1 Top Cryptocurrency to Buy Before It Soars 6,200%, According to Cathie Wood of Ark Invest

It’s no secret that Bitcoin (CRYPTO: BTC) is capable of some truly eye-watering returns. Unfortunately, unless you were aware of the relatively obscure phenomenon in its earliest days, you may have missed the boat on gains in the ballpark of, say, 30,000% in a year like the one you saw from the summer of 2010 to the summer of 2011. But that doesn’t mean Bitcoin is done delivering serious growth.

Cathie Wood, the maverick head of Ark Invest and outspoken Bitcoin advocate, definitely believes the cryptocurrency has a long way to go. Wood is not shy about making bold predictions when it comes to Bitcoin’s future. Her latest sets a target of $3.8 million by 2030. That’s more than a 6,200% return from today’s price and a compound annual growth rate (CAGR) of about 130%.

$3.8 million is the best-case scenario for Cathie Wood, not the most likely

To be clear, Wood and her firm have laid out several targets and $3.8 million is the best-case, most bullish scenario. At the other end of the spectrum, Wood set a bear case target of just under $260,000, while her base case — albeit one that she describes as conservative — is nearly $700,000. Those would still both be great returns that far exceed what can generally be expected from other asset classes.

Over the last decade, the S&P 500 — a useful proxy for the broader stock market — returned an average of 12%, while gold returned just 5%. Of course, past performance is never a predictor of future performance, but it’s useful to have some historical context.

Here’s what would have to happen to hit Cathie Wood’s Bitcoin price target

Wood sees several possible sources of Bitcoin’s growth. Her single biggest factor is the view that Bitcoin is a digital form of gold. It’s becoming a store of value that can be used to hedge against inflation and currency devaluation. She sees a shift in sentiment. Bitcoin is moving from a speculative investment to a vehicle of wealth protection, pointing to the banking crisis of 2023 that saw a surge in money moving into Bitcoin. During times of crisis and uncertainty, people tend to move money out of what they see as risky assets and into safer ones.

Another major driver is institutional adoption. This was an important shift in the market over the last five years as major financial firms like BlackRock and Goldman Sachs began adding Bitcoin to their balance sheets. This trend is growing. Nearly 40% of international investors had at least some exposure as of last year, up from 31% in 2022, and the recent approval of spot Bitcoin ETFs, like Wood’s own ARK 21Shares Bitcoin ETF, is further accelerating the trend.

In her bear case, these are the only major factors. However, in the base case, additional drivers like adoption as a currency in emerging markets, use by global high-net-worth investors worried about asset seizure, use as a bank settlement network, and a few other factors, all help to boost the figure.

Her $3.8 target would require all of these with an especially aggressive buy-in from institutional investors. She believes if the firms, on average, allocate 5% of their portfolios to Bitcoin, it would be enough to drive the price all the way to $3.8 million.

So, is Cathie Wood’s Bitcoin target reasonable?

I will say that although it is certainly possible, the bull case is a pretty aggressive target and not particularly likely in my view. While 5% of global institutional capital being invested in Bitcoin might not seem like much, keep in mind that the vast majority of that capital is invested in stock-style equities and fixed-income assets like bonds. “Alternatives,” an umbrella term that includes everything from private equity to real estate, accounts for just 7%.

Meanwhile, while it’s difficult to put an exact number on it, 55% of the biggest institutional investors have less than 1% of their assets in Bitcoin today. That’s where most of the financial market’s capital is concentrated. Sixteen percent have no Bitcoin to speak of. It would represent a fairly seismic shift in institutional behavior to reach 5% by 2030 from this rock-bottom level of crypto interest.

That being said, I do think institutional buy-in will continue to grow, reaching a level that is more in line with Wood’s bear or even base cases, 1% and 2.5%, respectively. Most firms say they are looking to expand their Bitcoin investments in the years to come and as that trend continues, more risk-averse players will begin to dip in their toes. Regardless of the specific target Bitcoin reaches, I agree with Wood that Bitcoin is likely to far exceed the broader market in the years ahead.

Should you invest $1,000 in Bitcoin right now?

Before you buy stock in Bitcoin, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Bitcoin wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $722,320!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 16, 2024

Johnny Rice has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Bitcoin and Goldman Sachs Group. The Motley Fool has a disclosure policy.

1 Top Cryptocurrency to Buy Before It Soars 6,200%, According to Cathie Wood of Ark Invest was originally published by The Motley Fool

Meihua International Medical Technologies Co., Limited Reports Unaudited 2024 First Half Financial Results

YANGZHOU, China, Sept. 20, 2024 /PRNewswire/ — Meihua International Medical Technologies Co., Ltd. (“MHUA” or the “Company”) MHUA, a reputable manufacturer and provider of Class I, II, and III disposable medical devices with operating subsidiaries in China, today reported its unaudited financial results for the six months ended June 30, 2024. All amounts below are in U.S. dollars.

First Half 2024 Unaudited Financial Metrics:

- Revenues was approximately $45.3 million for the six months ended June 30, 2024.

- Gross profit was approximately $15.2 million for the six months ended June 30, 2024.

- Gross margin was approximately 33.5% in the six months ended June 30, 2024.

- Income from operations was approximately $5.9 million for the six months ended June 30, 2024.

- Net income was approximately $4.7 million for the six months ended June 30, 2024.

Mr. Yongjun Liu, Chairman of the Company, commented, “In the first half of 2024, we have been actively transitioning toward the high-end medical device industry, which is reflected in our financial results. Our total revenue for the first half of 2024 was $45.3 million, with a gross profit of $15.2 million and a gross margin of 33.5%. Given the overall economic slowdown during this period, we are pleased with these results. While these headwinds have impacted our short-term profit, they underscore the need to strengthen our operational resilience and focus on long-term sustainability. Currently, we are actively optimizing our product mix, increasing our focus on high-margin, high-quality consumables, and expanding our premium medical products portfolio. At the same time, we are reinforcing our upstream and downstream supply chains with the goal of achieving greater efficiency. The integration of AI capabilities not only drives innovation and operational improvements within our company but also enhances the products we deliver to business partners, positioning us to offer advanced, intelligent solutions across the market. In particular, our Speed Fox warehouse management and logistics platform was launched in May, and we participated in the world’s second-ever remote robotic lobectomy in July.”

“In addition, the construction of our integrated medical industrial park in Hainan is progressing well, and we expect it to further support our long-term growth objectives. We are confident this project, along with our other innovations and developments, will enhance our competitiveness and set a strong foundation for future financial performance.”

“In line with our confidence in the Company’s long-term prospects, we have initiated a $3 million share repurchase plan, reflecting our belief in the underlying value of our business. This decision underscores our commitment to creating shareholder value while maintaining a disciplined approach to capital allocation. Despite the short-term hurdles, we believe we are well-positioned to navigate this period of uncertainty and build sustainable growth in the coming quarters.”

First Half 2024 Unaudited Financial Results:

Revenues

Revenues decreased slightly by approximately $2.9 million, or 5.9% to approximately $45.3 million for the six months ended June 30, 2024, from approximately $48.2 million in the same period of fiscal year 2023. The decrease in revenues was primarily driven by a decline in demand for customer orders, which we attributed to the stalling recovery of China’s economy.

Cost of revenues

Cost of revenues primarily included the cost of materials, direct labor expenses, overhead, and other related incidental expenses that are directly attributable to the Company’s principal operations. Cost of revenues decreased by approximately $0.9 million, or 2.8%, to approximately $30.2 million for the six months ended June 30, 2024, from approximately $31.0 million in the same period of fiscal year 2023. The decrease was generally in line with the decrease in revenue except for certain fixed costs such as lease expense and salary of administrative employees in our production department.

Gross profit and margin

Gross profit decreased by approximately $2.0 million, or 11.6%, to approximately $15.2 million for the six months ended June 30, 2024, from approximately $17.2 million in the same period of fiscal year 2023. Gross profit margin was 33.5% for the six months ended June 30, 2024, compared to 35.6% for the six months ended June 30, 2023. This decline was primarily due to certain fixed costs not decreasing proportionately with revenue, while other factors remained largely unchanged.

Operating costs and expenses

Our operating costs and expenses consist of selling expenses, general and administrative expenses, and research and development expenses.

-Selling

Selling expenses increased by approximately $40,000, or 1.2%, to approximately $3.2 million for the six months ended June 30, 2024, from approximately $3.2 million in the same period of 2023. The increase in selling expenses was mainly due to the market business development expenses increased.

1) Conference expenses increased by approximately $10,000, or approximately 2.4%, to $0.5 million for the six months ended June 30, 2024, from approximately $0.5 million for the six months ended June 30, 2023. Conference expenses are mainly related to the company’s market expansion, business development, business negotiation, medical expo, and exhibition affairs. These expenditures helped the Company promote its products, develop markets and channels, strengthen customer communication, and establish long-term and stable cooperative relations.

2) Transportation expenses decreased by approximately $20,000, or approximately 1.9%, to $1.1 million for the six months ended June 30, 2024, from $1.1 million for the six months ended June 30, 2023. The reduction in business travel was due to a decline in demand for customer orders.

3) Salary and benefits expenses decreased by approximately $30,000 or approximately 5.0%, to approximately $0.7 million for the six months ended June 30, 2024 from approximately $0.7 million for the six months ended June 30, 2023. The decrease was due to a decrease in the salary and benefits of the sales team, which was in line with revenue decrease.

4) Business development expenses amounted to approximately $0.6 million and $0.5 million for the six months ended June 30, 2024 and 2023, respectively.

5) Auto expenses increased by approximately $20,000 for the six months ended June 30, 2024. Other expenses mainly consisted of certification fees, depreciation expenses, express fees, communication fees and loading fees.

-General and administrative expenses

General and administrative expenses increased by approximately $50,000, or 1.5%, to approximately $3.5 million for the six months ended June 30, 2024, from approximately $3.5 million in the same period of fiscal year 2023. The increase was primarily due to service expenses increasing by approximately $0.2 million from $0.7 million for the six months ended June 30, 2023 to $0.9 million for the six months ended June 30, 2024 due to an increase in investment consulting fees.

– Research and development expenses

Research and development expenses remained at $1.5 million for the six months ended June 30, 2024, as compared to the same period of fiscal year 2023.

Income from operations

Income from operations was approximately $5.9 million for the six months ended June 30, 2024.

Net income

Net income was approximately $4.7 million for the six months ended June 30, 2024, as a result of the factors described above.

Recent developments

On June 26, 2024, the board of directors (the “Board”) of the Company approved and authorized the Company’s proposal to adopt a share repurchase plan of up to $3 million of the Company’s outstanding ordinary shares (the “Share Repurchase Plan”). Under the Share Repurchase Plan, Company management is authorized to purchase ordinary shares from time to time through open market purchases or privately negotiated transactions at prevailing prices as permitted by securities laws and other legal requirements, including Rule 10b-18 and Rule 10b5-1 under the Securities Exchange Act of 1934, as amended, as well as the Company’s insider trading policy, and subject to market conditions and other factors.

About Meihua International Medical Technologies Co., Ltd.

Meihua International Medical Technologies is a reputable manufacturer and provider of Class I, II and III disposable medical devices with operating subsidiaries in China. The Company manufactures and sells Class I disposable medical devices, such as HDPE bottles for tablets and LDPE bottles for eye drops, throat strips, and anal bags, and Class II and III disposable medical devices, such as disposable identification bracelets, gynecological examination kits, inspection kits, surgical kits, medical brushes, medical dressing, medical catheters, uterine tissue suction tables, virus sampling tubes, disposable infusion pumps, electronic pumps and anesthesia puncture kits, among other products which are sold under Meihua’s own brands and are also sourced and distributed from other manufacturers. The Company has received an international “CE” certification and ISO 13485 system certification and has also registered with the FDA (registration number: 3006554788) for over 20 Class I products. The Company has served hospitals, pharmacies, medical institutions and medical equipment companies for more than 30 years, providing over 800 types of products for domestic sales, as well as over 120 products which are exported to more than 30 countries internationally across Europe, North America, South America, Asia, Africa and Oceania.

For more information, please visit www.meihuamed.com.

Follow us on Webull: https://www.webull.com/quote/nasdaq-mhua.

Forward-Looking Statements

This press release contains forward-looking statements as defined by the Private Securities Litigation Reform Act of 1995. Forward-looking statements include statements concerning plans, objectives, goals, strategies, future events or performance, and underlying assumptions and other statements that are other than statements of historical facts. When the Company uses words such as “may,” “will,” “intend,” “should,” “believe,” “expect,” “anticipate,” “project,” “estimate” or similar expressions that do not relate solely to historical matters, it is making forward-looking statements. Forward-looking statements are not guarantees of future performance and involve risks and uncertainties that may cause the actual results to differ materially from the Company’s expectations discussed in the forward-looking statements. These statements are subject to uncertainties and risks including, but not limited to, the following: the Company’s ability to achieve its goals and strategies, and its ability to fully execute on the planned agreement, the Company’s future business development and plans of future business development, including its ability to successfully develop robotic assisted surgery systems and obtain licensure and certification for such systems, financial conditions and results of operations, product and service demand and acceptance, reputation and brand, the impact of competition and pricing, changes in technology, government regulations, fluctuations in general economic and business conditions in China, and assumptions underlying or related to any of the foregoing and other risks contained in reports filed by the Company with the U.S. Securities and Exchange Commission (“SEC”). For these reasons, among others, investors are cautioned not to place undue reliance upon any forward-looking statements in this press release. Additional factors are discussed in the Company’s filings with the SEC, including under the section entitled “Risk Factors” in its annual report on Form 20-F, as well as on Form 6-K and other filings, all of which are available for review at www.sec.gov. The Company undertakes no obligation to publicly revise these forward-looking statements to reflect events or circumstances that arise after the date hereof.

For investor and media inquiries, please contact:

IR Department

Email: secretary@meihuamed.com

Tel: +86-0514-89800199

Christensen

Yang Song

Email: yang.song@christensencomms.com

Tel: +86-010-59001548

![]() View original content:https://www.prnewswire.com/news-releases/meihua-international-medical-technologies-co-limited-reports-unaudited-2024-first-half-financial-results-302254551.html

View original content:https://www.prnewswire.com/news-releases/meihua-international-medical-technologies-co-limited-reports-unaudited-2024-first-half-financial-results-302254551.html

SOURCE Meihua International Medical Technologies Co., Ltd.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Where Will Apple Stock Be in 3 Years?

Apple (NASDAQ: AAPL) is the world’s most valuable company, with a market capitalization of almost $3.3 trillion. The popularity of the company’s iPhones played a central role in helping the tech giant reach this position. So it was not surprising to see Apple stock drop in price after TF International Securities analyst Ming-Chi Kuo pointed out that the demand for the company’s latest iPhones is not as strong as expected.

Kuo estimates that pre-orders of Apple’s latest iPhone 16 models are down nearly 13% year over year, with the first weekend’s sales estimated to come in at 37 million units. Apple touted this latest model as a significant change over previous iPhones because it’s the first to be artificial intelligence (AI)-enabled. But some doubters wonder if it was introduced too late. Samsung leads the generative AI smartphone market with a share of 36%, according to industry estimates, while Chinese manufacturers Xiaomi and Huawei control 22% and 13% share of this market, respectively.

Kuo’s report of lower pre-orders offers potential evidence that the doubters are right and it’s a cause for concern. However, a closer look at the reasons behind the reportedly poor start of the iPhone 16 lineup indicates that investors shouldn’t panic. It won’t be surprising to see Apple’s AI-enabled iPhones gradually gain sales momentum and help the stock deliver healthy gains over the next three years.

Apple investors need to be patient

The generative AI smartphone is in its early phases of growth, which is why investors shouldn’t start panicking based on just one weekend of sales data of Apple’s latest iPhones. According to market research firm IDC, shipments of generative AI smartphones are expected to hit 234 million units in 2024, an increase of a whopping 364% from last year.

Even then, generative AI smartphones are forecast to account for 19% of the global smartphone market this year, suggesting that their sales could keep growing at a tremendous pace in the coming years. IDC predicts that the generative AI smartphone market could clock a compound annual growth rate of 78% between 2024 and 2028, with shipments hitting 912 million units at the end of the forecast period. So it isn’t too late for Apple yet to make a dent in the generative AI smartphone market and witness an acceleration in growth in the future.

Another reason why the new iPhones are likely to get off to a slow start is that they won’t be running Apple Intelligence right out of the box. Apple’s suite of generative AI features will be first made available in U.S. English by way of a software update next month. Other English-speaking countries such as the U.K., Canada, Australia, New Zealand, and South Africa will join the list in December, while other languages such as French, Chinese, Spanish, and Japanese are likely to get Apple Intelligence next year.

As such, it is not surprising to see why customers may not be rushing to purchase the latest iPhone models at launch. However, the long-term opportunity for the company within the generative AI smartphone market remains intact, especially considering a sizable installed base of users in an upgrade window.

According to Counterpoint Research, there are 50 million iPhone 12 models that are currently in an upgrade window in the U.S. alone. Meanwhile, analyst Dan Ives of Wedbush estimates that around 300 million iPhones have not been upgraded in over four years. So, Apple could be sitting on a massive upgrade cycle that could help drive sales of the iPhone 16 and subsequent AI-enabled models.

That’s why investors would do well to look at the bigger picture instead of relying on one week of sales data. This is also the reason why analysts expect Apple’s growth to accelerate over the next couple of fiscal years.

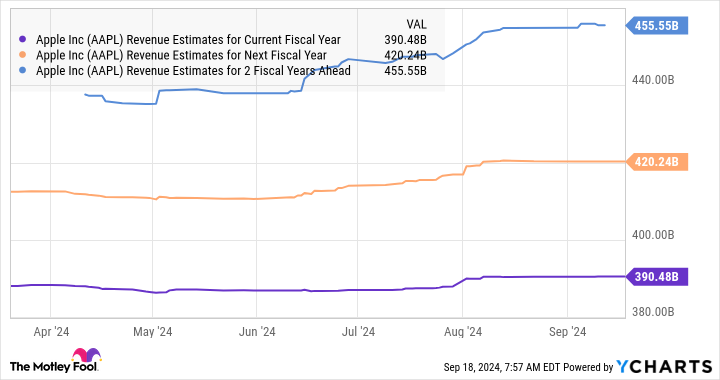

Apple is expected to generate just over $390 billion in revenue in the current fiscal year, which would be an improvement of less than 2% from its top line in fiscal 2023. However, the estimate for fiscal 2025, which will begin next month, suggests that the company’s revenue is on track to increase by almost 8%. The estimate for fiscal 2026 suggests that Apple is on track to maintain its revenue growth momentum.

Stronger earnings growth could send the stock higher over the next three years

The improvement in Apple’s top line is set to filter down to its bottom line as well. The company reported $6.13 per share in earnings in fiscal 2023, and the chart shows that its bottom line is on track to improve by 9% in fiscal 2024. However, the growth rate is set to improve over the next couple of years.

Assuming Apple’s earnings indeed jump to $8.39 per share after three years, and it trades at 33 times earnings at that time (in line with its current earnings multiple), its stock price could hit $277. That would be a 28% increase from current levels.

However, Apple stock could deliver stronger gains if the market decides to reward the company’s AI-powered growth with a richer earnings multiple, especially considering that it is currently trading at a discount to the U.S. technology sector’s average earnings multiple of 44.

So, Apple investors shouldn’t miss the forest for the trees, as the generative AI smartphone has a lot of room for growth, and the company already has a huge installed base of users that should help it start capitalizing on this lucrative opportunity.

Should you invest $1,000 in Apple right now?

Before you buy stock in Apple, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Apple wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $722,320!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 16, 2024

Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Apple. The Motley Fool has a disclosure policy.

Where Will Apple Stock Be in 3 Years? was originally published by The Motley Fool

Support For Taylor Swift's Get-Out-The-Vote Efforts Have Dropped 15 Points Since February Amid Super Bowl Conspiracy Theory

A recent survey revealed that more than half of voters back pop star Taylor Swift‘s initiative to encourage her fans to participate in this year’s election.

However, this support has dropped by 15 points since February, partly due to a conspiracy theory suggesting the Super Bowl was rigged, reported The Hill, citing the latest Monmouth University poll.

“Interestingly, support for the singer’s get-out-the-vote (GOTV) efforts were much higher seven months ago, when she was the subject of a debunked conspiracy theory around the election and the Super Bowl,” said Patrick Murray, director of the independent Monmouth University Polling Institute.

Swift has been recognized for directing a massive influx of over 330,000 visitors to vote.gov, following her public endorsement of Vice President Kamala Harris. This surge occurred less than 24 hours after Swift’s endorsement after the debate between Harris and former President Donald Trump.

However, the poll shows that 53% of voters support Taylor Swift’s efforts to encourage her fans to vote, while 35 percent disapprove, The Hill added. Additionally, 12% of respondents indicated that they were unsure.

“Republicans were wary of Swift all along. What we don’t know is whether this will have any effect on the part of her fan base who already leans right,” Murray added.

Swift is currently in a relationship with Kansas City Chiefs tight end Travis Kelce and was present at the team’s Super Bowl game against the San Francisco 49ers in Las Vegas. During that time, a conspiracy theory emerged suggesting that the game might be manipulated to benefit the Chiefs and maximize exposure for a potential Swift endorsement of President Biden.

No evidence supported this theory, nor had Swift made any endorsements at that point. However, Monmouth noted a significant decline in support for Swift’s voting initiatives following the conspiracy, the report added.

Despite Taylor Swift’s endorsement of the Democrats, an ABC News/Ipsos poll conducted earlier this week revealed that 81% of respondents believe her support for Kamala Harris will not affect their voting decisions.

Only 6% indicated they were more likely to vote for Harris due to Swift’s endorsement, while 13% said it made them less inclined to support the Democratic ticket, The Hill added.

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Read Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

The governments of Canada and Quebec announce the selection of a 24-social-and-affordable-housing-unit project in Thetford Mines

THETFORD MINES, QC, Sept. 20, 2024 /CNW/ – The Honourable Marie-Claude Bibeau, Minister of National Revenue and Member of Parliament for Compton–Stanstead, and Isabelle Lecours, Member of the National Assembly for Lotbinière–Frontenac and Parliamentary Assistant to the Quebec Minister of Education, are proud to announce a project with 24 housing units has been selected in the second call for projects of the Société d’habitation du Québec’s (SHQ’s) Programme d’habitation abordable Québec (PHAQ).

Project details:

City/Town: Thetford Mines

Name of project: Logéa Thetford

Project developer: Le Renaissance Développement

Number of housing units: 24

Client group: Families

The Government of Canada’s contribution comes through the Canada–Quebec Agreement under the Housing Accelerator Fund (HAF), by which Quebec has received $900 million from the federal government. The Government of Quebec also invested $900 million in new housing projects in the November 2023 economic update. The City of Thetford Mines is also a major financial partner for this project.

In response to the housing crisis, the governments of Canada and Quebec announced on February 16 that 2,574 new housing units will be quickly built across the province as part of 47 selected projects, including the one announced today. To ensure this project launches quickly, its developer must sign an agreement with a contractor within 12 months of being selected to remain eligible for PHAQ.

Quotes:

“Every Quebecer deserves a safe and affordable place to call home. The Government of Canada is proud to help create 24 new affordable housing units in Thetford Mines for the most vulnerable residents through the Canada-Quebec Agreement under the Housing Accelerator Fund. This demonstrates our unwavering commitment to ensuring that no one is left behind.”

The Honourable Sean Fraser, Minister of Housing, Infrastructure and Communities

“Thanks to the historic agreement we signed with the Government of Canada, we’re in a position to announce the construction of additional housing under the Programme d’habitation abordable Québec. This good news for Thetford Mines shows our firm commitment to boosting construction of affordable housing across Quebec. Every Quebecer deserves a home that meets their needs.”

France-Élaine Duranceau, Quebec Minister Responsible for Housing

“These new affordable units will provide seniors in the Thetford Mines area with a safe living environment designed to meet their needs. This is another great example of co-operation between community leaders and the various levels of government.”

The Honourable Marie-Claude Bibeau, Minister of National Revenue and Member of Parliament for Compton–Stanstead

“Our fellow citizens can count on our government to take concrete actions to tackle the housing crisis in our region. Today’s announcement shows what happens when we work together. I applaud our local partners and, of course, Le Renaissance Développement, which believes that affordable, social housing can contribute to a better quality of life in our community.”

Isabelle Lecours, Member of the National Assembly for Lotbinière–Frontenac and Parliamentary Assistant to the Minister of Education

“Considering that the vacancy rate is estimated at 0.3% in Thetford, the City must support actions that will provide new housing options for our residents. Like elsewhere in Quebec, demand for affordable housing continues to climb. We are therefore especially glad to be able to contribute to the Logéa project.”

Michel Verreault, Acting Mayor of the City of Thetford Mines

“Le Renaissance Group is proud to announce the construction of the Logéa Thetford project, which will include 24 affordable units, with the support of the SHQ, CMHC and the City of Thetford. Access to quality housing on a modest income has become an important issue. This project will give local people access to a comfortable unit without spending too much of their income on it, while contributing to the region’s economic vitality. Developing affordable housing on an exceptional site is a way for us to bring our values of caring, vitality and challenge to life.”

Vincent Fauteux, President, Le Renaissance Group

Highlights:

- To keep the other units affordable, a maintenance period for this assistance will be required. This period could last up to 35 years. Assistance rates will vary based on the term of the commitment. Rents may be indexed each year based on the percentages set by the Tribunal administratif du logement.

- The Programme d’habitation abordable Québec (PHAQ) aims to engage all partners who can develop affordable housing projects. Co-operatives, non-profits, housing bureaus and private-sector businesses can submit projects under the Program. The PHAQ also aims to accelerate residential construction, which is why its standards stipulate that projects must be started within 12 months of being selected.

- The Housing Accelerator Fund (HAF) is a $4-billion Government of Canada initiative launched in March 2023 that includes $900 million for Quebec. Its goal is to accelerate the construction of 100,000 additional housing units across the country.

- The Government of Quebec, as part of its fall 2023 economic update, also announced new investments of $900 million to accelerate housing construction.

- On December 11, 2023, the Government of Quebec announced the first wave of 14 projects from the PHAQ’s second call for projects (in French only), representing 999 units in total.

- The Government of Quebec is firmly committed to continuing its work to accelerate the construction of residential units in the province through the Act respecting land use planning and development and other provisions. Furthermore, the government will set up an interdepartmental project acceleration group in collaboration with Quebec municipal authorities, and it will also adopt new government directions on land use planning, including metrics for residential construction that municipalities will be required to use as a basis for setting targets. The government also intends to propose legislative amendments (which are being drafted and are subject to adoption by the National Assembly) aimed at improving urban densification and streamlining multi-unit construction approval to reduce the associated timelines.

About Canada Mortgage and Housing Corporation

As Canada’s authority on housing, Canada Mortgage and Housing Corporation (CMHC) contributes to the stability of the housing market and financial system, provides support for Canadians in housing need, and offers unbiased housing research and advice to all levels of Canadian government, consumers and the housing industry. CMHC’s aim is that by 2030, everyone in Canada has a home they can afford, and that meets their needs. For more information, follow us on Twitter, Instagram, YouTube, LinkedIn and Facebook.

About the Société d’habitation du Québec

As a leader in housing, the SHQ’s mission is to meet the housing needs of Quebecers through its expertise and services to citizens. It does this by providing affordable and low-rental housing and offering a range of assistance programs to support the construction, renovation and adaptation of homes, and access to homeownership.

To find out more about its activities, visit www.habitation.gouv.qc.ca/english.html.

SocietehabitationQuebec

HabitationSHQ

LinkedIn

SOURCE Canada Mortgage and Housing Corporation (CMHC)

![]() View original content to download multimedia: http://www.newswire.ca/en/releases/archive/September2024/20/c9357.html

View original content to download multimedia: http://www.newswire.ca/en/releases/archive/September2024/20/c9357.html

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Netflix, Eli Lilly Lead 5 Fast Growers Near Buy Points

Netflix (NFLX) and Eli Lilly (LLY) lead this weekend’s watch list of five stocks near buy points that are all enjoying rapid sales growth. In addition to Netflix stock and Eli Lilly, Interactive Brokers (IBKR), Shift4 Payments (FOUR) and Wingstop (WING) round out the list.

After a week in which a big Fed rate cut helped lift the S&P 500 to a record high, Netflix, Interactive Brokers, Shift4 and Wingstop stock are all flashing either a buy signal or early entry opportunity.

↑

X

Bulls Back In Charge As Powell Threads Needle; Constellation, Apple, Spotify In Focus

Wingstop and Interactive Brokers stock are both part of the flagship IBD 50 list. WING stock is on the watchlist for the IBD Leaderboard portfolio of elite stocks. Shift4 stock is on IBD Sector Leaders.

Be sure to read IBD’s The Big Picture column after each trading day to get the latest on the prevailing stock market trend and what it means for your trading decisions.

Netflix Stock

Netflix revenue growth has accelerated the past four quarters, going from 3% to 17%. That’s come as subscriber additions surged thanks to a crackdown on unpaid account sharing and the rollout of a lower-priced, advertising-supported service.

In Q2, Netflix added 8.05 million subscribers, trouncing forecasts for 4.53 million.

In August, Netflix said its second year of upfront negotiations with advertisers generated a 150% increase in ad sales commitments compared to last year.

Meanwhile, Netflix content costs have plateaued.

On Aug. 5, Jefferies reiterated its buy rating and 780 price target for NFLX stock, touting its “impressive content slate” and strong prospects of a price hike in Q4. The analysts noted that its latest price hike on the standard plan came in January 2022, while it offers the cheapest ad-supported plan among major players.

A day later, Disney increased prices for Disney+, Hulu and ESPN+, opening the door wider to a NFLX price hike.

NFLX rose 0.6% to 701.03 on the week, edging back above a 697.49 buy point from a cup base, according to a MarketSurge analysis. A week earlier, the streaming leader’s move off its 50-day moving average flashed an early entry.

Bulls Rule With Three Titans In Buy Areas; What To Do Now

Eli Lilly Stock

Eli Lilly has benefited from some rivals’ bad news recently. On Friday, Novo Nordisk (NVO) tumbled after its new approach to weight loss caused neuropsychiatric side effects.

Deutsche Bank analysts said the Phase 2a results for Novo remove a competitor to Eli Lilly’s orforglipron drug, which resulted in greater weight loss. The firm kept its buy rating and 1,025 LLY price target.

On Sept. 13, Citi analyst Peter Verdult resumed coverage of LLY with a buy rating and 1,060 price target, while noting that a rival oral GLP-1 drug from Roche (RHHBY) was dealt a setback from the prevalence of elevated heart rate and nausea.

Eli Lilly saw 38% sales growth last quarter.

LLY stock, after testing its 10-week and 50-day averages recently, darted past its 21-day exponential average on Friday’s Novo news, but settled for a mild 0.7% gain to 921.49.

A move past Friday’s intraday high of 939.86 could offer an early entry opportunity, confirming a break of the trendline sloping down from LLY’s recent plateau.

LLY has been consolidating for four weeks and ideally would forge a new base. For now, the consolidation since the Aug. 22 high of 972.53 could be treated as a high handle buy point.

Interactive Brokers Stock

The Fed news was mixed for Interactive Brokers and rivals. The company says a one-percentage-point rate cut by global central banks would cut net interest income by $307 million. On the other hand, a pivot to Fed rate cuts historically fuels further gains for the S&P 500.

For the month of August, the global electronic brokerage reported 2.712 million daily average revenue trades, up 40% from a year ago, though 2% below July’s total. Client equity rose 36% to $515.3 billion, while margin loan balances grew 30% to $54.9 billion.

IBKR rose 4.95% to 133.02 for the week, clearing a 128.98 handle buy point from a 15-week consolidation. The buy zone runs through 135.43.

IBKR has a 99 IBD Composite Rating out of a possible 99, according to IBD Stock Checkup. The rating combines a range of fundamental and technical factors.

Shift4 Stock

William Blair started coverage of Shift4 on Sept. 4 with an outperform rating, saying it’s capable of “steadily taking share” in the $12 trillion U.S. electronic payments market, while also expanding internationally.

Blair called Shift4 the “vertically integrated market leader” in serving professional sports and entertainment venues. Since then, the Miami Heat’s Kaseya Center joined its roster of more than 20 such facilities.

The research firm also sees its SkyTab point-of-sale solution taking share in the large hospitality and restaurant verticals.

Shift4 has averaged steady 30% revenue growth the past three quarters.

On Friday, Wells Fargo raised its Shift4 Payments price target to 95 from 75, keeping an overweight rating, anticipating an acceleration in organic growth in 2025, helped by synergistic opportunities from recent acquisitions.

FOUR rose 4.8% to 86.90 last week, clearing an 83.64 cup-with-handle buy point.

Wingstop Stock

On Monday, Wedbush raised its WING stock price target to 440 from 425, predicting 22% same-store sales growth in Q3 among franchised U.S. stores. That’s above the 20.6% consensus.

After Q2 results, Piper Sandler analyst Brian Mullan called sales trends “almost hard to believe.” Sales grew 45% to $155.7 million in the quarter as EPS surged 63% to 93 cents.

Wingstop had 2,352 restaurants at the end of June. In a CNBC Mad Money interview on Sept.10, CEO Michael Skipworth said Wingstop has “a ton of runway for brand awareness,” predicting the company would grow to 6,000 restaurants in the U.S. and 10,000 globally.

Wingstop stock rose 6.35% to 419.90 on the week, while flashing an early entry as it cleared 409.77, a short-term high.

WING has an official 431.03 buy point from a 12-week consolidation.

YOU MIGHT ALSO LIKE:

These Are The Best 5 Stocks To Buy And Watch Now

Join IBD Live Each Morning For Stock Tips Before The Open

IBD Digital: Unlock IBD’s Premium Stock Lists, Tools And Analysis Today

Election 2024: Why The S&P 500 May Vote No On A Trump Or Harris Clean Sweep

Why I’m not doing anything to cope with lower interest rates

How should a retail investor deal with Wednesday’s interest rate cut by the Federal Reserve and with the future rate cuts that seem to be on the horizon?

What I plan to do is nothing. Which may be what you should do too.

How can I say “do nothing” when the airwaves, print media, and the internet are filled with advice and suggestions — and warnings — about how to handle the Fed’s rate cut?

Let me show you why my wife and I aren’t planning to do anything about the rate cuts, which will reduce our interest income but not threaten our overall financial well-being. And why you may not want to do anything, either.

Here’s the deal. The Fed has cut the federal funds rate to between 4.5% and 4.75% from the former 5% to 5.25%. Fed Chairman Jerome Powell has made it clear that the Fed is planning at least one more rate cut this year.

8/29/24

The Fed controls only this short-term rate, but lowering it puts downward pressure on longer-term rates as well. That’s great, of course, for many of us, making it easier and cheaper to borrow. But it’s not great for savers. That’s because the income they get on their savings is going to decline.

Read more: The Fed rate cut: What it means for bank accounts, CDs, loans, and credit cards

We have significant cash holdings, which we keep in low-cost, high-quality money market funds. Our income from those funds, which has risen nicely over the past few years, is going to decline. But such is life.

Some people advise you to lock up yields by switching cash into long-term bonds or long-term certificates of deposit, whose interest rates are fixed and won’t fall because of the Fed’s rate cuts.

However, there’s a problem with doing that.

Locking up yields by buying long-term bonds or CDs makes your money illiquid. This exposes you to some long-term risks, such as having to sell at a loss if rates rise — which they will sooner or later, trust me —or if you need the cash that you’ve locked up long-term.

By contrast, if you’ve done what we have done — put our surplus cash into well-regarded, low-cost money market funds — your income will go down when the Fed’s rate cuts work their way through the financial system. But you’ve still got liquidity, the ability to access your cash on demand, which is very important.

The one thing that I won’t do — and that you shouldn’t do, either — is to put my money into a bank savings account, which typically pays yields approaching zero. The rates on those accounts aren’t likely to fall much, if at all, because they’re already so low.

So if you’ve got $3,000 or more of cash sitting in a bank savings account but don’t have a money fund account, you’ll probably do well to open an account in a low-cost, high-quality fund.

To be sure, unlike bank accounts, money funds aren’t backed by the Federal Deposit Insurance Corp. But there are plenty of high-quality, conservatively run low-cost funds. It’s a very competitive business, with $6.68 trillion in assets, according to Crane Data. They are highly unlikely to fail.

The most important thing for you to do now is to stay calm and remember that if you end up doing nothing to cope with lower interest rates, you’ll have plenty of company. Including me.

Update

Last July, I wrote a Yahoo Finance column with the headline, Warren Buffett is turning 94 next month. Should Berkshire investors start to worry? I said that Berkshire Hathaway stock had underperformed Admiral shares of Vanguard’s S&P 500 index fund since my wife and I bought Berkshire shares in January 2016.

Berkshire has since rallied and outperformed the S&P 500.

At Thursday’s market close, Berkshire was up 253% (15.6% a year) since we bought it. During that same period, the index fund has returned 242% (15.2% a year), according to Jeff DeMaso of the Independent Vanguard Adviser.

Score one for the Oracle of Omaha.

Allan Sloan, a contributor to Yahoo Finance, is a seven-time winner of the Loeb Award, business journalism’s highest honor.

Read the latest financial and business news from Yahoo Finance

Celebrity Property Portfolios Soar, With Bezos And Oprah Tied For The Top Spot

Jeff Bezos, Oprah Winfrey and Sandra Bullock top the list of celebrities with the highest number of properties in the U.S., each owning seven properties.

An analysis by real estate investment company SoCal homebuyers reveals that celebrity real estate portfolios are reaching new heights amid a growing trend of wealth diversification through property ownership.

Don’t Miss:

In terms of value, SoCal homebuyers found that Bezos’s portfolio is worth the most at $458.9 million, followed by Jay-Z and Beyoncé, who own five properties worth a total of $315.5 million.

“These celebrity portfolios offer valuable lessons for all investors,” SoCal homebuyers Co-Founder Doug Van Soest said. “While the scale is impressive, the underlying principles are universal. Diversification, location selection and long-term value appreciation are key, whether you’re investing millions or starting with a single property.”

Trending: Warren Buffett once said, “If you don’t find a way to make money while you sleep, you will work until you die.” These high-yield real estate notes that pay 7.5% – 9% make earning passive income easier than ever.

10 Celebrities With Highest Number Of Properties In U.S.

| Rank | Celebrity | Number of properties |

| 1 | Jeff Bezos | 7 |

| 1 | Oprah Winfrey | 7 |

| 1 | Sandra Bullock | 7 |

| 4 | Leonardo DiCaprio | 6 |

| 4 | Taylor Swift | 6 |

| 6 | George Lucas | 5 |

| 6 | Jay-Z and Beyoncé | 5 |

| 6 | Kim Kardashian | 5 |

| 9 | Kylie Jenner | 4 |

| 9 | Reese Witherspoon | 4 |

Source: SoCal homebuyers

Bezos’s portfolio includes a $165 million estate in Beverly Hills, California and a $78 million Hawaii resident property, reflecting his penchant for luxury and privacy. The Beverly Hills mansion, formerly owned by media mogul David Geffen, is on nine acres and boasts multiple buildings, a tennis court and a nine-hole golf course.

Trending: Will the surge continue or decline on real estate prices? People are finding out about risk-free real estate investing that lets you cash out whenever you want.

Winfrey‘s real estate investments range from a sprawling 66-acre estate in Montecito, California, to a ski home in Telluride, Colorado. Her California property, dubbed The Promised Land, features a 23,000-square-foot main house with many luxurious amenities. The Telluride ski house, valued at $14 million, offers mountain views and unique features like a 56-foot-long wine cellar.

Bullock’s diverse real estate portfolio includes homes in New Orleans, Southern California and Austin, Texas. Her $2.7 million Victorian home in the Big Easy’s Garden District showcases classic architectural details, while her lakefront home in Austin boasts modern design. Her Beverly Hills residence offers privacy in an exclusive gated community.

Trending: Oprah, Madonna and DiCaprio have turned to the alternative asset that is outperforming the S&P 500. Discover the potential of this market before other investors.

10 Celebrities With Highest-Value Property Portfolio In U.S.

| Rank | Celebrity | Total value paid for properties |

| 1 | Jeff Bezos | $458,900,000 |

| 2 | Jay-Z and Beyoncé | $315,450,000 |

| 3 | George Lucas | $196,100,000 |

| 4 | Mark Zuckerberg | $166,000,000 |

| 5 | Kim Kardashian | $115,100,000 |

| 6 | Taylor Swift | $92,750,000 |

| 7 | Ellen DeGeneres | $91,500,000 |

| 8 | Oprah Winfrey | $84,415,000 |

| 9 | Kylie Jenner | $66,750,000 |

| 10 | Madonna | $61,300,000 |

Source: SoCal homebuyers

“In our experience, successful real estate investment is about more than status – it’s about making informed decisions based on market trends and potential for growth,” Van Soest said. “Even in today’s dynamic market, real estate remains a powerful tool for building and preserving wealth when approached strategically.”

Read Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Check Out What Whales Are Doing With SNOW

Deep-pocketed investors have adopted a bearish approach towards Snowflake SNOW, and it’s something market players shouldn’t ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in SNOW usually suggests something big is about to happen.

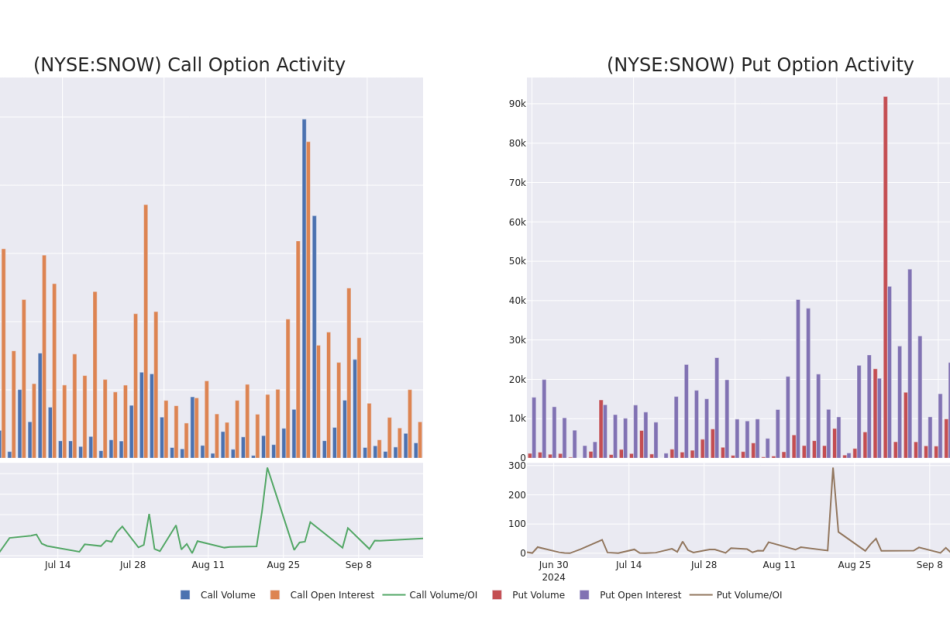

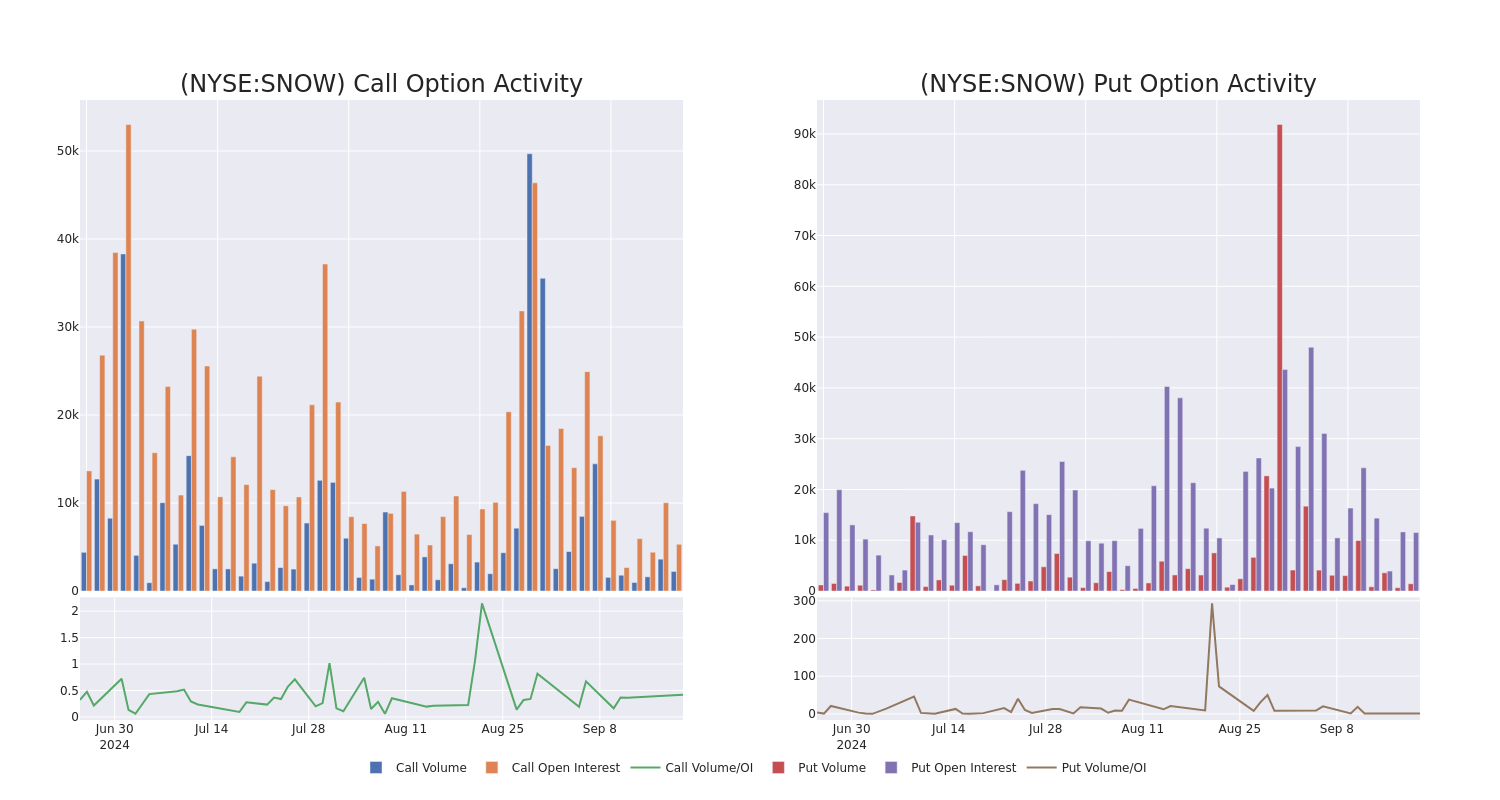

We gleaned this information from our observations today when Benzinga’s options scanner highlighted 14 extraordinary options activities for Snowflake. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 35% leaning bullish and 42% bearish. Among these notable options, 4 are puts, totaling $177,167, and 10 are calls, amounting to $773,215.

Projected Price Targets

After evaluating the trading volumes and Open Interest, it’s evident that the major market movers are focusing on a price band between $85.0 and $190.0 for Snowflake, spanning the last three months.

Analyzing Volume & Open Interest

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Snowflake’s options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Snowflake’s whale trades within a strike price range from $85.0 to $190.0 in the last 30 days.

Snowflake 30-Day Option Volume & Interest Snapshot

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| SNOW | CALL | TRADE | NEUTRAL | 11/15/24 | $4.25 | $4.15 | $4.2 | $120.00 | $210.0K | 2.9K | 737 |

| SNOW | CALL | TRADE | BEARISH | 12/20/24 | $12.0 | $11.9 | $11.91 | $110.00 | $178.6K | 714 | 457 |

| SNOW | CALL | SWEEP | NEUTRAL | 01/17/25 | $11.05 | $11.0 | $11.05 | $115.00 | $110.5K | 840 | 101 |

| SNOW | PUT | SWEEP | BEARISH | 06/20/25 | $6.45 | $6.3 | $6.45 | $85.00 | $76.7K | 2.4K | 119 |

| SNOW | CALL | TRADE | BULLISH | 12/20/24 | $11.5 | $11.35 | $11.5 | $110.00 | $57.5K | 714 | 164 |

About Snowflake

Founded in 2012, Snowflake is a data lake, warehousing, and sharing company that came public in 2020. To date, the company has over 3,000 customers, including nearly 30% of the Fortune 500 as its customers. Snowflake’s data lake stores unstructured and semistructured data that can then be used in analytics to create insights stored in its data warehouse. Snowflake’s data sharing capability allows enterprises to easily buy and ingest data almost instantaneously compared with a traditionally months-long process. Overall, the company is known for the fact that all of its data solutions that can be hosted on various public clouds.

Having examined the options trading patterns of Snowflake, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Snowflake’s Current Market Status

- With a trading volume of 6,314,299, the price of SNOW is down by -3.11%, reaching $110.47.

- Current RSI values indicate that the stock is is currently neutral between overbought and oversold.

- Next earnings report is scheduled for 68 days from now.

What Analysts Are Saying About Snowflake

In the last month, 5 experts released ratings on this stock with an average target price of $168.2.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* Maintaining their stance, an analyst from Rosenblatt continues to hold a Buy rating for Snowflake, targeting a price of $180.

* Maintaining their stance, an analyst from JMP Securities continues to hold a Market Outperform rating for Snowflake, targeting a price of $190.

* In a positive move, an analyst from HSBC has upgraded their rating to Hold and adjusted the price target to $121.

* An analyst from Needham has decided to maintain their Buy rating on Snowflake, which currently sits at a price target of $160.

* Maintaining their stance, an analyst from Canaccord Genuity continues to hold a Buy rating for Snowflake, targeting a price of $190.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Snowflake options trades with real-time alerts from Benzinga Pro.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Legionella Testing Market Size & Share to Surpass USD 742.5 million by 2034, Rising a CAGR 7.8%: Analysis by Transparency Market Research, Inc.

Wilmington, Delaware, United States, Transparency Market Research Inc. -, Sept. 20, 2024 (GLOBE NEWSWIRE) — Legionella testing industry (레지오넬라균 테스트 산업) revenues reached US$323.2 million in 2023. A CAGR of 7.8% is forecast from 2024 to 2034, resulting in US$ 742.5 million in 2034. Tests for legionella are an additional method of monitoring control measures designed to prevent legionella testing growth. Frequent testing permits the assessment of the effectiveness of the control measures and identifies any changes that may be required.

Testing for legionella contributes to water safety in places like homes, hospitals, and other buildings. Water systems detected with legionella bacteria can be cleaned and maintained to reduce the risk of Legionnaires’ disease. Internet of Things (IoT) devices and sensor technologies can monitor water systems’ temperature, pH, and disinfectant levels. Using IoT-enabled systems, proactive intervention can be made in the event of Legionella contamination.

As Legionella risk is assessed and managed, data analytics and predictive modeling methods will become more and more crucial. Predictive algorithms evaluate past data on environmental factors, water quality, and Legionella outbreaks to pinpoint high-risk sites and suggest targeted testing and preventative actions. Legislation and regulations governing legionella testing and management will likely change as more nations and areas introduce stricter legislation. Healthcare and hospitality organizations face high-risk environments, which will drive the need for testing services and solutions.

For More Details, Request for a Sample of this Research Report: https://www.transparencymarketresearch.com/legionella-testing-market.html

Key Findings of the Market Report

- Based on test type, the urinary antigen test (UAT) segment will likely drive demand for the legionella testing market.

- Clinical testing methods are expected to create a market for legionella testing market.

- The Asia Pacific exhibited significant growth and held a significant market share in 2023.

- A growing number of diagnostic laboratories is expected to create a market for legionella testing.

Global Legionella Testing Market: Growth Drivers

- The Legionella bacteria, which causes Legionnaires’ disease, can cause serious respiratory conditions and even death in susceptible people. Increasing cases of legionella in water systems have raised concerns about public health and safety, leading to routine Legionella testing as part of preventive measures. The demand for legionella testing services has increased due to educational programs, media coverage of outbreaks, and information sharing by health authorities.

- Globally, governments and regulatory agencies have enforced more stringent policies and standards concerning managing and avoiding legionella, particularly in high-risk environments, including hospitals, lodging establishments, and cooling towers.

- The need for testing services and solutions is driven by the requirement to regularly test and monitor water systems for legionella bacteria to comply with these requirements. Occupational health and safety standards dictate protective measures against exposure to dangerous substances, such as Legionella bacteria, in various industries.

Global Legionella Testing Market: Regional Landscape

- The demand for legionella testing is anticipated to be driven by Asia Pacific. The growing health industry and increasing infection control and patient care standards in Asia-Pacific countries have led to legionella testing in hospitals, clinics, and healthcare facilities. The use of legionella testing procedures and technology has risen as healthcare professionals prioritize preventing Legionnaires’ disease outbreaks.

- The Asia-Pacific region’s governments are placing more emphasis on public health campaigns and legislative measures aimed at preventing aquatic illnesses like Legionnaires’ disease. In multiple sectors, such as healthcare, hospitality, and industry, legionella testing is mandated as a compliance requirement.

- Increasing public awareness of legionella pollution and advancements in testing technologies have increased legionella testing in Asia-Pacific. Public, corporate, and government awareness of proactive testing and mitigation techniques is increasing.

- Increasing pollution problems and water scarcity in many Asian-Pacific countries have raised concerns about water safety and purity. Legionella testing services can benefit from ongoing expenditures in infrastructure development, such as distribution networks, industrial facilities, and water treatment plants.

- To reduce the danger of legionella contamination and guarantee regulatory compliance, these projects frequently need thorough water management planning and testing procedures.

Global Legionella Testing Market: Competitive Landscape

For companies operating in legionella testing, developments in rapid antigen tests and advancements in healthcare sectors are creating lucrative opportunities.

Market leaders are developing advanced treatments to meet the needs of customers and enhance their product portfolios. As a result, they are adopting various strategies to expand their business operations worldwide.

Key Players

- IDEXX Laboratories Inc.

- Becton, Dickinson and Company

- Thermo Fisher Scientific Inc.

- Bio-Rad Laboratories Inc.

- bioMérieux Inc.

- Qiagen

Key Developments

- IDEXX Laboratories Inc.– specializes in diagnostic solutions for the animal, water, and veterinary industries. Legionella testing is only one of the water testing solutions they offer along with their veterinary diagnostics.

- Becton, Dickinson and Company (BD)– offers diagnostic equipment and reagents among its wide range of products. In addition to microbiology testing, they can also provide legionella testing solutions.

- Thermo Fisher Scientific Inc.– offers laboratory equipment, reagents, and services and is a leading life sciences company. In addition to microbiology and water testing, they offer various diagnostic solutions that could include legionella tests.

For Complete Report Details, Request Sample Copy from Here – https://www.transparencymarketresearch.com/legionella-testing-market.html

Global Legionella Testing Market: Segmentation

Test Type

- Culture Methods

- Urinary Antigen Test (UAT)

- Serology

- Direct Fluorescent Antibody Test (DFA)

- Nucleic Acid-based Detection

Application

- Clinical Testing Methods

- Environmental Testing Methods

End User

- Hospitals

- Diagnostic Laboratories

- Clinics

- Others

Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

More Trending Reports by Transparency Market Research –

Non-invasive Prenatal Testing Market (非侵襲的出生前検査市場) – The global Non-invasive Prenatal Testing Market is projected to advance at a CAGR of 14.8% from 2022 to 2031

Enteric Disease Testing Market (سوق اختبار الأمراض المعوية) – The global Enteric Disease Testing Market is projected to expand at a CAGR of 3.3% during the forecast period from 2019 to 2027

About Transparency Market Research

Transparency Market Research, a global market research company registered at Wilmington, Delaware, United States, provides custom research and consulting services. Our exclusive blend of quantitative forecasting and trends analysis provides forward-looking insights for thousands of decision makers. Our experienced team of Analysts, Researchers, and Consultants use proprietary data sources and various tools & techniques to gather and analyses information.

Our data repository is continuously updated and revised by a team of research experts, so that it always reflects the latest trends and information. With a broad research and analysis capability, Transparency Market Research employs rigorous primary and secondary research techniques in developing distinctive data sets and research material for business reports.

Contact:

Transparency Market Research Inc.

CORPORATE HEADQUARTER DOWNTOWN,

1000 N. West Street,

Suite 1200, Wilmington, Delaware 19801 USA

Tel: +1-518-618-1030

USA – Canada Toll Free: 866-552-3453

Website: https://www.transparencymarketresearch.com

Email: sales@transparencymarketresearch.com

Follow Us: LinkedIn| Twitter| Blog | YouTube

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.