India's Competition Watchdog Seeks Financial Records From Amazon, Walmart-Backed Flipkart In Ongoing Antitrust Probe: Report

This story was originally published on the Benzinga India portal.

The Competition Commission of India (CCI) has reportedly intensified its antitrust investigation into e-commerce giants Amazon AMZN and Walmart WMT-backed Flipkart, requesting their financial statements.

What Happened: The CCI’s demand for financial records from Amazon Seller Services and Flipkart Internet will play a major role in determining a potential penalty on the firms, based on the companies’ defense in a four-year-long case, Mint reported.

A 2023 amendment to the competition law enables the CCI to impose a fine of up to 10% of a company’s global turnover or income of the preceding three financial years for anti-competitive conduct.

The global turnover is anticipated to encompass the revenue generated by the entity in India and overseas, excluding the turnover of any sister enterprise operating in a different market.

After CCI’s Director General of Investigation (DG) findings were reported in the media, Amazon and Flipkart raised concerns about the potential public disclosure of sensitive information in non-confidential reports.

Do you want to keep up with all the latest stock market updates in India? Sign up for the Benzinga India weekly newsletter.

The DG’s findings, which will serve as the foundation for CCI’s judgment on the case, examined complaints of alleged anti-competitive behavior by the two e-commerce giants. The companies will have the chance to defend their case once the confidential version of the report is shared with them.

This comes after the DG’s confirmation in August of suspected violations of competition law by the two internet platforms. Practices under scrutiny include giving preferential treatment and preferential listing to certain sellers on the platform, exclusive product launches and deep discounting, which may have adversely affected small retailers on the platform and beyond.

Read Next: Indian Coldplay Fans Cry Foul As Tickets Hit Sky-High Prices On Reselling Platform

Disclaimer: Artificial intelligence was used as a secondary aid in writing this story.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Compact C-Arm Market to Reach $714.1 Million, Globally, by 2033 at 5.7% CAGR: Allied Market Research

Wilmington, Delaware, Sept. 23, 2024 (GLOBE NEWSWIRE) —

Allied Market Research published a report, titled, “Compact C-Arm Market by Technology (Fluoroscopy Systems and Flat Detector Systems), Application (Pain Management, Gastroenterology, Neurology, Orthopedic and Trauma and Others), End User (Hospitals, Diagnostic Centers and Others): Global Opportunity Analysis and Industry Forecast, 2024-2033″. According to the report, the compact c-arm market was valued at $409.8 million in 2023, and is estimated to reach $714.1 million by 2033, growing at a CAGR of 5.7% from 2024 to 2033.

Request Sample of the Report on Compact C-Arm Market Forecast 2033 – https://www.alliedmarketresearch.com/request-sample/A323990

Prime determinants of growth

Rise in the prevalence of chronic disease, increase in the number of surgical procedures, rise in technological advancements are the major factors that drive the growth of the compact C-arm market growth. However, the high cost of C-arm devices and lack of skilled professionals restricts the market growth. Moreover, high growth potential in developing economies offers remunerative opportunities for the expansion of the global compact C-arm market.

Report coverage & details

| Report Coverage | Details |

| Forecast Period | 2024–2033 |

| Base Year | 2023 |

| Market Size in 2023 | $409.8 million |

| Market Size in 2033 | $714.1 million |

| CAGR | 5.7% |

| No. of Pages in Report | 228 |

| Segments Covered | Technology, Application, End User, and Region. |

| Drivers |

|

| Opportunity |

|

| Restraints |

|

Want to Explore More, Connect to our Analyst – https://www.alliedmarketresearch.com/request-sample/A323990

Segment Highlights

The flat detector systems held the highest market share in 2023.

By technology, the flat detector systems segment held the highest market share in 2023 due to the superior imaging capabilities of flat detector systems, including higher resolution, improved image clarity, and reduced radiation exposure. These attributes are crucial for performing intricate surgical procedures with precision and ensuring accurate diagnostics. In addition, healthcare providers increasingly favor flat detector systems for their ability to enhance patient safety while providing detailed real-time imaging, which is essential in minimally invasive surgeries and interventions thereby supports the segment growth.

The orthopedic and trauma segment held the highest market share in 2023.

By application, the orthopedic and trauma segment accounted for the largest share of the market in 2023. The dominance of this segment is attributed to the high incidence of musculoskeletal disease, increase in the number of road accidents and sports-related injuries. In addition, the rise in geriatric population contributes significantly as elderly individuals are more prone to orthopedic conditions requiring surgical intervention, thereby driving the demand for compact c-arm solutions.

The hospital segment held the highest market share in 2023.

By end user, the hospitals segment held the highest market share in 2023 as hospitals are increasingly adopting compact C-arm systems for their versatility and portability, which allow for efficient use in various departments including orthopedics, cardiology, and emergency rooms. In addition, rising healthcare expenditure globally and the growing emphasis on improving healthcare infrastructure further propel the demand for compact C-arm systems in hospitals.

Regional Outlook

North America held the highest market share in 2023.

North America held the highest market share in 2023 due to advanced healthcare infrastructure and a high adoption rate of innovative medical technologies, driving demand for sophisticated imaging solutions such as compact C-arm systems. In addition, the rise in prevalence of chronic diseases, rise in aging population necessitate precise diagnostic and therapeutic tools, and rise in technological advancements contribute to the market growth in this region.

For Purchase Related Queries/Inquiry – https://www.alliedmarketresearch.com/purchase-enquiry/A323990

Key Players

- Koninklijke Philips N.V.

- Nanjing Perlove Medical Equipment Co., Ltd.

- Shimadzu Corporation

- Xindray Medical International Co., Ltd.

The report provides a detailed analysis of these key players in the global compact C-arm market. These players have adopted different strategies such as agreement, product launches, expansion, and others to increase their market share and maintain dominant shares in different regions. The report is valuable in highlighting business performance, operating segments, product portfolio, and strategic moves of market players to highlight the competitive scenario.

Get Customized Reports with your Requirements – https://www.alliedmarketresearch.com/request-for-customization/A323990

Recent Developments in Compact C-Arm Industry

- In July 2022, Fujifilm Europe launched a new hybrid C-arm and portable x-ray device. FDR CROSS is a flexible, hybrid C-arm and portable x-ray machine designed to offer high quality fluoroscopic and static x-ray images during surgery and other medical procedures.

- In November 2021, FUJIFILM Healthcare Americas, a leading provider of diagnostic imaging and medical informatics solutions, announced the launch of the Persona CS mobile fluoroscopy system, its new, compact mobile C-arm imaging solution designed for rapid and seamless positioning in operating room (OR) environments. The powerful and compact system is designed to provide enhanced live image guidance during a wide range of surgeries in the OR, including orthopedic, complicated surgical, pain management (anesthetics) and emergency procedures.

Trending Reports in Healthcare Industry:

Breast Pumps Market – Global Opportunity Analysis and Industry Forecast, 2023-2032

Needle-free Injection Systems Market – Global Opportunity Analysis and Industry Forecast, 2023-2032

Medical Bionics Market – Global Opportunity Analysis and Industry Forecast, 2023-2032

Coronary Stents Market – Global Opportunity Analysis and Industry Forecast, 2023-2032

AVENUE- A Subscription-Based Library (Premium on-demand, subscription-based pricing model) Offered by Allied Market Research:

AMR introduces its online premium subscription-based library Avenue, designed specifically to offer cost-effective, one-stop solution for enterprises, investors, and universities. With Avenue, subscribers can avail an entire repository of reports on more than 2,000 niche industries and more than 12,000 company profiles. Moreover, users can get an online access to quantitative and qualitative data in PDF and Excel formats along with analyst support, customization, and updated versions of reports.

Get access to the library of reports at any time from any device and anywhere. For more details, follow the link: https://www.alliedmarketresearch.com/library-access

About Allied Market Research:

Allied Market Research (AMR) is a full-service market research and business-consulting wing of Allied Analytics LLP based in Wilmington, Delaware. Allied Market Research provides global enterprises as well as medium and small businesses with unmatched quality of “Market Research Reports” and “Business Intelligence Solutions.” AMR has a targeted view to provide business insights and consulting to assist its clients to make strategic business decisions and achieve sustainable growth in their respective market domains. AMR offers its services across 11 industry verticals including Life Sciences, Consumer Goods, Materials & Chemicals, Construction & Manufacturing, Food & Beverages, Energy & Power, Semiconductor & Electronics, Automotive & Transportation, ICT & Media, Aerospace & Defense, and BFSI.

We are in professional corporate relations with various companies and this helps us in digging out market data that helps us generate accurate research data tables and confirms utmost accuracy in our market forecasting. Allied Market Research CEO Pawan Kumar is instrumental in inspiring and encouraging everyone associated with the company to maintain high quality of data and help clients in every way possible to achieve success. Each and every data presented in the reports published by us is extracted through primary interviews with top officials from leading companies of domain concerned. Our secondary data procurement methodology includes deep online and offline research and discussion with knowledgeable professionals and analysts in the industry.

Contact

David Correa

1209 Orange Street,

Corporation Trust Center,

Wilmington, New Castle,

Delaware 19801 USA.

Toll Free: +1-800-792-5285

Int’l: +1-503-894-6022

UK: +44-845-528-1300

Hong Kong: +852-301-84916

India (Pune): +91-20-66346060

Fax: +1-855-550-5975

Web: https://www.alliedmarketresearch.com

Follow Us on: LinkedIn Twitter

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

1 Unstoppable Stock With 990% Upside, According to Cathie Wood's Ark Invest

Cathie Wood is the founder and chief investment officer of Ark Invest, which operates a family of exchange-traded and private funds. Each fund invests in innovative technologies like electric vehicles (EVs), robotics, space exploration, artificial intelligence (AI), and more.

Wood recently described Tesla (NASDAQ: TSLA) as the biggest AI opportunity in the world because of the introduction of its latest version of self-driving (FSD) technology, which could transform the company’s economics. For the same reason, Ark also published a report in June that included a price target of $2,600 for Tesla stock by 2029.

That implies a 990% upside from where the stock trades today, which might be ambitious considering Tesla’s EV sales are currently shrinking. In fact, even the company’s chief executive officer, Elon Musk, thinks Ark’s target will be tough to reach.

Tesla’s core business is facing headwinds

Tesla delivered a record 1.8 million vehicles in 2023, a 38% increase from the prior year. The company declined to offer a deliveries forecast for this year, but some analysts expect the number to come in at 2.2 million. That would represent a decelerated growth rate of just 22%.

Musk previously told investors that Tesla could increase its EV production (and by extension, deliveries) by 50% per year for the foreseeable future, which no longer appears likely. Plus, Tesla’s deliveries were down 6.5% in the first half of 2024 compared to the same period in 2023. That’s despite the company slashing prices during the past year to support demand, which has crushed its automotive gross profit margin. It came in at just 14.6% in the second quarter, which is a long way from its 2021 peak of more than 30%. (I’ll explain why that’s important later.)

So why is Tesla struggling to sell cars? Demand for EVs in general appears to be softening. In Europe, sales plummeted 44% in August compared to the same month last year, with EV market share slipping to just 14% from 21% previously. Legacy carmakers like Ford and General Motors have slashed billions of dollars in planned investments in the segment during the past year, citing demand concerns.

Research by Goldman Sachs suggests consumers are concerned about a lack of rapid charging infrastructure and also about depreciation because used-EV prices are falling sharply. Plus, high interest rates around the world have pushed up borrowing costs, so many consumers in the market for a new car might be opting for cheaper gas-powered models.

Then there is the competition factor. China-based BYD, for example, is now selling one of its EV models for less than $10,000 in its domestic market (where Tesla has a big presence), and it could make its way to Europe in 2025. Tesla simply can’t compete at that price point, but the company is working on a low-cost model that could sell for as little as $25,000. It’s due for release next year, and Tesla is hoping its reputation as a premium brand will be enough to entice lower-income consumers.

FSD is the key to Wood’s forecast

Tesla is a leading developer of autonomous driving software, and while that software isn’t approved for wide use on U.S. roads, Ark’s research suggests customers have driven 1.3 billion miles using beta versions of the technology so far. The latest version, 12.5 has fine times the parameters of version 12.4, so it should be the most capable iteration yet.

The company is expected to reveal a robotaxi called the Cybercab on Oct. 10. This is a key piece of Ark’s $2,600 price target for Tesla stock. It will be powered entirely by FSD, paving the way for new revenue streams like autonomous ride-hailing (think Uber, but without a human driver).

Musk wants to build a ridesharing network wherein Cybercabs can earn revenue around the clock. Tesla customers who pay for FSD will also be able to lend their vehicles to the network when they’re not using them, thereby earning additional income (which will be split with Tesla).

Ark believes Tesla will generate a whopping $1.2 trillion in revenue in 2029, with 63% ($756 billion) coming from the robotaxi platform. That doesn’t include potential FSD licensing deals with other automakers, which appear to be in the works. That is incredibly ambitious because the company is on track to deliver just $98.9 billion in total revenue this year, which implies the company will need compound annual growth of 64.7% from now until 2029 to meet Ark’s projections.

Remember, Musk himself previously forecast just 50% annual growth, and he isn’t even hitting that target at the moment. In fact, in a post on social media platform X back in June, he said meeting Ark’s forecast would be “extremely challenging.”

Hitting Ark’s price target by 2029 will be almost impossible

So Ark’s revenue model might be a considerable stretch based on the facts at hand today. But I want to circle back to Tesla’s shrinking gross profit margin, which I mentioned earlier, because it’s driving a sharp decline in the company’s earnings per share (EPS).

Tesla generated $0.42 in EPS in the second quarter of 2024, a decline of a whopping 46% year over year. The company’s trailing-12-month EPS is $3.56, and based on its stock price of about $238 as of this writing, it trades at a price-to-earnings (P/E) ratio of 67.

That’s more than double the 30.8 P/E ratio of the Nasdaq-100 index, implying Tesla is heavily overvalued relative to its big-tech peers. With Tesla’s earnings rapidly shrinking, it’s very hard to justify that premium valuation.

Investors might be paying up for the stock because of opportunities like FSD and the robotaxi, which, if Ark is correct, could eclipse Tesla’s EV business in the coming years. But nobody knows when (or if) those technologies will receive regulatory approval, so their potential financial impact on the company isn’t entirely relevant at the moment.

Therefore, I think it’s very unlikely Tesla stock will soar 990% to reach $2,600 by 2029 based on the math. I have no doubt the company has an exciting future, but investors are exposing themselves to downside risk if they buy the stock at its current price.

Should you invest $1,000 in Tesla right now?

Before you buy stock in Tesla, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Tesla wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $710,860!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 16, 2024

Anthony Di Pizio has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends BYD Company, Goldman Sachs Group, Tesla, and Uber Technologies. The Motley Fool recommends General Motors and recommends the following options: long January 2025 $25 calls on General Motors. The Motley Fool has a disclosure policy.

1 Unstoppable Stock With 990% Upside, According to Cathie Wood’s Ark Invest was originally published by The Motley Fool

If You Invested $1000 In This Stock 20 Years Ago, You Would Have $14,000 Today

Biomarin Pharmaceutical BMRN has outperformed the market over the past 20 years by 5.46% on an annualized basis producing an average annual return of 13.94%. Currently, Biomarin Pharmaceutical has a market capitalization of $13.44 billion.

Buying $1000 In BMRN: If an investor had bought $1000 of BMRN stock 20 years ago, it would be worth $13,575.00 today based on a price of $70.59 for BMRN at the time of writing.

Biomarin Pharmaceutical’s Performance Over Last 20 Years

Finally — what’s the point of all this? The key insight to take from this article is to note how much of a difference compounded returns can make in your cash growth over a period of time.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

S&P 500 Outpaces Wall Street Projections As Year-End Nears: Will The Rally Hold?

The S&P 500 Index – a measure of broader market performance, has been on a tear this year, thanks to inflation’s downward trajectory that allowed the Federal Reserve the leeway to cut rates, the resilient economy and robust corporate profit growth. With the year approaching its last leg, the question in the minds of everyone is whether the broader uptrend seen since the bear market bottom of Oct. 2022 would continue.

Gravity-Defying Rally: After the post-COVID-19 inflation surge sent markets across the globe lower in 2022, things began to take a turn for the better by the end of the year. The launch of OpenAI’s ChatGPT large language model-powered chatbot and the pullback in inflation from the June 2022 peak of 9.1% in response to aggressive Fed funds rate hikes helped restore sanity in the market.

The SPDR S&P 500 ETF Trust SPY, an exchange-traded fund that tracks the S&P 500 Index, has gained about 65% since bottoming at $346.35 on Oct. 12, 2022. This year alone, the ETF had soared nearly 21%.

Source: Benzinga Pro

S&P Goes Past Most Year-End Predictions: Wall Street’s year-end estimate for the S&P 500 Index ranges from 4,200 to 6,100, according to data shared by Trading platform TrendSpider on X, formerly Twitter. The highest estimate is from BMO Capital Markets and the lowest is from JPMorgan.

Financial data provider FactSet said in a recent report that the trailing 12-month price/earnings ratio for the S&P 500 Index is 26.7, above the 5-year average of 23.7 and the 10-year average of 21.7.

Room For More Upside? Most analysts and strategists see the scope for further upside, contingent on the economy averting a hard landing. Recent data showing the softening of the labor market is the primary reason for the Federal Reserve to drop its cautious stance and announce a bigger and bolder cut. Going forward, the labor market data is the key that will guide the central bank on future rate moves.

With the rate cut announced last week and two more 25 basis-point cuts anticipated this year, the market rally is expected to broaden. Analysts see small-cap and rate-sensitive stocks picking up momentum after lagging for an extended period, while they also expect the mega-caps that have so far spearheaded the rally, to hold up.

Uncertainty could prevail until the outcome of the Nov. 5 election is known, but the market could take advantage of the seasonal strength seen in the final few weeks of the year.

JPMorgan Global Investment Strategist Sarah Stillpass said in a report the September rate cut could bode well for equities. Since 1980, five of the 10 best years for the S&P 500 happened when the Fed was cutting rates without a recession, she said. She also noted that the Fed has cut rates 12 times when the S&P 500 was within 1% of its all-time high such as the current year. The market was higher one year later all 12 times, with a median return of 15%, she added.

In premarket trading on Monday, the SPY edged up 0.08% to $568.69, according to Benzinga Pro data.

Read Next:

Image Via Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Microsoft's Stock Buyback: History Says This Is the Likely Impact

While Microsoft (NASDAQ: MSFT) continues to pour money into capital expenditures (capex) to build its cloud computing infrastructure for artificial intelligence (AI) applications, the company has decided it also has money left to return to shareholders.

The software leader hiked its quarterly dividend by 10%, taking it to $0.83. That’s good for a forward yield of approximately 0.75%, which isn’t likely to draw a lot of income-focused investors. The dividend will be payable on Dec. 12 to shareholders of record as of Nov. 21.

Meanwhile, the company also announced a new $60 billion buyback plan, with no expiration date.

Microsoft has not been a big buyer of its stock this year, so investors might be wondering what impact this new repurchase plan could have. Let’s see what history has to say.

Will this buyback plan boost Microsoft’s stock?

This is the third time since the fall of 2019 that Microsoft has increased or initiated a buyback, with all three announcements coming in September. They have all been in the $40 billion to $60 billion range.

The company last adjusted its buyback plan three years ago, with a similar $60 billion repurchase plan. With the stock trading at around $300 at the time, it would drift lower and end 2022 at below $240 a share.

Before that, the company bolstered its buyback plan by $40 billion in September of 2019 with the stock trading just under $140. It then repurchased a lot of shares the next couple of quarters. It initially lifted the stock, but with the onset of COVID, by late March of 2020, the stock was back to around the same levels as when the buyback was initiated.

Overall, history indicates that the buyback will have little impact on Microsoft’s stock. While $60 billion sounds like a lot, it represents less than 2% of its shares outstanding and won’t move the needle much.

So what will affect Microsoft’s stock?

At this point, the biggest driver of Microsoft’s stock will likely come down to how well it can capture the AI opportunity. The company has been at the forefront of AI since it partnered with and greatly increased its investment in OpenAI last year.

Thus far, the Azure cloud computing business has been a big AI winner, consistently seeing growth of around 30% this year. This is a pay-as-you-go consumption business, and Microsoft has benefited from customers using its services to create their own AI solutions.

The GitHub segment, which is a platform for developers to create, store, and share their code, has seen its revenue surge following the introduction of an AI-powered assistant called Copilot that helps developers complete their coding. Last quarter, the company said its GitHub Copilot was behind 40% of the segment’s growth.

The company is also using AI in its other products, including Microsoft 365 and LinkedIn. While the company saw low double-digit growth in its Productivity segment, it is looking to continue to drive revenue through the recent introduction of improved Copilots for its Microsoft 365 suite of platforms, which include Excel, Word, PowerPoint, Teams, and Outlook.

The company currently changes $30 a month per user for its Microsoft 365 Copilot add-on, while the standard business subscription cost for Microsoft 365 is $12.50 per user per month, and $22.50 per user per month for its premium business subscription that includes a number of cybersecurity and identity management options.

Thus, you can see the potential revenue opportunity that Copilot offers Microsoft. The company added a number of attractive features that it hopes will draw customers to buy the Copilot add-ons, including being able to code with Python using natural language in Excel and a new collaborative feature called Copilot Pages that lets multiple users and AI work together on a shared platform.

Thus, while history says Microsoft’s buyback will have little effect on its stock, history also says the company’s ability to innovate and adapt will be a huge long-term positive. And on this front, I expect AI to continue to be a growth driver over the next several years, both with Azure and Copilot.

Should you invest $1,000 in Microsoft right now?

Before you buy stock in Microsoft, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Microsoft wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $710,860!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 16, 2024

Geoffrey Seiler has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Microsoft. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

Microsoft’s Stock Buyback: History Says This Is the Likely Impact was originally published by The Motley Fool

Top 3 Health Care Stocks That May Explode This Month

The most oversold stocks in the health care sector presents an opportunity to buy into undervalued companies.

The RSI is a momentum indicator, which compares a stock’s strength on days when prices go up to its strength on days when prices go down. When compared to a stock’s price action, it can give traders a better sense of how a stock may perform in the short term. An asset is typically considered oversold when the RSI is below 30, according to Benzinga Pro.

Here’s the latest list of major oversold players in this sector, having an RSI near or below 30.

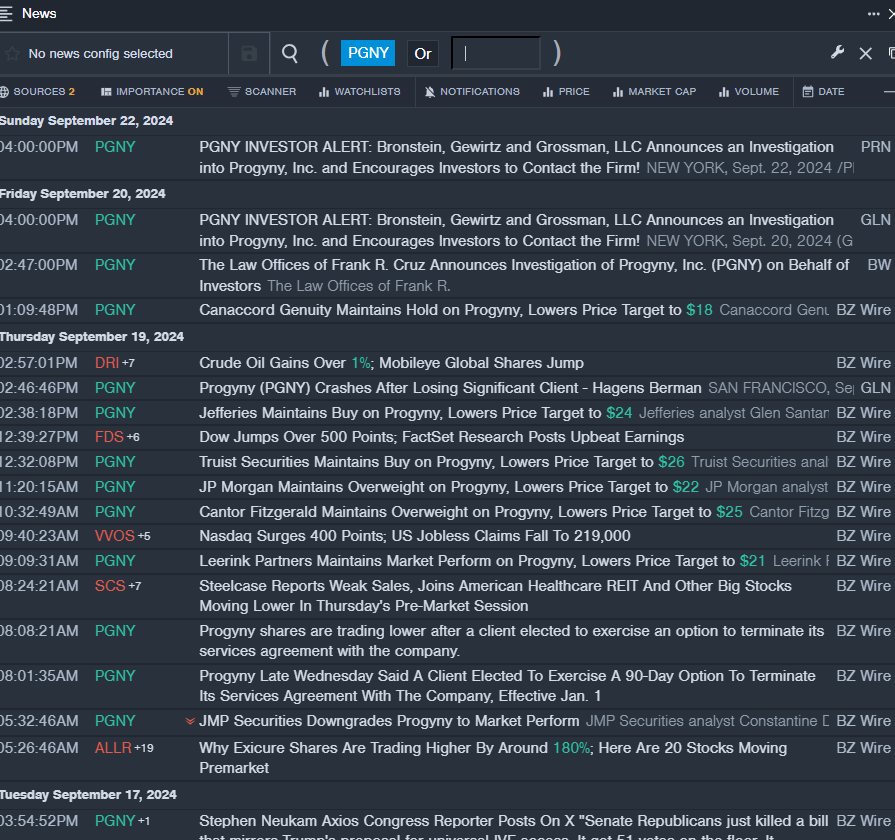

Progyny Inc PGNY

- On Sept. 19, the company said a client elected to exercise an option to terminate its services agreement with the company. The company’s stock fell around 32% over the past five days and has a 52-week low of $13.93.

- RSI Value: 26.50

- PGNY Price Action: Shares of Progyny rose 1% to close at $16.62 on Friday.

- Benzinga Pro’s real-time newsfeed alerted to latest PGNY news.

Indivior PLC INDV

- On Sept. 4, Indivior issued an update on Aelis Farma’s Phase 2B study with AEF0117 in participants with cannabis use disorder. It has a 52-week low of $9.14.

- RSI Value: 25.92

- RELI Price Action: Shares of Indivior fell 2.1% to close at $9.48 on Friday.

- Benzinga Pro’s charting tool helped identify the trend in INDV stock.

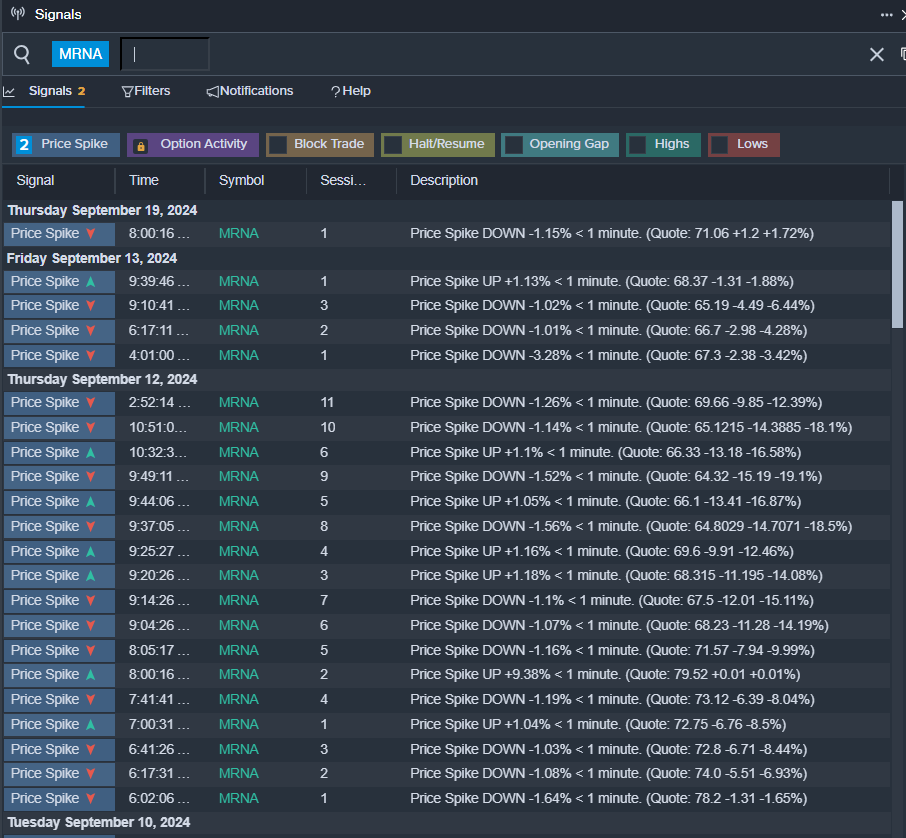

Moderna Inc MRNA

- On Sept. 17, Moderna announced that Health Canada approved its vaccine, SPIKEVAX, which aids in preventing COVID-19 in people six months of age or older.The vaccine targets the KP.2 variant of COVID-19. The company plans to begin delivery of the vaccine to the Public Health Agency of Canada shortly. “With the recent increase in COVID-19-infections, staying up to date with your COVID-19 vaccination remains one of the best ways to help protect yourself from severe illness,” said Dr. Shehzad Iqbal, country medical director, Moderna Canada. The company’s shares fell around 20% over the past month and has a 52-week low of $62.55.

- RSI Value: 28.17

- MRNA Price Action: Shares of Moderna fell 3.4% to close at $65.69 on Friday.

- Benzinga Pro’s signals feature notified of a potential breakout in MRNA shares.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trump Sold Bitcoin-Themed Sneakers And NFTs: Now He's Promoting A 'Self-Designed' Coin Featuring His Own Image

Former President Donald Trump announced the launch of the first edition of his silver medallion, which he claimed to have designed himself and was minted in the U.S.

What Happened: Trump revealed the details about the coins in an X post on Saturday, describing them as “true symbols of America’s greatness.” The Republican presidential hopeful tied the official coins with his “America First” policy.

The official website of the Trump Coins described them as a one-ounce 99.99% silver, featuring the former President’s profile on the obverse and the White House with Trump’s signature on the reverse.

Interestingly, spot silver was priced at $30.65 per ounce as of this writing, less than one-third of what Trump marketed his official coins at.

The website added a disclaimer that the coins haven’t been manufactured or distributed by Trump or any of the organizations affiliated with him.

See Also: Trump’s New Crypto Venture’s Legal Counsel Accused Of Attempting To Seize Control Of Rival Firm

Why It Matters: In an effort to bolster his finances, Trump has turned to selling a variety of merchandise to his supporters.

Nearly a month ago, he launched the fourth edition of his non-fungible tokens (NFTs), priced at $99 each. Before that, the Republican launched a line of limited-edition Bitcoin BTC/USD-themed sneakers.

The latest announcement comes a week after Trump’s entry into the cryptocurrency market with the launch of World Liberty Financial (WLFI), a decentralized finance (DeFi) platform centered around a cryptocurrency token.

But even as Trump ramped up efforts to raise funds for his election campaign, the odds were stacked against him. According to the decentralized prediction market Polymarket, Kamala Harris was the bettors’ favorite to win the elections with a 52% probability.

Image via Shutterstock

Did You Know?

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

1 Magnificent Electric Vehicle (EV) Stock Down 45.8% to Buy and Hold Forever

Want to add a massive growth stock to your portfolio without paying a huge premium? This is your chance. Right now, there’s an EV stock that’s preparing for a huge growth spurt, yet its shares have seen a dramatic reduction in value given selling pressures across the rest of its industry.

You’ll have to be strategic, but your portfolio could experience huge gains if you’re willing to stay patient.

Expect this company’s sales to skyrocket very soon

Usually when a company is experiencing rapid sales growth, its valuation reflects this. That is why it’s possible to lose money on a stock even if the company itself is growing by leaps and bounds. If you pay too much for that growth, you could be getting a raw deal.

To avoid this problem, you can try to purchase shares of a company before its growth takes off. That way, the investment benefits not only from the underlying sales growth, but also from the likely jump in valuation multiples that the stock could receive.

Of course, all of this is easier said than done. In reality, it’s rare to lock in a discounted valuation for a stock everyone expects to grow by leaps and bounds. To accomplish this, you usually need to be early to the party, investing well before that growth trajectory becomes clear to others. This is exactly the opportunity investors have with Rivian Automotive (NASDAQ: RIVN) right now.

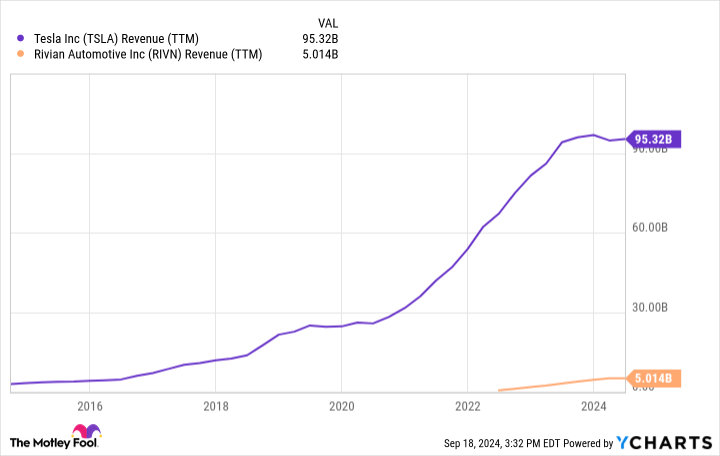

Rivian has already experienced a massive jump in sales. Over the past two years, revenue has grown by nearly 900% to reach $5 billion. But compared to the industry behemoth, Tesla, it’s clear that Rivian’s journey has just begun.

In the chart above, you can see when Tesla’s sales hit inflection points: right around 2016, and then again in 2020. These two points roughly correspond to the release of its first mass-market vehicles: the Model 3 and the Model Y.

While the Model S and Model X were well regarded by the market, their price point of around $100,000 remains far above what most consumers can afford. The Model 3 and Model Y, meanwhile, were priced around the $50,000 range, pushing Tesla into the mass market. They brought a huge uptick in sales, a pattern Rivian looks primed to repeat.

Right now, Rivian has only two luxury models: the R1T and the R1S. They have garnered plenty of fanfare, with Consumer Reports listing the company as having the highest level of brand loyalty among all auto manufacturers — electric or otherwise.

Earlier this year, the company surprised investors by announcing three new models: the R2, R3, and R3X. All are expected to debut under $50,000, pushing Rivian into the mass market for the first time. It’s not only possible, but probable that we’ll see a massive spike in sales from Rivian once those models hit the road.

How to invest in Rivian right now

Here’s the problem: The company doesn’t expect to release its new mass-market models until 2026, with some versions not arriving until 2027. That’s potentially two or three years away, a reality matched by Rivian’s diminutive market cap of just $13 billion.

Shares trade at 2.5 times sales versus Tesla’s valuation of 8.3. At this point, Rivian’s sales base is a promising start, but simply not enough to keep the company afloat.

Last quarter, the automaker lost $32,000 for every vehicle it sold. Its future will be made or broken based on the success of its less expensive models.

There’s even a question about whether it can raise enough capital to survive until then, a concern slightly blunted by a recent partnership with Volkswagen that could provide up to $5 billion in financing.

For now, the market remains skeptical, placing a heavy discount on shares compared to their previous trading levels. If the company can execute, Rivian stock can make a lot of money, but this stock is for long-term investors only.

Expect volatility, and perhaps some chances to dollar-cost average, until we gain more clarity on production and sales forecasts for its less costly vehicles. But investing now likely provides the most potential upside, even if there are legitimate risks.

Should you invest $1,000 in Rivian Automotive right now?

Before you buy stock in Rivian Automotive, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Rivian Automotive wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $710,860!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 16, 2024

Ryan Vanzo has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Tesla and Volkswagen. The Motley Fool recommends Volkswagen Ag. The Motley Fool has a disclosure policy.

1 Magnificent Electric Vehicle (EV) Stock Down 45.8% to Buy and Hold Forever was originally published by The Motley Fool

Snowflake's CFO Just Said 16 Words That Should Be Music to Every Shareholder's Ears

If you’re an informed investor, you likely read the quarterly reports from the companies you’ve invested in. If you’re looking for even deeper insight, you might listen to management’s commentary on quarterly earnings calls. But if you still have extra time, listening to presentations at investor conferences can provide even more insight.

On Sept. 12, data company Snowflake (NYSE: SNOW) made a presentation at the Goldman Sachs Communacopia + Technology Conference. In his remarks, CFO Mike Scarpelli said 16 words that are extremely important for investors. They even have me rethinking the stock as a potential investment.

Snowflake is making a big change

The artificial intelligence (AI) trend is undeniable, and Snowflake is swept up in it. For evidence, just look at its press releases. Its report for its fiscal Q2 2022 started with simply calling itself “The Data Cloud company.” But in its report for its fiscal Q2 2025, it called itself “The AI Data Cloud company.”

From my perspective, almost all tech companies are trying to convince investors that they’ve been leaders in the AI space for years. But in reality, most are investing aggressively in AI, desperately trying to just keep up. I’d lump Snowflake in this bunch. Indeed, the company has been buying graphics processing units (GPUs) to have what it needs to power AI workloads.

The problem is that GPUs are expensive, and it’s hurt Snowflake’s profit margins — more on that in a moment. Management has been saying that the investment in AI is ongoing. But Scarpelli’s tone sounded much different during his recent conference presentation.

While talking about the expensive price tags of GPUs, Scarpelli surprisingly said: “I’m not going to buy any more GPUs until I see the revenue to support it.” Those 16 words were both shocking, and, for me, a rare breath of fresh air.

Why it matters

During my investing career, I’ve seen stocks richly valued at more than 100 times sales, and I’ve seen companies with enormous market caps above $100 billion. But I’ve rarely seen both, as was the case with Snowflake stock shortly after it went public.

Investors were willing to make Snowflake stock one of the most expensive I’ve ever seen because it had a phenomenal growth rate and enviable profit margins. The general consensus was that the business would grow at such an impressive rate that it would be worth far more than $100 billion in short order.

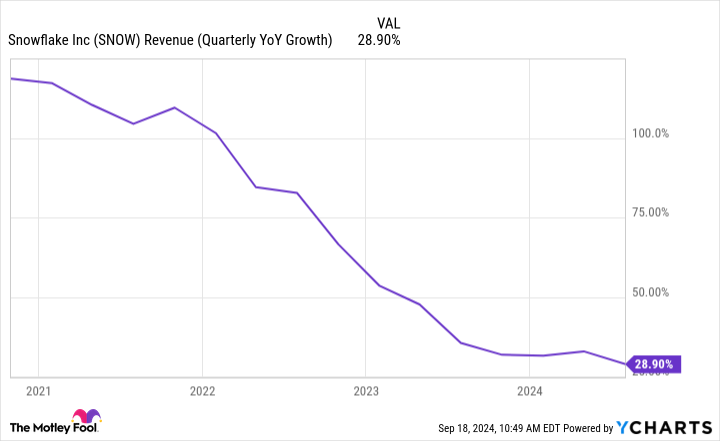

AI was also believed to be a catalyst for Snowflake. After all, it’s a data company, and AI doesn’t work without data. But AI hasn’t been the catalyst that many expected. The company’s growth rate is still strong, but it’s plunged steadily nonetheless. Investments in AI infrastructure also motivated management to lower its outlook for profits.

To put specific numbers here, Snowflake started fiscal 2025 expecting 22% growth for its product revenue, as well as a 6% operating margin and a 29% adjusted free cash flow margin. But as of Q2, it expects 26% growth, a 3% operating margin, and a 26% margin for free cash flow.

Snowflake’s outlook for revenue is up, yes. But don’t be quick to attribute this to AI. As Scarpelli said regarding AI: “The reality is that very few are using it en masse today.” Therefore, it seems AI is not boosting revenue. But AI is boosting expenses because the company is buying GPUs — this might be why Warren Buffett’s company recently sold Snowflake stock.

Generally speaking, it can be dangerous to invest in a company with rising expenses and without a boost for revenue. That’s why I find Scarpelli’s comments refreshing. He’s not buying any more GPUs unless it actually starts contributing to the growth of the business.

Is it time to rethink Snowflake stock?

When companies indiscriminately spend money on the latest “big thing,” it can be money forever wasted. But when businesses scrutinize spending and demand to see a financial benefit, good things can happen for shareholders. Meta Platforms is a good recent example. After dubbing 2023 its “year of efficiency,” the company’s profits soared without sacrificing growth.

For perspective, Meta Platforms stock has quadrupled since the start of 2023. In short, as it focused on justifying its spending, its profits skyrocketed, which lifted the stock to new highs.

Could something similar be in the works for Snowflake stock? It’s too early to say. But the company’s CFO demands to see a return on investment when it comes to AI. That’s the right mindset to have, and it could lead to better efficiency for Snowflake.

At 11 times sales, Snowflake stock has never been cheaper. And if it keeps growing at its current pace while keeping expenses under control, I believe better days could be ahead.

Should you invest $1,000 in Snowflake right now?

Before you buy stock in Snowflake, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Snowflake wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $710,860!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 16, 2024

Jon Quast has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Goldman Sachs Group and Snowflake. The Motley Fool has a disclosure policy.

Snowflake’s CFO Just Said 16 Words That Should Be Music to Every Shareholder’s Ears was originally published by The Motley Fool