Prediction: Nvidia Stock Is Going to Soar in the Remainder of 2024

Nvidia (NASDAQ: NVDA) stock jumped 150% in the first half of 2024, but it has been in a slump since mid-July as investors digested some potential headwinds.

There was a rumored delay with the company’s latest artificial intelligence (AI) chips for the data center, which are responsible for the majority of the company’s revenue. Analysts have also questioned how long Nvidia’s top customers will continue spending billions of dollars on their AI aspirations.

However, those concerns might have been put to rest over the last few weeks. Here’s why Nvidia stock could soar to new highs before the end of 2024.

All eyes are on the new Blackwell GPUs

Nvidia’s flagship H100 graphics processor (GPU) for the data center set the benchmark for the AI industry last year. GPUs are designed for parallel processing, which means they can handle multiple tasks at once while maintaining a high throughput. They also have built-in memory so they are ideal for processing large volumes of data, which is critical when training AI models and performing AI inference.

According to Nvidia CEO Jensen Huang, data center operators could spend $1 trillion building GPU infrastructure over the next few years. That presents a substantial opportunity, which is why the company continues to design new chips with more processing power and better energy efficiency to stay ahead of the competition.

Nvidia is now shipping its new H200 GPU, which can perform AI inference at almost twice the speed of the H100, while consuming half the amount of electricity. But the company recently unveiled an entirely new GPU architecture called Blackwell, which promises an even greater leap in performance.

The new Blackwell-based GB200 NVL72 system, for example, will perform AI inference at a staggering 30 times the pace of the equivalent H100 system. Each individual GB200 GPU will be priced between $30,000 and $40,000, which is similar to what many customers originally paid for the H100, so it’s going to drive an incredible improvement in cost efficiency. As a result, demand is likely to significantly outstrip supply.

In fact, Huang says Blackwell GPUs will bring in billions of dollars in revenue in the fourth quarter of fiscal 2025 (which begins in November) as the company ramps up shipments to customers, squashing previous rumors that the new chips could be delayed by months.

Many of Nvidia’s top customers are begging for more GPUs

Huang says data center operators can earn $5 in revenue over four years for every $1 they spend on GPUs, by renting the computing power to AI developers. That’s why the world’s largest cloud providers, like Microsoft, Amazon, and Oracle, are clamoring to get their hands on as many chips as possible.

Other technology companies also want more chips to develop AI for their own purposes. Tesla is aiming to bring a cluster of 50,000 GPUs online by the end of 2024 to further train its AI-based self-driving software. Meta Platforms wants to have a whopping 600,000 H100 equivalents in action by the end of the year to train the next iteration of its Llama large language models (LLMs), which will power new AI features on Facebook and Instagram.

Unfortunately for them, Nvidia can’t keep up with demand. Oracle chairman Larry Ellison said he recently went to dinner with Huang, alongside Tesla CEO Elon Musk. He and Musk apparently begged Huang to take more of their money for additional GPUs.

It’s no surprise supply is tight. Microsoft alone spent over $55 billion on capital expenditures (capex) in fiscal 2024 (ended June 30), most of which went toward AI data center infrastructure and chips. Similarly, Amazon says its capex spending will top $60 billion in calendar 2024.

That’s how Nvidia was able to generate a record $26.3 billion in data center revenue during its recent fiscal 2025 second quarter (ended July 28) alone, which was up 154% from the year-ago period. The result could have been even stronger if not for supply constraints.

Nvidia stock looks cheap based on its future potential earnings

Nvidia stock is currently trading 15% below its record high, but I think it will recover that ground (and then some) in the coming months.

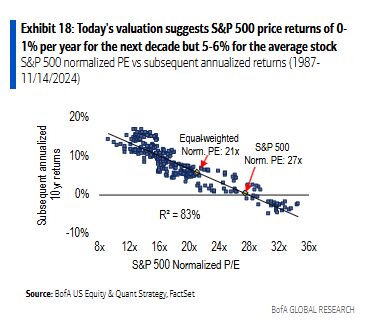

Based on the company’s trailing-12-month earnings per share of $2.20, its stock trades at a price-to-earnings (P/E) ratio of 52.5. That’s considerably more expensive than the tech sector as a whole, as represented by the 30.8 P/E ratio of the Nasdaq-100.

However, the stock market is a forward-looking machine and Nvidia’s fiscal 2026 begins at the end of January 2025, which is only a few months away. I think investors will soon start pricing the stock based on its potential earnings in the new year.

Wall Street expects Nvidia to deliver $4.02 in earnings per share during fiscal 2026, which places its stock at a forward P/E ratio of just 28.7. From that perspective, it actually looks quite cheap!

Microsoft, Oracle, and Meta Platforms are just some of the companies that have explicitly said they will increase their capex spending on AI in the coming year. Since they are among Nvidia’s biggest customers, it reduces some of the uncertainty surrounding Nvidia’s potential financial results next year. Therefore, I predict Nvidia stock will surpass its record closing high of $135.58 by the end of 2024.

Should you invest $1,000 in Nvidia right now?

Before you buy stock in Nvidia, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $694,743!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 16, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Anthony Di Pizio has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Amazon, Meta Platforms, Microsoft, Nvidia, Oracle, and Tesla. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

Prediction: Nvidia Stock Is Going to Soar in the Remainder of 2024 was originally published by The Motley Fool

Leave a Reply