I'm Expecting $3,000 in Social Security Each Month. What Strategies Can Reduce My Tax Burden?

SmartAsset and Yahoo Finance LLC may earn commission or revenue through links in the content below.

When determining your income taxes in retirement and on your Social Security benefits, the IRS uses your “combined income” and filing status as the two main markers. At $36,000 a year from Social Security, none of your benefits would be taxable, since only half of your benefits are calculated into combined income. However most, if not all, retirees have additional income sources, such as retirement account withdrawals, a pension, part-time wages and more. When accounting for these as well, you may be subject to taxes on up to 85% of your total benefits. You may be able to manage this by using Roth accounts, getting income from non-taxable sources or reducing your income by working less or taking smaller withdrawals.

Are you looking for professional help with managing your retirement income and Social Security benefits? Speak with a financial advisor today.

How Social Security Benefits Are Taxed

If you receive Social Security retirement benefits, you may have to pay income taxes on them. To see whether you’ll need to, divide your Social Security income in half. Then add your adjusted gross income (AGI), plus any income from tax-exempt sources, such as municipal bonds. The result is called your “combined income” and it, along with your filing status, helps determine how much of your Social Security income is taxable.

For example, if you get $36,000 a year ($3,000 a month) from Social Security and have no other income, your combined income is $36,000 divided by 2, or $18,000. None of your benefits are taxable if your income is below $25,000 for a single filer or $32,000 for joint filers. So, in this case, you’d owe nothing to the federal government.

Odds are good, though, that you don’t rely only on Social Security. The Federal Reserve’s Report on the Economic Well-Being of U.S. Households in 2022 found 79% of retirees had one or more sources of private income. If you’re one of this majority, some of your Social Security could be taxable. Here’s how the brackets work:

-

Single Filers

-

Combined income is less than $25,000: none of your benefits may be taxable

-

Combined income is between $25,000 and $34,000: up to 50% of your benefits may be taxable

-

Combined income is above $34,000: up to 85% of your benefits may be taxable

-

-

Joint Filers

-

Combined income is less than $32,000: none of your benefits may be taxable

-

Combined income is between $32,000 and $44,000: up to 50% of your benefits may be taxable

-

Combined income is above $44,000: up to 85% of your benefits may be taxable

-

An Example of Social Security Benefit Taxes

To see how this works, consider a single filer who receives $36,000 in Social Security and withdraws $24,000 from their retirement account annually. For this person, their combined income would be half their Social Security income ($18,000), plus $24,000 in other income, for a grand total of $42,000.

At $42,000 in combined income for a single filer, up to 85% of their Social Security benefits are taxable. That doesn’t mean you have to pay an 85% tax rate on your $36,000 in Social Security benefits, nor does it mean all 85% will actually apply.

To calculate how much your taxes are on these Social Security benefits, you’ll want to follow the complex process of determining it via IRS Publication 915. Using this calculation method, the IRS document will help you whittle down your income following a 19-step process that’s too complex to review here. In short, when coming to the end of this calculation, this situation will work out to your taxable Social Security benefits equaling $11,300. This amount will then need to be added to your taxable income for the tax year.

If you need help with Social Security or other retirement benefits, a financial advisor could be helpful. Talk to an advisor today.

Strategies for Potentially Reducing Your Social Security Benefit Taxes

You may want to consider moves to potentially shrink the amount of your Social Security benefits that are taxed. One is to generate less income from sources that increase combined income, should you be able to afford it. Again, combined income is equal to your AGI (withdrawals from retirement accounts, wages etc.), tax-exempt income, etc. However, you may not be able to afford going this route.

You could take withdrawals from a Roth IRA, should you have one. Roth withdrawals are not included in combined income, as they feature tax-free benefits in retirement. You could take any amount of Roth withdrawals without exposing any of your Social Security benefits to taxation. If your retirement savings are in both Roth and pre-tax accounts, you can also take a blended approach to avoid emptying your Roth account too quickly, while still minimizing some taxable income increases.

Selling investments that have lost value can also allow you to write off up to $3,000 a year, further reducing your combined income. If you don’t have any such investments, you might use cash reserves to pay the bills Social Security can’t cover. That also won’t increase your combined income.

Finally, you can time withdrawals. For instance, let’s say in one year your combined income is already so high that the maximum 85% of your Social Security benefits will be taxed. You could take even more withdrawals than you need that year and bank them for next year’s expenses. Since 85% is the maximum, you won’t be exposing any more Social Security benefits to taxes this year. And then next year, you can withdraw less and again minimize taxation of Social Security dollars.

These simple examples for illustration purposes don’t include some potentially important considerations. For instance, some states tax Social Security benefits. And, while most of these follow the federal approach, some apply taxes differently. Also, individual details such as filing status and whether a spouse also has Social Security benefits can significantly affect these situations. For personalized advice and help navigating the nuances, consider speaking with a financial advisor.

Retirement Planning Tips

-

If you’re looking for ways to manage your Social Security benefits alongside your other sources of retirement income, a financial advisor can help. Finding a financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to three vetted financial advisors who serve your area, and you can have a free introductory call with your advisor matches to decide which one you feel is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

-

Social Security is a critical part of many retirees’ income plans. Estimate how much you’ll get from this important source of income using SmartAsset’s Social Security calculator.

-

Keep an emergency fund on hand in case you run into unexpected expenses. An emergency fund should be liquid — in an account that isn’t at risk of significant fluctuation like the stock market. The tradeoff is that the value of liquid cash can be eroded by inflation. But a high-interest account allows you to earn compound interest. Compare savings accounts from these banks.

-

Are you a financial advisor looking to grow your business? SmartAsset AMP helps advisors connect with leads and offers marketing automation solutions so you can spend more time making conversions. Learn more about SmartAsset AMP.

Photo credit: ©iStock.com/FatCamera, ©iStock.com/SrdjanPav

The post I’m Going to Get $3,000 Per Month From Social Security. How Can I Reduce My Taxes? appeared first on SmartReads by SmartAsset.

ACADIA HEALTHCARE COMPANY, INC. ANNOUNCEMENT: If You Have Suffered Losses in Acadia Healthcare Company, Inc. (NASDAQ: ACHC), You Are Encouraged to Contact The Rosen Law Firm About Your Rights

NEW YORK, Sept. 20, 2024 (GLOBE NEWSWIRE) —

Why: Rosen Law Firm, a global investor rights law firm, announces an investigation of potential securities claims on behalf of shareholders of Acadia Healthcare Company, Inc. ACHC resulting from allegations that Acadia Healthcare may have issued materially misleading business information to the investing public.

So what: If you purchased Acadia Healthcare securities you may be entitled to compensation without payment of any out of pocket fees or costs through a contingency fee arrangement. The Rosen Law Firm is preparing a class action seeking recovery of investor losses.

What to do next: To join the prospective class action, go to https://rosenlegal.com/submit-form/?case_id=28482 or call Phillip Kim, Esq. toll-free at 866-767-3653 or email case@rosenlegal.com for information on the class action.

What is this about: On Sunday, September 1, 2024, The New York Times published an article entitled “How a Leading Chain of Psychiatric Hospitals Traps Patients.” This article stated that “Acadia Healthcare is one of America’s largest chains of psychiatric hospitals. Since the pandemic exacerbated a national mental health crisis, the company’s revenue has soared. [. . .] But a New York Times investigation found that some of that success was built on a disturbing practice: Acadia has lured patients into its facilities and held them against their will, even when detaining them was not medically necessary. In at least 12 of the 19 states where Acadia operates psychiatric hospitals, dozens of patients, employees and police officers have alerted the authorities that the company was detaining people in ways that violated the law, according to records reviewed by The Times. In some cases, judges have intervenes to force Acadia to release patients.”

On this news, the price of Acadia Healthcare stock fell by 4.5% on September 3, 2024.

Why Rosen Law: We encourage investors to select qualified counsel with a track record of success in leadership roles. Often, firms issuing notices do not have comparable experience, resources, or any meaningful peer recognition. Many of these firms do not actually litigate securities class actions. Be wise in selecting counsel. The Rosen Law Firm represents investors throughout the globe, concentrating its practice in securities class actions and shareholder derivative litigation. Rosen Law Firm has achieved the largest ever securities class action settlement against a Chinese Company. Rosen Law Firm was Ranked No. 1 by ISS Securities Class Action Services for number of securities class action settlements in 2017. The firm has been ranked in the top 4 each year since 2013 and has recovered hundreds of millions of dollars for investors. In 2019 alone the firm secured over $438 million for investors. In 2020, founding partner Laurence Rosen was named by law360 as a Titan of Plaintiffs’ Bar. Many of the firm’s attorneys have been recognized by Lawdragon and Super Lawyers.

Follow us for updates on LinkedIn: https://www.linkedin.com/company/the-rosen-law-firm, on Twitter: https://twitter.com/rosen_firm or on Facebook: https://www.facebook.com/rosenlawfirm/.

Attorney Advertising. Prior results do not guarantee a similar outcome.

Contact Information:

Laurence Rosen, Esq.

Phillip Kim, Esq.

The Rosen Law Firm, P.A.

275 Madison Avenue, 40th Floor

New York, NY 10016

Tel: (212) 686-1060

Toll Free: (866) 767-3653

Fax: (212) 202-3827

case@rosenlegal.com

www.rosenlegal.com

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

PROREIT ANNOUNCES SEPTEMBER 2024 DISTRIBUTION

MONTREAL, Sept. 20, 2024 /CNW/ – PRO Real Estate Investment Trust (“PROREIT” or the “REIT”) PRV announced today that a cash distribution of $0.0375 per trust unit of the REIT for the month of September 2024 ($0.45 on an annualized basis) will be payable on October 15, 2024 to unitholders of record as at September 30, 2024.

About PROREIT

PROREIT PRV is an unincorporated open-ended real estate investment trust established pursuant to a declaration of trust under the laws of the Province of Ontario. Founded in 2013, PROREIT owns a portfolio of high-quality commercial real estate properties in Canada, with a strong industrial focus in robust secondary markets.

For more information on PROREIT, please visit the website at: https://proreit.com.

SOURCE Pro Real Estate Investment Trust

![]() View original content: http://www.newswire.ca/en/releases/archive/September2024/20/c7818.html

View original content: http://www.newswire.ca/en/releases/archive/September2024/20/c7818.html

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

1 Simple Vanguard ETF Can Turn $500 Per Month Into $50,000 in Annual Dividend Income

Building a portfolio of great stocks that can pay out enough in dividends to cover most of your major expenses in retirement is a big goal for many investors. Experts and amateurs alike spend a lot of time and effort searching for great dividend stocks that not only pay a reasonably high yield today, but will also grow their payouts over time. Finding those stocks means you’ll likely receive an annual pay raise every year as long as you remain diversified. You might not ever have to sell a single stock to fund your retirement if you can find the right portfolio of dividend payers.

The great news for investors is that building a portfolio of dividend stocks that can pay out tens of thousands of dollars each year doesn’t have to be complicated. Consistently investing in an exchange-traded fund (ETF) every month and reinvesting the dividends during your career can result in a massive portfolio paying a substantial sum in annual income over time.

One simple Vanguard ETF, the Vanguard High Dividend Yield ETF (NYSEMKT: VYM), has the potential to turn a consistent investment of $500 per month into a $50,000 annual dividend machine.

The only ETF you need to build a diversified dividend portfolio

The Vanguard High Dividend Yield ETF tracks the performance of the FTSE High Dividend Yield index, which includes stocks forecast to pay above-average dividend yields. Some might find the stock selection for the index to be too simple, but higher-paying dividend stocks historically provide above-average total returns as a group over the long run, according to research conducted by Hartford Funds.

In other words, it historically pays off in the long run to simply buy every stock in the market with an above-average dividend yield. The top holdings in the Vanguard High Dividend Yield ETF (and their yields) are:

-

Broadcom (1.3% dividend yield)

-

JPMorgan Chase (2.2%)

-

ExxonMobil (3.3%)

-

Procter & Gamble (2.3%)

-

Johnson & Johnson (3%)

-

Home Depot (2.4%)

-

AbbVie (3.2%)

-

Walmart (1.1%)

-

Merck (2.6%)

-

Coca-Cola (2.7%)

As you can see, the biggest holdings in the ETF aren’t super-high-yield stocks you might associate with some funds. But they do, for the most part, offer yields well above the S&P 500‘s average of 1.3%. The fund’s 2.8% yield is still over twice the S&P 500’s.

Importantly, the fund contains 551 stocks, with just 24.8% of the fund held in the top 10 stocks, making it more diversified than the S&P 500 as well. That can provide extra downside protection if one company or industry suffers. That way, no single investment will bring down the value of the fund or the dividend it pays.

What’s more, you get the benefit of a super-low expense ratio. Vanguard charges just 0.06% of assets to invest in its index fund.

How $500 per month could generate $50,000 in annual dividends

The Vanguard High Dividend Yield ETF has produced an average compound total return of 8.7% since its inception in late 2006. While the returns of dividend stocks and the large-cap value stocks that the fund tilts toward will fluctuate over time, the historical return can help us estimate the growth of a consistent investment in the future.

Keep in mind that the total return includes reinvesting dividends. It’s a smart idea to automatically reinvest while accumulating assets, but eventually, you’ll want to start living off those dividends.

If the only thing you ever did was buy $500 worth of the Vanguard ETF at the start of every month and reinvest your dividends, you would be able to build a sizable portfolio over time. Here’s what your account balance might look like based on the historical returns and current yield.

|

Holding Period in Years |

Portfolio Value |

Annual Dividend Income |

|---|---|---|

|

1 |

$6,279 |

$176 |

|

5 |

$37,336 |

$1,045 |

|

10 |

$93,944 |

$2,630 |

|

15 |

$179,772 |

$5,034 |

|

20 |

$309,901 |

$8,677 |

|

25 |

$507,199 |

$14,202 |

|

30 |

$806,337 |

$22,577 |

|

35 |

$1,259,881 |

$35,277 |

|

40 |

$1,947,532 |

$54,531 |

Calculations by author. Figures are based on $500 invested monthly in the Vanguard High Dividend Yield ETF, with interest is calculated on a compounded basis.

As illustrated above, consistently investing $500 per month for 40 years results in a portfolio that pays out $54,531 per year based on the current dividend yield. That’s the amount you could collect from the portfolio without ever touching the principal investment. As such, you should expect the income stream to keep growing as the companies in the fund raise their dividends over time.

At the same time, you should see the total value of your portfolio continue to climb over time, even when you stop adding to your portfolio or reinvesting dividends. That could result in a substantial inheritance for your heirs.

There are a few important considerations for investors. First, future returns aren’t guaranteed to look like past returns. While the Vanguard fund has a long track record of good returns and dividend stocks historically perform well, there’s a chance they don’t continue to perform as they have in the past.

Moreover, investors shouldn’t expect steadily consistent returns month in and month out. The above table assumes a constant rate of return, but investors should expect volatility. The longer you invest, the more likely your returns will end with similar results to the table above, but the path to get there could be filled with ups and downs.

Second, the dividend yield for the Vanguard fund (and the stock market as a whole) could decline over the next 40 years. Yields aren’t nearly as high as they were 40 years ago, and they could fall further. On the other hand, they could increase in the future. You might find your dividend income doesn’t match the expectations as a result.

Lastly, it’s important to remember that $50,000 won’t be able to buy as much in 40 years as it does today. So be sure your long-term plan accounts for inflation if you’re aiming to replace your income with a steady stream of dividend payments.

If you keep those things in mind, the Vanguard High Dividend Yield ETF is one of the best options for building a strong portfolio of dividend stocks without the effort of evaluating individual stocks and businesses.

Should you invest $1,000 in Vanguard Whitehall Funds – Vanguard High Dividend Yield ETF right now?

Before you buy stock in Vanguard Whitehall Funds – Vanguard High Dividend Yield ETF, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Vanguard Whitehall Funds – Vanguard High Dividend Yield ETF wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $722,320!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 16, 2024

JPMorgan Chase is an advertising partner of The Ascent, a Motley Fool company. Adam Levy has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Home Depot, JPMorgan Chase, Merck, Vanguard Whitehall Funds-Vanguard High Dividend Yield ETF, and Walmart. The Motley Fool recommends Broadcom and Johnson & Johnson. The Motley Fool has a disclosure policy.

1 Simple Vanguard ETF Can Turn $500 Per Month Into $50,000 in Annual Dividend Income was originally published by The Motley Fool

3 Dirt Cheap Stocks to Buy Right Now

By most metrics, the stock market is priced at a premium these days. But that doesn’t mean bargains can’t still be found.

Three Motley Fool contributors think they’ve identified dirt-cheap healthcare stocks to buy right now. Here’s why they picked CRISPR Therapeutics (NASDAQ: CRSP), Gilead Sciences (NASDAQ: GILD), and Pfizer (NYSE: PFE).

You can still get in on the ground floor

Prosper Junior Bakiny (CRISPR Therapeutics): Valuing relatively small biotech companies that generate little-to-no revenue is not an exact science. Even so, CRISPR Therapeutics, a gene-editing specialist, looks cheap at its current levels. CRISPR Therapeutics’ market cap is $4.2 billion despite the recent approval of Casgevy, a treatment for two blood-related diseases it developed in collaboration with Vertex Pharmaceuticals.

CRISPR Therapeutics and Vertex Pharmaceuticals are looking at a massive opportunity with Casgevy. The medicine costs $2.2 million in the U.S. They estimate a market of 35,000 patients in the U.S. and Europe, with an additional 23,000 in some countries in the Middle East where Casgevy is also approved. CRISPR Therapeutics should eventually generate well over $1 billion in sales from Casgevy.

The company has also shown that its gene-editing platform can produce tangible results in unlocking treatments where few are available. There is a world of opportunities: Plenty of conditions have no approved treatments. Many others have a dire need for better standards of care. One of CRISPR Therapeutics’ more promising projects is its work in type 1 diabetes for which the company is attempting to develop a functional cure.

In my view, CRISPR Therapeutics is a biotech giant in the making. Casgevy will bring in the funds that will help it push its gene-editing platform forward. In the next five years, expect more important clinical and regulatory progress from the company. Though CRISPR Therapeutics has delivered strong returns since its 2016 initial public offering (IPO), there remains substantial upside for the biotech, at least for investors willing to be patient.

Gilead Sciences could make for an underrated growth stock

David Jagielski (Gilead Sciences): What’s a top pharmaceutical stock you won’t want to overlook right now? Gilead Sciences. While its single-digit (and sometimes negative) growth rate may look unimpressive over the past few years, the company does possess some promising catalysts which can lead to stronger numbers in the future. Plus, it pays a great dividend which yields 3.7% — nearly three times better than the S&P 500 average of 1.3%.

Gilead Sciences recently announced that lenacapavir, its twice-yearly HIV treatment, was highly effective in preventing HIV. It dramatically reduced infections by 96% in a phase 3 trial. Analysts estimate that the drug, which is already approved to treat people who have multidrug-resistant HIV, could generate $4 billion in sales at its peak. That could be a considerable revenue-generating product for the business as last year Gilead’s sales topped $27 billion.

Lenacapavir could do wonders for the company’s HIV business, which has been Gilead’s slowest growing of late. Through the first six months of 2024, HIV sales rose by just 3% year over year to $9.1 billion. While that’s still the company’s largest segment, growth rates in liver disease (13%) and oncology (17%) were both far higher during that time frame and also represent exciting growth opportunities for the business in the future.

Although Gilead’s shares are up a little this year, the biotech stock trades at a lowly 12 times its estimated future profits (based on analyst expectations). For long-term investors, this could be an excellent stock to buy and hold.

More than meets the eye

Keith Speights (Pfizer): Pfizer has been a big loser in recent years, although it has eked out a meager gain in 2024. However, I believe there’s more than meets the eye with this big drugmaker.

You can blame much of Pfizer’s woes on the declining sales of its COVID-19 products. I don’t anticipate the company will ever again see the booming numbers of 2021 and 2022. But I also think 2024 could be a trough year for Pfizer’s COVID-19 vaccine sales.

The other big challenge for the company is the impending patent expirations for several of its top products. Unfortunately for Pfizer, the list includes blockbuster drugs Eliquis, Ibrance, Vyndaqel, Xeljanz, and Xtandi.

Pfizer isn’t being blindsided by this patent cliff, though. It has invested in developing new products, with respiratory syncytial virus (RSV) vaccine Abrysvo especially standing out. The company has also used the tremendous cash generated from its COVID-19 vaccine during the worst of the pandemic to fund key acquisitions, including its 2023 purchase of Seagen. As a result, Pfizer should be able to deliver solid growth in the coming years despite losing patent exclusivity for multiple products.

Meanwhile, the pharma stock is priced at a discount. Pfizer’s shares trade at only 10.6 times forward earnings. That’s much lower than the S&P 500 healthcare sector’s forward-earnings multiple of 19.6.

If you’re looking for another reason to buy this dirt-cheap stock, check out its dividend. Pfizer offers a forward-dividend yield of 5.65%. Even better, the company’s management remains committed to growing its dividend payout over time.

Should you invest $1,000 in CRISPR Therapeutics right now?

Before you buy stock in CRISPR Therapeutics, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and CRISPR Therapeutics wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $722,320!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 16, 2024

David Jagielski has no position in any of the stocks mentioned. Keith Speights has positions in Pfizer and Vertex Pharmaceuticals. Prosper Junior Bakiny has positions in Vertex Pharmaceuticals. The Motley Fool has positions in and recommends CRISPR Therapeutics, Gilead Sciences, Pfizer, and Vertex Pharmaceuticals. The Motley Fool has a disclosure policy.

3 Dirt Cheap Stocks to Buy Right Now was originally published by The Motley Fool

I Just Bought the Dip on Super Micro Computer Stock

Super Micro Computer (NASDAQ: SMCI) investors have been on a roller-coaster ride in 2024. The stock entered the year at $280, then it quickly peaked at nearly $1,200 in March. Since then, it’s been a near-straight fall down, and the stock currently sits around $440.

There are some good reasons why Supermicro fell from its $1,000-plus stock price earlier this year, but I also think its current price is an absolute steal, which is why I just bought the dip on the stock.

Supermicro hasn’t had much positive news lately

Super Micro Computer builds components for computing servers as well as full server solutions themselves. Its claim to fame in this world is that it offers highly customizable servers that can be tailored for any workload size or type. Additionally, its liquid-cooled technology alongside other innovations make its servers the most efficient in the world. This is critical, as the energy input costs into these servers are incredibly high.

With massive demand for data center parts and servers, Supermicro’s business has boomed, following a similar growth trajectory as Nvidia. This caused the stock to rise earlier this year, but the company has hit two major stumbling blocks along the way.

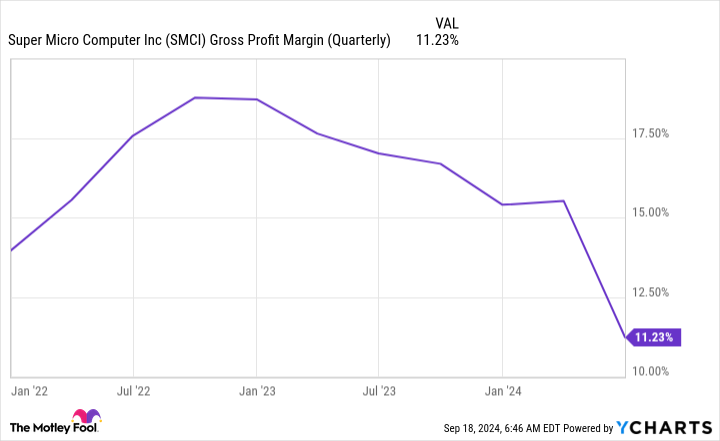

First, Supermicro’s gross margin plummeted in 2024, continuing a trend that started in 2023.

This is a problem, as a plummeting gross margin can signal pricing competition, indicating that Supermicro has no real competitive advantages. However, management points to the upfront costs of getting its liquid cooling technology up and running. It expects its gross margin to improve as components become more readily available throughout fiscal year 2025 (ending June 2025).

This should also improve bottom-line profitability and is a key trend to watch over the next year.

The second cause for Supermciro’s decline was Hindenburg Research’s short report. Hindenburg is a famed short-seller, which means it profits as the stock declines. It is known to release reports on various companies, explaining why it believes the stock is mispriced. In Supermicro’s case, it alleges accounting malpractice as one of the chief concerns. Supermicro didn’t do itself any favors in beating these allegations by delaying its end-of-year form 10K filing to the Securities and Exchange Commission (SEC) either.

The Hindenburg report doesn’t concern me as much as the falling margins do, as if there are any issues, it likely only accounts for a very small fraction of Supermicro’s business.

As for the margins, the market is valuing the stock like it will never return to normal, which is a huge investment opportunity.

The bar is fairly low for Supermicro’s stock to succeed

Fiscal year 2025 is expected to be another monster year of growth for Supermicro, with revenue expected to rise between 74% and 101% year over year. Furthermore, Supermicro’s CEO raised his long-term outlook to $50 billion in annual revenue for the company. There’s a massive opportunity here, and Supermicro will be one of the primary beneficiaries.

According to Wall Street estimates, Supermicro is projected to grow its earnings by 69% in fiscal 2025.

However, if Supermicro meets its revenue growth targets, its revenue growth will exceed earnings growth projections. This doesn’t make much sense, especially if margins improve throughout the year, as management forecasts.

This is a key reason why I’m investing in Supermicro: The stock’s base case is easily achievable. If Supermicro knocks it out of the park, grows revenue at the high end of expectations, and improves margins, the stock will likely be a home run.

With the general trends toward cloud computing and artificial intelligence (AI), Supermicro’s business isn’t slowing down anytime soon. As a result, I’m using the weakness to start a position, as it could be a huge winner in the next few years.

Should you invest $1,000 in Super Micro Computer right now?

Before you buy stock in Super Micro Computer, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Super Micro Computer wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $722,320!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 16, 2024

Keithen Drury has positions in Super Micro Computer. The Motley Fool has positions in and recommends Nvidia. The Motley Fool has a disclosure policy.

I Just Bought the Dip on Super Micro Computer Stock was originally published by The Motley Fool

What the Options Market Tells Us About JD.com

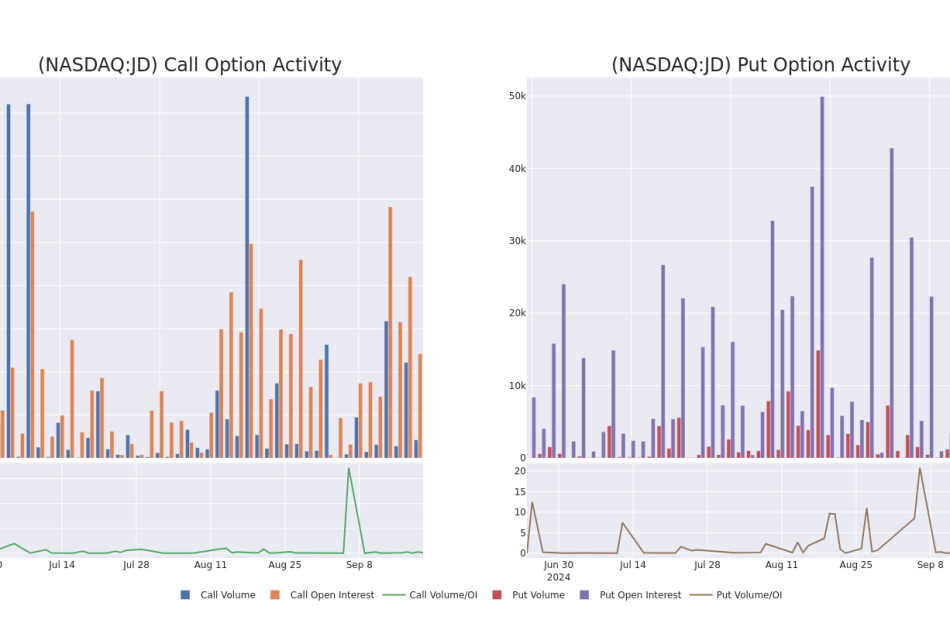

Benzinga’s options scanner just detected over 8 options trades for JD.com JD summing a total amount of $1,462,072.

At the same time, our algo caught 4 for a total amount of 1,325,899.

Projected Price Targets

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $25.0 to $30.0 for JD.com during the past quarter.

Volume & Open Interest Development

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

This data can help you track the liquidity and interest for JD.com’s options for a given strike price.

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of JD.com’s whale activity within a strike price range from $25.0 to $30.0 in the last 30 days.

JD.com Option Activity Analysis: Last 30 Days

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| JD | PUT | TRADE | BULLISH | 03/21/25 | $3.75 | $3.65 | $3.66 | $30.00 | $1.0M | 230 | 3.0K |

| JD | PUT | TRADE | BULLISH | 01/17/25 | $0.96 | $0.94 | $0.94 | $25.00 | $94.0K | 22.3K | 2.0K |

| JD | PUT | TRADE | BULLISH | 01/17/25 | $0.99 | $0.94 | $0.94 | $25.00 | $94.0K | 22.3K | 1 |

| JD | CALL | SWEEP | BEARISH | 09/20/24 | $1.05 | $1.03 | $1.06 | $27.50 | $54.6K | 31.4K | 875 |

| JD | CALL | TRADE | BULLISH | 09/20/24 | $1.0 | $0.96 | $0.99 | $27.50 | $52.9K | 31.4K | 2.6K |

About JD.com

JD.com is a leading e-commerce platform with its 2022 China GMV being similar to Pinduoduo (GMV not reported), on our estimate, but still lower than Alibaba. it offers a wide selection of authentic products with speedy and reliable delivery. The company has built its own nationwide fulfilment infrastructure and last-mile delivery network, staffed by its own employees, which supports both its online direct sales, its online marketplace and omnichannel businesses.

Having examined the options trading patterns of JD.com, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Present Market Standing of JD.com

- Trading volume stands at 9,633,570, with JD’s price down by -0.56%, positioned at $28.58.

- RSI indicators show the stock to be may be approaching overbought.

- Earnings announcement expected in 54 days.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for JD.com, Benzinga Pro gives you real-time options trades alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Can Nvidia Stock Hit $200 in 2024?

Over the last two years, the hype around the artificial intelligence (AI) boom has led to incredible operating momentum for Nvidia (NASDAQ: NVDA), the company that designs and manufactures most of the industry’s chips. But while business is roaring, the company’s stock price seems to have hit a roadblock. Let’s discuss why this might be happening and determine whether Nvidia’s shares can hit $200 before the end of the year.

Nvidia’s rocket-ship rally fades

With shares up by around 2,450% over the last five years, Nvidia has been a rewarding investment for its long-to-medium-term shareholders. However, the thesis is beginning to unravel, as strong operational results are no longer impressing the market as much as before.

Second-quarter revenue soared 122% year over year to $30 billion, driven by massive demand for Nvidia’s data center graphics processing units (GPUs), which help run and train AI algorithms. The company’s bottom line also remains buoyant, with operating income jumping 174% year over year to $18.6 million. Management expects the release of new AI hardware products based on the faster and more efficient Blackwell architecture to stimulate client demand in 2025 and beyond.

Nvidia’s board also approved a whopping $50 billion worth of share repurchases in the quarter, which can boost investors’ claim on future earnings by lowering the number of shares outstanding.

However, while these are objectively good results, Nvidia’s split-adjusted stock price has fallen around 10% since the release on Aug. 28, suggesting many market participants think the operational momentum is unsustainable.

Storm clouds gather over the AI industry

There are several reasons why investors might take Nvidia’s current results with a grain of salt. For starters, the consumer-facing software side of the generative AI industry is yet to prove its monetization potential. For instance, analysts at Goldman Sachs worry that today’s AI systems simply aren’t designed to solve problems complex enough to justify their costs.

And while the technology behind large language models (LLMs) like ChatGPT continues to improve, that doesn’t necessarily mean they will become easier to monetize because of competition from free, open-source rivals like Meta Platforms’ Llama or Elon Musk’s Grok.

There is a growing risk that AI could follow the pattern of previous hype cycles like the internet or electric vehicles, where corporations overbuilt capacity in anticipation of consumer demand that didn’t materialize quickly. If this happens with generative AI, the market for Nvidia’s pricey data center hardware could plateau or decline in the near term — even if the technology becomes widely adopted over the coming decades.

Nvidia’s uncertain path to $200 per share

After a 10-for-1 stock split in June, Nvidia’s modest $115 stock price belies its true size. With a market cap of $2.84 trillion, the GPU chipmaker is already the third-largest company in the world — behind Microsoft and Apple, which are worth $3.23 trillion and $3.3 trillion, respectively.

A 73% rally to $200 should take Nvidia’s market cap to roughly $4.9 billion, most likely putting it in the No. 1 spot. And with a forward price-to-earnings (P/E) multiple of just 41, the stock certainly looks like it has more room to run, considering its triple-digit earnings growth.

That said, unlike the typical megacap company, which usually built its business over decades by servicing established, profitable sectors in the economy, Nvidia’s business remains speculative and uncertain — earning it a discounted valuation. The company looks unlikely to hit a share price of $200 in 2024 or any time soon until the software side of the AI industry starts to carry its own weight. And that is far from guaranteed.

Should you invest $1,000 in Nvidia right now?

Before you buy stock in Nvidia, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $710,860!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 16, 2024

Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Will Ebiefung has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Apple, Goldman Sachs Group, Meta Platforms, Microsoft, and Nvidia. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

Can Nvidia Stock Hit $200 in 2024? was originally published by The Motley Fool

Wall Street Falls On Triple Witching Day, Fed's Waller Pushes Gold To Fresh Record Highs, FedEx Plummets: What's Driving Markets Friday?

Friday was a lackluster session on Wall Street, with major U.S. averages lingering in negative territory at midday trading in New York. This session coincided with the simultaneous expiration of a large volume of options and futures contracts, commonly referred to as “triple witching.”

However, rather than a sharp spike in volatility, stocks edged only slightly lower, failing to trigger a rise in the CBOE Volatility Index (VIX).

Investor sentiment remained defensive, with 10 out of 11 sectors of the S&P 500 falling, while utilities were the only sector to post a positive performance.

Dovish remarks from Federal Reserve Governor Christopher Waller indicated that he expects “very low” August Personal Consumption Expenditure (PCE) data.

Waller also hinted at the possibility of a 25 basis point rate cut in the next meeting or two if the data continues to come in as expected, with a stronger size of cut if the labor market weakens and inflation softens more rapidly.

Waller’s comments sent gold surging past $2,600 per ounce, marking new all-time highs.

Meanwhile, Bitcoin BTC/USD remained stable at $63,000.

| Major Indices | Price | Chg (1-day %) |

| Dow Jones | 42,015.17 | 0.0% |

| S&P 500 | 5,700.41 | -0.2% |

| Nasdaq 100 | 19,771.36 | -0.3% |

| Russell 2000 | 2,237.55 | -0.7% |

According to Benzinga Pro data:

- The SPDR S&P 500 ETF Trust SPY was 0.5% lower to $567.92.

- The SPDR Dow Jones Industrial Average DIA edged 0.2% down to $420.43.

- The tech-heavy Invesco QQQ Trust Series QQQ fell 0.3% to $481.96.

- The iShares Russell 2000 ETF IWM fell 0.7% to $222.50.

- The Utilities Select Sector SPDR Fund XLU outperformed, up 2.1%. The Industrials Select Sector SPDR Fund XLI lagged, down 0.7%.

Friday’s Stock Movers

- FedEx Corp. FDX tumbled 13.6% on dismal quarterly earnings.

- Lennar Corp. LEN also reacted to earnings, falling over 4%.

- Nike Inc. NKE rose over 6%, following the company’s appointment of Elliot Hill as the new CEO.

Read Now:

Wall Street illustration created using artificial intelligence via MidJourney.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Retirement Ready? Think Again As Experts Warn Homeowners Still Paying Mortgages That They 'Are Much More Likely To Be Overconfident'

Owning a home can give some people confidence about their retirement prospects, but experts warn that this confidence might be misplaced.

According to the Your Money Retirement Survey conducted by SurveyMonkey and CNBC.com, about 37% of workers – including those employed part-time, full-time, self-employed, or as business owners – believe they are “ahead of schedule” (7%) or “on schedule” (30%) with their retirement savings.

Don’t Miss:

Among those who feel on track, 42% attribute their progress to starting retirement savings early. Other key factors contributing to their preparedness include having little to no debt (38%) and home equity or ownership (37%).

The August survey gathered responses from 6,657 adults, including 2,603 retirees and 4,054 working adults.

See Also: The average American couple has saved this much money for retirement — How do you compare?

Angie Chen, a senior research economist and assistant director of savings research at the Center for Retirement Research at Boston College, suggests that homeowners’ confidence in their home’s value as a source of retirement wealth may be misguided.

“Homeowners are actually more likely to be overconfident in their retirement readiness,” Chen told CNBC. “There’s a lot of misconception in terms of how people assess whether they are ahead or not in retirement.”

Nevertheless, Winnie Sun, co-founder and managing director of Sun Group Wealth Partners in Irvine, California, points out that homeownership can offer other benefits during retirement.

Trending: This billion-dollar fund has invested in the next big real estate boom, here’s how you can join for $10.

The Center for Retirement Research’s (CRR) National Retirement Risk Index (NRRI) gauges the percentage of working-age households at risk of being financially unprepared for retirement. A 2023 CRR analysis revealed that 28% of people believe they are not at risk, despite the NRRI indicating otherwise.

“People who own houses but still owe a lot on their houses are much more likely to be overconfident or not worried enough,” Chen said.

Trending: This Jeff Bezos-backed startup will allow you to become a landlord in just 10 minutes, and you only need $100.

To accurately assess retirement preparedness, Chen emphasizes the importance of considering not just the value of your home but also the amount you have borrowed and still owe.

For instance, if you purchased a $500,000 home but still owe $400,000, your actual equity is $100,000. Experts caution that accessing this equity can be costly and risky, as borrowing against your home is not always straightforward.

“Housing is not liquid,” Chen said. “You might feel good about having this large asset, but you can’t consume that in retirement. You can’t spend it so that you can spend and consume other savings.”

Trending: Founder of Personal Capital and ex-CEO of PayPal re-engineers traditional banking with this new high-yield account — start saving better today.

Experts also point out some advantages to homeownership.

Owning a home offers financial benefits even if you’re not factoring in home equity for retirement. First, you build equity in your home. Sun said that when you sell the property, such as when downsizing in retirement, you can access that equity as a lump sum.

Additionally, while you own the property, you have a fixed housing cost, typically including a stable mortgage payment. Despite rising costs for home insurance and property taxes in recent years, you might be eligible for senior discounts on utilities by the time you retire.

Although a house is not a liquid asset, experts suggest you can still access your home equity if needed.

“In most cases for retirees, they kind of see equity as their emergency fund,” Sun said.

Read Next:

UNLOCKED: 5 NEW TRADES EVERY WEEK. Click now to get top trade ideas daily, plus unlimited access to cutting-edge tools and strategies to gain an edge in the markets.

Get the latest stock analysis from Benzinga?

This article Retirement Ready? Think Again As Experts Warn Homeowners Still Paying Mortgages That They ‘Are Much More Likely To Be Overconfident’ originally appeared on Benzinga.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.