Dyadic Provides Alternative Proteins Business Update and Announces Attendance at Bioprocess International Conference

JUPITER, Fla., Sept. 23, 2024 (GLOBE NEWSWIRE) — Dyadic International, Inc. (“Dyadic”, “we”, “us”, “our”, or the “Company”) DYAI, a biotechnology company focused on the efficient, large-scale manufacture of proteins for use in non-pharmaceutical applications including food, nutrition and wellness, as well as animal and human health therapeutics and vaccines, today provided an update on business progress and announced its attendance at the Bioprocess International Conference in Boston, September 23-26, 2024.

At the conference, Dyadic will highlight its C1 and Dapibus™ microbial platforms, which are designed to improve the efficiency and lower the cost of manufacturing recombinant proteins such as:

- Recombinant human albumin: for use in cell culture media, diagnostics, and as a stabilizing agent for vaccine production.

- Bovine transferrin: for use in cell culture media and delivery of cancer therapeutics, among other uses.

- Human lactoferrin: for use in research and pharmaceutical applications as potential antimicrobial, anti-inflammatory, and immune-supportive products.

- Bovine alpha-lactalbumin: for use in products including infant formula, dietary supplements, and functional foods.

As the Company enters the fourth quarter, Dyadic continues to advance partnerships supported by the Dapibus™ platform targeted at the alternative protein market, seeking near-term recurring revenue growth while continuing to advance the C1 platform in the animal and human health markets.

Recent Developments in Alternative Proteins and Life Sciences:

- Proliant Health and Biologicals (“PHB”), a leading manufacturer of proteins serving companies in microbiological, life sciences, biopharmaceutical, and veterinary sciences through its partnership with Dyadic, is expected to launch animal-free recombinant albumin in the first half of 2025 into the approximately $5B serum albumin market. Dyadic received $1 million in payments from PHB in Q3 and expects to receive additional payments after meeting certain productivity goals, and a share of profits from the sales of recombinant albumin products.

- The development of Dyadic’s DNase-I (deoxyribonuclease I) protein has been completed, and product sampling is ongoing. DNase-I is an enzyme that has several key potential applications across different industries, including pharmaceuticals, research, diagnostics, and therapeutic treatments.

- Dyadic’s project to produce recombinant bovine transferrin, used in cell culture media for the alternative protein market, has achieved high productivity, with further optimizations ongoing and application testing in cell culture media expected later this year.

- The development of recombinant human lactoferrin is ongoing, which has potential applications in multiple pharmaceutical and non-pharmaceutical markets.

- A project to produce recombinant bovine growth factor (FGF) is ongoing, with potential applications in cell culture, tissue engineering, stem cell research, and oncology. Initial results are expected in the fourth quarter.

Upcoming Conference:

Bioprocess International 2024

Hynes Convention Center, Boston, USA

September 23-26, 2024

If you would like to schedule a meeting with one of our management members at BPI, please contact Sam Closa at assistant@dyadic.com.

About Dyadic International, Inc.

Dyadic International, Inc. DYAI is a biotechnology company focused on the efficient, large-scale production of proteins for human and animal vaccines, therapeutics, and non-pharmaceutical applications in food, nutrition, and wellness.

Dyadic’s core technologies revolve around the highly productive, scalable fungus Thermothelomyces heterothallica, (formerly Myceliophthora thermophila). Its flagship C1-cell protein production platform, derived from the industrial microorganism C1, is designed to accelerate development, lower production costs, and enhance biologic vaccines and drugs for human and animal health markets at flexible commercial scales.

In addition to the C1 platform, Dyadic has developed the Dapibus™ filamentous fungal-based microbial protein production platform. Dapibus™ enables rapid, large-scale production of low-cost proteins, metabolites, and other biologic products for non-pharmaceutical sectors, including food, nutrition, and wellness.

Driven by a commitment to help partners develop effective treatments in both developed and emerging markets, Dyadic is advancing its proprietary microbial platforms. The Company is working on a potential “Adjuvanted, Self-assembling Ferritin Nanoparticle H5-2.3.4.4b A/Astrakhan Subunit Vaccine Candidate” for avian influenza, along with other biologic vaccines, antibodies, and related products.

To learn more about Dyadic and our commitment to helping bring vaccines and other biologic products to market faster, in greater volumes and at lower cost, please visit https://www.dyadic.com.

Safe Harbor Regarding Forward-Looking Statements

This press release contains forward-looking statements within the meaning of Section 27A of the Securities Act and Section 21E of the Exchange Act, including those regarding Dyadic International’s expectations, intentions, strategies, and beliefs pertaining to future events or future financial performance, such as the success of our protein production platforms, our research projects and third-party collaborations, as well as the availability of necessary funding. Forward-looking statements generally can be identified by use of the words “expect,” “should,” “intend,” “anticipate,” “will,” “project,” “may,” “might,” “potential,” or “continue” and other similar terms or variations of them or similar terminology. Forward-looking statements involve many risks, uncertainties or other factors beyond Dyadic’s control. These factors include, but are not limited to, the following: (i) our history of net losses; (ii) market and regulatory acceptance of our microbial protein production platforms and other technologies; (iii) competition, including from alternative technologies; (iv) the results of nonclinical studies and clinical trials; (v) our capital needs; (vi) changes in global economic and financial conditions; (vii) our reliance on information technology; (viii) our dependence on third parties; (ix) government regulations and environmental, social and governance issues; and (x) intellectual property risks. For a more complete description of the risks that could cause our actual results to differ from our current expectations, please see the section entitled “Risk Factors” in Dyadic’s annual reports on Form 10-K and quarterly reports on Form 10-Q filed with the SEC, as such factors may be updated from time to time in Dyadic’s periodic filings with the SEC, which are accessible on the SEC’s website and at www.dyadic.com. All forward-looking statements speak only as of the date made, and except as required by applicable law, Dyadic assumes no obligation to publicly update any such forward-looking statements for any reason after the date of this press release to conform these statements to actual results or to changes in our expectations.

Contact:

Dyadic International, Inc.

Ping W. Rawson

Chief Financial Officer

Phone: 561-743-8333

Email: ir@dyadic.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Qorvo Launches Smart Home Connectivity Solution: Will the Stock Gain?

Qorvo, Inc. QRVO recently introduced QPG6200L, an advanced system-on-chip solution, designed to deliver uninterrupted and consistent connectivity for smart home devices. The company has made available the sample and development kits for selected clients, with full-scale production expected to commence early next year.

In today’s rapidly growing and ever-evolving smart home environment, customers often tend to install devices that follow distinct wireless protocols such as Matter or Zigbee. Hence, there is a growing requirement of a flexible and interoperable system that enables these devices using different wireless standards to seamlessly communicate and function with each other.

Qorvo’s latest product QPG6200L, powered by ConcurrentConnect technology, efficiently addresses these requirements. It ensures smooth compatibility across multiple wireless standards by offering greater radio frequency performance and reliability for a vast array of IoT devices. One of the standout features of the product is its energy efficiency, making it suitable for low-power applications such as battery-operated sensors and energy harvesting devices.

The solution comes with a built-in secure element and PSA Certified Level 2, indicating it adheres to stringent security standards and is well equipped to mitigate common software attacks.

Will This Product Launch Drive QRVO’s Share Performance?

QRVO’s research and innovation strategy is aligned with broader industry trends, ensuring the interoperability and sustainability of IoT devices. The global smart home device market is growing at a rapid pace and sales are expected to reach around 1.2 billion units by 2028. The launch of energy-efficient, secure and versatile chips like QPG6200L will strengthen its portfolio and boost prospects in this emerging smart home market.

QRVO’s Stock Price Movement

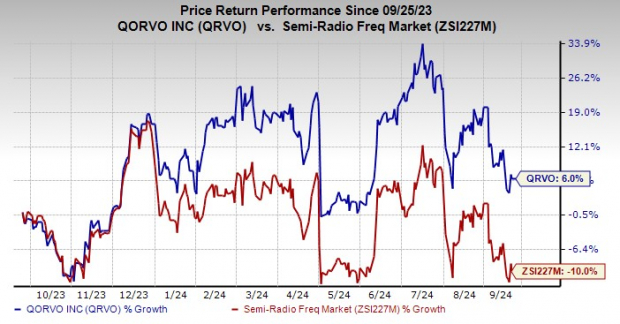

The stock has gained 6% over the past year against the industry’s decline of 10%.

Image Source: Zacks Investment Research

QRVO’s Zacks Rank & Stocks to Consider

Qorvo currently carries a Zacks Rank #3 (Hold).

Arista Networks, Inc. ANET carries a Zacks Rank #2 (Buy) at present. In the last reported quarter, it delivered an earnings surprise of 8.25%.

ANET is engaged in providing cloud networking solutions for data centers and cloud computing environments. The company offers 10/25/40/50/100 Gigabit Ethernet switches and routers optimized for next-generation data center networks.

Ubiquiti Inc. UI sports a Zacks Rank #1 at present. The company offers a comprehensive portfolio of networking products and solutions for service providers and enterprises.

UI’s excellent global business model, which is flexible and adaptable to evolving changes in markets, helps it to beat challenges and maximize growth. The company’s effective management of its strong global network of more than 100 distributors and master resellers improved its visibility for future demand and inventory management techniques.

Zillow Group, Inc. ZG, carries a Zacks Rank #2 at present. In the last reported quarter, it delivered an earnings surprise of 25.81%.

ZG delivered an earnings surprise of 37.41%, on average, in the trailing four quarters. The company is witnessing solid momentum in rental revenues, driven by growth in both multi and single-family listings, which is a positive factor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

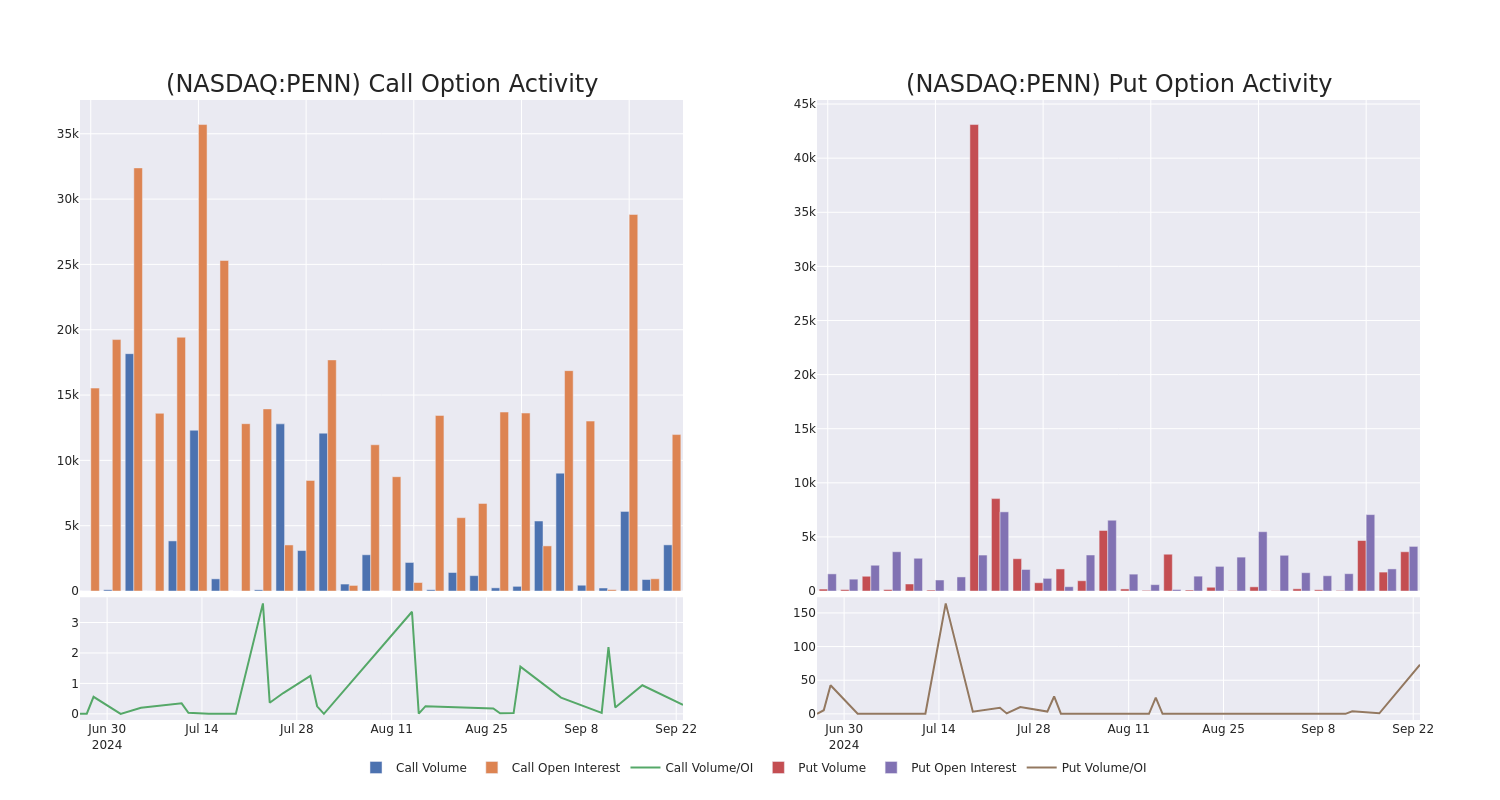

Looking At PENN Entertainment's Recent Unusual Options Activity

Investors with a lot of money to spend have taken a bearish stance on PENN Entertainment PENN.

And retail traders should know.

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don’t know. But when something this big happens with PENN, it often means somebody knows something is about to happen.

So how do we know what these investors just did?

Today, Benzinga‘s options scanner spotted 8 uncommon options trades for PENN Entertainment.

This isn’t normal.

The overall sentiment of these big-money traders is split between 37% bullish and 50%, bearish.

Out of all of the special options we uncovered, 5 are puts, for a total amount of $414,027, and 3 are calls, for a total amount of $102,120.

Expected Price Movements

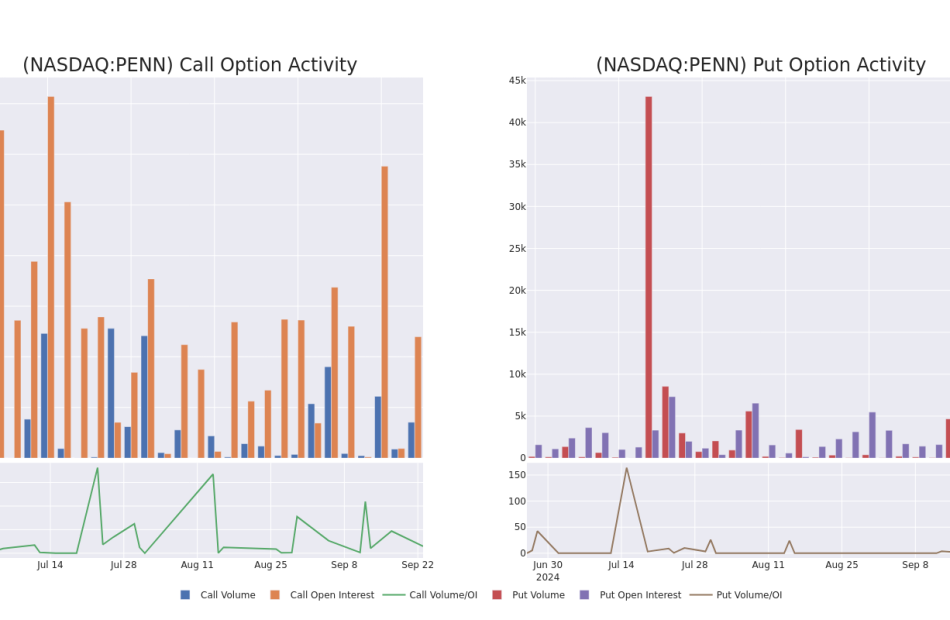

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $17.5 to $25.0 for PENN Entertainment during the past quarter.

Volume & Open Interest Trends

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in PENN Entertainment’s options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to PENN Entertainment’s substantial trades, within a strike price spectrum from $17.5 to $25.0 over the preceding 30 days.

PENN Entertainment 30-Day Option Volume & Interest Snapshot

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| PENN | PUT | SWEEP | BEARISH | 04/17/25 | $3.1 | $2.91 | $3.05 | $20.00 | $272.9K | 116 | 1.1K |

| PENN | CALL | SWEEP | BULLISH | 09/27/24 | $0.37 | $0.36 | $0.36 | $20.00 | $46.6K | 1.0K | 2.7K |

| PENN | PUT | SWEEP | BEARISH | 11/15/24 | $0.88 | $0.84 | $0.88 | $17.50 | $44.4K | 38 | 1.5K |

| PENN | PUT | SWEEP | BEARISH | 04/17/25 | $2.98 | $2.97 | $2.98 | $20.00 | $41.4K | 116 | 140 |

| PENN | CALL | SWEEP | BULLISH | 10/18/24 | $1.05 | $0.99 | $1.05 | $20.00 | $30.0K | 10.6K | 638 |

About PENN Entertainment

Penn Entertainment’s origins date back to its 1972 racetrack opening in Pennsylvania. Today, Penn operates 43 properties across 20 states and 12 brands, including Hollywood Casino and Ameristar. Land-based casinos represented 89% of total sales in 2023; 11% was from the interactive segment, which includes sports, iGaming, and media revenue. The retail portfolio generates mid-30s EBITDAR margins and helps position the company to obtain licenses for the digital wagering markets. Additionally, Penn’s media assets, theScore and ESPN (starting with its partnership launch in November 2023), provide access to sports betting/iGaming technology and clientele, helping it form a leading digital position.

Present Market Standing of PENN Entertainment

- With a trading volume of 3,203,819, the price of PENN is down by -2.84%, reaching $19.51.

- Current RSI values indicate that the stock is may be approaching overbought.

- Next earnings report is scheduled for 38 days from now.

Expert Opinions on PENN Entertainment

Over the past month, 1 industry analysts have shared their insights on this stock, proposing an average target price of $20.0.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* An analyst from Morgan Stanley has decided to maintain their Equal-Weight rating on PENN Entertainment, which currently sits at a price target of $20.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for PENN Entertainment, Benzinga Pro gives you real-time options trades alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Electrodeposited Copper Foils Market Size to Hit USD 22.2 billion by 2031, at a 9.9% CAGR | Analysis by Transparency Market Research, Inc.

Wilmington, Delaware, United States, Transparency Market Research, Inc. , Sept. 23, 2024 (GLOBE NEWSWIRE) — As per the report published by Transparency Market Research, the global electrodeposited copper foils market (mercado de aspiradoras domésticas) was worth US$ 9.5 Bn in 2022 and is expected to reach US$ 22.2 Bn by the year 2031 at a CAGR of 9.9 % between 2023 and 2031.

Electrodeposited copper foils are thin layers of copper created through an electroplating process, in which copper ions are deposited onto a substrate from a solution using an electric current. This method produces foils with high purity, excellent electrical conductivity, and a uniform, smooth surface. These foils are widely used in various industries, particularly in electronics, energy storage, and renewable energy systems.

Electrodeposited Copper Foils Market Unleashed

Electrodeposited copper foils are essential materials in various industries, particularly in the production of printed circuit boards (PCBs), lithium-ion batteries, and electronic devices. Their key advantages include excellent electrical conductivity, high thermal stability, and strong adhesion properties.

These foils are produced through an electrodeposition process that ensures uniform thickness, smooth surfaces, and high purity, making them ideal for applications requiring precise and reliable performance. Additionally, electrodeposited copper foils play a crucial role in enhancing the energy efficiency and durability of batteries, supporting the growth of electronics, renewable energy, and electric vehicle industries.

The rapid expansion of the consumer electronics industry is a major factor driving the electrodeposited copper foils market. As devices like smartphones, laptops, tablets, and wearables become increasingly integrated into daily life, the need for advanced printed circuit boards (PCBs) has surged.

For Complete Report Details, Request Sample Copy from Here – https://www.transparencymarketresearch.com/electrodeposited-copper-foils-market.html

Copper foils are critical components in PCBs, ensuring optimal electrical conductivity and performance in electronic devices. The increasing complexity of modern electronics, which requires thinner, more efficient PCBs, has driven demand for high-quality electrodeposited copper foils, supporting market growth.

The growing adoption of electric vehicles (EVs) is another significant factor boosting the electrodeposited copper foils market. Copper foils are a key material in the production of lithium-ion batteries, which are used in EVs for energy storage. As governments and consumers worldwide push for cleaner energy and reduced carbon emissions, the demand for electric vehicles continues to rise.

The high energy density and durability required for EV batteries rely on copper foils, particularly for anodes, making them indispensable in the EV manufacturing process. This trend is expected to drive market growth as the EV industry expands.

Electrodeposited copper foils are playing a vital role in renewable energy technologies, particularly in solar panels and energy storage systems. As global efforts toward transition to cleaner energy sources intensify, the demand for renewable energy infrastructure, including solar photovoltaic (PV) systems, is on the rise.

Copper foils are essential in the production of solar cells, where their conductivity and efficiency are critical to capturing and transmitting solar energy. The continued growth of the renewable energy sector, supported by government policies and environmental initiatives, is further driving the demand for electrodeposited copper foils.

Advancements in copper foil manufacturing techniques, such as improved electrodeposition processes, have led to higher-quality and more efficient foils. These innovations have allowed for the development of thinner and lighter copper foils, which are particularly important for modern electronics, where miniaturization and lightweight components are crucial.

Additionally, advancements in surface treatment technologies have enhanced the adhesion and performance of copper foils in high-frequency and high-temperature environments. These technological improvements are making electrodeposited copper foils more versatile, expanding their use across multiple industries and driving market growth.

The rollout of 5G networks and the other advanced communication technologies is significantly boosting the demand for electrodeposited copper foils. High-frequency circuits required for 5G infrastructure need copper foils that can provide superior electrical conductivity and signal transmission efficiency. As 5G technology continues to be deployed globally, the need for advanced PCBs, and by extension, high-performance copper foils, is increasing. This trend is expected to support long-term growth in the copper foils market as communication technologies evolve and demand higher-performance materials.

In conclusion, the growing use of electrodeposited copper foils in consumer electronics, electric vehicles, renewable energy, and communication technologies, combined with technological advancements, are key factors driving market growth. As industries continue to innovate and expand, the demand for high-performance copper foils is expected to rise, ensuring sustained market expansion.

Electrodeposited Copper Foils Market Regional Insights

- North America generated the largest market value in 2023. The region is expected to maintain its dominance during the forecast period as well.

The electrodeposited copper foils market share in Asia Pacific region is experiencing robust growth, driven by several key factors. One of the primary factors boosting the electrodeposited copper foils market in the Asia-Pacific region is the rapid growth of the electronics manufacturing industry.

Countries like China, Japan, South Korea, and Taiwan are global leaders in the production of consumer electronics products such as smartphones, laptops, and wearables. Electrodeposited copper foils are essential for the production of printed circuit boards (PCBs) used in these devices, providing superior electrical conductivity and stability.

As demand for electronic devices continues to rise, driven by increasing consumer spending and technological advancements, the market for electrodeposited copper foils in Asia-Pacific is expected to expand significantly.

Moreover, the electric vehicle (EV) market is experiencing rapid growth in the Asia-Pacific region, particularly in China, which is the largest EV market globally. Copper foils are a key component in the production of lithium-ion batteries, which power electric vehicles.

The shift toward cleaner, energy-efficient transportation solutions is driving the demand for high-quality copper foils used in battery anodes. Government incentives, favorable policies, and a strong push for reducing carbon emissions are further propelling the EV industry, directly influencing the growth of the electrodeposited copper foils market in the region.

Prominent Players Operating in Electrodeposited Copper Foils Industry

Oak-Mitsui Technologies LLC, Circuit Foil USA, All Foils, Inc., Mitsui Kinzoku, Sheldahl Flexible Technologies, Inc., Arlon, Rogers Corporation, JX Nippon Mining & Metals Corporation, Nitto Denko Corporation, Avocet Precision Metals, CIVEN Metal, Denkai America and Targray Technology International NAN YA PLASTICS CORPORATION are some of the leading players operating in the industry.

Buy this Premium Research Report: https://www.transparencymarketresearch.com/checkout.php?rep_id=70767<ype=S

Electrodeposited Copper Foils Market Segmentation

Form

Type

- Standard ED Copper

- Rolled Copper

- Resistive Copper

- Others

Application

- Printed Circuit Boards

- Copper Clad Laminates

- Li-ion Batteries

- IC Package Substrates

- High Density Interconnect (HDI) Boards

- High Frequency Circuit Substrate

- EMI Shielding

- Others

More Trending Reports by Transparency Market Research –

- Lubricant Additives Market – The lubricant additives market (mercado de aditivos lubricantes) is anticipated to expand at a CAGR of 2.8% during the forecast period, from 2022 to 2031.

- Polyisobutylene Market – The global polyisobutylene market (mercado del poliisobutileno) is expected to grow at a compound annual growth rate (CAGR) of 5.6% during the forecast period between 2022 and 2031.

- Smart Fabrics Market – The global smart fabrics market (mercado de tejidos inteligentes) is expected to advance at a CAGR of 19.6% during the forecast period from 2022 to 2031.

- Ethyl Lactate Market – The global ethyl lactate market (mercado del lactato de etilo) is projected to grow at a CAGR of 7.3% from 2022 to 2031.

About Transparency Market Research

Transparency Market Research, a global market research company registered at Wilmington, Delaware, United States, provides custom research and consulting services. Our exclusive blend of quantitative forecasting and trends analysis provides forward-looking insights for thousands of decision makers. Our experienced team of Analysts, Researchers, and Consultants use proprietary data sources and various tools & techniques to gather and analyses information.

Our data repository is continuously updated and revised by a team of research experts, so that it always reflects the latest trends and information. With a broad research and analysis capability, Transparency Market Research employs rigorous primary and secondary research techniques in developing distinctive data sets and research material for business reports.

Contact:

Transparency Market Research Inc.

CORPORATE HEADQUARTER DOWNTOWN,

1000 N. West Street,

Suite 1200, Wilmington, Delaware 19801 USA

Tel: +1-518-618-1030

USA – Canada Toll Free: 866-552-3453

Website: https://www.transparencymarketresearch.com

Email: sales@transparencymarketresearch.com

Follow Us: LinkedIn| Twitter| Blog | YouTube

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

This Warren Buffett Stock Just Hit Its Lowest Price in 2 Years. Why Isn't He Buying More?

Warren Buffett is currently sitting on more cash than he has good ideas to invest in. Berkshire Hathaway‘s (NYSE: BRK.A) (NYSE: BRK.B) cash and Treasury holdings could exceed $300 billion by the end of the third quarter. That’s driven by Buffett’s recent decisions to sell stocks from Berkshire’s equity portfolio without reinvesting the funds into new holdings. Buffett’s sold more stocks than he bought in each of the last seven quarters.

That trend is extremely evident these days. Buffett has sold over $7 billion worth of Bank of America stock since the start of the third quarter. Meanwhile, one of the few stocks that he’s consistently bought over the last two years is sitting near a two-year low, but he hasn’t purchased any additional shares.

In 2019, Berkshire Hathaway paid $10 billion for preferred shares of Occidental Petroleum (NYSE: OXY), including warrants to purchase shares at about $60 each. Over the last two years, Buffett’s consistently bought shares whenever they traded below that $60 price while letting Occidental retire his preferred shares. But with Occidental shares falling close to $50, Buffett hasn’t added any more to his position.

Buffett said he plans to hold Occidental shares indefinitely in his 2023 letter to shareholders. But he no longer seems interested in acquiring more.

Image source: The Motley Fool.

Why isn’t Buffett buying?

Occidental is far more sensitive to the price of oil than other integrated operators. It’s heavily concentrated on extracting oil from bedrock relative to other oil and gas companies, which means when oil prices fall, Occidental’s earnings fall, too.

Since the start of the third quarter, the price of West Texas Intermediate crude oil has dropped about 15%. The price dipped below $70 a barrel earlier this month before a slight recovery. That’s an important price for Occidental, which said last year’s CrownRock acquisition will increase free cash flow by $1 billion based on a $70-per-barrel price for WTI.

That CrownRock deal also left Occidental with a high level of debt on its balance sheet. Management is strategically divesting assets to accelerate its debt paydown. CEO Vicki Hollub expects to reduce the debt on its balance sheet from around $19.7 billion to $15 billion by the end of 2026 or the first quarter of 2027. The company retired $3 billion of debt in the third quarter, putting it well on its way toward that goal.

But it’ll be slower going from here, requiring excess cash flow to go toward that debt reduction. And with oil prices slumping, that cash flow won’t be nearly as much as when oil prices were up in the $80 range.

Hollub’s aggressive maneuvers in the industry show confidence in the price of oil bouncing back. And Buffett’s past purchases and praise for Hollub suggest he’s also bullish on the price of oil long-term. But the knife cuts both ways, and right now it’s hurting Occidental.

Should investors stay away or pounce on the opportunity?

Occidental is one of Buffett’s biggest holdings. As mentioned, he’s consistently added to his position in the company over the last two years whenever shares were priced below $60. As a result, Berkshire Hathaway now owns about 28% of the common stock of the company.

Buffett said he doesn’t plan to acquire a majority stake in the business, and perhaps he’s happy with the current level of investment in the company. With the pressure on Occidental’s cash flow, it’s unlikely to retire as much of his preferred shares for some time, and he receives an 8% dividend on the remaining $8.5 billion investment.

The vast majority of Buffett’s stake was acquired for prices between $55 and $60 per share. With shares currently trading closer to $52, investors are getting about a 10% discount on Buffett’s average price.

Despite the financial challenges for the company outlined above, there are reasons to be optimistic about Occidental. For one, its portfolio of assets, particularly in the Permian Basin, give it an enviable position for its upstream segment. It has cheap access to oil as a result, and when oil prices climb higher that position pays off in strong earnings for the business.

Additionally, Occidental is investing heavily in carbon capture technology. It recently received a $650 million award from the U.S. Department of Energy to build a Direct Air Capture (DAC) Hub in South Texas. Occidental plans to commercialize projects like its DAC Hub with the sale of carbon credits for companies to offset their emissions with some sales already lined up. Over the next few decades, carbon capture could balloon into a multitrillion-dollar industry. Buffett is also bullish on Occidental’s efforts in carbon capture.

At its current price, Occidental shares trade for an enterprise-value-to-EBITDA ratio of about 5.4. That’s a discount to its larger peers. And given the current price of oil and the company’s financial standing, perhaps it should trade at a discount. But investors bullish on the price of oil and the long-term prospects of carbon capture may want to take a closer look at Occidental shares at their current price.

Should you invest $1,000 in Occidental Petroleum right now?

Before you buy stock in Occidental Petroleum, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Occidental Petroleum wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $710,860!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 23, 2024

Bank of America is an advertising partner of The Ascent, a Motley Fool company. Adam Levy has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Bank of America and Berkshire Hathaway. The Motley Fool recommends Occidental Petroleum. The Motley Fool has a disclosure policy.

TYLin welcomes Kimberly Slaughter as Senior Vice President and Transportation Leader for North America

San Francisco, CA, Sept. 23, 2024 (GLOBE NEWSWIRE) — TYLin, a globally recognized full-service infrastructure consulting firm, today announced the appointment of Kimberly Slaughter as TYLin’s North America Transportation Leader.

With over 35 years of experience in the public and private transportation sectors, Ms. Slaughter will spearhead strategic initiatives to drive growth within our transportation sector. A key focus will be strengthening the presence of TYLin’s transportation services while leveraging the company’s technical expertise, talent, and geographic reach to enhance client delivery, retain and attract top talent, and drive collaboration.

“We are thrilled to welcome Kimberly to the TYLin team,” said Tom Price, Executive Vice President and Chief Operating Officer at TYLin. “Her depth of experience and dedication to delivering impactful infrastructure projects will be pivotal as we continue to diversify our services and clients across North America. We know her leadership will be instrumental in executing our vision for the future.”

“I’m excited to collaborate with an incredible team to support strategic growth and improve outcomes for our clients and communities,” said Ms. Slaughter. “Everyone deserves access to mobility in their community that is safe, affordable, convenient, context sensitive, and supports a healthy environment for their families.”

In addition to her wealth of experience with architecture, engineering, and consulting companies, Ms. Slaughter has spent decades as a public transit advocate, serving on boards and committees focused on transportation equity and community development. Notably, she serves on the Houston Fund for Social Justice and Economic Equity, the American Public Transportation Association executive committee, the Mineta Transportation Institute board, and the Conference of Minority Transportation Officials (COMTO) national board, among many others. In 2022, she was honored by COMTO as a “Woman Who Moves the Nation” and awarded the prestigious Shirley A. DeLibero Award.

About TYLin

Founded in 1954, TYLin is a globally recognized, full-service infrastructure consulting firm committed to providing innovative, cost-effective, constructible designs for the global infrastructure market. With 3,200 employees in 65 offices throughout the Americas, Asia, and Europe, the company provides support on projects of varying size and complexity. TYLin is a member of Sidara’s global collaborative of leading designers, engineers, planners, and consultants committed to advancing livability, sustainability, and well-being for all. For more information about the company, please visit www.tylin.com.

Michael Luhning TYLin 618-606-2595 michael.luhning@tylin.com

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

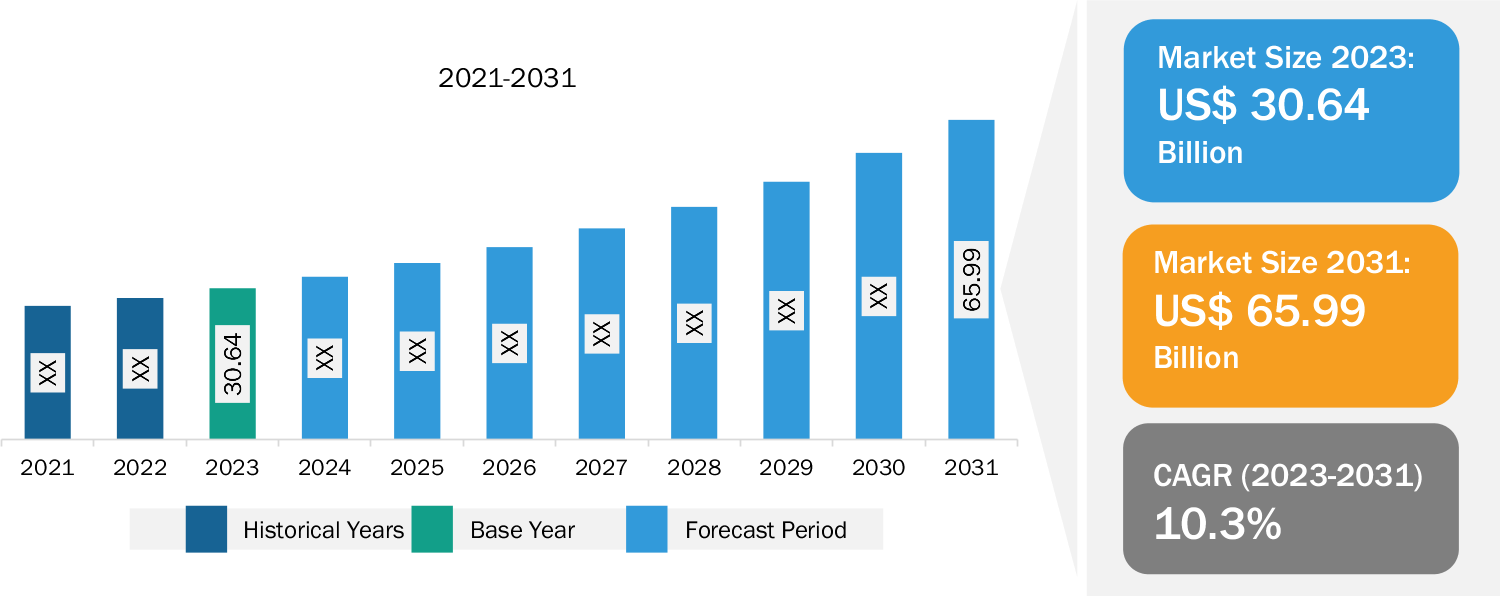

Electronic Data Interchange (EDI) Market Worth $65.99 Billion, Globally, by 2031 – Exclusive Report by The Insight Partners

US & Canada, Sept. 23, 2024 (GLOBE NEWSWIRE) — According to a new comprehensive report from The Insight Partners, the global electronic data interchange (EDI) market is observing significant growth owing to increasing adoption of EDI transactions and standards and rising digital transformation across Industries.

Global Electronic Data Interchange (EDI) Market Experiences Significant Growth Due to Increasing Adoption of EDI Transactions and Standards. Browse More Insights: https://www.theinsightpartners.com/reports/electronic-data-interchange-edi-market

The report carries out an in-depth analysis of market trends, key players, and future opportunities. In general, the electronic data interchange (EDI) market comprises a vast array of component, type, industry, and geography which are expected to register strength during the coming years.

Download Sample Report: https://www.theinsightpartners.com/sample/TIPRE00006160/

Overview of Report Findings:

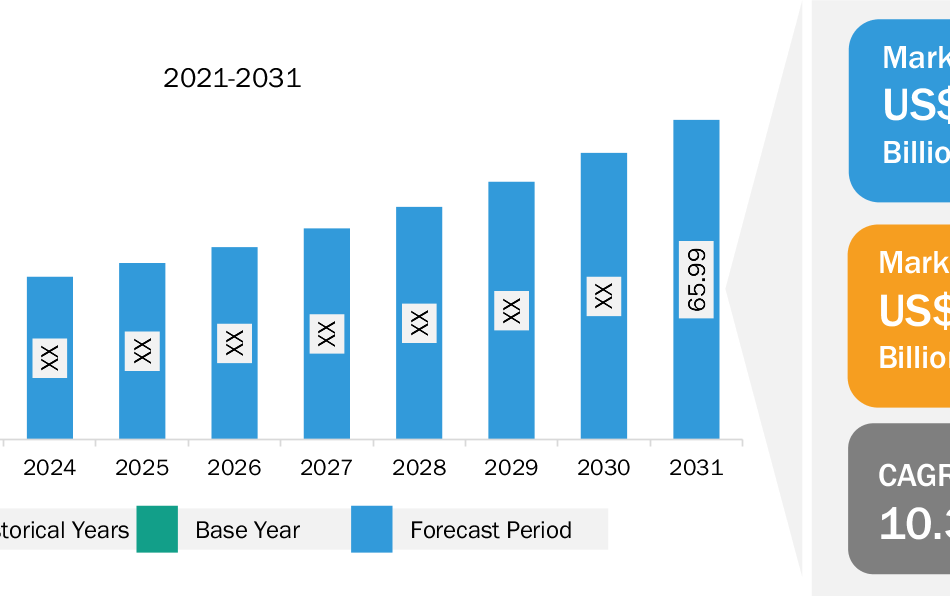

1. Market Growth: The electronic data interchange market was valued at US$ 30.64 billion in 2023 and is projected to reach US$ 65.99 billion by 2031; it is expected to register a CAGR of 10.3% during 2023–2031.

Identify The Key Trends Affecting This Market – Download Sample PDF: https://www.theinsightpartners.com/sample/TIPRE00006160/

2. By geography, the electronic data interchange market is segmented into North America, Europe, Asia Pacific, Middle East & Africa, and South & Central America. North America dominated the electronic data interchange (EDI) market in 2022. The US is a developed country in terms of modern technology and developed IT infrastructure. Technological advancements are leading to highly competitive markets across North America. The region hosts several technological giants, investing significantly in developing robust technologies. The US has clearly past the phase of early adoption of EDI solutions. With continuous increases in data transactions in B2C, B2B, etc., many organizations and their partners are projected to report business growth in the future. Huge numbers of enterprises are showing interest in EDI solutions to interchange their data accurately, efficiently, and safely.

3. Europe is the second-largest contributor to the global electronic data interchange (EDI) market, followed by Asia Pacific. Europe has a growing EDI market, with Germany and the UK leading the market growth. France, Estonia, Portugal, and Croatia are among the countries working aggressively to bring a B2G e-invoicing mandate. Furthermore, B2B e-invoicing mandates were planned in France and Serbia from 2023 and 2022, respectively. The businesses and governments of various countries in Europe highly adopt EDI solutions. Moreover, the wide market fragmentation and high cross-border trade between European countries drive the demand for efficient invoicing solutions.

Purchase Premium Copy of Electronic Data Interchange Market Growth Report (2023-2031) at: https://www.theinsightpartners.com/buy/TIPRE00006160/

Market Segmentation:

- Based on component, the market is bifurcated into solutions and services. The solutions segment held a larger share of the electronic data interchange (EDI) market in 2023.

- Global electronic data interchange (EDI) market is segmented by type into direct EDI, EDI via AS2, EDI via VAN, Mobile EDI, Web EDI, EDI Outsourcing, and Others. The EDI via AS2 segment held the largest share of the electronic data interchange (EDI) market in 2023.

- Based on industry, the market is segmented into BFSI, retail and consumer goods, healthcare, IT and telecommunication, transportation and logistics, and others. The retail and consumer goods segment held the largest share of the electronic data interchange (EDI) market in 2023.

- The electronic data interchange (EDI) market is segmented into five major regions: North America, Europe, APAC, Middle East and Africa, and South and Central America.

Obtain Analysis of Key Geographic Markets – Download Report PDF: https://www.theinsightpartners.com/sample/TIPRE00006160/

Competitive Strategy and Development:

- Key Players: A few major companies operating in the electronic data interchange (EDI) market include SPS Commerce, Inc.; International Business Machines Corp; Boomi, Inc; Cleo; and Mulesoft, LLC.

- Trending Topics: IoT sensors, Blockchain technology, and Artificial Intelligence (AI).

Global Headlines on Electronic Data Interchange Market:

- “Cleo’s announced the Procure-to-Pay automation solution (CIC PAVE)—an easy-to-use web portal that automatically enables EDI transactions—bringing SMB manufacturer’s greater control over their supplier ecosystem.”

- “SPS Commerce acquired InterTrade, a wholly owned subsidiary of mdf commerce inc. and a provider of technical solutions for product, information, and transaction data exchange between retailers and suppliers”

- “Cleo announced deeper integrations between the Cleo Integration Cloud (CIC) platform and Microsoft Dynamics 365 ERP. The Cleo solution enables organizations to connect their Dynamics 365 Supply chain solutions through the X12 EDI integration. It is expected to reduce the complexity of supporting an organization’s EDI network and seamlessly integrate it into its Dynamics application”

Want More Information about Competitors and Market Players? Get Sample PDF: https://www.theinsightpartners.com/sample/TIPRE00006160/

Conclusion:

The rising digital transformation and acceptance of EDI solutions for data transaction trends, growing EDI-related compliance requirements, and increasing government initiatives to boost EDI adoption are among the critical factors driving the market growth. However, there are a few issues/concerns related to EDI solutions, which may restrain frequent adoption of these solutions in the coming years. Despite some limitations, the growing demand for cloud-based solutions and the adoption of advanced technologies such as blockchain in the global EDI market are anticipated to fuel the market growth during the forecast period.

Require A Diverse Region or Sector? Customize Research to Suit Your Requirement: https://www.theinsightpartners.com/sample/TIPRE00006160/

Related Report Titles:

- Electronic Data Capture Systems Market Size and Forecasts (2021 – 2031)

- Blockchain Market Growth Insights to 2028

- Blockchain IoT Market Growth, Size, Share, Trends, Key Players Analysis, and Forecast till 2031

- Blockchain in Smart Home Market Size and Forecasts (2021 – 2031)

- Blockchain Consulting Market Trends, Share, Size by 2031

- Blockchain in Energy Market Size, Share, Growth by 2031

- Blockchain Finance Market Growth, Size, Share, Trends, Key Players Analysis, and Forecast till 2031

- Industrial Blockchain Market Size and Forecasts (2021 – 2031)

- Blockchain Distributed Ledger Market Scope, Share, Size – 2031

- Aviation Blockchain Market Growth, Share, Size by 2031

- Automotive Blockchain Market Overview, Growth, Trends, Analysis, Research Report (2021-2031)

- Data Storage Market Strategies, Top Players, Growth Opportunities, Analysis and Forecast by 2031

- Data Analytics Market Analysis and Forecast by Size, Share, Growth, Trends 2031

- Enterprise Data Management Market Strategies, Top Players, Growth Opportunities, Analysis, and Forecast by 2031

About Us:

The Insight Partners is a one stop industry research provider of actionable intelligence. We help our clients in getting solutions to their research requirements through our syndicated and consulting research services. We specialize in industries such as Semiconductor and Electronics, Aerospace and Defense, Automotive and Transportation, Biotechnology, Healthcare IT, Manufacturing and Construction, Medical Device, Technology, Media and Telecommunications, Chemicals and Materials.

Contact Us:

If you have any queries about this report or if you would like further information, please contact us:

Contact Person: Ankit Mathur

E-mail: ankit.mathur@theinsightpartners.com

Phone: +1-646-491-9876

Press Release: https://www.theinsightpartners.com/pr/electronic-data-interchange-edi-market

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trump Media stock sinks to another new low even as Donald Trump holds onto shares

Trump Media & Technology Group stock is in a free fall (again).

After the lockup period on Donald Trump’s shares came to an end Friday, shares of Trump Media — the company that owns the former president’s social media site, Truth Social — have slid to new lows. Shares fell 8%, trading at $12.44 each Monday afternoon.

That tipped the company’s market capitalization to $2.5 billion, a nearly 80% plunge from its high-flying days in the aftermath of its Nasdaq debut on March 26.

Despite speculation, Trump himself said earlier this month that he has “absolutely” no plans to dump his stake in the company — even though he stood to earn upwards of $2 billion from a potential stock sale.

“The reason I built it is because I don’t want to have my voice shut down,” Trump said during a press conference at his golf course near Los Angeles on Sept. 13. “A lot of people think that I will sell my shares, you know, they’re worth billions of dollars, but I don’t want to sell my shares. I don’t need money.”

Trump holds 114.75 million shares of Trump Media, or about 60% of the company’s outstanding stock. In a regulatory filing in June, Trump Media cited Trump’s divestment from the company as one of the top risks to its business.

Even as Trump continues to hold on to his shares, however, the stock has depreciated considerably in recent weeks, including after his debate performance against Vice President Kamala Harris.

That’s because much of the company’s success is tied to the former president’s personal and political fortunes. The company itself has warned in filings that “adverse reactions to publicity relating to [Trump], or the loss of his services, could adversely affect TMTG’s revenues and results of operations.”

As the presidential election nears, the stock could continue to face challenges. John Rekenthaler, vice president of research at Morningstar (MORN), previously told Quartz that he would “expect the stock to go to zero or something close to it, if [Trump] were to lose the election.”

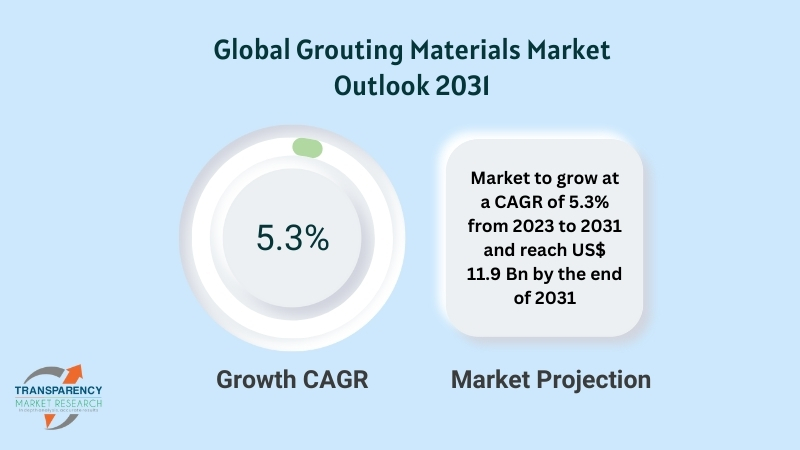

Grouting Materials Market Size to be Worth USD 11.9 billion by 2031, Growing at CAGR of 5.3% | Exclusive Report by Transparency Market Research, Inc.

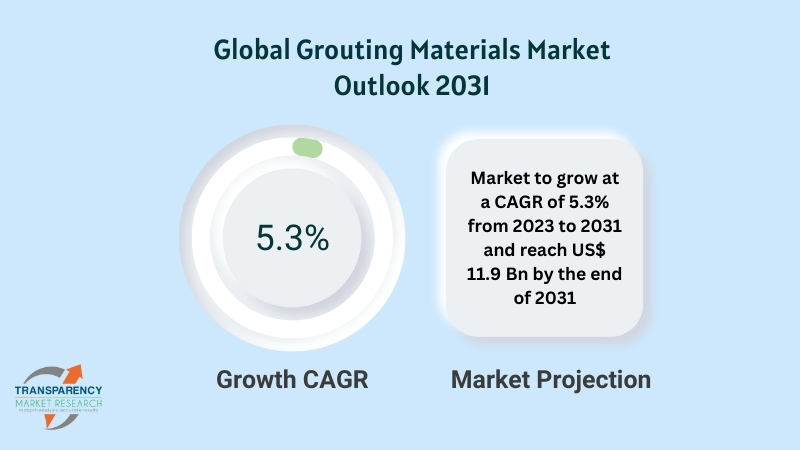

Wilmington, Delaware, United States, Transparency Market Research Inc. -, Sept. 23, 2024 (GLOBE NEWSWIRE) — The global grouting materials market (그라우팅 재료 시장) is estimated to flourish at a CAGR of 5.3% from 2023 to 2031. Transparency Market Research projects that the overall sales revenue for grouting materials is estimated to reach US$ 11.9 billion by the end of 2031.

The exploration of new applications and industries beyond traditional construction, such as mining, tunneling, and offshore installations, expands the scope of the grouting materials market.

Research into specialized grouting formulations tailored for specific conditions, such as extreme temperatures, high pressures, or corrosive environments, addresses niche market demands and enhances product performance. The trend towards offering customized grouting solutions, including pre-mixed formulations, rapid-setting options, and on-site technical support, meets the unique requirements of individual projects and enhances customer satisfaction.

Integration of digital tools and automation technologies into grouting processes, such as real-time monitoring systems, remote control applications, and automated mixing and injection systems, streamlines operations, improves efficiency, and reduces labor costs. Innovations in supply chain management, including just-in-time delivery, inventory management solutions, and strategic partnerships with suppliers, optimize logistics, reduce lead times, and ensure product availability, enhancing competitiveness in the grouting materials market.

For More Details, Request for a Sample of this Research Report: https://www.transparencymarketresearch.com/grouting-materials-market.html

Key Findings of the Market Report

- Chemical grouting leads the grouting materials market due to its versatility, effectiveness, and wide range of applications across various construction projects.

- Building & construction segment leads the grouting materials market due to extensive use in infrastructure projects such as bridges, tunnels, and buildings.

- Europe leads the grouting materials market due to extensive construction activities, stringent safety standards, and robust infrastructure projects across the region.

Grouting Materials Market Growth Drivers & Trends

- Increasing investments in infrastructure projects worldwide drive demand for grouting materials, particularly in construction, transportation, and energy sectors.

- Growing focus on renovation and repair activities fuels demand for grouting materials in aging infrastructure and buildings.

- Continuous innovation in grouting technologies enhances product performance, durability, and application versatility, catering to evolving customer needs and industry standards.

- Rising demand for sustainable construction solutions fosters the development of eco-friendly grouting materials with reduced environmental impact and enhanced durability.

- Rapid urbanization and population growth drive the construction of new buildings and infrastructure, driving the demand for grouting materials globally.

Global Grouting Materials Market: Regional Profile

- In North America, particularly in the United States and Canada, the grouting materials market is driven by robust infrastructure projects, including transportation, oil & gas, and civil engineering.

- Technological advancements and stringent safety standards contribute to the demand for high-performance grouting solutions, with key players like BASF SE and GCP Applied Technologies leading the market.

- Europe showcases a mature grouting materials market, supported by extensive construction activities, urbanization, and renovation projects. Countries like Germany, the UK, and France witness significant adoption of grouting materials in residential, commercial, and industrial sectors.

- Established players such as Sika AG and Fosroc International Ltd. dominate the regional market, emphasizing sustainability and innovation in product offerings.

- In Asia Pacific, rapid urbanization, infrastructure development, and industrialization drive the demand for grouting materials across emerging economies like China, India, and Southeast Asian countries.

- Growing investments in transportation, energy, and construction sectors fuel market growth, with local players and multinational corporations competing for market share. Government initiatives promoting sustainable infrastructure and urban development further propel the adoption of grouting materials in the region.

Grouting Materials Market: Competitive Landscape

The competitive landscape of the Grouting Materials Market is marked by a blend of established players and emerging competitors striving for market share and innovation. Key players such as BASF SE, Sika AG, and Fosroc International Ltd. dominate with extensive product portfolios and global reach. Regional players like Larson O’Brien and Five Star Products Inc. cater to niche markets with specialized offerings.

Competition intensifies as companies focus on product development, strategic partnerships, and geographical expansion to meet diverse customer demands. Sustainability initiatives and technological advancements play a pivotal role in shaping the competitive dynamics of the grouting materials industry. Some prominent players are as follows:

- BASF SE

- Sika AG

- Fosroc International Ltd.

- Mapei S.p.A

- Saint-Gobain Weber

- The Euclid Chemical Company

- Normet International Ltd.

- GCP Applied Technologies

- Five Star Products Inc.

- CICO Technologies Limited

- LATICRETE International Inc.

- Ardex Group

- AkzoNobel N.V.

- Tarmac Trading Limited

- Master Builders Solutions (MBCC Group)

Product Portfolio

- Sika AG offers a diverse product portfolio encompassing construction chemicals, adhesives, sealants, and waterproofing solutions. With a global presence and a focus on innovation, Sika provides sustainable solutions to enhance durability, efficiency, and performance in construction projects worldwide.

- Mapei S.p.A is a leading manufacturer of construction chemicals, adhesives, and sealants. With a dedication to research and development, Mapei offers a wide array of products for flooring, waterproofing, and concrete repair, ensuring high performance and sustainability in construction projects globally.

For Complete Report Details, Request Sample Copy from Here – https://www.transparencymarketresearch.com/grouting-materials-market.html

Grouting Materials Market: Key Segments

By Type

- Cement Grouting

- Chemical Grouting

- Structural Grouting

- Bentonite Grouting

- Bituminous Grouting

- Resin Grouting

- Others

By End Use

- Mining

- Building & Construction

- Oil & Gas

- Transportation

- Others

By Region

- North America

- Latin America

- Europe

- Asia Pacific

- Middle East & Africa

More Trending Reports by Transparency Market Research –

PEM Fuel Cell Materials Market (PEM燃料電池材料市場) – The global PEM fuel cell materials market is projected to advance at a CAGR of 50.58% from 2023 to 2031

Synthetic Fiber Market (سوق الألياف الاصطناعية) – The global synthetic fiber market is projected to expand at a CAGR of 4.8% during the forecast period from 2024 to 2034

About Transparency Market Research

Transparency Market Research, a global market research company registered at Wilmington, Delaware, United States, provides custom research and consulting services. Our exclusive blend of quantitative forecasting and trends analysis provides forward-looking insights for thousands of decision makers. Our experienced team of Analysts, Researchers, and Consultants use proprietary data sources and various tools & techniques to gather and analyses information.

Our data repository is continuously updated and revised by a team of research experts, so that it always reflects the latest trends and information. With a broad research and analysis capability, Transparency Market Research employs rigorous primary and secondary research techniques in developing distinctive data sets and research material for business reports.

Contact:

Transparency Market Research Inc.

CORPORATE HEADQUARTER DOWNTOWN,

1000 N. West Street,

Suite 1200, Wilmington, Delaware 19801 USA

Tel: +1-518-618-1030

USA – Canada Toll Free: 866-552-3453

Website: https://www.transparencymarketresearch.com

Email: sales@transparencymarketresearch.com

Follow Us: LinkedIn| Twitter| Blog | YouTube

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Bill Gates Says If He Started Microsoft Today, He'd Focus On This Industry Instead

Microsoft co-founder and one of the world’s most prominent tech visionaries, Bill Gates, is turning his attention toward a new type of technology.

In an interview with CNBC, Gates said that if he were to launch a startup today, he would leave his software roots behind and focus squarely on artificial intelligence (AI).

“Today, somebody could raise billions of dollars for a new AI company [that’s just] a few sketch ideas,” Gates told CNBC, reflecting AI’s fervor. So far this year, startups in the field have attracted more than $26 billion in investments, according to CNBC citing data from PitchBook.

Don’t Miss:

If Microsoft’s co-founder were to embark on the venture, Gates said his AI company would aim to compete with tech giants like Nvidia, Google and OpenAI or find an area where AI could deliver unique value.

“To really stand out as a small company, you have to pick something you’re going to do uniquely,” Gates told CNBC.

His shift in focus from software to AI mirrors a changing tech landscape. CNBC noted that when Microsoft was founded in 1976, Gates and co-founder Paul Allen were among the few who envisioned a future where computers would be part of everyday life.

Trending: Groundbreaking trading app with a ‘Buy-Now-Pay-Later’ feature for stocks tackles the $644 billion margin lending market – here’s how to get equity in it with just $500

“I was lucky that my belief in software made me unique,” Gates said. “Just believing in AI, that’s not unique. So I would have to develop some unique view of how you design AI systems – something that other people didn’t get.”

The billionaire said that entering the AI space at this stage comes with its own set of challenges. With foundational technologies already being developed by well-funded companies, new entrants may struggle to make an impact. Gates told entrepreneurs to focus on how AI could address specific business needs or improve daily life – whether by automating expensive tasks or generating strategic insights with broader applications.

Trending: Warren Buffett once said, “If you don’t find a way to make money while you sleep, you will work until you die.” These high-yield real estate notes that pay 7.5% – 9% make earning passive income easier than ever.

At 68, Gates’ priorities have shifted. While he once measured success by Microsoft’s growth, today he is more focused on adding value to the world, particularly through his philanthropic work with the Bill & Melinda Gates Foundation and his clean-energy investment firm, Breakthrough Energy.

He has been encouraging younger minds at Microsoft, OpenAI and other tech companies to push the boundaries of AI, telling them, “Because you’re taking a fresher look at this than I am, and that’s your fantastic opportunity.”

Just as his early faith in personal computing was prophetic, Gates’ focus on AI may again prove to be a bellwether for the future of technology.

Read Next:

Up Next: Transform your trading with Benzinga Edge’s one-of-a-kind market trade ideas and tools. Click now to access unique insights that can set you ahead in today’s competitive market.

Get the latest stock analysis from Benzinga?

This article Bill Gates Says If He Started Microsoft Today, He’d Focus On This Industry Instead originally appeared on Benzinga.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.