Chinese Stocks Defy Biden's Auto Import Ban Concerns, Rally To 4-Month Highs As Central Bank Unexpectedly Slashes Interest Rates

Chinese stocks surged to their highest levels in four months on Monday, following the People’s Bank of China’s (PBoC) slashing a key interest rate.

The surprise move reignites hopes for additional stimulus in the world’s second-largest economy.

The iShares China Large-Cap ETF FXI — which tracks major Chinese firms like Alibaba Group Holding Limited BABA, Tencent Holding Ltd. TCEHY, JD.com Inc. JD, and Baidu Inc. BIDU — is up more than 2% as of 11:20 a.m. ET in New York. It’s a level not seen since late May.

PBoC Cuts Rates, Inject Liquidity

On Sept. 23, the People’s Bank of China unexpectedly reduced the 14-day reverse repurchase rate by 10 basis points to 1.85%, down from 1.95%.

Additionally, the central bank injected CNY 74.5 billion ($10.2 billion) of liquidity into the banking system through this operation, according to an official statement. The PBoC also pumped CNY 160.1 billion via seven-day reverse repos, maintaining the rate at 1.7%.

These measures come on the heels of the central bank’s decision last week to keep key lending rates at record lows, following surprise cuts in July.

Monday’s policy moves in China are likely seen as part of broader efforts to stimulate consumption ahead of the National Day Holiday, a week-long break that starts on Oct. 1.

Market Reactions

Chinese ADRs (American Depository Receipts) rallied sharply in response, outpacing broader market gains.

Other Chinese-linked ETFs made moves Monday:

- Kraneshares CSI China Internet ETF KWEB was up 2%

- iShares MSCI China MCHI, up 1.7%

- Invesco China Technology ETF CQQQ up1.6%.

On the same day, the U.S. Commerce Department proposed a ban on the import and sale of Chinese-made vehicles equipped with automated driving systems and critical communications software and hardware due to national security concerns.

This ban is scheduled to take effect in 2027.

Electric vehicle (EV) manufacturers like Shanghai-based NIO Inc. NIO and Guangzhou, China-based Xpeng Inc. XPEV also joined the broader country stock rally despite the potential negative challenges from the new regulation.

Monday’s Movers Among Largest Chinese Stocks

| Name | Market Cap | 1-Day % |

| Alibaba Group Holding Limited | $210.26B | 2.44% |

| NetEase, Inc. NTES | $ 52.23B | 2.59% |

| JD.com, Inc. | $ 43.60B | 4.19% |

| Baidu, Inc. | $ 31.10B | 3.00% |

| Li Auto Inc. | $ 22.26B | 3.55% |

| DiDi Global Inc. | $ 19.42B | 0.75% |

| KE Holdings Inc. BEKE | $ 18.20B | 5.60% |

| ZTO Express (Cayman) Inc. | $ 17.43B | -0.9% |

| Tencent Music Entertainment Group TME | $ 16.34B | 4.44% |

| Yum China Holdings, Inc. YUMC | $ 13.85B | 2.38% |

| NIO Inc. | $ 11.53B | 3.13% |

Read Now:

Photo: Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Billionaires Are Selling Nvidia Stock and Buying an Index Fund That Could Soar Up to 77,675%, According to Wall Street Experts

Artificial intelligence (AI) is one of the hottest themes on Wall Street, and Nvidia has been one of the hottest stocks. Its share price surged 175% over the last year because the company dominates the market for AI chips. But AI is not the only trend that could turn small sums into fortunes.

Institutional investors are also betting on cryptocurrency. The hedge fund managers listed below sold shares of Nvidia in the first half of 2024, and they started positions in the iShares Bitcoin Trust (NASDAQ: IBIT), an exchange-traded fund that tracks Bitcoin (CRYPTO: BTC).

-

Steven Cohen at Point72 Asset Management sold 3.4 million shares of nvidia in the first half of 2024, cutting his stake by 63%. He also bought 1.6 million shares of the iShares Bitcoin Trust.

-

Israel Englander at Millennium Management sold 7.8 million shares of Nvidia in the first half of 2024, reducing his stake by 38%. He also bought 10.8 million shares of the iShares Bitcoin Trust.

-

Ken Griffin at Citadel Advisors sold 33.9 million shares of Nvidia in the first half of 2024, slashing his stake by 93%. He also bought 63,186 shares of the iShares Bitcoin Trust.

-

David Shaw at D.E. Shaw & Co. sold 26.3 million shares of Nvidia in the first half of 2024, cutting his stake by 70%. He also bought 2.6 million shares of the iShares Bitcoin Trust.

Those trades are especially noteworthy because Point72, Millennium, Citadel, and D.E. Shaw rank among the 15 best-performing hedge funds in history as measured by net gains since inception. However, all four money managers still have exposure to Nvidia, so it would be wrong to assume they have completely lost conviction in the AI chipmaker.

Instead, the lesson here is that portfolio diversification is important, and AI is not the only way to make money in the stock market. Indeed, Wall Street experts think Bitcoin could surge as much as 77,675% in the coming decades, which implies identical gains in the iShares Bitcoin Trust.

Wall Street pundits are predicting monster gains for Bitcoin

Bitcoin’s price soared 133% during the past year due to enthusiasm about spot Bitcoin ETFs and the halving event that took place in April. Bitcoin currently trades at $63,000, but the Wall Street pundits below expect that figure to increase substantially.

-

Tom Lee of Fundstrat Global Advisors thinks Bitcoin could reach $500,000 by 2029. That forecast implies 690% upside.

-

Gautam Chhugani and Mahika Sapra at Bernstein believe Bitcoin could be worth $1 million by 2033. That forecast implies 1,485% upside.

-

Cathie Wood at Ark Invest believes Bitcoin could reach $3.8 million by 2030. That forecast implies 5,930% upside.

-

Michael Saylor at MicroStrategy thinks Bitcoin’s price will land somewhere between $3 million and $49 million by 2045. That forecast implies upside ranging from 4,660% to 77,675%.

All four Bitcoin bulls based their predictions on two things. First, the recent approval of spot Bitcoin ETFs will increase demand, particularly among institutional investors. Second, the periodic halving events that limit Bitcoin’s supply will gradually reduce selling pressure from miners.

Spot Bitcoin ETFs are driving institutional demand for Bitcoin

Like any asset, Bitcoin’s price depends on supply and demand. But the cryptocurrency is somewhat atypical because its supply is limited to 21 million coins, so demand is the most consequential variable. That’s why spot Bitcoin ETFs could have a big impact. They eliminate traditional sources of friction, like maintaining separate accounts for stocks and cryptocurrencies, and paying high fees for each transaction.

To elaborate, spot Bitcoin ETFs let investors add cryptocurrency exposure to existing brokerage accounts, and many of the funds have relatively low expense ratios. The iShares Bitcoin Trust charges 0.25% per year, which means investors will pay $25 on every $10,000 invested. But Coinbase charges transaction fees ranging from 0.4% to 0.6% for orders under $10,000. Those fees are not only higher, but also investors get hit twice: once when they buy, and again when they sell.

The SEC approved spot Bitcoin ETFs in January, but they have already made good on their promise to unlock demand. The iShares Bitcoin Trust reached $10 billion in assets faster than any other ETF in history, according to The Wall Street Journal. Additionally, I’ve already mentioned four successful hedge fund managers that own shares of the iShares Bitcoin Trust, but 592 institutional investors reported positions in the second quarter, up from 436 in the first quarter.

If that trend continues, Bitcoin could be worth a lot more in the future. I say that because institutional investors have $120 trillion in assets under management, and allocating a little more than 5% of that total to Bitcoin (or spot Bitcoin ETFs) would propel its price to $3.8 million, according to Cathie Wood.

History says Bitcoin will hit a new high in 2025

Bitcoin’s supply limit is enforced by periodic halving events. Miners are rewarded with block subsidies (newly minted Bitcoin) when they successfully verify a transaction block, but the payout is reduced by 50% every time 210,000 blocks are added to the blockchain. That happens about once every four years.

Importantly, halving events reduce selling pressure from the mining community, simply because miners are minting less Bitcoin to sell. For instance, Michael Saylor estimates the April 2024 halving event will cut selling pressure from $12 billion per year to $6 billion per year. Accordingly, Bitcoin has consistently peaked 12 to 18 months following each halving event in the past, as shown in the chart below.

|

Halving Date |

Peak Return |

Time to Peak Return |

|---|---|---|

|

November 2012 |

10,485% |

371 days |

|

July 2016 |

3,103% |

525 days |

|

May 2020 |

707% |

546 days |

Source: Fidelity Digital Assets.

Bitcoin hit a record high of $73,000 earlier this year, prior to the April halving event. So, history says its price will exceed that level sometime between April 2025 and October 2025.

Investors should consider the downside before buying Bitcoin

Before putting money in Bitcoin, investors should consider two things. First, not even the smartest Wall Street analyst knows the future, so forecasts are simply educated guesses. There is no guarantee Bitcoin comes anywhere close to the price targets I’ve discussed. Second, Bitcoin has fallen more than 50% several times in its relatively short history, and similar drawdowns are probable in the future.

Risk-tolerant investors comfortable with that should consider putting a small portion of their portfolios into Bitcoin, either directly or through the iShares Bitcoin Trust. How small is a personal preference, but I would personally cap my investment around 5% of my portfolio. Remember, it is possible that Bitcoin could go to zero in the future. Don’t invest a single penny you aren’t prepared to lose.

Should you invest $1,000 in iShares Bitcoin Trust right now?

Before you buy stock in iShares Bitcoin Trust, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and iShares Bitcoin Trust wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $710,860!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 16, 2024

Trevor Jennewine has positions in Nvidia. The Motley Fool has positions in and recommends Bitcoin and Nvidia. The Motley Fool has a disclosure policy.

Billionaires Are Selling Nvidia Stock and Buying an Index Fund That Could Soar Up to 77,675%, According to Wall Street Experts was originally published by The Motley Fool

The Rise of AI Voice Generator Market: A $20.4 billion Industry Dominated by Tech Giants – IBM (US), NVIDIA (US), OpenAI (US) | MarketsandMarkets™

Delray Beach, FL, Sept. 23, 2024 (GLOBE NEWSWIRE) — The AI Voice Generator Market will increase from USD 3.0 billion in 2024 to USD 20.4 billion by 2030, with a compound annual growth rate (CAGR) of 37.1% during the forecast period., according to a new report by MarketsandMarkets™. Government initiatives and regulatory frameworks, development in deep learning algorithms, and the growing need for personalized customer experiences are all driving the growth of the AI voice generator market.

Browse in-depth TOC on “AI Voice Generator Market“

410 – Tables

67 – Figures

440 – Pages

Download PDF Brochure @ https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=144271159

AI Voice Generator Market Dynamics:

Drivers:

- Increasing demand for voice-enabled devices and virtual assistants

- Advancements in NLP and machine learning technologies to enhance capabilities of gen AI in audio and speech

- Growing need for accessibility solutions in digital content

Restraints:

- Lack of explainability in AI decision-making processes for audio generation

- High cost of developing and implementing advanced generative AI solutions to hinder market growth

- Ethical concerns surrounding use of AI-generated voices to lead to increased scrutiny

Opportunities:

- Integration of gen AI with emerging technologies like 5G and edge computing to enable real-time audio and speech generation

- Increasing demand for localized content and multilingual support in global markets to offer growth potential for AI-powered translation and dubbing services

- Growing market for personalized and emotionally intelligent AI assistants to present opportunities for advanced generative AI speech technologies

List of Key Companies in AI Voice Generator Market:

- IBM (US)

- NVIDIA (US)

- OpenAI (US)

- Meta (US)

- Microsoft (US)

- Google (US)

- AWS (US)

- Cisco (US)

- SoundHound (US)

- Speechify (US)

Request Sample Pages @ https://www.marketsandmarkets.com/requestsampleNew.asp?id=144271159

AI audio generator and AI speech generator is undergoing a significant transformation owing to recent technological advancements and regulatory changes. Human-like audio and speech synthesis is now possible because of the advancements in deep learning algorithms and neural network architectures. Advances like self-supervised learning and transformer models have sped up the creation of advanced voice assistants, real-time language translation, and customized speech synthesis applications. Global regulatory bodies are simultaneously strengthening ethical standards and data privacy laws calling for increased accountability and transparency in AI implementations. European Union’s GDPR and newly launched AI Act helps to prioritize user consent data protection and bias mitigation. These laws guarantee that generative AI applications meet strict ethical guidelines. The market is moving towards AI solutions that are more secure, robust, and ethically responsible by technological advancements and regulatory changes.

Based on Software type segment, transformer models are expected to have the highest compound annual growth rate (CAGR) in the AI voice generator market over the course of the forecast period. Transformer models help in processing and producing sequential data unlike traditional models. These models have capabilities like voice synthesis, natural language processing and real-time translation. The increasing demand for high-quality AI-driven applications is met by their capacity to handle massive datasets and learn context over extended sequences which improves the accuracy and fluency of generated speech. Transformer architectures like BERT GPT and T5 are also becoming extremely popular across a range of industries due to the ongoing evolution and advances in computing power and cloud-based AI services.

Inquire Before Buying@ https://www.marketsandmarkets.com/Enquiry_Before_BuyingNew.asp?id=144271159

Voice conversion and cloning is predicted to grow at the fastest compound annual growth rate (CAGR) in the AI voice generator market over the course of the forecast period. With amazing accuracy these applications can replicate and alter voices providing a host of advantages in terms of entertainment, customer support accessibility, and customized experiences. Voice cloning technologies are becoming increasingly popular due to the growing demand for personalized voice assistants, digital avatars, and automated customer support solutions. Their quick development is further supported by the incorporation of voice conversion and cloning into audiobooks, content creation platforms, and language learning aids.

AI voice generators offers many opportunities for industry players to explore and take advantage of. The need for customized voice assistants, language translation services, and immersive sound experiences in gaming and virtual reality are some of the focus areas in AI voice generator market. Businesses can explore these opportunities by utilizing technologies such as transformer models and neural networks to create speech synthesis and recognition systems. AI solutions have the potential to improve communication for people with speech impairments by addressing their accessibility needs. Organizations have the opportunity to collaborate with content creators, media companies, and educational institutions to offer tailored audio solutions for individual user requirements. Engaging in research and development, forming strategic partnerships, and introducing innovative products will help businesses grab a greater portion of the growing market and maintain continuous growth.

Get access to the latest updates on AI Voice Generator Companies and AI Voice Generator Industry

About MarketsandMarkets™ MarketsandMarkets™ has been recognized as one of America's best management consulting firms by Forbes, as per their recent report. MarketsandMarkets™ is a blue ocean alternative in growth consulting and program management, leveraging a man-machine offering to drive supernormal growth for progressive organizations in the B2B space. We have the widest lens on emerging technologies, making us proficient in co-creating supernormal growth for clients. Earlier this year, we made a formal transformation into one of America's best management consulting firms as per a survey conducted by Forbes. The B2B economy is witnessing the emergence of $25 trillion of new revenue streams that are substituting existing revenue streams in this decade alone. We work with clients on growth programs, helping them monetize this $25 trillion opportunity through our service lines - TAM Expansion, Go-to-Market (GTM) Strategy to Execution, Market Share Gain, Account Enablement, and Thought Leadership Marketing. Built on the 'GIVE Growth' principle, we work with several Forbes Global 2000 B2B companies - helping them stay relevant in a disruptive ecosystem. Our insights and strategies are molded by our industry experts, cutting-edge AI-powered Market Intelligence Cloud, and years of research. The KnowledgeStore™ (our Market Intelligence Cloud) integrates our research, facilitates an analysis of interconnections through a set of applications, helping clients look at the entire ecosystem and understand the revenue shifts happening in their industry. To find out more, visit www.MarketsandMarkets™.com or follow us on Twitter, LinkedIn and Facebook. Contact: Mr. Rohan Salgarkar MarketsandMarkets™ INC. 1615 South Congress Ave. Suite 103, Delray Beach, FL 33445 USA: +1-888-600-6441 Email: sales@marketsandmarkets.com Visit Our Website: https://www.marketsandmarkets.com/

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

These 5 Dividend Stocks are Down 21% to 77%. Here's Why They're Worth Buying and Holding for at Least 5 Years.

Occidental Petroleum (NYSE: OXY), ConocoPhillips (NYSE: COP), United Parcel Service (NYSE: UPS), Toyota Motor (NYSE: TM), and Estee Lauder (NYSE: EL) are all down big from their all-time highs.

Here’s why all have sold off and why each dividend stock is a great value now despite challenges.

Two beaten-down oil stocks to buy now

Exploration and production (E&P) company Occidental Petroleum, commonly known as Oxy, is the sixth-largest holding in Warren Buffett-led Berkshire Hathaway‘s public equity portfolio. Meanwhile, ConocoPhillips is, by far, the most valuable U.S.-based E&P by market cap. Despite these accolades, both companies have sold off during the past few months as West Texas Intermediate crude oil prices (the U.S. benchmark) have dipped below $70 per barrel.

Oxy and ConocoPhillips will sport lower profit margins when oil prices are low. But both companies can still be free cash flow (FCF) positive at prices much lower than today’s levels. Oxy’s portfolio has a breakeven level below $50 per barrel, while ConocoPhillips is working toward being FCF positive at just $35 per barrel.

Oxy completed its $12 billion acquisition of CrownRock in August, and ConocoPhillips announced plans to buy Marathon Oil for $22.5 billion in May. The more oil prices fall, the worse those deals will look, at least in the near term.

The sell-off is a buying opportunity for investors looking to scoop up shares of top E&Ps on sale. What’s more, Oxy has a dividend yield of 1.7% and ConocoPhillips has an ordinary dividend of $0.58 per share per quarter and a quarterly variable dividend based on the performance of the business. The variable dividend has been $0.20 per share for the past three quarters, so investors can estimate ConocoPhillips’ yield to be about 3%.

UPS can power a passive income portfolio

One look at the following chart, and it’s easy to see why UPS is down about 45% from its all-time high and is hovering near a four-year low.

UPS’s revenue has been falling for several years now, and margins have plummeted to 10-year lows. The main reason for the disappointing results is bloated costs due to overextended routes and higher operating expenses.

The good news is that UPS is returning to volume growth for U.S. package deliveries. It has assured investors that the dividend is safe, although it hinted that dividend raises are unlikely, given the company’s high dividend expense relative to its earnings.

Add it all up, and UPS and its 4.9% dividend yield stand out as a compelling turnaround play for investors who believe the company is set to return to growth.

Toyota is making the right long-term investments

After a red-hot start to 2024 and a new all-time high for Toyota in March, Japanese automakers have sold off big time.

Car sales in Japan and China have been falling, which is dragging down Toyota’s results. So although trailing-12-month sales, operating margins, and diluted earnings per share are all at 10-year highs, the concern is that growth could slow, especially if interest rate cuts fail to spur U.S. new car sales.

Toyota is capitalizing on hybrid vehicles and debuting new low-carbon engine designs. It also pays a growing dividend. Now is a great time to scoop up shares of the world’s largest automaker by global sales volume.

Estee Lauder has fallen far enough

Estee Lauder stock has been pulverized lately. The beauty brand conglomerate has been on the wrong side of just about every trend during the past few years. It depends heavily on consumer discretionary spending, which has been challenging amid inflationary pressures and higher interest rates. It relies on in-person shopping in boutique outlets, airports, and malls. It’s also big in China, which hasn’t been going well.

Estee Lauder’s best quality is its portfolio of timeless brands, which don’t have as great of a risk of falling out of favor with consumers as trending brands. If the company can improve its marketing strategy and get costs under control, it could be a worthwhile turnaround candidate for passive income investors, especially considering it has already fallen to an eight-year low and yields 3%.

Get paid to wait with dividend income

Despite their differences, there’s a common thread among the five companies discussed: All are down for good reasons but have what it takes to recover and reward patient investors.

Oxy and ConocoPhillips have a nice cushion to maintain profitability even if oil prices fall. Still, investors should monitor how each company integrates its recent acquisitions and navigates a potentially volatile period.

UPS has to show it is charting a path toward higher margins and package delivery volume growth.

Toyota must navigate macroeconomic challenges while investing in innovations across low-carbon internal combustion engines, electric vehicles, and hydrogen-fueled cars.

Estee Lauder needs to revamp its sales strategy to maximize its brand lineup.

When looking at turnaround companies, the key is to know what to look for and have the patience to hold through periods of volatility. Stocks that pay dividends provide an incentive to be patient, making Oxy, ConocoPhillips, UPS, Toyota, and Estee Lauder much easier to buy and hold for at least five years.

Should you invest $1,000 in Occidental Petroleum right now?

Before you buy stock in Occidental Petroleum, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Occidental Petroleum wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $710,860!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 16, 2024

Daniel Foelber has positions in Estée Lauder Companies. The Motley Fool has positions in and recommends Berkshire Hathaway. The Motley Fool recommends Occidental Petroleum and United Parcel Service. The Motley Fool has a disclosure policy.

These 5 Dividend Stocks are Down 21% to 77%. Here’s Why They’re Worth Buying and Holding for at Least 5 Years. was originally published by The Motley Fool

Automotive Gear Oil Market is Projected to Grow at a 3.4% CAGR, Expected to Hit US$ 5.01 Billion by 2034 | Fact.MR Report

Rockville, MD, Sept. 23, 2024 (GLOBE NEWSWIRE) — Fact.MR, a market research and competitive intelligence provider, in its newly published study, reveals that the global automotive gear oil market is pegged at US$ 3.59 billion in 2024. Worldwide demand for automotive gear oil is forecasted to reach a market valuation of US$ 5.01 billion by the end of 2034.

Automotive gear oil has high viscosity compared to engine oil and, therefore, finds use in the automotive sector. Increasing sales of vehicles is predicted to positively drive demand for automotive gear oil in the coming 10 years. Furthermore, increased expenditure on vehicle maintenance along with growing awareness about its importance in the efficiency of vehicles is driving opportunities for players.

In recent years, automatic transmission (AT) has been penetrating in passenger cars. In addition, increasing sales of AT vehicles are forecasted to generate the need for automatic transmission fluid. Implementation of stringent economic standards and environmental regulations is predicted to lead to the development of vehicle designs with better efficiency and performance. This is further projected to increase demand for automotive gear oil with high quality to help in achieving set standards.

For More Insights into the Market, Request a Sample of this Report:

https://www.factmr.com/connectus/sample?flag=S&rep_id=9671

Key Takeaways from Market Study:

- The global automotive gear oil market is estimated at US$ 3.59 billion in 2024.

- Worldwide sales of automotive gear oil are projected to reach US$ 5.01 billion by 2034-end.

- The market is predicted to expand at 3.4% CAGR from 2024 to 2034.

- East Asia is forecasted to account for 38.9% share of global market revenue by 2034.

- Sales of automotive gear oil in the United States are projected to reach US$ 945.2 million by 2034.

- Global demand for automotive gear oil for use in commercial vehicles is predicted to increase at 4.6% CAGR from 2024 to 2034.

“Increasing requirements for high-performance heavy vehicles owing to the expansion of construction and mining industries are stimulating demand for automotive gear oil,” says a Fact.MR analyst.

Leading Players Driving Innovation in the Automotive Gear Oil Market:

Leading manufacturers of automotive gear oil are ExxonMobil Corporation, Shell PLC, TOTAL S.A., BP PLC, FUCHS National Petroleum Corporation, ZF Friedrichshafen AG, China National Petroleum Corporation, Chevron Corporation, Valvoline LLC, Hindustan Petroleum Corporation Limited, Ferdinand Bilstein GmbH Co. KG, VIEROL AG, Elofic Industries Limited, and Hengst SE and Co. KG.

German Market Benefitting from Rapidly Rising Demand for Premium and Luxury Cars:

Germany is predicted to contribute to increased demand for automotive gear oil owing to the strong presence of premium and luxury cars. In addition, increasing per capita income and changing lifestyles are forecasted to contribute to the expansion of the automotive sector with rising spending capacity of people. These factors are predicted to result in increasing demand for automotive gear oil in the country.

Automotive Gear Oil Industry News:

- In July 2022, Shell USA, L. P., and Shell Midstream Partners formed a partnership to carry out their merger plan. It is anticipated that the latter will purchase common units that were held by the public and represented a limited partner’s interest in SHLX. It was anticipated that this transaction would be completed by 2022’s fourth quarter.

Get Customization on this Report for Specific Research Solutions: https://www.factmr.com/connectus/sample?flag=S&rep_id=9671

More Valuable Insights on Offer:

Fact.MR, in its new offering, presents an unbiased analysis of the automotive gear oil market, presenting historical demand data for 2018 to 2023 and forecast statistics for 2024 to 2034.

The study divulges essential insights into the market based on source (mineral-based, synthetic-based), vehicle category (passenger vehicles, commercial vehicles, two/three wheelers), transmission (automatic, manual), and distribution channel (OEMs. aftermarket), across six major regions of the world (North America, Europe, East Asia, Latin America, South Asia & Oceania, and MEA).

Check out More Related Studies Published by Fact.MR Research:

Automotive Gear Market: is analyzed to increase from US$ 4.88 billion in 2024 to US$ 8.5 billion by the end of 2034. Sales of automotive gear systems are evaluated to rise at 5.7% CAGR from 2024 to 2034.

Automotive Gear Shift System Market: is forecasted to expand at 4.8% CAGR from 2023 to 2033. As such, worldwide sales of automotive gear shift systems are projected to increase from US$ 27.1 billion in 2023 to US$ 43.5 billion by the end of 2033.

Automotive Pinion Gear Market: is valued at US$ 11.08 billion in 2023 and is forecasted to reach US$ 17.2 billion by 2033, expanding at a CAGR of 4.5% over the next ten years.

Polyurethane in Automotive Filter Market: is estimated at USD 791 Million in 2022 and is forecast to reach USD 1.2 Billion by 2032, growing with a CAGR of 4.5% from 2022 to 2032.

Automotive Spark and Glow Plug Market: size is expected to be pegged at US$ 6,988.2 million in 2024. The global market is forecasted to increase at 2.5% CAGR and reach a market value of US$ 8,945.5 million by the end of 2034.

About Us:

Fact.MR is a distinguished market research company renowned for its comprehensive market reports and invaluable business insights. As a prominent player in business intelligence, we deliver deep analysis, uncovering market trends, growth paths, and competitive landscapes. Renowned for its commitment to accuracy and reliability, we empower businesses with crucial data and strategic recommendations, facilitating informed decision-making and enhancing market positioning.

With its unwavering dedication to providing reliable market intelligence, FACT.MR continues to assist companies in navigating dynamic market challenges with confidence and achieving long-term success. With a global presence and a team of experienced analysts, FACT.MR ensures its clients receive actionable insights to capitalize on emerging opportunities and stay competitive.

Contact:

11140 Rockville Pike

Suite 400

Rockville, MD 20852

United States

Tel: +1 (628) 251-1583

Sales Team: sales@factmr.com

Follow Us: LinkedIn | Twitter | Blog

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Salary.com to Showcase Award-Winning Compensation Solutions at This Week's HR Technology Conference & Exposition 2024

WALTHAM, Mass., Sept. 23, 2024 (GLOBE NEWSWIRE) — In today’s rapidly changing labor market, staying ahead of the curve requires insightful analysis based on real-time compensation data. With this growing need for trusted data and intuitive software, Salary.com will highlight its award-winning solutions, including its latest offering, SalaryIQ™, during this week’s HR Technology Conference & Exposition.

Attendees will be able to see how the Salary.com platform, which draws over 10 billion compensation data points from 225+ industries, manages all aspects of the compensation process, from job description and compensation package creation to employee surveys, pay equality analysis, employee upskilling and more. This includes Salary.com’s recently released SalaryIQ real-time job posting solution, which continuously scans job boards, company career sites and other publicly available data to deliver actionable insights to end users. With this expanded data resource, HR teams are able to predict staffing needs, anticipate future trends and streamline processes.

Salary.com will also host the breakout session “How to Conduct a Pay Equity Audit” on September 25, 2024, from 10:45 to 11:30 a.m. PT. Led by Katie Stukowski, Vice President of Solutions Consulting, this session will guide attendees through the essential steps of conducting a pay audit. Attendees will learn how to navigate project management and identify critical problems, prepare for audits, address systemic issues in compensation practices and foster pay equity within their organizations.

In addition, employment attorney Heather Bussing, who recently co-authored the book “Get Pay Right” with Salary.com CEO Kent Plunkett, will present “Start with the Money: Pay Equity as the Foundation of Fairness.” In this session, taking place on September 24, 2024, from 10:30 to 11:15 a.m. PT, during the Women in HR Technology Summit, Bussing will delve into the importance of pay equity and how effective salary assessments can drive fairness in the workplace.

Carol Ferrari, VP, Product Marketing at Salary.com, commented, “To get pay right, employers need access to integrated compensation data and technology solutions. At this week’s HR Technology Conference & Exposition, attendees will have multiple opportunities to get answers to their most pressing pay questions directly from the Salary.com team. We’re looking forward to helping this year’s attendees make fair pay a reality.”

Conference attendees interested in learning about Salary.com are encouraged to participate in these educational sessions and meet with company representatives at Booth No. 4911 during expo hours. To pre-book a demo, visit https://www.salary.com/business/events/hr-technology-conference.

About Salary.com

Salary.com has been solving the complex human capital needs of global organizations for more than 20 years. The company leads the industry in compensation data, software and services. Over 30,000 organizations in 22 countries use Salary.com’s solutions to confidently hire and retain talent so they can better compete in a constantly changing landscape.

Salary.com provides more than 10 billion data points across more than 225 industries using our powerful, proprietary AI framework to get pay right. The company’s flagship product, CompAnalyst®, empowers organizations with a suite of tools that simplify hiring, eliminate compensation guesswork, and increase retention. Employee trust depends on fair pay and Salary.com’s solutions get pay right. Please visit www.salary.com/business.

Note to editors: Trademarks and registered trademarks referenced herein remain the property of their respective owners. Media Contact: Kate Achille The Devon Group for Salary.com kate@devonpr.com

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Creatine Market to Reach $0.5 Billion, Globally, by 2033 at 6.3% CAGR: Allied Market Research

Wilmington, Delaware, Sept. 23, 2024 (GLOBE NEWSWIRE) — Allied Market Research published a report, titled, “Creatine Market by Product Type (Creatine Monohydrate, Creatine Ethyl Ester, Creatine Hydrochloride and Others), Application (Sports Nutrition, Medical, and Others), Form (Powders, Tablets, Capsules, and Others), and Distribution Channel (Online Providers and Offline Providers): Global Opportunity Analysis and Industry Forecast, 2024-2033″. According to the report, the creatine market was valued at $0.2 billion in 2023, and is estimated to reach $0.5 billion by 2033, growing at a CAGR of 6.3% from 2024 to 2033.

Request Sample of the Report on Creatine Market Forecast 2033 – https://www.alliedmarketresearch.com/request-sample/A324396

Prime determinants of growth

Increasing demand in sports nutrition, expanding applications in medical settings, and increased awareness among athletes and fitness enthusiasts are the major factors that drive the growth of the creatine market growth. However, the side effects associated with creatine may restrict market growth. Moreover, high growth potential in developing economies offer remunerative opportunities for the expansion of the global creatine market.

Report coverage & details

| Report Coverage | Details |

| Forecast Period | 2024–2033 |

| Base Year | 2023 |

| Market Size in 2023 | $0.2 billion |

| Market Size in 2033 | $0.5 billion |

| CAGR | 6.3% |

| No. of Pages in Report | 233 |

| Segments Covered | Product Type, Application, Form, Distribution Channel, and Region. |

| Drivers |

|

| Opportunity |

|

| Restraint |

|

Want to Explore More, Connect to our Analyst – https://www.alliedmarketresearch.com/connect-to-analyst/A324396

Segment Highlights

Rise in adoption of creatine monohydrate.

By product type, the creatine monohydrate segment has a significant share in the market. This is attributed to as creatine monohydrate is widely recognized for its effectiveness, safety profile, and extensive research backing its benefits in enhancing muscle strength, power output, and overall athletic performance. In addition, creatine monohydrate is cost-effective compared to other forms, making it accessible to a broader consumer base thereby supporting the segment growth.

Significant role of creatine in sports medicine.

By application, the sports nutrition segment plays a significant role in market owing to its focus on optimizing athletic performance, injury prevention, and rehabilitation. Creatine supplements are widely recognized for their ability to enhance muscle strength, aid in faster recovery from intense physical activity, and support overall athletic conditioning.

Growing adoption of creatine powder form.

By form, the powder segment plays a significant role in the market owing to its convenience, versatility, and ease of consumption. Powdered creatine formulations are popular among consumers and athletes due to their ability to be easily mixed into beverages or shakes, providing a straightforward way to incorporate creatine into daily routines thereby supporting the segment growth.

Offline providers segment is likely to maintain its lead during the forecast period.

By distribution channel, the offline providers segment has a significant share of the market. This is attributed to its established presence in physical retail outlets, including supermarkets, specialty stores, drug stores, and fitness centers. In addition, the offline providers offer trusted shopping experience and customer service, which enhances consumer confidence in purchasing creatine supplements thereby driving the segment growth.

Regional Outlook

North America has a significant share in the creatine market and is expected to retain its dominance throughout the forecast period. This is primarily attributed to a well-established sports and fitness culture, with high levels of disposable income supporting widespread adoption of creatine products. Additionally, extensive research and development activities, coupled with advanced healthcare infrastructure and regulatory frameworks, contribute to the market’s stability and growth prospects in North America.

For Purchase Related Queries/Inquiry – https://www.alliedmarketresearch.com/purchase-enquiry/A324396

Key Players

- Tradichem S.L.

- AlzChem Group

- Chongqing Joywin Naturali Prodotti Co., Ltd

- Tiancheng International

- NACALAI TESQUE, INC.

- Merck KGaA

- Hefei TNJ Chemical Industry Co., Ltd.

- AVANSCHEM

- KANTO KAGAKU

- Supplement Manufacturing Partner Inc.

The report provides a detailed analysis of these key players in the global creatine market. These players have adopted different strategies such as agreement, investment, clinical trials, and others to increase their market share and maintain dominant shares in different regions. The report is valuable in highlighting business performance, operating segments, product portfolio, and strategic moves of market players to showcase the competitive scenario.

Recent Development in Creatine Industry

In August 2021, AlzChem Group AG invested approx. EUR 11 million in the expansion of Creapure capacities and precursors. The company has decided to significantly increase its production capacity for creatine monohydrate and to take advantage of additional opportunities in the market.

Trending Reports in Healthcare Industry:

CBCT Systems Market – Global Opportunity Analysis and Industry Forecast, 2023-2032

Idiopathic Pulmonary Fibrosis Market – Global Opportunity Analysis and Industry Forecast, 2023-2032

PET-CT Scanner Device Market – Global Opportunity Analysis and Industry Forecast, 2023-2032

Home Medical Equipment Market – Global Opportunity Analysis and Industry Forecast, 2023-2032

AVENUE- A Subscription-Based Library (Premium on-demand, subscription-based pricing model) Offered by Allied Market Research:

AMR introduces its online premium subscription-based library Avenue, designed specifically to offer cost-effective, one-stop solution for enterprises, investors, and universities. With Avenue, subscribers can avail an entire repository of reports on more than 2,000 niche industries and more than 12,000 company profiles. Moreover, users can get an online access to quantitative and qualitative data in PDF and Excel formats along with analyst support, customization, and updated versions of reports.

Get access to the library of reports at any time from any device and anywhere. For more details, follow the link: https://www.alliedmarketresearch.com/library-access

About Allied Market Research:

Allied Market Research (AMR) is a full-service market research and business-consulting wing of Allied Analytics LLP based in Wilmington, Delaware. Allied Market Research provides global enterprises as well as medium and small businesses with unmatched quality of “Market Research Reports” and “Business Intelligence Solutions.” AMR has a targeted view to provide business insights and consulting to assist its clients to make strategic business decisions and achieve sustainable growth in their respective market domains. AMR offers its services across 11 industry verticals including Life Sciences, Consumer Goods, Materials & Chemicals, Construction & Manufacturing, Food & Beverages, Energy & Power, Semiconductor & Electronics, Automotive & Transportation, ICT & Media, Aerospace & Defense, and BFSI.

We are in professional corporate relations with various companies and this helps us in digging out market data that helps us generate accurate research data tables and confirms utmost accuracy in our market forecasting. Allied Market Research CEO Pawan Kumar is instrumental in inspiring and encouraging everyone associated with the company to maintain high quality of data and help clients in every way possible to achieve success. Each and every data presented in the reports published by us is extracted through primary interviews with top officials from leading companies of domain concerned. Our secondary data procurement methodology includes deep online and offline research and discussion with knowledgeable professionals and analysts in the industry.

Contact

David Correa

1209 Orange Street,

Corporation Trust Center,

Wilmington, New Castle,

Delaware 19801 USA.

Toll Free: +1-800-792-5285

Int’l: +1-503-894-6022

UK: +44-845-528-1300

Hong Kong: +852-301-84916

India (Pune): +91-20-66346060

Fax: +1-855-550-5975

Web: https://www.alliedmarketresearch.com

Follow Us on: LinkedIn Twitter

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Intel Gets Multibillion-Dollar Apollo Offer as Qualcomm Circles

(Bloomberg) — Apollo Global Management Inc. has offered to make a multibillion-dollar investment in Intel Corp., people familiar with the matter said, providing the chipmaker with a vote of confidence in its turnaround strategy and an alternative to a potential takeover by larger rival Qualcomm Inc.

Most Read from Bloomberg

The alternative asset manager has indicated in recent days that it would be willing to make an equity-like investment in Intel of as much as $5 billion, one of the people said, asking not to be identified discussing confidential information.

The development comes after San Diego-based Qualcomm floated a friendly takeover of Intel, which has been working to reinvent itself amid the most difficult period in its 56-year history. Qualcomm’s move has raised the prospect of one of the biggest-ever M&A deals, as well as other bidders entering the fray. Broadcom Inc., at least for now, is on the sidelines.

Intel’s shares rose as much as 4.2% in early trading on Monday. The stock was up 2.7% at 9:43 a.m. in New York, giving the company a market value of about $96 billion.

Intel executives have been weighing Apollo’s proposal, according to the people. The size of Apollo’s potential investment could change or discussions could fall apart, they said. Representatives for Apollo and Santa Clara, California-based Intel declined to comment.

While Apollo may be best known today for its insurance, buyout and credit strategies, the firm started out in the 1990s as a distressed-investing specialist. The firm also has an existing relationship with Intel, which in June agreed to sell to Apollo a stake in a joint venture that controls a chip plant in Ireland for $11 billion, bringing in more external funding for a massive expansion of its factory network.

Under Chief Executive Officer Pat Gelsinger, Intel has been working on an expensive plan to remake itself and bring in new products, technology and outside customers. Still, the company is headed for its third consecutive year of shrinking sales and its shares have lost more than 50% of their value this year.

Intel’s shares did get a bounce last week after Gelsinger made a series of announcements signaling the beginnings of a turnaround. Those included a multibillion-dollar deal with Amazon.com Inc.’s Amazon Web Services cloud unit to co-invest in a custom AI semiconductor and a plan to turn its ailing manufacturing business into a wholly owned subsidiary. Intel also said it would pull back on some projects, including shelving plans for new factories in Germany and Poland for now.

Gelsinger believes the turnaround plan could be sufficient for Intel to remain an independent company but is open to considering the merits of different transactions, people familiar with the matter said on Saturday. Broadcom isn’t currently evaluating an offer for Intel, the people said, having previously assessed whether to pursue a deal.

A combination of Intel with a larger competitor would almost certainly draw intense scrutiny from antitrust regulators around the world, as chips are now integral to the digital framework supporting everyday life — from smartphones and computers, to washing machines and electric vehicles.

A Qualcomm-Intel deal would face multiple hurdles, Bloomberg Intelligence analysts Kunjan Sobhani and Oscar Hernandez Tejada wrote in a note.

“The deal faces significant regulatory, financial and execution challenges,” they wrote. “With only $13 billion in cash on hand, Qualcomm would likely need additional investors and asset divestitures to make the purchase feasible. The deal’s strategic fit could also raise concerns.”

Apollo has other experience in the chipmaking space. Last year, the New York-based firm agreed to lead a $900 million investment in Western Digital Corp., buying convertible preferred stock.

–With assistance from Dinesh Nair, Michelle F. Davis, Shadab Nazmi and Yasufumi Saito.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

Grid Forming Inverters Market to Reach $1.5 Billion, Globally, by 2033 at 8.2% CAGR: Allied Market Research

Wilmington, Delaware, Sept. 23, 2024 (GLOBE NEWSWIRE) — Allied Market Research published a report, titled, “Grid Forming Inverters Market by Type (Micro Inverters, Central Inverters and String Inverters), Power Rating (Below 50 KW, 50-100 KW and Above 100 KW), Application (Wind Power Plants, Solar PV Plants, Electric Vehicles and Energy Storage System): Global Opportunity Analysis and Industry Forecast, 2024-2033″. According to the report, the grid forming inverters market was valued at $0.7 billion in 2023, and is estimated to reach $1.5 billion by 2033, growing at a CAGR of 8.2% from 2024 to 2033.

Download PDF Brochure: https://www.alliedmarketresearch.com/request-sample/A11637

Prime determinants of growth

The global grid forming inverters market is experiencing growth due to increase in demand for renewable energy integration However, the high cost of grid-forming inverters and related infrastructure is expected to restrain the growth of the grid forming inverters market during the forecast period. Moreover, the increase in deployment of microgrids, especially in remote and off-grid areas, presents a significant opportunity for grid-forming inverters market.

Report coverage & details:

| Report Coverage | Details |

| Forecast Period | 2024–2033 |

| Base Year | 2023 |

| Market Size in 2023 | $0.7 billion |

| Market Size in 2033 | $1.5 billion |

| CAGR | 8.2% |

| No. of Pages in Report | 300 |

| Segments Covered | Type, Power Rating, Application, and Region |

| Drivers |

|

| Opportunities |

|

| Restraint |

|

The central inverters segment is expected to exhibit fastest growth throughout the forecast period

Central inverters have been crucial for converting direct current (DC) electricity generated by solar panels or wind turbines into alternating current (AC) that can be fed into the grid. However, the integration of grid-forming capabilities enhances their functionality significantly. Grid-forming inverters facilitate the integration of renewable energy sources into existing grid infrastructure more seamlessly. Their ability to provide stable voltage and frequency profiles ensures reliable and consistent power supply, which is critical for maintaining grid stability under varying conditions.

Procure Complete Report (300 Pages PDF with Insights, Charts, Tables, and Figures) @ https://www.alliedmarketresearch.com/checkout-final/grid-forming-inverters-market

The 50-100 KW segment is expected to lead throughout the forecast period

Grid-forming inverters in the range of 50-100 kW play a crucial role in various applications where stable and reliable power supply is essential. These inverters are commonly used in commercial and industrial settings, as well as in small to medium-scale renewable energy installations. One of their primary functions is to ensure grid stability by mimicking the behavior of traditional synchronous generators, which are crucial for maintaining grid frequency and voltage levels.

Energy storage systems lead the grid forming inverters market

Grid-forming inverters play a crucial role in energy storage systems (ESS), particularly in enhancing their stability, flexibility, and reliability. In energy storage systems applications, grid-forming inverters help manage the flow of electricity by regulating voltage and frequency. They enable seamless integration of renewable energy sources such as solar and wind power into the grid, smoothing out fluctuations in generation and consumption. This capability is essential for maintaining grid stability, especially as more intermittent renewable sources come online.

Asia-Pacific to maintain its dominance by 2031

Grid-forming inverters are increasingly gaining attention and adoption across Asia-Pacific countries as they play a crucial role in stabilizing and enhancing the resilience of electrical grids. In China, the world’s largest market for renewable energy installations, grid-forming inverters are crucial for managing the rapid expansion of wind and solar power. These inverters play a critical role in ensuring the stability of China’s interconnected grids, which are increasingly reliant on renewable energy sources to reduce carbon emissions and enhance energy security.

The deployment of grid-forming inverters aligns with China’s ambitious targets for renewable energy capacity expansion, underscoring their pivotal role in supporting the country’s energy transition efforts. Across Southeast Asia, grid-forming inverters are gaining traction as countries seek to integrate more renewable energy into their grids while maintaining stability. Countries like Thailand, Malaysia, and Vietnam are increasingly investing in grid modernization efforts that include the deployment of advanced inverters capable of supporting higher shares of renewable energy. These inverters are essential for mitigating the challenges posed by the intermittent nature of solar and wind power, thereby enhancing grid reliability and facilitating a more sustainable energy future for the region.

For Purchase Inquiry: https://www.alliedmarketresearch.com/grid-forming-inverters-market/purchase-options

Players: –

- ABB

- Schneider Electric

- Siemens

- GENERAL ELECTRIC

- SMA Solar Technology AG

- Huawei Technologies Co., Ltd.

- Delta Electronics, Inc.

- Enphase Energy

- Hitachi Energy Ltd.

- Eaton

The report provides a detailed analysis of these key players in the global grid forming inverters market. These players have adopted different strategies such as new product launches, collaborations, expansion, joint ventures, agreements, and others to increase their market share and maintain dominant shares in different regions. The report is valuable in highlighting business performance, operating segments, product portfolio, and strategic moves of market players to showcase the competitive scenario.

Trending Reports in Energy & Power Industry:

Solar (PV) Inverter Market Size, Share, Competitive Landscape and Trend Analysis Report, by Product Type, Connection Type, Phase and End User: Global Opportunity Analysis and Industry Forecast, 2021-2030

Solar Hybrid Inverter Market Size, Share, Competitive Landscape and Trend Analysis Report, by Product, by Application and, by End User: Global Opportunity Analysis and Industry Forecast, 2023-2032

Capacitor Bank Market Size, Share, Competitive Landscape and Trend Analysis Report, by Voltage, by Type, by Installation, by Connection Type, by Application: Global Opportunity Analysis and Industry Forecast, 2024-2031

Clean Energy Infrastructure Market Size, Share, Competitive Landscape and Trend Analysis Report, by Infrastructure Type, by End-Use: Global Opportunity Analysis and Industry Forecast, 2024-2033

Industrial Power Supply Market Size, Share, Competitive Landscape and Trend Analysis Report, by Type, by Product, by Application: Global Opportunity Analysis and Industry Forecast, 2024-2033

Renewable Energy Market Size, Share, Competitive Landscape and Trend Analysis Report, by Type and End Use: Global Opportunity Analysis and Industry Forecast, 2024-2033

AI in Energy Market Size, Share, Competitive Landscape and Trend Analysis Report, by Component type, By Application, By End user, By Deployment Type: Global Opportunity Analysis and Industry Forecast, 2021-2031

About us:

Allied Market Research (AMR) is a full-service market research and business-consulting wing of Allied Analytics LLP based in Wilmington, Delaware. Allied Market Research provides global enterprises as well as medium and small businesses with unmatched quality of “Market Research Reports” and “Business Intelligence Solutions.” AMR has a targeted view to provide business insights and consulting to assist its clients to make strategic business decisions and achieve sustainable growth in their respective market domain.

We are in professional corporate relations with various companies and this helps us in digging out market data that helps us generate accurate research data tables and confirms utmost accuracy in our market forecasting. Allied Market Research CEO Pawan Kumar is instrumental in inspiring and encouraging everyone associated with the company to maintain high quality of data and help clients in every way possible to achieve success. Each and every data presented in the reports published by us is extracted through primary interviews with top officials from leading companies of domain concerned. Our secondary data procurement methodology includes deep online and offline research and discussion with knowledgeable professionals and analysts in the industry.

Contact us:

David Correa

1209 Orange Street,

Corporation Trust Center,

Wilmington, New Castle,

Delaware 19801 USA.

Int’l: +1-503-894-6022

Toll Free: +1-800-792-5285

Fax: +1-800-792-5285

help@alliedmarketresearch.com

Web: https://www.alliedmarketresearch.com/reports-store/energy-and-power

Follow Us on | Facebook | LinkedIn | YouTube

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

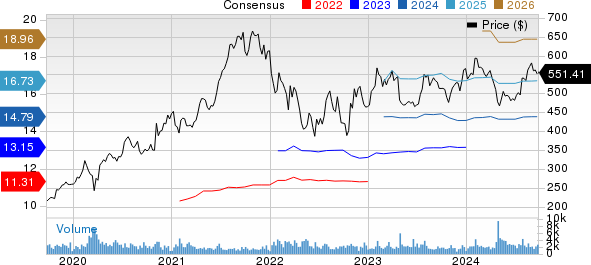

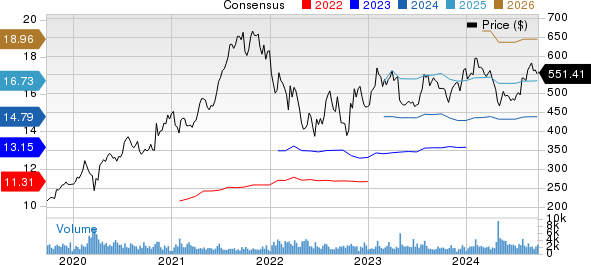

MSCI Shares Up 7% in a Year: Should You Buy, Hold or Sell the Stock?

MSCI MSCI shares moved up 6.7% in the past year compared with the broader Zacks Computer and Technology sector’s return of 39.8% and the Zacks Business – Software Services sector’s rise of 29.2%.

The underperformance is likely to have been caused by a tighter spending environment and longer sales cycles due to challenging macroeconomic conditions.

Increasing pricing pressure is also a major concern, primarily due to the growing availability of free indices from providers like Morningstar MORN.

As Morningstar continues to offer more accessible options, self-indexing and lower spending by asset managers on gathering data are other headwinds.

Will MSCI’s Strong Portfolio Drive Growth?

MSCI’s expanding portfolio along with robust adoption of its Climate and ESG solutions, have been a major growth driver.

In July, the company announced a partnership with Moody’s, marking a milestone in advancing ESG (Environmental, Social and Governance) transparency in financial markets.

MSCI announced a partnership with Moody’s. The partnership will leverage MSCI’s robust sustainability data and models, widely utilized by major asset managers worldwide, to bolster Moody’s offerings across banking, insurance and corporate sectors.

Moody’s will also integrate MSCI’s industry-leading ESG ratings and content into its solutions, gradually replacing its own ESG data offerings. The agreement also entails MSCI gaining access to Moody’s extensive Orbis database, paving the way for expanded private company ESG coverage and exploration into advanced solutions for the private credit market.

MSCI’s partnership with Microsoft has further expanded its clientele and is considered a major positive for the company.

The partnership with Microsoft aims to enhance the global investment industry by leveraging Microsoft’s cloud and AI technologies to modernize MSCI’s products and drive ESG solutions.

In second-quarter 2024, MSCI achieved 10% organic revenue growth, driven by strong performance across various segments, including Analytics, ESG and Index Investments. The company witnessed growth in its ESG and Climate solutions, with organic run rate growth of 14%.

Acquisitions have also played a significant role in shaping the company’s growth trajectory. In April, MSCI completed the acquisition of Foxberry, a London-based index provider, aimed at enhancing custom index production capabilities and providing simulation and back-testing capabilities for institutional investors.

MSCI’s Earnings Estimates Show Upward Movement

MSCI’s diverse portfolio and strategic acquisitions are contributing to its growth prospects continuously and driving top-line growth.

The Zacks Consensus Estimate for third-quarter 2024 revenues is currently pegged at $710.74 million, suggesting 13.64% growth year over year.

The consensus mark for earnings is currently pegged at $3.75 per share, unchanged in the past 30 days.

MSCI Shares are Overvalued

MSCI stock is not so cheap, as the Value Score of D suggests a stretched valuation at this moment.

The forward 12-month Price/Sales ratio for MSCI stands at 16.16X, higher than its Zacks Business – Software Services industry’s 11.26X, reflecting a stretched valuation.

MSCI currently carries Zacks Rank #3 (Hold), suggesting that it may be wise to wait for a more favorable entry point in the stock.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.