What the Options Market Tells Us About JD.com

Benzinga’s options scanner just detected over 8 options trades for JD.com JD summing a total amount of $1,462,072.

At the same time, our algo caught 4 for a total amount of 1,325,899.

Projected Price Targets

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $25.0 to $30.0 for JD.com during the past quarter.

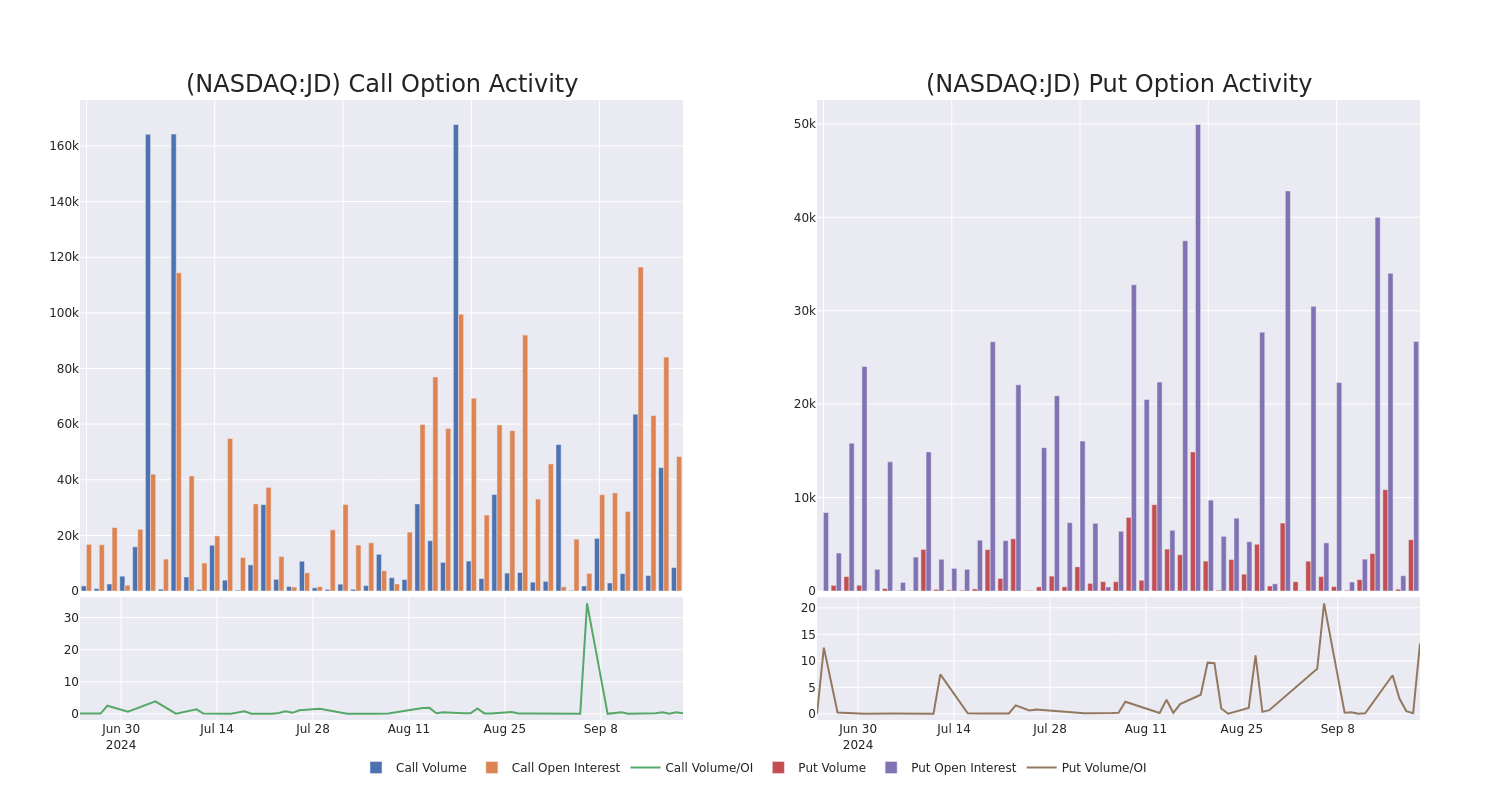

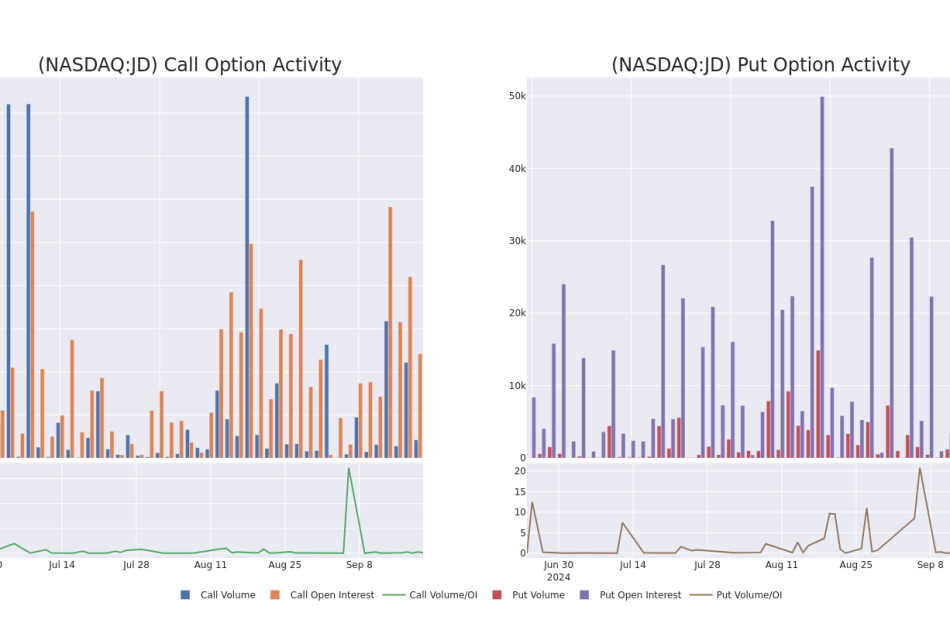

Volume & Open Interest Development

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

This data can help you track the liquidity and interest for JD.com’s options for a given strike price.

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of JD.com’s whale activity within a strike price range from $25.0 to $30.0 in the last 30 days.

JD.com Option Activity Analysis: Last 30 Days

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| JD | PUT | TRADE | BULLISH | 03/21/25 | $3.75 | $3.65 | $3.66 | $30.00 | $1.0M | 230 | 3.0K |

| JD | PUT | TRADE | BULLISH | 01/17/25 | $0.96 | $0.94 | $0.94 | $25.00 | $94.0K | 22.3K | 2.0K |

| JD | PUT | TRADE | BULLISH | 01/17/25 | $0.99 | $0.94 | $0.94 | $25.00 | $94.0K | 22.3K | 1 |

| JD | CALL | SWEEP | BEARISH | 09/20/24 | $1.05 | $1.03 | $1.06 | $27.50 | $54.6K | 31.4K | 875 |

| JD | CALL | TRADE | BULLISH | 09/20/24 | $1.0 | $0.96 | $0.99 | $27.50 | $52.9K | 31.4K | 2.6K |

About JD.com

JD.com is a leading e-commerce platform with its 2022 China GMV being similar to Pinduoduo (GMV not reported), on our estimate, but still lower than Alibaba. it offers a wide selection of authentic products with speedy and reliable delivery. The company has built its own nationwide fulfilment infrastructure and last-mile delivery network, staffed by its own employees, which supports both its online direct sales, its online marketplace and omnichannel businesses.

Having examined the options trading patterns of JD.com, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Present Market Standing of JD.com

- Trading volume stands at 9,633,570, with JD’s price down by -0.56%, positioned at $28.58.

- RSI indicators show the stock to be may be approaching overbought.

- Earnings announcement expected in 54 days.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for JD.com, Benzinga Pro gives you real-time options trades alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Leave a Reply