V.F. Corp Stock Gains 30% in 3 Months: What's Next for Investors?

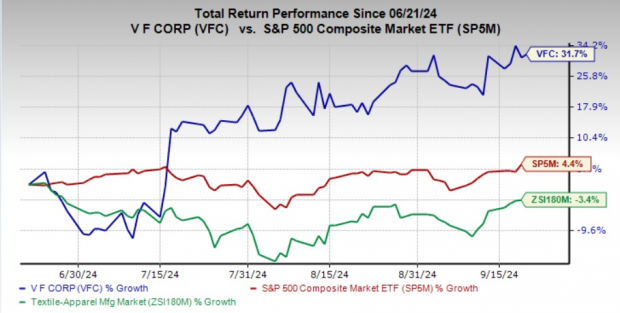

V.F. Corporation VFC has provided investors with solid gains, appreciating 31.7% over the past three months. This performance outpaces the industry’s decline of 3.5% and the S&P 500’s 4.4% growth. This gain is attributed to several factors, including its Reinvent transformation program, cost-reduction initiatives and strengthening balance sheet.

One of the most crucial aspects of V.F. Corp’s recent progress is its focus on stabilizing gross margins. While the company continues to face near-term uncertainties, it is encouraged by sequential improvements in sales at Vans, one of VFC’s key brands. Although overall sales have not yet returned to positive territory, the improvement is a promising sign.

Closing at $18.65, the stock trades close to its 52-week high mark of $20.69 touched in December 2023. Moreover, the stock’s current level reflects a premium of 70% from its 52-week low.

The technical indicators show that the stock is trading above both its 50 and 200-day moving averages, indicating strong upward momentum and suggesting sustained investor confidence in the company’s performance.

Image Source: Zacks Investment Research

What’s Fueling V.F. Corp’s Stock Rally?

V.F. Corp remains on track with its Reinvent transformation program, which focuses on brand-building and improving operational performance. The plan targets four key objectives: improving North American performance, turning around the Vans brand, reducing costs and strengthening the balance sheet.

As part of this plan, the company continues to streamline processes and invest in initiatives to drive brand demand and boost growth. In the first quarter of fiscal 2025, V.F. Corp generated $50 million in cost savings through the Reinvent program. This large-scale cost-reduction program is expected to deliver $300 million in fixed cost savings by reducing expenditure in non-strategic areas, and simplifying and right-sizing its structure in the first half of fiscal 2025.

The company’s strategic approach to selling the Supreme brand marks a significant shift, aims to refocus on its core business and improve operational efficiency. The company acknowledges that Supreme lacked synergy with its broader portfolio, leading to its divestiture. This move will help V.F. streamline its operations and enhance financial flexibility by reducing leverage.

VFC Stock’ Promising Outlook

V.F. Corp is set to benefit from its growth plan for fiscal 2023-2027. It expects revenues to witness a mid-to-high single-digit CAGR and earnings to record a high single to low double-digit CAGR. The company projects an operating margin of 15% by fiscal 2027, supported by gross margin expansion and lower SG&A expenses.

A key component of V.F. Corp’s recovery strategy is the revitalization of the Vans brand, which has encountered challenges in recent years. Analysts are optimistic, forecasting that the company will start to see gradual improvements in its fundamentals in the next four to six quarters.

While it is too early to declare a complete turnaround, we believe 2025 could mark a turning point for the brand, which is critical to the company’s broader recovery efforts.

Near-Term Concerns for VFC Stock

V.F. Corp’s first-quarter fiscal 2025 results were affected by a tough operating environment, and dismal performance across regions, channels and brands. This led to a decline in sales 9% year over year and 8% in constant currency. The decline was the result of soft performance across regions and channels, despite sequential improvement.

V.F. Corp is facing challenges with its well-known brands, The North Face and Vans. Both brands, once reliable revenue drivers, are experiencing declining sales and struggling to connect with their core customer bases. For The North Face, the issues arise from shifting consumer preferences and heightened competition in the outdoor apparel market. The brand has found it difficult to maintain its premium positioning while trying to appeal to a broader audience.

Vans, meanwhile, is dealing with a saturated sneaker market and a decline in its appeal among younger customers. However, a recovery strategy is in place, and there are expectations for improvement in the near term.

Three Picks You Can’t Miss

VFC currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the Consumer Discretionary space are Wolverine World Wide, GIII Apparel Group and Steven Madden, Ltd.

Wolverine World Wide designs, manufactures and distributes a wide variety of casual and active apparel and footwear. The company sports a Zacks Rank #1 (Strong Buy) at present.

The Zacks Consensus Estimate for WWW’s current financial-year sales indicates a decline of almost 23% from the year-ago reported figures. The consensus mark for EPS reflects significant growth to 85 cents from 5 cents reported in the prior year. WWW has a trailing four-quarter earnings surprise of 7.5%, on average.

G-III Apparel is a manufacturer, designer and distributor of apparel and accessories under licensed brands, owned brands and private label brands. It carries a Zacks Rank #1 at present.

GIII Apparel has a trailing four-quarter earnings surprise of 118.2%, on average. The Zacks Consensus Estimate for GIII Apparel’s current financial-year sales indicates growth of 3.3% from the year-ago figure.

Steven Madden designs, sources, markets and sells fashion-forward name-brand and private-label footwear. It currently has a Zacks Rank #2 (Buy).

The Zacks Consensus Estimate for Steven Madden’s 2024 earnings and sales indicates growth of 6.9% and 12.6%, respectively, from the year-ago actuals. SHOO has a trailing four-quarter average earnings surprise of 9.5%.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Leave a Reply