Billionaires Warren Buffett, David Tepper, and Terry Smith Are Sending a Very Clear Warning to Wall Street — Are You Paying Attention?

For the better part of two years, the bulls have been firmly in control on Wall Street. A resilient U.S. economy, coupled with excitement surrounding the rise of artificial intelligence (AI), have helped lift the ageless Dow Jones Industrial Average (DJINDICES: ^DJI), benchmark S&P 500 (SNPINDEX: ^GSPC), and growth-focused Nasdaq Composite (NASDAQINDEX: ^IXIC) to multiple record-closing highs in 2024.

However, optimism isn’t universal when it comes to investing. Some of the most prominent and widely followed billionaire money managers, including Berkshire Hathaway‘s (NYSE: BRK.A)(NYSE: BRK.B) Warren Buffett, Appaloosa’s David Tepper, and Fundsmith’s Terry Smith, have been sending an ominous warning to Wall Street with their trading activity.

Some of Wall Street’s top investors are retreating to the sidelines

Although no money manager is a carbon copy of another, Buffett, Tepper, and Smith are cut from similar cloths. While they may have different areas of expertise or dabble in investment areas the other two may not — e.g., David Tepper tends to be a bit of a contrarian and isn’t afraid to invest in distressed assets, including debt — all three tend to be patient investors who focus on locating undervalued/underappreciated companies that can be held for long periods in their respective funds. It’s a really simple formula that’s worked well for all three billionaire investors.

When Form 13Fs are filed with the Securities and Exchange Commission each quarter, professional and everyday investors flock to these reports to see which stocks, industries, sectors, and trends have been piquing the interest of Wall Street’s brightest investment minds. However, the latest round of 13Fs had a surprise for investors who closely follow the trading activity of Buffett, Tepper, and Smith.

The June-ended quarter marked the seventh consecutive quarter that Warren Buffett was a net seller of stocks. Jettisoning more than 389 million shares of top holding Apple during the second quarter, and north of 500 million shares, in aggregate, since Oct. 1, 2023, has led to a cumulative $131.6 billion in net stock sales since the start of October 2022.

Despite advocating that investors not bet against America, and emphasizing the value of long-term investing, Buffett’s short-term actions haven’t lined up with his long-term ethos.

But he’s not alone.

David Tepper’s Appaloosa closed out June with a 37-security investment portfolio worth around $6.2 billion. During the second quarter, Tepper and his team added to nine of these positions and reduced or completely sold his fund’s stake in 28 others, including Amazon, Microsoft, Meta Platforms, and Nvidia. Tepper dumped 3.73 million shares of Nvidia, equating to more than 84% of Appaloosa’s prior position.

U.K. stock picker extraordinaire Terry Smith ended June with a 40-stock portfolio worth roughly $24.5 billion. He added to his stakes in just three of these 40 stocks — Fortinet, Texas Instruments, and Oddity Tech — while reducing his fund’s position in the other 37.

These patient and historically optimistic investors are sending a message that’s undeniably clear: Value is hard to come by right now on Wall Street.

Stocks are historically pricey — and that’s a problem

Although “value” is a completely subjective term, one valuation tool points to stocks being at one of their priciest levels in history, dating back to the 1870s. I’m talking about the S&P 500’s Shiller price-to-earnings (P/E) ratio, which is also known as the cyclically adjusted price-to-earnings ratio (CAPE ratio).

Most investors are probably familiar with the traditional P/E ratio, which divides a company’s share price into its trailing-12-month earnings per share (EPS). While the P/E ratio tends to work pretty well for mature businesses, it falls short for growth stocks that reinvest a lot of their cash flow. It can also be adversely impacted by one-off events, such as the COVID-19 lockdowns.

The Shiller P/E ratio is based on average inflation-adjusted EPS over the last 10 years. Taking a decade’s worth of earnings history into account means short-term events don’t adversely affect this valuation model.

As of the closing bell on Sept. 16, the S&P 500’s Shiller P/E stood at 36.27, which is just below its 2024 high of roughly 37, and more than double the 153-year average of 17.16, when back-tested to 1871.

To be fair, the Shiller P/E has spent much of the last 30 years above its historic average due to two factors:

-

The internet democratized the access to information, which gave everyday investors more confidence to take risks.

-

Interest rates spent more than a decade at or near historic lows, which encouraged investors to pile into higher-multiple growth stocks that can benefit from low borrowing costs.

But when examined as a whole, there are only two other periods throughout history where the S&P 500’s Shiller P/E supported a higher level during a bull market. It peaked at 44.19 in December 1999, just prior to the dot-com bubble bursting, and briefly topped 40 during the first week of January 2022.

Following the dot-com bubble peak, the S&P 500 shed just shy of half of its value, while the Nasdaq Composite lost more than three-quarters before finding its footing. Meanwhile, the 2022 bear market saw the Dow Jones, S&P 500, and Nasdaq Composite all lose at least 20% of their value.

In 153 years, there have only been six occasions where the S&P 500’s Shiller P/E has surpassed 30 during a bull market, including the present. Following all five previous instances, the minimum downside in the S&P 500 has been 20%, with the Dow Jones Industrial Average losing as much as 89% during the Great Depression.

The point is that extended stock valuations can only be sustained for so long. Even though Warren Buffett would never bet against America, and Terry Smith is always on the lookout for undervalued assets, neither billionaire money manager feels compelled to put their capital to work. In fact, Berkshire Hathaway was sitting on a record $276.9 billion in cash at the end of June, and Buffett still isn’t a buyer of stocks… other than shares of his own company.

In short, some of Wall Street’s most-successful long-term, value-seeking investors want little to do with the stock market right now, and it’s a very clear warning that investors should be paying attention to.

Where to invest $1,000 right now

When our analyst team has a stock tip, it can pay to listen. After all, Stock Advisor’s total average return is 762% — a market-crushing outperformance compared to 167% for the S&P 500.*

They just revealed what they believe are the 10 best stocks for investors to buy right now…

*Stock Advisor returns as of September 16, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Sean Williams has positions in Amazon and Meta Platforms. The Motley Fool has positions in and recommends Amazon, Apple, Berkshire Hathaway, Fortinet, Meta Platforms, Microsoft, Nvidia, and Texas Instruments. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

Billionaires Warren Buffett, David Tepper, and Terry Smith Are Sending a Very Clear Warning to Wall Street — Are You Paying Attention? was originally published by The Motley Fool

This Monster Growth Stock Is Up Nearly 300% in 5 Years. Here's Why It's the Largest Stock Position in My Portfolio Right Now.

The last five years were chaotic, with a global pandemic, a presidential election, inflation, swift interest rate changes, bank failures, and more. Despite this level of economic disruption, the S&P 500 is up nearly 90%. That’s a good run, all things considered.

As good as these broad market returns have been, MercadoLibre (NASDAQ: MELI) stock has left the S&P 500 completely in the dust. Shares of this Latin American business are up over 280% in the last five years.

MercadoLibre is the largest position in my personal Roth IRA, and I’ll explain why in a moment. But first, I want to provide some context to prevent potential misunderstandings.

My Roth IRA is less than five years old. I previously had a retirement account with my employer. I didn’t have control over how that account was invested. But upon changing jobs, I rolled the account over and suddenly had investable cash and decision-making ability.

I quickly diversified the account to over 20 stock positions because diversification is important — it’s a core Motley Fool investing principle. In early 2022, I purchased shares of MercadoLibre for the first time, dollar-cost averaging into my new position until it was worth about 5% of the Roth IRA’s value.

It wasn’t the largest position at the time, but MercadoLibre stock certainly holds that title now. It’s worth far more than 5% of the total portfolio value. However, there are three reasons why I’m not looking to sell any MercadoLibre shares anytime soon.

1. MercadoLibre is poised for growth

Investors can make money in low-growth industries. But it’s way easier to find winning investments by concentrating on leaders in growing markets.

In MercadoLibre’s case, its two main business segments are its e-commerce marketplace and its financial technology (fintech) services. Competition would be far more fierce in North America or Europe. But in its native Latin America, MercadoLibre enjoys a leading position thanks to its early entry into the space.

In terms of market maturity, Latin American markets for e-commerce and digital financial products are younger than those markets in North America, generally speaking. This partly explains why MercadoLibre’s growth has been stellar and why it could remain strong for the foreseeable future.

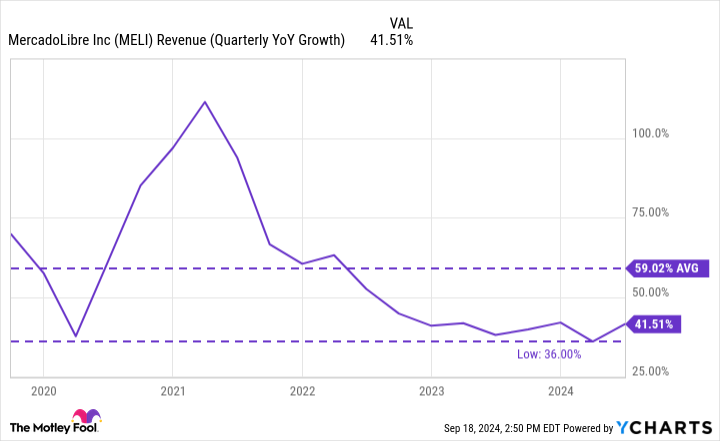

Regarding its growth rate, the chart below shows that MercadoLibre’s slowest growth rate of the last five years was 36% — most companies rarely have a single year of growth that good. And MercadoLibre has averaged top-line growth of nearly 60% across that period. At this rate, the business will quadruple in size every three years, which is just mind-blowing.

I’m not necessarily saying that MercadoLibre will maintain this current pace. But its growth still seems to have plenty of runway, which is the top reason I’m happy that MercadoLibre stock is the largest position in my Roth IRA.

2. MercadoLibre is poised for profits

Many years ago, MercadoLibre decided to sacrifice its good profit margins to invest in shipping and logistics. In its geographies, logistics was the challenge that few companies were solving for. It wasn’t quick, cheap, or easy. But today, MercadoLibre has impressive abilities.

For perspective, over half of orders on MercadoLibre’s e-commerce platform are being delivered same day or next day, which is a rare level of service in the company’s key markets.

Its strength in logistics supports the long-term growth of MercadoLibre’s e-commerce marketplace. Not only are more third-party sellers getting on board (feeding a high-margin revenue stream), but growth of the platform also allows for growth in advertising revenue. The company had around $250 million in ad revenue in the second quarter of 2024, which was up more than 50% year over year.

Moreover, MercadoLibre’s strength in logistics gives it a competitive advantage, and companies with powerful advantages often find ways to improve their margins over time.

In recent years, MercadoLibre’s revenue growth has been outstanding. But as the chart below shows, growth for profit metrics such as operating income and free cash flow has been even better.

I would expect more gains for MercadoLibre stock if its profits continue to grow as they are now.

3. Letting winners run is a winning strategy

One principle for investing the Motley Fool way is to have a diverse portfolio. Another principle is to let a winning investment continue running, rather than selling it prematurely.

Let’s face it, a diverse portfolio is going to be filled with plenty of bad investments — mine sure is. This can drag down overall long-term returns. However, a single winning stock can do the heavy lifting. But this can only happen if it’s allowed enough time to grow.

There are legitimate reasons to sell a stock. But MercadoLibre’s business is thriving, and it appears to have a long runway. For these reasons, I’ll keep holding my top stock and allow it to lift my portfolio as a whole.

Where to invest $1,000 right now

When our analyst team has a stock tip, it can pay to listen. After all, Stock Advisor’s total average return is 757% — a market-crushing outperformance compared to 167% for the S&P 500.*

They just revealed what they believe are the 10 best stocks for investors to buy right now… and MercadoLibre made the list — but there are 9 other stocks you may be overlooking.

*Stock Advisor returns as of September 16, 2024

Jon Quast has positions in MercadoLibre. The Motley Fool has positions in and recommends MercadoLibre. The Motley Fool has a disclosure policy.

This Monster Growth Stock Is Up Nearly 300% in 5 Years. Here’s Why It’s the Largest Stock Position in My Portfolio Right Now. was originally published by The Motley Fool

Trump's Historic Bitcoin Transaction, Ethereum Co-Founder Backs Trump Over Harris For Crypto, Gamestop Customer's Bitcoin Windfall, And More: This Week In Cryptocurrency

Over the weekend, the cryptocurrency world was buzzing with news. From Anthony Scaramucci‘s comments on former President Donald Trump‘s influence on the crypto industry to a lucky GameStop customer’s Bitcoin windfall, there was no shortage of intriguing developments. Here’s a quick recap of the top stories.

Scaramucci’s Warning on Trump’s Crypto Influence

Founder of SkyBridge Capital, Anthony Scaramucci, voiced his concerns about the potential impact of a Trump victory on the cryptocurrency industry at the Token2049 conference. Scaramucci emphasized Trump’s polarizing effect, suggesting his support for crypto could trigger a backlash from those opposed to him. Read the full article here.

GameStop Customer Strikes Bitcoin Gold

A GameStop Corporation GME customer hit the jackpot, turning a small purchase into a Bitcoin worth over $60,000. The windfall came from a redemption code in the Cardsmiths Currency Series 1 trading card series, which features influential figures in the cryptocurrency sector. Read the full article here.

Trump’s Historic Bitcoin Transaction

In a move hailed as ‘one of the most historic transactions’, former President Trump paid for his meal at a crypto-themed bar in New York using Bitcoin BTC/USD during a campaign stop. The move was seen as an attempt to garner support from the crypto community. Read the full article here.

Shiba Inu Launches K9 Finance Liquid Staking

The Shiba Inu team announced the launch of the K9 Finance liquid staking platform on the Shibarium network. The new platform is expected to boost SHIB by increasing the total value locked on Shibarium and the transaction volume on the network. Read the full article here.

Ethereum Co-Founder Backs Trump Over Harris for Crypto

Charles Hoskinson, co-founder of the Ethereum ETH/USD blockchain, expressed his preference for Donald Trump over Vice President Kamala Harris from a cryptocurrency perspective at the TOKEN2049 conference. Hoskinson emphasized the importance of global regulatory frameworks for crypto, regardless of the U.S. stance. Read the full article here.

Image Via Shutterstock

This story was generated using Benzinga Neuro and edited by Anan Ashraf.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Why Is Warren Buffett Buying This Stock-Split Stock Hand Over Fist?

Warren Buffett bought only seven stocks for Berkshire Hathaway‘s portfolio in the second quarter of 2024. He seemed to be especially enthusiastic about Sirius XM Holdings (NASDAQ: SIRI), increasing Berkshire’s stake by 262%.

Rest assured that Sirius XM’s 1-for-10 reverse stock split conducted earlier this month had nothing to do with Buffett’s purchase of more shares. The legendary investor might have liked the related decision to merge Liberty Media‘s holdings in the company with Sirius XM. However, he knows that stock splits of any shape, form, or fashion change nothing about the underlying business.

So, why is Buffett buying this stock-split stock hand over fist? I think there are three main reasons.

1. He understands Sirius XM’s business

Buffett famously shuns investing in businesses that he doesn’t understand. He missed out on huge gains in several of today’s top tech stocks because their business models weren’t in his wheelhouse. However, Buffett no doubt understands Sirius XM’s business.

He’s said to be a fan of Sirius XM’s satellite radio. Reportedly, Buffett especially likes the “Siriusly Sinatra” channel that plays Frank Sinatra music along with other similar crooners, including Tony Bennett and Dean Martin.

Although Sirius XM’s business isn’t the same as a newspaper’s business, there are some distinct similarities — notably including that they both rely on subscriptions for revenue. As a former paper boy, Buffett definitely knows how subscription models work.

Buffett has also always prized companies with dominant market positions. Sirius XM has a monopoly in the satellite radio business in the U.S. and is a major player in the podcast market.

2. He views management favorably

Many know Buffett once said, “[O]ur favorite holding period is forever.” What they often leave out, though, is that he prefaces that remark by saying it applies “when we own portions of outstanding businesses with outstanding managements.” I suspect a key reason Buffett has invested so heavily in Sirius XM is that he views its management favorably.

Sirius XM CEO Jennifer Witz joined the company in 2002. She served in several financial and operating positions, including chief marketing officer from August 2017 through March 2019 and president of sales, marketing and operations from March 2019 through December 2020. Witz moved into the CEO role in January 2021. Before working at Sirius XM, she held executive positions at Viacom (now part of Paramount Global) and Metro-Goldwyn-Mayer (now owned by Amazon).

Importantly, she has plenty of skin in the game. Witz owns nearly 12.1 million shares of Sirius XM.

3. He thinks the price is right

Buffett learned from Benjamin Graham, the “father of value investing.” He remains a value investor at heart despite straying from Graham’s philosophy somewhat over time. Buffett would never buy a stock if he didn’t think its valuation was attractive. He undoubtedly thinks the price is right with Sirius XM.

The numbers back him up. Sirius XM trades at a forward price-to-earnings ratio of 6.4, making it one of the cheapest stocks in Berkshire Hathaway’s portfolio.

In 2013, Buffett wrote to Berkshire Hathaway shareholders, saying his first step in evaluating whether to buy a stock is to “decide whether we can sensibly estimate an earnings range for five years out, or more.” If that answer is yes, he will buy the stock only if its price is attractive relative to the lower end of his estimated earnings range.

This approach shares much in common with a valuation metric popularized by Peter Lynch — the price-to-earnings-to-growth (PEG) ratio. Lynch maintained that a stock with a PEG ratio of less than 1.0 was valued attractively. Sirius XM’s PEG ratio is 0.64, according to data from LSEG.

Did Buffett look at Sirius XM’s low PEG ratio before buying the stock? Probably not. However, I suspect his analysis revealed that the company’s price is attractive with its earnings growth factored in.

Should you invest $1,000 in Sirius Xm right now?

Before you buy stock in Sirius Xm, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Sirius Xm wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $710,860!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 16, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Keith Speights has positions in Amazon and Berkshire Hathaway. The Motley Fool has positions in and recommends Amazon and Berkshire Hathaway. The Motley Fool has a disclosure policy.

Why Is Warren Buffett Buying This Stock-Split Stock Hand Over Fist? was originally published by The Motley Fool

3 High-Yield Dividend Stocks You Can Buy and Hold for a Decade

With the Federal Reserve finally cutting interest rates, it’s the perfect time to add some dividend stocks to your portfolio that have the potential to generate big returns in the coming years.

A dividend yield, however, should never be the only criterion for choosing which dividend stocks to buy. Stocks supporting high yields with steady and growing dividends have the highest potential to rise in the long run and generate big returns for their investors. With that in mind, here are three rock-solid, high-yield dividend stocks you can buy now and hold for a decade.

A bankable big yield for the next decade

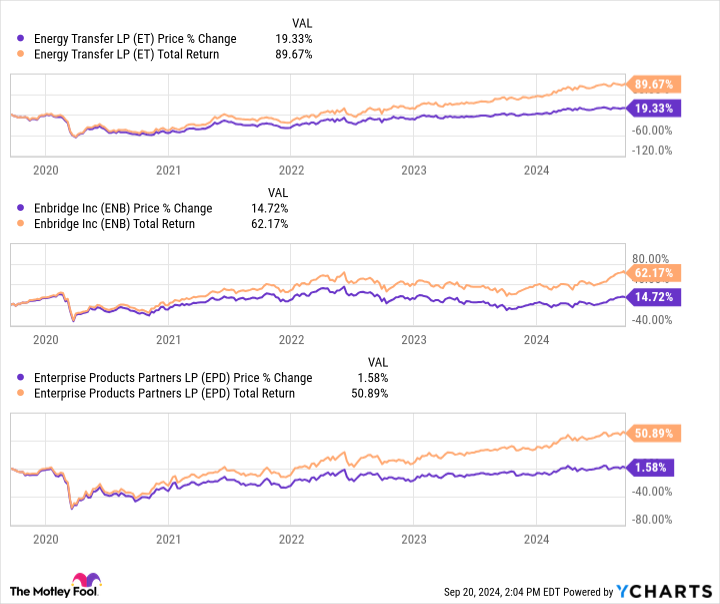

The first high-yield dividend stock I find promising is Energy Transfer (NYSE: ET), which yields a hefty 7.9%. Midstream oil and gas companies offer some of the most bankable dividends in the entire energy sector thanks to their contract-based business models. One could argue there are better-known stocks with stronger dividend histories than Energy Transfer to buy.

Energy Transfer stock, however, has generated far bigger returns than its larger counterparts, Enterprise Products Partners and Enbridge, in recent years and could continue to outperform, given its growth and dividend goals.

Energy Transfer gets almost 90% of its income from fee-based contracts, which means only about 10% of its earnings are exposed to the volatility in oil and gas prices. A large portion of those stable earnings and cash flows goes to its shareholders. To put some numbers to that, Energy Transfer aims to pay out a little over 50% of its distributable cash flows (DCF) in dividends, invest up to 40% of DCF in growth, and use the remaining cash to pay debt and repurchase shares in the long term.

Energy Transfer is about to acquire WTG Midstream Holdings in a $3.3 billion deal that will expand its footprint in the Permian Basin. The acquisition and organic growth should give Energy Transfer enough clout to increase its annual dividend per share by 3% to 5% in the near term. That dividend growth, combined with a high yield, could generate solid returns for investors who buy Energy Transfer stock now and hold for a decade.

A high-yield stock in a fast-growing industry

After global renewable energy capacity grew by 50% in 2023, the International Energy Agency (IEA) predicts the renewable energy industry will grow at its fastest pace ever over the next five years. Buying a renewable energy stock now and holding it for the next decade is, therefore, a no-brainer investment move. While many stocks look enticing, one underrated high-yield renewable energy stock I’d recommend today is Clearway Energy (NYSE: CWEN)(NYSE: CWEN.A).

The IEA expects solar and wind deployments in the U.S. to double through 2028. With a capacity of 9 gigawatts across 26 states, Clearway Energy is one of the largest renewable energy producers in the U.S., specializing in wind, solar, and energy storage.

Clearway Energy cut its dividend in 2019, but it wasn’t the company’s fault. A large customer, PG&E, filed for bankruptcy, hitting Clearway Energy’s cash flows. The renewable energy giant quickly won back investor confidence when it raised its dividend again in 2020, and it has continued to increase its dividend every year since.

Thanks to its relationship with Clearway Energy Group (CEG), a company jointly owned by Global Infrastructure Partners and TotalEnergies, Clearway Energy has access to CEG’s extensive pipeline of renewable energy projects it can acquire under drop-down transactions to grow its business.

For now, Clearway Energy is confident about increasing its annual dividend per share by 5%-8% through 2026. Even better, the company is already working on its next cash-flow and dividend growth goals for 2027, making its 6.2%-yielding stock an attractive buy and hold for the next decade.

This high-yield stock could be a multibagger

Infrastructure is the backbone of an economy, and one of the best ways to invest in it is to buy shares of a well-established diversified company that owns various infrastructure assets and operates them to the best of its capability. No company comes close to Brookfield Infrastructure (NYSE: BIPC)(NYSE: BIP), making it a no-brainer stock to buy and hold for the next decade.

It’s also a dividend growth stock, with units of its partnership yielding 4.8%, while the corporate shares yield 3.8%. You’d be surprised that Brookfield Infrastructure Partners stock has more than tripled investors’ money in the past decade, thanks to dividend growth. Shares of the corporation were listed in 2020 and have more than doubled investors’ money since with reinvested dividends.

What has worked for Brookfield Infrastructure so far should continue to work in the future. Specifically, Brookfield Infrastructure owns assets across utilities, transportation, midstream energy, and data infrastructure in the Americas, Europe, and Asia-Pacific regions. Thanks to the essential nature of these assets, 90% of the company’s cash flows are contracted and, therefore, highly predictable and stable.

A large portion of those cash flows is returned to shareholders as dividends. Since 2009, Brookfield Infrastructure has grown its funds from operations by a compound annual growth rate (CAGR) of 15% and its dividend by 9% CAGR.

Brookfield Infrastructure is an intriguing play on some of the biggest global trends, like digitalization and decarbonization. Growth opportunities are aplenty, and the company is confident in growing its annual dividend by 5%-9% in the long term. That pace of dividend growth should support the stock’s yield, making way for potential multibagger returns over the next decade.

Should you invest $1,000 in Brookfield Infrastructure Partners right now?

Before you buy stock in Brookfield Infrastructure Partners, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Brookfield Infrastructure Partners wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $710,860!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 16, 2024

Neha Chamaria has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Enbridge. The Motley Fool recommends Brookfield Infrastructure Partners and Enterprise Products Partners. The Motley Fool has a disclosure policy.

3 High-Yield Dividend Stocks You Can Buy and Hold for a Decade was originally published by The Motley Fool

Kamala Harris Finally Mentions Crypto And That Too On Wall Street: Promises To Encourage 'Innovative Technologies' Like Digital Assets

Democratic presidential candidate Kamala Harris formally referenced cryptocurrency for the first time during her election campaign, promising to safeguard the industry’s interests.

What happened: During a fundraiser at Cipriani Wall Street in Manhattan, the incumbent vice president marketed her pro-emerging technology agenda, Bloomberg reported Sunday.

“We will partner together to invest in America’s competitiveness, to invest in America’s future. We will encourage innovative technologies like AI and digital assets, while protecting our consumers and investors,” Harris said.

The first public mention of cryptocurrency elicited cheers from Harris campaign supporters.

Rep. Wiley Nickel (D-N.C.) dubbed it a “huge” policy development and a significant reset on her positions on cryptocurrencies and blockchains.

Anthony Scaramucci, CEO of investment firm SkyBridge Capital, said, “Kamala means Bitcoin BTC/USD in every language.”

Why It Matters: Cryptocurrency has emerged as a significant election issue this year, with one survey indicating that one-third of voters will consider a candidate’s stance on digital assets before making their political choices.

Former President Donald Trump has taken the lead in courting the expanding population, and the Republican contender even launched a cryptocurrency project right before the November elections.

Until the latest acknowledgment, Harris’s stance on cryptocurrencies was unclear, though advocacy groups like “Crypto for Harris” have been trying to muster support for her and counterbalance Trump’s campaign.

Price Action: At the time of writing, Bitcoin was exchanging hands at $63,887.21, up 1.07% in the last 24 hours, according to data from Benzinga Pro.

Image via Wikimedia Commons

Did You Know?

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Leading the effort to end encampments and address homelessness in Canada

OTTAWA, ON, Sept. 22, 2024 /CNW/ – As much progress as Canada makes to solve the housing crisis, it will not be over as long as there are people living in tents because they cannot afford a place to live.

Through Canada’s Housing Plan, we made it clear that we would be taking a leadership role to help end encampments and to address homelessness. We intend to do this by supplying funding and coordinating with other orders of government.

Today, the federal government announced that we are ready to negotiate agreements and invest in any province or territory who will cost-match the federal government’s funding to support communities facing the most pressure.

The government is allocating $250 million, as outlined in Budget 2024, to address the urgent issue of encampments and unsheltered homelessness. This funding is intended to be cost-matched by provinces and territories, leveraging up to $500 million to provide more shelter spaces, transitional homes, and services to help those in encampments find housing.

This builds on existing programs like Reaching Home, a federal investment of $5 billion over nine years to address homelessness. This includes a Budget 2024 investment of $1 billion over four years to stabilize program funding. Additionally, the federal government is investing $79.1 million through the Veteran Homelessness Program (VHP) to serve those in need.

We look forward to working with all provincial and territorial leaders who want to see the funding invested into their communities.

Canada’s housing crisis will not be solved by any one level of government, any single service provider, or any home builder alone. We must work together to put an end to encampments in our communities. Today, we are calling on provinces and territories to help us do just that.

Quotes

“Across Canada, playgrounds, parks, and public squares have become the last refuge for too many individuals. The harsh realities faced by those living without stable shelter do not reflect the values we hold as Canadians. This reality divides our communities and impacts us all. We must work together to help the country’s most vulnerable find safe and affordable places to call home. We can and must do better.”

The Honourable Sean Fraser, Minister of Housing, Infrastructure and Communities

Quick facts

- Provinces and territories will be required to cost-match federal investments. The Government of Canada will negotiate agreements with provincial and territorial governments on the roll-out of this funding, including the selection of communities.

- This funding complements federal investments made through Reaching Home: Canada’s Homelessness Strategy, which provides funding and support to urban, Indigenous, territorial and rural, and remote communities to help them address their local homelessness needs.

- Since 2015, the federal government has helped almost two million Canadians find a place to call home.

- In addition to investments to address homelessness, Budget 2024 includes the following measures to help solve Canada’s housing crisis:

- Launch a new Rapid Housing stream under the Affordable Housing Fund to build deeply affordable housing, supportive housing and shelters.

- Restore generational fairness for renters, particularly Millennials and Gen Z, by taking new action to protect renters’ rights and unlock pathways for them to become homeowners.

- Launch a new $6 billion Canada Housing Infrastructure Fund to accelerate the construction or upgrade of essential infrastructure across the country and get more homes built for Canadians.

- Top-up the Apartment Construction Loan Program with $15 billion, make new reforms so it is easier to access, and launch Canada Builds to call on all provinces and territories to join a Team Canada effort to build more homes, faster.

- Support renters by launching a new $1.5 billion Canada Rental Protection Fund to preserve more rental homes and make sure they stay affordable.

- Change the way we build homes in Canada by announcing over $600 million to make it easier and cheaper to build more homes, faster, including through a new Homebuilding Technology and Innovation Fund and a new Housing Design Catalogue.

Associated links

Reaching Home: Canada’s Homelessness Strategy

Canada’s National Housing Strategy

Canada’s Housing Plan

Infrastructure Canada – Funding Delivered under the Investing in Canada Plan

Follow us on Twitter, Facebook, Instagram, and LinkedIn

Web: Infrastructure Canada

SOURCE Department of Housing, Infrastructure and Communities

![]() View original content: http://www.newswire.ca/en/releases/archive/September2024/22/c4413.html

View original content: http://www.newswire.ca/en/releases/archive/September2024/22/c4413.html

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.