Why CrowdStrike Stock Was Climbing Today

Shares of CrowdStrike (NASDAQ: CRWD) were moving higher today after the company got a bullish analyst note from Citigroup. The analyst built on earlier Wall Street comments that the company seems to have escaped the worst of the backlash that followed its July incident when a faulty software update shut down flights and banking operations, and disrupted other industries.

As of 11:11 a.m. ET, CrowdStrike stock was up 4.5% on the news.

Wall Street thinks the worst is behind CrowdStrike

This morning, Citi was the latest Wall Street firm to issue a bullish rating on the stock following the Fal.Con conference earlier this week. Citi commended management’s transparency on the earlier software update debacle and cited evidence of customer resilience, noting churn is lower than expected and the cybersecurity company has done a good job of maintaining its pricing.

Citi reiterated a buy rating on CrowdStrike with a $300 price target. While that implies just a 4% rise in the stock, the note is clearly a positive as CrowdStrike is still trading below where it was before the incident happened.

Earlier in the week, a number of other research firms, including DA Davidson, Evercore ISI, Jefferies, and Truist all reiterated buy ratings on the stock and said the customer backlash following the software incident had largely passed.

Can CrowdStrike keep gaining?

It’s certainly a good sign that CrowdStrike has survived the worst of the incident, but the stock is still expensive and growth was slowing prior to the outage.

If the company is truly back on track, the stock should move higher, but investors should be mindful of the valuation as its price-to-sales ratio was 20. Expect the volatility in the stock to continue.

Where to invest $1,000 right now

When our analyst team has a stock tip, it can pay to listen. After all, Stock Advisor’s total average return is 762% — a market-crushing outperformance compared to 167% for the S&P 500.*

They just revealed what they believe are the 10 best stocks for investors to buy right now… and CrowdStrike made the list — but there are 9 other stocks you may be overlooking.

*Stock Advisor returns as of September 16, 2024

Citigroup is an advertising partner of The Ascent, a Motley Fool company. Jeremy Bowman has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends CrowdStrike, Jefferies Financial Group, and Truist Financial. The Motley Fool has a disclosure policy.

Why CrowdStrike Stock Was Climbing Today was originally published by The Motley Fool

Cancel Your Costco Membership Immediately if These 3 Things Apply to You

To me, paying $130 per year for an Executive membership at Costco is an easy call. The money I spend comes back to me — and then some — in the form of savings on bulk groceries and household essentials.

But just because a Costco membership makes sense for me doesn’t mean it’s right for you. Here are a few signs that it may be time to cancel yours.

1. You’ve moved far away from the closest store

I shop at Costco pretty much every week. And that’s doable, since my nearest Costco store is about 15 minutes away.

But if you’ve recently moved and you no longer have easy access to Costco, then it may be time to cancel your membership. You can tell yourself you’ll do the 40-minute drive each way several times a month. But if you’re busy, your membership might end up going to waste.

Also, don’t forget that your time is worth money. Even if you can technically get to Costco often enough to justify a membership, you don’t want to waste valuable time on the road when you have things to do.

It could make sense to stick to a regular supermarket if there’s one less than five minutes away. Or you may want to join another warehouse club if there’s a store that’s much closer to where you live now.

2. You’ve repeatedly landed in credit card due to overspending at Costco

It’s fun to roam the aisles at Costco and check out the store’s rotating inventory. But if you keep overspending at Costco to the point where it’s driven you into credit card debt, then it’s time to think about canceling your membership.

It’s one thing to occasionally make an impulsive purchase at Costco that adds $15 to your weekly grocery bill. But it’s another thing to spend a few hundred dollars extra at Costco each month — and then carry a balance on a credit card you can’t pay off because of it. If you just can’t seem to break that habit, then staying away from Costco could be a much better bet for your finances.

3. You throw away most of the food you buy in bulk

There’s a world of potential savings to be had when you buy groceries at Costco in bulk. But if you find that you typically throw away a good part of your haul, then you’re probably not saving yourself money. In reality, you may be wasting money repeatedly.

Be honest about your bulk food needs and cooking habits. Not everyone has the time or patience to prepare meals at home. If you can afford takeout five nights a week, there’s nothing wrong with that. But if that’s the case, there’s no sense in constantly buying bulk food from Costco that only gets thrown away.

And if it doesn’t pay to buy food at Costco, you’ll need to make sure the other items you might buy there save you enough money to justify a membership. If that’s not the case, canceling and looking out for sales on items like toilet paper could make more sense.

It’s okay to cut ties with Costco

I can’t imagine not shopping at Costco all the time. But I have the benefit of living close by and doing a fair amount of cooking at home. I also have a larger household, so buying groceries in bulk makes sense for us. And while I do my share of impulse shopping at Costco, it’s not to the point where my finances are taking a beating.

But you might be in a very different situation on all accounts. And so if, don’t hesitate to cancel your membership if it’s just not right for you.

Top credit card to use at Costco (and everywhere else!)

We love versatile credit cards that offer huge rewards everywhere, including Costco! This card is a standout among America’s favorite credit cards because it offers perhaps the easiest $200 cash bonus you could ever earn and an unlimited 2% cash rewards on purchases, even when you shop at Costco.

Add on the competitive 0% interest period and it’s no wonder we awarded this card Best No Annual Fee Credit Card.

Click here to read our full review for free and apply before the $200 welcome bonus offer ends!

We’re firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. The Ascent does not cover all offers on the market. Editorial content from The Ascent is separate from The Motley Fool editorial content and is created by a different analyst team.JPMorgan Chase is an advertising partner of The Ascent, a Motley Fool company. Maurie Backman has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Costco Wholesale and JPMorgan Chase. The Motley Fool has a disclosure policy.

Cancel Your Costco Membership Immediately if These 3 Things Apply to You was originally published by The Motley Fool

Mortgage rates fall to lowest level in two years: Here’s how much money you need to buy a $400,000 home

Mortgage rates fell to the lowest level in two years a day after the Federal Reserve cut its benchmark interest rate.

The 30-year fixed-rate mortgage averaged 6.09% as of Sept. 19, according to data released by Freddie Mac on Thursday.

Most Read from MarketWatch

It’s down 11 basis points from the previous week. One basis point is equal to one hundredth of a percentage point.

A year ago, the 30-year rate was averaging 7.19%.

The average rate on the 15-year mortgage was 5.15%, down from 5.27% last week. The 15-year rate was at 6.54% a year ago.

Freddie Mac’s weekly report on mortgage rates is based on thousands of applications received from lenders across the country that are submitted to Freddie Mac when a borrower applies for a mortgage.

Separate data by Mortgage News Daily said that the 30-year fixed-rate mortgage was averaging 6.15% as of Thursday morning. The Mortgage Bankers Association’s survey said that the 30-year was at 6.15% as of Sept. 6.

The big picture: Mortgage rates are 110 basis points lower than a year ago and are expected to go even lower, which could stimulate more activity in the housing market.

Homeowners who bought at higher rates are already jumping in to refinance their outstanding mortgage balances, as seen in recent data.

But buyers have largely been holding back. Though a decline in mortgage rates helps improve housing affordability, home buyers must still contend with high prices.

In August, home prices set a new record high for that month, and existing-home sales dropped to the lowest level since October 2023.

What Freddie Mac said: “While mortgage rates do not directly follow moves by the Federal Reserve, this first cut in over four years will have an impact on the housing market,” said Sam Khater, chief economist at Freddie Mac.

“Declining mortgage rates over the last several weeks indicate this cut was mostly baked in, but we expect rates to fall further, sparking more housing activity,” he added.

What are they saying? For buyers, a drop in rates increases purchasing power by nearly $12,000 from a year ago.

A buyer looking at a home at the median listing price of $430,000 this August, with a rate of 6.09% and a 20% down payment, would need an annual income of roughly $107,900, according to calculations provided to MarketWatch by Hannah Jones, a senior economic research analyst at Realtor.com.

The buyer’s monthly payment would be roughly $2,700. The analysis also assumes they are paying property taxes and homeowners insurance and are keeping housing costs within 30% of their gross income.

A year ago, as rates were averaging 7.19%, that same buyer would have had a payment of $3,000 a month for a $436,000 home and would have needed an annual income of around $119,500.

(Realtor.com is operated by News Corp subsidiary Move Inc. MarketWatch is a unit of Dow Jones, also a subsidiary of News Corp.)

Most Read from MarketWatch

Elon Musk Reacts After Cathie Wood Labels Gavin Newsom's Threat To Sue Tesla CEO Over Memes 'Unconstitutional': '…But That Didn't Stop Them'

Tesla and SpaceX CEO Elon Musk has fired back at Gov. Gavin Newsom’s (D) threat of legal action over his use of memes and deepfakes.

What Happened: Governor Newsom has denied any intention to suppress parodies and made it clear that he was laying down the law with Musk.

His statement came after days of escalating feud between the duo, which started with Newsom signing a stringent law banning political “deepfakes,” earlier this week.

Following the governor’s enactment of three bills aimed at restricting the use of AI in creating fake images for videos and political ads, Musk accused Newsom of trying to outlaw parody.

“I think Mr. Musk has missed the punchline. Parody is still alive and well in California but deepfakes and manipulation of elections that hurts democracy and the integrity of the system and trust.”

When probed about whether he intends to seek legal action against Musk, Newsom said, “The law asserts that many can seek injunction relief. I just signed the law … and I haven’t had a chance to review the specific lawsuit around a conservative blogger that seems offended by our laws.”

Musk responded to Newsom’s potential legal action on social media with one word: “Amazing.”

When Cathie Wood, CEO of ARK Invest, shared the same video and called it “Unconstitutional,” Musk agreed, stating, “Very much so, but that didn’t stop them.”

Subscribe to the Benzinga Tech Trends newsletter to get all the latest tech developments delivered to your inbox.

Why It Matters: Musk has faced accusations of manipulating the platform to prioritize his posts and suspending the accounts of journalists who report on him.

In response to Musk’s actions, several major advertisers have pulled their ads from X.

Meanwhile, the rising misuse of AI to produce deepfakes has become an increasing concern. A previous study by Google’s DeepMind showed that deepfakes of politicians and celebrities were more prevalent than AI-driven cyberattacks.

Earlier this year, AI image generation tools from OpenAI and Microsoft were linked to election misinformation scandals.

In January 2024, deepfake incidents involving public figures like Taylor Swift and President Joe Biden raised concerns at the White House.

The law signed by Newsom also came after an AI-manipulated campaign video ridiculing Democratic nominee Kamala Harris in July gained attention after being shared by Musk.

Check out more of Benzinga’s Consumer Tech coverage by following this link.

Read Next:

Disclaimer: This content was partially produced with the help of Benzinga Neuro and was reviewed and published by Benzinga editors.

Image Via Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Medline to Expand at Vornado Realty's THE MART by 110,000 Square Feet

Vornado Realty Trust VNO, with Medline, recently announced an agreement to increase Medline’s presence at THE MART by 110,000 square feet. The long-term lease agreement with Vornado will run until 2036.

This expansion positions Medline as one of the largest tenants at Vornado’s 3.7-million-square-foot property in downtown Chicago. Medline is set to increase its office space in THE MART from 51,000 to 161,000 square feet, expanding to a single, contiguous area that will occupy the majority of the 12th floor.

Headquartered in Northfield, IL, Medline is the largest manufacturer of medical-surgical products in the healthcare sector, as well as a provider of supply chain services and clinical solutions partner. The company enhances clinical, financial and operational results across various care settings, including large healthcare systems, independent physician practices, to home health patients and their families.

About Vornado’s THE MART

Encompassing two entire city blocks, THE MART is the home for Chicago’s technological innovative companies. This 25-story building stands as the largest and most important center for design in North America, featuring more than 250 premier design showrooms that provide the latest resources for both residential and commercial markets.

In the second quarter of 2024, at THE MART, 32,000 square feet of space (all at share) was leased for an initial rent of $56.39 per square foot and a weighted average lease term of 7.2 years. The tenant improvements and leasing commissions were $7.86 per square foot per annum or 13.9% of the initial rent.

Per Glen Weiss, executive vice president and co-head of Real Estate at Vornado, “With its prime location and unrivaled amenity program, THE MART aligns perfectly with Medline’s needs and continues to be a major bright spot in the Chicago office market.”

Wrapping Up

Vornado’s focus on having assets in such a few select high-rent, high barrier-to-entry geographic markets and its diversified tenant base, including Medline, are expected to drive steady cash flows and fuel its growth over the long term.

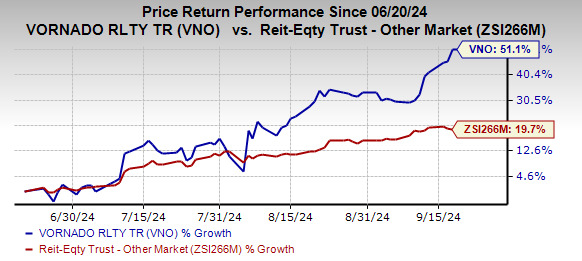

Over the past three months, shares of this Zacks Rank #3 (Hold) company have gained 51.1%, outperforming the industry’s growth of 19.7%.

Image Source: Zacks Investment Research

Stocks to Consider

Some better-ranked stocks from the broader REIT sector are Crown Castle Inc. CCI and Four Corners Property Trust FCPT, each carrying a Zacks Rank #2 (Buy) at present.

The Zacks Consensus Estimate for Crown Castle’s 2024 funds from operation (FFO) per share has moved marginally northward over the past two months to $6.97.

The Zacks Consensus Estimate for Four Corners’ current-year FFO per share has been raised marginally over the past month to $1.73.

Note: Anything related to earnings presented in this write-up represent funds from operations (FFO), a widely used metric to gauge the performance of REITs.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Insider Decision: Prescott General Partners LLC Offloads $5.15M Worth Of Credit Acceptance Stock

Revealing a significant insider sell on September 19, Prescott General Partners LLC, 10% Owner at Credit Acceptance CACC, as per the latest SEC filing.

What Happened: LLC’s decision to sell 11,586 shares of Credit Acceptance was revealed in a Form 4 filing with the U.S. Securities and Exchange Commission on Thursday. The total value of the sale is $5,154,730.

Monitoring the market, Credit Acceptance‘s shares down by 0.0% at $464.21 during Friday’s morning.

Discovering Credit Acceptance: A Closer Look

Credit Acceptance Corp is a consumer finance company that specializes in automobile loans. These loans are offered through a U.S. nationwide network of automobile dealers that benefit from sales of vehicles to consumers who could otherwise not obtain financing. The company also benefits from repeat and referral sales, and from sales to customers responding to advertisements for financing, but qualify for traditional financing. The company derives its revenue from finance charges, premiums earned on the reinsurance of vehicle service contracts, and other fees. Of these, financing charges, including servicing fees, are by far a source of revenue.

Key Indicators: Credit Acceptance’s Financial Health

Revenue Growth: Over the 3 months period, Credit Acceptance showcased positive performance, achieving a revenue growth rate of 12.42% as of 30 June, 2024. This reflects a substantial increase in the company’s top-line earnings. In comparison to its industry peers, the company trails behind with a growth rate lower than the average among peers in the Financials sector.

Key Insights into Profitability Metrics:

-

Gross Margin: The company maintains a high gross margin of 62.24%, indicating strong cost management and profitability compared to its peers.

-

Earnings per Share (EPS): Credit Acceptance’s EPS is below the industry average, signaling challenges in bottom-line performance with a current EPS of -3.83.

Debt Management: The company faces challenges in debt management with a debt-to-equity ratio higher than the industry average. With a ratio of 3.82, caution is advised due to increased financial risk.

Assessing Valuation Metrics:

-

Price to Earnings (P/E) Ratio: The current P/E ratio of 33.04 is below industry norms, indicating potential undervaluation and presenting an investment opportunity.

-

Price to Sales (P/S) Ratio: With a higher-than-average P/S ratio of 2.97, Credit Acceptance’s stock is perceived as being overvalued in the market, particularly in relation to sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): A high EV/EBITDA ratio of 42.5 positions the company as being more valued compared to industry benchmarks.

Market Capitalization Analysis: Reflecting a smaller scale, the company’s market capitalization is positioned below industry averages. This could be attributed to factors such as growth expectations or operational capacity.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

Delving Into the Significance of Insider Transactions

Insider transactions serve as a piece of the puzzle in investment decisions, rather than the entire picture.

Exploring the legal landscape, an “insider” is defined as any officer, director, or beneficial owner holding more than ten percent of a company’s equity securities, as stipulated by Section 12 of the Securities Exchange Act of 1934. This encompasses executives in the c-suite and major hedge funds. These insiders are required to report their transactions through a Form 4 filing, which must be submitted within two business days of the transaction.

Highlighted by a company insider’s new purchase, there’s a positive anticipation for the stock to rise.

But, insider sells may not necessarily indicate a bearish view and can be motivated by various factors.

The Insider’s Guide to Important Transaction Codes

Taking a closer look at transactions, investors often prioritize those unfolding in the open market, meticulously cataloged in Table I of the Form 4 filing. A P in Box 3 denotes a purchase, while S signifies a sale. Transaction code C denotes the conversion of an option, and transaction code A signifies a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of Credit Acceptance’s Insider Trades.

Insider Buying Alert: Profit from C-Suite Moves

Benzinga Edge reveals every insider trade in real-time. Don’t miss the next big stock move driven by insider confidence. Unlock this ultimate sentiment indicator now. Click here for access.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Universe Pharmaceuticals INC Reports Financial Results for The First Six Months of Fiscal Year 2024

JI’AN, Jiangxi, China, Sept. 20, 2024 (GLOBE NEWSWIRE) — Universe Pharmaceuticals INC (the “Company,” “we,” “our” and “us”) UPC, a pharmaceutical producer and distributor in China, today announced its unaudited financial results for the first six months of fiscal year 2024 ended March 31, 2024.

Mr. Gang Lai, Chairman of the Board of Directors and CEO of Universe Pharmaceuticals INC, commented, “During the first six months of fiscal year 2024, we navigated business uncertainties and adjusted our business strategy to offset the impact of the global economic slowdown. As a result, we generated $12.9 million in revenue for the six months ended March 31, 2024, lower than the $18.5 million revenue generated in the same period of last year. We made considerable efforts to implement our growth strategies during this challenging period. To complement our offline sales channels, we started developing online sales channels, which helped us seize more opportunities and we expect online sales to drive our business growth in the fast-evolving market. Through executing our growth strategy of emphasizing digital marketing and expanding our sales on e-commerce platforms, our goal is to improve our brand recognition, deliver products to more customers, and expand our business scale. Looking forward, we intend to continue implementing our expansion strategy, through which we hope to achieve greater market penetration and customer base expansion, with the goal of creating long-term value for our shareholders.”

Financial Highlights for the Six Months Ended March 31, 2024

| For the Six Months Ended March 31, | ||||||||||||

| ($ millions, except per share data) | 2024 | 2023 | % Change | |||||||||

| Revenues | 12.9 | 18.5 | -30.2 | % | ||||||||

| (Loss) income from operations | (1.7 | ) | 0.1 | -1,266.0 | % | |||||||

| Net loss | (13.1 | ) | (0.7 | ) | 1,731.3 | % | ||||||

| Loss per share | (3.59 | ) | (0.20 | ) | 1,720.7 | % | ||||||

- Revenues decreased by 30.2% to $12.9 million for the six months ended March 31, 2024 from $18.5 million for the six months ended March 31, 2023, primarily attributable to decreased sales volume of the Company’s traditional Chinese medicine derivatives (“TCMD”) products and third-party products by 1,863,919 and 1,712,660 units, or 23.4% and 29.9%, respectively, due to decrease in customer demand resulted from economic slowdown, as well as a 3.3% negative impact from fluctuations in foreign currency exchange rate.

- Loss from operations was $1.7 million for the six months ended March 31, 2024, compared to an income from operations of $0.1 million for the six months ended March 31, 2023, due to the decrease in revenue as discussed above.

- Net loss was $13.1 million for the six months ended March 31, 2024, compared to a net loss of $0.7 million for the six months ended March 31, 2023. Realized loss on short-term investments from wealth management financial products was $3,094,084 for the six months ended March 31, 2024, compared to short-term investment income of $166,931 for the six months ended March 31, 2023. The Company also recorded change in fair value of short-term investment of $7,617,502 for its investment holdings during the six months ended March 31, 2024. No change in fair value of short-term investment was recognized for the six months ended March 31, 2023.

- Loss per share was $3.59 for the six months ended March 31, 2024, compared to loss per share of $0.20 for the six months ended March 31, 2023.

Financial Results for the Six Months Ended March 31, 2024 Compared to the Six Months Ended March 31, 2023

Revenues

Total revenues decreased by $5,582,816, or 30.2%, to $12,884,370 for the six months ended March 31, 2024, from $18,467,186 for the six months ended March 31, 2023.

| For the Six Months Ended March 31, | ||||||||||||||||||||||

| 2024 | 2023 | |||||||||||||||||||||

| Revenue | Cost of revenue |

Gross margin |

Revenue | Cost of revenue |

Gross margin |

|||||||||||||||||

| TCMD products sales | $ | 6,870,591 | $ | 5,602,807 | 18.5 | % | $ | 9,374,312 | $ | 6,617,445 | 29.4 | % | ||||||||||

| Third-party products sales | 6,013,779 | 3,912,232 | 34.9 | % | 9,092,874 | 5,721,600 | 37.1 | % | ||||||||||||||

| Total | $ | 12,884,370 | $ | 9,515,039 | 26.2 | % | $ | 18,467,186 | $ | 12,339,044 | 33.2 | % | ||||||||||

Sales of TCMD products decreased by $2,503,721, or 26.7%, to $6,870,591 for the six months ended March 31, 2024, from $9,374,312 for the six months ended March 31, 2023. The decrease in the sales of TCMD products was mainly attributable to the following: (i) a 23.4% decrease in sales volume of TCMD products by 1,863,919 units, to 6,097,325 units sold in the six months ended March 31, 2024, from 7,961,244 units sold in the six months ended March 31, 2023. Global economic slowdown has led to a decline in customers’ spending power, and customer demand decreased during the six months ended March 31, 2024; and (ii) a 3.3% negative impact from fluctuations in foreign currency exchange rate, as the average exchange rate used in converting Renminbi (“RMB”) into U.S. dollars (“USD”) changed from US$1 to RMB6.9761 in for the six months ended March 31, 2023 to US$1 to RMB7.2064 in the six months ended March 31, 2024.

Sales of third-party products decreased by $3,079,095, or 33.9%, to $6,013,779 for the six months ended March 31, 2024, from $9,092,874 for the six months ended March 31, 2023. The decrease in the sales of third-party products was mainly attributable to the following: (i) a 29.9% decrease in sales volume of third-party products by 1,712,660 units, to 4,014,841 units sold in the six months ended March 31, 2024, from 5,727,501 units sold in the six months ended March 31, 2023 due to a decline in customer demand; and (ii) a 3.3% negative impact from fluctuations in foreign currency exchange rate.

Cost of revenues and Gross profit

Cost of revenues decreased by $2,824,005, or 22.9%, to $9,515,039 for the six months ended March 31, 2024, from $12,339,044 for the six months ended March 31, 2023, due to a decrease in sales volume of the Company’s TCMD products and third-party products, partially offset by an increase in the average cost of TCMD products by $0.09, or 10.8%, from $0.83 for the six months ended March 31, 2023 to $0.92 for the six months ended March 31, 2024. In the summer of 2023, a severe flood in Anhui Province and Hubei Province of China, which are two main producing areas of traditional Chinese medicinal materials, led to a decrease in the supply of such materials and an increase in the prices of the traditional Chinese medicine raw materials during the six months ended March 31, 2024.

Gross profit decreased by $2,758,811 to $3,369,331 for the six months ended March 31, 2024, from $6,128,142 for the six months ended March 31, 2023. Gross margin decreased by 7.0% to 26.2% for the six months ended March 31, 2024, from 33.2% for the six months ended March 31, 2023.

Operating expenses

Selling expenses increased by $1,723,849, or 74.0%, to $4,054,357 for the six months ended March 31, 2024, from $2,330,508 for the six months ended March 31, 2023, primarily attributable to (i) an increase in advertising expenses by $1,432,932, from $1,340,368 in the six months ended March 31, 2023, to $2,773,300 in the six months ended March 31, 2024. The Company entered into advertising service agreement with Health Headline to promote its brand on the Health Headline’s website and mobile app. The Company increased publicity efforts for its products and brand, and the advertising expenses increased significantly during the six months ended March 31, 2024; and (ii) an increase in salary and employee benefit expenses by $112,104, or 32.1%, as the Company recruited 10 new employees in the marketing department to promote sales of its products.

General and administrative expenses decreased by $411,445, or 29.8%, to $968,608 for the six months ended March 31, 2024 from $1,380,053 for the six months ended March 31, 2023, primarily attributable to (i) a decrease in bad debt expense by $265,530, because the Company accrued less bad debt expenses based on its assessment of the collectability of the accounts receivable and advance to suppliers; and (ii) a decrease in office supply and utility expense by $217,681 due to cost savings.

Research and development expenses decreased by $2,181,832, or 96.2%, to $86,503 for the six months ended March 31, 2024, from $2,268,335 for the six months ended March 31, 2023, primarily attributable to (i) a decrease in development expenditure on improving production process of the Company’s Chinese medicine products in the amount of $1,505,144. The Company entered into several cooperative agreements with external academic and research institutions to jointly conduct development of eight production process to improve production efficiency and product quality, with activities beginning in August 2022, and incurred significant amount of research and development expense in connection with such efforts during the six months ended March 31, 2023. These development activities were completed and results were integrated in production in September 2023, and no such expenses incurred during the six months ended March 31, 2024; and (ii) a decrease in the materials used in the research and development activities by $666,765 in connection with development activities on improving production process.

Other income (expenses), net

Total other expenses, net was $10,696,172 for the six months ended March 31, 2024, compared to total other income of $109,685 for the six months ended March 31, 2023. Realized loss on short-term investment from wealth management financial products was $3,094,084 for the six months ended March 31, 2024, compared to realized income on short-term investment of $166,931 for the six months ended March 31, 2023. The Company’s short-term investment consists of non-rated company bonds and shares of public companies, which represented 93.1% and 6.9% of the total investment as of March 31, 2024, respectively. The number of global corporate defaults nearly doubled in 2023 as inflation and higher interest rates squeezed some issuers’ cash flows. Furthermore, financing conditions were challenging for the lowest-rated borrowers and funding liquidity was tight. The Company incurred approximately 90% loss for two disposed bonds, and recorded change in fair value of short-term investment of $7,617,502 for its bond holdings during the six months ended March 31, 2024. No change in fair value of short-term investment was recognized for the six months ended March 31, 2023.

Provision for income taxes

Provision for income taxes was $665,148 for the six months ended March 31, 2024, representing a decrease of $309,210, or 31.7%, from $974,358 for the six months ended March 31, 2023, due to decreased taxable income. As the Company’s PRC principal subsidiaries, Jiangxi Universe Pharmaceuticals Co., Ltd. and Jiangxi Universe Pharmaceuticals Trade Co., Ltd., incurred net loss during the six months ended March 31, 2024, the Company evaluated the likelihood of the realization of deferred tax assets, determined that deferred tax assets arising from net operating loss carry-forwards in previous years might not be fully realized, and recognized $665,148 in valuation allowance for deferred tax assets during the six months ended March 31, 2024.

Net loss

Net loss was $13,101,457 for the six months ended March 31, 2024, representing a $12,386,030 decrease from a net loss of $715,427 for the six months ended March 31, 2023.

Basic and diluted loss per share were $3.59 for the six months ended March 31, 2024, compared with basic and diluted loss per share of $0.20 for the six months ended March 31, 2023.

Balance Sheet

As of March 31, 2024, the Company had cash of $8,861,590, as compared to $5,285,247 as of September 30, 2023.

Cash Flow

Net cash used in operating activities was $2,429,621 for the six months ended March 31, 2024, compared with cash provided by operating activities of $4,798,702 for the six months ended March 31, 2023.

Net cash used in investing activities was $67,656 for the six months ended March 31, 2024, compared with $646 for the six months ended March 31, 2023.

Net cash provided by financing activities was $6,067,732 for the six months ended March 31, 2024, compared with $2,080,918 for the six months ended March 31, 2023.

Subsequent Event

On July 15, 2024, the Company closed its self-underwritten public offering (“Offering”) of 20,000,000 ordinary shares, par value $0.01875 per share (the “Ordinary Shares”). The Ordinary Shares were priced at $1.25 per share. The Company raised a total of $25 million through that Offering, before deducting Offering-related expenses.

About Universe Pharmaceuticals INC

Universe Pharmaceuticals INC, headquartered in Ji’an, Jiangxi, China, is a pharmaceutical producer and distributor in China. The Company specializes in the manufacturing, marketing, sales and distribution of traditional Chinese medicine derivatives products targeting the elderly with the goal of addressing their physical conditions in the aging process and to promote their general well-being. The Company also distributes and sells biomedical drugs, medical instruments, Traditional Chinese Medicine Pieces, and dietary supplements manufactured by third-party pharmaceutical companies. Currently, the Company’s products are sold in 30 provinces of China. For more information, visit the company’s website at http://www.universe-pharmacy.com/.

Forward-Looking Statements

All statements other than statements of historical fact in this announcement are forward-looking statements. These forward-looking statements involve known and unknown risks and uncertainties and are based on current expectations and projections about future events and financial trends that the Company believes may affect its financial condition, results of operations, business strategy and financial needs. Investors can identify these forward-looking statements by words or phrases such as “may,” “will,” “expect,” “anticipate,” “aim,” “estimate,” “intend,” “plan,” “believe,” “potential,” “continue,” “is/are likely to” or other similar expressions. The Company undertakes no obligation to update forward-looking statements to reflect subsequent occurring events or circumstances, or changes in its expectations, except as may be required by law. Although the Company believes that the expectations expressed in these forward-looking statements are reasonable, it cannot assure you that such expectations will turn out to be correct, and the Company cautions investors that actual results may differ materially from the anticipated results and encourages investors to review other factors that may affect its future results in the Company’s most recent annual report on Form 20-F and in its other filings with the U.S. Securities and Exchange Commission.

For more information, please contact:

Email:IR@universe-pharmacy.com

Phone:+86-0796-8403687

| UNIVERSE PHARMACEUTICALS INC. AND SUBSIDIARIES CONDENSED CONSOLIDATED BALANCE SHEETS |

||||||||

| As of | ||||||||

| March 31, 2024 |

September 30, 2023 |

|||||||

| (Unaudited) | ||||||||

| ASSETS | ||||||||

| CURRENT ASSETS | ||||||||

| Cash | $ | 8,861,590 | $ | 5,285,247 | ||||

| Short-term investments | 2,527,603 | 13,219,005 | ||||||

| Accounts receivable, net | 14,384,228 | 10,667,603 | ||||||

| Due from related parties | – | 61,678 | ||||||

| Inventories, net | 3,386,052 | 3,343,266 | ||||||

| Advance to suppliers | 368,960 | 180,643 | ||||||

| Prepayment for acquisition | 3,462,460 | 3,426,535 | ||||||

| Prepaid expenses and other current assets | 539,240 | 590,377 | ||||||

| TOTAL CURRENT ASSETS | 33,530,133 | 36,774,354 | ||||||

| Property, plant and equipment, net | 3,522,997 | 3,699,965 | ||||||

| Prepayments made to a related party for purchase of property | 2,215,974 | 2,192,982 | ||||||

| Prepayments for construction in progress | 9,225,725 | 9,092,996 | ||||||

| Intangible assets, net | 147,652 | 148,584 | ||||||

| Investment in equity securities | 692,492 | 685,307 | ||||||

| Deferred tax assets | – | 656,980 | ||||||

| Prepaid expenses-related party, non-current | 96,141 | 35,864 | ||||||

| TOTAL NONCURRENT ASSETS | 15,900,981 | 16,512,678 | ||||||

| TOTAL ASSETS | $ | 49,431,114 | $ | 53,287,032 | ||||

| LIABILITIES AND SHAREHOLDERS’ EQUITY | ||||||||

| CURRENT LIABILITIES | ||||||||

| Short-term bank loans | $ | 4,431,949 | $ | 5,482,456 | ||||

| Accounts payable | 7,763,981 | 4,585,285 | ||||||

| Taxes payable | 172,374 | 434,758 | ||||||

| Due to related parties | 5,515,160 | 540,096 | ||||||

| Accrued expenses and other current liabilities | 2,726,078 | 2,711,736 | ||||||

| TOTAL CURRENT LIABILITIES | 20,609,542 | 13,754,331 | ||||||

| Long-term bank loans | 2,077,476 | – | ||||||

| TOTAL LIABILITIES | 22,687,018 | 13,754,331 | ||||||

| COMMITMENTS AND CONTINGENCIES | ||||||||

| SHAREHOLDERS’ EQUITY | ||||||||

| Ordinary shares, $0.01875 par value, 166,666,666 shares authorized, 3,645,974 and 3,625,000 shares issued and outstanding as of March 31, 2024 and September 30, 2023, respectively * | 68,362 | 67,969 | ||||||

| Additional paid in capital | 29,278,766 | 29,279,159 | ||||||

| Statutory reserve | 2,439,535 | 2,439,535 | ||||||

| Retained earnings | (2,942,153 | ) | 10,159,304 | |||||

| Accumulated other comprehensive loss | (2,100,414 | ) | (2,413,266 | ) | ||||

| TOTAL SHAREHOLDERS’ EQUITY | 26,744,096 | 39,532,701 | ||||||

| TOTAL LIABILITIES AND SHAREHOLDERS’ EQUITY | $ | 49,431,114 | $ | 53,287,032 | ||||

| UNIVERSE PHARMACEUTICALS INC. AND SUBSIDIARIES CONDENSED CONSOLIDATED STATEMENTS OF INCOME AND COMPREHENSIVE INCOME (UNAUDITED) |

||||||||

| For the Six Months Ended March 31, |

||||||||

| 2024 | 2023 | |||||||

| REVENUE | $ | 12,884,370 | $ | 18,467,186 | ||||

| COST OF REVENUE AND RELATED TAX | 9,515,039 | 12,339,044 | ||||||

| GROSS PROFIT | 3,369,331 | 6,128,142 | ||||||

| OPERATING EXPENSES | ||||||||

| Selling expenses | 4,054,357 | 2,330,508 | ||||||

| General and administrative expenses | 968,608 | 1,380,053 | ||||||

| Research and development expenses | 86,503 | 2,268,335 | ||||||

| Total operating expenses | 5,109,468 | 5,978,896 | ||||||

| INCOME (LOSS) FROM OPERATIONS | (1,740,137 | ) | 149,246 | |||||

| OTHER INCOME (EXPENSES) | ||||||||

| Interest expense, net | (136,613 | ) | (74,569 | ) | ||||

| Other income, net | 152,027 | 17,323 | ||||||

| Realized (loss) gain on short-term investments | (3,094,084 | ) | 166,931 | |||||

| Change in fair value of short-term investments | (7,617,502 | ) | – | |||||

| Total other (loss) income, net | (10,696,172 | ) | 109,685 | |||||

| (LOSS) INCOME BEFORE INCOME TAX PROVISION | (12,436,309 | ) | 258,931 | |||||

| PROVISION FOR INCOME TAXES | 665,148 | 974,358 | ||||||

| NET LOSS | (13,101,457 | ) | (715,427 | ) | ||||

| OTHER COMPREHENSIVE INCOME | ||||||||

| Foreign currency translation adjustment | 312,852 | 1,399,775 | ||||||

| COMPREHENSIVE (LOSS) INCOME | $ | (12,788,605 | ) | $ | 684,348 | |||

| Earnings per ordinary share – basic and diluted | $ | (3.59 | ) | $ | (0.20 | ) | ||

| Weighted average shares – basic and diluted * | $ | 3,645,974 | $ | 3,625,000 | ||||

| CONDENSED CONSOLIDATED STATEMENTS OF CHANGES IN SHAREHOLDERS’ EQUITY FOR THE SIX MONTHS ENDED MARCH 31, 2024 AND 2023 (UNAUDITED) |

||||||||||||||||||||||||||||

| Accumulated | ||||||||||||||||||||||||||||

| Additional | Other | |||||||||||||||||||||||||||

| Ordinary Share | Paid in | Statutory | Retained | Comprehensive | ||||||||||||||||||||||||

| Shares | Amount | Capital | Reserve | Earnings | Income | Total | ||||||||||||||||||||||

| Balance at September 30, 2022 | 3,625,000 | $ | 67,969 | $ | 29,279,159 | $ | 2,439,535 | $ | 16,322,365 | $ | (1,666,705 | ) | $ | 46,442,323 | ||||||||||||||

| Net loss | – | – | – | – | (715,427 | ) | – | (715,427 | ) | |||||||||||||||||||

| Foreign currency translation adjustment | – | – | – | – | – | 1,399,775 | 1,399,775 | |||||||||||||||||||||

| Balance at March 31, 2023 | 3,625,000 | $ | 67,969 | $ | 29,279,159 | $ | 2,439,535 | $ | 15,606,938 | $ | (266,930 | ) | $ | 47,126,671 | ||||||||||||||

| Accumulated | ||||||||||||||||||||||||||||

| Additional | Other | |||||||||||||||||||||||||||

| Ordinary Share | Paid in | Statutory | Retained | Comprehensive | ||||||||||||||||||||||||

| Shares | Amount | Capital | Reserve | Earnings | Income | Total | ||||||||||||||||||||||

| Balance at September 30, 2023 | 3,625,000 | $ | 67,969 | $ | 29,279,159 | $ | 2,439,535 | $ | 10,159,304 | $ | (2,413,266 | ) | $ | 39,532,701 | ||||||||||||||

| Reverse share-split adjustment | 20,974 | 393 | (393 | ) | – | – | – | – | ||||||||||||||||||||

| Net loss | – | – | – | – | (13,101,457 | ) | – | (13,101,457 | ) | |||||||||||||||||||

| Foreign currency translation adjustment | – | – | – | – | – | 312,852 | 312,852 | |||||||||||||||||||||

| Balance at March 31, 2024 | 3,645,974 | $ | 68,362 | $ | 29,278,766 | $ | 2,439,535 | $ | (2,942,153 | ) | $ | (2,100,414 | ) | $ | 26,744,096 | |||||||||||||

| UNIVERSE PHARMACEUTICALS INC. AND SUBSIDIARIES CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS (UNAUDITED) |

||||||||

| For the Six Months Ended March 31, |

||||||||

| 2024 | 2023 | |||||||

| Cash flows from operating activities: | ||||||||

| Net loss | $ | (13,101,457 | ) | $ | (715,427 | ) | ||

| Adjustments to reconcile net income to net cash provided by operating activities: | ||||||||

| Depreciation and amortization | 248,860 | 257,781 | ||||||

| Gain from disposal of fixed assets | – | (115 | ) | |||||

| Changes in allowance for doubtful accounts | (265,530 | ) | – | |||||

| Changes in inventory reserve | (34,303 | ) | (84,956 | ) | ||||

| Deferred income tax provision | 665,148 | 556,867 | ||||||

| Realized loss (gain) on short-term investments | 3,094,084 | (166,931 | ) | |||||

| Change in fair value of short-term investments | 7,617,502 | – | ||||||

| Changes in operating assets and liabilities: | ||||||||

| Accounts receivable | (3,346,205 | ) | (1,763,903 | ) | ||||

| Inventories | 26,553 | (488,746 | ) | |||||

| Advance to suppliers, net | (186,782 | ) | (187,460 | ) | ||||

| Prepaid expenses and other current assets | 57,436 | (220,969 | ) | |||||

| Prepaid expenses-related party, non-current | (60,016 | ) | – | |||||

| Accounts payable | 3,136,661 | 7,928,308 | ||||||

| Taxes payable | (267,456 | ) | 149,684 | |||||

| Accrued expenses and other current liabilities | (14,116 | ) | (465,431 | ) | ||||

| Net cash (used in) provided by operating activities | (2,429,621 | ) | 4,798,702 | |||||

| Cash flows from investing activities: | ||||||||

| Purchases of property and equipment | (30,189 | ) | (646 | ) | ||||

| Prepayments for construction in progress | (37,467 | ) | – | |||||

| Purchase of short-term investments | (313,541 | ) | ||||||

| Sale of short-term investments | 313,541 | |||||||

| Net cash used in investing activities | (67,656 | ) | (646 | ) | ||||

| Cash flows from financing activities: | ||||||||

| Proceeds from bank loans | 2,081,483 | 1,146,776 | ||||||

| Repayment of bank loans | (1,110,124 | ) | (1,146,776 | ) | ||||

| Proceeds from related party borrowings | 5,096,373 | 2,080,918 | ||||||

| Net cash provided by financing activities | 6,067,732 | 2,080,918 | ||||||

| Effect of changes of foreign exchange rates on cash | 5,888 | 364,084 | ||||||

| Net increase in cash | 3,576,343 | 7,243,058 | ||||||

| Cash, beginning of period | 5,285,247 | 5,711,458 | ||||||

| Cash, end of period | $ | 8,861,590 | $ | 12,954,516 | ||||

| Supplemental disclosure of cash flow information | ||||||||

| Cash paid for interest | $ | 148,861 | $ | 90,044 | ||||

| Cash paid for income tax | $ | 969,914 | $ | 575,132 | ||||

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

S&P 500 Nuclear Leader Jumps 20% After Inking 20-Year Microsoft Deal

S&P 500 component Constellation Energy (CEG) announced Friday it plans to restart a Three Mile Island reactor after it signed a two-decade long contract with Microsoft (MSFT) to provide power for the tech giant’s data centers. CEG shares surged Friday.

↑

X

How To Cope With Wild Market Volatility As Fed Cuts Rates

Constellation Energy said Friday it will be firing back up Pennsylvania’s Three Mile Island Unit 1, which ended operation in 2019, to provide the necessary energy to meet Microsoft’s needs over the life span of the 20-year contract. The company estimates the reactor will add 835 megawatts to the grid.

“This agreement is a major milestone in Microsoft’s efforts to help decarbonize the grid in support of our commitment to become carbon negative,” Bobby Hollis, Microsoft’s vice president of energy, said in a statement. “Microsoft continues to collaborate with energy providers to develop carbon-free energy sources to help meet the grid’s capacity and reliability needs.”

The Three Mile Island Unit 1 reactor is located adjacent to the Unit 2 reactor, which shut down in 1979 after the partial meltdown at the nuclear power plant. Accidents at Three Mile Island, Chernobyl and Fukushima loom large in the minds of utilities and their insurers. In addition, long-term safety and environmental concerns over storing and disposing of spent radioactive fuel rods create resistance to new nuclear development. Nuclear power has declined in recent years, with 13 plants closing since 2013.

Constellation Energy said Friday that to restart the reactor, “significant investments will be made to restore the plant, including the turbine, generator, main power transformer and cooling and control systems.”

The process also requires U.S. Nuclear Regulatory Commission approval following a comprehensive safety and environmental review, as well as permits from relevant state and local agencies.

AI Is Fueling A ‘Nuclear Renaissance.’ Bill Gates And Jeff Bezos Are In The Mix.

S&P 500: Constellation And Vistra Take Off

Constellation Energy, an S&P 500 stock, surged 22.3% to 253.98 during market trade on Friday. The S&P 500 stock advanced 4% to 208.50 on Thursday.

Meanwhile, Microsoft stock dropped 0.8% to 435.27. MSFT gained 1.8% to 438.69 on Thursday. Shares are currently in a cup base pattern with a 468.35 buy point.

Fellow S&P 500 nuclear power utilities play Vistra (VST) gained 16.6% Friday. Vistra has also been in reported discussions for power deals at both its nuclear and natural gas-power plants. The stock has skyrocketed 141% in 2024.

Uranium refiner Cameco (CCJ) jumped more than 8% Friday.

AI And Nuclear

So far in 2024, S&P 500 component Constellation Energy has been riding the artificial intelligence energy wave. Artificial intelligence — and the data centers needed to train the systems — are expected to boost energy demand throughout this decade. In the U.S., McKinsey & Co. projects that data center energy demand will grow around 10% every year through 2030.

Additionally, in 2022, the 2,700 U.S. data centers consumed around 4% of the country’s total electricity generated electricity, according to the International Energy Agency. The agency projects that by 2026, such centers will make up 6% of electricity use.

Bitcoin Miners Forge Lucrative AI Deals. They Have A Big Advantage.

Many technology companies are investing in or partnering with nuclear power providers to ensure energy supplies for their data centers.

Morgan Stanley analysts have proclaimed in recent months that a “nuclear renaissance” is underway.

They wrote that nuclear power, while still a divisive issue, is making a comeback. The firm sees $1.5 trillion in investment in new capacity through 2050.

Top hyperscalers — the largest cloud, data center and AI operators — include Microsoft, Amazon.com‘s (AMZN) AWS, Meta (META) and Alphabet (GOOGL). In March, Talen Energy announced its sale of a 960-megawatt data center campus to AWS for $650 million, sited near its Pennsylvania nuclear plant.

S&P 500: Constellation Energy Stock Performance

Constellation Energy stock is up 79% year to date through Thursday’s close. Shares rebounded above support and broke a down-sloping trendline this week.

The S&P 500 component has retreated around 11% since hitting an all-time high 236.30 on May 24. The stock is officially in consolidation, according to MarketSurge. That all-time high is technically a buy point. But the stock will be somewhat extended at that level, so investors should be watching for earlier entry opportunities.

In early August, Constellation Energy increased its full-year profit guidance even as second-quarter earnings and revenue came in slightly under analyst expectations. The company expects 2024 EPS between $7.60-$8.40 per share for 2024. Constellation Energy’s previous view was $7.23-$8.03 per share.

Constellation management said in May it will grow base earnings by at least 10% through the end of the decade.

Founded in 1999, Constellation Energy has gone through several phases. After an earlier stint as a public company, it merged with Exelon in 2012 as part of a deal worth roughly $8 billion. While with Exelon, the company’s moniker became Constellation Energy Generation. It then split from the utility giant in early 2022.

Constellation Energy owns 25% of U.S. nuclear power reactors. Further, it provides energy to more than 20% of the major commercial and industrial customers in the country.

Constellation Energy stock has a 78 Composite Rating out of a best-possible 99. The S&P 500 stock also has an 92 Relative Strength Rating and a 54 EPS Rating.

Please follow Kit Norton on X @KitNorton for more coverage.

YOU MAY ALSO LIKE:

Is Tesla Stock A Buy Or A Sell?

Get Full Access To IBD Stock Lists And Ratings

Learning How To Pick Great Stocks? Read Investor’s Corner

AI Is Fueling A ‘Nuclear Renaissance.’ Bill Gates And Jeff Bezos Are In The Mix.

Market Sends Clear Message; Three Magnificent 7 Stocks In Buy Areas

JPMorgan CEO Jamie Dimon Calls For Federal Employees To Return To Office, Says Empty Buildings 'Bother' Him: 'I Can't Believe…'

JPMorgan Chase JPM CEO Jamie Dimon has called for federal employees in Washington, DC, to return to their offices, highlighting the ongoing debate over remote work policies.

What Happened: Speaking at The Atlantic Festival, Dimon expressed his frustration with the number of empty buildings in the capital, according to Business Insider on Friday.

“By the way, I’d also make Washington, DC, go back to work. I can’t believe, when I come down here, the empty buildings. The people who work for you not going to the office,” he stated,

“That bothers me,” he added. Dimon emphasized that he does not allow such flexibility at JPMorgan.

Why It Matters: Dimon is not alone in his stance. Earlier this week, Amazon AMZN CEO Andy Jassy announced that Amazon employees would return to the office five days a week, reverting to pre-pandemic norms.

JPMorgan’s policy mandates managing directors to be in the office full-time, while other employees must work in person at least three days a week. Last year, the Biden Administration also pushed federal employees to return to in-person work.

Despite these efforts, many federal workers still have flexible work arrangements. For instance, some Environmental Protection Agency employees are required to be in the office only four days a month. Other agencies, like the Department of the Treasury and the Department of the Interior, require at least 50% in-office presence.

Office vacancy rates in DC remain high, with about 22% of office space empty in the second quarter of 2024, according to CBRE. The federal government and private-sector offices contribute to this trend.

This content was partially produced with the help of Benzinga Neuro and was reviewed and published by Benzinga editors.

Image via Flickr/ Frank Gruber

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Fonds de solidarité FTQ-Québec agreement – Official opening of Le Chevalier housing project in Lac-Mégantic

LAC-MÉGANTIC, QC, Sept. 20, 2024 /CNW/ – Together with the governments of Quebec and Canada, the Fonds de solidarité FTQ, the City of Lac-Mégantic, the Mégantic-area SADC, Hydro-Québec, and Ste Agnès Knights of Columbus Council 2043 of Lac-Mégantic have officially opened Le Chevalier, a building with 21 social and affordable housing units on three floors. The building, the first of its kind in Quebec, equipped with innovative technology and costing nearly $10.5 million, was built under the Fonds de solidarité FTQ-Québec agreement.

In addition to addressing a critical need for affordable housing, Le Chevalier will be a major hub for local community activities. In addition to housing, Lac-Mégantic Ste Agnès Knights of Columbus Council 2043’s building includes a common room on the ground floor. All units are accessible and adapted for people with reduced mobility. The building has been full since July 2024.

The financial package includes investments by the Government of Quebec ($4.3 million, including an amount from the Fonds au benefice de la communauté de Lac-Mégantic), the Government of Canada through Canada Mortgage and Housing Corporation, the Affordable Housing Fund (AHF), and CED Canada ($3.07 million), the City of Lac-Mégantic ($1.3 million), Ste Agnès Knights of Columbus Council 2043 of Lac-Mégantic ($760,000), Hydro-Québec ($600,000), the Fonds de solidarité FTQ ($350,000), the Mégantic-area SADC ($100,000) and Caisse Desjardins de Lac-Mégantic–Le Granit ($33,000).

A building that promotes energy efficiency

This innovative building is part of Quebec’s first microgrid and targets fundamental energy transition principles with its focus on energy efficiency and the technology it has for its tenants.

The Honourable Marie-Claude Bibeau, Minister of National Revenue and Member of Parliament for Compton–Stanstead, François Jacques, Member of the National Assembly for Mégantic and Government Caucus Chair, on behalf of France-Élaine Duranceau, Quebec Minister Responsible for Housing, Julie Morin, Mayor of Lac-Mégantic, Maude Gauthier, Director, Innovative Solutions–Distribution Network and Customers at Hydro-Québec, Marianne Duguay, Senior Vice-President, Social, Community and Affordable Housing at the Fonds immobilier de solidarité FTQ, Richard Boulanger, Denis Lacroix and Benoit Vachon, representing Ste Agnès Knights of Columbus Council 2043 of Lac-Mégantic, and Marc Cantin, Executive Director of the Mégantic-area SADC, proudly took part in the official opening.

Toward the creation of 2,250 social or affordable housing units

As part of the innovative partnership between the Government of Quebec and the the Fonds de solidarité FTQ, 2,250 social or affordable housing units are scheduled to be built by 2027. Most of the projects will be new construction, and will also include, to a lesser extent, acquisitions of existing buildings for the purpose of renovating them and sustaining rent affordability.

Quotes:

“I’ve often said that we need to innovate to build more housing, faster, especially given the current housing crisis. This collaboration with the Fonds de solidarité FTQ led to the official opening of another important project today. It’s further proof that our government is taking concrete action, alongside the Government of Canada, municipalities and housing organizations, to better house Quebecers.”

France-Élaine Duranceau, Quebec Minister Responsible for Housing

“Everyone deserves a home, and the Affordable Housing Fund is one way we’re making that vision a reality for Canadians. We’ll continue investing in affordable housing projects, like the ones announced today, and working with partners across the country to end the housing crisis.”

The Honourable Sean Fraser, Minister of Housing, Infrastructure and Communities

“I’m proud to see that we’re leveraging all the resources at our disposal to improve the quality of life for low-income families in the Estrie region. The involvement of Ste Agnès Knights of Columbus Council 2043 of Lac-Mégantic, combined with contributions from the provincial and federal governments, the City of Lac-Mégantic and all the partners, shows that we can be agile and join forces to build quality living spaces.”

François Jacques, Member of the National Assembly for Mégantic and Government Caucus Chair

“Every Quebecer deserves a safe and affordable place to call home. The Government of Canada is proud to contribute to the creation of 21 new affordable housing units for Lac-Mégantic’s most vulnerable through the Affordable Housing Fund. This demonstrates our unwavering commitment to ensuring that no one in Lac-Mégantic is left behind.”

The Honourable Marie-Claude Bibeau, Minister of National Revenue and Member of Parliament for Compton–Stanstead

“Le Chevalier is an innovative project that has put our community on course for a green future. The project has been eagerly awaited in our city, and we’re pleased to be among the many partners who have believed in it all along. We’re thrilled to get a new building that reflects every aspect of our vision for a vibrant, eco-responsible downtown where people really live.”

Julie Morin, Mayor of Lac-Mégantic

“This building is the first in Quebec to combine social and affordable housing with such an array of equipment and technology. Le Chevalier is equipped with hybrid solar panels, local heat storage and heat pumps. Hydro-Québec will be there to support the residents, working jointly with building managers to assess the ability of the equipment to increase building energy efficiency and contribute to cutting-edge management.”

Maude Gauthier, Director, Innovative Solutions–Distribution Network and Customers, Hydro-Québec

“We play a tangible role in sustainable real estate and work hard to accelerate housing starts. Today’s announcement shows that by sparing no effort and with the necessary funding, we can build the housing we need. And Le Chevalier isn’t just affordable housing, it meets key sustainable real estate criteria as well, satisfying our objectives in two ways.”

Marianne Duguay, Senior Vice-President, Social, Community and Affordable Housing, Fonds immobilier de solidarité FTQ

“We’re especially proud to see our financial contribution make this community centre a reality. It will without a doubt become a place where all residents will come together and share.”

Marc Cantin, Executive Director of the Mégantic-area SADC

“Our being together here today is rich with meaning. It’s a great source of pride for the Sainte Agnès Knights of Columbus to be rebuilding this common room and providing homes for the community. We found incredible partners to inspire us to take on a project of this scale—it all bears witness to tremendous strength—the strength of an entire community.”

Benoit Vachon, Ste Agnès Knights of Columbus Council 2043 of Lac-Mégantic

Highlights:

- Seniors who will occupy 11 of these units and are eligible may benefit from the Société d’habitation du Québec’s (SHQ’s) Rent Supplement Program, which would ensure that they don’t spend more than 25% of their income on housing. This financial assistance is covered by the SHQ (90%) and the City of Lac-Mégantic (10%).

- The Affordable Housing Fund (AHF) provides funding in the form of low-interest loans, forgivable loans or contributions. These funds are used to build affordable housing and renovate and repair existing affordable and community housing.

- As part of the 2023 Fall Economic Statement, the government announced an additional $1 billion for the AHF, bringing total funding to over $14 billion. To further support non-profit, co-operative and public housing providers and meet the needs of those most affected by the housing crisis, the 2024 budget committed an additional $1 billion to the fund.

- The building is equipped with heat pumps, double-sided solar panels that allow for the production of electricity and preheat water for domestic use, heat storage that will help manage respond to peak demand for heating in winter, LED lighting, and a state-of-the-art management system.

- The technologies integrated into the building are a first in Quebec. Combined, they will save tenants money on utility bills. Research is planned to understand the adoption of these technologies in an effort to replicate them in other buildings of the same type.

ABOUT THE SOCIÉTÉ D’HABITATION DU QUÉBEC

As a leader in housing, the SHQ’s mission is to meet the housing needs of Quebecers through its expertise and services to citizens. It does this by providing affordable and low-rental housing and offering a range of assistance programs to support the construction, renovation and adaptation of homes, and access to homeownership.

To find out more about its activities, visit www.habitation.gouv.qc.ca/english.html.

Facebook : SocietehabitationQuebec

X : HabitationSHQ

LinkedIn : LinkedIn

About Canada Mortgage and Housing Corporation

As Canada’s authority on housing, Canada Mortgage and Housing Corporation (CMHC) contributes to the stability of the housing market and financial system, provides support for Canadians in housing need, and offers unbiased housing research and advice to all levels of Canadian government, consumers and the housing industry. CMHC’s aim is that by 2030, everyone in Canada has a home they can afford, and that meets their needs. For more information, follow us on Twitter, Instagram, YouTube, LinkedIn and Facebook.

SOURCE Government of Canada

![]() View original content to download multimedia: http://www.newswire.ca/en/releases/archive/September2024/20/c1297.html

View original content to download multimedia: http://www.newswire.ca/en/releases/archive/September2024/20/c1297.html

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.