Moderna Unusual Options Activity For September 20

Financial giants have made a conspicuous bearish move on Moderna. Our analysis of options history for Moderna MRNA revealed 22 unusual trades.

Delving into the details, we found 31% of traders were bullish, while 54% showed bearish tendencies. Out of all the trades we spotted, 13 were puts, with a value of $4,197,475, and 9 were calls, valued at $516,749.

What’s The Price Target?

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $50.0 to $120.0 for Moderna over the last 3 months.

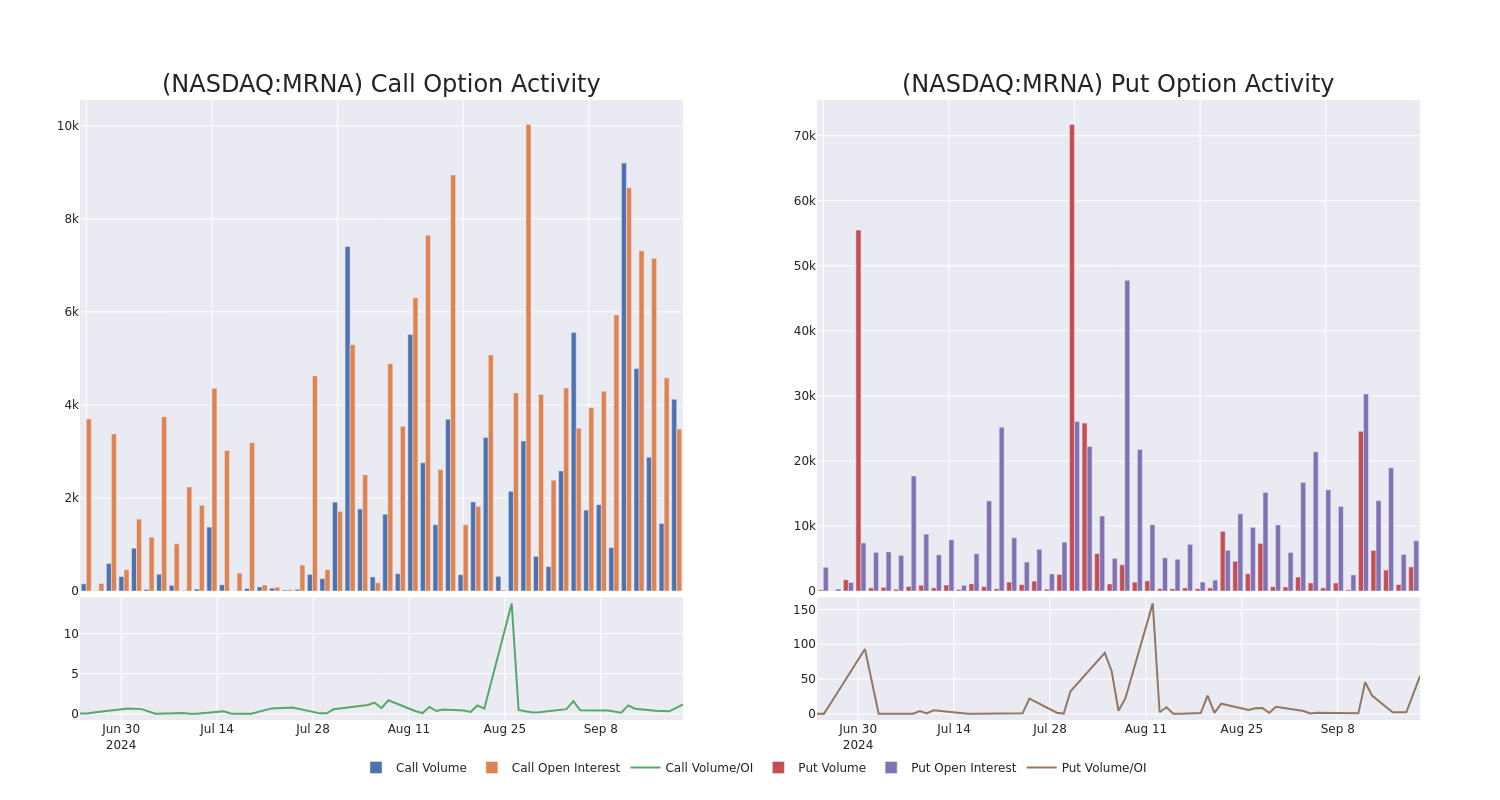

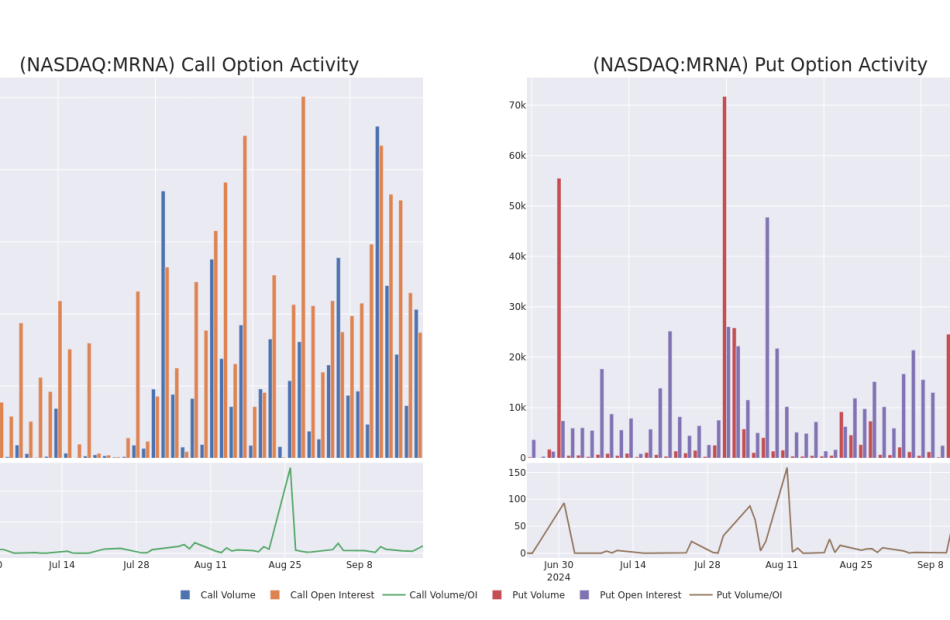

Analyzing Volume & Open Interest

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Moderna’s options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Moderna’s whale trades within a strike price range from $50.0 to $120.0 in the last 30 days.

Moderna Option Volume And Open Interest Over Last 30 Days

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| MRNA | PUT | SWEEP | BEARISH | 03/21/25 | $55.0 | $54.25 | $54.5 | $120.00 | $1.3M | 46 | 752 |

| MRNA | PUT | SWEEP | BEARISH | 03/21/25 | $55.0 | $54.75 | $55.0 | $120.00 | $1.0M | 46 | 952 |

| MRNA | PUT | SWEEP | BEARISH | 03/21/25 | $54.15 | $54.1 | $54.15 | $120.00 | $552.3K | 46 | 102 |

| MRNA | PUT | SWEEP | BULLISH | 03/21/25 | $54.05 | $54.0 | $54.05 | $120.00 | $502.6K | 46 | 272 |

| MRNA | PUT | TRADE | BEARISH | 12/18/26 | $19.05 | $16.6 | $18.45 | $65.00 | $276.7K | 104 | 150 |

About Moderna

Moderna is a commercial-stage biotech that was founded in 2010 and had its initial public offering in December 2018. The firm’s mRNA technology was rapidly validated with its covid vaccine, which was authorized in the United States in December 2020. Moderna had 40 mRNA development candidates in clinical development as of September 2024. Programs span a wide range of therapeutic areas, including infectious disease, oncology, cardiovascular disease, and rare genetic diseases.

Having examined the options trading patterns of Moderna, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Current Position of Moderna

- Trading volume stands at 12,030,554, with MRNA’s price down by -3.43%, positioned at $65.69.

- RSI indicators show the stock to be may be oversold.

- Earnings announcement expected in 41 days.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Moderna options trades with real-time alerts from Benzinga Pro.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Leave a Reply