AAR reports first quarter fiscal year 2025 results

- First quarter sales of $662 million, up 20% over the prior year

- First quarter GAAP diluted earnings per share of $0.50 compared to a loss per share of $0.02 in Q1 FY2024

- First quarter adjusted diluted earnings per share of $0.85, up 9% from $0.78 in Q1 FY2024

- Sales growth of 20% in both our commercial and government businesses

WOOD DALE, Ill., Sept. 23, 2024 /PRNewswire/ — AAR CORP. AIR, a leading provider of aviation services to commercial and government operators, MROs, and OEMs, today reported first quarter fiscal year 2025 consolidated sales of $661.7 million and net income of $18.0 million, or $0.50 per diluted share. For the first quarter of the prior year, the Company reported sales of $549.7 million and a net loss of $0.6 million, or $0.02 per diluted share. Our adjusted diluted earnings per share in the first quarter of fiscal year 2025 were $0.85, compared to $0.78 in the first quarter of the prior year.

Consolidated first quarter sales increased 20% over the prior year quarter. Our consolidated sales to commercial customers and to government customers both increased 20% over the prior year quarter. These increases were primarily due to the acquisition of the Product Support business and organic growth. Sales to commercial customers were 71% of consolidated sales in both the current and prior year quarters.

“During the quarter, we continued to execute well across the company. We drove 26% organic growth in our new parts distribution activities, had strong operational performance in our hangars and saw a return to growth in our government business. The quarter also included meaningful contributions from Trax, and the recent Product Support acquisition continues to exceed our expectations,” said John M. Holmes, Chairman, President and Chief Executive Officer of AAR CORP.

Selling, general, and administrative expenses were $75.9 million in the current quarter, compared to $74.7 million in the prior year quarter. Acquisition, amortization, and integration expenses were $7.1 million in the current quarter compared to $2.9 million in the prior year quarter.

Operating margins were 6.6% in the current quarter, compared to 4.6% in the prior year quarter. Adjusted operating margin increased from 7.3% in the prior year quarter to 9.1% in the current year quarter. The improved adjusted margin over the prior year is primarily driven by the favorable contribution from the recently acquired Product Support business as well as improved execution.

During and subsequent to the quarter, we received multiple new contract awards, including:

- Five-year firm fixed price IDIQ contract with an aggregate ceiling value of approximately $1.2 billion from the U.S. Navy’s Naval Air Systems Command (NAVAIR) to perform engine depot maintenance and repair for its P-8A Poseidon Aircraft fleet

- Five-year firm fixed price IDIQ contract with an aggregate ceiling value of approximately $1.2 billion by NAVAIR to perform P-8A Poseidon depot airframe maintenance and depot field team support for the U.S. Navy, government of Australia, and foreign military sales customers

- Multiple, long-term distribution agreements with Ontic that expand our support across various government and commercial platforms

Net interest expense for the quarter was $18.3 million, compared to $5.4 million last year, primarily due to increased debt levels as a result of funding the Product Support acquisition. Average diluted share count increased from 35.1 million shares in the prior year quarter to 35.6 million shares in the current year quarter. From a capital deployment perspective, we are prioritizing debt repayment but will evaluate share repurchases along with other attractive investment opportunities to deploy our capital. We have $52.5 million remaining on our $150 million share repurchase program.

Cash flow used in operating activities was $18.6 million during the current quarter compared to $18.7 million in the prior year quarter. As of August 31, 2024, our net debt was $942.7 million and our net leverage, pro forma for the last twelve months adjusted EBITDA of the Product Support business was 3.31x. Excluding our accounts receivable financing program, our cash flow used in operating activities was $33.9 million in the current quarter.

Holmes concluded, “We have been expanding our adjusted operating margin each quarter over the past three years and I am proud of our team’s strong execution. As we continue to drive growth in our higher margin activities as well as fully integrate the Product Support business, we expect further margin expansion. Demand remains exceptionally strong for our services and we expect continued growth across both our commercial and government businesses.”

Conference call information

On Monday, September 23, 2024, at 4 p.m. Central time, AAR will hold a conference call to discuss the results. A listen-only webcast and slides can be accessed at https://edge.media-server.com/mmc/p/4zxrgath/. Participants may join via phone by registering at https://register.vevent.com/register/BI842bfc6277834251b3d46d91d48ddae4. Once registered, participants will receive a dial-in number and a unique PIN that will allow them to access the call. The slides are also available on AAR’s website at https://www.aarcorp.com/f1q25investor.pdf.

A replay of the conference call will be available for on-demand listening shortly after the completion of the call at the webcast link and will remain available for approximately one year.

About AAR

AAR is a global aerospace and defense aftermarket solutions company with operations in over 20 countries. Headquartered in the Chicago area, AAR supports commercial and government customers through four operating segments: Parts Supply, Repair & Engineering, Integrated Solutions, and Expeditionary Services. Additional information can be found at aarcorp.com.

Contact: Investor Relations | +1-630-227-2017 | investors@aarcorp.com

|

This press release contains certain statements relating to future results, which are forward-looking statements as that term is defined in the Private Securities Litigation Reform Act of 1995, which reflect management’s expectations about future conditions, including, but not limited to, continued demand in the commercial and government aviation markets, anticipated activities and benefits under extended, expanded and new services, supply and distribution agreements, opportunities for capital deployment and margin improvement, earnings performance, contributions from our recent acquisitions, and expectations for our new parts distribution activities. |

|

Forward-looking statements often address our expected future operating and financial performance and financial condition, or sustainability targets, goals, commitments, and other business plans, and often may also be identified because they contain words such as “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “intend,” “likely,” “may,” “might,” “plan,” “potential,” “predict,” “project,” “seek,” “should,” “target,” “will,” “would,” or similar expressions and the negatives of those terms. |

|

These forward-looking statements are based on the beliefs of Company management, as well as assumptions and estimates based on information available to the Company as of the dates such assumptions and estimates are made, and are subject to certain risks and uncertainties that could cause actual results to differ materially from historical results or those anticipated, depending on a variety of factors, including: (i) factors that adversely affect the commercial aviation industry; (ii) adverse events and negative publicity in the aviation industry; (iii) a reduction in sales to the U.S. government and its contractors; (iv) cost overruns and losses on fixed-price contracts; (v) nonperformance by subcontractors or suppliers; (vi) a reduction in outsourcing of maintenance activity by airlines; (vii) a shortage of skilled personnel or work stoppages; (viii) competition from other companies; (ix) financial, operational and legal risks arising as a result of operating internationally; (x) inability to integrate acquisitions effectively and execute operational and financial plans related to the acquisitions; (xi) failure to realize the anticipated benefits of acquisitions; (xii) circumstances associated with divestitures; (xiii) inability to recover costs due to fluctuations in market values for aviation products and equipment; (xiv) cyber or other security threats or disruptions; (xv) a need to make significant capital expenditures to keep pace with technological developments in our industry; (xvi) restrictions on use of intellectual property and tooling important to our business; (xvii) inability to fully execute our stock repurchase program and return capital to stockholders; (xviii) limitations on our ability to access the debt and equity capital markets or to draw down funds under loan agreements; (xix) non-compliance with restrictive and financial covenants contained in our debt and loan agreements; (xx) changes in or non-compliance with laws and regulations related to federal contractors, the aviation industry, international operations, safety, and environmental matters, and the costs of complying with such laws and regulations; and (xxi) exposure to product liability and property claims that may be in excess of our liability insurance coverage. Should one or more of those risks or uncertainties materialize adversely, or should underlying assumptions or estimates prove incorrect, actual results may vary materially from those described. Those events and uncertainties are difficult or impossible to predict accurately and many are beyond our control. |

|

For a discussion of these and other risks and uncertainties, refer to our Annual Report on Form 10-K, Part I, “Item 1A, Risk Factors” and our other filings from time to time with the U.S Securities and Exchange Commission. These events and uncertainties are difficult or impossible to predict accurately and many are beyond the Company’s control. The risks described in these reports are not the only risks we face, as additional risks and uncertainties are not currently known or foreseeable or impossible to predict accurately or risks that are beyond the Company’s control or deemed immaterial may materially adversely affect our business, financial condition or results of operations in future periods. We assume no obligation to update any forward-looking statements to reflect events or circumstances after the date of such statements or to reflect the occurrence of anticipated or unanticipated events. |

|

AAR CORP. and subsidiaries |

|||||

|

Condensed consolidated statements of operations (In millions except per share data – unaudited) |

Three months ended August 31, |

||||

|

2024 |

2023 |

||||

|

Sales |

$ 661.7 |

$ 549.7 |

|||

|

Cost of sales |

544.5 |

448.4 |

|||

|

Gross profit |

117.2 |

101.3 |

|||

|

Provision for credit losses |

0.2 |

0.4 |

|||

|

Selling, general and administrative |

75.9 |

74.7 |

|||

|

Earnings (Loss) from joint ventures |

2.3 |

(0.9) |

|||

|

Operating income |

43.4 |

25.3 |

|||

|

Pension settlement charge |

–– |

(26.7) |

|||

|

Losses related to sale and exit of business |

(0.1) |

(0.7) |

|||

|

Interest expense, net |

(18.3) |

(5.4) |

|||

|

Other expense, net |

(0.1) |

–– |

|||

|

Income (Loss) before income taxes |

24.9 |

(7.5) |

|||

|

Income tax expense (benefit) |

6.9 |

(6.9) |

|||

|

Net income (loss) |

$ 18.0 |

$ (0.6) |

|||

|

Earnings (Loss) per share – Basic and Diluted |

$ 0.50 |

$ (0.02) |

|||

|

Share data: |

|||||

|

Weighted average shares outstanding – Basic |

35.2 |

34.7 |

|||

|

Weighted average shares outstanding – Diluted |

35.6 |

35.1 |

|||

|

AAR CORP. and subsidiaries |

|||

Condensed consolidated balance sheets (In millions) |

August 31, 2024 |

May 31, 2024 |

|

|

(unaudited) |

|||

|

ASSETS |

|||

|

Cash and cash equivalents |

$ 49.3 |

$ 85.8 |

|

|

Restricted cash |

13.8 |

10.3 |

|

|

Accounts receivable, net |

310.9 |

287.2 |

|

|

Contract assets |

147.9 |

123.2 |

|

|

Inventories, net |

748.2 |

733.1 |

|

|

Rotable assets and equipment on or available for lease |

70.4 |

81.5 |

|

|

Other current assets |

86.4 |

68.5 |

|

|

Total current assets |

1,426.9 |

1,389.6 |

|

|

Property, plant, and equipment, net |

161.5 |

171.7 |

|

|

Goodwill and intangible assets, net |

783.9 |

790.2 |

|

|

Rotable assets supporting long-term programs |

170.8 |

166.3 |

|

|

Operating lease right-of-use assets, net |

93.4 |

96.6 |

|

|

Other non-current assets |

146.8 |

155.6 |

|

|

Total assets |

$ 2,783.3 |

$ 2,770.0 |

|

|

LIABILITIES AND EQUITY |

|||

|

Accounts payable |

$ 257.5 |

$ 238.0 |

|

|

Other current liabilities |

209.4 |

228.9 |

|

|

Total current liabilities |

466.9 |

466.9 |

|

|

Long-term debt |

981.0 |

985.4 |

|

|

Operating lease liabilities |

78.9 |

80.3 |

|

|

Other liabilities and deferred revenue |

46.3 |

47.6 |

|

|

Total liabilities |

1,573.1 |

1,580.2 |

|

|

Equity |

1,210.2 |

1,189.8 |

|

|

Total liabilities and equity |

$ 2,783.3 |

$ 2,770.0 |

|

|

AAR CORP. and subsidiaries |

|||

| Condensed consolidated statements of cash flows

(In millions – unaudited) |

Three months ended August 31, |

||

|

2024 |

2023 |

||

|

Cash flows used in operating activities: |

|||

|

Net income (loss) |

$ 18.0 |

$ (0.6) |

|

|

Adjustments to reconcile net income (loss) to net cash used in operating activities: |

|||

|

Depreciation and amortization |

14.2 |

8.4 |

|

|

Stock-based compensation expense |

5.0 |

4.3 |

|

|

Pension settlement charge |

–– |

26.7 |

|

|

Changes in certain assets and liabilities: |

|||

|

Accounts receivable |

(23.7) |

(40.5) |

|

|

Contract assets |

(24.5) |

(12.3) |

|

|

Inventories |

(14.8) |

(39.8) |

|

|

Prepaid expenses and other current assets |

(8.5) |

(8.8) |

|

|

Rotable assets supporting long-term programs |

(6.5) |

(1.0) |

|

|

Accounts payable and other current liabilities |

8.5 |

54.2 |

|

|

Other |

13.7 |

(9.1) |

|

|

Net cash used in operating activities – continuing operations |

(18.6) |

(18.5) |

|

|

Net cash used in operating activities – discontinued operations |

–– |

(0.2) |

|

|

Net cash used in operating activities |

(18.6) |

(18.7) |

|

|

Cash flows used in investing activities: |

|||

|

Property, plant, and equipment expenditures |

(7.9) |

(9.1) |

|

|

Acquisition |

2.9 |

–– |

|

|

Other |

(0.3) |

(2.5) |

|

|

Net cash used in investing activities |

(5.3) |

(11.6) |

|

|

Cash flows provided by (used in) financing activities: |

|||

|

Short-term borrowings (repayments) on Revolving Credit Facility, net |

(5.0) |

35.0 |

|

|

Other |

(4.1) |

3.7 |

|

|

Net cash provided by (used in) financing activities |

(9.1) |

38.7 |

|

|

Increase (Decrease) in cash, cash equivalents, and restricted cash |

(33.0) |

8.4 |

|

|

Cash, cash equivalents, and restricted cash at beginning of period |

96.1 |

81.8 |

|

|

Cash, cash equivalents, and restricted cash at end of period |

$ 63.1 |

$ 90.2 |

|

|

AAR CORP. and subsidiaries |

|||

|

Third-party sales by operating segment (In millions – unaudited) |

Three months ended August 31, |

||

|

2024 |

2023 |

||

|

Parts Supply |

$ 249.7 |

$ 236.8 |

|

|

Repair & Engineering |

217.6 |

137.5 |

|

|

Integrated Solutions |

168.9 |

156.3 |

|

|

Expeditionary Services |

25.5 |

19.1 |

|

|

$ 661.7 |

$ 549.7 |

||

|

Operating income (loss) by operating segment (In millions – unaudited) |

Three months ended August 31, |

||

|

2024 |

2023 |

||

|

Parts Supply |

$ 30.1 |

$ 15.1 |

|

|

Repair & Engineering |

21.1 |

9.1 |

|

|

Integrated Solutions |

7.7 |

7.7 |

|

|

Expeditionary Services |

(1.7) |

1.3 |

|

|

57.2 |

33.2 |

||

|

Corporate and other |

(13.8) |

(7.9) |

|

|

$ 43.4 |

$ 25.3 |

||

Adjusted net income, adjusted diluted earnings per share, adjusted operating margin, adjusted cash provided by (used in) operating activities, adjusted EBITDA, net debt, net debt to adjusted EBITDA (net leverage), and net debt to pro forma adjusted EBITDA (net pro forma leverage) are “non-GAAP financial measures” as defined in Regulation G of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). We believe these non-GAAP financial measures are relevant and useful for investors as they illustrate our core operating performance, cash flows, and leverage unaffected by the impact of certain items that management does not believe are indicative of our ongoing and core operating activities. When reviewed in conjunction with our GAAP results and the accompanying reconciliations, we believe these non-GAAP financial measures provide additional information that is useful to gain an understanding of the factors and trends affecting our business and provide a means by which to compare our operating performance and leverage against that of other companies in the industries we compete. These non-GAAP measures should be considered as a supplement to, and not as a substitute for, or superior to, the corresponding measures calculated in accordance with GAAP.

Our non-GAAP financial measures reflect adjustments for certain items including, but not limited to, the following:

- Investigation costs comprised of legal and professional fees related to addressing potential violations of the U.S. Foreign Corrupt Practices Act, which we self-reported to the U.S. Department of Justice and other agencies.

- Expenses associated with recent acquisition activity including professional fees for legal, due diligence, and other acquisition activities, bridge financing fees, intangible asset amortization, integration costs, and compensation expense related to contingent consideration and retention agreements.

- Pension settlement charges associated with the settlement and termination of our frozen defined benefit pension plan.

- Legal judgments related to or impacted by the Russia/Ukraine conflict.

- Contract termination/restructuring costs comprised of gains and losses that are recognized at the time of modifying, terminating, or restructuring certain customer and vendor contracts, including the loss recognized from the U.S. government exercising their termination for convenience in the first quarter of fiscal 2025 for our Mobility business’s new-generation pallet contract.

- Losses related to the sale and exit from joint ventures and our Composites manufacturing business, including legal fees for the performance guarantee associated with the Composites’ A220 aircraft contract.

Adjusted EBITDA is net income (loss) before interest income (expense), other income (expense), income taxes, depreciation and amortization, stock-based compensation, and items of an unusual nature including but not limited to business divestitures and acquisitions, workforce actions, investigation and remediation compliance costs, pension settlement charges, legal judgments, acquisition, integration, and amortization expenses from recent acquisition activity, and significant customer contract terminations.

Pursuant to the requirements of Regulation G of the Exchange Act, we are providing the following tables that reconcile the above-mentioned non-GAAP financial measures to the most directly comparable GAAP financial measures:

|

Adjusted net income (In millions – unaudited) |

Three months ended August 31, |

|

|

2024 |

2023 |

|

|

Net income (loss) |

$ 18.0 |

$ (0.6) |

|

Acquisition, integration, and amortization expenses |

9.0 |

2.8 |

|

Investigation costs

|

5.0 |

1.1 |

|

Contract termination costs |

3.2 |

–– |

|

Loss (Gain) related to sale of business/joint venture

|

(1.3) |

0.7 |

|

Pension settlement charge |

––

|

26.7 |

|

Russian bankruptcy court judgment |

–– |

11.2

|

|

Tax effect on adjustments (a) |

(3.6) |

(14.6) |

|

Adjusted net income |

$ 30.3 |

$ 27.3 |

|

(a) |

Calculation uses estimated statutory tax rates on non-GAAP adjustments except for the tax effect of the pension settlement charge which includes income taxes previously recognized in accumulated other comprehensive loss. |

|

Adjusted diluted earnings per share (unaudited) |

Three months ended August 31, |

|

|

2024 |

2023 |

|

|

Diluted earnings (loss) per share |

$ 0.50 |

$ (0.02) |

|

Acquisition, integration, and amortization expenses |

0.25 |

0.08 |

|

Investigation costs |

0.14 |

0.03 |

|

Contract termination costs |

0.09 |

–– |

|

Loss (Gain) related to sale of business/joint venture |

(0.03) |

0.02 |

|

Pension settlement charge |

–– |

0.76 |

|

Russian bankruptcy court judgment |

–– |

0.32 |

|

Tax effect on adjustments (a) |

(0.10) |

(0.41) |

|

Adjusted diluted earnings per share |

$ 0.85 |

$ 0.78 |

|

(a) |

Calculation uses estimated statutory tax rates on non-GAAP adjustments except for the tax effect of the pension settlement charge which includes income taxes previously recognized in accumulated other comprehensive loss. |

|

Adjusted operating margin (In millions – unaudited) |

Three months ended

|

||

|

August 31, |

May 31, |

August 31, |

|

|

Sales |

$ 661.7 |

$ 656.5 |

$ 549.7 |

|

Contract termination costs |

(9.5) |

2.3 |

–– |

|

Adjusted sales |

$ 652.2 |

$ 658.8 |

$ 549.7 |

|

Operating income |

$ 43.4 |

$ 32.6 |

$25.3 |

|

Acquisition, integration, and amortization expenses |

9.0 |

18.6 |

2.8 |

|

Investigation costs |

5.0 |

4.8 |

1.1 |

|

Contract termination costs |

3.2 |

4.8 |

–– |

|

Gain related to sale of joint venture |

(1.4) |

–– |

–– |

|

Severance charges |

–– |

0.5 |

–– |

|

Russian bankruptcy court judgment |

–– |

–– |

11.2 |

|

Adjusted operating income |

$ 59.2 |

$ 61.3 |

$ 40.4 |

|

Adjusted operating margin |

9.1 % |

9.3 % |

7.3 % |

|

Adjusted cash flows used in operating activities (In millions – unaudited) |

Three months ended August 31, |

|

|

2024 |

2023 |

|

|

Cash flows used in operating activities |

$ (18.6) |

$ (18.7) |

|

Amounts outstanding on accounts receivable financing program: |

||

|

Beginning of period |

13.7 |

12.8 |

|

End of period |

(29.0) |

(13.7) |

|

Adjusted cash flows used in operating activities

|

$ (33.9) |

$ (19.6) |

|

Adjusted EBITDA (In millions – unaudited) |

Three months ended August 31, |

Year ended May 31, |

|||

|

2024 |

2023 |

2024 |

|||

|

Net income (loss) |

$ 18.0 |

$ (0.6) |

$ 46.3 |

||

|

Income tax expense (benefit) |

6.9 |

(6.9) |

12.0 |

||

|

Other expense, net |

0.1 |

–– |

0.4 |

||

|

Interest expense, net |

18.3 |

5.4 |

41.0 |

||

|

Depreciation and amortization |

13.5 |

8.4 |

41.2 |

||

|

Acquisition and integration expenses |

5.0 |

1.8 |

29.7 |

||

|

Investigation costs |

5.0 |

1.1 |

10.5 |

||

|

Contract termination/restructuring costs and loss provisions, net |

3.2 |

–– |

4.8 |

||

|

Loss (Gain) related to sale of business/joint venture |

(1.3) |

0.7 |

2.8 |

||

|

Pension settlement charge |

–– |

26.7 |

26.7 |

||

|

Russian bankruptcy court judgment |

–– |

11.2 |

11.2 |

||

|

Severance charges |

–– |

–– |

0.5 |

||

|

Stock-based compensation |

5.0 |

4.3 |

15.3 |

||

|

Adjusted EBITDA |

$ 73.7 |

$ 52.1 |

$ 242.4 |

||

|

Net debt (In millions – unaudited) |

August 31, |

August 31, |

|

|

Total debt |

$992.0 |

$307.0 |

|

|

Less: Cash and cash equivalents |

(49.3) |

(70.3) |

|

|

Net debt |

$942.7 |

$236.7 |

|

Net debt to adjusted EBITDA (In millions – unaudited) |

|

|

Adjusted EBITDA for the year ended May 31, 2024 |

$ 242.4 |

|

Less: Adjusted EBITDA for the three months ended August 31, 2023 |

(52.1) |

|

Plus: Adjusted EBITDA for the three months ended August 31, 2024 |

73.7 |

|

Adjusted EBITDA for the twelve months ended August 31, 2024 |

$ 264.0 |

|

Net debt at August 31, 2024 |

$ 942.7 |

|

Net debt to Adjusted EBITDA |

3.57 |

|

Net debt to pro forma adjusted EBITDA |

|

|

(In millions – unaudited) |

|

|

AAR CORP. adjusted EBITDA for the twelve months ended August 31, 2024 |

$ 264.0 |

|

Plus: Product Support adjusted EBITDA for the six months ended February 29, 2024 |

20.4 |

|

Pro forma adjusted EBITDA for the twelve months ended August 31, 2024 |

$ 284.4 |

|

AAR CORP. net debt at August 31, 2024 |

$ 942.7 |

|

Net debt to pro forma adjusted EBITDA |

3.31 |

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/aar-reports-first-quarter-fiscal-year-2025-results-302256085.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/aar-reports-first-quarter-fiscal-year-2025-results-302256085.html

SOURCE AAR CORP.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

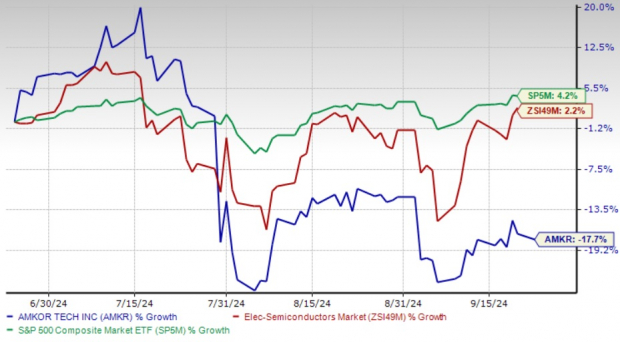

Amkor Falls 18% in 3 Months: How Should Investors Play the Stock?

Amkor Technology AMKR shares have lost 17.7% in the past three months, underperforming the Zacks Electronics – Semiconductors industry and the S&P 500 index’s return of 2.2% and 4.2%, respectively. The underperformance is attributable to a myriad of challenges that are keeping the investors away.

Throughout the past year, Amkor struggled with supply chain disruption caused by geopolitical tension and faced macroeconomic challenges caused by high inflation and interest rates. The outsourced semiconductor packaging and test services (OSAT) leader also suffered from the shortage of semiconductors, keeping its top and bottom lines constrained.

In the previous quarter, AMKR reported that it was still suffering from the slow recovery of automotive and industrial space, along with softness in traditional data center client demand. AMKR’s several factories have been reported not to be functioning at full capacity, hence hurting its top-line growth.

Amkor is also suffering from lower demand for its 2.5D integrated circuit caused by the inventory corrections in the automotive and industrial markets. In recent times, Amkor’s operating expenses have also risen due to the construction of a new factory in Vietnam. This has affected its bottom line.

Amkor Technology Three Month Performance

Image Source: Zacks Investment Research

AMKR Faces Stiff Competition in the OSAT Market

Amkor is a major player in the OSAT space, providing solutions for innovative packaging and test technologies with a solid reputation for high-volume manufacturing. AMKR’s presence in multiple countries in Asia and Europe makes it a global player in the OSAT space. The company partnered with the world’s leading tech giants, including Apple, Qualcomm, Intel, Broadcomm, AMD and many more.

In late 2023, Apple partnered with Amkor as the largest customer of the latter’s manufacturing and packaging facility in Peoria. In this partnership, Amkor was contracted to provide chip packaging solutions to Apple. This partnership grew over their decade-long relationship.

However, Amkor faces stiff competition in the OSAT space from Taiwan Semiconductor Manufacturing Company TSM and ASE Technology Holding ASX.

Both ASE Technology and Taiwan Semiconductor operate in the OSAT space internationally. TSM and ASX have their own fabrication facilities. Although TSM’s primary focus is on chip manufacturing, it has a strong advanced packaging division. ASX, on the other hand, is focused on IC packaging, testing and assembly services with products like System-in-Package and 3D IC technologies.

With all these headwinds, AMKR expects third-quarter fiscal 2024 revenues in the range of $1.785-$1.885 billion (mid-point $1.835 billion), while the Zacks Consensus Estimate for the same is pegged at $1.84 billion. The Zacks Consensus Estimate for fiscal 2024 revenues is pegged at $6.51 billion, indicating an improvement of 0.15% year over year.

Conclusion

Amkor is facing macroeconomic challenges, higher operational costs, stiff competition and a slow growth rate due to sluggish recovery in its end markets. Currently, AMKR carries a Zacks Rank #5 (Strong Sell). We suggest investors to sell the stock at present.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Dana Upgraded to Buy: What Does It Mean for the Stock?

Dana DAN appears an attractive pick, as it has been recently upgraded to a Zacks Rank #2 (Buy). This upgrade is essentially a reflection of an upward trend in earnings estimates — one of the most powerful forces impacting stock prices.

The Zacks rating relies solely on a company’s changing earnings picture. It tracks EPS estimates for the current and following years from the sell-side analysts covering the stock through a consensus measure — the Zacks Consensus Estimate.

The power of a changing earnings picture in determining near-term stock price movements makes the Zacks rating system highly useful for individual investors, since it can be difficult to make decisions based on rating upgrades by Wall Street analysts. These are mostly driven by subjective factors that are hard to see and measure in real time.

As such, the Zacks rating upgrade for Dana is essentially a positive comment on its earnings outlook that could have a favorable impact on its stock price.

Most Powerful Force Impacting Stock Prices

The change in a company’s future earnings potential, as reflected in earnings estimate revisions, has proven to be strongly correlated with the near-term price movement of its stock. That’s partly because of the influence of institutional investors that use earnings and earnings estimates for calculating the fair value of a company’s shares. An increase or decrease in earnings estimates in their valuation models simply results in higher or lower fair value for a stock, and institutional investors typically buy or sell it. Their bulk investment action then leads to price movement for the stock.

Fundamentally speaking, rising earnings estimates and the consequent rating upgrade for Dana imply an improvement in the company’s underlying business. Investors should show their appreciation for this improving business trend by pushing the stock higher.

Harnessing the Power of Earnings Estimate Revisions

Empirical research shows a strong correlation between trends in earnings estimate revisions and near-term stock movements, so it could be truly rewarding if such revisions are tracked for making an investment decision. Here is where the tried-and-tested Zacks Rank stock-rating system plays an important role, as it effectively harnesses the power of earnings estimate revisions.

The Zacks Rank stock-rating system, which uses four factors related to earnings estimates to classify stocks into five groups, ranging from Zacks Rank #1 (Strong Buy) to Zacks Rank #5 (Strong Sell), has an impressive externally-audited track record, with Zacks Rank #1 stocks generating an average annual return of +25% since 1988.

Earnings Estimate Revisions for Dana

For the fiscal year ending December 2024, this automotive equipment supplier is expected to earn $0.98 per share, which is a change of 16.7% from the year-ago reported number.

Analysts have been steadily raising their estimates for Dana. Over the past three months, the Zacks Consensus Estimate for the company has increased 34.2%.

Bottom Line

Unlike the overly optimistic Wall Street analysts whose rating systems tend to be weighted toward favorable recommendations, the Zacks rating system maintains an equal proportion of ‘buy’ and ‘sell’ ratings for its entire universe of more than 4000 stocks at any point in time. Irrespective of market conditions, only the top 5% of the Zacks-covered stocks get a ‘Strong Buy’ rating and the next 15% get a ‘Buy’ rating. So, the placement of a stock in the top 20% of the Zacks-covered stocks indicates its superior earnings estimate revision feature, making it a solid candidate for producing market-beating returns in the near term.

The upgrade of Dana to a Zacks Rank #2 positions it in the top 20% of the Zacks-covered stocks in terms of estimate revisions, implying that the stock might move higher in the near term.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

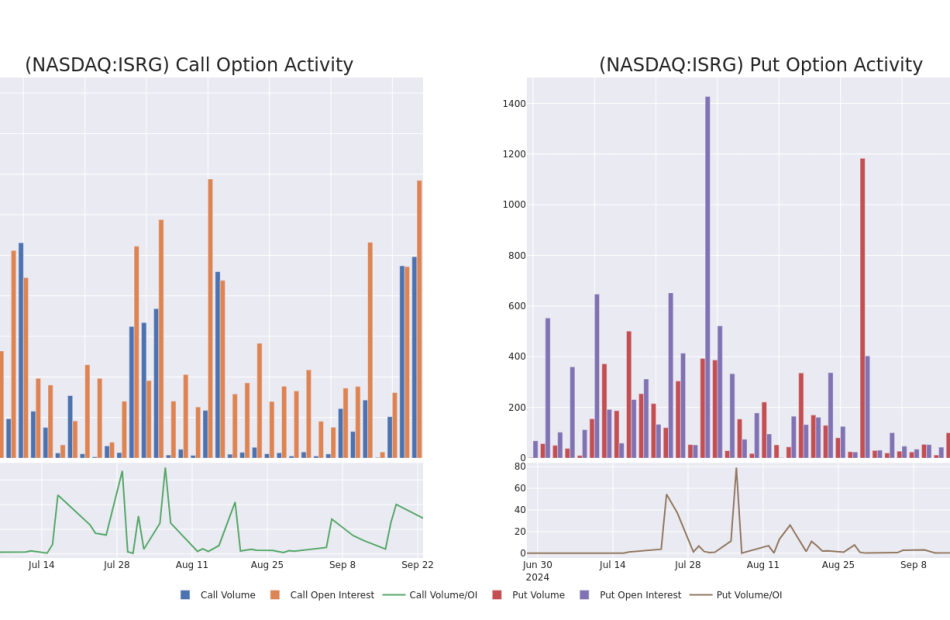

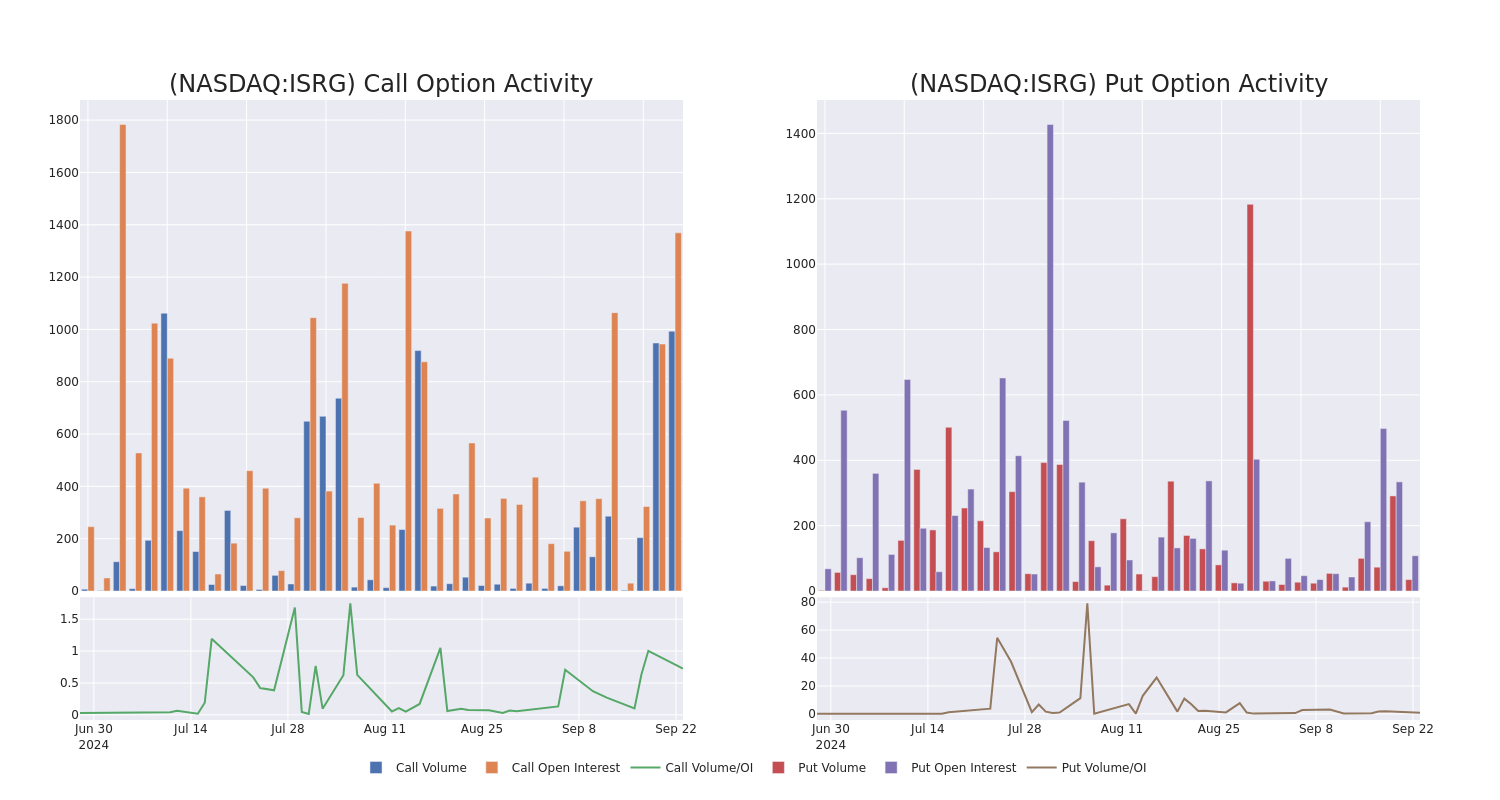

Intuitive Surgical Unusual Options Activity For September 23

Investors with a lot of money to spend have taken a bullish stance on Intuitive Surgical ISRG.

And retail traders should know.

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don’t know. But when something this big happens with ISRG, it often means somebody knows something is about to happen.

So how do we know what these investors just did?

Today, Benzinga‘s options scanner spotted 15 uncommon options trades for Intuitive Surgical.

This isn’t normal.

The overall sentiment of these big-money traders is split between 60% bullish and 40%, bearish.

Out of all of the special options we uncovered, 2 are puts, for a total amount of $63,430, and 13 are calls, for a total amount of $740,149.

Projected Price Targets

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $410.0 to $495.0 for Intuitive Surgical during the past quarter.

Volume & Open Interest Development

In today’s trading context, the average open interest for options of Intuitive Surgical stands at 164.11, with a total volume reaching 1,028.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Intuitive Surgical, situated within the strike price corridor from $410.0 to $495.0, throughout the last 30 days.

Intuitive Surgical Option Activity Analysis: Last 30 Days

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| ISRG | CALL | SWEEP | BEARISH | 10/18/24 | $16.9 | $16.8 | $16.9 | $490.00 | $310.9K | 309 | 256 |

| ISRG | CALL | TRADE | BEARISH | 10/18/24 | $84.2 | $80.3 | $80.82 | $410.00 | $80.8K | 152 | 10 |

| ISRG | CALL | TRADE | BEARISH | 10/18/24 | $16.0 | $15.9 | $15.9 | $492.50 | $39.7K | 0 | 27 |

| ISRG | CALL | SWEEP | BULLISH | 10/18/24 | $16.5 | $16.1 | $16.5 | $490.00 | $36.3K | 309 | 302 |

| ISRG | CALL | SWEEP | BULLISH | 01/17/25 | $40.0 | $38.9 | $40.0 | $485.00 | $36.0K | 169 | 82 |

About Intuitive Surgical

Intuitive Surgical develops, produces, and markets a robotic system for assisting minimally invasive surgery. It also provides the instrumentation, disposable accessories, and warranty services for the system. The company has placed more than 8,600 da Vinci systems in hospitals worldwide, with more than 5,000 installations in the US and a growing number in emerging markets.

Following our analysis of the options activities associated with Intuitive Surgical, we pivot to a closer look at the company’s own performance.

Present Market Standing of Intuitive Surgical

- With a volume of 868,586, the price of ISRG is up 0.59% at $489.07.

- RSI indicators hint that the underlying stock may be approaching overbought.

- Next earnings are expected to be released in 24 days.

What The Experts Say On Intuitive Surgical

In the last month, 1 experts released ratings on this stock with an average target price of $494.0.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* Consistent in their evaluation, an analyst from BTIG keeps a Buy rating on Intuitive Surgical with a target price of $494.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Intuitive Surgical, Benzinga Pro gives you real-time options trades alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

EPS-IA Applauds Bipartisan Bill to Advance Plastics Recycling

Crofton, MD., Sept. 23, 2024 (GLOBE NEWSWIRE) — The EPS Industry Alliance (EPS-IA), the leading North American trade association for the expanded polystyrene (EPS) industry, welcomes the introduction of the Accelerating a Circular Economy for Plastics and Recycling Innovation Act of 2024.

Introduced Thursday by Congressmen Dr. Larry Bucshon (R-Ind.) and Don Davis (D-N.C.), this important bipartisan legislation is a crucial step toward modernizing recycling infrastructure in the United States and spearheading a more sustainable future for plastics.

It is an encouraging development to see members of Congress work with the plastics industry toward implementing actionable solutions.

Ross Eisenberg, vice president of the American Chemistry Council’s plastics division, recently told POLITICO: “We think this bill is really important in the conversation around ending plastic pollution and taking strong steps in that direction. And it’s going to work. If this thing were put into law, it would raise recycling rates significantly higher. We would see meaningful progress in a pretty short amount of time.”

If passed, the Accelerating a Circular Economy for Plastics and Recycling Innovation Act of 2024 would:

- Task the Environmental Protection Agency (EPA) with establishing national plastic recycling standards. Currently, over 9,000 jurisdictions in the U.S. have differing practices, causing confusion and inconsistency.

- Mandate a minimum recycled content requirement for plastic packaging of 30% by 2030, which will encourage private investment in recycling and the development of recyclable packing materials. Future years could see even higher minimum levels of recycled content.

- Require the National Academy of Sciences to complete a lifecycle assessment comparing the carbon impact and greenhouse gas emissions produced different materials, for the purpose of guiding informed policy.

- Establish a legal framework for new recycling technologies to support investment and innovation.

“This bill is a transformative step,” said Betsy Bowers, Executive Director of the EPS Industry Alliance. “It is just as significant for smaller downstream converters across the country as it is for petrochemical industry giants. If enacted, it would mean regulatory certainty for businesses and stronger job security for employees. By making long overdue improvements to our national recycling infrastructure and setting clear national standards, the bill’s passage would incentivize investment, boost recycling rates, and reduce plastic waste.”

EPS-IA is calling on industry leaders and citizens alike to support this pivotal legislation. We encourage them to contact their representatives and voice their support for a more robust and sustainable recycling future.

ABOUT EPS-IA

The EPS Industry Alliance (EPS-IA) is the North American trade association for the expanded polystyrene (EPS) industry. Our members – more than 50 small businesses located in 44 states – manufacture EPS foam insulation used in building and construction and EPS protective packaging for consumer goods including appliances, electronics, pharmaceuticals, furniture, and other products. EPS is a versatile, lightweight material — 98 percent air —that supports a diverse range of industries and significant sectors of our national economy.

###

James DeMarco Red Banyan epsindustry@redbanyan.com

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Biohaven, Tesla And Other Big Stocks Moving Higher On Monday

U.S. stocks were lower, with the Dow Jones index falling around 200 points on Friday.

Shares of Biohaven Ltd. BHVN rose sharply during Monday’s session after the company announced its study of Troriluzole for the treatment of spinocerebellar ataxia in achieved the primary endpoint.

Biohaven shares jumped 18.4% to $47.83 on Monday.

Here are some other big stocks recording gains in today’s session.

- BitFuFu Inc. FUFU gained 11% to $3.80 amid strength in Bitcoin prices.

- TeraWulf Inc. WULF shares gained 10.9% to $4.99.

- Gevo, Inc. GEVO shares jumped 10.5% to $1.47. Gevo recently announced the $20 million sale in investment tax credits from the NW Iowa RNG facility.

- AirSculpt Technologies, Inc. AIRS surged 10.4% to $5.87.

- Super Hi International Holding Ltd. HDL gained 10% to $17.10.

- Hyliion Holdings Corp. HYLN gained 9.2% to $2.25.

- Veea Inc. VEEA surged 9.2% to $11.99.

- AeroVironment, Inc. AVAV gained 6.2% to $194.15.

- enCore Energy Corp. EU rose 6% to $4.0380.

- Tesla, Inc. TSLA gained 3.9% to $247.54. Cantor Fitzgerald analyst Andres Sheppard reiterated Tesla with a Neutral and maintained a $245 price target.

Now Read This:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

EMCOR Hits 52-Week High: Is the Stock Still Worth Buying?

EMCOR Group, Inc. EME shares reached a new 52-week high of $437.10 on Friday. The stock pulled back to end the trading session at $435.60, gaining 1.3% that day. Impressively, the stock marked a 9.9% surge in the past five days.

The move came in after the most awaited interest rate cut news, which boosted the overall market sentiments. On Wednesday, the Federal Reserve announced an interest rate cut by 50 cents to a range of 4.75% to 5%. Reduced interest rates can have a highly supportive effect on infrastructure stocks, benefiting from cheaper financing, increased government and private sector investment, higher appeal for dividend-seeking investors, and potential growth in related sectors like real estate.

In the year-to-date period (YTD), the stock surged more than 104%, handily outpacing the Zacks Building Products – Heavy Construction industry’s 79.9% growth, the broader Construction sector’s 22.6% rise and the S&P 500’s 19.6% increase. Investors looking for momentum stock may dig into EME right now.

Image Source: Zacks Investment Research

EMCOR, known for its strategic focus and diverse offerings, has seen significant growth in recent years amid a competitive landscape of non-residential services.

Substantiating the above-mentioned optimism, the 50-day SMA continues to read higher than the 200-day SMA, signaling a bullish trend. This technical strength underscores positive market sentiment and confidence in EMCOR’s financial health and prospects.

Image Source: Zacks Investment Research

Other stocks from the same industry that touched a 52-week high on Sept. 20 are Dycom Industries, Inc. DY, MasTec, Inc. MTZ and Great Lakes Dredge & Dock GLDD. These stocks surged 72.2%, 67.1% and 40.7%, respectively, in YTD.

Let’s delve deeper into the factors substantiating this Fortune 500 company’s resilience, which currently captures around $17 billion of total market share.

Solid Diversified Business

EMCOR has established itself as a leader in mechanical and electrical construction, industrial infrastructure, and building services. Its focus on these specialized sectors has positioned the company to dominate markets requiring expert solutions.

A key strength of EME is its investment in Virtual Design and Construction technologies, including Building Information Modeling (BIM), which helps the company design and coordinate complex projects. This technology also enhances its prefabrication processes, enabling customized fabrication for electrical, sheet metal, fire sprinkler, and piping systems, thus improving efficiency and competitiveness.

With the growing emphasis on energy efficiency and sustainability, EMCOR is well-positioned to benefit from the increased demand for HVAC and lighting retrofits, as well as building automation services. The Mechanical Services division, which generates nearly 65% of EMCOR’s total revenues, plays a crucial role in meeting this demand and driving the company’s success.

The company also expands in high-growth sectors and geographies via acquisitions. In the first half of 2024, EMCOR acquired four companies. The acquired companies are set to strengthen their Mechanical Construction, Building Services and Industrial Services segments, positioning them well for future growth.

EME’s High RPO Levels May Boost Growth

EMCOR reported remaining performance obligations (RPOs) of $9 billion at end of second-quarter 2024, reflecting an 8.6% year-over-year increase. This near-record RPO level highlights a robust pipeline of future projects, particularly in sectors like data centers, high-tech manufacturing, healthcare, and water/wastewater.

RPOs in the network and communications sector, which includes data centers, reached a record $1.7 billion, marking 40% year-over-year growth. This surge emphasizes EMCOR’s strong position in the expanding data center market, indicating significant future revenue potential.

Strong Cash Flow

The company generated $412 million in operating cash flow in the first six months of 2024, almost double the amount from the prior-year period. This strong cash flow supports the company’s ability to fund growth initiatives, pursue acquisitions, and return capital to shareholders.

EMCOR invests in expanding prefabrication and VDC technologies, including BIM, automation, and robotics, while also engaging in various M&A activities. Additionally, the company provides impressive returns to its stockholders through share repurchases and dividends. In 2024, EMCOR increased its quarterly dividend by 39% to 25 cents.

Obstacles Hindering EME’s Growth Trajectory

EMCOR has faced difficulties in the commercial real estate market due to reduced demand and the completion of several projects. The U.S. and U.K. site-based services businesses, particularly in the U.S. Building Services segment, have experienced revenue setbacks, mainly due to the non-renewal of certain contracts in the last reported quarter.

In addition to sector-specific challenges, EMCOR is exposed to risks from fluctuating global energy markets and supply-chain disruptions. These factors could limit infrastructure investments and increase project costs, creating obstacles to the company’s growth prospects.

Valuation, Return & Growth Trend

EMCOR’s shares are currently overvalued marginally. Its forward 12-month price-to-earnings (P/E) ratio of 22.27 is above its five-year median of 16.23 and the industry’s average of 21.66 currently.

EME provides solid investment returns compared to the industry’s average, as reflected by its current trailing 12-month Return on Equity of 32.7%. This indicates the company efficiently uses its shareholders’ funds.

Image Source: Zacks Investment Research

The Zacks Consensus Estimate for EME’s earnings has moved up in the past 60 days, indicating analysts are showing confidence in the stock. Over the last 60 days, forecasts for 2024 and 2025 have increased to $19.50 (from $16.10) and $19.59 (from $17.41), respectively.

Final Thoughts

EMCOR’s focus on advanced technologies and sustainability, robust capital allocation strategy, and strong financial performance make it a must-buy for investors looking for good long-term gain. Also, Fed’s rate cut is likely to bolster the infrastructure market by lowering borrowing costs, enhancing project viability, encouraging investment, and stimulating economic growth.

However, some industry headwinds and a high valuation depict a risk to the sustainability of its current price if the company’s future performance does not meet investors’ expectations.

We believe its impressive business structure, as well as economic rebound, will help the company generate higher earnings in coming quarters. Additionally, solid return and future earnings expectations reinforce its Zacks Rank #1 (Strong Buy) rating, making EMCOR an attractive addition to investors’ portfolio at present.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

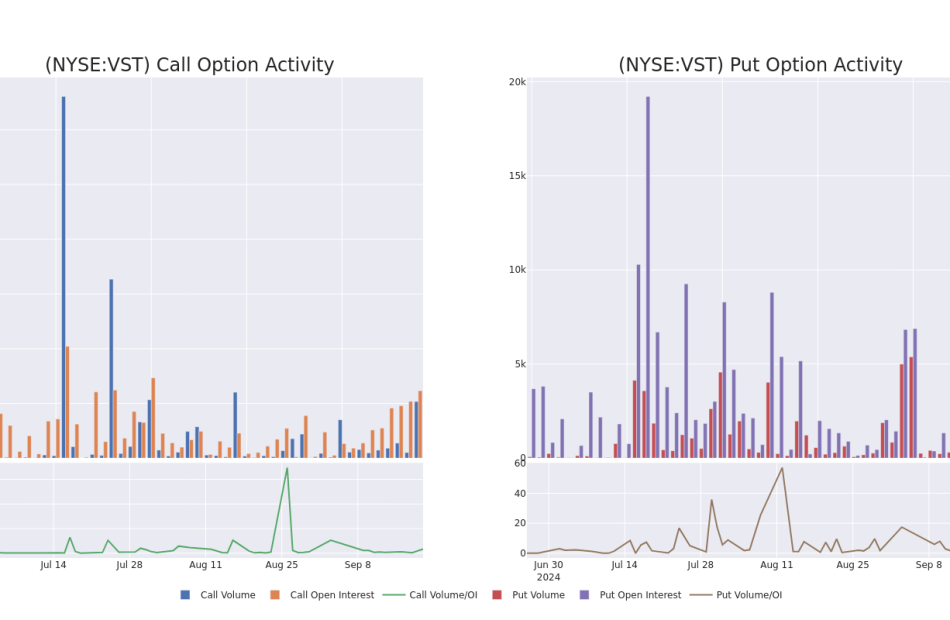

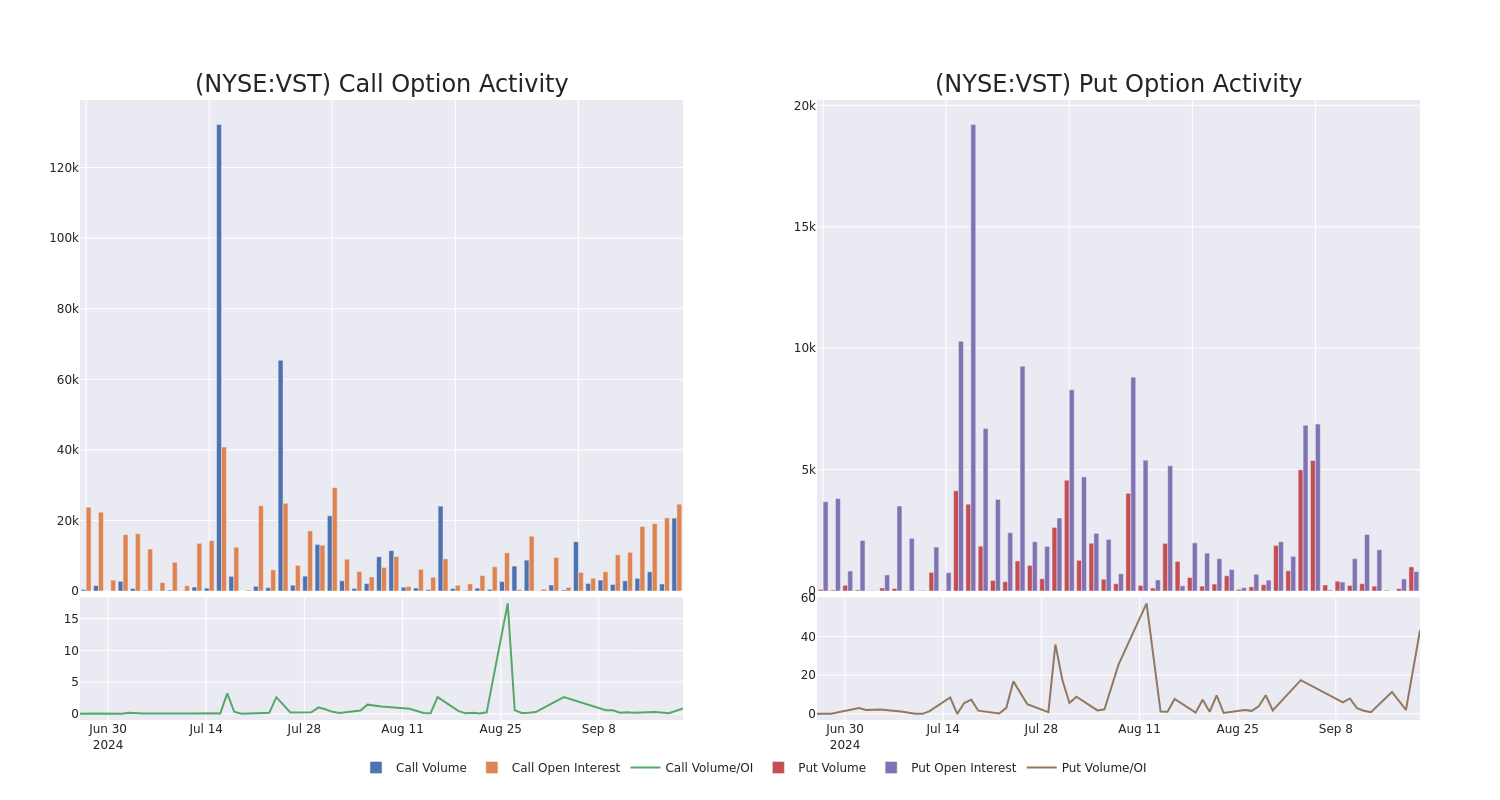

Market Whales and Their Recent Bets on VST Options

Financial giants have made a conspicuous bullish move on Vistra. Our analysis of options history for Vistra VST revealed 96 unusual trades.

Delving into the details, we found 41% of traders were bullish, while 40% showed bearish tendencies. Out of all the trades we spotted, 12 were puts, with a value of $643,223, and 84 were calls, valued at $7,549,105.

Expected Price Movements

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $50.0 to $155.0 for Vistra during the past quarter.

Volume & Open Interest Development

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

This data can help you track the liquidity and interest for Vistra’s options for a given strike price.

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Vistra’s whale activity within a strike price range from $50.0 to $155.0 in the last 30 days.

Vistra Option Activity Analysis: Last 30 Days

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| VST | CALL | TRADE | BULLISH | 11/15/24 | $24.4 | $23.9 | $24.2 | $90.00 | $605.0K | 802 | 253 |

| VST | CALL | SWEEP | BEARISH | 01/15/27 | $34.5 | $34.2 | $34.5 | $115.00 | $345.0K | 0 | 100 |

| VST | CALL | SWEEP | NEUTRAL | 10/18/24 | $21.6 | $21.3 | $21.3 | $87.50 | $223.6K | 708 | 121 |

| VST | CALL | SWEEP | BEARISH | 12/20/24 | $10.2 | $10.1 | $10.1 | $120.00 | $135.3K | 3.1K | 193 |

| VST | PUT | TRADE | BULLISH | 04/17/25 | $6.7 | $6.4 | $6.4 | $85.00 | $112.6K | 162 | 176 |

About Vistra

Vistra Energy is one of the largest power producers and retail energy providers in the us Following the 2024 Energy Harbor acquisition, Vistra owns 41 gigawatts of nuclear, coal, natural gas, and solar power generation along with one of the largest utility-scale battery projects in the world. Its retail electricity business serves 5 million customers in 20 states, including almost a third of all Texas electricity consumers. Vistra emerged from the Energy Future Holdings bankruptcy as a stand-alone entity in 2016. It acquired Dynegy in 2018.

Having examined the options trading patterns of Vistra, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Current Position of Vistra

- Currently trading with a volume of 15,603,256, the VST’s price is up by 3.85%, now at $112.03.

- RSI readings suggest the stock is currently may be overbought.

- Anticipated earnings release is in 43 days.

What Analysts Are Saying About Vistra

A total of 3 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $118.66666666666667.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* Maintaining their stance, an analyst from Morgan Stanley continues to hold a Overweight rating for Vistra, targeting a price of $132.

* An analyst from BMO Capital persists with their Outperform rating on Vistra, maintaining a target price of $125.

* In a cautious move, an analyst from Jefferies downgraded its rating to Buy, setting a price target of $99.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Vistra with Benzinga Pro for real-time alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Are you rich enough to score an Amex Centurion Card? (Spoiler: You're not)

All information about the American Express Centurion Card has been collected independently by Yahoo Finance. The details on this page have not been reviewed by the card issuer.

The American Express Centurion Card, also known as the Black Card, is the most exclusive credit card on the market. To apply, you need to receive an invitation from the card issuer — and to say the requirements are steep is an understatement.

There are business and personal versions of the Centurion Card, each of which comes with an astounding annual fee and an even more costly initiation fee. And because of the cards’ invite-only status, you’ll need to be willing to spend big just for a chance to own the card.

American Express keeps a tight lid on the card’s details and declined to comment on this story. But based on anecdotes from cardholders and online reports, here’s what we know about this card.

How to get approved for the Amex Centurion Card

American Express offers some of the most premium credit cards on the market, but the Black Card takes the cake. You can only apply for the card if you receive an invitation from the card issuer. Prospective cardholders were previously able to request consideration on the Centurion site, though that option has since been removed.

The card issuer doesn’t disclose the criteria it considers to extend an invitation, but online reports suggest you need to spend anywhere between $200,000 and $1 million a year on American Express credit cards.

You also typically need excellent credit, with some reporting a minimum score of 800.

Amex Centurion Card fees

The Amex Centurion Card offers a lot of value, but its eye-watering fees make it clear that its biggest benefit is prestige.

If you’re invited to apply and you accept, the card issuer charges a $10,000 initiation fee to become a Centurion member. On top of that, the card charges a $5,000 annual fee.

You can add authorized users to your Centurion account, too, but those extra cards come with the same $5,000 annual fee as your initial card.

There’s no preset spending limit and you generally need to pay your balance in full each month. As with other Amex cards, some purchases may be eligible for the Pay Over Time feature, which offers you more time to pay off the purchase with interest.

Read more: How does credit card interest work?

Amex Centurion rewards

Despite the large sums many Centurion cardholders spend, rewards are not this card’s greatest feature. There’s no welcome bonus or intro offer, and everyday purchases will net you just 1 point per dollar.

One way you can earn bonus Membership Rewards points is through large purchases. It’s unclear if bonus rewards extend to personal cardmembers, but Business Centurion cardholders will earn a bonus 1.5x points per dollar (up to spending caps) on eligible purchases of $5,000 or more.

If you’re looking to maximize your spending with Membership Rewards, you’ll get a much better value across categories with the American Express® Gold Card or The Platinum Card® from American Express. Even if you can score a Centurion Card invite, pairing your Black Card with these higher-earning Amex options can be a smart way to make the most of your spending — then pool the points you earn to take advantage of the Centurion’s travel redemptions.

Read more: The best credit cards from American Express

Redeeming rewards

You’ll earn American Express Membership Rewards points with the Centurion Card, which you can redeem the same way you would with any other Amex card.

Booking flights through Amex Travel or transferring points to Amex’s airline and hotel partners are typically the highest-value methods to redeem your Membership Rewards. However, you can also shop with points online, get statement credits, redeem for gift cards, book other travel, and more.

There’s one big redemption perk exclusively for Centurion cardholders: When you use your points to book flights through Amex Travel, you’ll get a 50% bonus. In other words, if you book a flight using 100,000 points, you’ll get 50,000 of those points back — essentially upping your rewards value to an incredible 2 cents per point.

Amex Centurion Card benefits

For such an expensive card, you’d expect best-in-class perks — and that’s exactly what you’ll get. Here’s a rundown of all the benefits you’ll get with a Centurion Card:

Elite status

As a cardholder, you’ll become an automatic elite member with several top travel loyalty programs. That includes:

-

Delta SkyMiles Platinum Medallion

-

Hilton Honors Diamond

-

IHG One Rewards Platinum Elite

-

Marriott Bonvoy Gold Elite

-

Hertz Platinum

-

Avis President’s Club

Airport lounge access

You’ll get access to the Amex Global Lounge Collection, which includes several airport lounge networks:

-

The Centurion Lounge

-

Priority Pass Select

-

Delta Sky Club

-

Lufthansa Lounges

-

Escape Lounges

-

Plaza Premium Lounges

Amex Global Lounge Collection includes over 1,400 airport lounges worldwide across 140 countries.

While some other Amex cardholders (including those with the Platinum Card) also have access to the collection, Centurion members get a few extra perks, including complimentary access — rather than paying a per-visit fee like some other cardholders. Other Centurion perks include priority check-in, complimentary premium drinks, and reserved seating at Centurion Lounges.

More travel and airport benefits

The Centurion Card really shines when it comes to travel benefits, which makes sense for a card tailored to frequent travelers.

At select airports, you can benefit from VIP arrival and departure services, including a personal guide if you’re flying business or first class. The card issuer can also arrange ground transportation for you. That’s just the start of perks you’ll get while flying, though:

-

Fee credit for Global Entry or TSA PreCheck: Receive statement credits every 4 years for Global Entry or every 4.5 years for TSA PreCheck fee costs.

-

CLEAR Plus credit: Receive up to $369 in statement credits each year for CLEAR Plus membership (subject to auto-renewal) for you and family members or friends added to your account.

-

International Airline Program: Get discounts for lower fares on international flights (First Class, Business Class, or Premium Economy tickets) when you book with select airlines through Amex Travel.

-

PS Membership and complimentary access: Get membership for PS private airport terminal access, though you’ll still need to pay to use PS Private Suites when you travel. Centurion members also get up to two complimentary visits to The Salon (currently available at LAX and ATL airports) annually.

-

Fine Hotels + Resorts: Access Fine Hotels + Resorts properties when you book an eligible stay through Amex Travel and get exclusive benefits as a Centurion member, including credits to use on select charges during your stay and upgrades when available.

Concierge services

Get access to Centurion Membership Services, essentially offering 24/7 access to a personal assistant to help you with a variety of needs, such as planning travel, scoring impossible-to-get reservations and event tickets, and finding unique gifts for your loved ones.

Read more: How to reserve a table at the hottest restaurant with your credit card

Travel protections and insurance

The Centurion Card has plenty of practical benefits, too, helping you rest assured that your travel bookings and card purchases are protected. Like any card, your purchases will only be covered if you use your Amex card for the transaction:

-

Premium Global Assist hotline: Use this 24/7 hotline to get help before and during an eligible trip more than 100 miles from home. Potential services include customs and vaccination information, lost passport replacement, translation services, missing luggage assistance, emergency medical referrals and transportation, emergency urgent message relay, legal referrals, and more.

-

Trip cancellation and interruption insurance: If your covered trip is canceled or interrupted for a covered reason, get reimbursed for non-refundable eligible expenses (up to $10,000 per covered trip and up to $20,000 per 12-month period).

-

Trip delay insurance: If your covered trip is delayed by more than six hours, get reimbursed for eligible related expenses, including meals, lodging, toiletries, etc. (up to $500 per covered trip, up to two claims per 12-month period).

-

Car rental loss and damage insurance: Coverage against rental vehicle damage or theft in eligible locations (secondary coverage only).

-

Baggage insurance plan: Protection against lost, damaged, or stolen baggage on an eligible common carrier vehicle trip: flight, train, ship, etc. (up to $2,000 for checked baggage and up to a combined $3,000 for carry-on baggage; different limits apply for New York state cardmembers).

-

Cell phone protection: Get reimbursed for eligible repair or replacement costs (whichever is less) if your cell phone is damaged or stolen (subject to $50 deductible; coverage up to $800, up to two claims per year).

-

Purchase protection: Protection for eligible purchases against theft, damage, or loss within 90 days of the purchase date (up to $10,000 per covered purchase, up to $50,000 per calendar year).

-

Return protection: If the merchant won’t accept a return within 90 days of purchase, Amex will refund you the purchase price of eligible items (up to $300 per item, up to $1,000 per calendar year; not including shipping and handling charges).

-

Extended warranty: Get up to three additional years’ coverage on eligible items with an original manufacturer’s warranty of five years or less (up to $10,000 per covered item, up to $50,000 per calendar year).

Eligibility and benefit level varies by card. Terms, conditions, and limitations apply. Please visit americanexpress.com/benefitsguide for more details. Underwritten by Amex Assurance Company.

Additional luxury benefits

The Centurion Card comes with a host of other premium perks. One thing to keep in mind is that your location often makes a difference; if you’re not located in a major city, you may have more difficulty taking advantage of some of these benefits:

-

Resy Global Dining Access: Get easier access to hard-to-get restaurant reservations and exclusive experiences through Resy when you add your Centurion Card to your account.

-

Centurion New York: Luxury space for Centurion members in midtown Manhattan; it includes a restaurant, bar, and lounge area for working or meetings.

-

Equinox Destination Access: Get complimentary Destination membership to Equinox gyms; this membership gets you access to clubs across the U.S., Canada, and the U.K., with some exceptions (Hudson Yards, E Clubs, etc.).

-

SoulCycle: Get $300 back when you purchase a SoulCycle at-home bike with your Centurion Card (Equinox+ membership required).

-

Saks credits: Get up to $250 in statement credits per quarter (with enrollment) toward purchases at Saks Fifth Avenue or at Saks.com, up to $1,000 in total each year.

-

Cruise Privileges Program: Benefits on eligible cruise sailings of five nights or more (booked through Amex Travel), including $100 to $300 per statement onboard credits and more.

Exclusive Centurion member perks

In addition to the official benefits and annual credits you can get as a Centurion cardmember, there are plenty of extra perks that can be harder to quantify.

For example, Amex regularly offers Centurion members exclusive experiences, from private performances to luxury travel experiences and exclusive access to sporting, entertainment, or arts events. You might even occasionally receive gifts from Amex just for being a Centurion member — credits when you shop with partners, free nights at select hotel properties, and gifted items from luxury brands.

You probably won’t open a Centurion Card solely for these perks — in fact, they’re often a surprise for recipients — but they do illustrate the above-and-beyond service that Centurion cardholders can expect.

Amex Centurion Card alternatives

The Amex Centurion Card is the holy grail of credit cards, but most people won’t receive an invitation to apply. If you don’t qualify for the Black Card, consider other premium credit cards to get the travel and lifestyle perks you’re looking for.

-

Rewards rate

- 5x points for flights booked directly with airlines or with American Express Travel (up to $500,000 per year)

- 5x points on prepaid hotels booked with American Express Travel

- 1x points on all other purchases

-

Benefits

- Get up to $200 back in statement credits each year on prepaid Fine Hotels + Resorts or The Hotel Collection bookings with American Express Travel (requires a minimum two-night stay)

- Get up to $199 back per calendar year on your CLEAR Plus membership (subject to auto-renewal) when you use your card (CLEARLanes are available at 100+ airports, stadiums, and entertainment venues)

- Enjoy Uber VIP status and up to $200 in Uber savings on rides or eats orders in the U.S. annually (you must have the latest version of the Uber App downloaded and your eligible American Express Platinum Card must be a method of payment in your Uber account; Amex benefit may only be used in United States)

The Platinum Card charges a steeper annual fee than most credit cards, but it still pales in comparison to the Centurion Card’s costs. This card is also more rewarding for travel spending, with up to 5x points on flights booked with airlines or through Amex Travel (up to $500,000 spent per calendar year) and on prepaid hotels booked through Amex Travel.

You can redeem your rewards for travel and more through American Express Membership Rewards, giving you up to 1 cent per point in value, or transfer them to one of the card issuer’s many airline and hotel loyalty program partners.

While you won’t get quite the same quality of lifestyle and travel benefits, the Platinum Card does come closest to the Centurion in added perks. Some of the card’s benefits include:

-

Up to $200 in airline fee credits with one qualifying airline each year

-

Up to $200 back in statement credits for select prepaid hotel bookings through Amex Travel

-

Up to $240 in digital entertainment credits with select providers each year (up to $20 per month; with enrollment)

-

Access to several airport lounges (the same list you get with the Black Card)

-

Up to $155 in statement credits toward an auto-renewing Walmart+ membership each year (up to $12.95 per month)

-

Up to $100 in statement credits for Saks Fifth Avenue purchases each year (enrollment required)

-

Up to $199 annual CLEAR Plus credit (subject to auto-renewal)

-

Hilton Honors Gold Status and Marriott Bonvoy Gold Elite Status

-

Elite status with Avis, Hertz, and National Car Rental

-

Application fee credit toward Global Entry or TSA PreCheck

-

Access to Platinum Travel Service consultants and Premium Global Assist Hotline

Read our full review of the Amex Platinum Card.

-

Rewards rate

- 10x points on hotels and rental cars purchased through Chase Travel℠*

- 5x points on flights purchased through Chase Travel*

- 3x points on dining and other travel purchases

- 1x points on all other purchases

- *After the first $300 is spent on travel purchases annually

-

Benefits

- Points are worth 50% more when you redeem through Chase Travel

- Earn up to $300 in annual statement credits for travel purchases

- Receive up to a $100 statement credit every four years to cover the application fee for Global Entry, TSA PreCheck, or NEXUS

The Sapphire Reserve charges a steep annual fee, and while its perks aren’t as impressive as what you’d get with the Platinum Card, it packs a significant punch with its rewards program.

When you’re ready to redeem your rewards, you’ll get 50% more value if you use them to book travel through Chase. Alternatively, you can transfer your rewards to one of the card issuer’s many airline and hotel transfer partners.

The card’s other benefits include:

-

$300 annual travel credit each anniversary year

-

Complimentary access to Priority Pass airport lounges and Chase Sapphire Lounges by The Club

-

VIP access to various events through Reserved by Sapphire

-

Special amenities and complimentary upgrades with Avis, Hertz, National Car Rental, and Audi On Demand

-

Bonus rewards and other perks with various partners, including Lyft, Peloton, DoorDash, and Instacart

Read our full review of the Chase Sapphire Reserve

-

Rewards rate

- 10x miles on hotels and rental cars booked through Capital One Travel

- 5x miles on flights and vacation rentals booked through Capital One Travel

- 2x miles on all other purchases

-

Benefits

- $300 annual credit for travel bookings through Capital One Travel

- 10,000 annual bonus miles (worth $100 in travel spending; starts on your first account anniversary)

- Unlimited access for you and two guests to Capital One Lounges and 1,300+ more lounges through partner networks

If you want some premium benefits but want to keep your annual fee to a minimum, consider the Capital One Venture X Rewards Credit Card.

On top of rewards, you’ll get benefits like an annual credit for bookings through Capital One Travel; access to airport lounges through the Capital One Lounges and the Partner Lounge Network; 10,000 bonus miles each year starting on your first cardmember anniversary; and more.

When redeeming your rewards, you can simply book directly through Capital One Travel and use miles to pay or use your card to book travel on your own and request a statement credit. You can also transfer your rewards to 15+ partner airline and hotel loyalty programs.

Read our full review of the Capital One Venture X Rewards Credit Card

Frequently asked questions about the Amex Centurion Card

How much does the Centurion card cost?

On top of the money you’ll have to spend with Amex just to get an invitation to the Centurion Card, there’s a big price tag. You’ll pay a $10,000 initiation fee just to open the card, plus a $5,000 annual fee each year of membership.

Who can apply for the Amex Black Card?

Unlike other credit cards, there’s no open application process for the Amex Centurion Card. You must receive an invitation to apply for the card. Invitations are typically based on your previous spending with Amex.

Is the Centurion Card worth it?

If you’ve spent enough money to get a Centurion Card invitation, you may find the benefits worth the price. Very frequent travelers and wealthy individuals or business owners who value privacy and exclusivity can probably find a lot to love about Centurion Member perks.

For the average consumer, though, Centurion benefits are likely not worth the card’s cost — even if they are covetable. Unless you’re already traveling very often, spending much of your income on travel, and can truly take advantage of the exclusive access and opportunities the Black Card offers, you’ll get more value from other rewards credit cards.

This article was edited by Alicia Hahn

Editorial Disclosure: The information in this article has not been reviewed or approved by any advertiser. All opinions belong solely to Yahoo Finance and are not those of any other entity. The details on financial products, including card rates and fees, are accurate as of the publish date. All products or services are presented without warranty. Check the bank’s website for the most current information. This site doesn’t include all currently available offers. Credit score alone does not guarantee or imply approval for any financial product.