Amkor Falls 18% in 3 Months: How Should Investors Play the Stock?

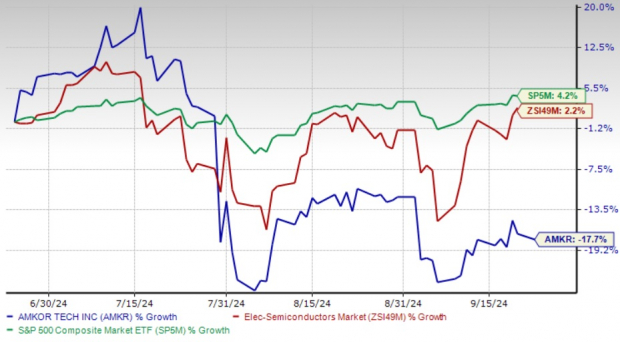

Amkor Technology AMKR shares have lost 17.7% in the past three months, underperforming the Zacks Electronics – Semiconductors industry and the S&P 500 index’s return of 2.2% and 4.2%, respectively. The underperformance is attributable to a myriad of challenges that are keeping the investors away.

Throughout the past year, Amkor struggled with supply chain disruption caused by geopolitical tension and faced macroeconomic challenges caused by high inflation and interest rates. The outsourced semiconductor packaging and test services (OSAT) leader also suffered from the shortage of semiconductors, keeping its top and bottom lines constrained.

In the previous quarter, AMKR reported that it was still suffering from the slow recovery of automotive and industrial space, along with softness in traditional data center client demand. AMKR’s several factories have been reported not to be functioning at full capacity, hence hurting its top-line growth.

Amkor is also suffering from lower demand for its 2.5D integrated circuit caused by the inventory corrections in the automotive and industrial markets. In recent times, Amkor’s operating expenses have also risen due to the construction of a new factory in Vietnam. This has affected its bottom line.

Amkor Technology Three Month Performance

Image Source: Zacks Investment Research

AMKR Faces Stiff Competition in the OSAT Market

Amkor is a major player in the OSAT space, providing solutions for innovative packaging and test technologies with a solid reputation for high-volume manufacturing. AMKR’s presence in multiple countries in Asia and Europe makes it a global player in the OSAT space. The company partnered with the world’s leading tech giants, including Apple, Qualcomm, Intel, Broadcomm, AMD and many more.

In late 2023, Apple partnered with Amkor as the largest customer of the latter’s manufacturing and packaging facility in Peoria. In this partnership, Amkor was contracted to provide chip packaging solutions to Apple. This partnership grew over their decade-long relationship.

However, Amkor faces stiff competition in the OSAT space from Taiwan Semiconductor Manufacturing Company TSM and ASE Technology Holding ASX.

Both ASE Technology and Taiwan Semiconductor operate in the OSAT space internationally. TSM and ASX have their own fabrication facilities. Although TSM’s primary focus is on chip manufacturing, it has a strong advanced packaging division. ASX, on the other hand, is focused on IC packaging, testing and assembly services with products like System-in-Package and 3D IC technologies.

With all these headwinds, AMKR expects third-quarter fiscal 2024 revenues in the range of $1.785-$1.885 billion (mid-point $1.835 billion), while the Zacks Consensus Estimate for the same is pegged at $1.84 billion. The Zacks Consensus Estimate for fiscal 2024 revenues is pegged at $6.51 billion, indicating an improvement of 0.15% year over year.

Conclusion

Amkor is facing macroeconomic challenges, higher operational costs, stiff competition and a slow growth rate due to sluggish recovery in its end markets. Currently, AMKR carries a Zacks Rank #5 (Strong Sell). We suggest investors to sell the stock at present.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Leave a Reply