Trump's Mars Landing Promise Gets Slammed By Peter Schiff Even As Elon Musk Says SpaceX Plans 5 Launches To Red Planet In 2 Years: 'Just Don't Want The Government To Do It'

Peter Schiff, a prominent gold advocate and vocal critic of Bitcoin BTC/USD, has raised concerns about former President Donald Trump‘s recent promise of a Mars landing. Schiff’s critique draws parallels between current economic challenges and historical spending on space exploration and social programs.

What Happened: In a post on social media platform X, Schiff stated, “The reason we had so much inflation during the 1970s was the deficit spending during the 1960s on the Great Society, the War on Poverty, the Vietnam War (we lost both wars), and going to the moon. Now, with the U.S. in worse financial shape, Trump has promised a Mars landing.”

Schiff’s remarks follow Trump’s recent declaration that the U.S. is leading in space over Russia and China, with plans to collaborate with Elon Musk to expedite a Mars landing before the end of his term.

Meanwhile, SpaceX and Tesla Inc CEO Musk has outlined ambitious plans for Mars exploration. Musk detailed a timeline that includes launching five uncrewed Starships to Mars within two years, with potential crewed missions in four years if these initial landings prove successful.

Musk emphasized the importance of making Mars travel accessible, stating, “We want to enable anyone who wants to be a space traveler to go to Mars!” He also expressed concerns about regulatory hurdles, noting that “the Starship program is being smothered by a mountain of government bureaucracy that grows every year.”

In response to Musk’s post, Schiff commented, “I have no issues with SpaceX going to Mars. I just don’t want the government to do it.”

Why It Matters: The debate over space exploration has intensified recently, with Musk facing regulatory hurdles for SpaceX. Rep. Kevin Kiley (R-Calif.) recently praised SpaceX’s Polaris Dawn mission but criticized bureaucratic obstacles. The mission, which launched on Sept. 10, saw a private crewed spaceflight reach the farthest distance from Earth since NASA’s Apollo program.

Additionally, Musk’s recent endorsement of Trump for the 2024 presidential race has added another layer to the political discourse. Musk, who previously leaned towards Joe Biden, now describes him as a “radical leftist puppet.”

Read Next:

Images via Shutterstock

This story was generated using Benzinga Neuro and edited by Kaustubh Bagalkote

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Why Working Longer to Max Out Social Security Isn't a Sure Bet

The idea of working longer before claiming Social Security benefits sounds like a great retirement strategy. Staying on the job means you can maximize your eventual benefit, continue to save for retirement and avoid tapping your investments to cover living expenses.

There’s just one problem: working longer is an unrealistic option for many. That’s the finding of the book, “Overtime: America’s Aging Workforce and the Future of Working Longer,” a collection edited by Lisa F. Berkman and Beth C. Truesdale, and published by Oxford University Press in 2022.

“Though today’s middle-aged adults are less financially prepared for retirement than today’s retirees, delayed retirement is not an adequate solution,” the editors write. “Precarious working conditions, family caregiving responsibilities, poor health, and age discrimination make it difficult or impossible for many to work longer.”

A financial advisor can help you decide when the right time is to retire. Find a fiduciary advisor today.

A Look at the Numbers

That conclusion is borne out by the Social Security Administration’s own statistics. While nearly 13% of workers nearing retirement say they’ll wait to claim the biggest possible payout, only 5% of people wait to claim benefits at age 70. Instead, about one-quarter of all men and one-third of all women opt to collect benefits as soon as become eligible at age 62.

Even worse, the administration notes that “[m]ore than one in eight of today’s 20-year-olds will die before reaching age 67.”

Nonetheless, financial advisers continue to promote the idea of waiting to maximize your benefit. On paper, it’s an idea that makes perfect sense: delaying your benefits from the full retirement age of 67 to 70 adds 8% to your benefit amount each year, a cumulative 32% increase in benefit cash. And, since Social Security benefits adjust with inflation, a bigger initial benefit means a bigger increase from the cost-of-living adjustments.

The Problem With Working Longer

As a 2022 report from the National Bureau of Economic Research noted, “Americans are notoriously bad savers. Large numbers are reaching old age too poor to finance retirements that could last longer than they worked.” The study concluded that “virtually all American workers age 45 to 62 should wait beyond age 65 to collect. More than 90 percent should wait till age 70.”

The idea makes sense and the “Overtime” editors agree. “Longer life expectancies mean that Americans need income to support more years of life, and working longer is a commonly proposed solution,” they write.

However, they cite five different factors that undermine the concept of working longer to boost retirement income, including “Trends and inequalities in American demographics, health, family dynamics, jobs, and politics,” which are often not factored in.

The editors outline an array of possible solutions. “Robust retirement and disability policies are essential complements to working-longer policies.” They add that, “Working-longer policies must be supported by ‘good jobs’ policies to succeed.”

Consider running your retirement strategy by a financial advisor for help evaluating your tradeoffs.

Bottom Line

Working longer and delaying retirement is a common strategy recommended to people who aren’t financially ready to retire. But a new book from Lisa F. Berkman and Beth C. Truesdale argues this alternative is unrealistic for many. Working conditions, caregiving responsibilities, health problems and age discrimination make it increasingly difficult for older Americans to continue to work.

Get matched with a fiduciary financial advisor who can help you establish a retirement plan appropriate for your goals.

Retirement Planning Tips

-

How much money will you need to save to be able to retire? Should you delay Social Security? These are just a couple questions that pre-retirees face. A financial advisor can help you answer them. Finding a financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to three vetted financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

-

Fidelity recommends that you have 10 times your annual income saved for retirement by age 67. To find out if you’re on track, try SmartAsset’s retirement calculator. This free tool will estimate how much you’ll have when the time comes to retire.

-

Keep an emergency fund on hand in case you run into unexpected expenses. An emergency fund should be liquid — in an account that isn’t at risk of significant fluctuation like the stock market. The tradeoff is that the value of liquid cash can be eroded by inflation. But a high-interest account allows you to earn compound interest. Compare savings accounts from these banks.

-

Are you a financial advisor looking to grow your business? SmartAsset AMP helps advisors connect with leads and offers marketing automation solutions so you can spend more time making conversions. Learn more about SmartAsset AMP.

Photo credit: ©iStock.com/PixelsEffect, ©iStock.com/FG Trade, ©iStock.com/ferrantraite

The post Working Longer to Max Out Social Security May Fail Most Workers appeared first on SmartAsset Blog.

Dow Jones Futures: Stock Market Bulls In Control; Meta, Apple, Tesla In Buy Areas

Dow Jones futures were little changed Sunday evening, along with S&P 500 futures and Nasdaq futures.

The stock market rally had a solid week, building on the prior week’s strong gains. With the Federal Reserve opting for a big rate cut, the S&P 500 and Dow Jones set record highs, while the Nasdaq and Russell 2000 are now decisively above their 50-day lines.

↑

X

Bulls Back In Charge As Powell Threads Needle; Constellation, Apple, Spotify In Focus

Most of all, dozens of leading stocks broke out or flashed buy signals.

Meta Platforms (META), Royal Caribbean (RCL), Spotify (SPOT), Apple (AAPL), Evercore (EVR) and Tesla (TSLA) are all actionable, though their charts vary.

Nvidia (NVDA) fell modestly last week, fighting around a key support level. Nvidia stock is not leading but is still important for the market and especially for AI stocks.

Investors should be looking to build up to heavy exposure — gradually — shifting portfolios more toward growth.

Nvidia and Meta stock are on IBD Leaderboard. Spotify stock and Royal Caribbean are on SwingTrader. Nvidia, Royal Caribbean and Meta Platforms are on the IBD 50. Meta Platforms was Friday’s IBD Stock Of The Day.

The video embedded in the article discusses the bullish market action in depth, while analyzing Constellation Energy (CEG), Spotify and Apple stock.

Dow Jones Futures Today

Dow Jones futures fell 0.1% vs. fair value. S&P 500 futures edged lower and Nasdaq 100 futures tilted higher.

Remember that overnight action in Dow futures and elsewhere doesn’t necessarily translate into actual trading in the next regular stock market session.

Join IBD experts as they analyze leading stocks and the market on IBD Live

Stock Market Rally

The stock market rally had solid gains this past week, mostly on Thursday’s belated jump on the big Fed rate cut.

The Dow Jones Industrial Average rose 1.6% in last week’s stock market trading. The S&P 500 index advanced 1.4%. The Nasdaq composite gained 1.5%. The small-cap Russell 2000 jumped 2.1%.

The S&P 500, Dow Jones and the Invesco S&P 500 Equal Weight ETF (RSP) hit record highs Thursday, pulling back modestly Friday.

The Nasdaq and Russell 2000 are now decisively above their 50-day moving averages. Both topped their late-August short-term highs on Thursday but ended the week just below those levels. The Nasdaq is also back below the 18,000 level.

A pause at current levels would be normal and healthy, perhaps allowing leading stocks to forge handles or other entries.

Broadly speaking, there’s been a shift from defensive sectors into growth, including aggressive growth. Homebuilders and financials continue to do well, along with aerospace and other industrials.

The 10-year Treasury yield climbed 8 basis points to 3.73% after hitting a 52-week low on Tuesday. The two-year Treasury yield was flat at 3.57%.

U.S. crude oil futures jumped 4.8% to $71.92 a barrel last week.

ETFs

Among growth ETFs, the Innovator IBD 50 ETF (FFTY) bounced 3.7% last week. The iShares Expanded Tech-Software Sector ETF (IGV) rose 2.1%. The VanEck Vectors Semiconductor ETF (SMH) edged up 0.4%. Nvidia stock is the largest SMH holding by far.

Reflecting stocks with more speculative stories, the ARK Innovation ETF (ARKK) gained 2.45% last week and ARK Genomics (ARKG) climbed 0.5%. Tesla stock is a major holding across ARK Invest’s ETFs, but Meta is an even bigger weight. Cathie Wood also has built up a big stake in NVDA stock.

The SPDR S&P Metals & Mining ETF (XME) ran up 2.9% last week. The U.S. Global Jets ETF (JETS) ascended 2.6%. The SPDR S&P Homebuilders ETF (XHB) stepped up 2.3%. The Energy Select SPDR ETF (XLE) rallied 3.7%, but the Health Care Select Sector SPDR Fund (XLV) fell 0.5%. The Industrial Select Sector SPDR Fund (XLI) was up 2%.

The Financial Select SPDR ETF (XLF) moved 2.4% higher and the SPDR S&P Regional Banking ETF (KRE) jumped 3.35%.

Time The Market With IBD’s ETF Market Strategy

Nvidia Stock

Nvidia stock fell 2.6% to 116 for the week, closing just below its 50-day moving average. The weekly decline did follow the prior week’s 15.8% surge.

NVDA stock has a 131.26 buy point from an unsightly handle. Investors also could use last week’s high of 120.79 as a much smaller handle.

After leading the market since early 2023, Nvidia has struggled somewhat over the past three months.

Ideally, Nvidia would keep pace with the market rally, or at least hold above key levels. If it can’t, that could raise questions about chips and AI hardware plays, including Taiwan Semiconductor.

Meta Stock

Meta Platforms stock jumped 7% for the week to 561.35, Shares ran past a 542.81 buy point and a 544.23 alternate entry from a three-weeks-tight pattern.

Tesla Stock

Tesla stock rose 3.5% to 238.25 for the week, clearing an aggressive entry of 235. Shares jumped 7.4% on Thursday, pulling back modestly on Friday. TSLA stock has a 271 cup-base buy point, according to MarketSurge. Investors might wait to see if the EV giant can forge a proper handle.

Tesla has a busy October, with third-quarter deliveries likely on Oct. 2, the robotaxi event on Oct. 10, and Q3 earnings on Oct. 16. Also, already fierce China EV competition will ramp up significantly next month.

Apple Stock

Apple stock advanced 2.6% to 228.20, gapping above its 50-day moving average and clearing a trendline entry. Apple stock has a handle buy point of 232.92. The Dow Jones tech titan rallied on positive comments about the iPhone 16, following concerns of underwhelming demand. The latest handsets, which began official sales Friday, will have AI features later this year.

Other Stocks In Buy Zones

Spotify jumped 8.1% to 365.17, clearing a 359.38 buy point, though 350.32 served as an early entry.

Royal Caribbean stock climbed 3.6% to 174.05, above a 169.47 cup-with-handle buy point.

Evercore stock leapt 7.4% to 256.57, clearing a 254.74 consolidation buy point. The M&A advisory firm offered early entries during the week.

What To Do Now

The S&P 500 and Dow Jones are at highs while the Nasdaq is reviving. A slew of stocks have flashed buy signals with many continuing to march higher.

The Fed has started to cut rates while the economy seems to be growing at a modest pace.

The news cycle is relatively light until earnings ramp up in mid-October. In the coming week, Micron Technology (MU), KB Home (KBH) and Costco Wholesale (COST) report. On Friday, investors will get the core PCE price index, the Fed’s favorite inflation gauge.

So this is a good time to be heavily invested and perhaps focus on aggressive holdings. If you’re still modestly invested, there are still opportunities to add exposure, but do so gradually.

So keep working on those watchlists.

But always have an eye to exit. If the Nasdaq falls back toward the 50-day line and growth falters, perhaps dragged down by Nvidia, listen to the market.

Read The Big Picture every day to stay in sync with the market direction and leading stocks and sectors.

Please follow Ed Carson on Threads at @edcarson1971 and X/Twitter at @IBD_ECarson for stock market updates and more.

YOU MIGHT ALSO LIKE:

Why This IBD Tool Simplifies The Search For Top Stocks

Best Growth Stocks To Buy And Watch

IBD Digital: Unlock IBD’s Premium Stock Lists, Tools And Analysis Today

The potential investor upside of a Google breakup — if John Rockefeller is any guide

Google’s (GOOG, GOOGL) legal troubles could force it to sell off some of its prized businesses, but investors worried about that outcome may find some comfort in what happened to John Rockefeller’s Standard Oil more than a century ago.

The empire that controlled nearly all US oil production during America’s industrial revolution had to split into 34 smaller companies after the Supreme Court in 1911 sided with the Justice Department in an antitrust challenge.

The divestiture of those companies made Rockefeller the richest man in the world. But it also made other shareholders in those new companies richer too, according to legal experts.

The companies became giants such as Chevron (CVX) and Exxon Mobil (XOM) that still rule the industry today.

“[T]he market cap total for all those companies increased about five- to six-fold based on what the valuation was thought for Standard Oil,” said Boston College Law School antitrust law professor David Olson.

New management and efficiencies that followed the breakup helped the smaller companies flourish, added Susman Godfrey antitrust litigation attorney Barry Barnett.

In the case of Google, existing shareholders may benefit as a scaled-back company tends to boost innovation and customer service, Barnett said. Google’s search engine, for example, could start producing more relevant results and become more valuable to advertisers.

“The people who own the company are not going to lose,” Barnett said.

Not everyone agrees with this rosy view. One analyst at Evercore ISI recently reduced a price target on Alphabet, Google’s parent company, after rereading a federal judge’s landmark US antitrust ruling against the company handed down in August.

US District Court Judge Amit Mehta, who decided the case, sided with the US Justice Department’s claims that Google’s Search business was an illegal monopoly that it abused to keep rivals at bay.

Mehta also agreed with the DOJ’s accusations that Google illegally monopolized the market for online search text advertising.

“[W]e believe a ‘worst case’ scenario is a more likely scenario than the market assumes,” Evercore’s analyst wrote in the note.

It is not yet known what remedies the judge may approve as a result of his ruling.

They could range from an outright breakup of Google to forcing the company to make its search engine data, its “index,” available to competitors.

It could also be forced to end the types of agreements that got Google into trouble with regulators, that secure its search engine as a default on mobile devices and internet browsers.

George Alan Hay, Cornell University law and economics professor and former DOJ antitrust division chief, said the DOJ is likely to request “some form of divestiture” where Google is found to have violated the law.

“It would be significant. It wouldn’t be backbreaking,” he said. “Google could survive.”

One concern for stockholders is that a breakup could affect Google’s huge profit engine. In 2023, Google Search generated more than $175 billion in revenue.

Coupled with Google’s YouTube ads and Google network revenue, both of which it promotes on its general search engine, advertising on the platforms accounted for a staggering $237 billion of the company’s $307 billion in total revenue.

In October 2020, when the DOJ and states filed suit, Google’s annual revenue was roughly half of that, totaling $162 billion.

Not all breakups of business empires have led to positive results, at least in the immediate aftermath.

Consider the breakup of the AT&T (T) telecom network in the 1980s that followed seven years of litigation with the DOJ.

The Justice Department sued AT&T in 1974, seeking a breakup of its phone service and phone equipment monopolies. It got most of what it wanted in 1984 following a 1982 settlement that created a number of regional companies.

But AT&T lost significant long-distance revenue to newcomers MCI and Sprint. From 1984 to 1996, its share of total long-distance revenue fell from 91% to 48%.

But Barnett said he expects a breakup of Google to impact its shareholders the way that Standard Oil’s breakup did.

“So if you’re an Alphabet shareholder, this may be good for you.”

Alexis Keenan is a legal reporter for Yahoo Finance. Follow Alexis on X @alexiskweed.

Click here for the latest technology news that will impact the stock market

Read the latest financial and business news from Yahoo Finance

Oil Prices Are Down. Here Are 3 Energy Stocks That Can Prosper No Matter Where Prices Go Next.

Oil prices have been on a downward trajectory since peaking in April. WTI, the primary U.S. oil price benchmark, has fallen from more than $85 a barrel to its recent level of around $70. That slump will have varying impacts across the oil patch.

Chevron (NYSE: CVX), Plains All American Pipeline (NASDAQ: PAA), and Enterprise Products Partners (NYSE: EPD) stand out to a few Fool.com contributors for their more resilient businesses. Here’s why these energy stocks should prosper no matter what happens with crude oil prices.

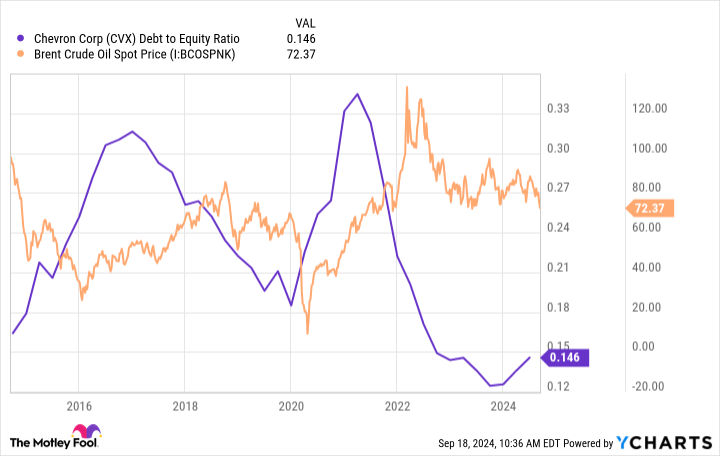

Chevron is solid as a rock

Reuben Gregg Brewer (Chevron): Chevron is well aware of the volatile nature of energy prices and what big oil and natural gas swings can do to its income statement. That’s why it pays so much attention to its balance sheet. And you should, too.

To start with a number, Chevron’s debt-to-equity ratio is a very low 0.15. That’s the lowest leverage among the company’s closest peers (and would actually be low for any company in any industry). This isn’t some small detail, given the cyclical nature of the industry. Simply put, low leverage gives Chevron the wherewithal to prosper in any oil market.

This is because Chevron has the room to add leverage when oil prices are weak, which allows the company to continue investing in its business and to pay its dividend. The dividend, for reference, has increased for 37 consecutive years, an incredible feat given the industry in which Chevron operates.

When oil prices recover, as they always have, Chevron reduces its leverage in preparation for the next downturn. Conservative income investors looking for an all-weather energy stock will be hard pressed to find a better option than 4.5%-yielding Chevron.

A well-oiled income-producing machine

Matt DiLallo (Plains All American Pipeline): Plains All American Pipeline operates an extensive network of oil pipelines, storage terminals, and natural gas liquids (NGL) infrastructure. The master limited partnership (MLP) primarily gets paid fees as crude oil and NGLs flow through its critical and integrated networks. Because of that, falling oil prices have minimal impact on its cash flows.

This year, the midstream company expects to generate more than $2.7 billion of adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA). It recently raised the midpoint of its guidance range by $75 million due to its strong first-half showing and outlook for the balance of the year. That updated outlook “underscores the resilience of our business model and highlights the flexibility of our asset base to capture opportunities in a dynamic and evolving market,” stated CEO Willie Chiang in the second-quarter earnings report.

Plains All American Pipeline expects to produce about $1.6 billion in adjusted free cash flow this year after funding growth capital projects (about $375 million). It will distribute nearly $1.2 billion of that cash to investors (the MLP’s distribution currently yields over 7%). The remaining money will help fund accretive bolt-on acquisitions, further debt reduction, or other investment opportunities. The company’s expansion-related investments should grow its earnings and cash flow.

The MLP’s ability to generate stable and growing cash flow drives its belief that it can steadily increase its cash distributions. It’s targeting to boost its payout by $0.15 per unit annually after 2024 (a double-digit rate from the current level). That’s after giving investors a 23% raise earlier this year. With Plains All American’s stable cash flow, a strong balance sheet, and a well-covered payout, investors can bank on this income stream even if oil prices continue to slide.

A wise approach

Neha Chamaria (Enterprise Products Partners): No oil stock is fully immune to the volatility in oil prices. Still, some companies can not only generate stable income and cash flows during an oil market turmoil, but also pay out regular dividends to their shareholders no matter where oil prices go.

Enterprise Products Partners, for example, has increased its dividend every year for 26 consecutive years. That period includes some of the toughest years for the oil market in history, including 2020, when oil prices plunged into the negative, even forcing some oil companies to slash their dividends.

While Enterprise Products’ business model hugely helps, the company also proactively adjusts its capital spending in response to market conditions to preserve cash where required. So on the one hand, the oil and gas pipeline giant generates steady cash flows under long-term contracts. On the other, it uses cash in such a way that it can continue to pay out bigger dividends every year while balancing debt management and growth spending.

Enterprise Products Partners’ strategy has worked well so far, as evidenced by its as evidenced by dividend growth, which has hugely contributed to shareholder returns over the decades.

Enterprise Products Partners is one of the largest midstream energy companies in the U.S., maintains a strong balance sheet, has projects worth nearly $6.7 billion under construction, and is committed to returning value to shareholders at all times. So no matter where oil prices head next, this 7.2%-yielding energy stock can prosper.

Should you invest $1,000 in Chevron right now?

Before you buy stock in Chevron, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Chevron wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $710,860!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 16, 2024

Matt DiLallo has positions in Chevron and Enterprise Products Partners. Neha Chamaria has no position in any of the stocks mentioned. Reuben Gregg Brewer has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Chevron. The Motley Fool recommends Enterprise Products Partners. The Motley Fool has a disclosure policy.

Oil Prices Are Down. Here Are 3 Energy Stocks That Can Prosper No Matter Where Prices Go Next. was originally published by The Motley Fool

Young Homeowner Profits $14K Per Year Living In A 'Luxury' Tiny Home In Her Own Backyard: 'It's Amazing'

Rent or mortgage payments are often the biggest monthly expenses in an individual’s life. One young homeowner found a way to flip her house payments into a source of passive income.

What To Know: CNBC contributor Precious Price, 26, built a luxury tiny home in her backyard for around $35,000 so she could free up her main house for rentals. Now she essentially gets paid to live out back.

“As I stared out the kitchen window into my huge backyard, something clicked: I could use that space to build a tiny home to live in, and fully rent out the main house,” Price wrote.

In 2019, Price bought a 1,400-square-foot house in Georgia for just under $200,000. She got started by listing spare rooms on Airbnb Inc ABNB to generate extra income, but when the pandemic hit, the amount of people looking to share living quarters dried up.

That’s when she got the idea to build the tiny home in her backyard. She actually purchased a shed and hired contractors to build it out into a home, which helped to simplify the process. She paid off the entire cost of the build in less than two years.

Check This Out: DIYer Builds Tiny Home For $17K That Brings In $50K A Year In ‘Almost Completely Passive’ Income

Price considers the 296-square-foot backyard house a “luxury tiny home” and she’s profiting from the build. She spends $1,580 per month on her mortgage, property taxes and utility bills, but she generates $2,725 per month by renting out the main house. That leaves her with close to $1,150 profit on a monthly basis, which means she’s getting paid close to $14,000 a year to live in her own backyard.

There are some drawbacks. She’s had to downsize her wardrobe and cut back on hosting get-togethers, but it’s well worth it, she says. She’s even planning to add a guest suite to the main home to be able to offer more rental options.

“It’s amazing what you can do with a bit of backyard space,” Price wrote.

Read Next:

This illustration was generated using artificial intelligence via MidJourney.

This story is part of a new series of features on the subject of success, Benzinga Inspire. Some elements of this story were previously reported by Benzinga and it has been updated.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Traders Need a New Stock Market Playbook for These Rate Cuts

(Bloomberg) — Wall Street traders have a unique challenge in placing bets on the stock market now that the Federal Reserve has started cutting interest rates: History is no longer a guide.

Most Read from Bloomberg

The classic trading playbook for when rates are coming down is to buy stocks in sectors that are considered defensive in nature because their demand is impervious to economic conditions, like consumer staples and health care. Another popular play is shares of industries that pay big dividends, like utilities.

The reason is the Fed typically lowers borrowing costs to fight off a weakening economy or boost one that’s already sunk into a recession. During those periods, companies in growth industries like technology tend to suffer. But that isn’t happening now.

Rather, the economy is growing, equity indexes are hitting all-time highs, corporate earnings are expected to keep expanding, and the Fed just went big with a half-percentage-point rate cut to kick off its easing cycle. There’s no playbook for this.

“With the Fed opting for a jumbo cutting amid quite loose financial conditions, it’s a clear signal for equity investors to position rather offensively,” said Frank Monkam, senior portfolio manager at Antimo. “The traditional play of defensive stocks, such as buy utilities or consumer staples, could fail to see much traction.”

So where are investment pros looking instead?

Financials are a good place to start, according to Walter Todd, president and chief investment officer at Greenwood Capital Associates LLC. He’s snapping up shares of Bank of America Corp., JPMorgan Chase & Co. and regional banks like PNC Financial Services Group Inc.

“This lowering of rates by the Fed should lower their cost of funding,” he said. “They should have to pay less on deposits than they were two days ago, so that should help their net interest margin.”

David Lefkowitz, head of US equities for UBS Global Wealth Management, also likes financials, as well as pockets within the industrial sector closely tied to a strong economy.

No History

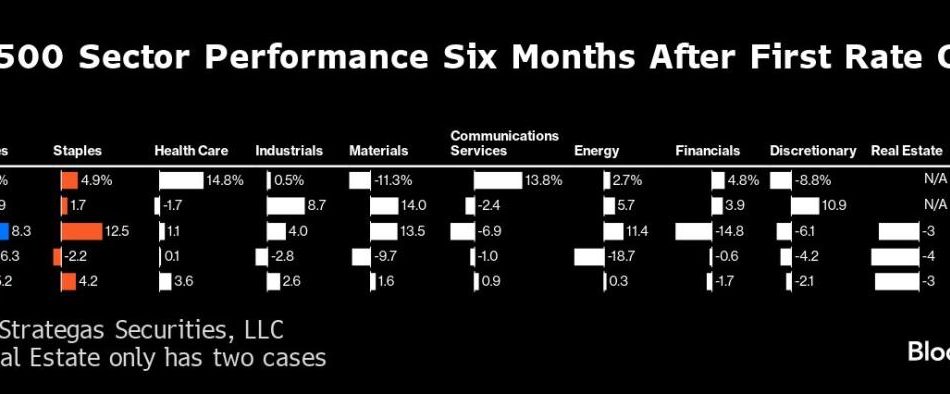

That positioning runs counter to what history would suggest. In four cutting cycles over the past three decades investors chased so-called safety stocks, like utilities, consumer staples and health care, that pay hefty dividends and are popular with income investors when bond yields sink, according to data compiled by Strategas Securities.

Looking six months out from the first rate cut in those four cycles, the best performing sector was utilities, rising 5.2% on average, Strategas data show. And the technology sector was the worst, falling 6.2%, with real estate, consumer discretionary and financials also among the groups that struggled most.

Positioning bullishly overall when the Fed is cutting rates and the economy is holding up is a historically winning play. Since 1970, the S&P 500 Index has risen 21% on average in the year after the first cut in an easing cycle — as long as the economy averted recession, according to data from Bank of America Corp.

What’s more, eight of the last nine easing cycles occurred when profits were decelerating. But profits are expanding now, which favors cyclicals and large-cap value shares, BofA’s head of US equity and quantitative strategy Savita Subramanian wrote in a note to clients on Friday.

“There is no Fed playbook — every easing cycle is different,” Subramanian wrote.

At the moment, it appears investors are plunging back into big-tech stocks and other growth corners of the market. Hedge funds were net buyers of US technology, media and telecommunications stocks at the fastest pace in four months last week, according to Goldman Sachs Group Inc.’s prime brokerage data.

‘Euphoric Consumer’

Meanwhile, others are attracted to stocks that would benefit from increased spending by Americans now that interest rates are falling.

“You’re going to have a euphoric consumer,” said Phil Blancato, chief executive officer at Ladenburg Thalmann Asset Management. “Seeing the cuts come down and seeing an opportunity to go out and get a mortgage will spur spending whether it’s the housing market, the auto market or just year end spending.”

Joe Gilbert, portfolio manager at Integrity Asset Management, sees opportunities in mall operators like Simon Property Group Inc., and within the industrial portion of the real estate sector, including Prologis Inc.

“A lot of these real estate companies have debt that they need to refinance,” Gilbert said. “We think lower rates will definitely help them.”

Utilities have been a popular bet as well, but not because of their dividends. It’s their exposure to artificial intelligence by powering the development of the technology that’s been drawing in investors, according to Mike Bailey, director of research at Fulton Breakefield Broenniman LLC. In fact, utilities have done so well this year, rising 26% as the second-best performing group in the S&P 500, that their valuations may be getting stretched.

“It’s hard to know if we’re front loading all the good news in utilities,” Bailey said. “It feels like we’re probably not going to see another wave of outperformance for those.”

That said, with this wild bull run anything seems possible — at least for now. Investors have shaken off concerns about lofty tech valuations, elevated volatility, US political uncertainty and a slowdown in hiring. Few of Wall Street’s prognosticators predicted the S&P 500 would have eclipsed 5,700 before the end of 2024. Yet, the index enters this week at 5,703 after rising 20% this year on the heels of last year’s 24% gain.

“This was the best-case scenario,” Ladenburg’s Blancato said. “We have an opportunity to probably hit close to 6,000 by the end of the year.”

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

Salesforce CEO Marc Benioff offers up this reminder to investors before his big birthday

This is The Takeaway from today’s Morning Brief, which you can sign up to receive in your inbox every morning along with:

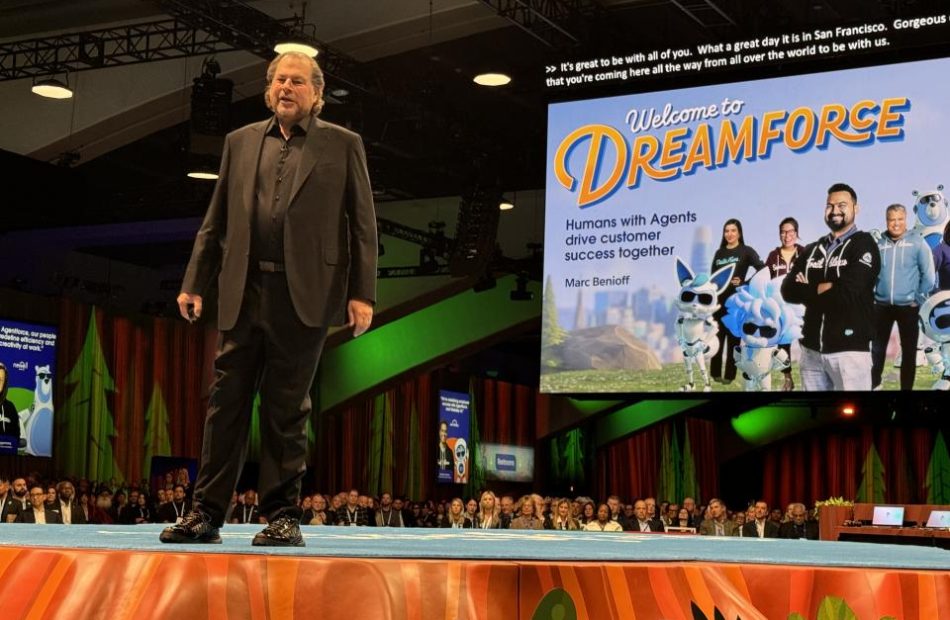

I think I have fully processed my time spent at Salesforce’s (CRM) annual extravaganza in San Francisco, known as Dreamforce.

This was my fourth Dreamforce, and it was fascinating per usual — including a dinner at the top of the 61-floor Salesforce Tower with Matthew McConaughey (a longtime friend and pitchman for the SaaS giant), Will.i.Am, Metallica lead drummer Lars Ulrich, one of Nvidia’s (NVDA) founding GPU creators, and Anthropic co-founder Daniela Amodei (who gave some great brief remarks on artificial intelligence).

This dinner ended with an acoustic performance by Alanis Morissette, who sang four songs that reminded me that, at one point over the last 42 years, I did have a personal life (filled with the teenage heartbreak that only fed my appetite for sappy Alanis songs on Myspace).

I digress.

Now that I’ve digested this latest West Coast tech swing, I’m here to say it’s good to see Salesforce co-founder and CEO Marc Benioff back to being Marc Benioff.

I realize that as a journalist, I’m supposed to be critical, and I am. Salesforce shocked the hell out of the market in late May with a weak outlook, and the stock got hammered. Not a lovely look.

But I can’t completely turn off the analyst DNA in me that still exists deep down.

And on that score, I liked what I saw from Benioff at Dreamforce from a few different perspectives.

I saw a founder pull thousands of employees into his vision of an AI future during a keynote. The room full of “trailblazers” — as Salesforce employees are called — was hanging on to his every word. The group was ready to run through a wall for Benioff, essential when you are trying to deploy a billion autonomous AI agents and deliver for Wall Street each quarter.

It was also significant that Benioff mostly did the keynote himself, only yielding the mic a few times.

“The reason is I think he feels that this is a very pivotal moment for his company, for the industry, and for the technology,” Goldman Sachs analyst Kash Rangan — who was also in attendance — told me.

“When these entrepreneurs like Marc and Oracle’s Larry Ellison that have founded their companies and have this deep sense of connection to the companies, and they understand those pivotal moments, it is like they kick into high gear and all they can think about is getting the company to be on the right side of technology.”

I saw a founder deeply engaged in the products he was pitching to the masses — not reading off talking points supplied by team members. Benioff even turned the tables and quizzed me on the Opening Bid podcast about what I learned from a product demo at the event. You can catch that exchange in the above video.

If he thought he was going to catch this fella flat-footed, hell no! Forever prepared!

I saw a founder perhaps doing what very few in corporate America could do: bring together huge names to drive meaningful discussions, which often transformed into convos about Salesforce innovations and their longtime personal ties with Benioff.

Benioff has one of the most extensive networks I’ve seen, and trust me, that has paid dividends for Salesforce in terms of reputation, business wins, and getting things done quickly.

“Marc can turn this ship like no one else when he gets an idea in his head,” one Benioff confidant told me at the Salesforce Tower dinner.

By all indications, Benioff is back to aggressively driving that huge Salesforce boat — shaking off the activist attacks that transpired a little while back.

“If I’m not enjoying it — I’m not doing it, and I think that I’m really enjoying Salesforce. I love it. I feel like we’ve done seminal work, especially in the last 18 months. We’ve gotten the company to the point where it is an absolute leader, where everyone is having to respond,” Benioff remarked when asked to reflect ahead of his big 60th birthday on Sept. 25.

So all this raises the question: Why isn’t there more optimism priced into Salesforce’s stock?

Its shares trade on a forward price-to-earnings multiple of 25 times, according to Yahoo Finance data. Microsoft (MSFT) trades at 33 times, whereas Oracle (ORCL) (Ellison is a mentor of Benioff’s dating back to his time at the company) is at 27 times. Salesforce quasi-rival ServiceNow (NOW) trades on a 53 times forward multiple.

Pros tell me the Street is generally worried about Salesforce’s propensity to spend big on acquisitions, which weighed on margins and free cash flow in the past. Others still aren’t sold on Salesforce monetizing its new AI initiatives.

But they all generally agree that the stock does appear cheap on a relative and historical basis.

“I would go far enough to say that not much optimism [at all] is being priced into Salesforce’s stock right now,” Rangan said. “The stock is pricing in as if there is no growth at all, which is absolutely ridiculous. So not only AI optimism is not priced in, there’s no optimism being priced in.”

Salesforce’s guidance calls for sales growth of 7% this year and up to 25% operating cash flow growth, FYI.

“I’m very optimistic about this company,” Rangan said. “People tend to dismiss Marc — but I’m a big bull on the company.”

Three times each week, I field insight-filled conversations with the biggest names in business and markets on Opening Bid. Find more episodes on our video hub. Watch on your preferred streaming service. Or listen and subscribe on Apple Podcasts, Spotify, or wherever you find your favorite podcasts.

In the below Opening Bid episode, BNY (BNY) CEO Robin Vince takes the wraps off his plan to grow the iconic US bank.

Brian Sozzi is Yahoo Finance’s Executive Editor. Follow Sozzi on X @BrianSozzi and on LinkedIn. Tips on deals, mergers, activist situations, or anything else? Email brian.sozzi@yahoofinance.com.

Click here for the latest technology news that will impact the stock market

Read the latest financial and business news from Yahoo Finance

NASDAQ-Listed Aurora Cannabis Breaks Up With Uruguay: It's Not You, It's The Market

In a dramatic turn, Aurora Cannabis ACB announced its breakup with Uruguay, closing operations by the end of September 2024. Acquired for $263 million in 2018, Aurora’s exit underscores a harsh reality: the market failed to meet its criteria for future growth, dashing hopes of becoming a leader in medical marijuana and hemp production.

- Get Benzinga’s exclusive analysis and the top news about the cannabis industry and markets daily in your inbox for free. Subscribe to our newsletter here. You can’t afford to miss out if you’re serious about the business.

Challenges In Paradise

Despite its potential, Uruguay’s cannabis industry has struggled with costly production and stagnant sales. The country faced numerous challenges, including a limited variety of strains and restricted THC flower availability, which hindered product diversity and the development of a robust supply chain.

Additionally, a lack of regulations to transition cannabis clubs into dispensaries and to support cannabis tourism stifled growth. Ultimately, the government’s failure to respond to market signals for a more open and diverse cannabis market has contributed to the industry’s stagnation, mirroring issues seen in Colombia‘s bottlenecked retail segment.

Since legalizing marijuana over a decade ago, the country has seen less than $30 million in exports, while other sectors thrive.

The lack of a robust business framework, compounded by regulatory hurdles, has driven many companies—including Pharmin and Global Cannabis Holdings—out of the market.

Exclusive Comments

An Aurora spokesperson told Benzinga Cannabis, “Our decision to exit Uruguay is part of a strategic focus on optimizing our global operations and concentrating resources on core markets that support sustainable growth.”

The spokesperson emphasized Aurora’s commitment to positive cash flow. “We are prioritizing investments in markets where we can achieve sustainable profitability.”

The person added that the decision aligns with Aurora’s goal of long-term value creation for shareholders. “Our operations in Uruguay, managed through our wholly owned subsidiary ICC Labs, did not meet the criteria for our future growth strategy.”

The spokesperson concluded, “While we recognize the challenges in Uruguay, we remain focused on leading in regulated markets like Canada, Germany, Poland, the UK, and Australia.”

Aurora Turns The Page Focused On Global Markets

Aurora Cannabis continues to solidify its position in the global cannabis market, accounting for over 30% of Canada’s medical marijuana exports. In the first half of 2024, international sales reached $28.9 million (C$39.3 million), driven by key markets such as Australia and Germany, following the full acquisition of MedReleaf.

In August, the company reported a cash position of approximately $134 million (C$182 million) and a positive free cash flow of $4.8 million (C$6.5 million) in Q1 FY2025.

Management anticipates that with adjusted EBITDA up 87% year-over-year, Aurora’s focus on high-margin medical cannabis will drive growth and profitability in the coming quarters.

Read Next: Aurora Cannabis CEO Takes On Dual Role: Here’s What’s Behind The Leadership Change

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Southwest Airlines warns staff of 'tough decisions' ahead, Bloomberg reports

(Reuters) – Southwest Airlines has warned employees that it will soon make tough decisions as part of a strategy to restore profits and counter demands from activist investor Elliott Investment Management, Bloomberg News reported on Saturday.

The airline is considering making changes to its flight routes and schedules to increase revenue, the report added, citing the transcript of a video message to employees by Chief Operating Officer Andrew Watterson.

“I apologize in advance if you as an individual are affected by it,” Watterson said, according to the report, adding that he didn’t offer any details on the pending moves.

Southwest did not immediately respond to a Reuters request for comment.

The airline has been struggling to find its footing after the COVID-19 pandemic, in part due to Boeing’s aircraft delivery delays and industry-wide overcapacity in the domestic market.

It plans to offer assigned and extra-legroom seats to attract premium travelers and start overnight flights. It will present the details to investors on Sept. 26.

Earlier this week, Reuters reported that Elliott, which owns 10% of Southwest’s common shares, told one of the company’s top unions it still wants to replace CEO Robert Jordan, even after the carrier pledged to shake up its board.

(Reporting by Surbhi Misra in Bengaluru; Editing by Paul Simao)