and Subsequent Operational Highlights

- Net revenue totaled $1.1 billion in fiscal year 2024.

- Gross profit increased to $128.9 million in fiscal year 2024, up 24% from the prior year, with gross margin improved 270bps to 11.7% on profitable sales strategy.

- Net income was $4.6 million in fiscal year 2024, a $40 million improvement from the net loss of $35.4 million in the prior year.

- Adjusted EBITDA improved by $41.9 million, rising to $24.3 million from a negative Adjusted EBITDA of $17.6 million in FY 2023, highlighting successful cost-saving initiatives and improved operational efficiencies.

- Higher-margin Direct-to-Consumer (DTC) sales contributed 36% of gross revenue in fiscal year 2024, up from 31% in the prior year.

- Inventory levels were reduced to $97 million as of June 30, 2024, down from $147 million the prior year, as a result of effective inventory management.

- Revolver balance reduced by 45%, from $133 million to $73 million, significantly improving liquidity and reducing debt service costs.

- Installed Sure Sort® X, a cost-saving sortation technology system from warehouse automation solutions provider OPEX® at its Kentucky facility.

- Secured a new three-year $120 million senior secured credit facility to refinance an existing credit facility, support working capital needs, and fuel future growth.

- Hosted first Investor and Analyst Tour at Shepherdsville, Kentucky warehouse in May 2024.

Bruce Ogilvie, Chairman of Alliance Entertainment, commented, “We made substantial progress in strengthening our business during fiscal 2024, and I am proud of the strategic actions we took to position Alliance Entertainment for long-term growth and profitability. Our exclusive distribution rights and broad content portfolio have allowed us to maintain resilient demand in key areas, such as physical music and movies, where we’ve seen growth in vinyl, CDs, and home video products.”

“We continued to grow our Direct-to-Consumer (DTC) channel in 2024, which now represents 36% of our gross revenue, up from 31% the previous year. This shift highlights the effectiveness of our approach in meeting evolving consumer preferences, and it is helping to diversify and strengthen our revenue base. These higher margin sales, combined with improved operational efficiencies and other strategic initiatives, have contributed to a $40 million turnaround in net income and a $41.9 million improvement in adjusted EBITDA during fiscal 2024.”

“Looking ahead, with new gaming hardware releases on the horizon and the collectibles market showing stability, we are confident in our ability to capture future demand and continue enhancing profitability as we move into fiscal 2025 and beyond.”

Jeff Walker, Chief Executive Officer of Alliance Entertainment, added, “Throughout fiscal 2024, we focused on executing our operational strategies to drive profitability and efficiency, and the results speak for themselves. Our emphasis on cost control and margin enhancement delivered a 24% increase in gross profit, raising gross margins to 11.7% and demonstrating our ability to extract value from our revenue streams and adapt to evolving market dynamics without sacrificing operational strength.

“One of our proudest achievements this year was turning around adjusted EBITDA. We improved it by $41.9 million, from a loss of $17.6 million last year to positive $24.3 million in fiscal 2024. This significant recovery is a testament to the cost efficiencies we’ve achieved, particularly through warehouse automation and the strategic reduction of non-essential expenditures. Our ability to streamline operations while focusing on higher-margin products has played a pivotal role in this positive trajectory.

“Our net income also saw a dramatic improvement, rising to $4.6 million for fiscal 2024, a $40 million turnaround from the prior year’s net loss of $35.4 million. This milestone highlights the success of our long-term initiatives aimed at reducing operational costs and improving overall profitability. The combination of a stronger margin profile and disciplined cost management has positioned us to continue delivering profitable growth.

“In specific product categories, we saw promising developments. In our gaming segment, we more than doubled the average selling price, particularly in hardware and retro arcade products. Our strategic shift toward higher-value offerings is proving successful, and we expect to benefit from new hardware releases in the coming year. Similarly, in consumer products, we improved margins and pricing, demonstrating the effectiveness of our inventory rationalization efforts.

“Physical media, a core part of our portfolio, continues to show resilience and growth. Vinyl sales grew 2%, and physical movie sales surged by 8% this year, driven by demand for premium formats like 4K UHD and collectible editions. We are well positioned to capture more of this demand as brick-and-mortar retailers increasingly cater to consumers seeking curated, high-quality entertainment experiences. Our ability to provide retailers with a diverse and extensive product range across both physical and digital channels remains a key differentiator.

“From a liquidity perspective, we have made significant strides in strengthening our financial position. We reduced our revolver balance by 45%, from $133 million to $70 million, and saw net cash from operations soar by 1,547%, reaching $55.8 million in fiscal 2024. Additionally, to support growth, we recently secured a new three-year $120 million senior secured asset-based credit facility with White Oak Commercial Finance. The proceeds were used to refinance our existing credit facility, fund working capital, and provide for general corporate purposes. These steps have positioned us well to execute our acquisition strategy and capitalize on future growth opportunities.

“As we look toward fiscal 2025, our focus remains on driving growth through continued expansion and diversification. By adding new exclusive licenses, expanding product categories, and building stronger retail partnerships, we are positioning ourselves to capture new opportunities in the marketplace. Our ongoing investments in cutting-edge technologies like the Sure Sort® X and the AutoStore™ systems are already driving significant efficiency improvements, and we expect these innovations to further streamline our operations and enhance profitability in the quarters ahead.

“With a disciplined approach to reducing expenses, lowering debt, and optimizing inventory management, we are confident in our ability to continue improving EBITDA and inventory turns in the year ahead. Demand for physical music, particularly vinyl and CD sales, remains strong, and we are excited about major upcoming releases and opportunities in this space. As we continue executing our strategy, we believe Alliance Entertainment is operating from a strong foundation that positions us to effectively capitalize on new opportunities and deliver sustained value to both our customers and shareholders,” concluded Walker.

Fourth Quarter FY 2024 Financial Results

- Net revenues for the fiscal fourth quarter ended June 30, 2024, were $236.4 million, compared to $247.1 million in the same period of 2023, a decrease of 4.3%.

- Gross profit for the fiscal fourth quarter ended June 30, 2024, was $26.9 million, compared to $30.2 million in the same period of 2023, a decrease of 10.9%.

- Gross profit margin for the fiscal fourth quarter ended June 30, 2024, was 11.4%, down from 12.2% in the same period of 2023, a decrease of 80 basis points.

- Net income for the fiscal fourth quarter ended June 30, 2024, was $2.6 million, compared to net loss of $4.6 million for the same period of 2023, an improvement of $7.2 million.

- Adjusted EBITDA for the fiscal fourth quarter ended June 30, 2024, was $2.1 million.

FY 2024 Financial Results

- Net revenues for the fiscal year ended June 30, 2024, were $1.10 billion, compared to $1.16 billion in fiscal year 2023, a decrease of 5%.

- Gross profit for the fiscal year ended June 30, 2024, was $128.9 million, compared to $103.9 million in fiscal year 2023, an increase of 24%.

- Gross profit margin for the fiscal year ended June 30, 2024, was 11.7%, up from 9.0% in fiscal year 2023, an increase of 270 basis points.

- Net income for the fiscal year ended June 30, 2024, was $4.6 million, compared to net loss of $35.4 million for fiscal year 2023, an improvement of $40.0 million.

- Adjusted EBITDA for the fiscal year ended June 30, 2024, improved by $41.9 million to $24.3 million from an Adjusted EBITDA loss of $17.6 million for fiscal year 2023.

- Net cash provided by operating activities for the fiscal year ended June 30, 2024, was $55.8 million, compared to $3.4 million in fiscal year 2023, an increase of 1,547%.

Jeff Walker added, “We were encouraged by the ongoing improvement in gross profit and gross margin in fiscal year 2024 over the prior year period as our cost-saving initiatives and focus on positive sales continue to yield results. Improvements also led to a fifth consecutive quarter of positive Adjusted EBITDA.”

Capital Structure Summary

As of June 30, 2024, Alliance Entertainment’s outstanding common stock totaled 50,828,548 shares, including its public float of 2,218,622 shares. Management owns 81.9% of outstanding common stock, as of September 19, 2024.

For additional information, please see the company’s quarterly report on Form 10-Q filed with the SEC.

Conference Call

Alliance Entertainment Executive Chairman Bruce Ogilvie and CEO and CFO Jeff Walker will host the conference call, which will be followed by a question-and-answer session. A presentation will accompany the call and can be viewed during the webcast or accessed via the investor relations section of the Company’s website here.

To access the call, please use the following information:

| Date: | Thursday, September 19, 2024 |

| Time: | 4:30 p.m. Eastern Time, 1:30 p.m. Pacific Time |

| Toll-free dial-in number: | 1-877-407-0784 |

| International dial-in number: | 1-201-689-8560 |

| Conference ID: | 13748735 |

Please call the conference telephone number 5-10 minutes prior to the start time. An operator will register your name and organization. If you have any difficulty connecting with the conference call, please contact RedChip Companies at 1-407-644-4256.

The conference call will be broadcast live and available for replay at https://viavid.webcasts.com/starthere.jsp?ei=1686884&tp_key=bc464c4da4 and via the investor relations section of the Company’s website here.

A telephone replay of the call will be available approximately three hours after the call concludes and can be accessed through November 19, 2024, using the following information:

| Toll-free replay number: | 1-844-512-2921 |

| International replay number: | 1-412-317-6671 |

| Replay ID: | 13748735 |

About Alliance Entertainment

Alliance Entertainment AENT is a premier distributor of music, movies, toys, collectibles, and consumer electronics. We offer over 325,000 unique in-stock SKU’s, including over 57,300 exclusive compact discs, vinyl LP records, DVDs, Blu-rays, and video games. Complementing our vast media catalog, we also stock a full array of related accessories, toys, and collectibles. With more than thirty-five years of distribution experience, Alliance Entertainment serves customers of every size, providing a robust suite of services to resellers and retailers worldwide. Our efficient processing and essential seller tools noticeably reduce the costs associated with administrating multiple vendor relationships, while helping omni-channel retailers expand their product selection and fulfillment goals. For more information, visit www.aent.com.

Forward Looking Statements

Certain statements included in this Press Release that are not historical facts are forward-looking statements for purposes of the safe harbor provisions under the United States Private Securities Litigation Reform Act of 1995. Forward-looking statements generally are accompanied by words such as “believe,” “may,” “will,” “estimate,” “continue,” “anticipate,” “intend,” “expect,” “should,” “would,” “plan,” “predict,” “potential,” “seem,” “seek,” “future,” “outlook,” and similar expressions that predict or indicate future events or trends or that are not statements of historical matters. These forward-looking statements include, but are not limited to, statements regarding estimates and forecasts of other financial and performance metrics and projections of market opportunity. These statements are based on various assumptions, whether identified in this Press Release, and on the current expectations of Alliance’s management and are not predictions of actual performance. These forward-looking statements are provided for illustrative purposes only and are not intended to serve as and must not be relied on by an investor as, a guarantee, an assurance, a prediction, or a definitive statement of fact or probability. Actual events and circumstances are difficult or impossible to predict and will differ from assumptions. Many actual events and circumstances are beyond the control of Alliance. These forward-looking statements are subject to a number of risks and uncertainties, including risks relating to the anticipated growth rates and market opportunities; changes in applicable laws or regulations; the ability of Alliance to execute its business model, including market acceptance of its systems and related services; Alliance’s reliance on a concentration of suppliers for its products and services; increases in Alliance’s costs, disruption of supply, or shortage of products and materials; Alliance’s dependence on a concentration of customers, and failure to add new customers or expand sales to Alliance’s existing customers; increased Alliance inventory and risk of obsolescence; Alliance’s significant amount of indebtedness; our ability to refinance our existing indebtedness; our ability to continue as a going concern absent access to sources of liquidity; risks and failure by Alliance to meet the covenant requirements of its revolving credit facility, including a fixed charge coverage ratio; risks that a breach of the revolving credit facility, including Alliance’s recent breach of the covenant requirements, could result in the lender declaring a default and that the full outstanding amount under the revolving credit facility could be immediately due in full, which would have severe adverse consequences for the Company; known or future litigation and regulatory enforcement risks, including the diversion of time and attention and the additional costs and demands on Alliance’s resources; Alliance’s business being adversely affected by increased inflation, higher interest rates and other adverse economic, business, and/or competitive factors; geopolitical risk and changes in applicable laws or regulations; risk that the COVID-19 pandemic, and local, state, and federal responses to addressing the pandemic may have an adverse effect on our business operations, as well as our financial condition and results of operations; substantial regulations, which are evolving, and unfavorable changes or failure by Alliance to comply with these regulations; product liability claims, which could harm Alliance’s financial condition and liquidity if Alliance is not able to successfully defend or insure against such claims; availability of additional capital to support business growth; and the inability of Alliance to develop and maintain effective internal controls.

For investor inquiries, please contact:

Dave Gentry

RedChip Companies, Inc.

1-407-644-4256

AENT@redchip.com

| ALLIANCE ENTERTAINMENT HOLDING CORP. CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE INCOME (LOSS) |

|||||||

| Year Ended | Year Ended | ||||||

| ($ in thousands except share and per share amounts) | June 30, 2024 | June 30, 2023 | |||||

| Net Revenues | $ | 1,100,483 | $ | 1,158,722 | |||

| Cost of Revenues (excluding depreciation and amortization) | 971,594 | 1,054,788 | |||||

| Operating Expenses | |||||||

| Distribution and Fulfillment Expense | 48,818 | 62,841 | |||||

| Selling, General and Administrative Expense | 57,651 | 59,060 | |||||

| Depreciation and Amortization | 5,880 | 6,629 | |||||

| Transaction Costs | 2,086 | 5,014 | |||||

| IC DISC Commissions | – | 2,833 | |||||

| Restructuring Cost | 280 | 306 | |||||

| Loss on Disposal of Fixed Assets | 33 | (3 | ) | ||||

| Total Operating Expenses | 114,748 | 136,680 | |||||

| Operating Income (Loss) | 14,141 | (32,746 | ) | ||||

| Other Expenses | |||||||

| Interest Expense, Net | 12,247 | 11,715 | |||||

| Change in Fair Value of Warrants | 41 | 1 | |||||

| Total Other Expenses | 12,288 | 11,716 | |||||

| Income (Loss) Before Income Tax Benefit | 1,853 | (44,462 | ) | ||||

| Income Tax Benefit | (2,728 | ) | (9,058 | ) | |||

| Net Income (Loss) | 4,581 | (35,404 | ) | ||||

| Other Comprehensive Income (Loss) | |||||||

| Foreign Currency Translation | (2 | ) | (11 | ) | |||

| Total Comprehensive Income (Loss) | 4,579 | (35,415 | ) | ||||

| Net Income (Loss) per Share – Basic and Diluted | $ | 0.09 | $ | (0.74 | ) | ||

| Weighted Average Common Shares Outstanding – Basic | 50,828,548 | 48,138,393 | |||||

| Weighted Average Common Shares Outstanding – Diluted | 50,837,148 | 48,398,623 | |||||

| ALLIANCE ENTERTAINMENT HOLDING CORP. CONSOLIDATED BALANCE SHEETS |

|||||||

| ($ in thousands) | June 30, 2024 | June 30, 2023 | |||||

| Assets | |||||||

| Current Assets | |||||||

| Cash | $ | 1,129 | $ | 865 | |||

| Trade Receivables, Net | 92,357 | 104,939 | |||||

| Inventory, Net | 97,429 | 146,763 | |||||

| Other Current Assets | 5,298 | 8,299 | |||||

| Total Current Assets | 196,213 | 260,866 | |||||

| Property and Equipment, Net | 12,942 | 13,421 | |||||

| Operating Lease Right-Of-Use Assets | 22,124 | 4,855 | |||||

| Goodwill | 89,116 | 89,116 | |||||

| Intangibles, Net | 13,381 | 17,356 | |||||

| Other Long-Term Assets | 503 | 1,017 | |||||

| Deferred Tax Asset, Net | 6,533 | 2,899 | |||||

| Total Assets | $ | 340,812 | $ | 389,530 | |||

| Liabilities and Stockholders’ Equity | |||||||

| Current Liabilities | |||||||

| Accounts Payable | $ | 133,221 | $ | 151,622 | |||

| Accrued Expenses | 9,371 | 9,340 | |||||

| Current Portion of Operating Lease Obligations | 1,979 | 3,902 | |||||

| Current Portion of Finance Lease Obligations | 2,838 | 2,449 | |||||

| Promissory Note | — | 495 | |||||

| Contingent Liability | 511 | 150 | |||||

| Revolving Credit Facility, Net | — | 133,281 | |||||

| Total Current Liabilities | 147,920 | 301,239 | |||||

| Revolving Credit Facility, Net | 69,587 | — | |||||

| Finance Lease Obligation, Non- Current | 5,016 | 7,029 | |||||

| Operating Lease Obligations, Non-Current | 20,413 | 1,522 | |||||

| Shareholder Loan (subordinated), Non-Current | 10,000 | — | |||||

| Warrant Liability | 247 | 206 | |||||

| Total Liabilities | 253,183 | 309,996 | |||||

| Commitments and Contingencies (Note 11) | |||||||

| Stockholders’ Equity | |||||||

| Preferred Stock: Par Value $0.0001 per share, Authorized 1,000,000 shares, Issued and Outstanding 0 shares as of June 30, 2024 and June 30, 2023 | — | — | |||||

| Common Stock: Par Value $0.0001 per share, Authorized 550,000,000 shares at June 30, 2024, and at June 30, 2023; Issued and Outstanding 50,957,370 Shares at June 30, 2024, and 49,167,170 at June 30, 2023 | 5 | 5 | |||||

| Paid In Capital | 48,058 | 44,542 | |||||

| Accumulated Other Comprehensive Loss | (79 | ) | (77 | ) | |||

| Retained Earnings | 39,645 | 35,064 | |||||

| Total Stockholders’ Equity | 87,629 | 79,534 | |||||

| Total Liabilities and Stockholders’ Equity | $ | 340,812 | $ | 389,530 | |||

| ALLIANCE ENTERTAINMENT HOLDING CORP. CONSOLIDATED STATEMENTS OF CASH FLOWS |

|||||||

| Year Ended | Year Ended | ||||||

| ($ in thousands) | June 30, 2024 | June 30, 2023 | |||||

| Cash Flows from Operating Activities: | |||||||

| Net Income (Loss) | $ | 4,581 | $ | (35,404 | ) | ||

| Adjustments to Reconcile Net Income (Loss) to | |||||||

| Net Cash Provided by (Used in) Operating Activities: | |||||||

| Inventory write-down | – | 10,800 | |||||

| Depreciation of Property and Equipment | 1,904 | 2,221 | |||||

| Amortization of Intangible Assets | 3,976 | 4,408 | |||||

| Amortization of Deferred Financing Costs (Included in Interest) | 861 | 167 | |||||

| Bad Debt Expense | 687 | 598 | |||||

| Deferred Income Taxes | (3,634 | ) | (8,171 | ) | |||

| Stock-based Compensation Expense | 1,386 | 216 | |||||

| Gain (Loss) on Disposal of Fixed Assets | 75 | (3 | ) | ||||

| Changes in Assets and Liabilities | |||||||

| Trade Receivables | 11,896 | (4,626 | ) | ||||

| Related Party Receivable | – | 245 | |||||

| Inventory | 49,334 | 99,729 | |||||

| Income Taxes PayableReceivable | 517 | (1,533 | ) | ||||

| Operating Lease Right-Of-Use Assets | (17,269 | ) | 3,505 | ||||

| Operating Lease Obligations | 16,968 | (3,893 | ) | ||||

| Other Assets | 3,357 | 5,031 | |||||

| Accounts Payable | (18,401 | ) | (68,950 | ) | |||

| Accrued Expenses | (420 | ) | (952 | ) | |||

| Net Cash Provided by Operating Activities | 55,818 | $ | 3,388 | ||||

| Cash Flows from Investing Activities: | |||||||

| Cash Received for Business Acquisitions, Net of Cash Acquired | – | 1 | |||||

| Capital Expenditures | (228 | ) | (825 | ) | |||

| Cash Inflow from Asset Disposal | 66 | – | |||||

| Net Cash Used in Investing Activities | (162 | ) | (824 | ) | |||

| Cash Flows from Financing Activities: | |||||||

| Payments on Financing Leases | (2,965 | ) | (304 | ) | |||

| Payments on Revolving Credit Facility | (1,095,772 | ) | (1,092,306 | ) | |||

| Borrowings on Revolving Credit Facility | 1,035,428 | 1,089,453 | |||||

| Payments on Shareholder Note (Subordinated), Current | (36,000 | ) | (7,596 | ) | |||

| Proceeds from Shareholder Note (Subordinated), Non-Current | 46,000 | 7,596 | |||||

| Issuance of common stock, net of transaction costs | 2,130 | — | |||||

| Deferred Financing Costs | (4,211 | ) | — | ||||

| Net Cash Used in Financing Activities | (55,390 | ) | (3,157 | ) | |||

| Net Increase (Decrease) in Cash | 266 | (593 | ) | ||||

| Net Effect of Currency Translation on Cash | (2 | ) | (11 | ) | |||

| Cash, Beginning of the Period | 865 | 1,469 | |||||

| Cash, End of the Period | $ | 1,129 | $ | 865 | |||

| Supplemental disclosure for Cash Flow Information | |||||||

| Cash Paid for Interest | $ | 12,247 | $ | 11,425 | |||

| Cash Paid for Income Taxes | $ | 444 | $ | 648 | |||

| Supplemental Disclosure for Non-Cash Investing and Financing Activities | |||||||

| Conversion of Treasury stock | $ | – | $ | 2,674 | |||

| Fixed Asset Financed with Debt | $ | 7,853 | $ | 10,080 | |||

| Capital Contribution | $ | – | $ | 6,592 | |||

| Business Combination: Reverse recapitalization | $ | – | (787 | ) | |||

Non-GAAP Financial Measures: We define Adjusted EBITDA as net income or loss adjusted to exclude: (i) income tax expense; (ii) other income (loss); (iii) interest expense; and (iv) depreciation and amortization expense and (v) other infrequent, non- recurring expenses. Our method of calculating Adjusted EBITDA may differ from other issuers and accordingly, this measure may not be comparable to measures used by other issuers. We use Adjusted EBITDA to evaluate our own operating performance and as an integral part of our planning process. We present Adjusted EBITDA as a supplemental measure because we believe such a measure is useful to investors as a reasonable indicator of operating performance. We believe this measure is a financial metric used by many investors to compare companies. This measure is not a recognized measure of financial performance under GAAP in the United States and should not be considered as a substitute for operating earnings (losses), net earnings (loss) from continuing operations or cash flows from operating activities, as determined in accordance with GAAP. See the table below for a reconciliation, for the periods presented, of our GAAP net income (loss) to Adjusted EBITDA.

| Year Ended | Year Ended | ||||||

| ($ in thousands) | June 30, 2024 | June 30, 2023 | |||||

| Net Income (Loss) | $ | 4,581 | $ | (35,404 | ) | ||

| Add back: | |||||||

| Interest Expense | 12,247 | 11,715 | |||||

| Income Tax (Benefit) Expense | (2,728 | ) | (9,058 | ) | |||

| Depreciation and Amortization | 5,880 | 6,629 | |||||

| EBITDA | 19,980 | (26,118 | ) | ||||

| Adjustments | |||||||

| IC-DISC | – | 2,833 | |||||

| Transaction Costs | 2,086 | 5,014 | |||||

| Restructuring Costs | 280 | 306 | |||||

| Stock-based Compensation Expense | 1,386 | 216 | |||||

| Change in Fair Value of Warrants | 41 | 1 | |||||

| Contingent Loss | 461 | 150 | |||||

| Loss (Gain) on Disposal of PPE | 33 | (3 | ) | ||||

| Adjusted EBITDA | $ | 24,267 | $ | (17,601 | ) | ||

| Adjusted EBITDA for the year ended June 30, 2023, included the following expenses: | |||||||

| Excessive International Transportation Costs (Units Sold) | 8,241 | ||||||

| Excessive International Transportation Costs (On Hand) | 7,100 | ||||||

| Markdown for Arcades Sold | 12,156 | ||||||

| Incremental Storage Fees Arcades | 4,643 | ||||||

| Consumer Products Inventory Reserve | 3,700 | ||||||

| Total | 35,840 | ||||||

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

New Research From BrightEdge Finds Google's AI Overviews Are Getting Smarter

SAN MATEO, Calif., Sept. 19, 2024 (GLOBE NEWSWIRE) — BrightEdge, the global leader in AI-driven organic search, content, and digital marketing automation, today released new research highlighting significant shifts in Google’s AI Overview (AIO) rollout.

“The refinement of Google’s AI Overviews represents a key moment for Google as it turns on AI for more users and prepares for mainstream deployment,” said Jim Yu, Founder and Executive Chairman at BrightEdge. “Our new research highlights how Google is adapting given the increased popularity of AI-native search engines like SearchGPT from artificial intelligence giant OpenAI and Perplexity. In the last few months, we’ve seen seismic shifts in Search; Google and other players are on the offensive.”

Top findings from the report include:

Specialized and expert sources gain prominence in Google AIO

AI Overviews are overhauling its citations, directing traffic to expert, niche sources and enhancing the depth, transparency and credibility of AI-generated results. Healthcare, education, technology and the news industries saw significant changes in what AIO sources in its results. Most notably:

- In the news and media industry, citations for USAToday.com dropped 10.3% and NYTimes.com dropped 3.1%. However, Bloomberg.com saw an increase in AIO results due to its industry-specific and specialized content around the stock market, business news and finance trends.

- Technology review websites experienced a similar decrease in AIO mentions, as TechRadar.com dropped 47.3% and TomsGuide.com dropped 16.4%. This change aligns with AIO’s preference for product and industry-specific expert sources and less on consumer-focused insights and reporting.

- Healthcare websites saw significant changes in what AIO cites for its results, steering away from consumer-focused media and blogs, and opting for authoritative expert content instead. Consumer news and general health websites like VerywellHealth.com (-77.9%) and EverydayHealth.com (-95.6%) saw declines, while MayoClinic.org (+32.4%) and the National Institutes of Health website from the U.S. Department of Health & Human Services (+83.2%) saw rapid increases in AIO inclusion.

- Additionally, niche health queries resulted in an uptick in specialty health websites, including Spine-Health.com (+266.7%) and Arthritis.org (+89.5%). Terms like “ACL tear symptoms” now benefit from comprehensive AI-generated answers, demonstrating Google’s push toward more detailed, factual content in AI Overviews.

AI Overviews push comparative content to shoppers

During a period of high inflation and high expectations from consumers, shoppers are more conscious about their purchases and want to compare and contrast products across brands and retailers.

As the holiday shopping season approaches, BrightEdge found that AIOs are refining search results to focus on comparative content, which rose by 12% in August. AIOs prioritized product carousels with engaging imagery, which rose by 172%. Unordered lists (lists of items that are related but in no specific order, such as general searches for “winter boots” or “iPhone cases”) also increased by 42%.

These adjustments make AI Overviews more user-friendly by organizing complex product features and specifications for easier decision-making.

Interestingly, eCommerce queries saw a 90% drop in AI Overviews for non-logged-in users, signaling a cautious approach by Google to introduce AI-powered results in this high-transaction sector.

Gen AI takes up more real estate on Google Search

Google is experimenting with the visual formatting for AIOs. After months of shrinking AIO screen real estate, Brightedge data shows that the panel has increased in height by 10%, growing from 647 pixels in July to 712 pixels in August.

This additional screen real estate allows for richer, more comprehensive answers and comparisons. This change is particularly evident in the eCommerce sector, where high-resolution product visuals and detailed specs and descriptions are presented more prominently. Additionally, the extra space for AIOs aligns with the rise in product carousels and unordered lists.

Google’s end goal is likely to help companies elevate their search results and provide users with a better browsing experience, where they can compare and contrast their options and easily find pertinent information for each result.

“As Google continues to refine AI Overviews, we expect to see more gradual changes that improve visibility for expert sources with detailed information and engaging visuals, whether it’s for the eCommerce sector or news and media industry,” said Albert Gouyet, VP of Operations at BrightEdge. “AIOs are likely going to become more selective with the content from which it sources its responses. Marketers have a unique opportunity to capitalize on these changes by ensuring their content is high-quality in imagery and information.”

SearchGPT Surges Ahead in Referral Traffic

BrightEdge also found explosive growth for SearchGPT, which quickly surpassed Perplexity in terms of referral traffic despite having been in a limited beta. This rapid expansion is a positive indicator for both marketers and publishers as Search and AI begin to show their full potential. Perplexity and Claude continue to grow at 14% and 26% monthly rates, respectively, though from smaller user bases.

To view the report and learn more, visit: www.brightedge.com/ai-overviews

About BrightEdge

BrightEdge, the global leader in Enterprise SEO and content performance, empowers digital marketers to transform online opportunities into tangible business results. Its all-in-one platform provides organizations with crucial market insights and intelligent AI-driven solutions. The BrightEdge platform contains the industry’s most unique and extensive data set that connects key search, social, content, and digital media data points. Its deep-learning engine, DataMind, has been powering SEO AI-driven solutions since 2015, allowing marketers to benefit from high-fidelity data-led insights and automated action. Over 57% of Fortune 100 companies and nine of the top ten international agencies trust BrightEdge to help them provide the best performance by becoming an integral part of the digital experience.

Contact

LaunchSquad for BrightEdge

BrightEdge@launchsquad.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.