Is Super Micro Computer Stock a Buy Now?

Following a terrific start to the year, Super Micro Computer‘s (NASDAQ: SMCI) stock chart has undergone a stark reversal over the past six months. It has lost close to 60% of its value from its peak, and recent developments seem to have further dented investor confidence in the company.

First, the fiscal 2024 fourth-quarter results it released on Aug. 6 weren’t up to Wall Street’s expectations, and management’s guidance was disappointing. Second, short-seller Hindenburg Research released a report alleging accounting irregularities at Supermicro. Then, Supermicro management announced that it was delaying the filing of its annual report, which only added to the negative press.

Those factors explain why Wall Street analysts have been downgrading the stock lately. But given that shares of this server and storage systems manufacturer are now trading at an attractive 22 times trailing earnings and 13 times forward earnings, opportunistic investors may be tempted to buy Supermicro. Should they be doing that in light of the recent developments?

Addressing the elephant in the room

Investors should note that Hindenburg is a short-seller, and it has a financial interest in seeing Supermicro’s stock price fall. In that context, we cannot be sure that the allegations that Hindenburg is making are valid, especially considering that the short-seller has been wrong in the past. That said, Supermicro was charged by the Securities and Exchange Commission (SEC) for accounting violations in August 2020, when it was found to have prematurely recognized revenue and understated its expenses over a three-year period.

However, the company has recovered remarkably since then, clocking outstanding gains over the past couple of years thanks to the emergence of a new catalyst in the form of artificial intelligence (AI). Its revenue in its fiscal 2024 more than doubled to $14.9 billion from $7.1 billion in the previous year. Non-GAAP earnings shot up to $22.09 per share, from $11.81 per share in fiscal 2023.

Addressing the delay in Supermicro’s annual filing, management clarified that “we don’t anticipate any material changes in our fourth quarter or fiscal year 2024 financial results.” It added that the company is looking forward to a “historic” 2025 with “a record number of orders, a strong and growing backlog of design wins and leading market positions across a number of areas.”

Supermicro says that the recent developments won’t affect its production capabilities, and it’s on track to meet the demand for its AI server solutions. It’s worth noting that Supermicro is expecting its fiscal 2025 revenue to land between $26 billion and $30 billion. That would be another year of remarkable growth from its $14.9 billion in fiscal 2024.

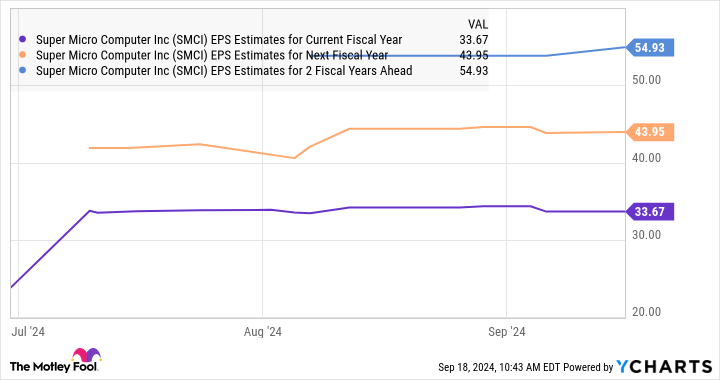

Though it is facing margin challenges due to the increased investments it’s making as it boosts capacity to meet the strong demand for its liquid-cooled server solutions, management is confident that it will return to its normal margin range before the fiscal year ends. Analysts’ consensus estimates also indicate that Supermicro’s earnings are on track to increase at an incredible pace in the current fiscal year, followed by healthy jumps in the next couple of years as well.

What should investors do?

The delay in Supermicro’s annual filing led JPMorgan to downgrade the stock from overweight to neutral and to slash its price target to $500 from $950. Even Barclays downgraded the stock to equal weight from overweight, citing the margin pressure that Supermicro faces as well as the filing delay. However, JPMorgan’s downgrade wasn’t a result of the Hindenburg report nor a reflection of its ability to become compliant, but because of the near-term uncertainty that surrounds the company and the lack of a compelling argument to buy the stock.

So, risk-averse investors would do well to wait for more clarity before buying this AI stock. However, those with higher risk appetites who are looking to add a fast-growing company to their portfolios can consider buying Supermicro now. It seems capable of sustaining its impressive growth in the long run thanks to the huge opportunities available to it in the AI server market.

Analysts expect Supermicro’s earnings to grow at an annualized rate of 62% over the next five years. If the company can get past its current troubles, it could turn out to be a solid investment considering the valuation at which it is trading right now.

Should you invest $1,000 in Super Micro Computer right now?

Before you buy stock in Super Micro Computer, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Super Micro Computer wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $710,860!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 16, 2024

JPMorgan Chase is an advertising partner of The Ascent, a Motley Fool company. Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends JPMorgan Chase. The Motley Fool recommends Barclays Plc. The Motley Fool has a disclosure policy.

Is Super Micro Computer Stock a Buy Now? was originally published by The Motley Fool

Elon Musk Boosts House Republicans With Record $289,100 Donation

Elon Musk reportedly intensified his political contributions in August, making his largest-known donation to bolster House Republicans’ efforts to maintain a vulnerable majority.

The National Republican Congressional Committee announced that it received $289,100 from Musk in August, reported Politico, citing a report filed with the Federal Election Commission.

Musk’s political stance has evolved significantly over the years.

In August, Musk explained his support for Donald Trump, stating that his track record has been moderate and he has not been particularly political in the past. He revealed this during a conversation with Trump, touching on various topics from immigration to electric vehicles.

Musk, one of the world’s wealthiest individual with a net worth exceeding $250 billion, has previously donated to both Democrats and Republicans, though never in such substantial sums.

In September, Musk commented on a debate between Trump and Harris, expressing dissatisfaction with the debate hosts and raising concerns about the lack of discussion on the national debt crisis. He also mentioned that Harris exceeded most people’s expectations during the debate.

Musk has increased his political engagement lately, developing a connection with Trump by funding America PAC, a pro-Trump organization. This group, which recently experienced a leadership change, is set to significantly aid in voter mobilization efforts for Trump and has begun investing in competitive House races nationwide.

It remains uncertain how much Musk will ultimately invest in the election. In July, the Wall Street Journal suggested he intended to contribute about $45 million monthly to support Trump, though Musk later refuted this claim. Despite Musk’s significant donation, the NRCC raised only $9.7 million in August, while its Democratic counterpart collected $22.2 million.

Recently, Musk faced backlash for a controversial post on X, which he later deleted. The post questioned why no one was attempting to assassinate President Joe Biden or Harris, following an assassination attempt on Trump. The White House labeled the post as “irresponsible.”

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Read Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Georgia's Ruwa Romman: First Muslim Woman in State House Navigates Complex Political Landscape

Arab-American voters, represented by 31-year-old Palestinian American Ruwa Romman, face a complex dilemma this election season in Georgia.

Romman, a legislator in the swing state, was nominated to represent the Uncommitted National Movement, reported Al Jazeera. This protest initiative aims to urge Democratic presidential nominee Kamala Harris to reconsider her support for Israel’s actions in Gaza.

While she planned to share her family’s story at the Democratic National Convention in mid-August, she didn’t get the chance.

Nonetheless, her advocacy outside the convention has propelled her into the national spotlight.

Romman embodies the struggle many Arab-Americans experience as they balance their support for the Democratic Party with criticism of its largely pro-Israel platform.

Romman was among three speakers proposed by the movement to convey the Palestinian experience at the convention.

In an interview with Al Jazeera, she mentioned that, had she been allowed to speak, her address would have included an endorsement for Harris.

Romman viewed her potential speech as a chance to humanize the plight of Palestinians, who have lost over 41,250 lives in the ongoing conflict. When questioned about whether she would rule out endorsing Harris, Romman indicated that she didn’t have a definite answer. She mentioned that she had extended her endorsement, but noted that neither the Harris campaign nor the DNC acknowledged it.

Regarding the issue of an official endorsement, she remarked that it was more a matter for them to decide, rather than for her.

Born in Jordan, Romman made history in 2022 as the first Muslim woman elected to the Georgia State House of Representatives. She was part of a record wave of 153 Muslim-American candidates who won office during that year’s midterm elections.

Read Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Is SoFi Stock a Buy?

SoFi Technologies (NASDAQ: SOFI) stock has been volatile this year. It made progress on a comeback last year, doubling in price, but it’s down 19% year to date as we close in on the last quarter of 2024.

Let’s get into what SoFi’s all about, why investors have been disappointed, and whether or not it’s a good idea to buy right now.

The right bank at the right time

SoFi started as a student loan cooperative, and as a young bank started by recent grads, it targets students and young professionals with a user interface that speaks their language. It was developed as an all-digital bank, and it offers high savings rates, low fees, and an easy-to-use platform that check the boxes for its young, digital-savvy clientele.

There are many things going right at SoFi. It’s attracting hundreds of thousands of new customers and adding even more new products, and revenue is growing at double-digit rates.

SoFi acquired Pacific Bancorp in 2022 and got a bank charter, and it’s been expanding its line of products and services. That helps to increase engagement among its membership and generate higher revenue as well as mitigate the risk of putting all of its business in lending. That’s allowed it to stay in growth mode throughout the high-interest-rate environment, when lending is under pressure.

It’s also leading to scale and profits. SoFi reported its third consecutive quarterly profit in the 2024 second quarter, and it’s expecting to stay profitable. It raised guidance after the second quarter, and Wall Street analysts are expecting earnings per share of $0.10 in 2024 and $0.26 in 2025.

So what’s the problem?

It’s not the right time for any bank

SoFi is a fintech company. It’s not your standard, established bank, with reliable cash flow and attractive dividends. It’s still working its way toward those features. Its tech focus is leading to the strong growth it’s been reporting, but the flip side of that is risk and volatility.

What’s happening at SoFi is that the lending segment, which is the larger segment, has been reporting slow growth. It’s also largely responsible for SoFi’s new profits, and if growth is slowing down or decreasing, investors get worried.

Here’s how it played out in the second quarter. Total revenue increased 20% year over year, and it posted a consolidated net profit of $17 million. Financial services and tech platform, its two nonlending segments, increased 46% year over year. Sounds fabulous.

Digging deeper, you’ll notice that lending segment revenue increased only 3% year over year, and it still accounts for the bulk of revenue — 55%. What’s more, its contribution profit was $198 million, an 8% increase over last year. The other segments’ combined contribution profit was only $86 million. For now, at least, as much as management talks up the strength of its expansion model, lending remains SoFi’s bread and butter.

Has SoFi stock bottomed out?

SoFi stock has gone up and down this year as the market has found it difficult to price. There’s so much good, but there are clear concerns. So far this year, the concerns have been winning out.

However, things might be starting to change. First and foremost, if interest rates start coming down, the lending segment should get a nice boost. As it is, even with the slowdown, there are encouraging results. Total loan products increased 19% over last year in the second quarter with a 22% increase in origination volume. As the housing industry rebounds, which could take a while, mortgages in particular should begin to accelerate.

The market is already sensing this, and SoFi stock is up 16% over the past month. If you have a strong risk tolerance, this looks like a good opportunity to buy shares on the dip; it isn’t likely to last much longer. If you have even a small appetite for some risk, you might want to take a small position at this price.

Should you invest $1,000 in SoFi Technologies right now?

Before you buy stock in SoFi Technologies, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and SoFi Technologies wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $722,320!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 16, 2024

Jennifer Saibil has positions in SoFi Technologies. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

Is SoFi Stock a Buy? was originally published by The Motley Fool

Zuckerberg Tells His Daughter She Can't Be Like Taylor Swift: 'You Can't Do It, That's Not Available To You'

In a recent podcast interview, Facebook founder Mark Zuckerberg shared his parenting philosophy, emphasizing the importance of individuality over fame.

What Happened: Zuckerberg recounted a conversation with his 7-year-old daughter August Chan Zuckerberg, where he encouraged her to aspire to be herself rather than a celebrity. This discussion was prompted by her desire to be like Taylor Swift.

According to a report by Business Insider, Annie Wright, a therapist who works with affluent parents, praised Zuckerberg’s advice. She noted that parents often grapple with their children’s growing desire to become influencers. Wright urges parents to help their children cultivate a strong sense of self-worth and individuality, instead of pursuing popularity.

According to the outlet, Zuckerberg said in the interview, “I was like, ‘But you can’t. That’s not available to you. And she thought about it and she’s like, ‘Alright when I grow up I want people to want to be like August Chan Zuckerberg, and I was like, ‘Hell yeah. Hell yeah.’”

Wright also highlighted that children from high-achieving families often experience intense pressure to succeed, leading to feelings of inadequacy. She promotes the idea of parents downplaying goals like fame and having open dialogues about its drawbacks.

Also Read: Elon Musk’s Ex-Girlfriend Grimes Says Mark Zuckerberg ‘Wildly Under Qualified’ To Run Metaverse

“His advice to his daughter to aspire to be herself, not Taylor Swift or some other icon, I do think it’s an important reminder for all parents,” Wright told the outlet.

Part of Zuckerberg’s parenting strategy includes assigning chores to his children, a practice Wright believes is an effective way to teach vital life skills, particularly in affluent families.

She stated, “Chores create an understanding that rewards come from effort, not entitlement.”

Why It Matters: Zuckerberg’s parenting approach offers a unique perspective in a society where fame and celebrity status are often glamorized. His advice underscores the importance of self-worth and individuality, values that can help children navigate the pressures of growing up in high-achieving families.

Furthermore, his emphasis on chores as a means to teach life skills provides a practical approach to parenting that encourages effort and discourages entitlement.

This advice is particularly relevant in today’s digital age, where the allure of becoming an influencer can often overshadow the importance of personal growth and self-discovery.

Read Next

Big Tech’s Security Spending Spree: Zuckerberg Leads In Lavish Security Measures

This content was partially produced with the help of Benzinga Neuro and was reviewed and published by Benzinga editors.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Controversial Ally Mark Robinson Absent From Donald Trump Rally In Pivotal North Carolina

Donald Trump returned to North Carolina on Saturday to campaign in Wilmington, a key battleground in the upcoming November election.

However, he was without Lt. Gov. Mark Robinson, the GOP gubernatorial nominee and one of Trump’s primary supporters in the state, reported AP News.

A CNN report on Thursday regarding Robinson’s inflammatory remarks about race, gender, and sexual orientation has left the Republicans scrambling.

As per the CNN report, Robinson commented on a pornography website’s message board, where he self-identified as a “Black Nazi” and expressed a desire for the return of slavery.

Democrats, on the other hand, are highlighting Robinson’s connections to other candidates, including Trump, who has previously praised the North Carolina lieutenant governor.

Robinson was not scheduled to attend the Wilmington event, said AP News, citing two individuals with knowledge of the situation, who requested anonymity.

Although Robinson secured victory in his GOP gubernatorial primary back in March, he has fallen behind Democratic nominee Josh Stein, the state attorney general, in several recent polls.

State Republican leaders continue to support Robinson, but his choice to persist with his campaign might jeopardize the GOP’s chances in other crucial races, including Trump’s efforts in a battleground state he has won twice before.

Trump has consistently expressed admiration for Robinson, a Black politician, calling him a figure reminiscent of Martin Luther King, but with added intensity. When endorsing Robinson prior to the GOP gubernatorial primary, Trump stated that he believes Robinson surpasses King in significance, AP News added.

While presidential candidates have focused more on the Rust Belt states like Pennsylvania, Michigan, and Wisconsin, both Trump and Harris have made several visits to North Carolina, underscoring the state’s significance.

After Biden exited the race in July, Trump organized his first major rally there, shifting his attention entirely toward Harris.

Read Next:

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

New York's Beleaguered Cannabis Equity Officer Resigns After Being Cleared Of Retaliation Claims

New York’s chief equity officer at the Office of Cannabis Management (OCM), Damian Fagon, resigned from his post, effective Nov. 27, despite being cleared of retaliation allegations.

According to GreenMarketReport, This decision follows months of controversy, beginning with his administrative leave in March after cannabis processor Jenny Argie accused Fagon of retaliating against her company.

See Also: New Yorkers In A Bind As Top-Shelf Cannabis Supply Falls Short, Could Home Cultivation Help?

Argie withdrew the lawsuit in July, which claimed that Fagon instigated a product recall after she criticized the OCM.

Exoneration And Transition

An investigation by the state’s inspector general found no merit to the accusations. In an email statement on Friday, OCM acting executive director Felicia Reid confirmed that the inspector general’s office had exonerated Fagon. Despite his clearance, Fagon opted to move on from the department.

“Mr. Fagon will be on leave and will focus solely on transitioning his equity portfolio to OCM leadership. This announcement comes after the conclusion of the NYS Inspector General investigation, which resulted in a determination that the allegations were unsubstantiated,” Reid said.

“I know that Mr. Fagon has done tremendous work leading OCM’s equity efforts, setting up OCM to take the most innovative and equity-driven approach to the development of New York’s cannabis industry. I am thankful to him for his time and talent. I wish him well and great success in his future endeavors,” Reid added.

Fagon significantly spearheaded New York’s cannabis equity program, working to ensure that marginalized communities, disproportionately impacted by previous marijuana laws, were included in the industry’s growth.

OCM Leadership In Flux

The OCM itself is undergoing significant leadership changes. Fagon’s resignation comes on the heels of former executive director Chris Alexander‘s departure in May, with Reid serving as interim executive director following an appointment by Governor Kathy Hochul.

OCM is actively searching for a permanent replacement for Alexander, but how the equity program will move forward without Fagon at the helm remains uncertain.

Read Next:

Cover image made with AI.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

SEC Greenlights Options Trading For BlackRock's Spot Bitcoin ETF, Offering New Hedge For Institutional Investors

The U.S. Securities and Exchange Commission (SEC) has given the green light for the listing and trading of options for BlackRock Inc.’s BLK spot Bitcoin BTC/USD exchange-traded fund (ETF).

What Happened: The approved options will be listed on the Nasdaq under the ticker symbol “IBIT.” This move allows institutional investors and traders to hedge their exposure to bitcoin more efficiently.

Options trading provides a cost-effective way to amplify exposure to bitcoin, offering an alternative method for managing investments in the world’s largest cryptocurrency. The approval marks another significant step for cryptocurrency, which has been gaining mainstream acceptance.

Earlier this year, bitcoin ETFs were launched, bringing the asset class closer to widespread adoption. Options give holders the right to buy or sell an asset at a predetermined price by a set date, adding flexibility to investment strategies.

Exchanges began applying for spot bitcoin ETF options as soon as it became evident that the SEC would approve the underlying ETFs in January. The SEC oversees the technical rule changes required for exchanges to list options and confirmed that existing surveillance procedures will apply to IBIT options.

Why It Matters: The approval of Bitcoin ETF options comes at a time when the cryptocurrency market is showing signs of strength. Analysts have projected Bitcoin to reach $65,000 in the near term, citing increased long positions and bullish options activity. This positive market sentiment is further bolstered by the SEC’s recent approval, which is likely to attract more institutional investors to the crypto space.

Moreover, the outcome of the 2024 election could have a significant impact on Bitcoin’s price, according to a Bernstein report. A Trump victory could potentially propel Bitcoin to new heights, reaching $80,000 to $90,000 by the end of Q4, while a Harris win could see Bitcoin retreating to the $30,000 to $40,000 range. The approval of Bitcoin ETF options, therefore, adds another layer of intrigue to the potential impact of the election on the cryptocurrency market.

Read Next: Elon Musk Says Warren Buffett Is Positioning For Kamala Harris Win With His $277B Cash Pile

This content was partially produced with the help of Benzinga Neuro and was reviewed and published by Benzinga editors.

Image: Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Brace For Stagflation After Fed's Benevolence, Warns Analyst, Raising 5 Corporate Red Flags: 'Inflation Is Transitory Mistake All Over Again'

The Federal Reserve announced Wednesday a deep 50 basis-point cut to its Fed funds rate, which is likely to ease the pressure on consumers. An analyst, however, sees a return of recession along with stagnation.

What Happened: “Get ready for stagnation,” said GLJ Research’s Gordon Johnson, adding that, this is the “inflation is Transitory” mistake all over again. To make his case, he noted four corporate announcements suggesting the near could be challenging.

China Drags Skechers: Skechers U.S.A., Inc. SKX, which designs, manufactures and distributes footwear, sees softness in China’s business. CFO John Vandemore said, at the Wells Fargo Consumer Conference, “We’ve definitely seen worse conditions unfold in China than we expected for the back half of the year, so I would expect the back of the year’s going to be more disappointing than what we had originally thought.” The shares reacted with a sharp tumble on Thursday, settling down 9.62% to $61.56

Rough Road For Mercedes-Benz: Also German automaker Mercedes-Benz Group AG MBGAF late Thursday said its 2024 earnings before interest and taxes will likely come in “significantly below” the previous year, citing a further deterioration in the macroeconomic environment, mainly in China. The automaker also said it expects its adjusted return on sales to be between 7.5% and 8.5%, down from its earlier forecast of 10% to 11%. The company’s shares listed on the Frankfurt exchange fell nearly 7%.

See Also: Best Depression Stocks

FedEx Doesn’t Deliver: Package-shipping company FedEx Corp. FDX reported first-quarter earnings that fell year-over-year and missed expectations. The company reduced the high end of the full-year adjusted operating income guidance. The predicament was blamed on circumspect consumers favoring cheaper services over pricey and speedier options. The stock fell over 13% in premarket trading on Friday.

Lennar’s Underwhelming Quarter: Homebuilder Lennar Corp. LEN reported roughly 8% revenue growth to $9.42 billion and earnings per share were up 10% but the average sales price of houses fell.

More Cuts At Warner Music: Entertainment and record-label company Warner Music Group Corp. WMG said Thursday it plans to reduce its workforce by about 750 employees, representing 13% of its total headcount, more than the 10% expected earlier.

R-Word Still Floats Around: Chief Global Strategist of BCA Research Peter Berezin said in an X post that the 50 basis-point cut and another 50 bps reduction the central bank is penciling in before the year-end may not ensure a soft landing. He pointed out to the previous two rate-cut cycles when recession followed following 100 basis-point cuts.

The SPDR S&P 500 ETF Trust SPY, an exchange-traded fund that tracks the S&P 500 Index, fell 0.26% to $567.76, according to Benzinga Pro data. The ETF, however, is up nearly 21% so far this year.

Read Next:

Image Via Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trump Ally Sarah Huckabee Sanders Jabs Kamala Harris For Not Having Biological Children: "Doesn't Have Anything Keeping Her Humble!"

In a surprising jab at Kamala Harris during a town hall for Trump in Flint, Michigan, Arkansas Gov. Sarah Huckabee Sanders (R) asserted that Harris lacks the grounding influences that only biological children can provide.

Sanders recounted a moment when her own daughter innocently commented on her appearance, highlighting how her kids help keep her humble, reported Politico.

“Unfortunately, Kamala Harris doesn’t have anything keeping her humble,” Sanders said.

The narrative reignited the “childless cat lady” narrative linked to Donald Trump‘s campaign, jabbing Harris for not having biological children.

In July, Republican vice-presidential nominee Sen. JD Vance clarified his 2021 remark about “childless cat ladies,” asserting that he was not targeting individuals without children but rather was criticizing Democrats for their “anti-family and anti-kid” policies.

This clarification, given on Megyn Kelly’s SiriusXM podcast, followed the viral reappearance of a video where Vance questioned some Democrats, including Harris, for not having biological children, despite Harris having two stepchildren.

Harris is a stepmother to two children from her husband, Doug Emhoff, and his family, including his ex-wife, has praised her parenting role with his now-adult kids.

Meanwhile, regarding Sanders’ latest comments, even Bryan Lanza, a senior adviser for Trump’s campaign, interpreted Sanders’ comment in this context, joining fellow panelists on CNN to denounce the remark.

“I found that comment to be actually offensive. I don’t know what more to say about that,” Lanza said. “I’m disappointed in Sarah saying that.”

Earlier this year, Sanders caught media headlines for making a bold prediction about the upcoming 2024 presidential election, foreseeing a significant victory for Trump.

Sanders stated that Trump has maintained his front-runner status since the beginning of his campaign and is likely to secure a substantial victory in November.

“I fully expect that he’s’ gonna win, and win big in November,” Sanders said, The Hill reported in June quoting her in an appearance on Fox News’s “America’s Newsroom.”

Read Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.