Unpacking the Latest Options Trading Trends in Carvana

Financial giants have made a conspicuous bullish move on Carvana. Our analysis of options history for Carvana CVNA revealed 24 unusual trades.

Delving into the details, we found 62% of traders were bullish, while 25% showed bearish tendencies. Out of all the trades we spotted, 12 were puts, with a value of $609,015, and 12 were calls, valued at $2,048,631.

Expected Price Movements

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $70.0 to $250.0 for Carvana over the recent three months.

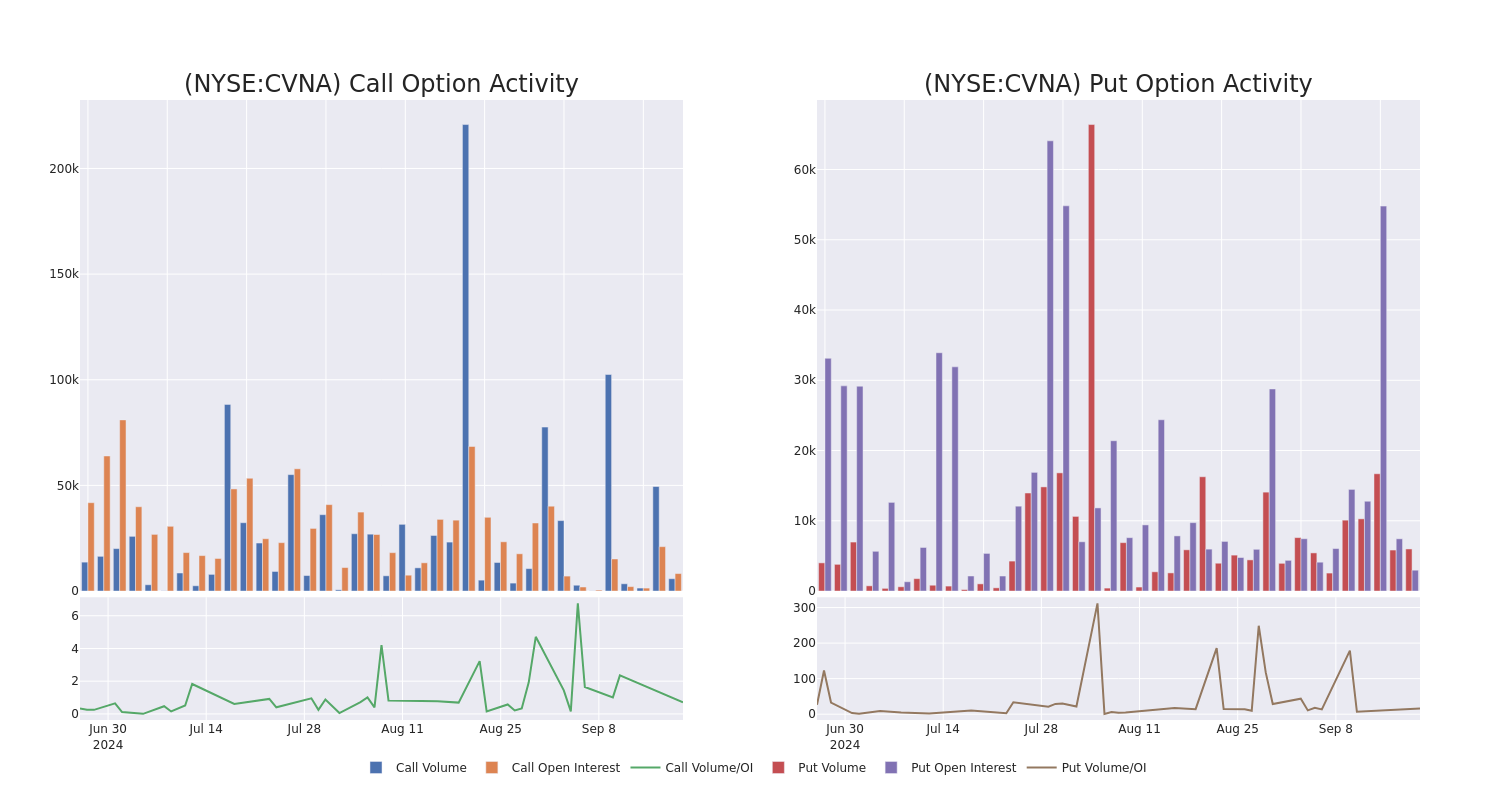

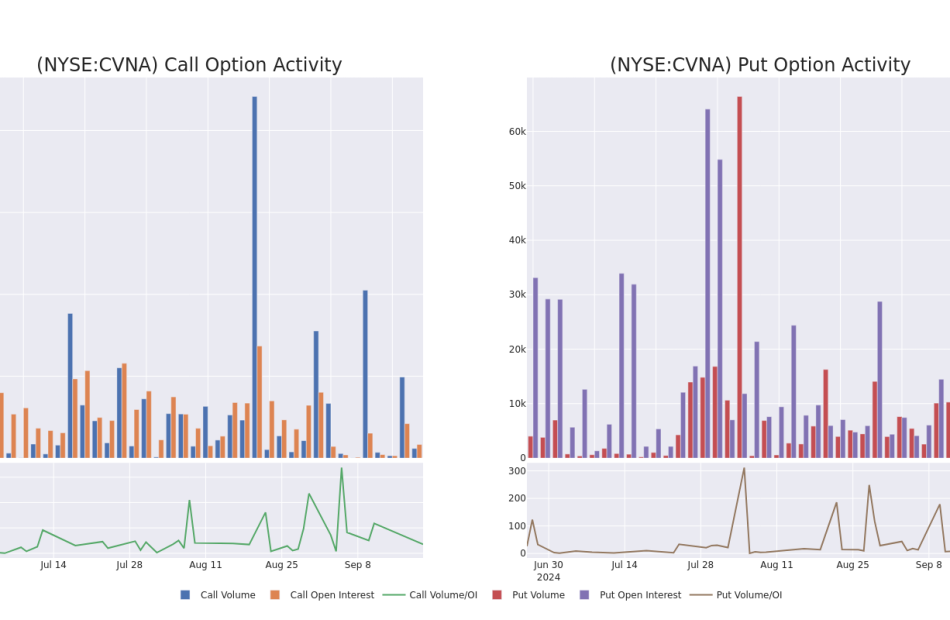

Volume & Open Interest Development

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

This data can help you track the liquidity and interest for Carvana’s options for a given strike price.

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Carvana’s whale activity within a strike price range from $70.0 to $250.0 in the last 30 days.

Carvana 30-Day Option Volume & Interest Snapshot

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| CVNA | CALL | SWEEP | BULLISH | 09/27/24 | $26.9 | $24.35 | $26.67 | $146.00 | $1.3M | 3.8K | 3.0K |

| CVNA | CALL | SWEEP | BULLISH | 12/20/24 | $69.4 | $68.05 | $69.4 | $105.00 | $138.8K | 20 | 0 |

| CVNA | CALL | SWEEP | BEARISH | 09/27/24 | $2.24 | $2.03 | $2.04 | $180.00 | $102.5K | 619 | 1.6K |

| CVNA | CALL | SWEEP | BULLISH | 11/15/24 | $72.5 | $71.4 | $72.5 | $100.00 | $94.2K | 222 | 0 |

| CVNA | CALL | TRADE | NEUTRAL | 10/04/24 | $20.2 | $18.35 | $19.14 | $155.00 | $78.4K | 2.2K | 1.0K |

About Carvana

Carvana Co is an e-commerce platform for buying and selling used cars. The company derives revenue from used vehicle sales, wholesale vehicle sales and other sales and revenues. The other sales and revenues include sales of loans originated and sold in securitization transactions or to financing partners, commissions received on VSCs and sales of GAP waiver coverage. The foundation of the business is retail vehicle unit sales. This drives the majority of the revenue and allows the company to capture additional revenue streams associated with financing, VSCs, auto insurance and GAP waiver coverage, as well as trade-in vehicles.

Carvana’s Current Market Status

- With a volume of 5,365,127, the price of CVNA is up 1.65% at $173.56.

- RSI indicators hint that the underlying stock may be approaching overbought.

- Next earnings are expected to be released in 41 days.

What Analysts Are Saying About Carvana

Over the past month, 4 industry analysts have shared their insights on this stock, proposing an average target price of $183.0.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* In a cautious move, an analyst from B of A Securities downgraded its rating to Buy, setting a price target of $185.

* An analyst from Evercore ISI Group has decided to maintain their In-Line rating on Carvana, which currently sits at a price target of $157.

* An analyst from JMP Securities has revised its rating downward to Market Outperform, adjusting the price target to $200.

* An analyst from Stephens & Co. downgraded its action to Overweight with a price target of $190.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Carvana options trades with real-time alerts from Benzinga Pro.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Leave a Reply