'We Watch Where Taylor Goes Because Our Demand Booms:' Taylor Swift's Eras Tour Sparks 25% Flight Demand Surge For United Airlines

Taylor Swift‘s Eras Tour has led to a 25% increase in demand for United Airlines Holdings Inc UAL flights. The surge is attributed to fans traveling to her concerts.

What Happened: Andrew Nocella, United’s executive vice president and chief commercial officer, revealed at the Skift Global Forum 2024 on Wednesday that the airline closely monitors Swift’s tour dates and locations to adjust flight availability accordingly, the Observe reported on Thursday.

“Quite frankly, we watch where Taylor goes because our demand booms,” Nocella stated.

The impact is significant for both domestic and international flights, with United previously offering discounts on flights coinciding with Swift’s U.S. concerts. The Eras Tour is projected to generate $4.6 billion in North America and £1 billion ($1.3 billion) in the U.K. economy.

Other airlines, like Southwest, have also noticed the trend, adding additional flights during Swift’s tour dates. United plans to enhance the travel experience further by introducing free Wi-Fi through a partnership with SpaceX‘s Starlink, starting in late 2025, according to the report.

Why It Matters: Taylor Swift’s influence extends beyond music, impacting various sectors including politics. Her endorsement of Vice President Kamala Harris for president drove over 330,000 visitors to vote.gov, highlighting her political sway. This endorsement also led to a viral backlash, with a mother selling her daughter’s concert tickets in protest.

Swift’s concerts have also been the target of security threats. The CIA thwarted an ISIS attack at her Vienna concert, preventing potential mass casualties. This underscores the high stakes and extensive planning involved in ensuring the safety of her events.

Moreover, Swift’s cultural impact is evident in other areas. London’s Victoria and Albert Museum hosted a free art exhibition inspired by her Eras Tour, featuring her iconic outfits and personal memorabilia. This exhibition attracted significant attention, further cementing her status as a cultural icon.

Read Next:

Image via Wikimedia Commons

This story was generated using Benzinga Neuro and edited by Kaustubh Bagalkote

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Barito’s Plunge Extends to 36% on Ejection From FTSE Index

(Bloomberg) — PT Barito Renewables Energy shares plunged by the daily limit for a second day after FTSE Russell said it would exclude the company from its indexes.

Most Read from Bloomberg

The shares fell 20% on Monday, bringing its two-day loss to nearly 36%. The index compiler said last week that the Indonesian power company will be deleted from its gauges on Tuesday after being added on Monday, citing “high shareholder concentration.”

FTSE’s unusual decision is the latest twist for the group, whose shares have been on a wild ride since it went public late last year. The gauge operator in June delayed adding the stock to its indexes after it was placed on the Indonesian exchange’s watchlist for volatile and troubled companies.

READ: World’s Most Volatile Big Stock Is Rocking Indonesia’s Market

Barito said in a filing late Sunday that it had published its shareholding information to the bourse during the initial public offering in 2023. Four shareholders held around 96% stake as of Sept. 19, compared with 97% stated in the company’s IPO prospectus, the company said.

“Neither Jupiter Tiger nor Prime Hill is an affiliated party of Barito Renewables Energy or its controlling shareholders,” the company’s corporate secretary Merly, who goes by one name, said in a separate statement.

As much as 11.7% of its shares met the free float requirement as of Sept. 19, according to the statement, citing daily data from the Indonesia Central Securities Depository. “The company will continue to monitor compliance with the free float rules determined by the exchange,” Barito said.

Barito was the biggest drag on Indonesia’s stock benchmark, which fell as much as 0.9% before rebounding.

Indonesia’s exposure to Barito and related companies “makes it hard for the broader index to stay insulated from a sharp decline like this,” said Mohit Mirpuri, a fund manager at Singapore-based SGMC Capital Pte.

–With assistance from Claire Jiao.

(Updates with table and company comment in fifth paragraph. A previous version was corrected to clarify details of shareholding and free float.)

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

Premium Products International (PPI) Announces Strategic Shift to Brazilian Sourcing for US-Based Companies

RAMSEY, N.J., Sept. 23, 2024 (GLOBE NEWSWIRE) — Premium Products International (PPI), a leading company specializing in the sourcing, logistics, pricing, and marketing of wholesale products, is excited to announce a strategic shift in its supply chain strategy. In response to the rising ocean freight rates and logistical challenges associated with sourcing from Asia, PPI is now focusing on Brazil as a primary sourcing origin for US-based companies.

Addressing Supply Chain Challenges

The global trade environment has become increasingly complex, with recent spikes in ocean freight rates significantly impacting the cost and reliability of sourcing from Asia. Freight rates for a 40ft container from China to the US have surged from $3,500 to $7,000. Companies like MSC now charge premium rates, ranging from $8,000 to $10,000 from China to the US for guaranteed space, and from India to the US is $10,000 or more for guaranteed space.

Bad weather in Asia, longer transit routes due to geopolitical tensions, and container shortages have exacerbated these challenges. These factors have led to significant delays and increased costs. By shifting focus to Brazil, PPI aims to mitigate these challenges by leveraging Brazil’s stable shipping rates, high-quality manufacturing options, and reduced transit times, ensuring a more reliable and cost-effective supply chain for US-based companies.

Why Brazil?

PPI recognizes the critical need for diversification in supply chains to mitigate risks and ensure stability. Brazil presents a promising alternative with stable shipping rates and a range of high-quality manufacturing options. Key benefits of sourcing from Brazil include:

- Cost Savings: Stable shipping rates enable more predictable logistics costs, improving overall budget planning and pricing strategies.

- Reduced Risk: Diversifying suppliers reduces exposure to geopolitical issues, trade restrictions, and supply chain disruptions.

- Quality and Reliability: Brazil offers high-quality manufacturing options that meet international standards.

- Faster Lead Times: Depending on the location, sourcing from Brazil can result in shorter lead times compared to China, ensuring quicker product turnaround.

CEO’s Vision

Nabil Nahra, President of PPI, stated, “Our mission at PPI has always been to provide our clients with the most cost-effective and reliable sourcing solutions. By shifting our focus to Brazil, we are not only addressing the current logistical challenges but also positioning our clients to benefit from a more diversified and resilient supply chain. This strategic move underscores our commitment to helping businesses navigate the complexities of global trade and achieve sustainable growth.”

Partnering with PPI

PPI’s team of experts specializes in connecting businesses with reliable partners in Brazil. Leveraging an extensive network and deep understanding of international trade, PPI offers tailored solutions to meet specific sourcing needs. By partnering with PPI, businesses can:

– Reduce Costs: Access cost-effective production solutions in Brazil.

– Streamline Operations: Benefit from PPI’s expertise in managing international supply chains.

– Enhance Quality: Ensure products are manufactured to the highest standards.

About Premium Products International (PPI)

Premium Products International (PPI), established in 1992, is a leader in sourcing, logistics, pricing, and marketing wholesale products. Headquartered in New Jersey, USA, PPI has a proven track record of successfully introducing U.S. brands to international markets such as the Middle East, South America, and Europe.

PPI offers comprehensive export consulting services, including market research, branding, financial analysis, and English, French, and Arabic training seminars.

The company emphasizes strategic branding, financial analysis, pricing strategies, and product positioning to differentiate and provide superior customer service. PPI has been awarded the ‘Small Business Success Award’ by the State of New Jersey. Nabil Nahra, with over 40 years of experience in domestic and international marketing, leads PPI with a focus on creating scalable, standardized processes to support business growth.

Contact Information

For more information about Premium Products International and its services, visit https://ppiinc.biz

Contact:

Nabil Nahra

President, Premium Products International, Inc.

Email: info@ppiinc.biz

Stay Connected:

– Follow Nabil on LinkedIn: https://www.linkedin.com/in/nabil-nahra-366b398/

– Follow us on LinkedIn: https://www.linkedin.com/company/ppiinc/

A video accompanying this announcement is available at:

https://www.globenewswire.com/NewsRoom/AttachmentNg/d611c888-de29-4336-a325-29e0c992a44c

A PDF accompanying this announcement is available at:

http://ml.globenewswire.com/Resource/Download/33e599f3-b63c-4d6f-8b21-e1e28adcc0d2

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Apollo eyes $5 billion investment in Intel, Bloomberg News reports

(Reuters) -U.S.-based asset management company Apollo Global Management has offered to make an investment of as much as $5 billion in Intel, Bloomberg News reported on Sunday.

Apollo has indicated in recent days it would be willing to make an equity-like investment of billions of dollars in Intel, the report said, citing a person familiar with the matter.

The news comes at a moment of weakness for Intel, which was once the most valuable chipmaker in the world, but whose shares have lost nearly 60% of their value since the start of the year.

Intel executives have been weighing Apollo’s proposal, Bloomberg reported, adding that talks regarding the deal are in a preliminary stage and have not been finalized.

Bloomberg said that the size of the potential investment in Intel could change and discussions regarding a deal could also fall through.

Intel declined to comment on the Bloomberg News report, while Apollo did not respond to a Reuters’ request for comment.

Earlier this year, Apollo said it will acquire a 49% equity interest in a joint venture related to Intel’s new manufacturing facility in Ireland for $11 billion.

The development for an investment in Intel comes soon after Qualcomm has in recent days approached Intel to explore a potential acquisition of the troubled chipmaker in what could be a transformational deal in the sector but faces many hurdles.

Qualcomm CEO Cristiano Amon is personally involved in the negotiations to acquire five-decade-old Intel, which are currently in an early stage, Reuters reported on Friday citing a source who was briefed on the matter.

Previously, Qualcomm has also explored acquiring pieces of Intel’s chip design business.

(Reporting by Mrinmay Dey in Bengaluru; Editing by Lisa Shumaker)

Uxin Reports Unaudited First Quarter of Fiscal Year 2025 Financial Results

BEIJING, Sept. 23, 2024 /PRNewswire/ — Uxin Limited (“Uxin” or the “Company”) UXIN, China’s leading used car retailer, today announced its unaudited financial results for the first quarter ended June 30, 2024.

Highlights for the Quarter Ended June 30, 2024

- Transaction volume was 5,605 units for the three months ended June 30, 2024, an increase of 38.1% from 4,058 units in the last quarter and an increase of 72.2% from 3,254 units in the same period last year.

- Retail transaction volume was 4,090 units, an increase of 30.9% from 3,124 units in the last quarter and an increase of 142.4% from 1,687 units in the same period last year.

- Total revenues were RMB401.2 million (US$55.2 million) for the three months ended June 30, 2024, an increase of 25.7% from RMB319.2 million in the last quarter and an increase of 38.8% from RMB289.0 million in the same period last year.

- Gross margin was 6.4% for the three months ended June 30, 2024, compared with 6.6% in the last quarter and 6.1% in the same period last year.

- Loss from operations was RMB62.5 million (US$8.6 million) for the three months ended June 30, 2024, compared with RMB109.8 million in the last quarter and RMB63.2 million in the same period last year.

- Non-GAAP adjusted EBITDA[1] was a loss of RMB33.9 million (US$4.7 million), compared with a loss of RMB39.7 million in the last quarter and a loss of RMB46.6 million in the same period last year.

Mr. Kun Dai, Founder, Chairman and Chief Executive Officer of Uxin, commented, “We are pleased to deliver another quarter of strong performance, with retail transaction volume reaching 4,090 units, representing a 31% increase sequentially and a 142% increase year-over-year. Our vehicle turnover efficiency remains healthy, with inventory turnover days around 30. Alongside our robust sales growth, customer satisfaction has also improved, as our Net Promoter Score reached 65 during the quarter, the highest level in the industry.”

Mr. Dai continued, “Our integrated online and offline model continues to demonstrate its strong competitiveness and growth potential. We have already begun expanding our inventory, and we expect sales to continue growing rapidly over the coming quarters. In addition, we are actively expanding our network of superstores, with a recent strategic partnership in Zhengzhou and ongoing discussions with several other cities. This expansion will significantly enhance Uxin’s market presence in new regions, driving continued sales growth and improving overall business performance.”

Mr. Feng Lin, Chief Financial Officer of Uxin, commented: “During the quarter, our retail vehicle sales revenue totaled RMB325 million, reflecting a 74% year-over-year increase, while we maintained a stable gross margin amid intense market competition. At the same time, through disciplined cost control, we reduced our adjusted EBITDA loss to RMB33.9 million, narrowing it by 27% compared to the same period last year. Our business is now on a rapid growth trajectory, and we expect our retail transaction volume for the next quarter to be in the range of 5,800 to 6,000 units, representing over 40% sequential growth. We also expect to further narrow our adjusted EBITDA loss to under RMB10 million for the next quarter and remain confident in achieving EBITDA profitability for the December quarter of 2024.”

|

[1] This is a non-GAAP measure. We believe non-GAAP measures help investors and users of our financial information understand the effect of adjusting items on our selected reported results and provide alternate measurements of our performance, both in the current period and across periods. See our Financial Supplement, filed as Exhibit 99.1 to our Current Report on Form 6-K on September 23, 2024 with the SEC, “Unaudited Reconciliations of GAAP And Non-GAAP Results” for a reconciliation and additional information on non-GAAP measures. |

Financial Results for the Quarter Ended June 30, 2024

Total revenues were RMB401.2 million (US$55.2 million) for the three months ended June 30, 2024, an increase of 25.7% from RMB319.2 million in the last quarter and an increase of 38.8% from RMB289.0 million in the same period last year. The increases were mainly due to the increase of retail vehicle sales revenue.

Retail vehicle sales revenue was RMB325.0 million (US$44.7 million) for the three months ended June 30, 2024, representing an increase of 20.6% from RMB269.4 million in the last quarter and an increase of 73.9% from RMB186.8 million in the same period last year. For the three months ended June 30, 2024, retail transaction volume was 4,090 units, an increase of 30.9% from 3,124 units last quarter and an increase of 142.4% from 1,687 units in the same period last year. The increases in retail vehicle sales revenue were mainly due to the increase of retail transaction volume. By offering superior products and services, the Company’s superstores have built strong customer trust and established Uxin as the leading brand in regional markets. This further boosted the in-store customer conversion rate and improved the retail vehicle inventory turnover rate, enabling the Company to achieve higher retail transaction volumes with a relatively stable inventory size. Additionally, in response to the new car price wars and intense industry competition in the past fiscal year, the Company has significantly enhanced its pricing capabilities. By promptly adjusting prices to align with actual market demand, the Company mitigated the effects of new car price reductions and accelerated vehicle sales.

Wholesale vehicle sales revenue was RMB63.9 million (US$8.8 million) for the three months ended June 30, 2024, compared with RMB39.7 million in the last quarter and RMB94.6 million in the same period last year. For the three months ended June 30, 2024, wholesale transaction volume was 1,515 units, representing an increase of 62.2% from 934 units last quarter and a decrease of 3.3% from 1,567 units in the same period last year. Wholesale vehicle sales refer to vehicles purchased by the Company from individuals that do not meet the Company’s retail standards and are subsequently sold through online and offline channels. The quarter-over-quarter increase in wholesale transaction volume was a natural growth after the traditional off-season for used car sales due to the Chinese New Year last quarter. Compared with the same period last year, as the Company continued to improve its inventory capacity and reconditioning capabilities, an increased number of acquired vehicles were reconditioned to meet the Company’s retail standards, rather than being sold through wholesale channels. As a result, the wholesale vehicle sales revenue declined year-over-year.

Other revenue was RMB12.3 million (US$1.7 million) for the three months ended June 30, 2024, compared with RMB10.0 million in the last quarter and RMB7.6 million in the same period last year. Other revenues mainly consist of revenue from value-added services.

Cost of revenues was RMB375.6 million (US$51.7 million) for the three months ended June 30, 2024, compared with RMB298.1 million in the last quarter and RMB271.4 million in the same period last year.

Gross margin was 6.4% for the three months ended June 30, 2024, compared with 6.6% in the last quarter and 6.1% in the same period last year. The Company’s gross margin remained stable quarter-over-quarter.

Total operating expenses were RMB90.9 million (US$12.5 million) for the three months ended June 30, 2024. Total operating expenses excluding the impact of share-based compensation were RMB78.9 million.

- Sales and marketing expenses were RMB59.4 million (US$8.2 million) for the three months ended June 30, 2024, an increase of 16.8% from RMB50.8 million in the last quarter and an increase of 27.5% from RMB46.5 million in the same period last year. The quarter-over-quarter increase was mainly due to the increased salaries for the sales teams. Compared with the same period last year, in addition to the increased salaries for the sales teams, the year-over-year increase was also attributed to the increase in right-of-use assets depreciation expenses as a result of relocation to the Company’s Hefei Superstore in September 2023.

- General and administrative expenses were RMB28.1 million (US$3.9 million) for the three months ended June 30, 2024, representing a decrease of 62.7% from RMB75.3 million in the last quarter and a decrease of 15.1% from RMB33.1 million in the same period last year. The decrease was mainly due to a decrease of the share-based compensation expense. Additionally, due to the execution of a series of initiatives to realign its organizational structure and reduce the company-wide costs and expenses last quarter, salaries and benefits expenses for personnel performing general and administrative functions decreased accordingly.

- Research and development expenses were RMB3.4 million (US$0.4 million) for the three months ended June 30, 2024, representing a decrease of 43.9% from RMB6.0 million in the last quarter and a decrease of 61.9% from RMB8.9 million in the same period last year. The decrease was mainly due to a decrease of the salaries and benefits expenses of employees engaged in research and development as a result of the decrease in headcount.

Other operating income, net was RMB2.8 million (US$0.4million) for the three months ended June 30, 2024, compared with RMB0.9 million for the last quarter and RMB 7.0 million in the same period last year.

Loss from operations was RMB62.5 million (US$8.6 million) for the three months ended June 30, 2024, compared with RMB109.8 million for the last quarter and RMB63.2 million in the same period last year.

Interest expenses were RMB22.9 million (US$3.1 million) for the three months ended June 30, 2024, representing a decrease of 4.6% from RMB24.0 million in the last quarter and an increase of 346.4% from RMB5.1 million in the same period last year. The quarter-over-quarter decrease was mainly due to the repayment of long-term borrowings in April, 2024. The year-over-year increase was mainly due to the increase of interest expenses on finance lease liabilities relating to the lease of Changfeng Superstore in September, 2023.

Net loss from operations was net loss of RMB49.8 million (US$6.9 million) for the three months ended June 30, 2024, compared with net loss of RMB142.7 million for the last quarter and net loss of RMB91.6 million for the same period last year.

Non-GAAP adjusted EBITDA was a loss of RMB33.9 million (US$4.7 million) for the three months ended June 30, 2024, compared with a loss of RMB39.7 million in the last quarter and a loss of RMB46.6 million in the same period last year.

Liquidity

As of June 30, 2024, the Company had cash and cash equivalents of RMB17.2 million, compared to RMB23.3 million as of March 31, 2024.

The Company has incurred accumulated and recurring losses from operations, and cash outflows from operating activities. In addition, the Company’s current liabilities exceeded its current assets by approximately RMB315.6 million as of June 30, 2024.

The Company’s ability to continue as a going concern is dependent on management’s ability to increase sales, achieve higher gross profit margin and control operating costs and expenses to reduce the cash that will be used in operating cash flows, and to enter into financing arrangements, including but not limited to renewal of the existing borrowings and obtaining new debt and equity financings. There is uncertainty regarding the implementation of these business and financing plans, which raises substantial doubt about the Company’s ability to continue as a going concern. The accompanying unaudited financial information does not include any adjustment that is reflective of these uncertainties.

Recent Development

On September 13, 2024, Uxin announced that it entered into a memorandum of understanding (MOU) with Pintu (Beijing) Information Technology Co., Ltd. (the “Investor”), an indirect wholly-owned subsidiary of Dida Inc. (HKEX: 2559), regarding a proposed investment of US$7.5 million in Uxin. The Investor intends to subscribe for 1.54 billion Class A ordinary shares of the Company at a subscription price of US$0.004858 per share (or US$1.4575 per ADS).

Additionally, the Investor has extended a loan of the RMB equivalent of US$7.5 million to Youxin (Anhui) Industrial Investment Co., Ltd., a wholly-owned subsidiary of Uxin. The proposed investment is subject to the execution of definitive agreements and the satisfaction of customary closing conditions. This strategic investment marks an important step in strengthening Uxin’s financial position and supporting its future growth initiatives.

Business Outlook

For the three months ending September 30, 2024, the Company expects its retail transaction volume to be within the range of 5,800 units to 6,000 units. The Company estimates that its total revenues including retail vehicle sales revenue, wholesale vehicle sales revenue and other revenue to be within the range of RMB480 million to RMB500 million. The Company expects its Non-GAAP adjusted EBITDA to be less than a loss of RMB10 million. These forecasts reflect the Company’s current and preliminary views on the market and operational conditions, which are subject to changes.

Conference Call

Uxin’s management team will host a conference call on Monday, September 23, 2024, at 8:00 A.M. U.S. Eastern Time (8:00 P.M. Beijing/Hong Kong time on the same day) to discuss the financial results. In advance of the conference call, all participants must use the following link to complete the online registration process. Upon registering, each participant will receive access details for this conference including an event passcode, a unique access PIN, dial-in numbers, and an e-mail with detailed instructions to join the conference call.

Conference Call Preregistration:

https://dpregister.com/sreg/10192717/fd80b45d74

A telephone replay of the call will be available after the conclusion of the conference call until September 30, 2024. The dial-in details for the replay are as follows:

|

U.S.: |

+1 877 344 7529 |

|

International: |

+1 412 317 0088 |

|

Replay PIN: |

8291145 |

A live webcast and archive of the conference call will be available on the Investor Relations section of Uxin’s website at http://ir.xin.com.

About Uxin

Uxin is China’s leading used car retailer, pioneering industry transformation with advanced production, new retail experiences, and digital empowerment. We offer high-quality and value-for-money vehicles as well as superior after-sales services through a reliable, one-stop, and hassle-free transaction experience. Under our omni-channel strategy, we are able to leverage our pioneering online platform to serve customers nationwide and establish market leadership in selected regions through offline inspection and reconditioning centers. Leveraging our extensive industry data and continuous technology innovation throughout more than ten years of operation, we have established strong used car management and operation capabilities. We are committed to upholding our customer-centric approach and driving the healthy development of the used car industry.

Use of Non-GAAP Financial Measures

In evaluating the business, the Company considers and uses certain non-GAAP measures, including Adjusted EBITDA and adjusted net loss from operations per share – basic and diluted, as supplemental measures to review and assess its operating performance. The presentation of the non-GAAP financial measure is not intended to be considered in isolation or as a substitute for the financial information prepared and presented in accordance with U.S. GAAP. The Company defines Adjusted EBITDA as EBITDA excluding share-based compensation, fair value impact of the issuance of senior convertible preferred shares, foreign exchange (losses)/gains, other income/(expenses), dividend from long-term investment, net gain from extinguishment of debt. The Company defines adjusted net loss attributable to ordinary shareholders per share – basic and diluted as net loss attributable to ordinary shareholders per share excluding impact of share-based compensation, fair value impact of the issuance of senior convertible preferred shares and accretion on redeemable non-controlling interests. The Company presents the non-GAAP financial measures because they are used by the management to evaluate the operating performance and formulate business plans. The Company also believes that the use of the non-GAAP measures facilitates investors’ assessment of its operating performance as this measure excludes certain finance or non-cash items that the Company does not believe directly reflect its core operations. The Company believes that excluding these items enables us to evaluate our performance period-over-period more effectively and relative to our competitors.

The non-GAAP financial measures are not defined under U.S. GAAP and are not presented in accordance with U.S. GAAP. The non-GAAP financial measures have limitations as analytical tools. One of the key limitations of using Adjusted EBITDA is that it does not reflect all items of income and expenses that affect the Company’s operations. Share-based compensation, foreign exchange (losses)/gains and other income/(expenses) have been and may continue to be incurred in the business. Further, the non-GAAP measures may differ from the non-GAAP information used by other companies, including peer companies, and therefore their comparability may be limited.

The Company compensates for these limitations by reconciling the non-GAAP financial measure to the nearest U.S. GAAP performance measure, all of which should be considered when evaluating the Company’s performance. The Company encourages you to review its financial information in its entirety and not rely on a single financial measure.

Reconciliations of Uxin’s non-GAAP financial measures to the most comparable U.S. GAAP measure are included at the end of this press release.

Exchange Rate Information

This announcement contains translations of certain RMB amounts into U.S. dollars (“US$”) at specified rates solely for the convenience of the reader, except for those transaction amounts that were actually settled in U.S. dollars. Unless otherwise stated, all translations from RMB to US$ were made at the rate of RMB7.2672 to US$1.00, representing the index rate as of June 28, 2024 set forth in the H.10 statistical release of the Board of Governors of the Federal Reserve System. The Company makes no representation that the RMB or US$ amounts referred could be converted into US$ or RMB, as the case may be, at any particular rate or at all.

Safe Harbor Statement

This announcement contains forward-looking statements. These statements are made under the “safe harbor” provisions of the United States Private Securities Litigation Reform Act of 1995. These forward-looking statements can be identified by terminology such as “will,” “expects,” “anticipates,” “future,” “intends,” “plans,” “believes,” “estimates” and similar statements. Among other things, the business outlook and quotations from management in this announcement, as well as Uxin’s strategic and operational plans, contain forward-looking statements. Uxin may also make written or oral forward-looking statements in its periodic reports to the SEC, in its annual report to shareholders, in press releases and other written materials and in oral statements made by its officers, directors or employees to third parties. Statements that are not historical facts, including statements about Uxin’s beliefs and expectations, are forward-looking statements. Forward-looking statements involve inherent risks and uncertainties. A number of factors could cause actual results to differ materially from those contained in any forward-looking statement, including but not limited to the following: impact of the COVID-19 pandemic, Uxin’s goal and strategies; its expansion plans; its future business development, financial condition and results of operations; Uxin’s expectations regarding demand for, and market acceptance of, its services; its ability to provide differentiated and superior customer experience, maintain and enhance customer trust in its platform, and assess and mitigate various risks, including credit; its expectations regarding maintaining and expanding its relationships with business partners, including financing partners; trends and competition in China’s used car e-commerce industry; the laws and regulations relating to Uxin’s industry; the general economic and business conditions; and assumptions underlying or related to any of the foregoing. Further information regarding these and other risks is included in Uxin’s filings with the SEC. All information provided in this press release and in the attachments is as of the date of this press release, and Uxin does not undertake any obligation to update any forward-looking statement, except as required under applicable law.

For investor and media enquiries, please contact:

Uxin Limited Investor Relations

Uxin Limited

Phone: +86 10 5691-6765

Email: ir@xin.com

The Blueshirt Group

Mr. Jack Wang

Phone: +86 166-0115-0429

Email: Jack@blueshirtgroup.com

|

Uxin Limited |

||||||

|

Unaudited Consolidated Statements of Comprehensive Loss |

||||||

|

(In thousands except for number of shares and per share data) |

||||||

|

For the three months ended June 30, |

||||||

|

2023 |

2024 |

|||||

|

RMB |

RMB |

US$ |

||||

|

Revenues |

||||||

|

Retail vehicle sales |

186,849 |

324,967 |

44,717 |

|||

|

Wholesale vehicle sales |

94,647 |

63,897 |

8,793 |

|||

|

Others |

7,526 |

12,320 |

1,695 |

|||

|

Total revenues |

289,022 |

401,184 |

55,205 |

|||

|

Cost of revenues |

(271,381) |

(375,599) |

(51,684) |

|||

|

Gross profit |

17,641 |

25,585 |

3,521 |

|||

|

Operating expenses |

||||||

|

Sales and marketing |

(46,548) |

(59,353) |

(8,167) |

|||

|

General and administrative |

(33,103) |

(28,119) |

(3,869) |

|||

|

Research and development |

(8,861) |

(3,380) |

(465) |

|||

|

Reversal of credit losses, net |

696 |

– |

– |

|||

|

Total operating expenses |

(87,816) |

(90,852) |

(12,501) |

|||

|

Other operating income, net |

6,985 |

2,783 |

383 |

|||

|

Loss from operations |

(63,190) |

(62,484) |

(8,597) |

|||

|

Interest income |

102 |

16 |

2 |

|||

|

Interest expenses |

(5,120) |

(22,858) |

(3,145) |

|||

|

Other income |

2,367 |

633 |

87 |

|||

|

Other expenses |

(272) |

(800) |

(110) |

|||

|

Net gain from extinguishment of debt (i) |

– |

35,222 |

4,847 |

|||

|

Foreign exchange (losses)/gains |

(425) |

479 |

66 |

|||

|

Fair value impact of the issuance of senior |

(36,869) |

– |

– |

|||

|

Loss before income tax expense |

(103,407) |

(49,792) |

(6,850) |

|||

|

Income tax expense |

(165) |

(38) |

(5) |

|||

|

Dividend from long-term investment |

11,970 |

|||||

|

Net loss, net of tax |

(91,602) |

(49,830) |

(6,855) |

|||

|

Add: net loss/(profit) attribute to redeemable non- |

2 |

(1,641) |

(226) |

|||

|

Net loss attributable to UXIN LIMITED |

(91,600) |

(51,471) |

(7,081) |

|||

|

Net loss attributable to ordinary shareholders |

(91,600) |

(51,471) |

(7,081) |

|||

|

Net loss |

(91,602) |

(49,830) |

(6,855) |

|||

|

Foreign currency translation, net of tax nil |

3,314 |

(1,216) |

(167) |

|||

|

Total comprehensive loss |

(88,288) |

(51,046) |

(7,022) |

|||

|

Add: net loss/(profit) attribute to redeemable non- |

2 |

(1,641) |

(226) |

|||

|

Total comprehensive loss attributable to |

(88,286) |

(52,687) |

(7,248) |

|||

|

Net loss attributable to ordinary shareholders |

(91,600) |

(51,471) |

(7,081) |

|||

|

Weighted average shares outstanding – basic |

1,423,659,403 |

56,412,679,304 |

56,412,679,304 |

|||

|

Weighted average shares outstanding – diluted |

1,423,659,403 |

56,412,679,304 |

56,412,679,304 |

|||

|

Net loss per share for ordinary shareholders, |

(0.06) |

– |

– |

|||

|

Net loss per share for ordinary shareholders, |

(0.06) |

– |

– |

|||

|

|

||||||

|

Uxin Limited |

||||||

|

Unaudited Consolidated Balance Sheets |

||||||

|

(In thousands except for number of shares and per share data) |

||||||

|

As of March 31, |

As of June 30, |

|||||

|

2024 |

2024 |

|||||

|

RMB |

RMB |

US$ |

||||

|

ASSETS |

||||||

|

Current assets |

||||||

|

Cash and cash equivalents |

23,339 |

17,162 |

2,362 |

|||

|

Restricted cash |

594 |

744 |

102 |

|||

|

Accounts receivable, net |

2,089 |

3,104 |

427 |

|||

|

Loans recognized as a result of payments under |

– |

– |

– |

|||

|

Other receivables, net of provision for credit |

18,080 |

25,592 |

3,522 |

|||

|

Inventory, net |

110,494 |

143,356 |

19,726 |

|||

|

Prepaid expenses and other current assets |

71,787 |

72,106 |

9,922 |

|||

|

Total current assets |

226,383 |

262,064 |

36,061 |

|||

|

Non-current assets |

||||||

|

Property, equipment and software, net |

74,243 |

70,095 |

9,645 |

|||

|

Long-term investments (i) |

279,300 |

– |

– |

|||

|

Other non-current assets |

268 |

107 |

15 |

|||

|

Finance lease right-of-use assets, net |

1,339,537 |

1,332,768 |

183,395 |

|||

|

Operating lease right-of-use assets, net |

168,418 |

164,347 |

22,614 |

|||

|

Total non-current assets |

1,861,766 |

1,567,317 |

215,669 |

|||

|

Total assets |

2,088,149 |

1,829,381 |

251,730 |

|||

|

LIABILITIES, MEZZANINE EQUITY AND |

||||||

|

Current liabilities |

||||||

|

Accounts payable |

80,745 |

83,970 |

11,555 |

|||

|

Other payables and other current liabilities |

370,802 |

315,535 |

43,418 |

|||

|

Current portion of operating lease liabilities |

12,310 |

11,047 |

1,520 |

|||

|

Current portion of finance lease liabilities |

51,160 |

51,984 |

7,153 |

|||

|

Short-term borrowing from third parties |

71,181 |

105,584 |

14,529 |

|||

|

Short-term borrowing from related party |

7,000 |

9,500 |

1,307 |

|||

|

Current portion of long-term debt (i) |

291,950 |

– |

– |

|||

|

Total current liabilities |

885,148 |

577,620 |

79,482 |

|||

|

Non-current liabilities |

||||||

|

Consideration payable to WeBank (ii) |

– |

41,947 |

5,772 |

|||

|

Finance lease liabilities |

1,191,246 |

1,210,420 |

166,559 |

|||

|

Operating lease liabilities |

154,846 |

153,171 |

21,077 |

|||

|

Total non-current liabilities |

1,346,092 |

1,405,538 |

193,408 |

|||

|

Total liabilities |

2,231,240 |

1,983,158 |

272,890 |

|||

|

Mezzanine equity |

||||||

|

Redeemable non-controlling interests |

149,991 |

151,641 |

20,866 |

|||

|

Total Mezzanine equity |

149,991 |

151,641 |

20,866 |

|||

|

Shareholders’ deficit |

||||||

|

Ordinary shares |

39,806 |

39,807 |

5,478 |

|||

|

Additional paid-in capital |

18,928,837 |

18,942,103 |

2,606,521 |

|||

|

Subscription receivable from shareholders |

(107,879) |

(80,786) |

(11,117) |

|||

|

Accumulated other comprehensive income |

225,090 |

223,874 |

30,806 |

|||

|

Accumulated deficit |

(19,378,705) |

(19,430,176) |

(2,673,681) |

|||

|

Total Uxin’s shareholders’ deficit |

(292,851) |

(305,178) |

(41,993) |

|||

|

Non-controlling interests |

(231) |

(240) |

(33) |

|||

|

Total shareholders’ deficit |

(293,082) |

(305,418) |

(42,026) |

|||

|

Total liabilities, mezzanine equity and |

2,088,149 |

1,829,381 |

251,730 |

|||

|

(i) Long-term borrowing outstanding as of March 31, 2024 was pledged with the equity interest the Group holds in an |

||||||

|

* Share-based compensation charges included are as follows: |

||||||

|

For the three months ended June 30, |

||||||

|

2023 |

2024 |

|||||

|

RMB |

RMB |

US$ |

||||

|

Sales and marketing |

332 |

136 |

19 |

|||

|

General and administrative |

9,425 |

11,784 |

1,622 |

|||

|

Research and development |

394 |

128 |

18 |

|||

|

Uxin Limited |

||||||

|

Unaudited Reconciliations of GAAP And Non-GAAP Results |

||||||

|

(In thousands except for number of shares and per share data) |

||||||

|

For the three months ended June 30, |

||||||

|

2023 |

2024 |

|||||

|

RMB |

RMB |

US$ |

||||

|

Net loss, net of tax |

(91,602) |

(49,830) |

(6,855) |

|||

|

Add: Income tax expense |

165 |

38 |

5 |

|||

|

Interest income |

(102) |

(16) |

(2) |

|||

|

Interest expenses |

5,120 |

22,858 |

3,145 |

|||

|

Depreciation |

6,413 |

16,577 |

2,281 |

|||

|

EBITDA |

(80,006) |

(10,373) |

(1,426) |

|||

|

Add: Share-based compensation expenses |

10,151 |

12,048 |

1,659 |

|||

|

– Sales and marketing |

332 |

136 |

19 |

|||

|

– General and administrative |

9,425 |

11,784 |

1,622 |

|||

|

– Research and development |

394 |

128 |

18 |

|||

|

Other income |

(2,367) |

(633) |

(87) |

|||

|

Other expenses |

272 |

800 |

110 |

|||

|

Foreign exchange (losses)/gains |

425 |

(479) |

(66) |

|||

|

Dividend from long-term investment |

(11,970) |

– |

– |

|||

|

Net gain from extinguishment of debt |

– |

(35,222) |

(4,847) |

|||

|

Fair value impact of the issuance of senior |

36,869 |

– |

– |

|||

|

Non-GAAP adjusted EBITDA |

(46,626) |

(33,859) |

(4,657) |

|||

|

For the three months ended June 30, |

||||||

|

2023 |

2024 |

|||||

|

RMB |

RMB |

US$ |

||||

|

Net loss attributable to ordinary |

(91,600) |

(51,471) |

(7,081) |

|||

|

Add: Share-based compensation expenses |

10,151 |

12,048 |

1,659 |

|||

|

– Sales and marketing |

332 |

136 |

19 |

|||

|

– General and administrative |

9,425 |

11,784 |

1,622 |

|||

|

– Research and development |

394 |

128 |

18 |

|||

|

Fair value impact of the issuance of senior |

36,869 |

– |

– |

|||

|

Add: accretion on redeemable non- |

– |

1,650 |

227 |

|||

|

Non-GAAP adjusted net loss attributable to |

(44,580) |

(37,773) |

(5,195) |

|||

|

Net loss per share for ordinary shareholders – |

(0.06) |

– |

– |

|||

|

Net loss per share for ordinary shareholders – |

(0.06) |

– |

– |

|||

|

Non-GAAP adjusted net loss to ordinary |

(0.03) |

– |

– |

|||

|

Weighted average shares outstanding – basic |

1,423,659,403 |

56,412,679,304 |

56,412,679,304 |

|||

|

Weighted average shares outstanding – diluted |

1,423,659,403 |

56,412,679,304 |

56,412,679,304 |

|||

|

Note: The conversion of Renminbi (RMB) into U.S. dollars (USD) is based on the certified exchange rate of |

||||||

![]() View original content:https://www.prnewswire.com/news-releases/uxin-reports-unaudited-first-quarter-of-fiscal-year-2025-financial-results-302255388.html

View original content:https://www.prnewswire.com/news-releases/uxin-reports-unaudited-first-quarter-of-fiscal-year-2025-financial-results-302255388.html

SOURCE Uxin Limited

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Stock-Split Watch: 2 AI Stocks That Look Ready to Split

Artificial intelligence (AI) stocks have led the current bull market, so it shouldn’t come as a surprise that there have already been several stock splits among AI stocks.

Nvidia and Broadcom, two of the biggest chip stocks, have already done 10-for-1 stock splits in recent months. Super Micro Computer, a maker of AI servers, is set for its own 10-for-1 stock split to go into effect on Oct. 1. Lam Research has also announced a 10-for-1 split set to go into effect on Oct. 2.

However, with plenty of other AI stocks soaring, a number of candidates in the sector appear ready to split their stocks.

While a stock split doesn’t change a stock’s fundamentals, investors generally cheer such moves as they act as a reset in the share price, giving the stock another chance to soar. There’s also some evidence that stocks outperform in the year after the split, perhaps because stocks tend to split when management believes they have the momentum to keep gaining.

Keep reading to see two AI stocks that could split their shares in the near future.

1. ASML

ASML (NASDAQ: ASML) is the leading maker of lithography equipment, the complex machines used to make semiconductors. ASML supplies companies like Taiwan Semiconductor Manufacturing Company, Samsung, and Intel, and it’s the only maker of extreme ultraviolet (EUV) machines used to make the most advanced chips.

ASML’s leadership position in a crucial category of the semiconductor industry has given it a market cap of more than $300 billion and a share price hovering around $800 a share. That makes the company eligible for a range of stock splits as it already has one of the highest individual share prices of any stock on the market.

ASML has split its stock in the past, but it hasn’t had a traditional stock split since 2000, when it executed a 3-for-1 split. In 2007, it enacted an 8-for-9 reverse split in combination with a special dividend, and it performed a synthetic buyback in 2012, along with a 77-for-100 reverse stock split.

If the stock continues to gain, which seems like a good bet given the growth in AI, a stock split seems likely.

2. Equinix

Equinix (NASDAQ: EQIX) isn’t your typical AI stock. The company is a real estate investment trust (REIT) and the world’s largest data center REIT, giving investors exposure to the AI boom from another angle. As a REIT, its growth rates tend to be modest, but the company still has a huge growth opportunity in front of it, especially with the boom in data centers from AI.

Revenue in the second quarter was up 7% to $2.2 billion, and it posted its first-ever quarter of better than $1 billion in earnings before interest, taxes, depreciation, and amortization (EBITDA) at $1.04 billion.

Equinix is rapidly expanding its property base, with 54 major projects underway. The company also bought a more than 200-acre parcel of land in the Atlanta area, which it said will help it “pursue larger AI and hyperscale workloads in the U.S.”

Equinix looks like a good candidate for a stock split as the stock is now trading at a share price of around $860. Equinix has never had a stock split but did a reverse stock split in 2002, from $1 to $32, after the value of the stock plunged when the dot-com bubble burst.

The data center REIT hasn’t made the kind of gains that other AI stocks have recently, so a stock split might not be as urgent. However, with the stock approaching a $1,000 share price, splitting the stock could make it more attractive to retail and beginning investors, many of whom are eager to buy AI stocks.

Should you invest $1,000 in ASML right now?

Before you buy stock in ASML, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and ASML wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $710,860!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 16, 2024

Jeremy Bowman has positions in Broadcom. The Motley Fool has positions in and recommends ASML, Equinix, Lam Research, Nvidia, and Taiwan Semiconductor Manufacturing. The Motley Fool recommends Broadcom and Intel and recommends the following options: short November 2024 $24 calls on Intel. The Motley Fool has a disclosure policy.

Stock-Split Watch: 2 AI Stocks That Look Ready to Split was originally published by The Motley Fool

Stifel Warns Of 12% Market Drop By End Of 2024 As S&P 500 Faces High Valuations And Speculative Risks

Stifel foresees a significant market downturn by the end of 2024. Chief equity strategist Barry Bannister warned the S&P 500 could fall by 12% in the fourth quarter.

What Happened: Bannister highlighted various concerns, including high valuations and speculative investor behavior. “Our instruments tell us to expect an S&P 500 correction to the very low 5,000s by 4Q24,” he stated, reported Business Insider.

He noted that current stock market valuations are nearing a “near three-generation high” with the S&P 500’s price-to-earnings multiple around 24x. Additionally, the outperformance of large-cap growth stocks relative to value stocks is reminiscent of peaks seen in February 2000 and August 2020, which preceded bear markets.

Bannister also pointed out that rising labor supply from increased immigration has bolstered economic growth, but overall labor demand is waning. “Fading labor demand is now symbolic of recession risk,” he said, mentioning that the non-farm payroll 6-month diffusion index has dipped below a “recession trigger level.”

He further explained that the typical “pre-election juice” for the economy might diminish towards year-end, impacting stock performance. Lastly, Bannister warned of a potential bubble in technology stocks, comparing it to the dot-com bubble of the 1990s.

Why It Matters: The warning from Stifel comes on the heels of several significant market events.

Additionally, in early September, equity strategist Tom Lee warned of a potential 7%-10% market pullback, attributing this to historical trends showing September as the weakest month for stocks. Lee urged caution but also advised investors to be ready to “buy that dip.”

More recently, the Federal Reserve’s decision to cut interest rates by 0.5% triggered a market rally, despite concerns over inflated valuations. This move led to a significant surge in U.S. stocks and commodities, while reducing bond market volatility.

The rate cut also influenced investor behavior, with a shift away from money market funds and into longer-duration bonds, as noted by fixed-income portfolio manager Timothy Ng.

Read Next:

Image via Unsplash

This story was generated using Benzinga Neuro and edited by Kaustubh Bagalkote

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

3 Artificial Intelligence Stocks Down More Than 50% From Their 52-Week Highs. Could They Be Bargain Buys Right Now?

It’s hard not to get caught up in the hype with artificial intelligence (AI) when analysts are projecting so much growth. Grand View Research projects that by 2030, the AI market will be worth $1.8 trillion, up from approximately $279 billion this year. With growth like that, investors who don’t own AI stocks could feel like they’re missing out.

But buying shares of chipmaker Nvidia or other AI stocks that have already generated massive returns may not be all that enticing given their lofty valuations. Buying at these high levels could limit the gains you make from a stock both in the short and long term.

Another option is to consider AI stocks that haven’t been doing so well recently. You may be taking on more risk but could net some strong gains if they eventually rebound. Snowflake (NYSE: SNOW), Super Micro Computer (NASDAQ: SMCI), and SoundHound AI (NASDAQ: SOUN) are all AI stocks down more than 50% from their 52-week highs. Below, I’ve ranked them based on how likely it is they can turn things around.

1. Super Micro Computer

Super Micro Computer, also known as Supermicro, was one of the hottest AI stocks to own earlier this year. But it has been struggling for weeks after its fiscal 2024 Q4 earnings release and a report from notable short seller Hindenburg research questioning the company’s accounting practices. Although such reports may be biased and contain unproven allegations, investors have nonetheless been bearish on the stock following these developments.

Today, Supermicro stock is trading at around $450 per share, more than 60% below its 52-week high of $1,229. The company’s business has been booming as it provides customers with servers and IT infrastructure to help them grow their operations, particularly as they expand their AI products and services.

For the fiscal year ended June 30, Supermicro’s sales totaled $14.9 billion, up 110% year over year. Profits also jumped from $640 million to $1.2 billion. However, the latest earnings report alarmed investors as its gross margin has been shrinking, which could drastically hinder its earnings outlook should that trend continue.

Supermicro makes for an intriguing contrarian buy because Hindenburg’s short report and the latest quarterly results have managed to overshadow what’s still an incredible growth streak. There is indeed risk from its shrinking margins, but it may be an AI stock worth taking a chance on right now.

2. Snowflake

Data storage company Snowflake has been struggling in 2024 as it posted unimpressive results, and investors have been bearish since the company’s CEO unexpectedly retired earlier in the year. It also didn’t help the company was involved in a big data breach, which impacted many large customers. Down more than 40% year to date, Snowflake’s decline has persisted since shares peaked in late 2021.

For Snowflake to turn things around, it needs to deliver better numbers, particularly on the bottom line. While the company has been growing its business, that’s not so encouraging when its losses have also been getting bigger. Through the first two quarters this year, Snowflake’s operating loss grew 26% year over year to $703.9 million, nearly matching its 31% top-line growth over the same period. And to make matters worse, management reduced its margin guidance for full-year fiscal 2025.

Until Snowflake can show there’s hope of profitability in the future, I’d avoid the stock.

3. SoundHound AI

Shares of SoundHound AI took off early in the year as investors learned Nvidia had invested in the company. While the stock has leveled off in recent months, it’s still up more than 130% year to date, even after declining 52% from its high of $10.25.

SoundHound’s voice AI technology can help restaurants take orders and follow voice commands. While the business is growing, competition in this space is intense, and its numbers may not be high enough to suggest its share of the market is all that big.

In the second quarter, the company’s revenue rose 54% to $13.5 million, but its net loss ballooned 60% to $37.3 million.

There’s still a fair bit of uncertainty around SoundHound AI, and it’s arguably the riskiest pick on this list given its sky-high valuation. I’d avoid it despite the sell-off.

Should you invest $1,000 in Super Micro Computer right now?

Before you buy stock in Super Micro Computer, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Super Micro Computer wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $710,860!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 16, 2024

David Jagielski has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Nvidia and Snowflake. The Motley Fool has a disclosure policy.

3 Artificial Intelligence Stocks Down More Than 50% From Their 52-Week Highs. Could They Be Bargain Buys Right Now? was originally published by The Motley Fool

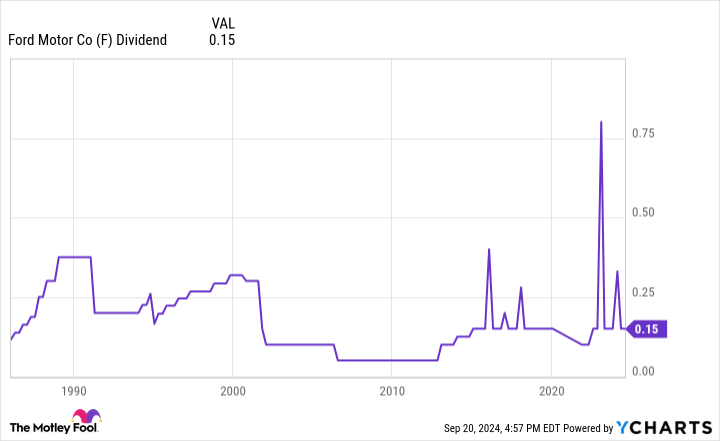

How Much Will Ford Motor Company Pay Out in Dividends This Year?

You may like Ford Motor Company‘s (NYSE: F) above-average dividend yield. As veteran investors can attest, however, there’s more to the story. Is the dividend growing? Can the company afford to continue paying it? Some dividend stocks aren’t as attractive once put under scrutiny.

With that as the backdrop, here’s a look at how much the automobile manufacturer is likely to pay out in dividends this year, and what it means for shareholders.

Ford Motor’s dividend snapshot

Ford was once a titan, but competitors, circumstances, and time finally caught up with the automaker in the 1990s. That’s when the carmaker’s dividend began to shrink more than grow, particularly during periods of economic weakness.

To its credit, Ford has made efforts to supplement ho-hum quarterly payments with the occasional “special dividend.” The company’s regular quarterly payout of $0.15 per share plus February’s special dividend of $0.18 per share puts it on track to dish out $0.78 worth of per-share dividend payments in 2024, translating into a dividend yield of 7.2%.

That’s going to cost the automaker on the order of $3.7 billion, by the way, or roughly two-thirds of its likely 2024 net income based on generally accepted accounting principles (GAAP). On a per-share basis, it’s a little less than half the earnings of $1.93 per share that analysts expect this year.

Not particularly great for any investing goal

There’s the rub for interested investors. A huge chunk of this company’s profits are earmarked for dividends rather than reinvestment.

Then again, what growth opportunity merits more reinvestment? The company is sitting on nearly $25 billion worth of cash it’s struggling to find something more constructive to do with. A lack of spendable cash isn’t an issue.

Whatever its fiscal situation is, Ford Motor isn’t a top pick for any investor in need of predictable or growing dividend income. The automobile business itself also faces only modest growth prospects for the foreseeable future. There are far better options out there regardless of your investment goal.

Should you invest $1,000 in Ford Motor Company right now?

Before you buy stock in Ford Motor Company, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Ford Motor Company wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $710,860!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 16, 2024

James Brumley has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

How Much Will Ford Motor Company Pay Out in Dividends This Year? was originally published by The Motley Fool

Progressive Planet demonstrates strong start with profitable Q1 following year of cost control implementation and continued improvements versus prior year Q1

/NOT FOR DISTRIBUTION IN THE USA/

EBITDA improves to $743K from $(113K) in prior year

- Progressive Planet reports first profitable Q1 since 2022 acquisition of Absorbent Products

- Changes in operations and product offerings result in 19.1% gross profit increase from Q1 2024 to Q1 2025

KAMLOOPS, BC, Sept. 23, 2024 /CNW/ – Progressive Planet Solutions Inc. PLAN ASHXF (“Progressive Planet”, “PLAN”, or the “Company”) is pleased to announce its financial results for its first quarter ending on July 31, 2024.

“In fiscal year 2024, which ended on April 30, 2024, we prioritized implementing cost controls in preparation for long term growth. The first quarter of FY 2025 demonstrated our continued commitment to cost control and to selling higher margin products, resulting in our first profitable Q1 since the acquisition of Absorbent Products in February 2022. I’m proud of our team’s commitment to creating long-term shareholder value,” stated Steve Harpur, CEO.

The Company’s implementation of its cost cutting plan beginning in late fiscal 2023, as well as its focus on transitioning to higher margin products, have contributed to a significant improvement in profitability during the first quarter of the current fiscal year, compared to the prior first quarter.

Q1 Fiscal 2024 vs. Q1 Fiscal 2025:

- Increased EBITDA1 by $856K, from $(113K) to $743K

- Revenue decreased from $4.93 million to $4.67 million

- Gross profit increased by 19.1%, from $1.31 million to $1.56 million

- Gross margin2 increased from 26.6% to 33.5%

- Operating cash flow increased from $130K to $434K

- Income from operations improved by $903K, from a loss of $(371K) to income of $532K

- Net income improved from a loss of $(487,870) to income of $373,364

“As we continue to maintain higher gross margins and control costs, our current and future focus is on growing our revenue per employee,” shared Harpur. “Our engineering team is focused on improving productivity in our valve pack powder bagging and palletizing production line, and we anticipate the installation of mechanical lifting equipment and robotic palletizing in coming quarters. In addition, our restructured sales team is now fully operational and focused on growing high margin revenues.”

The decline in revenue was primarily due to Progressive Planet no longer selling a low margin mineral which was formerly sourced from a US third party supplier.

- EBITDA is a non-IFRS financial measure. This ratio expresses earnings before interest, income taxes, depreciation, and amortization. It assists in explaining the Company’s results from period to period. There is not directly comparable IFRS measure.

- Gross margin is a non-IFRS financial measure. This ratio expresses gross profit as a percentage of revenue for a given period. It assists in explaining the Company’s results from period to period and measuring profitability. This ratio is calculated by dividing gross profit for a period by the corresponding revenue for the period. There is no directly comparable IFRS measure.

Progressive Planet provides regular information for investors on its website: progressiveplanet.com/investors/. This includes press releases and other information about financial performance, patents filed, and information on corporate governance.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accept responsibility for the adequacy or accuracy of this release.

About Progressive Planet:

Progressive Planet, a manufacturing company operating out of Kamloops, British Columbia, is reimagining what is possible when we prioritize our planet’s health. Our expertise lies in developing products using our owned mineral assets and recycled materials to create Products for a Healthy Planet™.

Our C-Quester™ Centre of Sustainable Solutions is proudly disrupting the cement, agricultural and animal care industries. Our product lines include patented and patent pending products which are developed with the express intent of promoting a healthy planet using naturally occurring minerals and the urban mining of recycled materials. Our products are found in over 10,000 retail stores across North America.

Forward-Looking Statements:

Certain statements in this release are forward-looking statements, which reflect the expectations of management regarding the matters described herein including statements regarding the NCIB and the repurchases thereunder as well as the effect of those repurchases, statements regarding the future of the Bromley Creek Zeolite Mine and statements regarding the development of future products. Forward-looking statements consist of statements that are not purely historical, including any statements regarding beliefs, plans, expectations, or intentions regarding the future. Such statements are subject to risks and uncertainties that may cause actual results, performance, or developments to differ materially from those contained in the statements. No assurance can be given that any of the events anticipated by the forward-looking statements will occur or, if they do occur, what benefits the Company will obtain from them. These forward-looking statements reflect management’s current views and are based on certain expectations, estimates and assumptions which may prove to be incorrect. A number of risks and uncertainties could cause our actual results to differ materially from those expressed or implied by the forward-looking statements, including factors beyond the Company’s control. These forward-looking statements are made as of the date of this news release.

Disclaimer:

This news release, required by Canadian laws, does not constitute an offer of securities and is not for distribution or dissemination outside Canada.

SOURCE Progressive Planet Solutions Inc.

![]() View original content to download multimedia: http://www.newswire.ca/en/releases/archive/September2024/23/c6713.html

View original content to download multimedia: http://www.newswire.ca/en/releases/archive/September2024/23/c6713.html

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.