Intel Stock Jumps On Report It Was Approached By Qualcomm About Possible Takeover

Intel (INTC) stock jumped late Friday on a report that Qualcomm (QCOM) had approached the chip giant about a possible takeover.

↑

X

Stocks Jump, Dow Tops 42,000 Post-Fed; Ferrari, CRS, Taiwan Semi In Focus

Qualcomm made its move in “recent days,” the Wall Street Journal reported, citing unnamed sources.

It’s unclear whether a deal was being considered, the report said.

But the report underlines the cloud of uncertainty surrounding what was once the most dominant semiconductor company in the world. Intel has struggled to keep up with rivals led by AMD (AMD) and Nvidia (NVDA), especially in the data center market and the fast-growing artificial intelligence trend.

A merger with Qualcomm will likely face intense antitrust scrutiny. Qualcomm is a major player in the market for smartphone chips and wireless communications technology.

The news also comes just days after Intel unveiled a major reorganization of its business, which included a plan to turn its manufacturing business into an independent unit with its own board. The Dow Jones chip giant also announced a $3 billion federal funding award to make chips for the Pentagon.

Mizuho Securities analyst Jordan Klein told clients in a note that the news “moves (the) patient from life support to critical condition.”

“If there was ever a company and stock in need of some positive news flow it was Intel,” Klein said. “Shares were down 60% year to date and grinding lower and lower vs. (the) semi sector up 34% year to date.”

Intel stock rallied more late afternoon trades, gaining 3.3% to close at 21.84. Qualcomm shed 2.9% to close at 168.92.

YOU MAY ALSO LIKE:

Novo Dives — And Corbus Crashes — On Psychiatric Side Effects Of Weight-Loss Drug

CrowdStrike Spotlights Consolidation Push In Cybersecurity Amid ‘Fear Of Frankenstein’

Apple iPhone 16 Handsets Are Finally Out In The Wild

Futures: Market Sends Clear Message; Three Magnificent 7 Stocks In Buy Areas

Energy Servs of America Insider Trades Send A Signal

A substantial insider sell was reported on September 19, by Samuel Kapourales, Director at Energy Servs of America ESOA, based on the recent SEC filing.

What Happened: Kapourales’s recent move involves selling 50,000 shares of Energy Servs of America. This information is documented in a Form 4 filing with the U.S. Securities and Exchange Commission on Thursday. The total value is $505,000.

At Friday morning, Energy Servs of America shares are down by 0.0%, trading at $10.38.

All You Need to Know About Energy Servs of America

Energy Services of America Corporation is engaged in providing contracting services for energy-related companies. The company is predominantly engaged in the construction, replacement, and repair of natural gas pipelines and storage facilities for utility companies and private natural gas companies. It services the gas, petroleum, power, chemical, and automotive industries and does incidental work such as water and sewer projects. Energy Service’s other services include liquid pipeline construction, pump station construction, production facility construction, water and sewer pipeline installations, various maintenance and repair services, and other services related to pipeline construction.

Financial Insights: Energy Servs of America

Revenue Growth: Energy Servs of America’s revenue growth over a period of 3 months has been noteworthy. As of 30 June, 2024, the company achieved a revenue growth rate of approximately 0.46%. This indicates a substantial increase in the company’s top-line earnings. As compared to its peers, the company achieved a growth rate higher than the average among peers in Energy sector.

Profitability Metrics:

-

Gross Margin: The company issues a cost efficiency warning with a low gross margin of 17.82%, indicating potential difficulties in maintaining profitability compared to its peers.

-

Earnings per Share (EPS): The company excels with an EPS that surpasses the industry average. With a current EPS of 1.06, Energy Servs of America showcases strong earnings per share.

Debt Management: Energy Servs of America’s debt-to-equity ratio stands notably higher than the industry average, reaching 0.66. This indicates a heavier reliance on borrowed funds, raising concerns about financial leverage.

Insights into Valuation Metrics:

-

Price to Earnings (P/E) Ratio: The Price to Earnings ratio of 7.14 is lower than the industry average, indicating potential undervaluation for the stock.

-

Price to Sales (P/S) Ratio: With a lower-than-average P/S ratio of 0.49, the stock presents an attractive valuation, potentially signaling a buying opportunity for investors interested in sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): At 4.32, Energy Servs of America’s EV/EBITDA ratio reflects a below-par valuation compared to industry averages signalling undervaluation

Market Capitalization: Indicating a reduced size compared to industry averages, the company’s market capitalization poses unique challenges.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

The Impact of Insider Transactions on Investments

Insider transactions shouldn’t be used primarily to make an investing decision, however an insider transaction can be an important factor in the investing decision.

In legal terms, an “insider” refers to any officer, director, or beneficial owner of more than ten percent of a company’s equity securities registered under Section 12 of the Securities Exchange Act of 1934. This can include executives in the c-suite and large hedge funds. These insiders are required to let the public know of their transactions via a Form 4 filing, which must be filed within two business days of the transaction.

When a company insider makes a new purchase, that is an indication that they expect the stock to rise.

Insider sells, on the other hand, can be made for a variety of reasons, and may not necessarily mean that the seller thinks the stock will go down.

Essential Transaction Codes Unveiled

Investors prefer focusing on transactions that take place in the open market, indicated in Table I of the Form 4 filing. A P in Box 3 indicates a purchase, while S indicates a sale. Transaction code C indicates the conversion of an option, and transaction code A indicates grant, award or other acquisition of securities from the company.

Check Out The Full List Of Energy Servs of America’s Insider Trades.

Insider Buying Alert: Profit from C-Suite Moves

Benzinga Edge reveals every insider trade in real-time. Don’t miss the next big stock move driven by insider confidence. Unlock this ultimate sentiment indicator now. Click here for access.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Wire & Cable Market Estimated to Reach $266.2 billion by 2029 Globally, at a CAGR of 5.8%, says MarketsandMarkets™

Delray Beach, FL, Sept. 20, 2024 (GLOBE NEWSWIRE) — The Wire & Cable Market is projected to grow from USD 201.0 billion in 2024 to USD 266.2 billion by 2029, at a CAGR of 5.8% during the forecast period, as per the recent study by MarketsandMarkets. Due to the pressing need for cables in the renewable energy sector, governments worldwide are investing significantly in renewable energy projects, particularly offshore wind energy. The rising emphasis on renewable energy in the power sector creates substantial demand for wires and cables in various regions, leading to market growth and innovative developments.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=247134084

Browse in-depth TOC on “Wire & Cable Market”

120 – Market Data Tables

60 – Figures

312 – Pages

List of Key Players in Wire & Cable Market:

- Prysmian (Italy)

- Belden Inc. (US)

- Fujikura Ltd. (Japan)

- Furukawa Electric Co., Ltd (Japan)

- Leoni Ag (Germany)

- Nexans (France)

- Emerson Electric Co. (US)

- Hellenic Cables (Greece)

- KEI Industries (India)

- Sumitomo Electric Industries, Ltd. (Japan)

- NKT A/S (Denmark)

- Finolex Cables Ltd (India)

- Helukabel (Germany)

- LS Cable and System (South Korea)

Drivers, Restraints, Opportunities and Challenges in Wire & Cable Market:

- Drivers: Rising demand for cables from renewable energy sector

- Restraints: Fluctuating raw material prices

- Opportunity: Surge in demand for cables in EV infrastructure

- Challenge: Enhancing insulation durability

Key Findings of the Study:

- Infrastructural development and rapid urbanization to drive demand for underground cable installation

- Rising dependence on computers and high–end automobiles to boost demand for electronic wires.

- Excellent electrical conductivity of metal cables to drive market.

- Rising applications of low-voltage cables in residential and commercial settings to drive market.

- Increasing offshore wind energy projects to boost demand for energy and power industries.

- Fast economic growth and investments in power generation to boost demand for wires and cables in Asia Pacific.

Get Sample Pages: https://www.marketsandmarkets.com/requestsampleNew.asp?id=247134084

Based on Installation, the wire & cable market is divided into three types namely, overhead, underground, and submarine. The underground installation has the maximum demand in the wires & cables market. This is because human tends to require greater reliability and visibility in Urban areas which has also boosted the trend. There are many advantages of underground cables over overhead installation for instance they are not affected by weather conditions, they are less likely to be affected by an accident or a falling tree and they are less visible and thus are not disrupting the aesthetic view of an area. Also, installations located underground are less exposed to interference and acts of vandalism, and, therefore, suitable for dense neighbourhoods and important connections. The market share of underground solutions will also continue to increase in the future as cities grow and develop, in general, requiring various solutions to fit modern society’s needs.

Based on product type, the wire & cable market is divided into five types namely, electronic wires, power cables, control & instrumentation cables, communication cables, and flexible & specialty cables. The electronic wires dominate the market with the highest market share and also is expected to be the fastest-growing type of product. Electronic wires have immense application various electronic devices including smartphones, computers, and other consumer electronic equipment. Thus, with the growing proliferation of these electronic devices, there is an expected growth in the demand of electronic wires.

Get 10% Customization on this Report: https://www.marketsandmarkets.com/requestCustomizationNew.asp?id=247134084

Based on material type, the wire & cable market is divided based on metal and polymer. The metal is an irreplaceable part of the wire and cables and thus dominates the material segment of the wire & cable market. Metals include copper and aluminium which have excellent electrical conductivity properties. Copper is used for high-voltage power transmission and is on the expensive side whereas aluminium is used in lightweight and cost-effective wires and cables. Metals comprise the major part of wire and cables, whereas the polymer is mainly used to sheath them to protect from external damage.

Based on voltage, the wire & cable market is segmented into four types low, medium, high, and extra-high voltage. Low voltage wires and cables market comprises a major part of the wire and cable market because of their versatility. These components are useful in transmitting electric power and signals in residential, commercial, and industrial premises. This is because they are commonly used in society publicly and domestically due to they are cheap, and used widely in lighting systems, appliances, and network circuits age. Since more advanced constructions and structures are being put up and energy-saving features are incorporated in constructions, there is always a need to supply and support high-quality low voltage cables.

Browse Adjacent Markets: Advanced Materials Market Research Reports & Consulting

Related Reports:

- Industrial Coatings Market

- Industrial Gases Market

- Synthetic Lubricants Market

- Green Hydrogen Market

- Protective Packaging Market

About MarketsandMarkets™ MarketsandMarkets™ has been recognized as one of America's best management consulting firms by Forbes, as per their recent report. MarketsandMarkets™ is a blue ocean alternative in growth consulting and program management, leveraging a man-machine offering to drive supernormal growth for progressive organizations in the B2B space. We have the widest lens on emerging technologies, making us proficient in co-creating supernormal growth for clients. Earlier this year, we made a formal transformation into one of America's best management consulting firms as per a survey conducted by Forbes. The B2B economy is witnessing the emergence of $25 trillion of new revenue streams that are substituting existing revenue streams in this decade alone. We work with clients on growth programs, helping them monetize this $25 trillion opportunity through our service lines - TAM Expansion, Go-to-Market (GTM) Strategy to Execution, Market Share Gain, Account Enablement, and Thought Leadership Marketing. Built on the 'GIVE Growth' principle, we work with several Forbes Global 2000 B2B companies - helping them stay relevant in a disruptive ecosystem. Our insights and strategies are molded by our industry experts, cutting-edge AI-powered Market Intelligence Cloud, and years of research. The KnowledgeStore™ (our Market Intelligence Cloud) integrates our research, facilitates an analysis of interconnections through a set of applications, helping clients look at the entire ecosystem and understand the revenue shifts happening in their industry. To find out more, visit www.MarketsandMarkets™.com or follow us on Twitter, LinkedIn and Facebook. Contact: Mr. Rohan Salgarkar MarketsandMarkets™ INC. 1615 South Congress Ave. Suite 103, Delray Beach, FL 33445 USA: +1-888-600-6441 Email: sales@marketsandmarkets.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Palantir's Joe Lonsdale Backs Elon Musk's Twitter Acquisition, Saying If He Had Not Bought It 'The Entire West Would Be At 10x The Threat'

Benzinga and Yahoo Finance LLC may earn commission or revenue on some items through the links below.

Palantir Technologies, Inc. (NYSE:PLTR) co-founder, Joe Lonsdale, has expressed his support for Tesla and SpaceX CEO Elon Musk’s acquisition of Twitter, now rebranded as X.

What Happened: On Thursday, while appearing on CNBC’s Squawk Box, Lonsdale was asked about Musk’s sentiments toward his $44 billion purchase of Twitter.

Lonsdale responded positively, suggesting that Musk’s acquisition was a crucial step for the preservation of the West.

“If Elon hadn’t bought Twitter, if he hadn’t done this, the entire West would be at 10x the threat,” he said and went on to underscore the significance of free speech in maintaining our civilization.

Check It Out:

When probed about the financial implications of the acquisition, Lonsdale acknowledged a decrease in revenue due to brands pulling their support.

However, he contended that this was a result of illegal coordination and attacks, which he deemed “probably illegal.”

he stated that while brands have the right to withdraw their support, behind-the-scenes coordination to damage a company is inappropriate.

Musk also shared the clip from this discussion on X and said, “Thanks Joe.”

Why It Matters: Musk’s acquisition of Twitter has been fraught with controversy. Just earlier this month, it was reported that X is expected to see a drastic reduction in advertising expenditure in 2025, following a 26% decline in marketers’ ad spending on the platform.

Trending: A billion-dollar investment strategy with minimums as low as $10 — you can become part of the next big real estate boom today.

This is a paid advertisement. Carefully consider the investment objectives, risks, charges and expenses of the Fundrise Flagship Fund before investing. This and other information can be found in the Fund’s prospectus. Read them carefully before investing.

Last month, it was reported that since Musk’s acquisition, X’s revenue has plummeted by 84%. This number also reportedly sparked fears among Tesla investors that Musk might sell more of his Tesla stock to fill the financial gap.

Previously, Meta Platforms Inc’s president for global affairs, Nick Clegg, also criticized X for becoming a “tiny” platform for elites that permits anyone to say anything.

He also noted that individuals banned from Meta’s platforms like Facebook and Instagram remain active on X and Telegram, and were involved in the far-right protests and riots in Britain last month.

Meanwhile, on Thursday morning, Palantir shares made a new 52-week high. This development came after the company got a new contract from the U.S. Army worth $99.8 million.

Keep Reading:

This article Palantir’s Joe Lonsdale Backs Elon Musk’s Twitter Acquisition, Saying If He Had Not Bought It ‘The Entire West Would Be At 10x The Threat’ originally appeared on Benzinga.com

Boeing Worker Side Hustles Could Drag Strike Out for Months

(Bloomberg) — Around Boeing Co.’s vast aircraft manufacturing hub in Seattle, the great belt tightening has begun as the planemaker and its factory workers settle in for a labor dispute that will test the resolve of both sides.

Most Read from Bloomberg

Striking employees received their final Boeing paycheck on Thursday, and the company stops paying for their health insurance on Sept. 30. Both measures will pinch household finances, typically ratcheting up the pressure and stakes for union negotiators to reach an agreement on a new contract.

But as workers stare down the embattled manufacturer for better pay and benefits, the 33,000 members of IAM District 751 have the full benefit of a tight labor market and gig economy that provides a quick transition into jobs that help make ends meet. That gives the union bargaining leverage, potentially frustrating Boeing’s effort to swiftly end a conflict that’s costing it an estimated $100 million each day.

While the battle between one of the world’s largest exporters and its blue-collar workers may look like an uneven fight on its surface, Boeing finds itself in an increasingly untenable situation with its finances so dire that it can ill afford a drawn-out paralysis.

“I think everybody is ready for the long haul,” said Christopher Dahl, 38, who has worked at Boeing for 10 years, now testing flight-control systems. “I’ve gone through every strike because my parents were Boeing employees, so I know the game. And before, there wasn’t the options like we have to make money on the side.”

Companies like food-delivery provider DoorDash Inc. or Uber Technologies Inc. weren’t around 16 years ago, when Boeing’s largest union last walked off the job, shutting down its commercial airplane manufacturing for two months. Now, such companies, alongside a still-tight labor market, are providing possible options to sustain the strike.

Workers are once again digging in for a holdout after bucking their union leadership by voting overwhelmingly to reject a 25% pay raise. On picket lines outside the Renton factory where Boeing builds 737 Max jets, employees said they’ve been saving for years to strike for as long as it takes — without pay, aside from $250 weekly deposits from the IAM local.

Contract talks are at a stalemate, with no new sessions scheduled after two days of federal mediation. Updates from IAM District 751 earlier in the week showed union leaders drawing a hard line around 40% pay raises and reinstating pensions.

“With a 96% strike vote, we thought Boeing would finally understand that IAM 751 Machinists are demanding more,” the union said in a scathing update posted after the initial day of talks on Sept. 17.

With Washington state’s unemployment rate running at 4.9%, it’s easy to pick up temporary work in construction or driving for Amazon.com Inc. Across the street from the Boeing gate where union members were grilling hot dogs and waving at cars honking in support, Topgolf Callaway Brands Corp. prominently posted a sign saying “Now Hiring.”

“There’s so many jobs all over the place,” said Luis Arteaga, 54, who’s been at Boeing for 18 years. “Red Robin is hiring, LA Fitness, any restaurant is hiring, FedEx, UPS — I mean, every place is hiring. ”

Arteaga said he started planning his finances for this strike at least two years ago, and could easily last as long as three months without a regular Boeing paycheck, especially if he picks up a side job.

Others on the 24-hour picket lines estimated they could hold out until Christmas. Carmen Kim, who was striking with her husband — like her a Boeing employee — is prepared to get by for an entire year without regular work.

Boeing, meanwhile, is launching into a broad set of cost cuts to conserve cash. The austerity measures include unpaid leave for tens of thousands of US workers, and a cutback in travel that requires senior executives to fly in economy cabin seats. The planemaker is even contemplating selling equity to supplement its rapidly dwindling cash and maintain its investment-grade credit rating.

“While we are disappointed the discussions didn’t lead to more progress, we remain very committed to reaching an agreement as soon as possible that recognizes the hard work of our employees and ends the work stoppage in the Pacific Northwest,” Kelly Ortberg, Boeing’s new chief executive officer, said in a message to employees on Friday.

The labor strife at Boeing is remarkable for themes that resonate across other American companies: lost pensions and frustration over stagnating wages that haven’t kept pace with inflation, said Brian Bryant, international president of the International Association of Machinists and Aerospace Workers.

“The entire labor movement is watching this closely,” Bryant said in an interview. “This isn’t just a Boeing issue. Workers in this country have been left behind. There’s a movement here. Workers have said enough is enough.”

The Biden Administration has been monitoring the strike as well, said Bryant, whose union represents almost 700,000 members across North America.

“They’ve reached out to see what the status is, what support they can give, anything they can do to get the parties back together,” he added.

Many machinists interviewed by Bloomberg News cited a strong sense of injustice over what they perceived as union-busting tactics in the wake of the 2008 strike. Among them, Boeing started a second assembly line for the 787 Dreamliner in South Carolina, eroding its Seattle manufacturing base.

“While new CEO Kelly Ortberg has taken a more conciliatory approach, there is 16 years of history pitched against him,” said Rob Stallard, an analyst at Vertical Research Partners, adding that “the gap between what the IAM union members want and what Boeing is currently offering is large.”

A controversial 2014 contract extension looms particularly large. IAM members were pressured into a long-term deal that froze their pensions, increased health care premiums and locked in modest pay increases in order to keep manufacturing of the 777X jet in the Seattle area. It’s the deal that expired on Sept. 12.

“For 10 years, the union had no room to maneuver and lost all their leverage,” said Leon Grunberg, a sociology professor emeritus at the University of Puget Sound. “That may be contributing to the sense of payback or retribution.”

Boeing can’t resort to the same playbook in these talks. It doesn’t have a new jet development program in the pipeline after five years of heavy financial losses. It also can’t shift more manufacturing to the Southeastern US, since unemployment is still hovering near record-low rates in that region.

In fact, striking Boeing workers say they are getting many online help-wanted ads from Airbus SE, the company’s European rival, along with rocket maker Blue Origin LLC. Both have manufacturing plants in Alabama, where unemployment stood at 2.8% in July.

Bruce McFarland, an instrumentation technician at Boeing and IAM officer, pointed to another change that’s transformed the union from the past strikes: the spread of social media accounts that allow union members to stay connected and keep morale high over what could be months without work.

While it’s early days, many of his colleagues are driven by an idealistic goal as well as pocketbook concerns, he said. They want a fair contract, but they’d also to rebuild Boeing’s culture so workers are treated with dignity.

“I love my job, I love the work,” McFarland said. “Sometimes you have to wonder what the company’s doing.”

–With assistance from Eric Johnson and Anne Cronin.

(Updates with Boeing CEO’s comment in 15th paragraph)

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

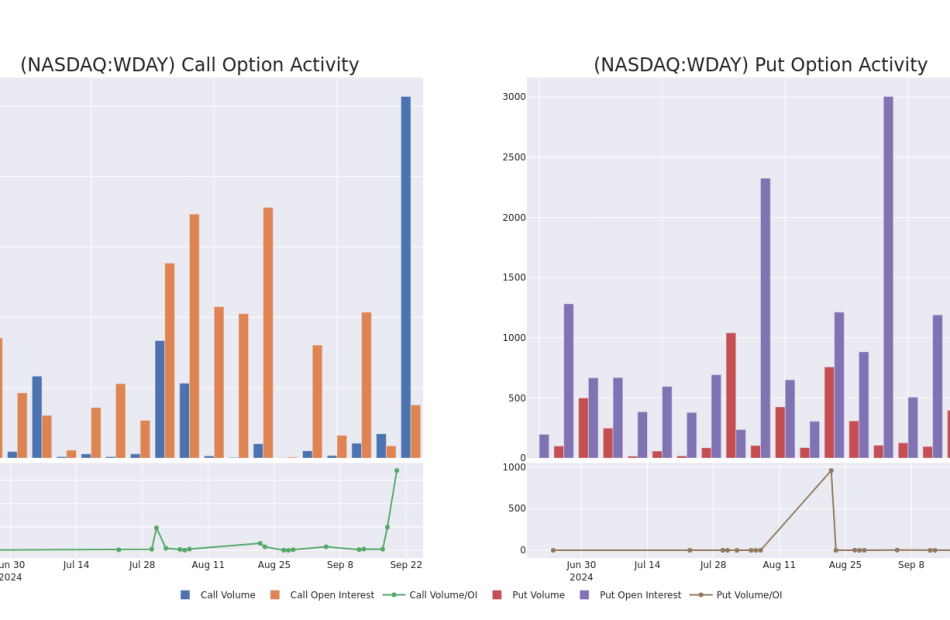

Workday's Options: A Look at What the Big Money is Thinking

Investors with a lot of money to spend have taken a bullish stance on Workday WDAY.

And retail traders should know.

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don’t know. But when something this big happens with WDAY, it often means somebody knows something is about to happen.

So how do we know what these investors just did?

Today, Benzinga‘s options scanner spotted 13 uncommon options trades for Workday.

This isn’t normal.

The overall sentiment of these big-money traders is split between 76% bullish and 7%, bearish.

Out of all of the special options we uncovered, 3 are puts, for a total amount of $112,330, and 10 are calls, for a total amount of $1,420,928.

Expected Price Movements

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $240.0 to $250.0 for Workday over the recent three months.

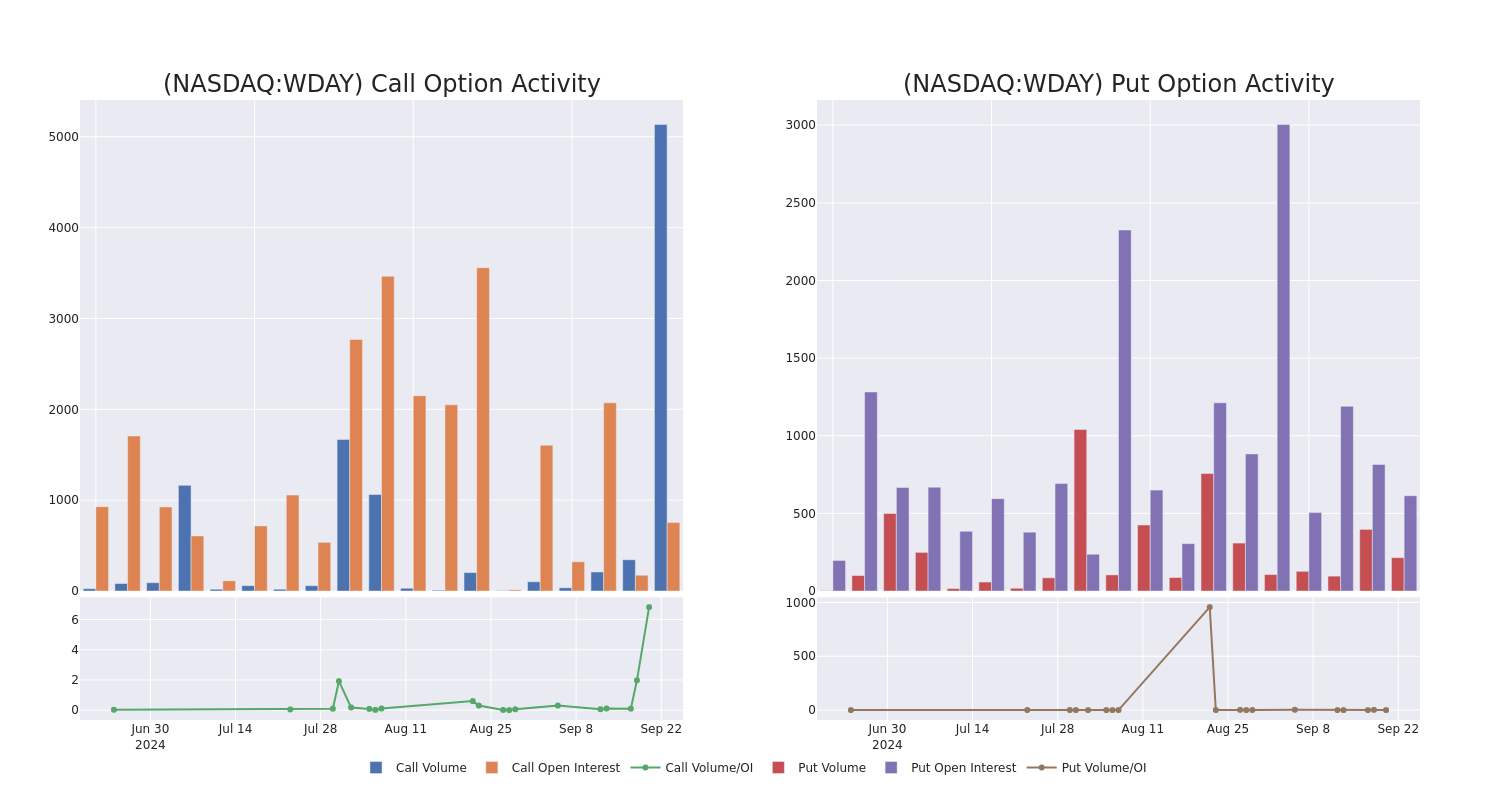

Analyzing Volume & Open Interest

In today’s trading context, the average open interest for options of Workday stands at 683.5, with a total volume reaching 5,349.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Workday, situated within the strike price corridor from $240.0 to $250.0, throughout the last 30 days.

Workday Option Activity Analysis: Last 30 Days

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| WDAY | CALL | SWEEP | BULLISH | 12/20/24 | $15.9 | $15.6 | $15.73 | $250.00 | $225.6K | 753 | 673 |

| WDAY | CALL | SWEEP | BULLISH | 12/20/24 | $15.8 | $15.7 | $15.87 | $250.00 | $223.3K | 753 | 882 |

| WDAY | CALL | SWEEP | BULLISH | 12/20/24 | $16.1 | $15.6 | $15.85 | $250.00 | $205.0K | 753 | 222 |

| WDAY | CALL | SWEEP | BULLISH | 12/20/24 | $15.9 | $15.7 | $15.87 | $250.00 | $158.4K | 753 | 511 |

| WDAY | CALL | SWEEP | BEARISH | 12/20/24 | $15.9 | $15.8 | $15.86 | $250.00 | $156.8K | 753 | 386 |

About Workday

Workday is a software company that offers human capital management, or HCM, financial management, and business planning solutions. Known for being a cloud-only software provider, Workday is headquartered in Pleasanton, California. Founded in 2005, Workday now employs over 18,000 employees.

Having examined the options trading patterns of Workday, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Current Position of Workday

- Currently trading with a volume of 3,612,779, the WDAY’s price is up by 0.35%, now at $248.29.

- RSI readings suggest the stock is currently may be approaching oversold.

- Anticipated earnings release is in 67 days.

What The Experts Say On Workday

A total of 5 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $297.0.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* An analyst from Goldman Sachs has decided to maintain their Buy rating on Workday, which currently sits at a price target of $305.

* Maintaining their stance, an analyst from Keybanc continues to hold a Overweight rating for Workday, targeting a price of $305.

* Maintaining their stance, an analyst from Deutsche Bank continues to hold a Hold rating for Workday, targeting a price of $275.

* An analyst from Wells Fargo has decided to maintain their Overweight rating on Workday, which currently sits at a price target of $300.

* Maintaining their stance, an analyst from BMO Capital continues to hold a Outperform rating for Workday, targeting a price of $300.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Workday with Benzinga Pro for real-time alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Polyimide Foam Market to Reach $419.9 Million, Globally, by 2032 at 4.5% CAGR: Allied Market Research

Wilmington, Delaware , Sept. 20, 2024 (GLOBE NEWSWIRE) — Allied Market Research published a report, titled, “Polyimide Foam Market by Type (Regid Foam and Flexible Foam) and Application (Aerospace, Marine, Renewable Energy, Medical and Others): Global Opportunity Analysis and Industry Forecast, 2024-2032″. According to the report, the polyimide foam market was valued at $282.0 million in 2023, and is estimated to reach $419.9 million by 2032, growing at a CAGR of 4.5% from 2024 to 2032.

Prime determinants of growth

The global polyimide foam market is experiencing growth due to several factors such as increase in demand for lightweight material in automotive and aerospace industries is expected to drive the growth of polyimide foam market. However, limited temperature resistance hinders market growth. Moreover, Polyimide foam utilization in renewable energy sector offers remunerative opportunities for the expansion of the global polyimide foam market.

Download Sample Pages of Research Overview: https://www.alliedmarketresearch.com/request-sample/A323757

Report coverage & details:

| Report Coverage | Details |

| Forecast Period | 2024–2032 |

| Base Year | 2022 |

| Market Size in 2022 | $282.0 million |

| Market Size in 2032 | $419.9 million |

| CAGR | 4.6% |

| No. of Pages in Report | 300 |

| Segments Covered | Type, Application, and Region. |

| Drivers |

|

| Opportunities |

|

| Restraint |

|

The polyimide foam market is segmented into type, application, and region. By type, the market is bifurcated into rigid foam, and flexible foam. As per application, the market is categorized into aerospace, marine, renewable energy, medical, and others. Region-wise the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

The flexible foam is expected to remain the largest type throughout the forecast period.

Polyimide flexible foam is extensively used in aerospace applications, including aircraft interiors, thermal insulation, gaskets, seals, and vibration dampening components. Its lightweight nature, combined with thermal and chemical resistance, makes it ideal for aircraft interiors and structural components. Polyimide flexible foam is utilized in electronic devices for thermal management, shock absorption, and electrical insulation. It serves as a protective cushioning material for delicate electronic components, ensuring reliability and longevity.

The aerospace segment is expected to lead throughout the forecast period.

Polyimide foam is widely used in aerospace applications due to its lightweight nature, high-temperature resistance, and excellent thermal and acoustic insulation properties. It is utilized in aircraft interiors, engine components, thermal protection systems, and other critical aerospace applications.

Furthermore, the significance of polyimide foam extends beyond passenger comfort, permeating into the realm of engine components and thermal protection systems. Within the heart of aircraft propulsion systems, where temperatures soar to extremes, polyimide foam emerges as a stalwart guardian, providing reliable thermal insulation to critical components. Its ability to withstand high temperatures ensures the integrity and longevity of engine structures, thereby bolstering the aircraft’s overall performance and safety.

Procure Complete Report (300 Pages PDF with Insights, Charts, Tables, and Figures) @ https://www.alliedmarketresearch.com/checkout-final/polyimide-foam-market

Asia-Pacific to maintain its dominance by 2033.

The Asia-Pacific region is a hub for electronics manufacturing, and polyimide foam finds application in this industry for thermal management in electronic devices such as smartphones, laptops, tablets, and LED displays. Its lightweight nature makes it suitable for use in portable electronic devices.

China utilizes polyimide foam extensively in electronics manufacturing, automotive production, aerospace components, and construction projects. With a focus on innovation and technological advancement, Chinese industries employ polyimide foam for thermal management, acoustic insulation, and lightweighting solutions.

Japan is known for its advanced technology and engineering prowess. Polyimide foam is widely used in Japan’s aerospace and automotive industries for thermal insulation and weight reduction in aircraft, spacecraft, automobiles, and high-speed trains. Additionally, it finds applications in electronics, medical devices, and construction projects across the country.

Want to Access the Statistical Data and Graphs, Key Players’ Strategies: https://www.alliedmarketresearch.com/polyimide-foam-market/purchase-options

Players: –

- Polymer Technologies, Inc

- The Claremont Sales Corporation

The report provides a detailed analysis of these key players in the global polyimide foam market. These players have adopted different strategies such as new product launches, collaborations, expansion, joint ventures, agreements, and others to increase their market share and maintain dominant shares in different regions. The report is valuable in highlighting business performance, operating segments, product portfolio, and strategic moves of market players to showcase the competitive scenario.

About Us

Allied Market Research (AMR) is a full-service market research and business-consulting wing of Allied Analytics LLP based in Portland, Oregon. Allied Market Research provides global enterprises as well as medium and small businesses with unmatched quality of “Market Research Reports” and “Business Intelligence Solutions.” AMR has a targeted view to provide business insights and consulting to assist its clients to make strategic business decisions and achieve sustainable growth in their respective market domain.

Pawan Kumar, the CEO of Allied Market Research, is leading the organization toward providing high-quality data and insights. We are in professional corporate relations with various companies and this helps us in digging out market data that helps us generate accurate research data tables and confirms utmost accuracy in our market forecasting. Each and every data presented in the reports published by us is extracted through primary interviews with top officials from leading companies of domain concerned. Our secondary data procurement methodology includes deep online and offline research and discussion with knowledgeable professionals and analysts in the industry.

Contact:

David Correa

United States

1209 Orange Street,

Corporation Trust Center,

Wilmington, New Castle,

Delaware 19801 USA.

Int’l: +1-503-894-6022

Toll Free: +1-800-792-5285

Fax: +1-800-792-5285

help@alliedmarketresearch.com

Web: www.alliedmarketresearch.com

Allied Market Research Blog: https://blog.alliedmarketresearch.com

Blog: https://www.newsguards.com/

Follow Us on | Facebook | LinkedIn | YouTube |

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

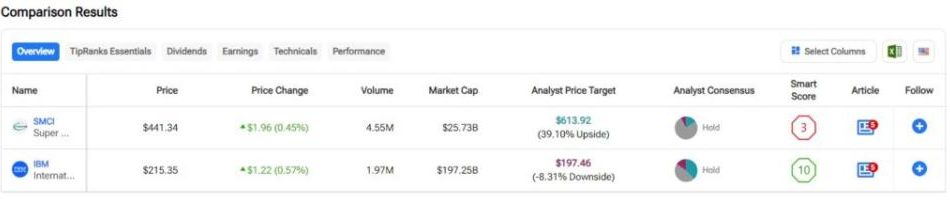

SMCI vs. IBM: Which Data Center Stock Is Better?

In this piece, I am evaluating two data center stocks: Super Micro Computer (SMCI) and IBM (IBM). A closer look leads me to establish a bearish view for Super Micro Computer and a neutral view for IBM.

Super Micro Computer (Super Micro) manufactures servers for cloud computing, data centers, big data, artificial intelligence, 5G, and the Internet of Things. It also offers other computer products, including energy-efficient computing technology. Meanwhile, IBM is of course a legacy computing giant that now offers servers for data centers and a wide range of enterprise software, networking equipment, and other computing needs.

Super Micro stock is still higher by 55% YTD after plummeting 52% over the past three months. The shares are also up 78% over the past year. On the other hand, IBM stock has soared 25% over the last three months, bringing its year-to-date return to 35%. Shares of ‘Big Blue’ have surged 53% over the last year.

(SMCI = green, IBM = black line)

Despite such different three-month performances, the respective valuations for Supermicro and IBM aren’t that far apart. We compare their price-to-earnings (P/E) ratios to assess their valuations against each other and that of their industry.

For comparison, the information technology industry is trading at a P/E of 44.5x, versus its three-year average of 67.9x.

Super Micro Computer

With a trailing P/E of 21.8x, Super Micro Computer is trading at a sizable discount to its sector. However, such a discount seems warranted given recent developments at the company. A bearish view seems appropriate, at least until things blow over and we receive some transparency into the situation.

A negative report on SMCI from short seller Hindenburg Research raised all sorts of red flags. The firm makes a variety of allegations against the company, including that it has manipulated its financials. Hindenburg alleged accounting issues along with undisclosed transactions between related parties, sanctions violations, and problems with export control. Short sellers benefit when a stock price plummets, so may be motivated to issue reports on the companies they’re shorting for that reason. However, on the other hand, Hindenburg Research has a pretty good track record, and was correct about fraud at Nikola (NKLA) in 2020.

Additionally, Super Micro has already had documented accounting violations in the past, having settled a previous case with the Securities and Exchange Commission in 2020 for $17.5 million. As a result, investors might want to steer clear of SMCI until additional transparency is available, especially after the company decided to delay the release of its annual report.

What is the Price Target for SMCI stock?

Super Micro Computer has a Hold consensus rating based on one Buy, 10 Holds, and one Sell rating assigned over the last three months. At $615.18, the average Super Micro Computer stock price target implies upside potential of 38.44%.

At a P/E of 23.7x, IBM is also trading at a deeply discounted valuation versus its sector, and also offers an attractive dividend yield. However, a review of the company’s valuation history reveals that the stock is trading at the top of its typical range going back to October 2019. Thus, a neutral view seems appropriate, as does monitoring for a buy-the-dip opportunity.

I’m cautious on IBM right now due to its valuation, even though there is much to like about this stock. Of course, IBM has been around for a long time, and it isn’t going anywhere anytime soon. It’s a stalwart, growing technology company, although it doesn’t post the level of revenue increases required to be considered a growth stock. Going back to October 2019, the company’s typical P/E range has been between about 17.5x and 25.1x. Therefore the stock does look a little pricey versus its historical range, suggesting that a buy-the-dip opportunity could surface before too long.

However, investors looking for technology exposure in their dividend portfolio may not find a better stock, as IBM’s dividend yield stands at around 3.1% with a healthy payout ratio of 65.4%, suggesting that the dividend is both appealing and pretty safe. Additionally, IBM has a 29-year history of raising its dividend annually, further sweetening the pot.

Finally, IBM’s long-term share-price appreciation demonstrates the stock’s appear as a buy-and-hold investment in a dividend portfolio. The shares are up 92% over the last three years, 101% over the last five, and 80.6% over the last 10. IBM has recently nudged into overbought territory with a Relative Strength Indicator of 73.8. Anything above 70 suggests a stock is overbought and that a correction to the downside could be near. I would simply wait for IBM stock to drop down to the lower end of its typical P/E range before potentially buying the shares.

What is the Price Target for IBM stock?

IBM has a Hold consensus rating based on five Buys, six Hold, and two Sell ratings assigned over the last three months. At $197.46, the average IBM stock price target implies downside potential of 8.69%.

Conclusion: Bearish on SMCI, Neutral on IBM

On one hand, Super Micro could present a buy-the-dip opportunity right now due to the short-seller’s report. However, there’s usually fire where there’s smoke, and the short seller who’s targeting the company has a good track record thus far. The delayed annual report also enforces the major lack of transparency and can represent a serious breach of trust with shareholders, so investors may want to steer clear of Super Micro Computer at this time.

On the other hand, there is much to like about IBM, although the price for its stock is pretty high, relatively speaking. Even if someone were to buy shares at the current price, the dividend and long-term appreciation potential still make this a buy-and-hold stock for the long term. However, I believe that we could see a pullback in IBM before too long, so I think it’s best to wait before pulling the trigger.

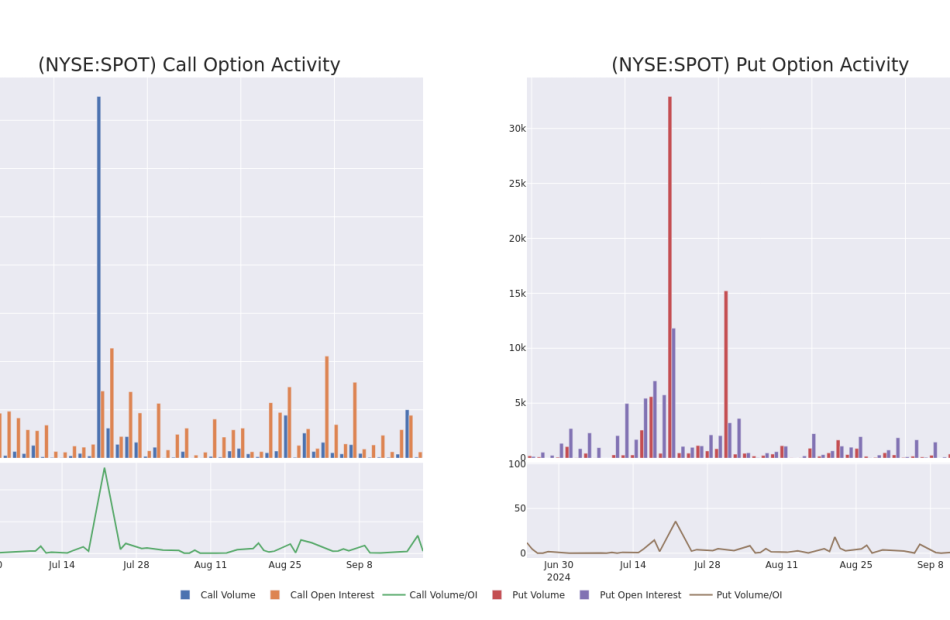

Spotlight on Spotify Technology: Analyzing the Surge in Options Activity

Investors with a lot of money to spend have taken a bearish stance on Spotify Technology SPOT.

And retail traders should know.

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don’t know. But when something this big happens with SPOT, it often means somebody knows something is about to happen.

So how do we know what these investors just did?

Today, Benzinga‘s options scanner spotted 11 uncommon options trades for Spotify Technology.

This isn’t normal.

The overall sentiment of these big-money traders is split between 27% bullish and 54%, bearish.

Out of all of the special options we uncovered, 7 are puts, for a total amount of $312,552, and 4 are calls, for a total amount of $198,826.

Predicted Price Range

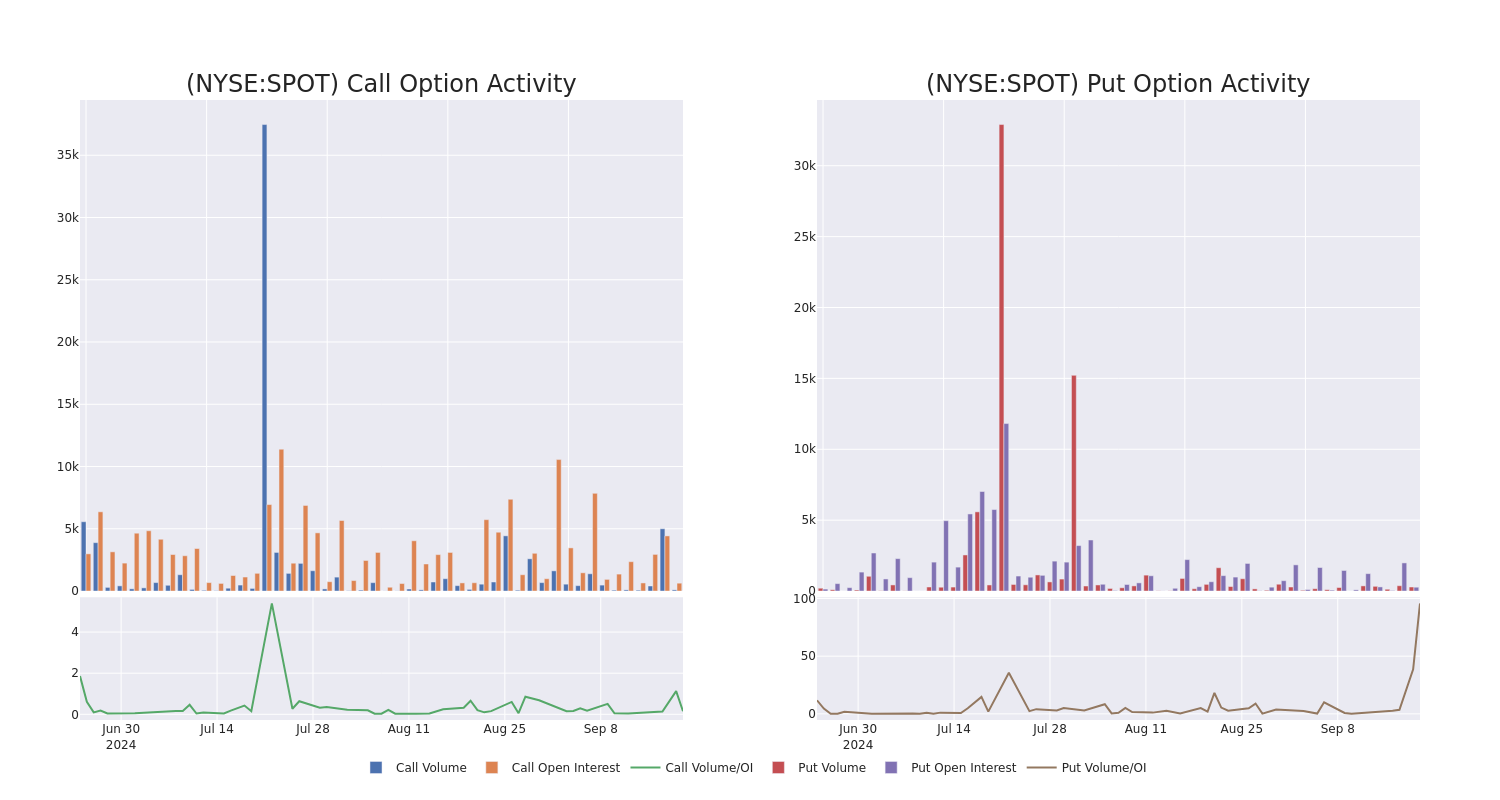

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $270.0 to $500.0 for Spotify Technology during the past quarter.

Analyzing Volume & Open Interest

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Spotify Technology’s options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Spotify Technology’s whale trades within a strike price range from $270.0 to $500.0 in the last 30 days.

Spotify Technology Call and Put Volume: 30-Day Overview

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| SPOT | CALL | SWEEP | BULLISH | 11/15/24 | $27.65 | $27.1 | $27.65 | $360.00 | $102.3K | 4 | 45 |

| SPOT | PUT | SWEEP | BEARISH | 03/21/25 | $18.5 | $18.3 | $18.5 | $320.00 | $70.3K | 138 | 38 |

| SPOT | PUT | SWEEP | BEARISH | 11/15/24 | $32.2 | $31.65 | $32.15 | $380.00 | $48.2K | 2 | 75 |

| SPOT | PUT | SWEEP | BULLISH | 10/18/24 | $14.55 | $14.4 | $14.4 | $370.00 | $43.2K | 125 | 34 |

| SPOT | PUT | SWEEP | BEARISH | 11/15/24 | $32.3 | $31.6 | $32.25 | $380.00 | $41.9K | 2 | 30 |

About Spotify Technology

Spotify, headquartered in Stockholm, Sweden, is one of the world’s largest music streaming service providers, with 602 million monthly active users at the end of 2023. The firm monetizes its users through a paid subscription model, referred to as its premium service, and an ad-based model, referred to as its ad-supported service. Revenue from premium and ad-supported services represented 86% and 14% of Spotify’s 2023 total revenue, respectively.

Present Market Standing of Spotify Technology

- With a volume of 826,486, the price of SPOT is up 1.52% at $365.69.

- RSI indicators hint that the underlying stock may be approaching overbought.

- Next earnings are expected to be released in 32 days.

What Analysts Are Saying About Spotify Technology

A total of 4 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $437.5.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* Consistent in their evaluation, an analyst from Evercore ISI Group keeps a Outperform rating on Spotify Technology with a target price of $460.

* Consistent in their evaluation, an analyst from Keybanc keeps a Overweight rating on Spotify Technology with a target price of $440.

* Maintaining their stance, an analyst from Pivotal Research continues to hold a Buy rating for Spotify Technology, targeting a price of $510.

* Reflecting concerns, an analyst from Cantor Fitzgerald lowers its rating to Neutral with a new price target of $340.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Spotify Technology options trades with real-time alerts from Benzinga Pro.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Want Safe Dividend Income in 2024 and Beyond? Invest in These 3 Ultra-High-Yield Stocks.

If your gut tells you now is a good time to add some safe dividend payers to your investment portfolio, you’d be wise to listen. Between geopolitical turmoil, lingering inflation, unpredictable interest rates, rising loan delinquencies, and political uncertainty, the near future may not be a great environment for some — or maybe any — growth stocks.

However, these three high-yield dividend stocks are up to the job of providing investors with solid returns, and they should remain so indefinitely.

1. Altria Group

The United States’ tobacco industry is living on borrowed time. That’s the top takeaway from the World Health Organization’s (WHO) most recent look at the matter anyway, which suggests only 18.2% of the nation’s adult population will be regular tobacco users (smokers, mostly) in 2025. That’s measurably less than 2000’s figure of 23.3%.

The United States’ tobacco business may actually have more years ahead of it than you might expect, however. Also recognizing the smoking-cessation movement is slowing down, the same WHO report suggests 16.5% of U.S. adults will still be regularly using tobacco by 2030. People are picking up alternative vices like vaping and the use of e-cigarettes in droves in the meantime. The National Center for Health Statistics reports over 4% of the country’s adults use vape products regularly, offsetting the shrinking number of smokers.

Connect the dots. Given the nation’s expected population growth between now and then (and beyond), there’s still plenty of opportunity to turn these common consumer habits into lots of cash.

The backdrop bodes well for Altria Group (NYSE: MO), parent to Philip Morris USA, which owns familiar U.S. cigarette brands like Marlboro, Virginia Slims, and others. And, even though cigarettes remain its top seller, it also owns vaping brand NJOY and oral nicotine pouch maker Helix Innovations. These other initiatives are softening the impact of tobacco’s slow demise on Altria, which has adopted the motto “Moving beyond smoking.” By accepting the gradual but inevitable decline of the cigarette market rather than resisting it, the company can continue generating good revenue by managing — and even steering — the transition to other nicotine products. More important to shareholders, managing this evolution lets Altria continue producing the profits that have supported 55 straight years of annual dividend increases.

It’s important for investors to understand that there won’t likely be any meaningful or sustainable capital appreciation here. Altria doesn’t even appear to be trying to muster growth. Its focus is entirely on maintaining the cash flow that funds its dividend payments.

With a forward yield of 7.7% and a dividend that could continue growing and being paid for decades though, that’s not a bad trade-off.

2. Realty Income

Contrary to a common assumption, not all sections of the retail industry are on the ropes. The bulk of the weakness is limited to department stores and the malls where they’re typically found. Strip malls and neighborhood shopping centers are actually doing pretty well, catering to consumers where and how they like to shop.

Enter Realty Income (NYSE: O).

It’s not a retailer, although its fate is tied to a wide swath of that industry. It’s a real estate investment trust (REIT), renting brick-and-mortar properties to retailers, sparing its tenants some of the financial commitments of owning all those buildings.

That may still seem like a risky proposition on the surface. The landlord is still renting to companies in a retail industry that’s being pressured by the ongoing growth of e-commerce.

This overarching idea ignores a couple of important details though. One is that a great deal of retail consumption is still (for convenience and speed reasons) handled in person at stores. And the other reason? The bulk of Realty Income’s tenants are among the retailers with the most staying power, like Dollar General, Walgreens, 7-Eleven, and even Walmart. Once these chains have established a brick-and-mortar presence in a location, they’re unlikely to abandon it.

That’s what this REIT’s dividend track record suggests anyway. Not only has it distributed its monthly (yes, monthly) payments like clockwork ever since they began in 1969, those payouts have been raised 127 times. Those who buy the stock today would be stepping in while Realty Income’s forward dividend yield stands at 5%.

3. Whirlpool

Last but not least, add home appliance maker Whirlpool (NYSE: WHR) to your list of dividend stocks to consider buying while its forward yield stands at 7%.

It’s a suggestion that might raise a few eyebrows. Even if you don’t know for sure, intuitively, it doesn’t seem as if there’d be great demand for home appliances at this time. Growing competition from the likes of Samsung, Bosch, and LG further deflates the bullish argument for owning a stake in this iconic brand name.

Things may not be quite as challenging on this front as it seems they should be, though.

Unlike some other large purchases, the purchase of a major home appliance can’t always be put off. Appliances are also more affordable than cars or homes, for example, so getting financing is less of a hurdle. To this end, the Conference Board’s consumer sentiment measure ticked higher in August specifically because — in apparent defiance of the economic backdrop — more U.S. consumers said they intend to purchase a refrigerator, washing machine, or TV within the next six months. It was the fourth straight month these purchasing plans improved.

Investors who already know Whirlpool will likely also know that while it has continued to make its dividend payments, it hasn’t increased them since 2022, when it raised the quarterly payout to $1.75 per share.

Keep things in perspective though, its ability to maintain its payout was never in question. The decision to halt its long-established cadence of dividend growth was rooted in an abundance of caution at an extraordinary time in modern history. The COVID-19 pandemic and the ripple effects from it not only temporarily up-ended purchases of appliances, they impeded companies’ ability to manufacture them. This year’s expected 14% revenue dip and subsequent profit setback should mark the end of these woes though. Analysts forecast that Whirlpool’s business will turn the corner next year. In the meantime, with the stock trades down 60% from its 2021 high and is valued at less than 9 times next year’s estimated earnings, the worst-case scenario is already priced in … and then some.

Should you invest $1,000 in Altria Group right now?

Before you buy stock in Altria Group, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Altria Group wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $694,743!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 16, 2024

James Brumley has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Realty Income and Walmart. The Motley Fool has a disclosure policy.

Want Safe Dividend Income in 2024 and Beyond? Invest in These 3 Ultra-High-Yield Stocks. was originally published by The Motley Fool