Kevin O'Leary's Dad Warned Him He'd 'Starve To Death' If He Pursued His Passion. Getting An MBA Ended Up Changing His Life

Kevin O’Leary, the outspoken investor known as “Mr. Wonderful” from Shark Tank, didn’t always plan on being a business mogul. His first love was something completely different: photography.

Fresh out of high school, Kevin dreamed of turning his passion into a career. He even set up a lab in his basement and was doing everything he loved. But his father had a harsh dose of reality for him.

Don’t Miss:

“You’re not good enough and you’ll starve to death,” his dad bluntly told him. His father pushed him to go to college and earn a degree, telling him not to follow his heart. This tough love turned out to be some of the best advice Kevin could have received, even though it might have felt like his aspirations were being dashed.

When I first wanted to be a photographer, My dad told me I wasn’t good enough—I’d starve. So, I got an MBA and ended up building and selling a company for $4.2 billion. It all came together—business, creativity, and the drive to win. I wouldn’t change a thing. pic.twitter.com/Xv8ttJFk2V

— Kevin O’Leary aka Mr. Wonderful (@kevinolearytv) September 17, 2024

Trending: General Motors and other leaders revealed to be investing in this revolutionary lithium start-up — allowing easy entry by launching at just $9.50/share with a $1,000 minimum.

Kevin took his father’s advice and went to college, eventually earning an MBA. Though it wasn’t part of his original plan, this degree would later be a game-changer. He soon found a way to merge his passion for photography and production with his business skills, launching his first company, Special Event Television, which produced programming for East Coast hockey games.

That first venture set the stage for a highly successful career. Kevin and his co-founders eventually sold the company and Kevin used the money to start his next venture, a software business called Softkey, which he later sold for $4.2 billion.

Trending: Unlock a $400 billion opportunity by investing in the future of EV infrastructure on this startup already valued at $50 million with just $500.

Still in his mid-30s, Kevin decided to retire and live the kind of financially independent life that most of us can only imagine. He traveled the world, visiting the most beautiful beaches and other stunning locations. However, something unexpected happened – he found himself bored in spite of the luxury and endless travel. “I went to every beach on Earth,” he says, but after three years, “It was really boring.”

Trending: Elon Musk and Jeff Bezos are bullish on one city that could dethrone New York and become the new financial capital of the US. Investing in its booming real estate market has never been more accessible.

The excitement of creating something, taking chances and participating in the business world was something he missed. Retirement proved unsatisfactory, even though it seemed like the ultimate goal.

Apart from his father giving him tough advice, Kevin also credits his mother for giving him some of the best financial advice he ever received. She taught him and his brother a simple but effective lesson: “Boys, never spend the principal, only the interest.” Although he didn’t fully understand it then, this lesson has guided him throughout his life and career.

Kevin O’Leary’s life story shows that success typically doesn’t follow a straight line but often involves following difficult-to-hear advice.

Read Next:

UNLOCKED: 5 NEW TRADES EVERY WEEK. Click now to get top trade ideas daily, plus unlimited access to cutting-edge tools and strategies to gain an edge in the markets.

Get the latest stock analysis from Benzinga?

This article Kevin O’Leary’s Dad Warned Him He’d ‘Starve To Death’ If He Pursued His Passion. Getting An MBA Ended Up Changing His Life originally appeared on Benzinga.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

3 Stocks to Take Advantage of the Next Wave of Artificial Intelligence (AI) Investing

Nvidia has been the king of the first wave of artificial intelligence (AI) investing. Its graphics processing units (GPUs) are being purchased by the truckload by the biggest cloud computing and AI modeling companies. Eventually, if they have all the computing power they want, Nvidia’s business would decline as new computing capacity wouldn’t be needed.

This will give way to the next wave of AI investments, and if you’re looking to cash in on this trend, I’ve got three companies that are slated to do well.

Cloud computing is going to grow tremendously

The next wave will benefit companies currently training and developing AI models or those offering cloud computing services to companies developing AI. The major cloud computing players are Amazon (NASDAQ: AMZN), Microsoft (NASDAQ: MSFT), and Alphabet (NASDAQ: GOOG) (NASDAQ: GOOGL). As the industry leaders, they have been some of the largest purchasers of Nvidia’s GPUs in recent quarters.

All three also have affiliations with generative AI models, with Amazon and Microsoft investing in and partnering with Anthropic and Open AI, respectively. Alphabet is developing its generative AI model, Gemini, in-house. With all three companies having strong ties to top-tier generative AI models, they have properly positioned themselves to provide users with the tools they need to create AI models.

However, having a generative AI model for cloud computing clients is just table stakes for a much larger game. Many workloads are still processed on-site at businesses around the globe. While some of these workloads may never migrate to the cloud, a large majority will. This is why the cloud computing market opportunity is expected to increase from $676 billion in 2024 to $2.3 trillion by 2032, according to Fortune Business Insights.

Because it is easy to scale up or down the computing power you rent in the cloud, it is ideal for training in-house AI models, as businesses don’t have to buy expensive computing power from companies like Nvidia permanently. With the general trend toward the cloud being accelerated by AI demand, it’s clear this will be a huge investment trend.

But does that make all three stocks buys?

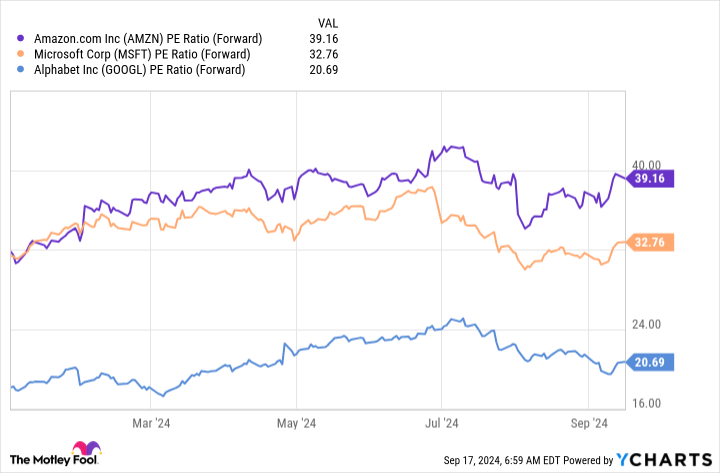

All three stocks have unique price points

The wrinkle with each of these companies is that cloud computing isn’t the only thing they do. While cloud computing continues to be one of the best (if not the best) performing segments in each of these businesses, other core businesses steer the stocks. Additionally, the prices you must pay for the stocks vary widely.

Amazon is the most expensive, but that’s because it has the most potential in cloud computing. Amazon Web Services (AWS) is the market leader in cloud computing. But because Amazon’s ancillary businesses are all fairly low-margin, AWS accounts for 64% of its operating profit despite only contributing 18% of revenue. This means that if AWS sees brisk growth, Amazon’s profits will quickly rise, decreasing Amazon’s expensive valuation rapidly.

Although Amazon technically is more expensive from a forward price-to-earnings (P/E) ratio, I’d argue that Microsoft is the most expensive. Its business has steadily grown revenue, but its profit margins have remained relatively flat. As a result, there really isn’t any big upside for Microsoft; it must maintain its status quo to retain its premium price tag.

Last is Alphabet, which is actually cheaper than the broader market (measured by the S&P 500, which trades at 22.7 times forward earnings). Alphabet doesn’t have the premium valuation of its peers because it has been behind on several key product launches, but that doesn’t mean it can’t be a solid investment. Alphabet has much to gain from its cloud computing wing because it is just starting to turn profitable and could be a huge boost to profits as it moves toward AWS-like margins.

All three cloud computing businesses have merits, but Amazon and Alphabet stand out as better investment options than Microsoft right now, solely based on their potential to grow profits.

Should you invest $1,000 in Amazon right now?

Before you buy stock in Amazon, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Amazon wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $710,860!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 16, 2024

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Keithen Drury has positions in Alphabet and Amazon. The Motley Fool has positions in and recommends Alphabet, Amazon, Microsoft, and Nvidia. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

3 Stocks to Take Advantage of the Next Wave of Artificial Intelligence (AI) Investing was originally published by The Motley Fool

Trump Family's Crypto Venture Revealed: New Buying Rules, Who Can Invest and What It Means for Early Adopters

The team behind Donald Trump‘s latest crypto venture, World Liberty Financial, took over two hours to release the key detail many were waiting for at Monday night’s event on X.

The suspense finally ended when they revealed who could buy the forthcoming tokens and how shares would be distributed. Billed as the next big step for the former president and his family, this launch had built up anticipation for weeks.

Don’t Miss:

Zak Folkman, one of the project’s founders, explained that the platform’s WLFI token will be divided among several groups. “Twenty percent of the tokens are set aside for the founding team,” he said, referring to a group that includes the Trumps.

Another 17% will go toward user rewards, while the remaining 63% of tokens will be publicly available. He emphasized, “There will be no presales or early buy-ins.”

Trending: According to Cathie Wood, holding 6 Ethereum (ETH) could make you a millionaire, here’s why it can be true.

This was a crucial clarification, as an earlier draft of the project’s outline, which had been leaked, raised eyebrows. The draft indicated that the founders would control 70% of the tokens, leading many to worry that it might just be another quick-cash scheme.

The structure of the offering, a Regulation D token offering, allows World Liberty Financial to raise funds without registering with the Securities and Exchange Commission (SEC), as long as they meet certain criteria. This led to a conversation about how the SEC, under its chair Gary Gensler, has been regulating the crypto industry, often using enforcement actions instead of clear guidelines.

Trending: If there was a new fund backed by Jeff Bezos offering a 7-9% target yield with monthly dividends would you invest in it?

Trump himself was part of the action, speaking openly about his initial lack of interest in crypto. “I wasn’t overly interested,” Trump said, adding that his perspective changed when his children introduced him to crypto through the success of his non-fungible token collections. “I think my children opened my eyes more than anything else,” he remarked.

The event took place against an unusual backdrop for Trump. Just the day before, there was an alleged assassination attempt while Trump was golfing with Steve Witkoff, his longtime friend and a key figure in World Liberty Financial.

Trending: One trailblazing female with an expertise in renewable energy built a company that’s bringing the EV revolution to disadvantaged communities — here’s how you can invest at just $500

The incident took place at Trump’s West Palm Beach golf club and the FBI has been investigating. Despite the dramatic incident, Witkoff joined Trump for Monday’s event, where he spoke about how the venture began.

Witkoff recounted how his son had introduced him to two young crypto entrepreneurs, Chase Herro and Zak Folkman, who convinced him that decentralized finance (DeFi) could be the future of money.

“These guys are as sharp as any currency traders I’ve ever met,” Witkoff said. He then described how he brought the Trump family into the fold. “We had a meeting with Eric, Don Jr., the president and his counsel. We’ve been on it for close to nine months,” he revealed.

Trending: During market downturns, investors are learning that unlike equities, these high-yield real estate notes that pay 7.5% – 9% are protected by resilient assets, buffering against losses.

The similarities between World Liberty Financial and Trump’s previous project, Trump Media & Technology Group, didn’t go unnoticed. Like the media company that launched the conservative social platform Truth Social, this crypto venture is expected to turn heads.

However, despite the Trump family’s involvement, they do not own or manage the platform. Eric Trump and Steve Witkoff are the two figures at the helm and both are new to the crypto space. Though Trump has been warming to crypto in recent months, even delivering a keynote at the largest bitcoin event in July, the public remains curious – and cautious – about this new project.

The founders were tight-lipped about plans, offering little clarity on timelines. The only clue provided was that updates would come through official channels and they warned fans to be wary of scammers eager to take advantage of the buzz surrounding the project.

Read Next:

UNLOCKED: 5 NEW TRADES EVERY WEEK. Click now to get top trade ideas daily, plus unlimited access to cutting-edge tools and strategies to gain an edge in the markets.

Get the latest stock analysis from Benzinga?

This article Trump Family’s Crypto Venture Revealed: New Buying Rules, Who Can Invest and What It Means for Early Adopters originally appeared on Benzinga.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trump's New Crypto Venture's Legal Counsel Accused Of Attempting To Seize Control Of Rival Firm

The legal counsel for former President Donald Trump’s new cryptocurrency venture, World Liberty Financial (WLFI), a new decentralized finance (DeFi) platform has been accused of trying to seize control of another digital asset company.

What Happened: Alex Golubitsky, the general counsel for World Liberty Financial, was previously fired from a different cryptocurrency company, Umami, in January 2023.

Following his dismissal, Golubitsky allegedly attempted to take over Umami, according to the company’s CEO, Alex O’Donnell, reported Business Insider, citing court documents.

Trump announced his association with World Liberty Financial on Monday, although his official role remains unclear.

He is listed as the “chief crypto advocate” in a company white paper. Three of Trump’s children, including his youngest son Barron Trump, are also linked to the venture.

After his dismissal from Umami, Golubitsky and another former employee reportedly appointed themselves to Umami’s board and tried to take the company’s intellectual property.

A Delaware vice chancellor ruled in O’Donnell’s favor last year and awarded O’Donnell over $375,000 in legal fees and costs, the report noted.

Other key employees of World Liberty Financial, including Chase Herro and Zachary Folkman, have also faced scrutiny for their professional pasts.

Their previous crypto venture, Dough Finance, was hacked this summer, resulting in the theft of over $2 million from users.

Why It Matters: Trump’s foray into the crypto space with World Liberty Financial was officially announced during a live X, formerly Twitter, Spaces event, marking his formal embrace of blockchain technology.

His interest in cryptocurrencies was largely influenced by the success of his NFT collection and the influence of his children, according to the former President.

The venture has already sparked concerns, with Ethereum co-founder Charles Hoskinson expressing reservations about the platform becoming a political issue.

The 2024 election outcome could also significantly impact Bitcoin’s price, with a Trump victory potentially propelling Bitcoin to new heights, according to a Bernstein report.

Read Next:

Disclaimer: This content was partially produced with the help of Benzinga Neuro and was reviewed and published by Benzinga editors.

Image created via photos on Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

2 Ultra-High-Yield Dividend Stocks You Can Buy and Hold for a Decade

If you are an income investor looking at the S&P 500‘s miserly 1.3% dividend yield and feeling glum, don’t despair. You can find attractive higher-yielding stocks if you look hard enough. The list today includes W.P. Carey (NYSE: WPC) and its 5.5% yield and Bank of Nova Scotia (NYSE: BNS) and its 6% yield. Although both come with some warts, they are still the kinds of stocks that you can buy and hold for a decade (or more!). Here’s a quick look at each one.

Why you should consider buying dividend cutter W.P. Carey

How can a company that just cut its dividend at the start of 2024, even though it has a hefty 5.5% yield, be the type of stock any dividend investor would want to own? It is important to understand why this real estate investment trust (REIT) cut its dividend.

For many years W.P. Carey had been reducing its exposure to office properties, which were a part of its highly diversified net lease portfolio (a net lease requires tenants to pay most property-level operating costs). But after the pandemic lockdowns ended management came to the conclusion that a rapid exit was in the best long-term interest of the business and its shareholders. So it ripped the bandage off. But office represented 16% of rents. That was just too large a piece of the rental pie to eliminate without trimming the dividend.

There are two interesting things to consider. First, W.P. Carey has already gotten back into its normal cadence of quarterly dividend increases. Clearly, the cut was related to the office exit, not some terrible fundamental problem. Second, the office exit has left W.P. Carey’s liquidity at an all-time high. That means it has a pile of cash to invest that will help to spur long-term growth. So the cut was a hard pill to swallow, but it has set W.P. Carey up for a brighter future. The risk here seems fairly minimal while the potential rewards are already high and likely to go even higher.

Why has Bank of Nova Scotia hit the pause button on dividend growth?

Bank of Nova Scotia, normally just called Scotiabank, didn’t cut its dividend. However, it has stopped increasing the dividend for at least a year. Most long-term dividend investors will recognize that this can be a sign of trouble at dividend-paying companies. So what’s going on? Scotiabank is dealing with a business revamp.

Historically, large Canadian banks like Scotiabank have opted to expand into the U.S. But Scotiabank went down a different path, expanding in Latin America. The logic was sound, given that the region has less competition and is filled with emerging economies that offer greater growth prospects than mature ones like the U.S. But Latin America hasn’t been a big win, thanks to the higher risks inherent in emerging markets. Scotiabank has trailed its peers on key metrics like earnings growth, non-interest revenue growth, and return on equity.

The company has taken a good look at its geographic exposure and decided it needs to shift gears, which will be a multiyear effort. The dividend pause is intended to give management the breathing room to make changes. The big moves are going to be the exit of less desirable markets (Colombia) and a renewed focus on more desirable ones (Mexico and the U.S.). To this end, it has already announced plans to buy nearly 15% of Keycorp (NYSE: KEY).

The goal is to create a North American banking giant, which is more in line with what its peers are doing. If that sounds reasonable to you, then the bank’s hefty 6% dividend yield will probably be worth a deep dive. Note, also, that Scotiabank has paid a dividend every year since 1833, so this is not some fly-by-night bank.

More yield, not that much more risk

With the market’s yield so low, finding ultra-high-yield dividend stocks is likely to require taking on some added risk. The key for investors is to find a balance between yield and risk that is favorable and likely being misjudged by the market. That’s exactly the case with dividend cutter W.P. Carey, which has set itself up for faster growth in the future. It’s also the case for Bank of Nova Scotia, which is taking a breather so it can revamp the business. Either one would likely be a good long-term addition to most dividend portfolios.

Should you invest $1,000 in W.P. Carey right now?

Before you buy stock in W.P. Carey, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and W.P. Carey wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $722,320!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 16, 2024

Reuben Gregg Brewer has positions in Bank Of Nova Scotia and W.P. Carey. The Motley Fool recommends Bank Of Nova Scotia. The Motley Fool has a disclosure policy.

2 Ultra-High-Yield Dividend Stocks You Can Buy and Hold for a Decade was originally published by The Motley Fool

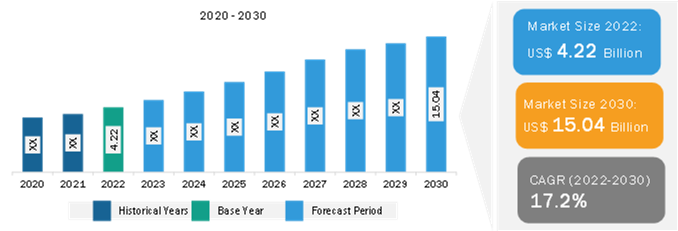

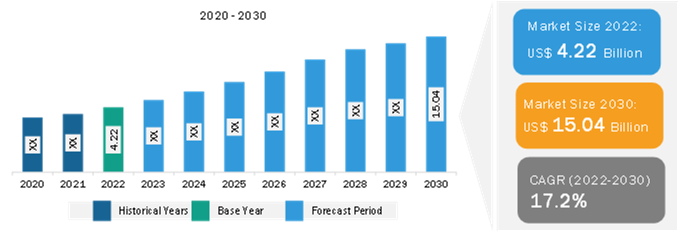

Digital English Language Learning Market Worth $15.03 Billion, Globally, by 2030 – Exclusive Report by The Insight Partners

US & Canada, Sept. 20, 2024 (GLOBE NEWSWIRE) — According to a new comprehensive report from The Insight Partners, the tremendous progress in the information and communication technology (ICT) industry has brought a paradigm shift in various business sectors, including education sector, which is contributing to the Digital English Language Learning market growth. Digitalization has had a far-reaching impact on the education sector, where the power of technology has been harnessed to simplify learning processes by making them more interactive for students, thus propelling the market growth.

Global Digital English Language Learning Market Experiences Significant Growth Due to Growing Digitalization in Education Sector. Browse More Insights: https://www.theinsightpartners.com/reports/english-language-learning-market

The report runs an in-depth analysis of market trends, key players, and future opportunities. In general, the Digital English Language Learning market comprises of product type, business type, and end user which are expected to register strength during the coming years.

Download Sample Report: https://www.theinsightpartners.com/sample/TIPRE00003296/

Overview of Report Findings:

1. Market Growth: The Digital English Language Learning Market is expected to reach US$ 15.04 billion by 2030 from US$ 4.22 billion in 2022, at a CAGR of 17.2% during the forecast period.

Identify The Key Trends Affecting This Market – Download Sample PDF: https://www.theinsightpartners.com/sample/TIPRE00003296/

2. Gamification of Language Learning Platforms: Gamification capitalizes on the inherent human desire for rewards, competition, and achievement, making learning enjoyable. In 2022, ~60% of all digital language learning platforms had some form of gamification combined with their systems.

3. Governmental Initiatives: Governments and companies of various countries, such as China, the US, Brazil, Saudi Arabia, Australia, and the UAE, have initiated digital education schemes in the past years, which has helped these countries boost their English education systems. For instance, in November 2023, Cambridge provided an English learning platform for Ukraine.

4. Virtual Reality and Augmented Reality: Various companies, such as VirtualSpeech, Engage VR, ClassVR, Mondly VR, VRChat, Language Lab, ImmerseMe, and Fulldive, are providing VR tools to explore the world of English learning. There are more opportunities for language learning due to the incorporation of AR and VR. The use of VR and AR technologies can place students in virtual worlds where they can engage with people who speak English.

5. Geographical Insights: APAC dominated the Digital English Language Learning Market in 2023. Europe is the second-largest contributor to the Global Digital English Language Learning Market, followed by North America, South America, and Middle East and Africa.

Purchase Premium Copy of Digital English Language Learning Market Growth Report (2022-2030) at: https://www.theinsightpartners.com/buy/TIPRE00003296/

Market Segmentation:

- By product type, the digital English language learning market is divided into cloud and on-premise. In 2022, the cloud segment held the largest share of the global Digital English Language Learning market. The cloud-based digital English language learning market is expected to witness a prime growth rate during the forecast period, which is majorly due to the penetration of the Internet in major cities in Asia Pacific.

- In terms of business type, the digital English language learning Market is segmented into business-to-business and business-to-customer. The business-to-business segment holds the largest share in 2022. This can be attributed to the constantly rising demand for technologically driven English language learning among schools, universities, and training institutes.

- Based on end user, the digital English language learning market is segmented into non-academic learners and academic learners. The academic learners segment holds the largest share in 2022. Schools, universities, and institutions in various countries are heavily emphasizing on English language learning since English has become the common language in the global business sector.

Obtain Analysis of Key Geographic Markets – Download Report PDF: https://www.theinsightpartners.com/sample/TIPRE00003296/

Competitive Strategy and Development:

- Key Players: A few major companies operating in the digital English language learning market include Cambridge University Press, Cengage/National Geographic Learning, EF Education First, English Language Institute China, McGraw-Hill Education, Oxford University Press, Pearson ELT, Sanako Corporation, Springer Nature Limited, and Transparent Language, Inc.

- Trending Topics: Digital Language Learning Market, Digital Education Market, Education Technology Market, Academic Software Market, and Others.

Want More Information about Competitors and Market Players? Get Sample PDF: https://www.theinsightpartners.com/sample/TIPRE00003296/

Global Headlines on Digital English Language Learning Market:

- “Digitas India bagged the digital communications mandate of Duolingo English Test, a part of Duolingo Inc., an American technology company.”

- ” Google’s gunning for Duolingo with a new Google Search feature designed to help people practice — and improve — their English-speaking skills”

- “Cambridge University Press and Assessment (CUP&A) announced its partnership with the National Skill Development Corporation (NSDC) to improve the English language skills of students seeking to travel abroad”

Conclusion:

English is the most preferred language in terms of business perspectives across the globe, and close to 30 nations have English as their primary language for communication. As a result, the English language has been given importance by various industry sectors as a common language for communication. Further, the increasing globalization trend has led businesses to different parts of the world where English is considered a mandatory communication language. Digital English language learning encompasses digital content and products that facilitate easy learning through various ICT-based interactive tools. The various interactive tools include mobile applications, e-books, audio clips, videos, games, digital software, and online tutoring.

Require A Diverse Region or Sector? Customize Research to Suit Your Requirement: https://www.theinsightpartners.com/sample/TIPRE00003296/

The report from The Insight Partners, therefore, provides several stakeholders—including software providers, service providers, and others—with valuable insights into how to successfully navigate this evolving market landscape and unlock new opportunities.

Related Report Titles:

- Asia Pacific Digital English Language Learning Market to Grow at a CAGR of 17.6% to reach USD 6,116.1 million from 2020 to 2027

- Digital Language Learning Market Scope, Size & Forecasts to 2027

- Europe Digital language learning Market to Reach US$ 3.20 Bn at a CAGR of 11.0% in 2027

- Language Translation Software Market Size and Forecasts (2021 – 2031)

- Learning Management System Market Scope, Share, and Analysis 2031

- E-Learning Market Analysis and Forecast by Size, Share, Growth, Trends 2031

- Smart Learning Systems Market Size and Forecasts (2021 – 2031)

- Synchronous E-learning Market Size and Forecasts (2021 – 2031)

- Corporate M-Learning Market Size and Forecasts (2021 – 2031)

- Digital Education Market Trends, Forecast, and Growth 2031

- Education Technology Market Size and Forecasts (2021 – 2031)

- Education Apps Market Size and Forecasts (2021 – 2031)

- Education ERP Market Size and Forecasts (2021 – 2031)

- Educational Robot Market Growth, Size, Share, Trends, Key Players Analysis, and Forecast till 2031

- Academic Software Market Trends with COVID-19 Impact by 2027

- Digital Education Publishing Market Overview, Growth, Trends, Analysis, Research Report (2021-2031)

- Digital Publishing Market Overview, Growth, Trends, Analysis, Research Report (2021-2031)

About Us:

The Insight Partners is a one stop industry research provider of actionable intelligence. We help our clients in getting solutions to their research requirements through our syndicated and consulting research services. We specialize in industries such as Semiconductor and Electronics, Aerospace and Defense, Automotive and Transportation, Biotechnology, Healthcare IT, Manufacturing and Construction, Medical Device, Technology, Media and Telecommunications, Chemicals and Materials.

Contact Us:

If you have any queries about this report or if you would like further information, please contact us:

Contact Person: Ankit Mathur

E-mail: ankit.mathur@theinsightpartners.com

Phone: +1-646-491-9876

Press Release: https://www.theinsightpartners.com/pr/english-language-learning-market

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Here's the Income You Need to Be in the Top 50% of American Households

The Census Bureau’s Current Population Survey (CPS) collects data from roughly 60,000 U.S. households each month, representing about 110,000 individuals aged 15 and older. The surveys are administered monthly to provide continuity, but the results are published annually.

In 2023, those U.S. households reported a median income of $80,610, up 4% from $77,540 in 2022. That means half of households reported less income, and half reported more. In other words, any household that made more than $80,610 ranks among the top 50% nationally.

However, age is an important variable where income is concerned, simply because older people have had more time to accumulate assets and advance in their careers. For that reason, anyone interested in benchmarking their financial status should use age-based data so that they are comparing themselves to their peers.

The median income across U.S. households by age

The Census Bureau defines income as including wages from employment, Social Security benefits, welfare payments, interest on savings or bonds, dividends, unemployment and workmen’s compensation, and private and government pensions.

The chart below shows median before-tax incomes by age demographics among the respondents to the Current Population Survey.

|

Age of Respondent |

Before-Tax Median Household Income |

|---|---|

|

15 to 24 |

$54,930 |

|

25 to 34 |

$85,780 |

|

35 to 44 |

$101,300 |

|

45 to 54 |

$110,700 |

|

55 to 64 |

$90,640 |

|

65 and older |

$54,710 |

|

All respondents |

$80,610 |

Data source: U.S. Census Bureau.

As shown, the median income across all households was $80,610 in 2023. Households represented by people aged 45 to 54 had the highest median income at $110,700, while those aged 65 and older had the lowest median income at $54,710.

The 2023 Current Population Survey also provides information on income distribution. The chart below shows household income at selected percentiles.

|

Percentile |

Before-Tax Income |

|---|---|

|

10th percentile |

$18,980 |

|

20th percentile |

$33,000 |

|

30th percentile |

$47,910 |

|

40th percentile |

$62,200 |

|

50th percentile (median) |

$80,610 |

|

60th percentile |

$101,000 |

|

70th percentile |

$127,300 |

|

80th percentile |

$165,300 |

|

90th percentile |

$234,900 |

Data source: U.S. Census Bureau.

The percentile distribution above details what shares of the population had income above and below specific thresholds. For instance, income at the 10th percentile was $18,980 in 2023. That means 10% of American households reported less income last year, and 90% of American households reported more.

Similarly, income at the 70th percentile was $127,300 in 2023. That means 70% of American households had less income last year, while 30% of American households had more.

How workers with median incomes can build $1 million portfolios

Many financial advisors recommend the 50-30-20 budgeting framework, which divides after-tax income into three spending categories:

-

Needs: 50% of a household’s after-tax income should be dedicated to non-discretionary expenses like groceries, rent or mortgage, and utilities. Minimum interest payments are also grouped into this category.

-

Wants: 30% of after-tax income should be dedicated to discretionary expenses like dining out, hobbies, luxury items, and travel.

-

Savings: 20% of after-tax income should dedicated to retirement savings. Interest payments above the minimum are also grouped into this category.

The 2023 Current Population Survey reported a median after-tax income of $77,790 for households represented by those 64 and younger. I selected that age group because many people have stopped saving for retirement once they reach 65, and are instead drawing down on their retirement account balances.

With that in mind, the 50-30-20 framework stipulates the median worker under 65 should save about $15,550 per year, which is about $1,295 per month. One smart place to invest that money would be an index fund that tracks the S&P 500 (SNPINDEX: ^GSPC) like the Vanguard S&P 500 ETF (NYSEMKT: VOO).

The S&P 500 is widely regarded as the best barometer for the U.S. stock market. It outperformed almost every other asset class over the last two decades, and it has never produced a negative return over any 20-year period in history. That means investors are essentially guaranteed to profit if they put money into an S&P 500 index fund and leave it there for at least two decades.

Moreover, the S&P 500 has typically produced robust returns. The index’s total return level (with dividends reinvested) has been about 2,000% over the last 30 years, which equates to 10.6% annually. At that rate of return, if a person invested $650 monthly in an S&P 500 index fund — that is, about half the amount the median household should save each month under the 50-30-20 framework — their portfolio would be worth $127,900 after one decade, $478,300 after two decades, and $1.4 million after three decades.

In short, the median U.S. household income is more than sufficient for an investor to build a $1 million portfolio, provided they invest consistently over the long haul.

Should you invest $1,000 in S&P 500 Index right now?

Before you buy stock in S&P 500 Index, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and S&P 500 Index wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $722,320!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 16, 2024

Trevor Jennewine has positions in Vanguard S&P 500 ETF. The Motley Fool has positions in and recommends Vanguard S&P 500 ETF. The Motley Fool has a disclosure policy.

Here’s the Income You Need to Be in the Top 50% of American Households was originally published by The Motley Fool

Mary Trump Says Americans Pay The Price As Her Uncle Sets World On Fire With His Provocations: 'I Worry About What Will Happen'

Mary Trump, a psychologist and author, last week shared her thought on her uncle Donald Trump‘s psychology and also the media sane-washing him.

Lover Of Violence: Mary Trump called her uncle a lover of violence, especially when it is committed on his behalf, said Mary Trump in a Substack post. Weighing in on a second assassination attempt against the former president, she noted that it was only a few days before the incident that he refused to condemn the bomb threats, school evacuations, and general sense of terror in Springfield, Ohio, that he and his running mate Sen. JD Vance (R-Ohio) have unleashed by their “vicious targeting of Haitian immigrants who live and work there.”

“Threats of violence and actual violence from the right are now a regular part of our political discourse and behavior —Donald makes sure of that on an almost daily basis,” she said.

Mary Trump noted that in early days of her uncle’s 2016 campaign, he encouraged rally goers to assault protesters. “Before and during the assault on the Capitol on Jan. 6, 2021, Donald encouraged and stoked violence and people listened,” she said.

“Every day, Americans pay the price while Donald sets the world on fire with his provocations and then spends the day playing golf, completely insulated from the chaos he sows,” she added.

The former president believes that the only way to maintain his grip on power is to “keep us divided, angry, and afraid,” Mary Trump said.

“America can’t go on like this,” she said, adding that “I worry about what will happen in the next 50 days and the uncertain weeks that will follow.”

Sane-washing Trump: Mary Trump also shared a MSNBC interview in which she discussed about the media sane-washing Donald Trump. “They are just pretending that he said these understandable, coherent things but much worse than that they are imbuing his meaningless statements with meaning that is not there,” she said. This makes the former president more serious and less delusional than he actually is, she added.

For years now, it has been told that some of the most disqualifying things about Donald Trump are baked in and so nobody cares about them anymore, the psychologist said. But she called it as a “wrong take.” This “gives him an enormous advantage because he can do anything and we are all just supposed to assume that that’s just fine and it gives him permission to get away with worse,” she said.

Although this isn’t anything new, it is now just increasingly less hinged, more delusional, more dangerous, Mary Trump said, adding that the people he surrounds himself with have always been awful, they too are becoming more dangerous to democracy and to American citizens.

Mary Trump also delved into her uncle’s claims about Haitian illegal immigrants eating pets in Springfield, Ohio. This is just the latest example of something he has been doing for years. This is stochastic terrorism,” she said, adding that this is deadly serious.

“Donald Trump has and will get people killed because of his dangerous rhetoric and the fact that he is willing to stop at nothing if he thinks demeaning the most vulnerable people among us is going to get him another vote,” Mary Trump said.

Did You Know?

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Microsoft Just Raised Its Dividend By Double Digits: What Investors Need to Know

Dividends that can grow above the rate of inflation for years can be huge wealth-builders over time.

Although artificial intelligence (AI) stocks aren’t exactly known for their dividends, some of these tech giants are now beginning to pay out dividends and to grow them by double-digit percentages.

In fact, on Monday, the oldest dividend payer of the big AI tech stocks, Microsoft (NASDAQ: MSFT), announced a dividend increase of more than 10%. Here are the essential things to know about Redmond’s new bigger payout to owners.

A hike coming for shareholders in December

Microsoft announced it would raise its quarterly payout from $0.75 to $0.83, good for a 10.7% increase. The hike will go into effect for the December dividend payout, which will go to holders of the stock as of Nov. 20, with an ex-dividend date of Nov. 21.

However, the new dividend yield at today’s share price would only amount to roughly 0.8%.

In addition to the dividend hike, Microsoft also authorized a $60 billion share buyback program. When a company repurchases its shares, that lowers the share count, increasing the remaining shareholders’ stake in the company. Note that while that amount seems large, $60 billion in repurchases would only retire a small fraction (about 2%) of Microsoft shares at today’s market cap.

But regular increases like these seem highly sustainable

While that shareholder return may seem paltry to some, this year’s increases should be repeatable and sustainable. This is because even though the dividend hike was strong at nearly 11%, Microsoft’s diluted earnings per share actually grew 22% over the past fiscal year.

Hence, Microsoft’s dividend payout ratio in relation to earnings will actually go down. That means more room for payout increases in the future.

Also underpinning consistent growth is Microsoft’s impeccable balance sheet, with $75 billion in cash against just $50 billion in short- and long-term debt. That cash hoard remains after the massive $69 billion all-cash acquisition of Activision Blizzard, which closed last December.

The Activision acquisition should bolster earnings even more in the year ahead, as it really only affected half of Microsoft’s past fiscal year. But Microsoft’s main businesses — its AI-powered cloud computing and business productivity software segments — will determine most of its earnings growth.

Potential risks to raising the payout

While all these factors are positive, it’s possible Microsoft won’t lavish that entire $60 billion of repurchases on investors this year. Cash flow may be a concern, given that all the cloud giants are currently spending heavily on AI data centers. Of note, Microsoft’s free cash flow amounted to $74 billion last year, markedly below its net income of $88.9 billion.

Microsoft spent $13.9 billion in cash on capital expenditures in the fourth quarter — and if that continues, an annual pace of $56 billion would be a marked increase from last year’s $44.5 billon. That number is likely to run higher for fiscal 2025, as the AI races show no signs of slowing down.

The company is also likely to generate more AI-related revenue in the year ahead. For instance, it’s charging $30 per seat for the AI-powered Copilot version of Microsoft 365. On Microsoft’s recent conference call, CEO Satya Nadella noted that the number of Office 365 Copilot users grew 60% quarter over quarter, and that Copilot for GitHub contributed 40% of that segment’s growth. Still, any success in AI would likely lead to more spending on AI data centers, making free cash flow lower than earnings again this year.

Looking back at the past year, Microsoft only spent $17.2 billion on share repurchases, which was even lower than the $22.2 billion spent in the prior year. So, it seems unlikely it will repurchase $60 billion worth this year. While last year’s conservatism made room for the Activision purchase, it may also have been intended to save cash for heavy AI investments. Additionally, Microsoft’s stock isn’t exactly screamingly cheap at 36.5 times earnings, limiting the effect of repurchases.

Both the AI-related spending and high valuation could keep management conservative in 2025 as well, meaning a lot of the $60 billion may go unspent.

A nice boost for longtime holders, but not so much for new buyers

The dividend increase probably isn’t enough to entice yield-focused investors to Microsoft, but could benefit those who have owned the stock for a long time.

Newer shareholders have to view Microsoft as a growth stock with a small dividend kicker as a bonus, and hope that AI will turbocharge revenue and earnings in spite of the company’s enormous size.

But if you’re a dividend-focused investor, and would like a material payout within the next few years, it may be better to wait for a pullback in the stock price for a better entry point.

Should you invest $1,000 in Microsoft right now?

Before you buy stock in Microsoft, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Microsoft wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $722,320!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 16, 2024

Billy Duberstein and/or his clients have positions in Microsoft. The Motley Fool has positions in and recommends Microsoft. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

Microsoft Just Raised Its Dividend By Double Digits: What Investors Need to Know was originally published by The Motley Fool

1 Unstoppable Vanguard ETF That Could Turn $400 Per Month Into $1 Million

Can you afford to save and invest $400 per month into the stock market? If so, then you could be putting yourself on track to growing your portfolio to at least $1 million in the future.

And the good thing is, you don’t have to take on risky investments or worry about picking individual stocks, either. Through an exchange-traded fund (ETF), you can have the best of both worlds — the safety that comes with diversification and the strong returns that can come from investing in top growth stocks.

Vanguard has many top ETFs investors can choose from, and an excellent one that investors can put money into each month is the Vanguard Growth ETF (NYSEMKT: VUG). Here’s why it’s a great buy, especially if you want to build up a big balance over the years.

The fund targets top growth stocks

If you want to earn a significant return in the long run, growth stocks are likely going to play a crucial role in your investing strategy. They can deliver better gains than dividend stocks, which focus more on providing investors with recurring income rather than with pursuing aggressive growth strategies. The Vanguard Growth ETF specifically tracks large-cap growth stocks.

There are 188 stocks in the portfolio, although the top three stocks — Apple, Microsoft, and Nvidia — account for a big chunk and represent 36% of the ETF’s total holdings. But outside those three, no other stock accounts for 5% of the ETF’s overall weight. At nearly 60% of its total holdings, the fund is heavily dependent on tech stocks and how they perform. That means there could be some bad years due to the volatility that comes with investing in tech, but long term, the stocks should help the fund deliver some great returns.

How investing $400 per month could grow to $1 million

Not having a lump sum to invest right now doesn’t mean your returns can’t eventually get to $1 million. If you invest $400 each month, that’s $4,800 you will have invested over a full year. If you do that for 20 years, you’ve put aside $96,000. And if you can extend that streak to 30 years, then you will have invested $144,000.

That can be a lot of money to put aside in an ETF. But thanks to the effects of compounding, your total investment can be worth a lot more than that.

Consider that the Vanguard Growth ETF has grown by 880% over the past 20 years, when including its dividend. That averages out to a compounded annual growth rate of approximately 12.1%.

For the sake of being conservative, however, let’s assume that you average a slightly slower annual return of approximately 11%. If you were to invest $400 per month and average that type of return in the long run, your portfolio would grow to more than $630,000 after a period of 25 years. And if you can keep investing for 30 years, your portfolio would be worth more than $1.1 million.

Disciplined investing is the key to growing your portfolio

Even without swinging for the fences and assuming an extremely high rate of return, you can get your portfolio to the $1 million mark. The key is being able to save and invest each month, and being able to keep that money invested for the long haul. It’s not easy to maintain, but there’s definitely a big motivating reason to do so — it could help you grow your portfolio to more than $1 million.

The Vanguard Growth ETF is just one ETF you can consider, but there are many other solid funds you can choose to invest in as well.

Should you invest $1,000 in Vanguard Index Funds – Vanguard Growth ETF right now?

Before you buy stock in Vanguard Index Funds – Vanguard Growth ETF, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Vanguard Index Funds – Vanguard Growth ETF wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $722,320!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 16, 2024

David Jagielski has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Apple, Microsoft, Nvidia, and Vanguard Index Funds – Vanguard Growth ETF. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

1 Unstoppable Vanguard ETF That Could Turn $400 Per Month Into $1 Million was originally published by The Motley Fool