1 Magnificent High-Yield Dividend Growth Stock Down 40% to Buy and Hold Forever

Normally, investors looking for dividend growth wouldn’t expect to find it in the real estate investment trust (REIT) sector. But sometimes there are gems that get overlooked because they don’t conform to the norms. Rexford Industrial Realty (NYSE: REXR) is just such a genre-defying stock. Here are three reasons why this is one magnificent high-yield dividend growth stock you’ll want to consider buying and holding forever.

1. Rexford’s yield is attractive

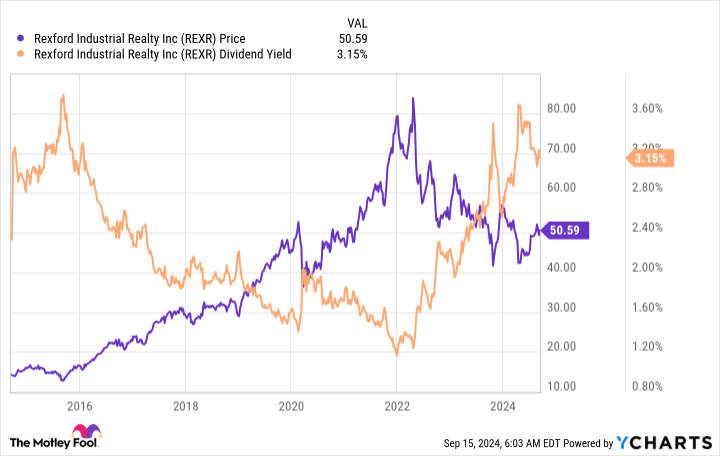

To get the bad news out first, Rexford Industrial’s yield is a little below average for a REIT. Rexford’s dividend yield is 3.3% while the average REIT has a yield of roughly 3.7%. However, when you compare Rexford to the broader market, it looks a lot better. That 3.3% yield is nearly three times larger than the S&P 500 index’s paltry 1.2% yield.

And, thanks to a dramatic pullback in Rexford’s stock price, the dividend yield is also near its highest levels of the decade. So you can find higher-yielding REITs, but Rexford’s yield still looks fairly attractive on both an absolute basis and relative to its own history.

2. Rexford’s dividend growth is hugely attractive

You can’t just look at Rexford Industrial’s yield and call it a day. The REIT’s most impressive dividend statistic is the rate of dividend growth it has achieved over the past decade. REITs are generally known as slow and steady growers; a mid-single-digit dividend growth rate is usually considered quite good. Rexford’s dividend expanded at an annualized rate of 13% over the past decade. That would be a huge number for any company but is downright phenomenal for a REIT.

When you add the dividend growth to the yield, it becomes clear that Rexford is a very attractive growth and income stock. In fact, over roughly the past 10 years the dividend has grown from $0.12 per share per quarter (in 2013) to $0.4175 per share (in 2024). That’s a nearly 250% leap, something that just about any dividend investor would appreciate.

3. Rexford’s business model is differentiated

Rexford is an industrial REIT, which isn’t particularly special in any way. However, it has a unique geographic focus that sets it apart from its peers. Unlike most industrial REITs, which focus on diversification, Rexford has gone all in on the Southern California market. That’s right — it only invests in one region of the United States. There is a clear risk in this approach, but given the company’s strong dividend history, the bet management has made is paying off.

That’s actually not too shocking if you step back and examine the Southern California market. It is the largest industrial market in the United States and ranks as the No. 4 market globally. Notably, it is an important gateway for goods coming to North America from Asia. Being a vital cog in the global supply chain has resulted in high demand, with the Southern California region having a dramatically lower vacancy rate than the rest of the country. Add in supply constraints, and Rexford has been able to increase rates on expiring leases in recent quarters drastically.

Add that tailwind to the REIT’s development plans and acquisitions, and you get a REIT that looks likely to continue rewarding investors very well for years to come.

Dividend growth investors should buy Rexford while they can

So why is Rexford’s stock down 40% or so from its all time highs? The answer really boils down to investor sentiment, which got a bit overheated during the coronavirus pandemic as demand for warehouse space increased along with online shopping. Although the excitement has worn off, Rexford’s business continues to perform well. If you are a dividend growth investor, you should consider buying Rexford and holding on to it for a very long time.

Should you invest $1,000 in Rexford Industrial Realty right now?

Before you buy stock in Rexford Industrial Realty, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Rexford Industrial Realty wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $710,860!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 16, 2024

Reuben Gregg Brewer has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Rexford Industrial Realty and Vanguard Real Estate ETF. The Motley Fool has a disclosure policy.

1 Magnificent High-Yield Dividend Growth Stock Down 40% to Buy and Hold Forever was originally published by The Motley Fool

Leave a Reply