'What's Next? The Future With Bill Gates': Microsoft Co-Founder Unveils Behind The Scenes Of His New Netflix Series

Microsoft Corporation co-founder Bill Gates has shared the “behind the scenes” of his new Netflix Inc. series, “What’s Next? The Future with Bill Gates.”

What Happened: The new series which delves into future challenges with Gates interviewing politicians, celebrities, and business leaders was released earlier this week.

In a blog post on Wednesday, Gates highlights three standout discussions with Lady Gaga, Senator Bernie Sanders and Phoebe Gates, his daughter.

About Gaga he said that their conversation centered around misinformation. “Our conversation was valuable in helping me think through what is (and might not be) possible when it comes to preventing misinformation.”

With Sanders, the conversation focused on income inequality and taxation of the wealthy.

Gates mentioned that several of his friends weren’t sure about him meeting the senator because “Sen. Sanders is the first U.S. Senator in history to go on record saying that billionaires shouldn’t exist.”

However, they had a nice discussion, during which the senator asked some tough questions.

Gates also shared that when they were going to their respective cars after parting, a jogger identified them in a way that made it clear they were an “unexpected duo.”

The Microsoft co-founder also wrote about his daughter Phoebe, with whom he discussed the impact of misinformation on women’s rights activism. “I’m so proud of how Phoebe uses her voice to advocate for women and girls.”

Subscribe to the Benzinga Tech Trends newsletter to get all the latest tech developments delivered to your inbox.

Why It Matters: The five-part docuseries tackles various challenges such as AI, climate change, misinformation, disease eradication, and income inequality.

Among the guests are Anthony Fauci, Bono, Greg Brockman, James Cameron, Lady Gaga, Mark Cuban, Phoebe Gates, Senator Sanders, and Senator Mitt Romney.

According to a poll conducted by Benzinga, most users are interested in the episode featuring Cuban.

The billionaire entrepreneur and “Shark Tank” star won the poll, securing nearly 50% of the votes, following him in second place was Fauci, likely due to his insights on COVID-19 and vaccines.

Meanwhile, Netflix, in July, Netflix reported second-quarter revenue of $9.56 billion, representing a 16.8% increase compared to the previous year. This figure surpassed the Street’s consensus estimate of $9.53 billion, according to data from Benzinga Pro.

Check out more of Benzinga’s Consumer Tech coverage by following this link.

Read Next:

Disclaimer: This content was partially produced with the help of Benzinga Neuro and was reviewed and published by Benzinga editors.

Image via Wikimedia Commons

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Kind Lending Expands Regional Leadership with Eduardo Paras as Regional Manager

SANTA ANA, Calif., Sept. 20, 2024 /PRNewswire/ — Kind Lending, LLC is excited to announce the addition of Eduardo Paras as Regional Manager. With a remarkable career in the mortgage industry and a proven track record of driving multi-million-dollar sales growth, Eduardo is set to make a significant impact at Kind Lending.

Eduardo brings a wealth of experience in growing businesses and leading teams to success in highly competitive markets. His career highlights include successfully expanding market presence through strategic acquisitions and organic growth, particularly in the Eastern United States. Eduardo’s expertise in the purchase business, maintaining an impressive 90/10 purchase-to-refinance ratio, and his deep knowledge of FHA lending make him a valuable asset to our team. His focus on serving Spanish-speaking first-time homebuyers and his ability to close an average of $3 million per month through the Realtor/Affinity channel showcases his dedication and skill in addressing diverse market needs.

Prior to joining Kind Lending, Eduardo held key leadership roles where he was instrumental in expanding and growing retail production, building high-performing teams, and achieving operational excellence. His extensive background in sales metrics, P&L management, and performance management aligns perfectly with Kind Lending’s vision for growth and innovation.

Jim Linnane, president of retail at Kind expressed, “I’m really excited to welcome Eduardo and his team to the Kind family as one of our first Enterpise model groups. Eduardo brings decades of experience and relationships to our growing Kind team.Looking forward to growing this model with Eduardo and others as Kind expands.”

Eduardo will be based in Illinois, overseeing regional operations and spearheading growth initiatives. His leadership is expected to drive significant advancements in Kind Lending’s regional strategy and support our mission of transforming the mortgage experience for our clients and partners.

About Kind Lending, LLC.

Kind Lending, LLC is a leading mortgage lender that provides innovative technology and exceptional customer service to help customers achieve their home financing goals. With a focus on transparency, efficiency, and personalized service, Kind Lending is committed to making the home financing process simple and stress-free for its customers.

@2024 Kind Lending, LLC Corporate Office is located at 4 Hutton Centre Drive, Suite 1000, Santa Ana, CA 92707. For Advertisement Purpose Only. All Rights Reserved. NMLS #3925 #888-250-5463. For licensing information go to http://nmlsconsumeraccess.org/. This is not a commitment to lend. Credit and collateral are subject to approval. Program and other restrictions may apply. Programs, rates, terms, and conditions are subject to change without notice.

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/kind-lending-expands-regional-leadership-with-eduardo-paras-as-regional-manager-302254578.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/kind-lending-expands-regional-leadership-with-eduardo-paras-as-regional-manager-302254578.html

SOURCE Kind Lending, LLC

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Reece A Kurtenbach Expands Holdings With Daktronics Stock Options

In a recent SEC filing, it was disclosed that Reece A Kurtenbach, Chairman at Daktronics DAKT, made a noteworthy acquisition of company stock options on September 19,.

What Happened: A Form 4 filing from the U.S. Securities and Exchange Commission on Thursday showed that Kurtenbach, Chairman at Daktronics, a company in the Information Technology sector, acquired stock options for 4,180 shares of DAKT. The options allow Kurtenbach to buy the company’s stock at $11.87 per share.

As of Friday morning, Daktronics shares are down by 0.0%, with a current price of $12.44. This implies that Kurtenbach’s 4,180 shares have a value of $2,382.

Discovering Daktronics: A Closer Look

Daktronics Inc designs and manufactures electronic scoreboards, programmable display systems, and large-screen video displays for sporting, commercial, and transportation applications. It is engaged in a full range of activities: marketing and sales, engineering and product design and development, manufacturing, technical contracting, professional services, and customer service and support. The company offers a complete line of products, from small scoreboards and electronic displays to large multimillion-dollar video display systems as well as related control, timing, and sound systems. The company has five reportable segments: Commercial, Live Events, High School Park and Recreation, Transportation, and International. The company makes the majority of its revenue from Live events.

Daktronics: Delving into Financials

Negative Revenue Trend: Examining Daktronics’s financials over 3 months reveals challenges. As of 31 July, 2024, the company experienced a decline of approximately -2.77% in revenue growth, reflecting a decrease in top-line earnings. As compared to its peers, the revenue growth lags behind its industry peers. The company achieved a growth rate lower than the average among peers in Information Technology sector.

Navigating Financial Profits:

-

Gross Margin: The company shows a low gross margin of 26.4%, indicating concerns regarding cost management and overall profitability relative to its industry counterparts.

-

Earnings per Share (EPS): Daktronics’s EPS is below the industry average. The company faced challenges with a current EPS of -0.11. This suggests a potential decline in earnings.

Debt Management: Daktronics’s debt-to-equity ratio is below the industry average at 0.32, reflecting a lower dependency on debt financing and a more conservative financial approach.

Assessing Valuation Metrics:

-

Price to Earnings (P/E) Ratio: Daktronics’s stock is currently priced at a premium level, as reflected in the higher-than-average P/E ratio of 59.24.

-

Price to Sales (P/S) Ratio: The Price to Sales ratio is 0.71, which is lower than the industry average. This suggests a possible undervaluation based on sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): The company’s EV/EBITDA ratio 6.28 is below the industry average, indicating that it may be relatively undervalued compared to peers.

Market Capitalization Analysis: The company’s market capitalization is below the industry average, suggesting that it is relatively smaller compared to peers. This could be due to various factors, including perceived growth potential or operational scale.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

The Relevance of Insider Transactions

Insider transactions serve as a piece of the puzzle in investment decisions, rather than the entire picture.

In the context of legal matters, the term “insider” refers to any officer, director, or beneficial owner holding more than ten percent of a company’s equity securities, as outlined by Section 12 of the Securities Exchange Act of 1934. This includes executives in the c-suite and significant hedge funds. Such insiders are obligated to report their transactions through a Form 4 filing, which must be completed within two business days of the transaction.

Pointing towards optimism, a company insider’s new purchase signals their positive anticipation for the stock to rise.

Despite insider sells not always signaling a bearish sentiment, they can be driven by various factors.

Understanding Crucial Transaction Codes

Delving into transactions, investors typically prioritize those unfolding in the open market, as precisely outlined in Table I of the Form 4 filing. A P in Box 3 indicates a purchase, while S signifies a sale. Transaction code C signals the conversion of an option, and transaction code A denotes a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of Daktronics’s Insider Trades.

Insider Buying Alert: Profit from C-Suite Moves

Benzinga Edge reveals every insider trade in real-time. Don’t miss the next big stock move driven by insider confidence. Unlock this ultimate sentiment indicator now. Click here for access.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Factoring Services Market to Reach $5,872.00 billion, Globally, by 2031 at 6.1% CAGR: Allied Market Research

Wilmington, Delaware, Sept. 20, 2024 (GLOBE NEWSWIRE) — Allied Market Research published a report, titled, ”Factoring Services Market by Provider (Banks and NBFCs), Enterprise Size (Large Enterprises and SMEs), Application (Domestic and International) and Industry Vertical (Construction, Manufacturing, Healthcare, Transportation & Logistics, Energy & Utilities, IT & Telecom, Staffing, and Others): Global Opportunity Analysis and Industry Forecast, 2022-2031“. According to the report, the “factoring services market” was valued at $3,271.45 billion in 2021, and is projected to reach $5,872.00 billion by 2031, growing at a CAGR of 6.1% from 2022 to 2031.

Get Your Research Report Sample & TOC: https://www.alliedmarketresearch.com/request-sample/A17187

The rise in open account trading opportunities and the need for alternate sources of financing for small & medium enterprises (SMEs) to meet immediate business goals are driving the global factoring service market. Moreover, increased awareness and understanding of supply chain financing benefits are boosting the factoring service market size. However, the lack of a stringent regulatory framework for debt recovery mechanisms and foreign currency restrictions, and stamp duties is hampering the factoring service market growth. On the contrary, the rise in technological advancements such as automated invoices is expected to offer remunerative opportunities for the expansion of the factoring service market during the forecast period.

The large enterprises segment held the highest market share in 2021.

By enterprise size, the large enterprises segment dominated the market in 2021, this dominance is attributed to the substantial working capital needs of large organizations and their reliance on factoring services to maintain cash flow and liquidity. Large enterprises often engage in significant trade volumes, making factoring an attractive solution to manage accounts receivable and reduce payment delays. However, the SMEs segment is expected to witness the largest CAGR of 6.2%, small and medium-sized enterprises (SMEs) are increasingly turning to factoring as a means to improve cash flow, manage working capital, and reduce the financial burden of long payment cycles from clients. With limited access to traditional financing methods, SMEs are finding factoring services to be a flexible and accessible solution for unlocking funds tied up in accounts receivable.

The domestic segment held the highest market share in 2021.

By application, the domestic segment accounted for the largest share in 2021. this dominance is driven by the significant demand for domestic factoring services within national markets, where businesses seek to optimize their cash flow and manage credit risks related to local trade transactions. However, the international segment is expected to witness the largest CAGR of 6.5%. This growth is driven by the increasing globalization of trade, with businesses expanding their operations across borders and seeking more efficient ways to manage international receivables. As companies engage in cross-border transactions, the need for factoring services to mitigate the risks associated with foreign trade, such as currency fluctuations and credit risks, has become more prominent.

Get More Information Before Buying: https://www.alliedmarketresearch.com/purchase-enquiry/A17187

Regional Insights: The Europe region held the highest market share in 2021.

By region, the factoring services market was dominated by Europe in 2021. Europe’s dominance is largely attributed to the strong presence of well-established financial institutions and a highly developed trade finance infrastructure. Factoring is widely used by businesses across the continent, particularly in countries like the UK, Germany, France, and Italy, where the practice has become a key financial tool for managing working capital and reducing payment risks.

Key Industry Developments

- In March 2024, Cashinvoice partnered with SBI Global Factors to broad base the use of factoring solutions for MSMEs. With this collaboration, the company is targeting additional credit disbursement of $360 million across over 100 MSMEs in tier 2 and tier 3 areas in the financial year 2024-2025.

- In June 2023, The African Export-Import Bank (Afreximbank) signed the deal to provide lines of credit totaling $24.61 million to enable factoring companies to expand their factoring activities in Africa.

- In August 2023, Exim Bank launched India Exim Finserve, its subsidiary, in GIFT City, Gujarat. The company provides a range of services for Indian exporters, focusing on export factoring with a combination of receivables financing, accounts receivable servicing, and coverage of non-payment risks.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the factoring services market analysis from 2021 to 2031 to identify the prevailing factoring services market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter’s five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the factoring services market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global factoring services market outlook.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global factoring services market trends, key players, market segments, application areas, and factoring services market opportunity.

- The study provides an in-depth analysis of the global factoring services market forecast along with current & future trends to explain the imminent investment pockets.

Get Your Personalized Sample Report & TOC Now: https://www.alliedmarketresearch.com/request-for-customization/A17187

Factoring Services Market Report Highlights:

Aspects Details

By Industry Vertical

- Transportation & Logistics

By Provider

By Enterprise Size

By Application

By Region

- North America (U.S., Canada)

- Europe (United Kingdom, Germany, France, Italy, Spain, Netherlands, Rest of Europe)

- Asia-Pacific (China, India, Japan, South Korea, Australia, Singapore, Rest of Asia-Pacific)

- LAMEA (Latin America, Middle East, Africa)

Key Market Players

KUKE Finance JSC, Advanon AG, BNP Paribas, China Construction Bank, HSBC group, Societe Generale, ALAMI Technologies, Deutsche Factoring Bank, The Southern Bank Company, Eurobank, Aldermore Bank, ICBC, Barclays, Mizuho Financial Group, Inc., Hitachi Capital (UK) PLC, AwanTunai, Riviera Finance of Texas, Inc.

Trending Reports in BFSI Industry (Book Now with 10% Discount + COVID-19 Scenario):

WealthTech Solutions Market Size, Share, Competitive Landscape and Trend Analysis Report, by Component, by Deployment Mode, by Enterprise Size, by End User : Global Opportunity Analysis and Industry Forecast, 2022-2031

Tax Advisory Services Market Size, Share, Competitive Landscape and Trend Analysis Report, by Type, by Organization Size, by Industry Vertical : Global Opportunity Analysis and Industry Forecast, 2021-2031

Management Consulting Services Market Size, Share, Competitive Landscape and Trend Analysis Report, by Type, by Organization Size, by Industry Vertical : Global Opportunity Analysis and Industry Forecast, 2021-2031

Medical Professional Liability Insurance Market Size, Share, Competitive Landscape and Trend Analysis Report, by Type, by Claim Type, by Coverage, by Application, by Distribution Channel : Global Opportunity Analysis and Industry Forecast, 2021-2031

Open Banking Market Size, Share, Competitive Landscape and Trend Analysis Report, by Financial Services, by Distribution Channel : Global Opportunity Analysis and Industry Forecast, 2020-2031

About Us:

Allied Market Research (AMR) is a full-service market research and business-consulting wing of Allied Analytics LLP based in Wilmington, Delaware. Allied Market Research provides global enterprises as well as medium and small businesses with unmatched quality of “Market Research Reports Insights” and “Business Intelligence Solutions.” AMR has a targeted view to provide business insights and consulting to assist its clients to make strategic business decisions and achieve sustainable growth in their respective market domain.

We are in professional corporate relations with various companies and this helps us in digging out market data that helps us generate accurate research data tables and confirms utmost accuracy in our market forecasting. Allied Market Research CEO Pawan Kumar is instrumental in inspiring and encouraging everyone associated with the company to maintain high quality of data and help clients in every way possible to achieve success. Each and every data presented in the reports published by us is extracted through primary interviews with top officials from leading companies of domain concerned. Our secondary data procurement methodology includes deep online and offline research and discussion with knowledgeable professionals and analysts in the industry.

Contact:

David Correa

1209 Orange Street,

Corporation Trust Center,

Wilmington,

New Castle,

Delaware 19801 USA.

Int’l: +1-503-894-6022

Toll Free: +1-800-792-5285

UK: +44-845-528-1300

India (Pune): +91-20-66346060

Fax: +1-800-792-5285

help@alliedmarketresearch.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Surprise! Billionaire Money Managers Are Selling Shares of Nvidia and Piling Into 2 Off-the-Radar Stock-Split Stocks.

Although artificial intelligence (AI) has been an exceptionally popular market trend that has helped power the growth-fueled Nasdaq Composite and benchmark S&P 500 to new heights, the enthusiasm shown by investors for stocks conducting splits has played an equally vital role in lifting select equities higher in 2024.

A stock split allows a publicly traded company to adjust its share price and outstanding share count by the same factor. Splits are purely a cosmetic tool in the sense that they have no impact on a company’s underlying operations or its market cap. Rather, they’re designed to increase or decrease a company’s share price, often with a very clear purpose.

A reverse split aims to increase a company’s share price, usually with the goal of maintaining its listing on a major stock exchange. Since this type of split is often conducted by struggling businesses, it’s one that investors tend to shy away from.

On the other hand, forward stock splits reduce a company’s share price to make it more nominally affordable to retail investors and/or employees who can’t purchase fractional shares. This type of split is typically completed by top-notch businesses that are out-innovating and out-executing their peers. Unsurprisingly, this is where a majority of investors focus their attention.

Since 2024 began, a little over a dozen prominent businesses have announced or completed a stock split; only one was a reverse split.

Billionaire investors have certainly taken note of the outperformance of the Class of 2024 stock-split stocks. However, their outlook for this group is mixed.

While most investors have been fixated on brand-name stock-split stocks, such as Nvidia (NASDAQ: NVDA), billionaire money managers have been quietly sending shares of Nvidia to the chopping block in favor of two off-the-radar stock-split stocks.

Wall Street’s smartest and richest asset managers are passing on Nvidia

Though it was Walmart that officially kicked off stock-split euphoria early in 2024, there hasn’t been a more-anticipated split this year than Nvidia’s. The AI juggernaut completed its historic 10-for-1 forward split following the close of trading on June 7.

Even though Nvidia’s AI graphics processing units (GPUs) are dominating in AI-accelerated data centers, this hasn’t halted a nine-month exodus by billionaire asset managers from the company’s stock. Based on form 13F filings with the Securities and Exchange Commission for the June-ended quarter, seven billionaires were sellers, including (total shares sold in parenthesis):

-

Ken Griffin of Citadel (9,282,018 shares)

-

David Tepper of Appaloosa Management (3,730,000)

-

Stanley Druckenmiller of Duquesne Family Office (1,545,370)

-

Cliff Asness of AQR Capital Management (1,360,215)

-

Israel Englander of Millennium Management (676,242)

-

Steven Cohen of Point72 Asset Management (409,042)

-

Philippe Laffont of Coatue Management (96,963)

Although ringing the register following a greater than 700% gain since the start of 2023 likely explains some of this continued selling activity, history might be the primary culprit that has billionaires eager to reduce their stake in Nvidia.

Since the broad-based proliferation of the internet three decades ago, we haven’t witnessed a single highly touted innovation, technology, or trend escape a bubble early in its existence. This is to say that investors have consistently overshot how quickly a new innovation would have utility or become mainstream. Considering that most businesses lack a well-defined plan to generate a positive return on their AI investments, we’re likely witnessing the early stages of an AI bubble.

Billionaires might also be following the cue of CEO Jensen Huang and other Nvidia insiders. Huang has been a persistent seller of his company’s stock since the midpoint of June. To boot, no company insiders have made an open-market purchase of their company’s stock since December 2020. If insiders don’t view their stock as a good value, why would billionaire money managers think it’s a deal?

The final catalyst behind this selling looks to be increasing competition. Besides external competitors bringing their AI GPUs to market, Nvidia’s top customers by net sales are also internally developing chips for use in their high-performance-computing data centers.

Instead of focusing on Wall Street’s most-popular stock-split stock of 2024, billionaire money managers chose to pile into two of the most under-the-radar companies enacting splits.

Sony Group

The first stock-split stock that has garnered only a fraction of the attention that Nvidia has — but had investors champing at the bit to purchase shares in the second quarter — is consumer electronics provider Sony Group (NYSE: SONY). Sony’s American depositary receipts (ADRs), which are set to split 5-for-1 on Oct. 8, had six billionaire buyers in the June-ended quarter (total shares purchased in parenthesis):

-

Ken Fisher of Fisher Investments (847,814 shares)

-

Ken Griffin of Citadel (251,987)

-

Israel Englander of Millennium Management (71,777)

-

John Overdeck and Davd Siegel of Two Sigma (19,400)

-

Cliff Asness of AQR Capital Management (4,573)

Although it has been nearly four years since Sony introduced its PlayStation 5 gaming console, the company is finding new and innovative ways to spur growth in its consumer-facing gaming segment. On top of increasing the price of its console in Japan to boost sales, it’s been enjoying a notable uptick in PlayStation Plus revenue. This subscription service allows users to game with their friends, access exclusive games, and store their data in the cloud.

We’re also inching closer to the expected release of Sony’s next-generation gaming console. While this release is still probably two years away, it’s not uncommon for investors to anticipate the sales and profit boost that console makers enjoy when releasing new systems.

Beyond gaming, Sony Group’s Imaging and Sensing Solutions (I&SS) segment is enjoying meaningful growth, with sales up 21% year over year. It is a key supplier of image sensors used in next-generation smartphones and digital cameras. In particular, the ongoing rollout of 5G networks by wireless companies, and the desire of businesses and consumers to take advantage of these faster download speeds, has led to a device replacement cycle that’s lifted demand for Sony’s products.

The final piece of the puzzle is that Sony’s board has authorized the repurchase of up to 30 million shares, representing close to 2.5% of its outstanding share count. For companies with steady or growing net income, buybacks have a way of boosting earnings per share and making a company more fundamentally attractive to investors.

Cintas

The other under-the-radar stock-split stock that billionaire money managers have decisively chosen over Nvidia is Cintas (NASDAQ: CTAS). The provider of corporate uniforms and business services completed its largest-ever forward split (4-for-1) last week and had four billionaire buyers during the second quarter:

-

Israel Englander of Millennium Management (1,117,976 shares)

-

Jeff Yass of Susquehanna International Group (164,424)

-

John Overdeck and David Siegel of Two Sigma (155,932)

Aside from the excitement surrounding the company’s first stock split in 24 years, the primary lure for Cintas is that it’s cyclical. In other words, it ebbs and flows with the health of the U.S. economy.

Though recessions are an inevitable part of the economic cycle, they are known for resolving quickly. Only three of 12 U.S. recessions since the end of World War II surpassed the 12-month mark, and none endured longer than 18 months. By comparison, most periods of growth have easily topped 18 months. Aligning Cintas’ success with the U.S. economy has allowed it to grow steadily over the long run.

Cintas also has more than 1 million corporate clients. Providing everything from uniforms to floor mats, soap dispensers, and safety kits ensures that no single business is crucial to its success or capable of rocking the boat.

However, the one glaring concern with Cintas is the company’s valuation. While there’s no denying that bolt-on acquisitions and ongoing product innovation have helped Cintas sustain high-single-digit growth, its forward price-to-earnings ratio of 45 implies that it’s priced for perfection — something for current and prospective investors to keep in mind.

Should you invest $1,000 in Sony Group right now?

Before you buy stock in Sony Group, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Sony Group wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $694,743!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 16, 2024

Sean Williams has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Nvidia and Walmart. The Motley Fool recommends Cintas. The Motley Fool has a disclosure policy.

Surprise! Billionaire Money Managers Are Selling Shares of Nvidia and Piling Into 2 Off-the-Radar Stock-Split Stocks. was originally published by The Motley Fool

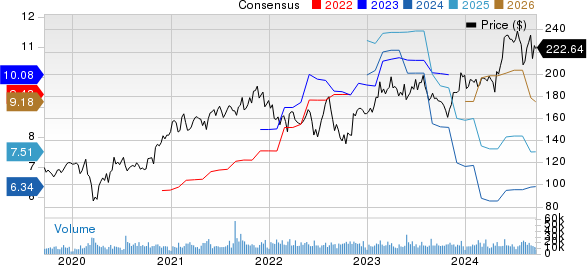

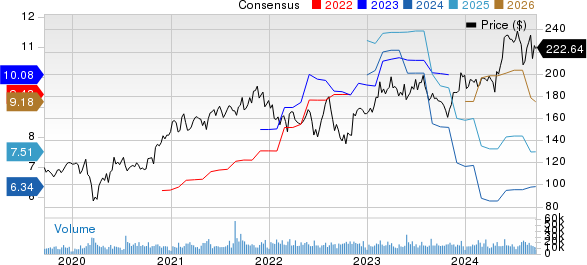

Synopsys Down 6.2% Since Last Earnings Report: Can It Rebound?

It has been about a month since the last earnings report for Synopsys SNPS. Shares have lost about 6.2% in that time frame, underperforming the S&P 500.

Will the recent negative trend continue leading up to its next earnings release, or is Synopsys due for a breakout? Before we dive into how investors and analysts have reacted as of late, let’s take a quick look at its most recent earnings report in order to get a better handle on the important catalysts.

Synopsys Q3 Earnings Beat Estimates, Revenues Rise Y/Y

Synopsys reported better-than-expected earnings for the third quarter of fiscal 2024. The company’s fiscal third-quarter non-GAAP earnings per share of $3.43 surpassed the Zacks Consensus Estimate of $3.28. The bottom line improved 27% year over year, primarily driven by higher revenues and better cost management.

Revenues jumped 13% year over year to $1.53 billion and came in line with the Zacks Consensus Estimate. The top line was driven by growth across multiple business segments.

Synopsys’ revenue growth was driven by ongoing investments from semiconductor and systems companies in its solutions to enhance its R&D capabilities.

Synopsys revealed that it has presented the Software Integrity business as a discontinued operation in its consolidated financial statements for all periods due to its ongoing divestment. Notably, the company has agreed to sell its Software Integrity business to Clearlake Capital and Francisco Partners in a deal worth $2.1 billion.

Quarter in Detail

In the license-type revenue group, Time-Based Product revenues (52.6% of the total revenues) of $803.1 million were down by 2.9% year over year. Upfront Product revenues (29%) moved upward by 51.2% to $442.5 million. Maintenance and Service revenues (18.4%) increased 19.5% to $280.1 million from the year-ago quarter’s $234.3 million.

Segment-wise, Electronic Design Automation (“EDA”) revenues (66.9% of revenues) were $1.02 billion, up 4.9% year over year. Design IP revenues (30.4% of revenues) amounted to $463.1 million. Other revenues were $42.5 million, representing 2.7% of the total revenues.

Geographically, Synopsys’ revenues in North America (44% of the total) and Europe (9%) were $672.6 million and $144.6 million, respectively. Revenues from Korea (13%), China (17%) and other (16%) were $194.8 million, $266.7 million and $247 million, respectively.

The non-GAAP operating margin was 40%, expanding 360 basis points (bps) year over year.

Synopsys’ EDA’s adjusted operating margin rose 70 bps to 41.5%. The Design IP segment’s margin showed a massive improvement to 36.7% from 23.6% in the year-ago quarter.

Balance Sheet & Cash Flow

Synopsys had cash and short-term investments of $1.99 billion as of Jul 31, 2024, compared with $1.66 billion as of Apr 30, 2024.

The total long-term debt was $15.6 million at the end of the reported quarter, which decreased from $17 million reported in the previous quarter.

The company’s cash flow from operating activities, including discontinued operations, was $844.2 million in the first nine months compared with the year-ago quarter’s cash flow of $1.37 billion.

Guidance Update

For fiscal 2024, SNPS expects revenues between $6.105 billion and $6.135 billion compared with the previously announced guidance of $6.09-$6.15 billion. Non-GAAP earnings are expected in the range of $13.07-$13.12 compared with the previous guidance of $12.9-$12.98. Non-GAAP expenses are now expected in the range of $3.76-$3.77 billion compared with the previously projected range of $3.77-$3.81 billion.

For the fourth quarter of fiscal 2024, Synopsys expects revenues between $1.614 billion and $1.644 billion. Management estimates non-GAAP EPS between $3.27 and $3.32. Non-GAAP expenses are anticipated in the band of $1.027-$1.037 billion.

How Have Estimates Been Moving Since Then?

It turns out, fresh estimates flatlined during the past month.

The consensus estimate has shifted -5.87% due to these changes.

VGM Scores

Currently, Synopsys has a subpar Growth Score of D, a grade with the same score on the momentum front. Following the exact same course, the stock was allocated a grade of D on the value side, putting it in the bottom 40% for this investment strategy.

Overall, the stock has an aggregate VGM Score of F. If you aren’t focused on one strategy, this score is the one you should be interested in.

Outlook

Synopsys has a Zacks Rank #3 (Hold). We expect an in-line return from the stock in the next few months.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Stock market today: US stocks end mixed but finish the week near record highs after the Fed's first rate cut in 4 years

-

US stocks were mostly lower Friday, though the Dow eked out a gain to close at a record high.

-

The Federal Reserve’s first interest rate cut since 2020 helped drive the week’s gains.

-

Investors see the Fed’s easing as a positive sign for the economy and the stock market.

US stocks closed mostly lower on Friday, but finished the week higher by just over 1% for the S&P 500, Nasdaq 100, and Dow Jones Industrial Average.

The Dow edged slightly higher in Friday’s session to clinch another record close to cap off the week.

The anticipation and delivery of the Federal Reserve’s first interest rate cut since 2020 helped drive the gains this week.

The Fed issued a jumbo 50 basis point interest rate cut to “recalibrate” monetary policy, as Fed Chairman Jerome Powell put it nine times during his FOMC speech on Wednesday.

Investors took the move as assurance that the US economy is on track for a soft landing, as inflation continues to cool and the labor market normalizes.

US stocks soared on Thursday after declining slightly on Wednesday, as investors had more time to digest the Fed’s interest rate decision.

Going forward, there should be more gains in store for the stock market, according to Raymond James CIO Larry Adam.

“The combination of Fed easing, and a soft landing should prove to be a tailwind for risk assets (equities in particular). Historically, Fed easing cycles have been positive for the equity market. In fact, the S&P 500 has been up ~5% on average in the 12 months following the Fed’s first cut,” Adam said in a note on Friday.

The S&P 500 and Dow Jones Industrial Average both hit record highs on Thursday. But those record highs could become a liability if the economy weakens, according to Adam.

“With the S&P 500 rallying to record levels and currently at some of the most expensive valuations (23.5 LTM P/E) that we have seen in history, there is not much room for disappointment if the soft-landing scenario were to falter,” Adam said.

Here’s where US indexes stood at the 4:00 p.m. closing bell on Friday:

Here’s what else happened today:

In commodities, bonds, and crypto:

-

West Texas Intermediate crude oil decreased 0.10% to $71.09 a barrel. Brent crude, the international benchmark, dropped 0.39% to $74.59 a barrel.

-

Gold was up 1.17% to $2,645.30 an ounce.

-

The 10-year Treasury yield was higher by 2 basis points at 3.733%.

-

Bitcoin was down 0.11% to $62,894.

Read the original article on Business Insider

Elon Musk Claps Back After SEC Threatens Sanctions Against Tesla CEO For Evading Twitter Depositions, Says He Was Overseeing 'Highest Risk Astronaut Mission' Of SpaceX: 'I Had To Make A Go Vs No-Go Decision. Their Lives Came First'

The Securities and Exchange Commission (SEC) has urged a federal judge to sanction Tesla Inc. TSLA and SpaceX CEO Elon Musk if he continues to avoid appearing for a deposition.

What Happened: The SEC is probing whether Elon Musk or his associates engaged in securities fraud in 2022 when Musk sold Tesla shares and increased his stake in Twitter, now rebranded as X.

In May, Musk was ordered by the court to appear for a deposition by the financial regulators regarding the Twitter deal.

However, the tech billionaire twice failed to appear before the SEC, first in September 2023 and again last week, in defiance of a clear court order, according to SEC attorney Robin Andrews, reported CNBC.

Andrews has requested the judge to consider sanctions if Musk continues to delay. The SEC also plans to ask the court to hold Musk in “civil contempt” for canceling a deposition on Sept. 10 with only a few hours’ notice.

Musk’s deposition has been rescheduled for early October at an SEC office.

Musk’s attorney, Alex Spiro, responded that “such drastic action would be inappropriate,” adding that Musk and his companies have been cooperating with the SEC in multiple other ongoing investigations.

A user on X shared the news about the SEC’s intent to seek sanctions against Musk, and argued that the tech billionaire “was busy overseeing the launch of SpaceX’s Polaris Dawn mission that day.”

In response, Musk seemingly agreed and described the mission as “our highest-risk astronaut mission ever.”

He noted that stringent weather constraints were only met on the night of the launch.

“The weather constraints on this mission are also extremely high and only cleared that night. I had to make a go vs no-go decision. Their lives came first.”

Why It Matters: Earlier this year in April, the U.S. Supreme Court upheld a 2018 SEC settlement following Musk’s claim of having “funding secured” to privatize Tesla, which the SEC deemed false.

Musk has also previously expressed dissatisfaction with the SEC on Lex Fridman‘s podcast, criticizing the agency’s failure to protect retail investors from hedge funds. “Not once did the SEC go after any of the hedge funds who were nonstop shorting and distorting Tesla. Not once,” he stated at the time.

Last year, after the SEC filed a lawsuit against Musk over his Twitter stock purchase, to which Musk responded that a comprehensive overhaul of these agencies is sorely needed.

Read Next:

Disclaimer: This content was partially produced with the help of Benzinga Neuro and was reviewed and published by Benzinga editors.

Image via Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Walmart 10% Owner Sold $170.98M In Company Stock

Disclosed on September 19, ALICE WALTON, 10% Owner at Walmart WMT, executed a substantial insider sell as per the latest SEC filing.

What Happened: WALTON’s decision to sell 2,163,616 shares of Walmart was revealed in a Form 4 filing with the U.S. Securities and Exchange Commission on Thursday. The total value of the sale is $170,979,096.

Monitoring the market, Walmart‘s shares up by 1.18% at $78.96 during Friday’s morning.

About Walmart

Walmart serves as the preeminent retailer in the United States, with its strategy predicated on superior operating efficiency and offering the lowest priced goods to consumers to drive robust store traffic and product turnover. Walmart augmented its low-price business strategy by offering a convenient one-stop shopping destination with the opening of its first supercenter in 1988.Today, Walmart operates over 4,600 stores in the United States (5,200 including Sam’s Club) and over 10,000 stores globally. Walmart generated over $440 billion in domestic namesake sales in fiscal 2024, with Sam’s Club contributing another $86 billion to the company’s top line. Internationally, Walmart generated $115 billion in sales. The retailer serves around 240 million customers globally each week.

Walmart: A Financial Overview

Revenue Growth: Walmart’s revenue growth over a period of 3 months has been noteworthy. As of 31 July, 2024, the company achieved a revenue growth rate of approximately 4.77%. This indicates a substantial increase in the company’s top-line earnings. In comparison to its industry peers, the company trails behind with a growth rate lower than the average among peers in the Consumer Staples sector.

Profitability Metrics: Unlocking Value

-

Gross Margin: With a high gross margin of 25.11%, the company demonstrates effective cost control and strong profitability relative to its peers.

-

Earnings per Share (EPS): Walmart’s EPS is notably higher than the industry average. The company achieved a positive bottom-line trend with a current EPS of 0.56.

Debt Management: Walmart’s debt-to-equity ratio is below the industry average at 0.73, reflecting a lower dependency on debt financing and a more conservative financial approach.

In-Depth Valuation Examination:

-

Price to Earnings (P/E) Ratio: Walmart’s stock is currently priced at a premium level, as reflected in the higher-than-average P/E ratio of 40.65.

-

Price to Sales (P/S) Ratio: With a relatively high Price to Sales ratio of 0.95 as compared to the industry average, the stock might be considered overvalued based on sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): Walmart’s EV/EBITDA ratio, surpassing industry averages at 18.43, positions it with an above-average valuation in the market.

Market Capitalization: Surpassing industry standards, the company’s market capitalization asserts its dominance in terms of size, suggesting a robust market position.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

The Relevance of Insider Transactions

Insider transactions should be considered alongside other factors when making investment decisions, as they can offer important insights.

In the realm of legality, an “insider” is defined as any officer, director, or beneficial owner holding more than ten percent of a company’s equity securities under Section 12 of the Securities Exchange Act of 1934. This includes executives in the c-suite and major hedge funds. These insiders are required to disclose their transactions through a Form 4 filing, to be submitted within two business days of the transaction.

Notably, when a company insider makes a new purchase, it is considered an indicator of their positive expectations for the stock.

Conversely, insider sells may not necessarily signal a bearish stance on the stock and can be motivated by various factors.

Exploring Key Transaction Codes

Investors prefer focusing on transactions that take place in the open market, indicated in Table I of the Form 4 filing. A P in Box 3 indicates a purchase, while S indicates a sale. Transaction code C indicates the conversion of an option, and transaction code A indicates grant, award or other acquisition of securities from the company.

Check Out The Full List Of Walmart’s Insider Trades.

Insider Buying Alert: Profit from C-Suite Moves

Benzinga Edge reveals every insider trade in real-time. Don’t miss the next big stock move driven by insider confidence. Unlock this ultimate sentiment indicator now. Click here for access.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

ADI Partners With India's Tata Group: How Should You Play the Stock?

Analog Devices ADI recently announced its strategic alliance with Tata Group to advance the semiconductor ecosystem in India and leverage its products in Tata applications like electric vehicles and network infrastructure.

This collaboration is expected to be mutually beneficial and is a significant step in establishing a robust electronics manufacturing ecosystem in India for domestic and global consumption.

Tata Electronics, Tata Motors and Tejas Networks signed a Memorandum of Understanding with ADI to enhance strategic and business cooperation and explore opportunities for semiconductor manufacturing in India.

Strategic Partnerships to Boost ADI’s Prospects

ADI’s recent collaboration with Honeywell HON to digitize commercial spaces without replacing existing wiring, reducing costs and downtime is a noteworthy development.

Analog Devices announced a strategic partnership with Flagship Pioneering to speed up the development of a fully digitized biological world.

Analog Devices Suffers From Stiff Competition

Despite having a strong partner base, macroeconomic challenges remain a concern. Geo-political tensions and recessionary fears are major negatives.

ADI faces stiff competition from players like Texas Instruments TXN, which is also making efforts to integrate generative AI capabilities into its products.

On a year-to-date basis, ADI has underperformed TXN, which gained 17.7%.

ADI shares have plunged 12.1% year to date against the broader Zacks Computer and Technology sector’s return of 19.4%.

In the first half of fiscal 2024, ADI reported revenues of $4.67 billion, down 36% from the year-ago period. This underperformance can be firmly pointed toward the softness in the industrial, communications and automotive end markets.

ADI’s Q4 Guidance Positive

For fourth-quarter fiscal 2024, ADI expects revenues of $2.40 billion (+/- $100 million), up 4% sequentially at the midpoint. The Zacks Consensus Estimate for the same is pegged at $2.41 billion, indicating a fall of 11.4% year over year.

ADI anticipates a non-GAAP operating margin of 41% (+/- 100 bps).

The company expects non-GAAP earnings to be $1.63 (+/- $0.10) per share. The consensus mark for the same is pegged at $1.63 per share, suggesting a decline of 18.9% year over year.

Zacks Rank and Valuation

ADI shares currently have a stretched valuation, as suggested by a Value Score of D.

Analog Devices stock is trading with a forward 12-month Price/Sales of 10.86X compared with the industry’s 7.78X.

ADI currently carries a Zacks Rank #3 (Hold), implying that investors should wait for a favorable entry point.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.