Chief Financial Officer At A-Mark Precious Metals Exercises Options Worth $1.02M

In a new SEC filing on September 20, it was revealed that TaylorSimpson, Chief Financial Officer at A-Mark Precious Metals AMRK, executed a significant exercise of company stock options.

What Happened: TaylorSimpson, Chief Financial Officer at A-Mark Precious Metals, made a strategic move by exercising stock options for 25,000 shares of AMRK as detailed in a Form 4 filing on Friday with the U.S. Securities and Exchange Commission. The transaction value amounted to $1,015,699.

A-Mark Precious Metals shares are trading up 0.02% at $43.44 at the time of this writing on Friday morning. Since the current price is $43.44, this makes TaylorSimpson’s 25,000 shares worth $1,015,699.

All You Need to Know About A-Mark Precious Metals

A-Mark Precious Metals Inc is a precious metal trading company. It is principally engaged in the wholesale of gold, silver, platinum, copper, and palladium bullion and related products in the form of bars, wafers, coins, and grains. The company’s operating segment includes Wholesale Sales and Ancillary Services; Secured Lending and Direct-to-Consumer. It generates maximum revenue from the Wholesale Trading and Ancillary Services segment. The Wholesale Trading and Ancillary Services segment comprises business units such as Industrial, Coin and Bar, Trading and Finance, Storage, Logistics, and Mint. Geographically, it derives a majority of its revenue from the United States and the rest from Europe, Asia Pacific, Australia, Africa, and other regions.

Financial Insights: A-Mark Precious Metals

Revenue Challenges: A-Mark Precious Metals’s revenue growth over 3 months faced difficulties. As of 30 June, 2024, the company experienced a decline of approximately -19.06%. This indicates a decrease in top-line earnings. When compared to others in the Consumer Discretionary sector, the company faces challenges, achieving a growth rate lower than the average among peers.

Holistic Profitability Examination:

-

Gross Margin: With a low gross margin of 1.7%, the company exhibits below-average profitability, signaling potential struggles in cost efficiency compared to its industry peers.

-

Earnings per Share (EPS): A-Mark Precious Metals’s EPS is below the industry average. The company faced challenges with a current EPS of 1.34. This suggests a potential decline in earnings.

Debt Management: A-Mark Precious Metals’s debt-to-equity ratio stands notably higher than the industry average, reaching 1.28. This indicates a heavier reliance on borrowed funds, raising concerns about financial leverage.

Valuation Analysis:

-

Price to Earnings (P/E) Ratio: A-Mark Precious Metals’s P/E ratio of 15.3 is below the industry average, suggesting the stock may be undervalued.

-

Price to Sales (P/S) Ratio: The current P/S ratio of 0.11 is below industry norms, suggesting potential undervaluation and presenting an investment opportunity for those considering sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): Boasting an EV/EBITDA ratio of 12.89, A-Mark Precious Metals demonstrates a robust market valuation, outperforming industry benchmarks.

Market Capitalization Analysis: Positioned below industry benchmarks, the company’s market capitalization faces constraints in size. This could be influenced by factors such as growth expectations or operational capacity.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

The Importance of Insider Transactions

Insider transactions shouldn’t be used primarily to make an investing decision, however, they can be an important factor for an investor to consider.

Considering the legal perspective, an “insider” is defined as any officer, director, or beneficial owner holding more than ten percent of a company’s equity securities, according to Section 12 of the Securities Exchange Act of 1934. This includes executives in the c-suite and major hedge funds. These insiders are mandated to disclose their transactions through a Form 4 filing, to be submitted within two business days of the transaction.

Pointing towards optimism, a company insider’s new purchase signals their positive anticipation for the stock to rise.

Nevertheless, insider sells may not necessarily indicate a bearish view and can be influenced by various factors.

A Deep Dive into Insider Transaction Codes

When it comes to transactions, investors tend to focus on those in the open market, detailed in Table I of the Form 4 filing. A P in Box 3 denotes a purchase, while S indicates a sale. Transaction code C signals the conversion of an option, and transaction code A denotes a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of A-Mark Precious Metals’s Insider Trades.

Insider Buying Alert: Profit from C-Suite Moves

Benzinga Edge reveals every insider trade in real-time. Don’t miss the next big stock move driven by insider confidence. Unlock this ultimate sentiment indicator now. Click here for access.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

3 Artificial Intelligence (AI) Stock-Split Stocks That Could Help Set You Up for Life

Back in the dot-com boom era, stock splits became commonplace in response to soaring share prices. Amid the current artificial intelligence (AI) boom, a similar pattern could be developing. Already, several AI companies have split their shares, and more splits could be on the way among the others that are trading at lofty prices.

Investors should understand that stock splits don’t fundamentally change the value of a stock or the underlying business, but they usually come in the wake of significant share price appreciation, and signal management’s confidence that the stock can keep going higher.

There’s also evidence, according to a Bank of America study, that stocks outperform in the year after they split. While there’s no guarantee that any given stock-split stock will beat the S&P 500, it does offer historical evidence that the average stock-split stock does. On that note, these three AI stock-split stocks look like long-term winners.

1. Nvidia

Nvidia (NASDAQ: NVDA) needs little introduction at this point. The AI chip superstar has paced the sector, gaining roughly 700% since the start of 2023. Nvidia’s most recent stock split — a 10-for-1 split — took effect after the market closed on June 7, and the stock is down since then.

Nvidia continues to show a lot of upside potential even as its market cap is now hovering just shy of $3 trillion. The company has a huge lead in data center GPUs, the cutting-edge chips needed to power AI models like ChatGPT, and it seems likely that its lead will only get wider following the launch of chips built on its new Blackwell platform in the fourth quarter.

Additionally, the company is on pace to keep growing rapidly; revenue rose 122% year over year in its fiscal 2025 second quarter to $30 billion.

While some investors are concerned about the possibility of an AI sector bubble, there’s still plenty of evidence that demand for Nvidia’s components is soaring. The latest anecdote to support that theory: Reportedly, Oracle founder Larry Ellison and Tesla CEO Elon Musk recently took Nvidia CEO Jensen Huang to dinner so that they could beg him in person to sell their companies more GPUs.

Given its entrenched competitive advantages, surging demand for its wares, and a long development path ahead in generative AI, Nvidia still looks like a smart buy.

2. Super Micro Computer

Super Micro Computer (NASDAQ: SMCI) is another breakout AI stock. Like Nvidia, its revenue has soared, up 144% in its most recent quarter to $5.31 billion. However, the company’s gross margin declined, weighing on profits, and the market bid the stock downward.

Later, Supermicro shares plunged after a short-seller attacked the company, and management said its annual 10-K would be delayed. CEO Charles Liang responded to the short-seller’s charges, saying that business remains strong. Importantly, he also said that despite the filing delay, the company doesn’t anticipate any material changes to its financial results from what it previously reported.

Supermicro is known for manufacturing high-density servers that perform especially well in AI applications, and it’s dominating the market for liquid-cooled AI servers, giving it a competitive advantage.

A great reason to buy the stock now is Supermicro’s valuation. It currently trades at a price-to-earnings ratio of just 22, which looks like a dramatic undervaluation, assuming neither of those two issues is material.

Supermicro’s 10-for-1 stock split is scheduled for Oct. 1. That event could be a catalyst for the stock’s rebound.

3. Broadcom

Broadcom‘s (NASDAQ: AVGO) business is diversified across cybersecurity, virtualization software, semiconductors, and networking infrastructure. It doesn’t have the same level of exposure to AI that Nvidia and Supermicro do, but it’s seeing growing demand due to the new technology thanks in part to its switches, networking solutions, and custom accelerators for AI data centers.

CEO Hock Tan said he expected the company’s revenue from AI to reach $12 billion this year — roughly a quarter of its total sales.

The tech giant also has a long track record of success in growing its business both organically and through acquisitions, in which it typically cuts costs to drive profits higher. In its most recent fiscal quarter, the company reported adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) of $8.2 billion. That amounted to 63% of its total revenue, a ratio that’s nearly as good as Nvidia’s.

Broadcom executed a 10-for-1 stock split on July 12, and its stock has edged down since then along with the rest of the AI sector. Currently, Broadcom trades at a price-to-earnings ratio of 37, a reasonable level for an AI leader whose profitability should improve as it completes the integration of its massive VMware acquisition.

All three of these AI stocks have delivered strong results and look poised to continue doing so. With strong competitive advantages, huge growth opportunities, and affordable valuations, they all look like smart long-term buys.

Should you invest $1,000 in Nvidia right now?

Before you buy stock in Nvidia, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $694,743!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 16, 2024

Bank of America is an advertising partner of The Ascent, a Motley Fool company. Jeremy Bowman has positions in Bank of America and Broadcom. The Motley Fool has positions in and recommends Bank of America, Nvidia, Oracle, and Tesla. The Motley Fool recommends Broadcom. The Motley Fool has a disclosure policy.

3 Artificial Intelligence (AI) Stock-Split Stocks That Could Help Set You Up for Life was originally published by The Motley Fool

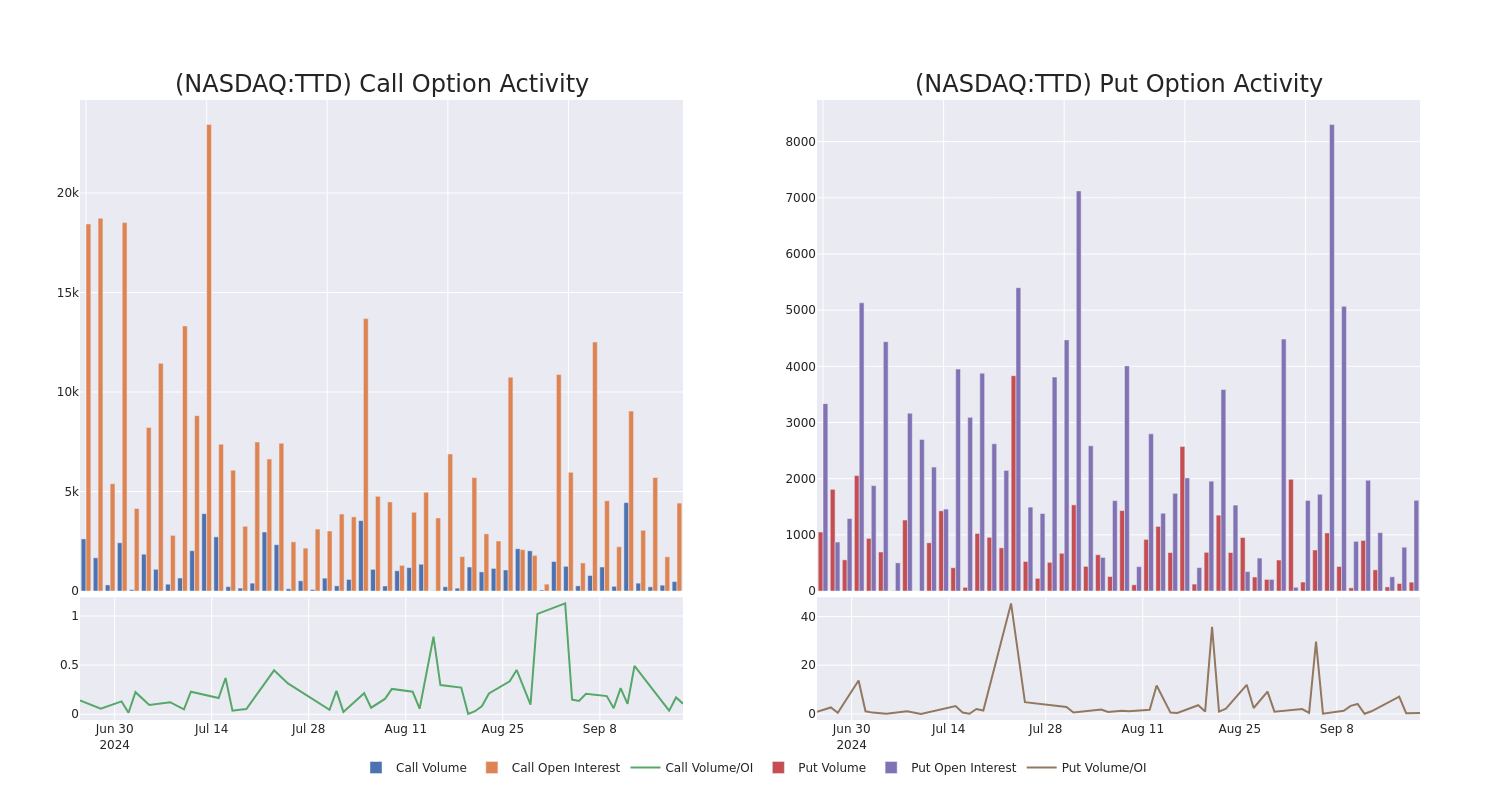

Spotlight on Trade Desk: Analyzing the Surge in Options Activity

Investors with a lot of money to spend have taken a bearish stance on Trade Desk TTD.

And retail traders should know.

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don’t know. But when something this big happens with TTD, it often means somebody knows something is about to happen.

So how do we know what these investors just did?

Today, Benzinga‘s options scanner spotted 8 uncommon options trades for Trade Desk.

This isn’t normal.

The overall sentiment of these big-money traders is split between 25% bullish and 75%, bearish.

Out of all of the special options we uncovered, 4 are puts, for a total amount of $808,150, and 4 are calls, for a total amount of $244,857.

Predicted Price Range

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $50.0 to $115.0 for Trade Desk over the recent three months.

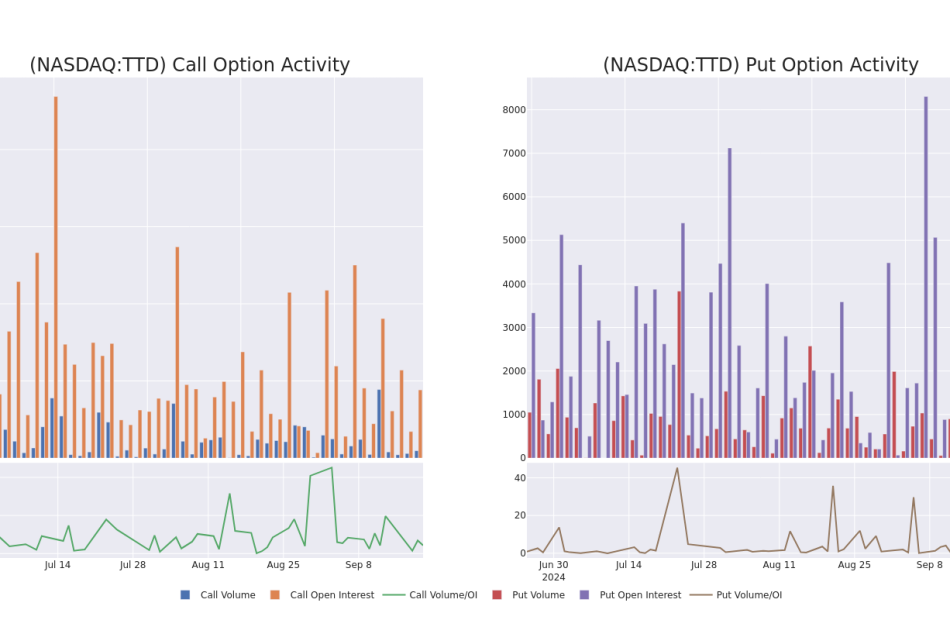

Volume & Open Interest Trends

In terms of liquidity and interest, the mean open interest for Trade Desk options trades today is 754.25 with a total volume of 633.00.

In the following chart, we are able to follow the development of volume and open interest of call and put options for Trade Desk’s big money trades within a strike price range of $50.0 to $115.0 over the last 30 days.

Trade Desk Option Volume And Open Interest Over Last 30 Days

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| TTD | PUT | TRADE | BEARISH | 03/21/25 | $15.05 | $14.4 | $15.02 | $115.00 | $600.8K | 208 | 0 |

| TTD | PUT | TRADE | BULLISH | 01/16/26 | $14.9 | $14.3 | $14.3 | $100.00 | $143.0K | 440 | 100 |

| TTD | CALL | SWEEP | BULLISH | 09/20/24 | $4.55 | $4.35 | $4.52 | $105.00 | $118.4K | 2.4K | 401 |

| TTD | CALL | SWEEP | BEARISH | 09/20/24 | $19.6 | $19.2 | $19.2 | $90.00 | $57.6K | 1.3K | 50 |

| TTD | CALL | SWEEP | BEARISH | 12/20/24 | $22.7 | $21.6 | $21.6 | $90.00 | $43.2K | 451 | 20 |

About Trade Desk

The Trade Desk provides a self-service platform that helps advertisers and ad agencies programmatically find and purchase digital ad inventory (display, video, audio, and social) on different devices like computers, smartphones, and connected TVs. It utilizes data to optimize the performance of ad impressions purchased. The firm’s platform is referred to as a demand-side platform in the digital ad industry. The firm generates its revenue from fees based on a percentage of what its clients spend on advertising.

After a thorough review of the options trading surrounding Trade Desk, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Where Is Trade Desk Standing Right Now?

- Trading volume stands at 3,241,277, with TTD’s price down by -0.57%, positioned at $109.51.

- RSI indicators show the stock to be may be approaching overbought.

- Earnings announcement expected in 48 days.

What Analysts Are Saying About Trade Desk

5 market experts have recently issued ratings for this stock, with a consensus target price of $119.0.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* An analyst from Loop Capital persists with their Buy rating on Trade Desk, maintaining a target price of $120.

* Reflecting concerns, an analyst from Needham lowers its rating to Buy with a new price target of $115.

* In a cautious move, an analyst from B of A Securities downgraded its rating to Buy, setting a price target of $135.

* An analyst from Wedbush persists with their Outperform rating on Trade Desk, maintaining a target price of $115.

* Reflecting concerns, an analyst from Cantor Fitzgerald lowers its rating to Neutral with a new price target of $110.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Trade Desk, Benzinga Pro gives you real-time options trades alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

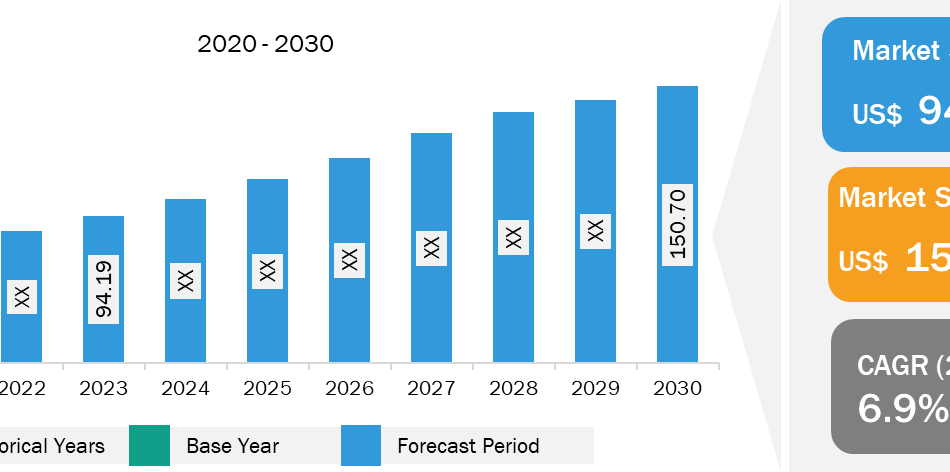

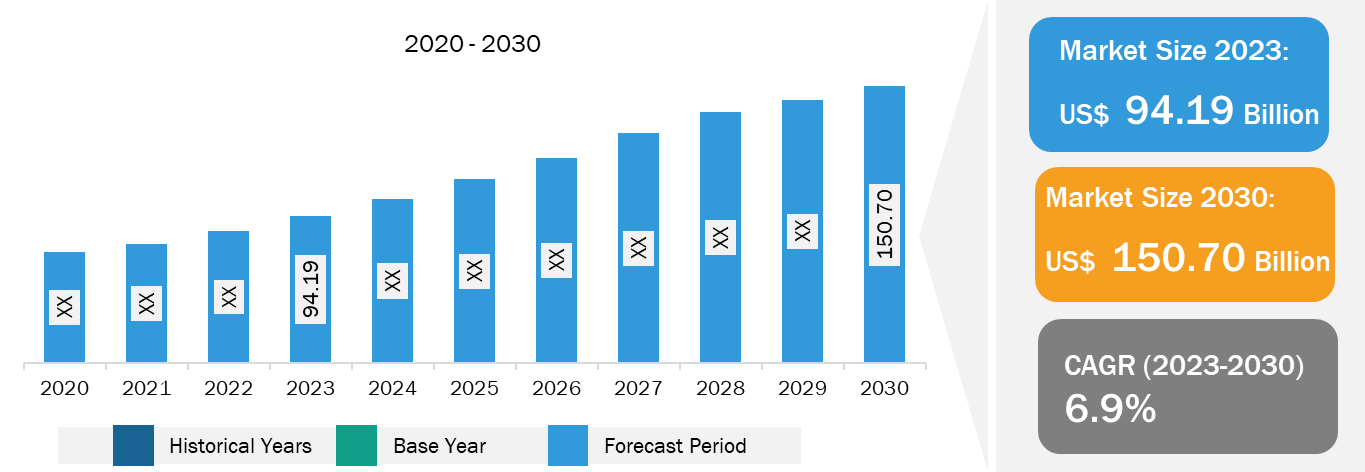

Wire Harness Market Worth $150.70 Billion, Globally, by 2030 – Exclusive Report by The Insight Partners

US & Canada, Sept. 20, 2024 (GLOBE NEWSWIRE) — According to a new comprehensive report from The Insight Partners, several favorable government initiatives are contributing to the wire harness market growth. For instance, under Section 80EEB of the Income Tax Act, Government of India announced that one can claim US$ 1,879.46 against the interest on their electric vehicle loan. Due to this, electric vehicles are gaining traction, leading to the massive demand for wire harnesses, and thus propelling the market growth.

Global Wire Harness Market Experiences Significant Growth Due to Increasing Technological Advancements in Automobiles. Browse More Insights: https://www.theinsightpartners.com/reports/wire-harness-market/

The report runs an in-depth analysis of market trends, key players, and future opportunities. In general, the wire harness market comprises of component, material, and end user which are expected to register strength during the coming years.

Download Sample Report: https://www.theinsightpartners.com/sample/TIPRE00017188/

Overview of Report Findings:

1. Market Growth: The Wire Harness Market is expected to reach US$ 150.70 billion by 2030 from US$ 94.19 billion in 2023, at a CAGR of 6.9% during the forecast period.

2. Technological Advancements in Automobiles: Technologies such as automatic high beam control, self-driving, cruise control, and automatic lift gates are highly adopted by automobile companies as buyers are largely lured by attractive design, specifications, quality, and features. Some of the technologically advanced vehicles have approximately 40 wire harnesses comprising ~3,000 wires and around 700 connectors.

Identify The Key Trends Affecting This Market – Download Sample PDF: https://www.theinsightpartners.com/sample/TIPRE00017188/

3. Increasing Wire and Cable Consumption: The growth in manufacturing and infrastructure in telecommunication, power, residential, and other sectors have resulted in the high consumption of wires and cables. The consumption is further driven by renewable energy development and government initiatives. For instance, the Government of India has been launching several initiatives (such as “Power for All”) and providing the necessary infrastructure to ensure uninterrupted electricity supply across the country. These government-promoted initiatives have exponentially increased the consumption of wire and cables in the power industry in India over the last five years.

4. Lightweight Wire Harness: The lightweight wire harness reduces the vehicle exhaust emission and fuel consumption. Moreover, the countries, such as China and Japan are more into the production of miniaturization of OEMs. For these OEMS, the firms try to select components based on price, quality and weight.

5. Geographical Insights: APAC dominated the Wire Harness Market in 2022. North America is the second-largest contributor to the global Wire Harness Market, followed by Europe, Middle East and Africa, and South America.

Purchase Premium Copy of Wire Harness Market Growth Report (2023-2030) at: https://www.theinsightpartners.com/buy/TIPRE00017188/

Market Segmentation:

- By component, the Wire Harness Market is divided into wire harness connector, wire harness terminal, and other. In 2022, the others segment held the largest share of the global wire harness market. Global wire and cable consumption has increased in the past few years due to rising infrastructure developments, development of power generation and distribution infrastructure, government projects for electrification, housing development, greater customer involvement in electrical purchase and rising urbanization and industrialization in developing countries.

- In terms of material, the wire harness market is segmented into PVC, vinyl, thermoplastic elastomer, polyurethane, and polyethylene. The PVC segment holds the largest share in 2022. PVC has a good combination of properties which explains why it is popularly used for cable insulation and sheathing. PVC is durable, UV resistant and has good water and chemical resistance, which is one of the major factors for the segmental growth.

Obtain Analysis of Key Geographic Markets – Download Report PDF: https://www.theinsightpartners.com/sample/TIPRE00017188/

- Based on end user, the wire harness market is segmented into automotive, marine, aerospace & defense, consumer durables, medical, agriculture, industrial, and others. The automotive segment holds the largest share in 2022. Wiring harnesses in the automotive industry are used in motorcycles, three-wheeled vehicles, cars, utility vehicles, and commercial vehicles.

Competitive Strategy and Development:

- Key Players: A few major companies operating in the wire harness market include Fujikura Ltd.; Furukawa Electric Co. Ltd.; Lear; LEONI; Motherson Group; Nexans; Sumitomo Electric Industries, Ltd; THB Group; Yazaki Corporation; Yura Corporation.

- Trending Topics: Wire and Cable Market, Insulated Wire and Cable Market, Wire Rod Market, Electronics Bonding Wire Market, and Others.

Want More Information about Competitors and Market Players? Get Sample PDF: https://www.theinsightpartners.com/sample/TIPRE00017188/

Global Headlines on Wire Harness Market:

- “Lear entered joint venture with Hu Lane Associate Inc., automotive connector products manufacturer. This joint venture extends Lear’s capacity of connector system products manufacturing and makes it more competitive in the wire harness business”

- “Sumitomo Electric and Valens Semiconductor formed collaboration for making the Sumitomo’s wiring harness systems meets the channel needs of the A-PHY specifications. The collaboration has been made for A-PHY technology and departments”

Conclusion:

Wire harnesses reduce clutter, simplify usage, improve safety, and reduce installation time. Technological advancements in food & beverages and agricultural equipment have increased the demand for wire harnesses. In food & beverages, appliances such as microwave, vending machine and brewing machine consumption is increasing rapidly in residential and commercial sectors. In addition, the growth in manufacturing and infrastructure in telecommunication, power, residential, and other sectors has resulted in the high consumption of wires and cables. Furthermore, the demand for lightweight wire harness is increasing globally, particularly in automobile and aerospace industries.

Require A Diverse Region or Sector? Customize Research to Suit Your Requirement: https://www.theinsightpartners.com/sample/TIPRE00017188/

The report from The Insight Partners, therefore, provides several stakeholders—including component providers, system integrator, system manufacturers and others—with valuable insights into how to successfully navigate this evolving market landscape and unlock new opportunities.

Related Report Titles:

- Commercial Vehicle Wiring Harness Market Growth, Size, Share, Trends, Key Players Analysis, and Forecast till 2031

- Electric Vehicle Wiring Harness Market Growth, Size, Share, Trends, Key Players Analysis, and Forecast till 2031

- Automotive Wiring Harness Market Trends and Forecast 2031

- Boat Wiring Harness Market Size and Forecasts (2021 – 2031)

- Aircraft Engine Electrical Wiring Harnesses and Cable Assembly Market Size and Forecasts (2021 – 2031)

- Railway Wiring Harness Market Size and Forecasts (2021 – 2031)

- Wire and Cable Market Strategies, Top Players, Growth Opportunities, Analysis and Forecast by 2031

- USB and Firewire Cables Market Size and Forecasts (2021 – 2031)

- Flat Wire Market Size and Forecasts (2021 – 2031)

- Insulated Wire and Cable Market Size and Forecasts (2021 – 2031)

- Phosphate Bronze Wire Market Size and Forecasts (2021 – 2031)

- Prestressed Concrete (PC) Wire and Strand Market Size and Forecasts (2021 – 2031)

- Electronics Bonding Wire Market Size and Forecasts (2021 – 2031)

- Wire Rod Market Growth, Size, Share, Trends, Key Players Analysis, and Forecast by 2031

About Us:

The Insight Partners is a one stop industry research provider of actionable intelligence. We help our clients in getting solutions to their research requirements through our syndicated and consulting research services. We specialize in industries such as Semiconductor and Electronics, Aerospace and Defense, Automotive and Transportation, Biotechnology, Healthcare IT, Manufacturing and Construction, Medical Device, Technology, Media and Telecommunications, Chemicals and Materials.

Contact Us:

If you have any queries about this report or if you would like further information, please contact us:

Contact Person: Ankit Mathur

E-mail: ankit.mathur@theinsightpartners.com

Phone: +1-646-491-9876

Press Release: https://www.theinsightpartners.com/pr/wire-harness-market

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

A millennial FIRE couple shares how moving abroad and living on a $50k income helped them quadruple their net worth to $700k in 6 years

-

A millennial couple grew their net worth to over $700,000 from $150,000 in 2018.

-

Living abroad and only spending one of their incomes, which is $50,000, helped boost their finances.

-

Brian Davis shared why his goal isn’t to retire early but to pursue his dream work.

About two decades ago, before he’d ever heard of the FIRE movement, Brian Davis decided to pursue financial independence and an early retirement.

He began investing his savings in rental properties, thinking that if he owned enough of them, he’d eventually be able to live off the rental income alone, the 43-year-old told Business Insider via email.

But this didn’t go according to plan. He hated being a landlord, and some of the investments proved to be less profitable than he’d expected. The idea of retiring ahead of schedule seemed like it could be out of reach, so he decided to explore other options. Today, he runs a digital real estate investing platform.

However, in the years since, a lot has changed for Davis — both from a financial and philosophical perspective. For one, he’s grown his net worth to more than $700,000 as of May from roughly $150,000 in 2018, according to documents viewed by BI.

Davis and his wife have aimed to live entirely off of his wife’s roughly $50,000 a year school counselor salary while saving and investing all of his income, which comes primarily from a real estate business he cofounded in 2016 — he said their annual household income is around $150,000. This saving strategy has been key to boosting their finances.

Davis’s financial goals have also evolved. After learning more about the FIRE movement — a financial lifestyle aimed at saving enough to become financially independent and retire before the traditional retirement age — Davis said he discovered that most people who managed to retire early eventually got bored of “sipping margaritas on the beach” and returned to work in some form. Rather than early retirement, Davis said his current goal is to live his ideal life, and he thinks remaining in the workforce can help him accomplish this.

“I have no plans to retire, but I do hope to reach financial independence within the next five years,” he said. “The less you worry about money, the more your work opens up to be fun, creative, and without limits on opportunities.”

While many Americans are having trouble saving for retirement, some are putting themselves in a position to stop working ahead of schedule through various savings and investment strategies. However, not all of these people are aiming for an early retirement. Some people, like Davis, want to continue working as they pursue financial security. But not just any kind of work: They want to spend their time on work that they enjoy or find fulfilling.

Davis shared how he’s grown his net worth — and why he thinks finding one’s dream work can help them live their ideal life.

Lower living expenses can make it easier to save

Davis and his family, including his wife Katie and their daughter, have a huge financial advantage: They don’t pay for housing.

This is among the perks of Katie’s job: She works as a school counselor at international schools around the world. Davis said they first moved abroad in 2015, spending four years in Abu Dhabi and four years in Brazil before moving to Lima, Peru about a year ago. Davis said it’s not unusual for international schools to provide free housing for faculty and staff.

In addition to saving money on housing, they’ve been able to take advantage of the “lower cost of living overseas,” including cheaper food and healthcare costs. Davis said this was among the main reasons they decided to venture abroad.

“You can buy beef and pork in South America for a quarter of the cost in the US,” he said.

Davis said another big way he’s been able to save money is by avoiding car ownership — he said he hasn’t owned a car in five years.

“People don’t realize how much more cars cost than just the monthly payment,” he said. “Without a car, we don’t have to pay for car insurance, repairs and maintenance, gas, parking.”

The family’s reduced living expenses have enabled them to live entirely on Katie’s salary. However, Davis said that they don’t expect to have these financial perks forever, so they’re trying to take advantage of them now.

“At some point, we know we’ll have to move back to the US for family reasons,” Davis said. “So we’re trying to build our net worth and passive income streams as quickly as possible before we do.”

How pursuing dream work can help one live their ideal life

When Davis learned that many early retirees return to work in some form, he said this revelation was in some ways disappointing.

However, he’s since changed his tune. For example, if a person retires at age 60 — rather than age 50 — then it would be much easier for them to hit their retirement savings goal.

“It means that you don’t need nearly as much money as you thought you did,” Davis said. “If you’re going to keep doing some kind of work on your own terms, you’ll keep earning active income.”

However, that extra decade of work might not be satisfactory for everyone. That’s why Davis thinks the key is finding one’s dream work.

Davis said if someone is doing work they enjoy, then they likely won’t be so desperate to give up work and retire. And even if this means transitioning to work that’s lower-paying than one’s old job, Davis said this is where the savings strategies well-discussed in the FIRE community can come in handy: They can help bridge the gap between one’s desired and actual income.

“You just need enough money to cover any shortfall between what you want to spend and what your dream work pays,” he said. “In other words, you can start living your ideal life now, or very soon, without being financially independent.”

To be sure, finding a job — forget about one’s dream job — is easier said than done in today’s economy. Many Americans are having a harder time finding work as companies pull back on hiring.

For Davis, his business is one component of his dream work. He said he gets all the benefits of real estate investment without the headaches of being a landlord.

“I don’t consider myself financially independent, but I’m living the same life that I would be if I were,” he said. “I get to do work I love, on my own schedule, from anywhere in the world.”

His top advice for people is to envision their ideal lifestyle and determine what type of work and income level they need to make it a reality.

“Once you reframe FIRE in those terms, it gets both easier and more fulfilling, rather than just dreaming about sitting on a beach as a bum for the rest of your life,” he said.

Have your savings and wealth grown significantly in recent years? Are you willing to share your top financial strategies? Reach out to this reporter at jzinkula@businessinsider.com.

Read the original article on Business Insider

Donald Trump Stock: Trump Media Hits New Low As Former President, Insiders Can Sell DJT Stock

Trump Media & Technology (DJT) fell Friday to a record low, as selling restrictions on former President Donald Trump and other insiders ended.

On Sept. 13, Donald Trump posted on Trump Media’s Truth Social that he wouldn’t sell DJT stock when the lockup expired. That lifted shares by 12% that day, but the selling quickly resumed. Trump owns a majority of DJT stock.

↑

X

Harris-Trump Debate: 4 Takeways For Investors

DJT Stock

Trump Media stock plunged 8% to 13.52, hitting a record low. Shares dived 24.6% for the week.

DJT stock began trading on March 26, as Trump Media came public via a SPAC merger with Digital World Acquisition. Even including the pre-SPAC DWAC trading, Trump Media set its lowest price in more than a year.

Trump Media has scant revenue, reporting roughly $800,000 in each of the last three quarters, along with ongoing losses.

DJT stock has traded at times as a sentiment indicator about Donald Trump’s political campaign.

DJT stock hit a recent high of 46.27 on July 12, just after the first Trump assassination attempt, with the former president showing a commanding lead over President Biden, who later dropped out in favor of Vice President Kamala Harris.

Please follow Ed Carson on Threads at @edcarson1971 and X/Twitter at @IBD_ECarson for stock market updates and more.

YOU MAY ALSO LIKE:

Why This IBD Tool Simplifies The Search For Top Stocks

Best Growth Stocks To Buy And Watch

IBD Digital: Unlock IBD’s Premium Stock Lists, Tools And Analysis Today

Here’s How Much Stocks Historically Rise On The First Fed Rate Cut.

Market Sends Clear Message; Three Magnificent 7 Stocks In Buy Areas

Why a top analyst just raised his year-end S&P 500 price target to the highest on Wall Street

-

BMO’s Brian Belski raised his S&P 500 price target to 6,100, signaling 7% upside by year-end.

-

The Fed’s rate cut and favorable seasonal data support the bullish stance.

-

Belski cites broadening market gains and a likely soft landing for the US economy as key factors to watch.

Brian Belski of BMO has taken the spot as the most bullish equity strategist on Wall Street.

In a note on Thursday, Belski raised his S&P 500 price target for 2024 to 6,100, representing potential upside of 7% over the next three months.

Belski’s prior 2024 price target for the S&P 500 was 5,600.

A combination of factors, including the Federal Reserve’s 50 basis point interest rate cut on Wednesday, was enough to make Belski even more bullish on stocks.

“Much like our last target increase in May, we continue to be surprised by the strength of market gains and decided yet again that something more than an incremental adjustment was warranted,” Belski said.

Belski said favorable seasonal data suggests the stock market will finish the year strong in the fourth quarter, “especially since the Fed has shifted to easing mode.”

Since 1950, there have been eight years when the S&P 500 was higher by about 15% to 20% in the first nine months of the year.

According to Belski, in those years, the S&P 500 saw an average fourth quarter return of about 6%, which is about 50% higher than the average fourth quarter return for all years.

Belski also finds it encouraging that recent stock market gains have not been concentrated in just the mega-cap technology stocks.

Instead, the stock market rally has been broadening out to other sectors and smaller-sized companies.

“This is a trend we expect to continue and should help to support future market gains even if the price and fundamental performance of Mag-X stocks continues to decelerate in the months ahead,” Belski explained.

Finally, with the increased likelihood of a soft landing in the US economy, Belski said that elevated valuations are justified.

Based on Belski’s 6,100 price target, that implies a price-to-earnings ratio of 24.4x, which is above historical averages.

“We continue to believe a soft landing is the most likely economic scenario which makes the current environment most comparable to the mid-1990s – a period where the index was able to sustain a greater-than 20x multiple for several years,” Belski said.

Read the original article on Business Insider

Rubber Processing Chemicals Market to Boost at a CAGR of 3.8% to reach USD 6.7 Billion by 2034: Transparency Market Research Inc.

Wilmington, Delaware, United States, Transparency Market Research Inc. -, Sept. 20, 2024 (GLOBE NEWSWIRE) — Rubber processing chemicals market (고무 가공 화학물질 시장) value estimated at US$ 4.5 billion in 2023. Towards the end of 2034, the market is expected to reach US$ 6.7 billion, expanding at a CAGR of 3.8% from 2024 to 2034. Technological advancements in rubber recycling could have a big effect on the market.

Rubber recycling can now be done more effectively and efficiently thanks to new technologies and procedures that are being developed. This allows rubber materials to be reused in a variety of applications. The circular economy and waste reduction are the goals of these inventions.

Synthetic rubber compositions use carbon nanotubes as a notable advancement. With this method, rubber’s mechanical and electrical qualities are improved without compromising its flexibility, which improves rubber compounds’ strength, conductivity, and durability.

Developing environmentally friendly rubber processing chemicals has been a priority as sustainable manufacturing practices have gained importance. These substances don’t contain many volatile organic compounds (VOCs) and adhere to rules established by institutions such as the European Union. Manufacturers are spending money on research and development to provide cutting-edge, environmentally friendly rubber processing chemicals with improved performance, durability, and sustainability.

For More Details, Request for a Sample of this Research Report: https://www.transparencymarketresearch.com/rubber-processing-chemicals-market.html

Key Findings of the Market Report

- In 2023, the non-tire segment was forecast to account for the largest share of the market.

- A significant portion of the global economy was centered in the Asia Pacific region in 2023

- Rubber processing chemicals are expected to gain market traction as tire applications increase.

- A growing manufacturing sector boosts market revenue for rubber processing chemicals.

Global Rubber Processing Chemicals Market: Growth Drivers

- The growing automotive industry’s demand for rubber goods, such as tires, hoses, and belts, places high demands on rubber processing chemicals. A large amount of the demand in the rubber sector is for tires.

- The market for rubber processing chemicals is influenced by variables such as rising car ownership, the need for high-performance tires, and tire replacement cycles.

- The demand for new and improved rubber processing chemicals is driven by advancements in technology and processes related to rubber processing, including green processing methods, automation, and creative formulations.

- Stringent laws governing product safety, quality, and environmental effects promote the creation and use of sustainable and environmentally friendly rubber processing chemicals. As high-performance rubber goods become more common in aerospace, electronics, and healthcare sectors, advanced rubber processing chemicals are in higher demand.

Global Rubber Processing Chemicals Market: Regional Landscape

- Asia Pacific is home to some of the world’s largest automobile markets, including China, Japan, India, and South Korea. These nations’ automotive industries, which are continuously expanding, fuel the demand for rubber products, especially tires. As the Asia-Pacific region becomes more industrialized and urbanized, rubber-based products will become more common in manufacturing, infrastructure, and construction. As a result of the increased demand for rubber products, the market is expanding.

- Governments in the Asia-Pacific area are making significant investments in trains, bridges, and other infrastructure projects. These initiatives increase the demand for rubber-based materials, raising the price of RPC. To lessen their reliance on fossil fuels and reduce carbon emissions, many Asian and Pacific nations are encouraging the use of electric vehicles.

- Specialized rubber components are needed to produce electric vehicles, which has increased demand for RPC to fit the unique specifications of EV production.

- Rising disposable income levels in countries like China and India have increased consumer spending on automobiles, goods, and infrastructure projects. Due to this growth in spending, rubber goods, and RPC are in high demand in the region.

- A growing concern about the environment is leading Asian governments to enforce stronger laws regarding product quality, safety, and environmental effects. This promotes the region’s use of sustainable and environmentally friendly rubber processing chemicals.

Global Rubber Processing Chemicals Market: Competitive Landscape

Rubber processing chemical manufacturers are strengthening their positions in the global market by launching new products, investing in new production facilities, and merging with other companies.

Key Players

- BASF SE

- Eastman

- AkzoNobel N.V.

- Sumitomo Chemical Co., Ltd.

- LANXESS

- Arkema S.A.

- Solvay

- China Petroleum & Chemical Corporation (Sinopec)

- Emerald Performance Materials LLC

- Merchem Limited

Key Developments

- In March 2024, Specialty chemicals company LANXESS presented its tire additive and solution portfolio at the Tire Technology Expo 2024 in Hanover, Germany. Tire manufacturers were able to reduce their ecological footprint during production and during product use from March 19 to 21.

- In April 2024, The Sumitomo Chemical Group plans to attend Chinaplas 2024, a world-famous trade show for plastics and rubber. Using green chemistry to create a carbon-neutral future will be the group’s slogan, which will exhibit polyolefins produced using renewable ethanol and recyclable Sumicle® polyethylene.

For Complete Report Details, Request Sample Copy from Here – https://www.transparencymarketresearch.com/rubber-processing-chemicals-market.html

Global Rubber Processing Chemicals Market: Segmentation

Type

- Antidegradants

- Accelerators

- Stabilizers

- Vulcanizing Agents

- Others (including Processing Aids, Peptizers, and Anti-tack Agents)

Application

- Automotive

- Building & Construction

- Industrial

- Others (including Medical, Aerospace, And Footwear)

Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Have a Look at More Valuable Insights of Chemicals And Materials

Foam Blowing Agents Market (発泡剤市場) : The foam blowing agents market was estimated to have acquired US$ 1.8 billion in 2021. It is anticipated to register a 5.7% CAGR from 2022 to 2031 and by 2031, the market is likely to gain US$ 2.9 billion.

Welding Products Market (Markt für Schweißprodukte): According to the report, the global welding products market was valued at USD 19.3 billion in 2021 and is expected to reach USD 30.2 billion by 2031, expanding at a CAGR of 5.1% between 2022 and 2031.

About Transparency Market Research

Transparency Market Research, a global market research company registered at Wilmington, Delaware, United States, provides custom research and consulting services. Our exclusive blend of quantitative forecasting and trends analysis provides forward-looking insights for thousands of decision makers. Our experienced team of Analysts, Researchers, and Consultants use proprietary data sources and various tools & techniques to gather and analyses information.

Our data repository is continuously updated and revised by a team of research experts, so that it always reflects the latest trends and information. With a broad research and analysis capability, Transparency Market Research employs rigorous primary and secondary research techniques in developing distinctive data sets and research material for business reports.

Contact:

Transparency Market Research Inc.

CORPORATE HEADQUARTER DOWNTOWN,

1000 N. West Street,

Suite 1200, Wilmington, Delaware 19801 USA

Tel: +1-518-618-1030

USA – Canada Toll Free: 866-552-3453

Website: https://www.transparencymarketresearch.com

Email: sales@transparencymarketresearch.com

Follow Us: LinkedIn| Twitter| Blog | YouTube

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

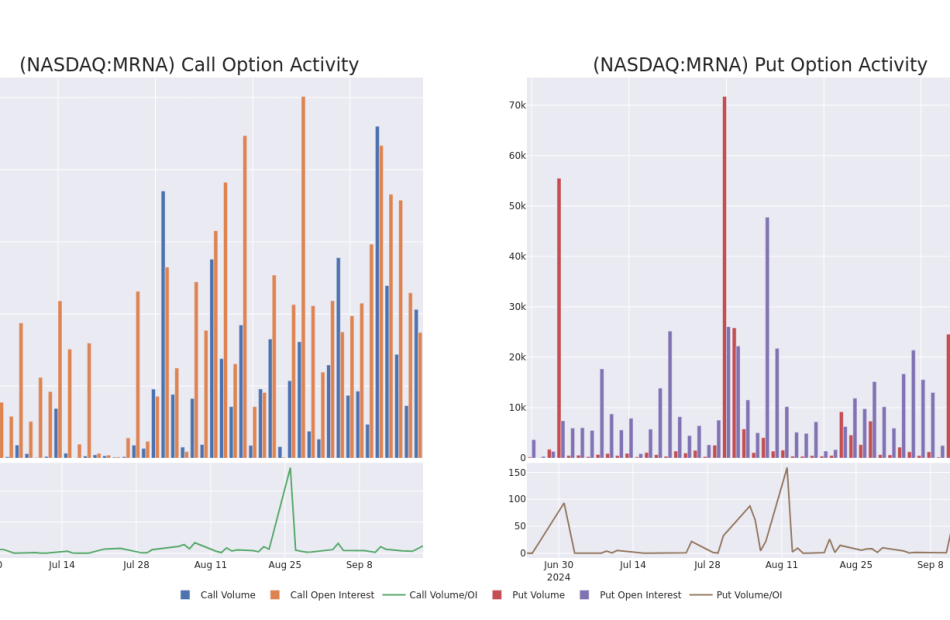

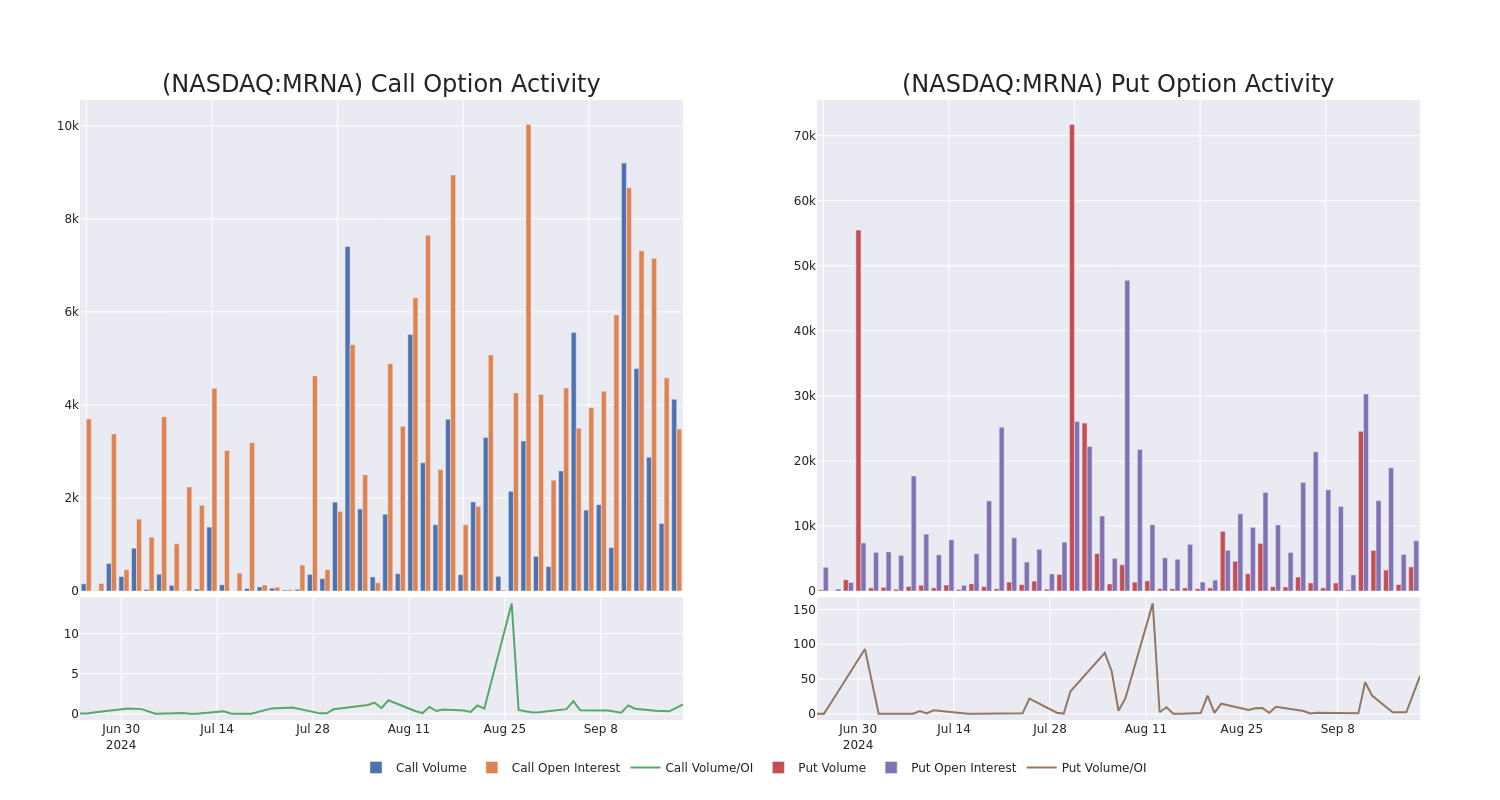

Moderna Unusual Options Activity For September 20

Financial giants have made a conspicuous bearish move on Moderna. Our analysis of options history for Moderna MRNA revealed 22 unusual trades.

Delving into the details, we found 31% of traders were bullish, while 54% showed bearish tendencies. Out of all the trades we spotted, 13 were puts, with a value of $4,197,475, and 9 were calls, valued at $516,749.

What’s The Price Target?

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $50.0 to $120.0 for Moderna over the last 3 months.

Analyzing Volume & Open Interest

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Moderna’s options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Moderna’s whale trades within a strike price range from $50.0 to $120.0 in the last 30 days.

Moderna Option Volume And Open Interest Over Last 30 Days

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| MRNA | PUT | SWEEP | BEARISH | 03/21/25 | $55.0 | $54.25 | $54.5 | $120.00 | $1.3M | 46 | 752 |

| MRNA | PUT | SWEEP | BEARISH | 03/21/25 | $55.0 | $54.75 | $55.0 | $120.00 | $1.0M | 46 | 952 |

| MRNA | PUT | SWEEP | BEARISH | 03/21/25 | $54.15 | $54.1 | $54.15 | $120.00 | $552.3K | 46 | 102 |

| MRNA | PUT | SWEEP | BULLISH | 03/21/25 | $54.05 | $54.0 | $54.05 | $120.00 | $502.6K | 46 | 272 |

| MRNA | PUT | TRADE | BEARISH | 12/18/26 | $19.05 | $16.6 | $18.45 | $65.00 | $276.7K | 104 | 150 |

About Moderna

Moderna is a commercial-stage biotech that was founded in 2010 and had its initial public offering in December 2018. The firm’s mRNA technology was rapidly validated with its covid vaccine, which was authorized in the United States in December 2020. Moderna had 40 mRNA development candidates in clinical development as of September 2024. Programs span a wide range of therapeutic areas, including infectious disease, oncology, cardiovascular disease, and rare genetic diseases.

Having examined the options trading patterns of Moderna, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Current Position of Moderna

- Trading volume stands at 12,030,554, with MRNA’s price down by -3.43%, positioned at $65.69.

- RSI indicators show the stock to be may be oversold.

- Earnings announcement expected in 41 days.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Moderna options trades with real-time alerts from Benzinga Pro.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Prediction: Nvidia Stock Is Going to Soar in the Remainder of 2024

Nvidia (NASDAQ: NVDA) stock jumped 150% in the first half of 2024, but it has been in a slump since mid-July as investors digested some potential headwinds.

There was a rumored delay with the company’s latest artificial intelligence (AI) chips for the data center, which are responsible for the majority of the company’s revenue. Analysts have also questioned how long Nvidia’s top customers will continue spending billions of dollars on their AI aspirations.

However, those concerns might have been put to rest over the last few weeks. Here’s why Nvidia stock could soar to new highs before the end of 2024.

All eyes are on the new Blackwell GPUs

Nvidia’s flagship H100 graphics processor (GPU) for the data center set the benchmark for the AI industry last year. GPUs are designed for parallel processing, which means they can handle multiple tasks at once while maintaining a high throughput. They also have built-in memory so they are ideal for processing large volumes of data, which is critical when training AI models and performing AI inference.

According to Nvidia CEO Jensen Huang, data center operators could spend $1 trillion building GPU infrastructure over the next few years. That presents a substantial opportunity, which is why the company continues to design new chips with more processing power and better energy efficiency to stay ahead of the competition.

Nvidia is now shipping its new H200 GPU, which can perform AI inference at almost twice the speed of the H100, while consuming half the amount of electricity. But the company recently unveiled an entirely new GPU architecture called Blackwell, which promises an even greater leap in performance.

The new Blackwell-based GB200 NVL72 system, for example, will perform AI inference at a staggering 30 times the pace of the equivalent H100 system. Each individual GB200 GPU will be priced between $30,000 and $40,000, which is similar to what many customers originally paid for the H100, so it’s going to drive an incredible improvement in cost efficiency. As a result, demand is likely to significantly outstrip supply.

In fact, Huang says Blackwell GPUs will bring in billions of dollars in revenue in the fourth quarter of fiscal 2025 (which begins in November) as the company ramps up shipments to customers, squashing previous rumors that the new chips could be delayed by months.

Many of Nvidia’s top customers are begging for more GPUs

Huang says data center operators can earn $5 in revenue over four years for every $1 they spend on GPUs, by renting the computing power to AI developers. That’s why the world’s largest cloud providers, like Microsoft, Amazon, and Oracle, are clamoring to get their hands on as many chips as possible.

Other technology companies also want more chips to develop AI for their own purposes. Tesla is aiming to bring a cluster of 50,000 GPUs online by the end of 2024 to further train its AI-based self-driving software. Meta Platforms wants to have a whopping 600,000 H100 equivalents in action by the end of the year to train the next iteration of its Llama large language models (LLMs), which will power new AI features on Facebook and Instagram.

Unfortunately for them, Nvidia can’t keep up with demand. Oracle chairman Larry Ellison said he recently went to dinner with Huang, alongside Tesla CEO Elon Musk. He and Musk apparently begged Huang to take more of their money for additional GPUs.

It’s no surprise supply is tight. Microsoft alone spent over $55 billion on capital expenditures (capex) in fiscal 2024 (ended June 30), most of which went toward AI data center infrastructure and chips. Similarly, Amazon says its capex spending will top $60 billion in calendar 2024.

That’s how Nvidia was able to generate a record $26.3 billion in data center revenue during its recent fiscal 2025 second quarter (ended July 28) alone, which was up 154% from the year-ago period. The result could have been even stronger if not for supply constraints.

Nvidia stock looks cheap based on its future potential earnings

Nvidia stock is currently trading 15% below its record high, but I think it will recover that ground (and then some) in the coming months.

Based on the company’s trailing-12-month earnings per share of $2.20, its stock trades at a price-to-earnings (P/E) ratio of 52.5. That’s considerably more expensive than the tech sector as a whole, as represented by the 30.8 P/E ratio of the Nasdaq-100.

However, the stock market is a forward-looking machine and Nvidia’s fiscal 2026 begins at the end of January 2025, which is only a few months away. I think investors will soon start pricing the stock based on its potential earnings in the new year.

Wall Street expects Nvidia to deliver $4.02 in earnings per share during fiscal 2026, which places its stock at a forward P/E ratio of just 28.7. From that perspective, it actually looks quite cheap!

Microsoft, Oracle, and Meta Platforms are just some of the companies that have explicitly said they will increase their capex spending on AI in the coming year. Since they are among Nvidia’s biggest customers, it reduces some of the uncertainty surrounding Nvidia’s potential financial results next year. Therefore, I predict Nvidia stock will surpass its record closing high of $135.58 by the end of 2024.

Should you invest $1,000 in Nvidia right now?

Before you buy stock in Nvidia, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $694,743!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 16, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Anthony Di Pizio has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Amazon, Meta Platforms, Microsoft, Nvidia, Oracle, and Tesla. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

Prediction: Nvidia Stock Is Going to Soar in the Remainder of 2024 was originally published by The Motley Fool