MFC Stock Near 52-Week High: Should You Buy or Wait for a Pullback?

Shares of Manulife Financial Corporation MFC closed at $28.87 on Thursday, near its 52-week high of $28.89. A strong-performing Asia business, expanding Wealth and Asset Management business and a solid capital position are driving the stock price higher.

The company is one of the three dominant life insurers within its domestic Canadian market and possesses rapidly growing operations in the United States and several Asian countries. Earnings grew 4.9% in the last five years, better than the industry average of 4.6%.

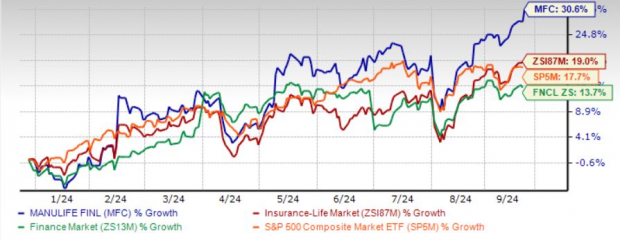

Shares have rallied 30.6% year to date, outperforming the industry’s increase of 19%, the Finance sector’s increase of 13.7% and the S&P 500 composite’s rise of 17.7%.

MFC Outperforms Industry, Sector, S&P 500 YTD

Image Source: Zacks Investment Research

MFC shares are trading well above the 50-day moving average, indicating a bullish trend.

MFC’s Return on Equity

Manulife’s return on equity (ROE) for the trailing 12 months is 16.2%, better than the industry average of 15.5%. This reflects Manulife’s efficiency in utilizing shareholders’ funds. It expects to generate a ROE of more than 18% by 2027.

Optimistic Growth Outlook

The Zacks Consensus Estimate for 2024 and 2025 earnings per share is pegged at $2.72 and $2.86, respectively, suggesting an increase of 5.8% and 5.2% year over year. The long-term earnings growth rate is currently pegged at 10%. Manulife expects core EPS growth of 10-12% over the medium term.

Factors Favoring MFC

Manulife’s Asia business continues to be a major contributor to earnings. Asia has been the fastest-growing insurance segment, supported by strong volume growth and attractive margins. This market appears attractive, given its changing demographics. MFC now expects core earnings from Asia to contribute 50% to overall earnings by 2027.

As part of its strategic priorities, Manulife is also investing in high ROE and growth segments in North America. The company’s highest potential businesses, including operations in Asia, Global WAM, Canada group benefits and behavioral insurance products, currently contribute two-thirds to core earnings. The insurer now looks to increase it to 75% and thus is expediting growth in these highest potential businesses.

In tandem with the wave of digitalization going on, MFC is digitalizing and automating workflows through GenAI and advanced analytics. Accelerated digitalization should help it achieve an expense efficiency ratio of less than 45% in the medium term.

Manulife has been strengthening its balance sheet by improving liquidity and leverage. It targets a leverage ratio of 25%. Notably, its free cash flow conversion has remained more than 100% over the last many quarters, reflecting its solid earnings.

The life insurer, banking on consistent cash flow, hiked dividends at a six-year CAGR of 10% and targets a 35-45% dividend payout over the medium term.

Concerns Regarding MFC

Despite the upside potential, there are a few factors that investors should keep an eye on.

Manulife targeted an expense efficiency ratio of less than 50% or $1 billion in cost savings and avoidance. It is on track to deliver an efficiency ratio of less than 45% in the future. However, its net margin has been contracting over the last six quarters.

Manulife draws a substantial portion of its earnings from the international market, which makes its profitability vulnerable to foreign exchange losses. In an attempt to lower its forex exposure, the company has started incurring hedging costs.

Though the leverage has been gradually improving, times interest earned has been declining.

The return on invested capital in the trailing 12 months was 0.66%, comparing unfavorably with the industry average of 0.68%, reflecting the insurer’s inefficiency in utilizing funds to generate income.

MFC Shares Expensive

MFC shares are trading at a price-to-earnings multiple of 10.23, higher than the industry average of 8.40.

Shares of other insurers like Sun Life Financial SLF and Aflac Incorporated AFL are trading at a multiple higher than the industry average.

Parting Thoughts

MFC’s focus on building a high-growth, high-return and high cash generation company, wealth distribution to shareholders and ROE expansion instills confidence in this Zacks Rank #3 (Hold) insurer.

However, given the stock’s premium valuation, it will be wise for new investors to wait for a better entry point.

Investors who already hold MFC stock should retain it, given its growth prospects.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Leave a Reply