EVP & CFO Of Adobe Makes $3.35M Sale

Daniel Durn, EVP & CFO at Adobe ADBE, reported an insider sell on September 19, according to a new SEC filing.

What Happened: Durn’s recent move involves selling 6,500 shares of Adobe. This information is documented in a Form 4 filing with the U.S. Securities and Exchange Commission on Thursday. The total value is $3,350,328.

During Friday’s morning session, Adobe shares down by 0.14%, currently priced at $525.7.

Discovering Adobe: A Closer Look

Adobe provides content creation, document management, and digital marketing and advertising software and services to creative professionals and marketers for creating, managing, delivering, measuring, optimizing, and engaging with compelling content multiple operating systems, devices, and media. The company operates with three segments: digital media content creation, digital experience for marketing solutions, and publishing for legacy products (less than 5% of revenue).

Breaking Down Adobe’s Financial Performance

Positive Revenue Trend: Examining Adobe’s financials over 3 months reveals a positive narrative. The company achieved a noteworthy revenue growth rate of 1.86% as of 31 August, 2024, showcasing a substantial increase in top-line earnings. As compared to competitors, the company encountered difficulties, with a growth rate lower than the average among peers in the Information Technology sector.

Evaluating Earnings Performance:

-

Gross Margin: With a high gross margin of 89.76%, the company demonstrates effective cost control and strong profitability relative to its peers.

-

Earnings per Share (EPS): Adobe’s EPS is notably higher than the industry average. The company achieved a positive bottom-line trend with a current EPS of 3.78.

Debt Management: Adobe’s debt-to-equity ratio is below the industry average at 0.42, reflecting a lower dependency on debt financing and a more conservative financial approach.

In-Depth Valuation Examination:

-

Price to Earnings (P/E) Ratio: The P/E ratio of 44.58 is lower than the industry average, implying a discounted valuation for Adobe’s stock.

-

Price to Sales (P/S) Ratio: With a lower-than-average P/S ratio of 11.4, the stock presents an attractive valuation, potentially signaling a buying opportunity for investors interested in sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): Adobe’s EV/EBITDA ratio, lower than industry averages at 29.91, indicates attractively priced shares.

Market Capitalization: Boasting an elevated market capitalization, the company surpasses industry averages. This signals substantial size and strong market recognition.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

The Importance of Insider Transactions

Investors should view insider transactions as part of a multifaceted analysis and not rely solely on them for decision-making.

Considering the legal perspective, an “insider” is defined as any officer, director, or beneficial owner holding more than ten percent of a company’s equity securities, according to Section 12 of the Securities Exchange Act of 1934. This includes executives in the c-suite and major hedge funds. These insiders are mandated to disclose their transactions through a Form 4 filing, to be submitted within two business days of the transaction.

Pointing towards optimism, a company insider’s new purchase signals their positive anticipation for the stock to rise.

Nevertheless, insider sells may not necessarily indicate a bearish view and can be influenced by various factors.

Transaction Codes To Focus On

When analyzing transactions, investors tend to focus on those in the open market, detailed in Table I of the Form 4 filing. A P in Box 3 denotes a purchase,while S signifies a sale. Transaction code C signals the conversion of an option, and transaction code A denotes a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of Adobe’s Insider Trades.

Insider Buying Alert: Profit from C-Suite Moves

Benzinga Edge reveals every insider trade in real-time. Don’t miss the next big stock move driven by insider confidence. Unlock this ultimate sentiment indicator now. Click here for access.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Wealthy Residents In These States Could Feel The Tax Pinch If Harris Wins – Is Yours On The List?

As the possibility of a Kamala Harris presidency looms, high-income earners across the country are increasingly concerned about how potential changes to tax policy might affect their finances.

While wealthy people nationwide could feel the impact, experts suggest that residents of certain states may bear the brunt of the changes.

Don’t Miss:

Cliff Ambrose, founder and wealth manager at Apex Wealth, said that states already saddled with high taxes, such as California and New York, could see the most significant financial hits.

Similarly, Anthony DeLuca, a financial planner at Annuity.org, warns that high-tax and tax-friendly states could face shifts, particularly if federal tax increases are implemented.

Trending: Elon Musk and Jeff Bezos are bullish on one city that could dethrone New York and become the new financial capital of the US. Investing in its booming real estate market has never been more accessible.

“If Kamala Harris wins, states like California and New York are likely to see upper-class paychecks take a hit,” Ambrose told GOBankingRates. “Both states already have high state income taxes and Harris’s proposed tax increases on higher earners could further reduce take-home pay for the wealthy.”

DeLuca agrees, emphasizing that any state with a state income tax will become more burdensome to upper-class members.

Trending: A billion-dollar investment strategy with minimums as low as $10 — you can become part of the next big real estate boom today.

He pointed to New York in particular, where people might face “a 43.9% federal-state capital gains tax” if Harris wins. DeLuca also noted that New York and California are home to the most S&P 500 headquarters, suggesting that the concentrations of major corporations in high-tax states could have wider economic consequences.

States without income taxes may not escape the impact of potential changes.

“In states like Florida, which doesn’t have a state income tax, the impact could come from federal tax increases rather than state-level changes,” Ambrose said.

That suggests even upper-class residents in tax-friendly states could see changes in their paychecks due to possible shifts in federal tax policy.

Trending: Warren Buffett once said, “If you don’t find a way to make money while you sleep, you will work until you die.” These high-yield real estate notes that pay 7.5% – 9% make earning passive income easier than ever.

DeLuca also highlighted New Jersey and Massachusetts as states where upper-class incomes could be significantly impacted. He noted that these states, along with New York and California, “will rise above the 40% mark” in combined federal and state tax rates for high-income earners.

While much attention is on income and capital gains taxes, DeLuca highlighted another critical factor: energy policy. States heavily reliant on fossil fuel industries could experience economic shifts under a Harris administration.

“Wyoming produces 41% of U.S. coal production,” he said. “Any employer or family business grounded in this industry would be at serious risk from [Harris’s] economic and energy administration ideas.”

Trending: Will the surge continue or decline on real estate prices? People are finding out about risk-free real estate investing that lets you cash out whenever you want.

DeLuca also mentioned New Mexico, which accounted for 13% of U.S. crude oil production in 2022, could face challenges if funding shifts toward alternative energy sources.

Understanding the potential changes under a Harris administration involves recognizing they are part of a larger policy agenda. Harris’s proposed tax increases on high earners aim to fund programs like health care and infrastructure, potentially impacting the broader economy.

See Also: This Jeff Bezos-backed startup will allow you to become a landlord in just 10 minutes, and you only need $100.

DeLuca emphasized that many states poised for the most substantial effects on upper-class paychecks are also key national gross domestic product players. This highlights the complex relationship between tax policy, economic growth and income distribution.

It’s important to remember that campaign proposals are just that – proposals. They don’t always become law as envisioned, as any legislative changes must navigate the complexities of Congress.

Read Next:

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

1 Magnificent High-Yield Dividend Growth Stock Down 40% to Buy and Hold Forever

Normally, investors looking for dividend growth wouldn’t expect to find it in the real estate investment trust (REIT) sector. But sometimes there are gems that get overlooked because they don’t conform to the norms. Rexford Industrial Realty (NYSE: REXR) is just such a genre-defying stock. Here are three reasons why this is one magnificent high-yield dividend growth stock you’ll want to consider buying and holding forever.

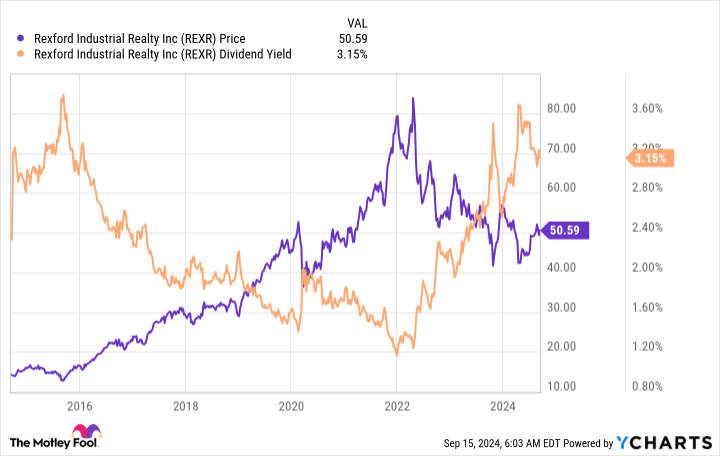

1. Rexford’s yield is attractive

To get the bad news out first, Rexford Industrial’s yield is a little below average for a REIT. Rexford’s dividend yield is 3.3% while the average REIT has a yield of roughly 3.7%. However, when you compare Rexford to the broader market, it looks a lot better. That 3.3% yield is nearly three times larger than the S&P 500 index’s paltry 1.2% yield.

And, thanks to a dramatic pullback in Rexford’s stock price, the dividend yield is also near its highest levels of the decade. So you can find higher-yielding REITs, but Rexford’s yield still looks fairly attractive on both an absolute basis and relative to its own history.

2. Rexford’s dividend growth is hugely attractive

You can’t just look at Rexford Industrial’s yield and call it a day. The REIT’s most impressive dividend statistic is the rate of dividend growth it has achieved over the past decade. REITs are generally known as slow and steady growers; a mid-single-digit dividend growth rate is usually considered quite good. Rexford’s dividend expanded at an annualized rate of 13% over the past decade. That would be a huge number for any company but is downright phenomenal for a REIT.

When you add the dividend growth to the yield, it becomes clear that Rexford is a very attractive growth and income stock. In fact, over roughly the past 10 years the dividend has grown from $0.12 per share per quarter (in 2013) to $0.4175 per share (in 2024). That’s a nearly 250% leap, something that just about any dividend investor would appreciate.

3. Rexford’s business model is differentiated

Rexford is an industrial REIT, which isn’t particularly special in any way. However, it has a unique geographic focus that sets it apart from its peers. Unlike most industrial REITs, which focus on diversification, Rexford has gone all in on the Southern California market. That’s right — it only invests in one region of the United States. There is a clear risk in this approach, but given the company’s strong dividend history, the bet management has made is paying off.

That’s actually not too shocking if you step back and examine the Southern California market. It is the largest industrial market in the United States and ranks as the No. 4 market globally. Notably, it is an important gateway for goods coming to North America from Asia. Being a vital cog in the global supply chain has resulted in high demand, with the Southern California region having a dramatically lower vacancy rate than the rest of the country. Add in supply constraints, and Rexford has been able to increase rates on expiring leases in recent quarters drastically.

Add that tailwind to the REIT’s development plans and acquisitions, and you get a REIT that looks likely to continue rewarding investors very well for years to come.

Dividend growth investors should buy Rexford while they can

So why is Rexford’s stock down 40% or so from its all time highs? The answer really boils down to investor sentiment, which got a bit overheated during the coronavirus pandemic as demand for warehouse space increased along with online shopping. Although the excitement has worn off, Rexford’s business continues to perform well. If you are a dividend growth investor, you should consider buying Rexford and holding on to it for a very long time.

Should you invest $1,000 in Rexford Industrial Realty right now?

Before you buy stock in Rexford Industrial Realty, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Rexford Industrial Realty wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $710,860!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 16, 2024

Reuben Gregg Brewer has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Rexford Industrial Realty and Vanguard Real Estate ETF. The Motley Fool has a disclosure policy.

1 Magnificent High-Yield Dividend Growth Stock Down 40% to Buy and Hold Forever was originally published by The Motley Fool

2 Supercharged Dividend Stocks to Buy If There's a Stock Market Sell-Off

Stock market sell-offs aren’t fun if you’re already fully invested. However, they’re opportunities for those who have cash to deploy. That’s why I always try to keep some cash on the sidelines — so I’m ready to capitalize when Wall Street takes a tumble.

I also keep a watch list of stocks that I know I’d like to buy if they ever fall to more attractive levels, and Realty Income (NYSE: O) and W. P. Carey (NYSE: WPC) are currently at the top of that list. These real estate investment trusts (REITs) already offer supercharged dividend yields. However, they’ll likely become even more attractive during the next market slump.

A model of consistency

Realty Income’s dividend yield at its current share price is over 5%. That’s several times higher than the S&P 500‘s average dividend yield, which is now below 1.4%. This monthly dividend payer has a terrific track record of increasing its payouts: It recently delivered its 108th consecutive quarterly increase and its 127th boost since coming public in 1994.

The diversified REIT owns a portfolio of retail (74.4% of its rent), industrial (14.5%), gaming (3.3%), and other (2.8%) properties, which it rents under triple net lease agreements to high-quality tenants in durable industries. That lease structure makes tenants responsible for all of a property’s operating expenses, including routine maintenance, building insurance, and real estate taxes.

Meanwhile, Realty Income’s typical tenants are in businesses that are resistant to the impact of both recessions and e-commerce competition, such as grocery chains, convenience stores, and pharmacies. These features supply Realty Income with stable rental income.

The REIT pays out about three-quarters of its stable cash flow to investors via dividends. That gives it a big cushion while also allowing it to retain a meaningful amount of cash with which it can expand its portfolio of income-generating properties.

Realty Income believes it can grow its adjusted funds from operations (FFO) by around 4% to 5% annually. That should support continued growth in its high-yielding dividend.

Back to rising after a reset

W. P. Carey shares a lot of similarities with Realty Income. It’s also a diversified REIT that inks triple net lease deals with its tenants. However, it concentrates more on industrial and warehouse properties (64% of its rent), with the balance coming from retail (21%) and other properties (15%). W. P. Carey also has a portfolio of operating self-storage facilities.

The company focuses on owning operationally critical commercial real estate. Because these properties are particularly vital to their tenants, they tend to pay rent on time and renew their leases at market rates. W. P. Carey’s leases also typically have built-in rent escalators that either boost rents at a fixed rate or one tied to inflation. Its rents rose at a 2.9% annualized rate in the second quarter, much faster than the roughly 1% annualized rental growth rate Realty Income expects this year.

W. P. Carey aims to pay out less than three-quarters of its steadily rising rental income via dividends. At the current share price, its payout yields around 5.5%. The REIT aims to grow its dividend by around the same rate as its adjusted FFO. While it cut its dividend by almost 20% late last year following its strategic decision to exit the office sector, it has already increased its payments twice in 2024 (albeit by small amounts). The REIT uses the cash flow it retains and its strong financial profile to expand its portfolio, which should grow its rental income and dividend.

Supercharged income streams

Realty Income and W. P. Carey already offer big-time dividend yields backed by high-quality real estate portfolios that produce stable rental income. Those payouts should steadily rise in the future as the REITs expand their durable portfolios.

However, their stock prices will likely decline during a market sell-off. That makes a downturn a good time to lock in an even higher dividend yield. So if you haven’t done so already, now would be a great time to start building up a bit of a cash reserve. Then you can add these dividend stocks to your watch list so that you’ll be able to supercharge your return potential by picking up shares following the next sell-off.

Should you invest $1,000 in W.P. Carey right now?

Before you buy stock in W.P. Carey, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and W.P. Carey wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $722,320!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 16, 2024

Matt DiLallo has positions in Realty Income and W.P. Carey. The Motley Fool has positions in and recommends Realty Income. The Motley Fool has a disclosure policy.

2 Supercharged Dividend Stocks to Buy If There’s a Stock Market Sell-Off was originally published by The Motley Fool

Don't Let Hidden Debt Fool You: How Cannabis Investors Can Tell If They Are Safe

Why Hidden Debt Matters

Investors often focus on basic financial figures, but it’s essential to consider hidden debt when evaluating a company’s true worth.

Insights from Viridian Capital Advisors reveal that overlooked liabilities can significantly change how we view a company’s value, making it crucial to dig deeper.

- Get Benzinga’s exclusive analysis and the top news about the cannabis industry and markets daily in your inbox for free. Subscribe to our newsletter here. You can’t afford to miss out if you’re serious about the business.

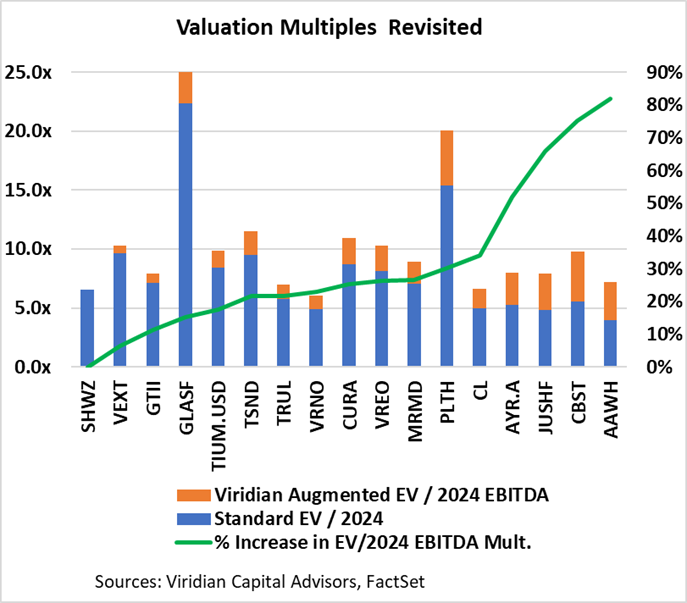

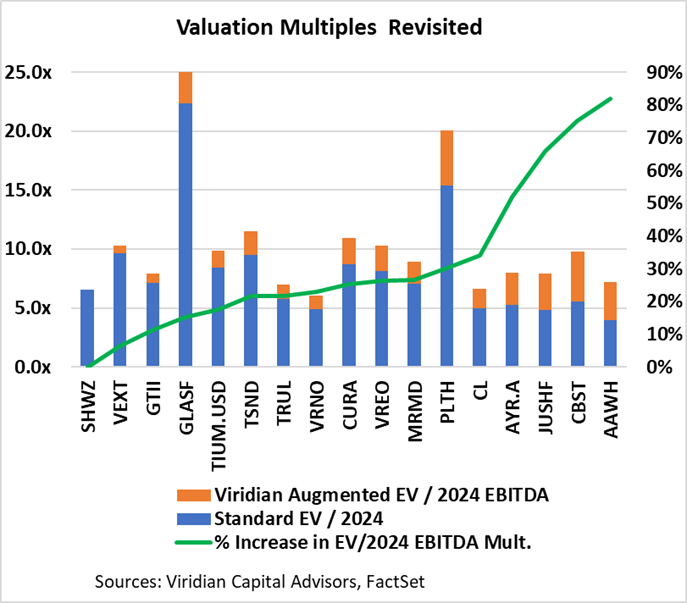

Viridian’s Approach To Valuation

Typically, enterprise value (EV) is calculated using standard methods. However, Viridian takes a more thorough approach by including lease obligations and overdue tax payments.

They also consider long-term tax liabilities that companies have yet to address. This results in a higher debt figure and leads to revised calculations that show companies may be more valuable than initially thought.

The Impact On Investor Decisions

A recent graph compares traditional valuation methods with Viridian’s updated figures. Companies that appeared cheap may be less undervalued than previously believed, particularly those burdened by significant lease or tax liabilities.

Market Perception of Undervalued Cannabis Stocks

Companies like Planet 13 Holdings PLNH and MariMed MRMD, which initially appeared undervalued based on traditional EV/EBITDA multiples, saw significant valuation increases when Viridian Capital’s augmented EV calculations factored in hidden debt. This reveals that investors who overlook these liabilities might mistakenly view these companies as more attractive investments than they truly are.

Impact of Debt on Investor Sentiment

In contrast, companies such as Schwazze SHWZ, Vext Science VEXTF, and Green Thumb Industries GTII show minimal changes in valuation, suggesting cleaner balance sheets that could strengthen investor confidence.

Read Next: 5 Reasons Why Lower Interest Rates Could Boost The Cannabis Industry

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Click on the image for more info.

Cannabis rescheduling seems to be right around the corner

Want to understand what this means for the future of the industry?

Hear directly for top executives, investors and policymakers at the Benzinga Cannabis Capital Conference, coming to Chicago this Oct. 8-9.

Get your tickets now before prices surge by following this link.

One Wall Street Analyst Just Added Palantir to Its Top Investment List and Says It Could Climb 35%. Time to Buy?

Right now is an exciting moment for Palantir Technologies (NYSE: PLTR). It’s set to join the S&P 500 index on Monday, showing that the company is one of today’s leaders.

The stock has soared more than 100% so far this year, even climbing in recent weeks when other tech stocks have stumbled. And Palantir is starting to see big results from the launch of its Artificial Intelligence Platform (AIP) last year.

On top of this, Bank of America recently added Palantir to its list of top investments and predicts the shares could rise 35% from their current level. The bank selected the stock for its U.S. 1 List and expressed optimism about its addition to the S&P 500 and long-term prospects. The list represents the bank’s favorites among its buy-rated stocks.

Is it time to follow Bank of America’s advice and buy Palantir shares? Let’s find out.

Palantir’s biggest growth driver

First, a look at Palantir’s path so far. For many years, the company was associated with government contracts, and these were its biggest growth driver. But in recent times, its U.S. commercial business has emerged as having great potential for Palantir. It has seen these customers increase from just 14 four years ago to nearly 300 today.

And those customers span a wide range of industries. Palantir recently extended its agreement with oil company BP to “improve and accelerate human decision-making” and signed a new deal with fast-food chain Wendy’s that will first focus on decision-making and then include supply chain management and waste prevention.

In the most recent quarter, U.S. commercial revenue soared 55% and commercial-customer count increased 83%, showing strong momentum here. On top of this, the company posted $134 million in net income in the quarter, its highest quarterly profit ever.

Now, let’s consider what’s ahead. The growth we’ve seen in the commercial business along with the fact that it is driven by Palantir’s AIP is reason to be optimistic.

Artificial intelligence is one of today’s highest-growth fields, with companies hoping to use the technology to become more efficient and profitable. AIP is showing these customers and potential customers (through company “boot camps” that allow them to test the platform) how they can do this, and then AIP delivers on those promises — so we could imagine demand for AIP continuing.

Transforming Palantir’s business

CEO Alex Karp emphasizes this idea, saying that demand for AIP “shows no sign of relenting” and that the platform “has already transformed our business.” The general AI market is expected to climb from $200 billion today to $1 trillion later this decade, suggesting that AIP, which is helping customers reach their AI goals, could continue to drive growth at Palantir.

But just because the company’s commercial business is soaring doesn’t mean it has neglected the customers that once were its bread and butter. Its government business continues to excel — in fact, in this recent quarter, for the first time ever, trailing-12-month revenue for the U.S. government business surpassed $1 billion.

Now, let’s return to our question. Is it time to follow Bank of America’s recommendation and buy Palantir stock? Not all analysts are as bullish on it. Actually, the average analyst estimate expects Palantir shares to fall 27% within the coming 12 months.

And the stock isn’t the cheapest around. It actually looks pretty expensive, trading at more than 100 times forward earnings estimates. So, if you’re looking for bargain-priced stocks, Palantir isn’t right for you.

That said, growth companies are often known to trade at steep valuations during certain moments of their story. So if you’re investing in a quality company with plenty of growth ahead, you still can score a win if you buy today and hold on for the long term — even if the shares are pricey today. Palantir has shown that it has what it takes to keep earnings climbing, and the fact that it operates in the high-growth area of AI is another plus.

And all of this means Palantir makes a great investment today for growth investors who have the patience to invest now and stick with this exciting story as many chapters unfold.

Should you invest $1,000 in Palantir Technologies right now?

Before you buy stock in Palantir Technologies, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Palantir Technologies wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $710,860!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 16, 2024

Bank of America is an advertising partner of The Ascent, a Motley Fool company. Adria Cimino has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends BP, Bank of America, and Palantir Technologies. The Motley Fool has a disclosure policy.

One Wall Street Analyst Just Added Palantir to Its Top Investment List and Says It Could Climb 35%. Time to Buy? was originally published by The Motley Fool

Exclusive-US to propose ban on Chinese software, hardware in connected vehicles, sources say

By David Shepardson

WASHINGTON (Reuters) -The U.S. Commerce Department is expected on Monday to propose prohibiting Chinese software and hardware in connected and autonomous vehicles on American roads due to national security concerns, two sources told Reuters.

The Biden administration has raised serious concerns about the collection of data by Chinese companies on U.S. drivers and infrastructure as well as the potential foreign manipulation of vehicles connected to the internet and navigation systems.

The proposed regulation would ban the import and sale of vehicles from China with key communications or automated driving system software or hardware, said the two sources, who declined to be identified because the decision had not been publicly disclosed.

The move is a significant escalation in the United States’ ongoing restrictions on Chinese vehicles, software and components. Last week, the Biden administration locked in steep tariff hikes on Chinese imports, including a 100% duty on electric vehicles as well as new hikes on EV batteries and key minerals.

Commerce Secretary Gina Raimondo said in May the risks of Chinese software or hardware in connected U.S. vehicles were significant.

“You can imagine the most catastrophic outcome theoretically if you had a couple million cars on the road and the software were disabled,” she said.

President Joe Biden in February ordered an investigation into whether Chinese vehicle imports pose national security risks over connected-car technology – and if that software and hardware should be banned in all vehicles on U.S. roads.

“China’s policies could flood our market with its vehicles, posing risks to our national security,” Biden said earlier. “I’m not going to let that happen on my watch.”

The Commerce Department plans to give the public 30 days to comment before any finalization of the rules, the sources said. Nearly all newer vehicles on U.S. roads are considered “connected.” Such vehicles have onboard network hardware that allows internet access, allowing them to share data with devices both inside and outside the vehicle.

The department also plans to propose making the prohibitions on software effective in the 2027 model year and the ban on hardware would take effect in January 2029 or the 2030 model year. The prohibitions in question would include vehicles with certain bluetooth, satellite and wireless features as well as highly autonomous vehicles that could operate without a driver behind the wheel.

A bipartisan group of U.S. lawmakers in November raised alarm about Chinese auto and tech companies collecting and handling sensitive data while testing autonomous vehicles in the United States.

The prohibitions would extend to other foreign U.S. adversaries, including Russia, the sources said.

A trade group representing major automakers including General Motors, Toyota Motor, Volkswagen, Hyundai and others had warned that changing hardware and software would take time.

The carmakers noted their systems “undergo extensive pre-production engineering, testing, and validation processes and, in general, cannot be easily swapped with systems or components from a different supplier.”

The Commerce Department declined to comment on Saturday. Reuters first reported, in early August, details of a plan that would have the effect of barring the testing of autonomous vehicles by Chinese automakers on U.S. roads. There are relatively few Chinese-made light-duty vehicles imported into the United States.

The White House on Thursday signed off on the final proposal, according to a government website. The rule is aimed at ensuring the security of the supply chain for U.S. connected vehicles. It will apply to all vehicles on U.S. roads, but not for agriculture or mining vehicles, the sources said.

Biden noted that most cars are connected like smart phones on wheels, linked to phones, navigation systems, critical infrastructure and to the companies that made them.

(Reporting by David Shepardson in Washington; Editing by Lananh Nguyen, Paul Simao and Matthew Lewis)

Have $500? 2 Absurdly Cheap Stocks Long-Term Investors Should Buy Right Now

Just because the stock market is near all-time highs doesn’t mean all stocks are expensive. Sure, you might refer to the stock market as a thing, but it’s really a collection of thousands of companies — each with its own story. You could say that Wall Street isn’t a stock market, but a market of stocks.

In other words, there is always a deal somewhere. You just have to know where to look.

Here are two growth stocks trading at compelling prices. One trades near all-time highs, and the other has fallen 65% from its peak. You can own shares of both companies for less than $500 today.

Here is the story behind each one.

1. An e-commerce giant trading near all-time highs

E-commerce and cloud computing giant Amazon (NASDAQ: AMZN) is already a historically lucrative investment. Yet, today, the stock has more to offer despite Amazon’s nearly $2 trillion market cap. Amazon is the top U.S. online retailer with 38% market share, and the top global cloud platform with 31%. The great thing is that both businesses still have more growth ahead. E-commerce is still just 16% of total retail in the U.S., and Amazon still has a long road ahead in underpenetrated niches like grocery and pharmacy. Meanwhile, the global cloud market is poised to grow due to artificial intelligence (AI) and digitalization, as companies shift from on-premise computer systems to the cloud.

Analysts believe Amazon can grow earnings by an average of 27% annually for the next three to five years. Today, the stock trades at 39 times Amazon’s estimated 2024 earnings. That forward price-to-earnings is an attractive price point for a company growing its bottom line this fast. Additionally, suppose you value the stock by its operating cash flow, which gives investors a look at Amazon’s profits before it reinvests in the business. In that case, the valuation is near a decade low.

Amazon stock is trading within shouting distance of all-time highs. But fundamentally speaking, long-term investors still have an opportunity to acquire a wonderful business at an attractive price today.

2. This energy drink brand has fallen from its lofty perch

Energy drink brand Monster is a famously successful stock, but Celsius (NASDAQ: CELH), an up-and-coming energy drink brand, has emerged to challenge Monster’s market share and stock returns. Celsius has exploded in popularity over the past five years, resulting in more than 6,000% investment returns at the stock’s peak. However, the stock has fallen 65% from those highs, and now investors must decide whether the company’s fundamentals can lift Celsius stock back to its former glory.

Ultimately, Celsius enjoyed rampant growth during the pandemic’s height. Then PepsiCo invested in the company and helped Celsius expand its distribution, further turbo-charging growth. However, this growth spurt has ended, and revenue growth slowed sharply this year, explaining the stock’s struggles.

It’s fair that the stock would earn a lower valuation as growth slows, but Celsius could now be approaching a point that interests investors again. The company is still taking market share — Celsius grew sales by 23% year over year in the second quarter in an industry growing at a low-single-digit rate. Celsius is highly profitable, and analysts believe it will grow its earnings by an average of 16% annually for the next three to five years.

The company’s stock trades at a forward P/E of 40 today. That valuation and growth rate produce roughly the same price/earnings-to-growth (PEG) ratio Monster trades at today. Yet, Celsius is the company taking market share in the U.S., and it has a tremendous opportunity in international markets.

The stock’s decline has made Celsius an attractive long-term idea worth considering today. Still, it’s impossible to call a bottom on a declining stock, so investors who believe in Celsius’ long-term potential should buy shares slowly to avoid jumping in too aggressively.

Should you invest $1,000 in Amazon right now?

Before you buy stock in Amazon, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Amazon wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $722,320!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 16, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Justin Pope has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Amazon, Celsius, and Monster Beverage. The Motley Fool has a disclosure policy.

Have $500? 2 Absurdly Cheap Stocks Long-Term Investors Should Buy Right Now was originally published by The Motley Fool

Mark Cuban Embraces Elon Musk's Humor: 'I Have No Problem Throwing Elon Under The Bus, But I'll Save It For When It's Truly Deserved'

In the wake of a recent Secret Service probe into Elon Musk‘s online remarks, billionaire entrepreneur Mark Cuban has come to the defense of the Tesla Inc. CEO’s contentious social media conduct.

What Happened: In a recent podcast interview, Cuban characterized Musk’s online conduct as “kind of insane” but not out of character for the Tesla chief.

The dialogue ensued following Musk’s recent jest about pop icon Taylor Swift‘s endorsement of Vice President Kamala Harris for the presidency. Cuban, who has previously corresponded with Musk, stood up for the tycoon’s comedic style. In the interview Cuban said that Musk’s joke was “kind of insane” and defended him by saying “that’s just the kind of banter you’d expect from him.”

Cuban also said that he sent Musk a text once adding that they’re “not friends” but have communicated in the past.

“We just texted back and forth a few times and he had just had a child, and I said: ‘Congrats on your 90th child,’” Cuban said during the interview.

“And his response was — ‘Mars needs people.’ Right, so that’s just Elon’s sense of humor, right? I have no problem throwing Elon under the bus, but I’ll save it for when it’s truly deserved,” he said.

Also Read: Mark Cuban Asks Elon Musk Why He’s Losing Followers Despite Paying For Twitter Blue

Musk’s digital behavior has previously gotten him into trouble. In 2018, a tweet about making Tesla a private company resulted in a $40 million agreement with the Securities and Exchange Commission.

More recently, a tweet speculating about a potential assassination attempt on former President Donald Trump triggered a Secret Service investigation.

The Secret Service verified to Bloomberg that they were cognizant of Musk’s tweet but refrained from further comments due to ongoing enforcement actions. Musk removed the tweet on the same day, subsequently tagging it as a joke.

Why It Matters: Musk’s social media behavior has been a topic of controversy and legal scrutiny in the past. His tweets have not only led to legal consequences but also impacted Tesla’s stock performance.

Cuban’s defense of Musk’s online conduct highlights the ongoing debate about the role and impact of social media in the corporate world, especially when used by high-profile executives.

This incident underscores the potential legal and reputational risks associated with such behavior.

Read Next

Elon Musk Reacts After Mark Cuban Says He Would Buy X ‘In A Heartbeat’

This content was partially produced with the help of Benzinga Neuro and was reviewed and published by Benzinga editors.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Boeing stock at 52-week lows as plane maker furloughs workers to preserve cash

After a tumultuous year, the last thing Boeing needed was a union strike.

Shares of the aircraft manufacturing giant touched new 52-week lows on Friday as a labor dispute involving its largest unionized workforce — the International Association of Machinists and Aerospace Workers (IAM) — was set to enter into a second week.

“Boeing — its entire infrastructure, its entire founding, if you will — right now is under severe stress. I think they’re going to be forced to try to settle this as quickly as they can,” Mike Boyd, president of aviation research and consulting company Boyd Group International, told Yahoo Finance in a recent interview.

It’s estimated that the first full week of the strike has already cost Boeing’s workers and shareholders at least $571 million, according to consulting firm Anderson Economic Group.

This past week, Boeing laid out aggressive cost-cutting measures culminating in the announcement of temporary furloughs expected to impact “a large number” of executives, managers, and employees.

“While this is a tough decision that impacts everybody, it is in an effort to preserve our long-term future and help us navigate through this very difficult time,” Boeing’s CEO Kelly Ortberg wrote in a note to employees on Wednesday.

Ortberg, who took over the CEO job last month, said he and his leadership team would also take a pay cut for the duration of the strike.

While Moody’s recently placed Boeing’s credit rating under review, S&P Global said its status is safe for now, provided the strike is short-lived.

“A shorter strike, on the order of weeks, would likely be manageable for Boeing and not lead to a negative rating action. However, we believe an extended strike would be costly and difficult to absorb, given the company’s already strained financial position,” said S&P said in a statement this week.

Wall Street analysts anticipate the company will seek to raise cash by selling stock. At the end of the second quarter, Boeing had roughly $58 billion in total debt and $12.6 billion in cash.

“BA could target liquidity to support debt paydown over the next 18 months,” wrote Jefferies analysts in a recent note.

It remains to be seen how patient investors will be about the ongoing dispute at a time when the company is aiming to ramp production of its bestselling 737 Max jets to 38 per month by the end of the year, up from roughly 25 per month in June and July.

Morningstar equity analyst Nicolas Owens wrote in a recent note that Boeing’s relationship with its machinist union has been “contentious” for decades and that he expects the strike could last through the holidays until the end of the year.

The analyst lowered his price target on the stock to $216 per share from $219 to reflect loss of productivity in the fourth quarter of 2024 and slowing production ramp-ups in subsequent periods.

“[Boeing has] a lot of pressure to get their assembly line in good order,” Owens told Yahoo Finance on Monday. “And the strike interferes with that and delays any progress they were making on basically recertifying their assembly process for planes like the 737.”

IAM members went on strike last Friday after rejecting a contract offer from Boeing. The incident is a test of the company’s new management and recovery from a series of mishaps this year.

In early January, the fuselage of a 737 Max 9 ripped open during an Alaska Airlines (ALK) flight, sparking a series of regulatory investigations, a production overhaul, and a CEO replacement.

Last month Ortberg, an aerospace industry veteran and Boeing outsider, took over the top job at the company.

At a Morgan Stanley conference, CFO Brian West recently noted “good momentum” prior to the strike, with “ramping production, while, at the same time, incorporating significant improvements” into the manufacturer’s quality and production system.

The union and Boeing met on Tuesday and Wednesday with a mediator to facilitate talks.

Boeing is “ready to hammer out an agreement,” a source close to the negotiations told Yahoo Finance earlier this week.

But after two full days of mediation, the two sides seemed far apart.

“Throughout the day, we conveyed the priorities of our members to the company via the mediator. Unfortunately, mediation concluded today without reaching any resolution,” read an update on IAM’s website.

The update said there are no additional discussion dates scheduled.

Boeing shares are down more than 35% year to date. The company is expected to report quarterly results next month.

Ines Ferre is a senior business reporter for Yahoo Finance. Follow her on X at @ines_ferre.

Click here for the latest stock market news and in-depth analysis, including events that move stocks

Read the latest financial and business news from Yahoo Finance