Bragar Eagel & Squire, P.C. Reminds Investors That Class Action Lawsuits Have Been Filed Against Indivior, CrowdStrike, DXC, and Five Below and Encourages Investors to Contact the Firm

NEW YORK, Sept. 21, 2024 (GLOBE NEWSWIRE) — Bragar Eagel & Squire, P.C., a nationally recognized shareholder rights law firm, reminds investors that class actions have been commenced on behalf of stockholders of Indivior PLC INDV, CrowdStrike Holdings, Inc. CRWD, DXC Technology Company DXC, and Five Below, Inc. FIVE. Stockholders have until the deadlines below to petition the court to serve as lead plaintiff. Additional information about each case can be found at the link provided.

Indivior PLC INDV

Class Period: February 22, 2024 – July 8, 2024

Lead Plaintiff Deadline: October 1, 2024

The Complaint alleges that, throughout the Class Period, Defendants made materially false and misleading statements regarding the Company’s business, operations, and prospects. Specifically, Defendants (1) grossly overstated their ability to forecast the negative impact of certain legislation on the financial prospects of Indivior products, which forecasting ability was far less capable and effective than Defendants had led investors and analysts to believe; (2) overstated the financial prospects of SUBLOCADE, PERSERIS and OPVEE, and thus overstated the Company’s anticipated revenue and other financial metrics; (3) knew or recklessly disregarded that because of the negative impact of certain legislation on the financial prospects of Indivior’s products, Indivior was unlikely to meet its own previously issued and repeatedly reaffirmed FY 2024 net revenue guidance, including its FY 2024 net revenue guidance for SUBLOCADE, PERSERIS and OPVEE; (4) knew or recklessly disregarded that Indivior was at a significant risk of, and/or was likely to, cease all sales and marketing activities related to PERSERIS; and (5) knew or recklessly disregarded that, as a result of the foregoing, the Company’s public statements were materially false and misleading at all relevant times.

For more information on the Indivior class action go to: https://bespc.com/cases/INDV

CrowdStrike Holdings, Inc. CRWD

Class Period: November 29, 2023 – July 29, 2024

Lead Plaintiff Deadline: September 30, 2024

CrowdStrike is a global cybersecurity company that provides software that helps prevent data breaches. According to the complaint, CrowdStrike’s main product is the Falcon software platform, which purportedly uses artificial intelligence and machine learning technologies to detect, prevent, and respond to security breach threats.

The CrowdStrike class action lawsuit alleges that defendants throughout the Class Period made false and/or misleading statements and/or failed to disclose that: (i) CrowdStrike had instituted deficient controls in its procedure for updating Falcon and was not properly testing updates to Falcon before rolling them out to customers; (ii) this inadequate software testing created a substantial risk that an update to Falcon could cause major outages for a significant number of CrowdStrike’s customers; and (iii) such outages could pose, and in fact ultimately created, substantial reputational harm and legal risk to CrowdStrike.

The CrowdStrike class action lawsuit further alleges that on July 19, 2024, news broke that a flawed Falcon content update caused major worldwide technology outages for millions of devices running Microsoft Windows. On this news, the price of CrowdStrike stock fell more than 11%, according to the complaint.

Then, on July 22, 2024, the CrowdStrike class action lawsuit further alleges that Congress called on CrowdStrike CEO, defendant George Kurtz, to testify regarding the crisis and CrowdStrike’s stock rating was downgraded by analysts such as Guggenheim and BTIG. On this news, the price of CrowdStrike stock fell more than 13%, according to the complaint.

Finally, on July 29, 2024, news outlets reported that Delta Air Lines had hired prominent attorney David Boies to seek damages from CrowdStrike following the software outage, according to the complaint. On this news, the price of CrowdStrike stock fell nearly 10%, according to the CrowdStrike class action lawsuit.

For more information on the CrowdStrike class action go to: https://bespc.com/cases/CRWD

DXC Technology Company DXC

Class Period: May 26, 2021 – May 16, 2024

Lead Plaintiff Deadline: October 1, 2024

According to the complaint, during the class period, defendants misrepresented its ongoing “transformation journey” and the Company’s ability to integrate previously acquired companies and business systems. While touting its ongoing success in implementing that integration, DXC repeatedly stressed its commitment to reducing the Company’s restructuring and transaction, separation, and integration (“TSI”) costs in order to increase its free cashflow and “unleash [its] true earnings power.” In truth, Defendants knew or recklessly disregarded that the Company was only able to reduce its restructuring and TSI costs by limiting its integration efforts.

The complaint alleges that on August 3, 2022, DXC reported disappointing first quarter results, despite having reiterated its guidance just six weeks prior. DXC blamed its poor performance on the fact that its “cost optimization efforts have moved at a slower pace than anticipated.” These disclosures caused the price of DXC common stock to decline by 17%, from $31.52 per share to $26.15 per share.

Then, on May 16, 2024, DXC’s CEO admitted that “the previous restructurings did not set a real, clean, solid, fully integrated baseline for profitable growth” because the systems that were acquired over time were “never integrated, never deduped,” and admitted that the Company was “not [a] fully functional organization.” DXC also announced it would need to spend an additional $250 million to achieve the restructuring and integration process it falsely claimed to have been successfully implementing during the Class Period. These disclosures caused the price of DXC common stock to decline nearly 17%, from $19.88 per share to $16.52 per share.

For more information on the DXC class action go to: https://bespc.com/cases/DXC

Five Below, Inc. FIVE

Class Period: December 1, 2022 – July 16, 2024

Lead Plaintiff Deadline: September 30, 2024

According to the lawsuit, during the Class Period, defendants provided investors with false and/or materially misleading information about Five Below’s financial strength and operations, including its outlook for the first quarter and full year 2024. This information included Five Below’s statement that net sales are expected to be in the range of $826 million to $846 million based on opening approximately 55 to 60 new stores in the first quarter. Further, Five Below claimed that net sales for the full year are expected to be in the range of $3.97 billion to $4.07 billion based on opening between 225 and 235 new stores. Investors discovered that these statements were false and/or materially misleading when, on June 5, 2024, Five Below announced disappointing first quarter 2024 sales result and cut its full year 2024 guidance stating, “Net sales are expected to be in the range of $3.79 billion to $3.87 billion based on opening approximately 230 new stores.” At the same time, Five Below claimed that for the second quarter, “Net sales are expected to be in the range of $830 million to $850 million based on opening approximately 60 new stores.” When the true details entered the market, the lawsuit claims that investors suffered damages.

For more information on the Five Below class action go to: https://bespc.com/cases/FIVE

About Bragar Eagel & Squire, P.C.:

Bragar Eagel & Squire, P.C. is a nationally recognized law firm with offices in New York, California, and South Carolina. The firm represents individual and institutional investors in commercial, securities, derivative, and other complex litigation in state and federal courts across the country. For more information about the firm, please visit www.bespc.com. Attorney advertising. Prior results do not guarantee similar outcomes.

Contact Information:

Bragar Eagel & Squire, P.C.

Brandon Walker, Esq.

Marion Passmore, Esq.

(212) 355-4648

investigations@bespc.com

www.bespc.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Warren Buffett's Safest Stock Might Not Be Apple or Coca-Cola. 1 Other Stock That Could Be a Better Buy in the Long Run.

In the mid-2000s, a former medical student turned portfolio manager named Michael Burry predicted the housing crisis and its economic implications during the Great Recession. In more recent history, billionaires such as Chamath Palihapitiya have emerged as prominent talking heads for markets, politics, and everything in between.

But the investment industry’s “what have you done for me lately?” mentality has me skeptical that Burry or Palihapitiya will remain relevant over the course of the next several decades. That’s a tough thing to do.

I can think of one investor for whom this question doesn’t really apply. Over the course of several decades, Warren Buffett has become one of the most well-known investors on the planet thanks to an unrelenting commitment to simplicity and an aversion to drama and outsize risk.

Let’s take a look at Buffett’s philosophy and assess his portfolio. While the Oracle of Omaha has had a lot of multibaggers over the years, I see one stock as a special opportunity for the long haul.

Breaking down Buffett’s investment philosophy

Buffett’s investment style is rooted in a lot of simple, straightforward philosophies.

For starters, Buffett is a contrarian. To be fair, so is Michael Burry. But unlike Burry, Buffett isn’t one to take short positions or bet against America in times of recession.

Rather, Buffett looks for value opportunities that may be underappreciated or misunderstood. In other words, a specific stock price or valuation multiple may not always tell the entire story about a business.

Time and again, Buffett has taken positions that looked like head-scratchers on the surface. But after a thorough analysis, investors have come to see that he has a knack for identifying companies with strong, consistent cash flow and broad brand appeal.

Notable Buffett investments

Given the explanation above, it’s probably not surprising to learn that Buffett loves blue chip stocks. While he has dabbled with some growth stocks in emerging areas such as artificial intelligence (AI), the overwhelming majority of his portfolio is concentrated in more mundane businesses across financial services, consumer packaged goods, telecommunications, and energy.

Some of Buffett’s biggest winners over the years include Apple and Coca-Cola. Unlike many technology companies, Apple is unique because it fits squarely with Buffett’s criteria of looking for growth but not at the expense of consistent profits.

Even though Buffett hasn’t even owned shares of Apple for a decade, it is his largest position right now — and that’s even after offloading a good chunk of the position and re-investing profits into Treasury Bills.

Regarding Coca-Cola, Buffett has held the stock for decades. While this has led to significant price appreciation in his position, the real sweetener for Buffett is Coca-Cola’s generous and reliable dividend.

Which Warren Buffett stock do I think is the best long-term option?

My top Warren Buffett stock is Berkshire Hathaway (NYSE: BRK.A) (NYSE: BRK.B), the holding company for all of his positions.

Even though companies such as Apple and Coca-Cola are pretty safe choices for investors, no one stock is immune to macrothemes such as economic slowdowns or changes in monetary policy. These can have ripple effects throughout the stock market regardless of industry sector or specific companies.

Investing in Berkshire Hathaway inherently provides exposure to a number of high-quality companies across different industries. In addition to Apple and Coca-Cola, some of Berkshire’s largest positions include American Express, Occidental Petroleum, Bank of America, Chevron, and Visa.

The Berkshire portfolio provides investors with a level of diversification akin to the S&P 500. But the added bonus is that you also get the intangible qualities of Buffett’s mindset along with unparalleled expertise in his portfolio-management team featuring Ted Weschler and Todd Combs.

Berkshire’s track record speaks for itself. From 1964 to 2023, Berkshire generated an overall gain of 4,384,748%. By comparison, the S&P 500’s gain was 31,223%.

Considering Buffett has been able to produce compounded annual gains of 20% on average for several decades, I’m hard-pressed to pick another stock over Berkshire itself. I think investors looking for consistent growth over a long-term time horizon while also achieving a deep level of portfolio diversification are best off owning Berkshire stock and letting Buffett’s magic do the rest.

Should you invest $1,000 in Berkshire Hathaway right now?

Before you buy stock in Berkshire Hathaway, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Berkshire Hathaway wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $710,860!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 16, 2024

Bank of America is an advertising partner of The Ascent, a Motley Fool company. American Express is an advertising partner of The Ascent, a Motley Fool company. Adam Spatacco has positions in Apple. The Motley Fool has positions in and recommends Apple, Bank of America, Berkshire Hathaway, Chevron, and Visa. The Motley Fool recommends Occidental Petroleum. The Motley Fool has a disclosure policy.

Warren Buffett’s Safest Stock Might Not Be Apple or Coca-Cola. 1 Other Stock That Could Be a Better Buy in the Long Run. was originally published by The Motley Fool

Translumina Therapeutics, India's largest domestic player in the coronary stents market, announces the initiation of direct operations in the UAE

NEW DELHI, Sept. 21, 2024 /PRNewswire/ — Translumina was incorporated in 2011 as a sales & marketing company specialising in coronary intervention devices. Since its inception, the company has successfully established their own manufacturing capabilities and developed in-house product lines, which are endorsed by interventional cardiologists worldwide.

“At Translumina, we have a clear ambition to put India on the global map for medical devices and fulfil our national vision of ‘Make in India, Make for the world’. Indian engineering & innovation will be at the forefront of the medical devices industry, and the launch of our direct presence in the UAE is a step in that direction,” remarked Gurmit Singh Chugh, Co-Founder and Chairman of Translumina Therapeutics.

Echoing this sentiment, Punita Sharma Arora, Co-Founder & Vice-Chairman of Translumina, added, “We’ve been present in international markets for more than five years now and have built up a strong direct presence in Europe & South Asia. In just the last one year, we have invested in a direct presence LATAM & SEA, and now with the addition of the MENA region, we have full conviction that our comprehensive product portfolio will be able to reach every corner of the world.”

The company’s drug-eluting stent technologies have been developed through a technological collaboration with the prestigious German Heart Centre, which has led to the development of groundbreaking medical devices, including the world’s longest-studied DES, with over 10 years of safety and efficacy data.

Last year, Translumina acquired Blue Medical, a Dutch medical device company renowned for specializing in drug-coated balloons, and Lamed, a leading player in the vascular surgery market in Germany, further enhancing the company’s product offerings. Arjun Oberoi, Managing Director of Everstone Capital, and board member at Translumina, reflected, “We partnered with Translumina with the vision of making it a truly global company. Paired with the acquisitions of Blue Medical and Lamed, the UAE launch will enhance our global presence, most importantly in the fast-growing MENA region.”

“We are excited to establish our presence in the UAE, known for its strategic importance and business innovation,” added Indranil Mukherjee, Group CEO of Translumina. “This will allow us to better serve the MENA region while strengthening our global presence and making high-quality healthcare more accessible.”

For further queries, please contact:

Dr. Nancy Chugh

drnancychugh@translumina.in

Photo: https://stockburger.news/wp-content/uploads/2024/09/Translumina_UAE_office.jpg

Logo: https://stockburger.news/wp-content/uploads/2024/09/Translumina_Logo.jpg

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/translumina-therapeutics-indias-largest-domestic-player-in-the-coronary-stents-market-announces-the-initiation-of-direct-operations-in-the-uae-302254270.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/translumina-therapeutics-indias-largest-domestic-player-in-the-coronary-stents-market-announces-the-initiation-of-direct-operations-in-the-uae-302254270.html

SOURCE Translumina

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Democrats and Republicans finally agree on something: America faces a retirement crisis

A new survey from a global investment firm recently uncovered a rare point on which Republicans and Democrats seem to agree: America faces a retirement savings crisis.

Only about half of American households have retirement savings accounts. The Social Security program may soon run short of funds, and those benefits were never meant to cover the full costs of retirement.

In an August survey, BlackRock asked 1,000 registered voters for their thoughts on retirement security in America. The responses transcended party lines.

When the survey asked voters if they think there is a retirement savings crisis in this country, 93% of Republicans answered yes, joined by 86% of Democrats and 94% of independents.

Three-quarters of Republicans said they are concerned about “not being able to maintain their standard of living” in retirement, joined by three-quarters of Democrats and a slightly smaller share of independents.

On questions of retirement security, Republicans and Democrats agree

The survey found broad bipartisan agreement on several other metrics of retirement security:

-

Republicans said they expect to need $2.1 million in savings to get through retirement, on average, compared with $2 million for Democrats and $3 million for independents.

-

Despite those lofty savings targets, roughly two-thirds of Democrats, Republicans and Independents in the survey report having less than $150,000 saved for retirement.

-

One quarter of Democrats and Republicans who responded to the survey said they have no emergency savings, along with 29% of independents.

-

The average Democrat and independent expects to retire at 64, the average Republican at 63.

BlackRock officials provided a detailed breakdown of survey responses by party affiliation in response to a request from USA TODAY. They said 45% of respondents were Democrats, 42% Republicans and 13% independents.

Retirement fears cut across party lines, even in fractious times

Retirement experts say retirement security is a universal concern, one that cuts across party lines, even in politically fractious times.

“Aging and preparing for a financially secure retirement is an ‘everybody’ issue and an ‘everybody’ opportunity. We’re all in this together,” said Catherine Collinson, CEO of the nonpartisan Transamerica Center for Retirement Studies.

Legislation on retirement security has also enjoyed “a long history of collaboration on both sides of the aisle,” Collinson said. She cited Secure Act 2.0 of 2022, which reaped bipartisan support. That measure rewrote many rules for retirement saving, with a goal of boosting retirement security.

The BlackRock survey provides fresh evidence of two major quandaries that face Americans who are in retirement or approaching it.

The first is a yawning gap between how much Americans save for retirement and how much they think they will need.

The second problem is a gap between when Americans expect to retire and when they actually retire. The average American retires at 62, according to two major retirement surveys. But the average over-50 worker expects to retire closer to 67.

From Harris and Trump, markedly different plans for Social Security

Former President Donald Trump and Vice President Kamala Harris have markedly different platforms on Social Security, a fund that is projected to run short in about a decade.

Harris pledges to “strengthen Social Security and Medicare for the long haul by making millionaires and billionaires pay their fair share in taxes.”

She would presumably follow the lead of President Joe Biden, who has vowed to raise new revenue by going after wealthy tax cheats and by raising tax rates on wealthy individuals and corporations.

Harris may also be alluding to the idea of extending the Social Security payroll tax to higher incomes, according to an analysis by Bankrate, the personal finance site. Workers don’t pay Social Security taxes on earnings above $168,600 in 2024.

Trump has “taken a more ambiguous stance” on Social Security, Bankrate reports, pledging to protect the benefits but not offering details on exactly how. Trump has made a case that economic growth and job creation would naturally boost payroll tax revenues, shoring up Social Security.

The Republican Party platform for 2024 includes a pledge to “fight for and protect Social Security and Medicare with no cuts, including no changes to the retirement age.” Trump has previously supported raising the American retirement age to 70.

When the candidates talk Social Security, older voters listen

Election-year surveys consistently suggest older voters are paying attention to what the candidates say about Social Security.

In a series of polls this summer, AARP has found that voters over age 50 in battleground states are more likely to vote for candidates who “commit to protecting Social Security,” among other issues.

“What they’re looking for is an acknowledgement” from the candidates “that they’re going to do what they can do to preserve Social Security for future generations,” said John Hishta, senior vice president of AARP. “That is one unifying issue that cuts across party lines.”

An annual retirement survey from Transamerica suggests the threat to Social Security ranks among the top five retirement fears of middle-class Americans in 2024.

“Our research finds that millions of Americans – tens of millions of Americans – are at risk of not being able to finance a secure retirement,” Collinson said. “And Social Security is the No. 1 issue on people’s minds.”

According to Transamerica research, the top priorities listed by middle-class Americans for the president and Congress are to fix Social Security’s funding shortfalls, to make health care and prescription drugs more affordable, and to ensure that all workers can save for retirement at work.

More: What if every worker in America were auto-enrolled in retirement savings?

Wealthy Americans share many of the same fears about retirement. In a 2023 report, Transamerica found that retirement security rises with income – but only to a point. Even among Americans with more than $200,000 in household income, the report found, only 42% said they are “very confident” they can maintain a comfortable lifestyle in retirement.

“Even with objectively high net-worth individuals, the idea of retiring and starting to spend your own assets and the threat of running out of money is scary,” said Peter Lazaroff, a certified financial planner in St. Louis. “And it doesn’t matter what your politics are.”

This article originally appeared on USA TODAY: Republicans and Democrats agree: America faces a retirement crisis

Prediction: This Is What Eli Lilly Stock Will Do Next (Hint: It's Not a Stock Split)

With a market capitalization of over $800 billion, Eli Lilly (NYSE: LLY) is the largest pharmaceutical company in the world. Much that is thanks to the rise of glucagon-like peptide-1 (GLP-1) agonists such as Mounjaro and Zepbound, which are fueling a new wave of growth for the company.

Over the past 12 months, its shares have soared 58% — nearly double the gains generated from the S&P 500 and Nasdaq Composite. Given its soaring share price, some investors might think a stock split could be on the horizon. While this is possible, I see it as unlikely. Lilly hasn’t split its stock since October 1997.

Instead, I think the company is going to raise its dividend. Let’s dig into Lilly’s dividend history, and explore why I think a raise could come before year-end.

Eli Lilly’s dividend history

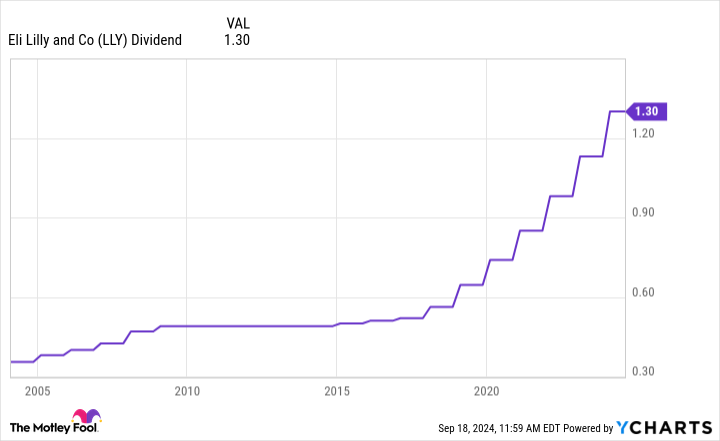

On its corporate website, Eli Lilly’s financial records date back to 1972. Back then, Lilly paid a modest quarterly dividend of just $0.01 per share. Today, investors receive quarterly dividend payments of $1.30 (or $5.20 per year) for each share they own.

While it’s nice to see that Lilly has raised its dividend throughout its history, that hasn’t always been the case. Note in the graph below how between 2009 and 2014 Lilly’s dividend stayed flat. However, the company began to steadily raise its dividend starting in 2015, and this is a theme that has remained to today.

One of the reasons behind the dividend hike in 2015 could have been the approval of Lilly’s diabetes medication Trulicity, which got the nod from the Food and Drug Administration (FDA) in late 2014.

While GLP-1 medicines such as Zepbound and Mounjaro are currently Lilly’s newest bellwethers, the company’s expanded indication for its cancer drug, Verzenio, plus its recent approval for its Alzheimer’s treatment signal further growth ahead.

For these reasons, I think Lilly is positioned for more than just maintaining its dividend, but raising it again.

When does Elil Lilly historically raise its dividend?

Although Lilly started consistently raising its dividend in 2015, investors should be aware of some details around the schedule of these payments. Every year since then, Lilly announced a hike to its dividend payment in December with an ex-dividend date slotted for mid-February.

The bottom line

While I can’t say for certain that Lilly will raise its dividend again this upcoming December, historical trends are on my side. If you do think Lilly is going to announce a dividend hike in December, then you may want to scoop up shares before the ex-dividend date (likely to be sometime in February).

Lilly has enormous potential between GLP-1 treatments, treating Alzheimer’s disease, and even longer-term bets in artificial intelligence. But the bigger idea here is that there is more to investing in Lilly than just its blockbuster drugs. The company offers investors a unique value proposition in that you’re exposed to several cutting-edge areas in the healthcare realm, while also collecting a dividend.

I see Lilly as an under-the-radar passive income opportunity and think now is as good a time as ever to buy shares, whether a dividend hike occurs again in December or not.

Should you invest $1,000 in Eli Lilly right now?

Before you buy stock in Eli Lilly, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Eli Lilly wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $710,860!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 16, 2024

Adam Spatacco has positions in Eli Lilly. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

Prediction: This Is What Eli Lilly Stock Will Do Next (Hint: It’s Not a Stock Split) was originally published by The Motley Fool

1 No-Brainer Electric Vehicle (EV) Stock to Buy With $200 Right Now

It wasn’t long ago that nearly every electric vehicle (EV) stock was soaring in value. In 2021, for example, industry hype was at a fever pitch. Several EV companies — including Rivian Automotive and Lucid Group — debuted on the public markets with great fanfare, while conventional automakers were boasting about plans to aggressively expand their EV lineups.

A lot has changed since then. And after a steep industry sell-off, it’s time to go bargain shopping. One iconic EV stock in particular should be capturing your attention right now.

Is this famous EV stock finally a bargain?

Tesla (NASDAQ: TSLA), the automaker led by the controversial Elon Musk, took the market by storm a decade ago. It’s taken for granted by some today, but it had to prove to a skeptical consumer base that EVs could be beautiful, reliable, and downright fun.

Its multibillion-dollar investments into its charging network, meanwhile, spurred global demand for a vehicle category that, at least at the time, still had a higher total ownership cost than conventional internal-combustion alternatives.

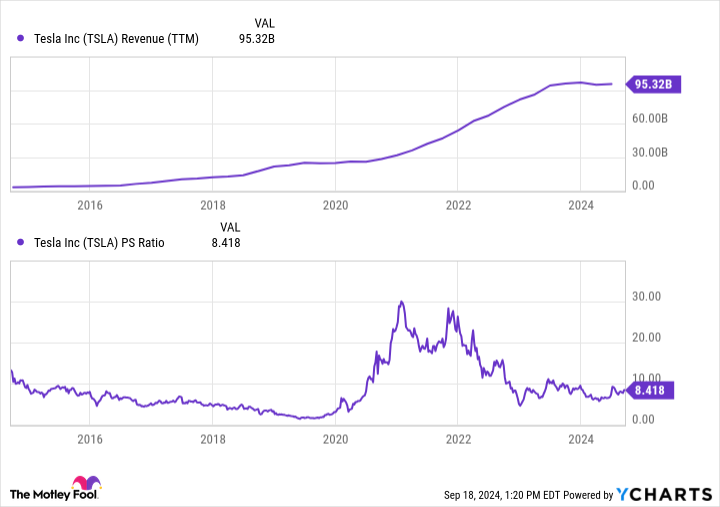

Tesla’s early mover advantage gave it a strong foothold in an industry that had structurally underinvested in its EV lineups. It had the personnel, capital, fan base, and manufacturing capabilities to scale up production rapidly just as EV demand started to take off. From 2018 to 2022, for instance, sales grew by an astounding 357%.

But then a curious thing happened. EV sales in the U.S. continued to climb, but slower than expected. This put a huge dent in the premium valuations the market had formerly assigned to EV stocks.

From 2022 to 2024, for example, Tesla’s valuation fell from nearly 30 times sales to under 10 times sales — a two-thirds reduction over 24 months. Other EV makers like Rivian and Lucid saw similar valuation declines.

More recently, Tesla’s revenue base has not only flattened, but has also declined in certain quarters. To be fair, the stock is still relatively expensive at 8.4 times sales. But if you have been waiting to buy into this iconic EV stock, this could be your chance. One statistic in particular should get you excited.

Tesla is still the king of EVs

While Tesla is involved in other business ventures, including solar energy and battery storage, more than 90% of its revenue base is still tied up in its automotive segment. Its future will be made or broken based on the success of this business, and most of its valuation is related to its fate.

It’s important to keep in mind that it still commands a dominant share of the U.S. EV market. Various estimates peg it with a 50% to 80% market share.

And demand for EVs continues to grow despite a reduction in forecasts. Over the next five years, domestic EV sales are now expected to grow by more than 10% annually, with industry revenue for EVs in the U.S. surpassing $150 billion by 2029.

Globally, EV sales are expected to top $1 trillion by 2029. That’s good news considering Tesla has a projected 39.4% market share globally, greater than the next eight competitors combined.

Put simply, the EV market is still Tesla’s to lose. It has more capital, more brand-name recognition, and more manufacturing capacity than any other competitor. And right now, several conventional automakers are pulling back on their EV plans, potentially allowing the company to maintain its dominant industry position for years to come.

We might look back at 2024 as a clear outlier in Tesla’s long-term growth trajectory. Sales are expected to decline by 8.2% this year. But in 2025, analysts are expecting a rebound, with revenue jumping by 15.8%.

Is the stock still expensive at 8.4 times sales? Absolutely. But its long-term promise remains intact, and the current valuation is a relative bargain compared to years past.

If you believe in EVs long term, it’s hard not to bet on the current industry leader, even if there are some near-term challenges on the road ahead. It would be a speculative bet, but investors who have been eyeing Tesla for years while waiting for a pullback should consider a small investment. If shares continue to decline, it could be a prime opportunity for dollar-cost averaging.

Should you invest $1,000 in Tesla right now?

Before you buy stock in Tesla, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Tesla wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $710,860!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 16, 2024

Ryan Vanzo has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Tesla. The Motley Fool has a disclosure policy.

1 No-Brainer Electric Vehicle (EV) Stock to Buy With $200 Right Now was originally published by The Motley Fool

Qualcomm wants to buy Intel. Would that be enough to overtake Nvidia?

This story originally appeared in The Technology Letter and is republished here with permission.

Most Read from Fast Company

Shares of Intel jumped 3% Friday as The Wall Street Journal’s Lauren Thomas, Laura Cooper, and Asa Fitch reported that Qualcomm has approached Intel about acquiring it for perhaps as much as $90 billion, citing multiple unnamed sources.

The “massive” deal, as the authors put it, is financially daunting, as Qualcomm has just $13 billion in cash and equivalents on its balance sheet against $13 billion of long-term debt. Even a mostly stock exchange would require some large debt raise. Intel, moreover, already has $19 billion of net long-term debt.

The deal is much larger than Qualcomm’s attempted acquisition of NXP Semiconductor in 2016 for $38 billion. That was initiated at a time when Qualcomm had an enormous amount of cash trapped overseas prior to 2017’s Tax Cuts and Jobs Act that let Qualcomm bring it back to the U.S. (Qualcomm ultimately spent $22 billion of repatriated money on buybacks when the NXP deal was canceled.)

The profile of the combination, moreover, would be financially unattractive, as Intel has a 35% gross profit margin to Qualcomm’s 76%. And Qualcomm’s pretax operating margin is near 30%, whereas Intel’s is break-even on an adjusted basis, but actually negative by 15% when all costs are factored in. Intel would immediately dilute Qualcomm’s profit profile.

Assuming, however, Qualcomm could pull it off financially, what are the synergies— meaning, what is to be gained financially and strategically from such a move?

What Qualcomm needs most is diversification, as it is still considered by investors to be a cell phone chipmaker. It still gets about 70% of its chip revenue quarterly from mobile, even though Qualcomm has for several years been selling chips into the Internet of Things (IoT) market and the automotive market.

Buying Intel would immediately make the company the top PC microprocessor and server processor vendor, which would certainly change the profile of the company.

Intel needs to regain its manufacturing prowess. The positive announcements from the company earlier this week included references to the company having “momentum” in getting its newest chip technology, 18A, out the door next year. It’s hard to know what that momentum really means, and whether it’s going to restore Intel to greatness. It’s conceivable Intel needs a helping hand.

Qualcomm, which has no factories of its own, offers, ostensibly, nothing to help Intel in that regard. While it is possible Qualcomm’s higher-margin products could give Intel a much needed financial lifeline that would advance that momentum, I’m not sure throwing money at the problem is the solution. More cooks in the kitchen is not going to streamline the intricate challenge of enhancing Intel’s factory operations.

Moreover, neither company has, individually or collectively, the solution to their mutual problem, Nvidia. While both Intel and Qualcomm have ample artificial intelligence resources, neither has been able to put a dent in Nvidia’s market dominance despite years of trying.

It’s possible that Qualcomm’s CEO, Cristiano Amon, sees something deeper. One possibility is that he sees a grand alliance, of sorts, of Intel’s server chips and Qualcomm’s mobile chips that might somehow box Nvidia out of the AI market as AI moves to mobile phones.

The phenomenon is called in the industry “AI at the edge,” where the server and the handset intelligently apportion the work between them to make the most efficient processing of AI where it makes sense for the available computing resources. One does stuff that’s private and low-resource on the handset, and the really heavy-lifting sorts of AI, in the cloud.

Nvidia doesn’t have a mobile chip offering, so that line of argument has a certain appeal. Moreover, Intel’s substantial assets in what’s called chip “packaging,” the ability to combine multiple chips into one giant chip, could allow for new kinds of mobile products beyond what Qualcomm currently builds with the help of Taiwan Semiconductor Manufacturing.

A grand alliance to defeat Nvidia still faces the problem that Intel’s x86 chip architecture, which dominates PCs and servers, is nowhere in the handset business. It’s not clear the combined efforts of the two companies could make it relevant in that regard, with or without lots of AI capabilities.

You can imagine lots of other, less-glamorous possibilities. Intel is going to spend billions of CHIPS Act funding to build U.S. factories, and perhaps Amon sees the possibility there of boosting Qualcomm’s profile by making it an American-made company.

It’s also possible that Amon simply sees a stock trading too cheaply. Intel shares fetch two times the revenue and 19 times next year’s expected earnings per share, among the lowest multiples in the industry.

For the moment, Qualcomm investors don’t see too much to cheer about. Qualcomm stock was down 3% on the news. Qualcomm has trailed the Nasdaq Composite this year, rising 17% versus 20% for the Index.

This story originally appeared in The Technology Letter and is republished here with permission.

This post originally appeared at fastcompany.com

Subscribe to get the Fast Company newsletter: http://fastcompany.com/newsletters

Fed Rate Cut Fuels Market Rally Amidst Valuation Fears

Wall Street is rejoicing as the Federal Reserve’s half-point rate cut triggers a market rally, even amidst rising apprehensions about inflated valuations.

What Happened: The Federal Reserve’s lenient approach has uplifted the economic forecast, resulting in a jump in U.S. stocks and commodities, and a reduction in bond market volatility.

The Nasdaq 100 experienced its most significant two-week surge since November, dismissing worries that the Fed chief had postponed concluding a two-year fight against inflation.

Nonetheless, inflated valuations are emerging as a substantial hurdle, leaving little margin for mistakes if any event disrupts investors’ large-scale bets, reports Bloomberg.

A model adjusting S&P 500 earnings yields and 10-year Treasury rates for inflation suggests that cross-asset pricing is now higher than at the commencement of all previous 14 Fed easing cycles, typically linked with recessions.

Also Read: Fed Chair Powell’s Signal Sets Stage For Global Rate Cuts As Central Banks Aim To Revive Economy

Lauren Goodwin, economist and chief market strategist at New York Life Investments, cautions that while high prices are just one factor contributing to a multifaceted market environment, they amplify market vulnerability if any other aspect goes awry.

U.S. stocks surged, propelling the S&P 500’s total return for 2024 above 20%. The index leaped 1.7% on Thursday, marking its 39th record close of the year, following the Fed’s rate cut and data indicating labor market resilience.

However, many stock-valuation measures are stretched, including the Buffett indicator, which divides the total market capitalization of U.S. stocks by the total dollar value of the nation’s GDP. This indicator is near a record high, at a time when Warren Buffett has recently downsized some high-profile equity holdings.

Why It Matters: Despite these concerns, the rally in U.S. stocks persists, justified by earnings growth keeping pace with high valuations.

However, the potential for disappointment is high in the Treasury market, where futures trading continues to anticipate more interest-rate cuts than Fed policymakers themselves see as likely over the next year.

Read Next

Brighter Outlook: Goldman Sachs Optimistic On U.S. Economy, Cuts Recession Risk Down To 20%

This content was partially produced with the help of Benzinga Neuro and was reviewed and published by Benzinga editors.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Federal Reserve's Bold Rate Cut, Retail Sales Rise And More: This Week In Economics

The past week was a rollercoaster ride for the financial world, with the Federal Reserve making a bold move, retail sales showing unexpected resilience, and prominent voices sharing their views on the economy. Here’s a quick recap of the top stories that made headlines.

Federal Reserve Slashes Interest Rates

In a surprising move, the Federal Reserve cut interest rates by 0.5% at its September Federal Open Market Committee meeting, marking the first rate cut in over four years. This decision, which broke a 12-month streak of steady rates, caught Wall Street analysts off guard as they had anticipated a more modest 25-basis-point cut. Read the full article here.

Obama-Era Economist Surprised by JD Vance’s Economic Optimism

Betsey Stevenson, a former economic advisor in the Obama administration, expressed her astonishment at Donald Trump’s running mate J.D. Vance and his supporters’ economic optimism despite the Federal Reserve’s recent rate cut. Stevenson stated, “I have to admit that I am pleasantly surprised that J.D. Vance and his supporters think the economy is too strong for the rate cut.” Read the full article here.

See Also: Trump Media & Technology Group Stock Slides As Lockup Expiration Looms: What’s Going On?

Retail Sales Rise More Than Expected

U.S. retail sales rose more than expected by 0.1% month-over-month in August, signaling a resilient consumer spending momentum in the middle of the third quarter. This increase, which was more than anticipated, could boost the chances of a smaller interest rate cut. Read the full article here.

Analyst Warns of Stagflation After Fed’s Rate Cut

Following the Federal Reserve’s deep 50 basis-point cut to its Fed funds rate, an analyst warned of a return of recession along with stagnation. GLJ Research’s Gordon Johnson stated, “Get ready for stagnation,” adding that this is the “inflation is Transitory” mistake all over again. Read the full article here.

Ray Dalio Highlights Challenges for the Fed

Billionaire investor Ray Dalio pointed out the difficulties faced by the U.S. Federal Reserve as it navigates interest rate cuts amid a heavily indebted economy. Dalio emphasized that the Fed must balance keeping interest rates high enough to benefit creditors while not excessively burdening debtors. Read the full article here.

Read Next: Elon Musk Says Warren Buffett Is Positioning For Kamala Harris Win With His $277B Cash Pile

Image via Pexels/ Pixabay

This story was generated using Benzinga Neuro and edited by Navdeep Yadav.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Bragar Eagel & Squire, P.C. Reminds Investors That Class Action Lawsuits Have Been Filed Against Moderna, Lululemon, XPEL, and Nano Nuclear and Encourages Investors to Contact the Firm

NEW YORK, Sept. 21, 2024 (GLOBE NEWSWIRE) — Bragar Eagel & Squire, P.C., a nationally recognized shareholder rights law firm, reminds investors that class actions have been commenced on behalf of stockholders of Moderna, Inc. MRNA, Lululemon Athletica Inc. LULU, XPEL, Inc. XPEL, and Nano Nuclear Energy Inc. NNE. Stockholders have until the deadlines below to petition the court to serve as lead plaintiff. Additional information about each case can be found at the link provided.

Moderna, Inc. MRNA

Class Period: January 18, 2023 – June 25, 2024

Lead Plaintiff Deadline: October 8, 2024

The Complaint alleges that, throughout the Class Period, Defendants made materially false and misleading statements regarding the Company’s business, operations, and prospects. Specifically, the Complaint alleges that Defendants made false and/or misleading statements and/or failed to disclose that: (1) mRNA-1345 was less effective than Defendants had led investors to believe; (2) accordingly, mRNA-1345’s clinical and/or commercial prospects were overstated; and (3) as a result, the Company’s public statements were materially false and misleading at all relevant times.

For more information on the Moderna class action go to: https://bespc.com/cases/MRNA

Lululemon Athletica Inc. LULU

Class Period: December 7, 2023 – July 24, 2024

Lead Plaintiff Deadline: October 7, 2024

According to the complaint, during the class period, defendants failed to disclose to investors: (1) that the Company was struggling with inventory allocation issues and color palette execution issues; (2) that, as a result, the Company’s Breezethrough product launch underperformed; (3) that, as a result of the foregoing, the Company was experiencing stagnating sales in the Americas region; and (4) that, as a result of the foregoing, Defendants’ positive statements about the Company’s business, operations, and prospects were materially misleading and/or lacked a reasonable basis.

Plaintiff alleges that the Company’s stock suffered significant loss after defendants disclosed its financial results for the fourth quarter and full year ended January 28, 2024. Further, after reports regarding the Company’s inconsistent inventory allocation and the Company’s decision to “pause on sales [of the Breezethrough yoga wear] for now to make any adjustments necessary to deliver the best possible product experience,” the stock again declined.

For more information on the Lululemon class action go to: https://bespc.com/cases/LULU

XPEL, Inc. XPEL

Class Period: November 8, 2023 – May 2, 2024

Lead Plaintiff Deadline: October 7, 2024

According to the Complaint, the Company made false and misleading statements to the market. XPEL touted its ability to increase its market share penetration by reaching customers outside of the enthusiast car market. The Company claimed this ability would substantially grow revenues in 2023 and 2024. The Company would eventually admit that it was losing customers in the aftermarket channel. Based on these facts, the Company’s public statements were false and materially misleading throughout the class period. The complaint alleges that when the market learned the truth about XPEL, investors suffered damages.

For more information on the XPEL class action go to: https://bespc.com/cases/XPEL

Nano Nuclear Energy Inc. NNE

Class Period: May 8, 2024 – July 18

Lead Plaintiff Deadline: October 8, 2024

The suit alleges that throughout the Class Period, Defendants made false and/or misleading statements, and failed to disclose material facts, including that: 1) Nano Nuclear Energy, Inc.’s purported progress toward regulatory approval for the design of its planned micro reactors and fuel fabrication plant was nonexistent; 2) Nano Nuclear Energy, Inc.’s timelines for commercialization were wildly optimistic, at best, and most likely impossible; 3) the foregoing issues were likely to have a material negative impact on the Company’s projected revenues and growth; 4) as a result, the Company’s financial position and/or prospects were overstated; and 5) as a result, Defendants’ public statements were materially false and misleading at all relevant times. The suit further alleges that when the truth emerged, Nano Nuclear Energy, Inc. shares fell significantly, damaging investors according to the allegations of the suit.

For more information on the Nano Nuclear class action go to: https://bespc.com/cases/NNE

About Bragar Eagel & Squire, P.C.:

Bragar Eagel & Squire, P.C. is a nationally recognized law firm with offices in New York, California, and South Carolina. The firm represents individual and institutional investors in commercial, securities, derivative, and other complex litigation in state and federal courts across the country. For more information about the firm, please visit www.bespc.com. Attorney advertising. Prior results do not guarantee similar outcomes.

Contact Information:

Bragar Eagel & Squire, P.C.

Brandon Walker, Esq.

Marion Passmore, Esq.

(212) 355-4648

investigations@bespc.com

www.bespc.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.