Why Granite Point Mortgage Trust Shares Are Trading Higher; Here Are 20 Stocks Moving Premarket

Shares of Granite Point Mortgage Trust Inc. GPMT rose sharply in today’s pre-market trading after the company announced a third-quarter common and preferred stock dividends.

After the market close on Friday, Granite Point Mortgage Trust declared a quarterly cash dividend of 5 cents per share of common stock for the third quarter of 2024. The company’s board also declared a quarterly cash dividend of 43.75 cents per share of the 7.00% Series A Fixed-to-Floating Rate Cumulative Redeemable Preferred Stock.

Granite Point Mortgage Trust shares gained 3.2% to $2.93 in the pre-market trading.

Here are some other stocks moving in pre-market trading.

Gainers

- Nukkleus Inc. NUKK gained 73.3% to $0.3683 in pre-market trading after gaining over 5% on Friday.

- Linkage Global Inc LGCB gained 54.1% to $0.6445 in the pre-market trading session after dipping 57% on Friday.

- Wheeler Real Estate Investment Trust, Inc. WHLR rose 42.9% to $19.99 in pre-market trading after dipping more than 25% on Friday.

- Nuvve Holding Corp NVVE shares rose 30.9% to $5.13 in pre-market trading after tumbling over 16% on Friday.

- Garden Stage Limited GSIW gained 26.7% to $1.70 in pre-market trading after dipping 83% on Friday.

- Treasure Global Inc. TGL gained 23.5% to $0.84 in pre-market trading.

- Gogoro Inc. GGR gained 16.4% to $0.60 in pre-market trading after falling 13% on Friday.

- Stem, Inc. STEM rose 12.8% to $0.4006 in pre-market trading after dipping 12% on Friday. Stem recently named David Buzby as interim CEO following John Carrington’s departure.

- AC Immune SA ACIU shares gained 7.1% to $3.95 in pre-market trading.

Losers

- Jin Medical International Ltd. ZJYL fell 21.5% to $3.20 in pre-market trading after jumping around 55% on Friday.

- PainReform Ltd. PRFX shares fell 21.1% to $0.6080 in pre-market trading. The company recently announced findings regarding the compatibility of sutures in human clinical trials of PRF-110.

- SolarMax Technology Inc SMXT shares dipped 19.7% to $0.70 in pre-market trading after surging 9% on Friday.

- Aditxt, Inc. ADTX fell 19% to $0.31 in pre-market trading following a 4% decline on Friday.

- Chijet Motor Company, Inc. CJET shares declined 18.5% to $2.28 in pre-market trading. Chijet Motor Company announced issuance of ordinary shares to holders of contingent value rights.

- CERo Therapeutics Holdings, Inc. CERO fell 16% to $0.10 in today’s pre-market trading after jumping 37% on Thursday.

- Gaxos.ai Inc. GXAI shares declined 15.2% to $2.05 in pre-market trading. Gaxos.ai announced exercise of warrants for $3.24 million gross proceeds.

- Maxeon Solar Technologies, Ltd. MAXN declined 14.8% to $0.0780 in pre-market trading after the company received Nasdaq delisting notification.

- Primega Group Holdings Limited PGHL shares fell 10.3% to $15.00 in pre-market trading after gaining more than 5% on Friday.

- James Hardie Industries plc JHX shares fell 6% to $39.49 in pre-market trading after gaining more than 8% on Friday.

Now Read This:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Wall Street Eyes Modestly Positive Start As Atypical September Rally Generates Positive Sentiment, China Cuts Rate: Intel, Palantir, Bitcoin Make Huge Moves

U.S. index futures are modestly higher at the start of a new week as the rate cut euphoria fades and traders look ahead to the next key catalysts. The tech space could get a lift from a potential lifeline for struggling Intel Corp. INTC and traders may also look ahead to Micron Corp.’s MU earnings report due later this week. FedEx Corp.’s FDX annual shareholder meeting and conference presentations by companies could also be on traders’ radar.

A few Fed speeches and private sector activity data due on Monday will also be of interest to the market, which has had an atypically strong September. China followed up with more cuts on Monday as the country strives to bring the struggling economy back on track.

| Futures | Performance (+/-) |

| Nasdaq 100 | +0.24% |

| S&P 500 | +0.15% |

| Dow | +0.06% |

| R2K | +0.32% |

In premarket trading on Monday, the SPDR S&P 500 ETF Trust SPY rose 0.15% to $569.09 and the Invesco QQQ ETF QQQ climbed 0.27% to $483.06, according to Benzinga Pro data.

Cues From Last Week:

U.S. stocks recorded gains for the second straight week as the Fed’s 50 basis-point cut set the market on fire, although a session after the announcement. After a mixed start to the week, positive retail sales generated buying interest in the market on Tuesday. Sentiment soured on Wednesday despite the initial positive reaction to the rate cut and the major indices closed lower.

Traders reacted with a lag to the rate cut, sending averages sharply higher on Thursday. The S&P 500 Index and the Dow Jones Industrial Average scaled record highs in the session. Caution returned on Friday as the market closed the triple-witching session on a mixed note. The Dow built on its gains on Friday and ended at a new high.

“This might be a September rally to remember on Wall Street, as history is not on the side of September delivering many market rallies,” said fund manager Louis Navellier.

| Index | Weekly Performance (+/) |

Value |

| Nasdaq Composite | +1.50% | 17,948.32 |

| S&P 500 Index | +1.36% | 5,702.55 |

| Dow Industrials | +1.62% | 42,063.36 |

| Russell 2000 | +2.08% | 2,227.89 |

Insights From Analysts:

The atypical September rally points to more gains ahead before the year ends, says Carson Group’s Chief Market Strategist Ryan Detrick. A new high for the S&P 500 Index in September has meant an even better fourth quarter in the past, he said. The market has risen 19 out of 21 times and the average gain is nearly 5%, he said. If the new high was made in September, which also happens to be an election year, the fourth quarter is higher 100% of the time with an average gain of 6%.

The S&P 500 Index, which closed Friday’s session, just shy of an all-time high, is now above year-end price predictions of 70% of Wall Street analysts. This has rendered S&P valuation slightly higher than the average number for the past five and past 10 years, FactSet data showed.

JPMorgan Global Investment Strategist Sarah Stillpass said in a report the September rate cut could bode well for equities. Since 1980, five of the 10 best years for the S&P 500 happened when the Fed was cutting rates without a recession, she said. She also noted that the Fed has cut rates 12 times when the S&P 500 was within 1% of its all-time high such as the current year. The market was higher one year later all 12 times, with a median return of 15%, she added.

See also: Best Futures Trading Software

Upcoming Economic Data:

A slew of Fed speeches and the core personal consumption expenditure index, which is part of the personal income and spending report, are the key data the market will likely look forward to in the unfolding week. Traders may also keep a close eye on the weekly jobless claims data, flash private sector activity readings from S&P Global, a consumer confidence reading, the August durables goods orders data and a couple of housing market readings.

On Monday, Atlanta Fed President Raphael Bostic is scheduled to speak at 8 a.m. EDT, followed by Chicago Fed President Austan Goolsbee at 10:15 a.m. EDT and Minneapolis Fed President Neel Kashkari at 1 p.m. EDT.

S&P Global will release its flash manufacturing and service sector purchasing managers’ indices for September at 9:45 a.m. EDT. Economists, on average, expect the manufacturing purchasing managers’ index to rise from 47.9 in August to 48.4 in September, suggesting the sector continued to contract. The service sector PMI is widely expected to hold steady at 55.4 compared to August’s 55.7.

The Treasury will auction three- and six-month notes at 11:30 a.m. EDT.

Stocks In Focus:

- Intel rose about 3% in premarket trading amid reports that Apollo Global Management seeks to invest $5 billion in the chipmaker in return for an equity stake in the company. Incidentally, Qualcomm, Inc. QCOM is rumored to be interested in buying Intel.

- Bitcoin’s BTC/USD rally is sending crypto-linked stocks higher on Monday.

- Palantir Technologies, Inc. PLTR fell over 1.60% following a negative analyst action. The company will be added to the S&P 500 Index, along with Dell Technologies Inc. DELL and Erie Indemnity Company ERIE.

- AAR Corp. AIR is due to announce its quarterly results after the market closes.

Commodities, Bonds And Global Equity Markets:

Crude oil and gold futures are modestly higher, with the latter trading near record territory. Bitcoin has gone past the $63.5K level. The 10-year Treasury note yield rose 1.1 points to 3.739%.

The Asian markets closed on a lackluster note, although the Japanese market remained closed for a public holiday. The People’s Bank of China announced a cut to its 14-day reverse repurchase rate, following up with the downward adjustments that began in July. Chinese central bank governor Pan Gongsheng will hold a press conference Tuesday on financial support for economic development, alongside two other officials, Bloomberg reported.

European stocks also showed tentativeness as domestic traders digested weak private sector activity data from the region.

Read Next:

Photo via Shutterstock

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Apollo to Offer Multibillion-Dollar Investment in Intel

(Bloomberg) — Apollo Global Management Inc. has offered to make a multibillion-dollar investment in Intel Corp., according to people familiar with the matter, in a move that would be a vote of confidence in the chipmaker’s turnaround strategy.

Most Read from Bloomberg

The alternative asset manager has indicated in recent days it would be willing to make an equity-like investment of as much as $5 billion in Intel, said one of the people, who asked not to be identified discussing confidential information. Intel executives have been weighing Apollo’s proposal, the people said. The size of Apollo’s potential investment could change or discussions could fall apart, they said.

The development comes after San Diego-based Qualcomm Inc. floated a friendly takeover of Intel, people with knowledge of the matter said on Saturday, raising the prospect of one of the biggest-ever M&A deals. Neither deal has been finalized.

Representatives for Apollo and Intel declined to comment.

Under Chief Executive Officer Pat Gelsinger, Intel has been working on an expensive plan to remake itself and bring in new products, technology and outside customers. Still, the company is headed for its third consecutive year of shrinking sales and its shares have lost more than 50% of their value this year. While Apollo may best be known today for its insurance, buyout and credit strategies, the firm started out in the 1990s as a distressed-investing specialist.

Intel’s shares rose as much as 5% in premarket trading in New York on Monday before giving up some of those gains. The stock had closed 3.3% higher at $21.84 on Friday, giving the company a market value of $93.4 billion.

The company’s shares bounced last week after Gelsinger made a series of announcements to accelerate the turnaround. Those included a multibillion-dollar deal with Amazon.com Inc.’s Amazon Web Services cloud unit to co-invest in a custom AI semiconductor and a plan to turn its ailing manufacturing business into a wholly owned subsidiary. Intel also said it would pull back on some projects, including shelving plans for new factories in Germany and Poland for now.

Intel and Apollo already have a relationship. Santa Clara, California-based Intel agreed in June to sell a stake in a joint venture that controls a plant in Ireland for $11 billion to Apollo, bringing in more external funding for a massive expansion of its factory network.

Apollo also has other experience in the chipmaking space. Last year, the New York-based firm agreed to lead a $900 million investment in Western Digital Corp., buying convertible preferred stock.

–With assistance from Shadab Nazmi and Yasufumi Saito.

(Updates premarket share trading in sixth paragraph.)

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

Amazon Has Enforced Full-Time Return To Office Policy, But It Hasn't Gone Down Well With The UK Government, Which Is Pushing For Flexible Working As Holiday Season Approaches: Here's What's Happening

Ahead of the holiday season, Amazon.com Inc AMZN is enforcing a return-to-office five days a week mandate, clashing with the UK government’s push for flexible working rights.

What Happened: Amazon argues that in-office work fosters better invention, collaboration, and connection among employees. However, the UK government links flexible working to improved performance and a more loyal workforce, reported BBC.

Microsoft‘s study during the pandemic indicated that remote workers collaborated more within existing networks but built fewer new connections. Real-time communication also declined, replaced by more emails and instant messages.

Contrastingly, a Stanford University study found that Chinese home workers were 13% more productive due to fewer breaks and sick days. However, fully remote work could lead to a 10% drop in productivity compared to full-time office work.

Other tech giants like Goldman Sachs, JPMorgan, and Morgan Stanley have also required employees to return to the office. Elon Musk‘s companies, Tesla and SpaceX, enforce similar policies, with SpaceX losing 15% of its senior employees after implementing the rule, according to a study published earlier this year.

The debate continues as the UK government believes that some level of home working boosts productivity, while Amazon maintains that full-time office work is essential for their operational success.

Why It Matters: The clash between Amazon and the UK government over remote work policies is part of a broader trend among major corporations. Recently, JPMorgan Chase CEO Jamie Dimon called for federal employees to return to their offices, expressing frustration over empty buildings in Washington, DC.

Amazon’s decision to end remote work and mandate office presence starting in January has sparked significant attention. Former employees, like John McBride, have criticized the move, suggesting it may be driven by economic factors to reduce headcount and boost margins.

Additionally, Amazon has been making headlines with its recent initiatives. The company announced a pay increase for its front-line employees, raising the average compensation to over $29 per hour and investing $2.2 billion ahead of the holiday season.

However, Amazon’s new benefits, such as free Prime membership, are exclusively available to warehouse workers, leaving corporate staff out.

Read Next:

Image Via Shutterstock

This story was generated using Benzinga Neuro and edited by Kaustubh Bagalkote

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Kamala Harris' First Public Mention Of Cryptocurrencies On Campaign Trail Sparks Excitement Among Enthusiasts: 'This Is Progress And Progress Is Good…'

After weeks of uncertainty, Democratic presidential hopeful Kamala Harris finally put her cryptocurrency cards on the table, eliciting mixed reactions from industry observers.

What happened: At a fundraising event at Wall Street, the vice president vowed to protect the interests of emerging technologies like artificial intelligence and digital assets.

Harris’ first-ever public mention of cryptocurrencies on the campaign trail got enthusiasts excited, especially the ones favoring her in the election

Anthony Scaramucci, CEO of investment firm SkyBridge Capital, said, “Kamala means Bitcoin BTC/USD in every language.”

Another prominent market observer and founder of venture fund Cinneamhain Ventures, Adam Cochran, said Harris proved naysayers wrong with her “pro-digital assets” remark.

That said, neutral observers also welcomed Harris’ crypto-friendly remark. Coinbase’s Chief Policy Officer Faryar Shirzad dubbed the statement “important and constructive.”

“We should press for more, but her statement today means a lot and we should recognize that,” the executive noted.

Jake Chervinsky, Chief Legal Officer at Variant Fund, said, “This is progress and progress is good,” although he wanted to know more about her policy.

However, not everyone was convinced. Pierre Rochard, VP of Research at Riot Platforms, said that Harris was “fully aligned” with anti-cryptocurrency crusader Senator Elizabeth Warren (D-Mass.) on pushing central bank digital currencies and shadow-banning Bitcoin.

Additionally, Ryan Selkis, the founder of on-chain analytics firm Messari, also known for his pro-Trump statements, outrightly dismissed Harris’ overture.

Price Action: Bitcoin rallied sharply since Harris’ remarks, climbing as high as $64,660 before relinquishing gains to trade at $63,539.22 as of this writing, according to data from Benzinga Pro.

Check This Out:

Photo created using Shutterstock and Midjourney.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

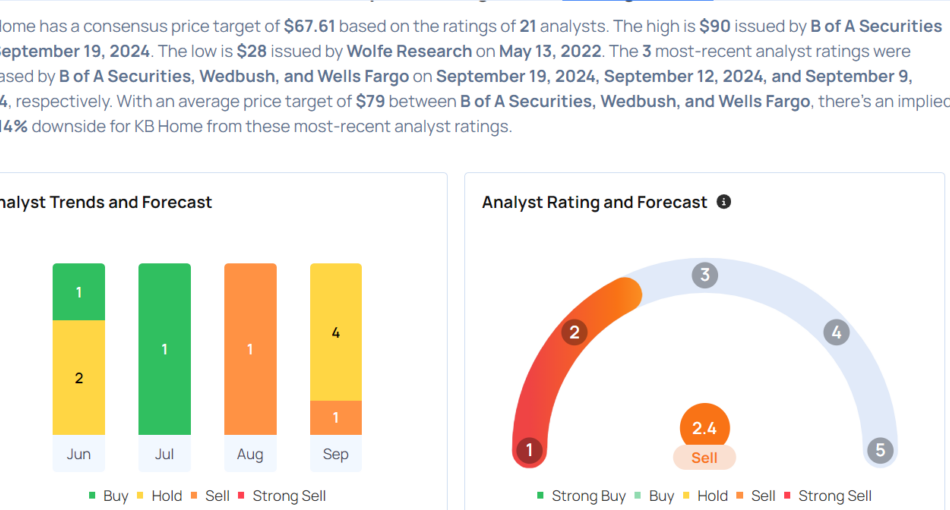

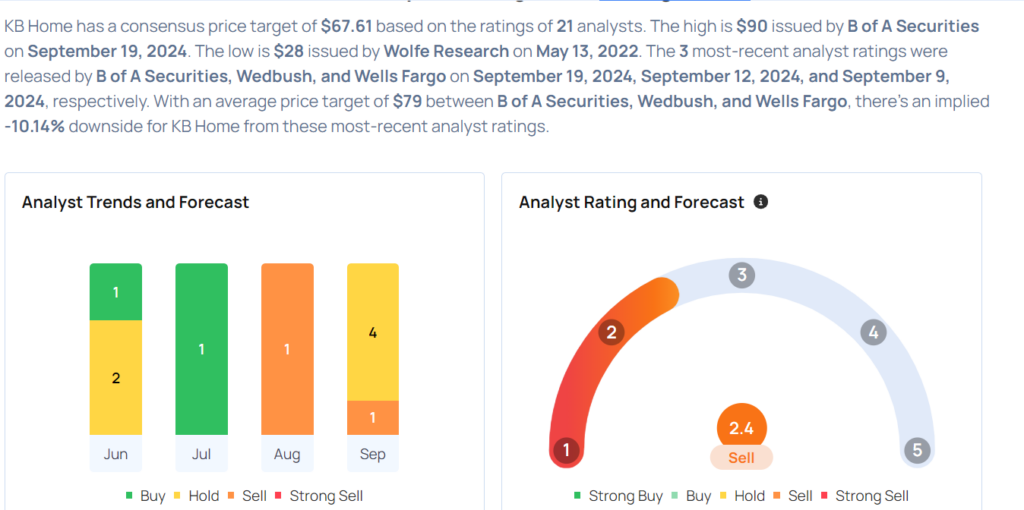

KB Home Earnings Are Imminent; These Most Accurate Analysts Revise Forecasts Ahead Of Earnings Call

KB Home KBH will release earnings results for its third quarter, after the closing bell on Tuesday, Sept. 24.

Analysts expect the Los Angeles, California-based company to report quarterly earnings at $2.06 per share, up from $1.80 per share in the year-ago period. KB Home is projected to post quarterly revenue of $1.73 billion, according to data from Benzinga Pro.

On July 18, the company’s board of directors declared a quarterly cash dividend of 25 cents per share on the company’s common stock.

KB Home shares fell 2.7% to close at $87.23 on Friday.

Benzinga readers can access the latest analyst ratings on the Analyst Stock Ratings page. Readers can sort by stock ticker, company name, analyst firm, rating change or other variables.

Let’s have a look at how Benzinga’s most-accurate analysts have rated the company in the recent period.

- B of A Securities analyst Rafe Jadrosich maintained a Neutral rating and raised the price target from $75 to $90 on Sept. 19. This analyst has an accuracy rate of 72%.

- Wedbush analyst Jay McCanless reiterated a Neutral rating with a price target of $67 on Sept. 12. This analyst has an accuracy rate of 84%.

- Wells Fargo analyst Sam Reid maintained an Equal-Weight rating and raised the price target from $70 to $80 on Sept. 9. This analyst has an accuracy rate of 85%.

- RBC Capital analyst Mike Dahl downgraded the stock from Sector Perform to Underperform with a price target of $70 on Sept. 5. This analyst has an accuracy rate of 74%.

- Goldman Sachs analyst Susan Maklari maintained a Neutral rating and increased the price target from $72 to $82 on Sept. 3. This analyst has an accuracy rate of 63%.

Considering buying KBH stock? Here’s what analysts think:

Read This Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

This Cryptocurrency Could Soar by 23,000% Over the Next 2 Decades, According to MicroStrategy's Michael Saylor

Although Bitcoin (CRYPTO: BTC) is sitting as of this writing almost 25% below its all-time high of $73,750 reached earlier this year, there are plenty of bullish crypto investors who are still convinced that Bitcoin will skyrocket over the long run. Among them is Michael Saylor, founder and executive chairman of MicroStrategy (NASDAQ: MSTR), who recently doubled down on his prediction that a single Bitcoin would be worth $13 million by the year 2045.

At last report, MicroStrategy owned 226,500 Bitcoins with a market value around $14 billion. It touts itself as “the largest corporate holder of bitcoin and the world’s first bitcoin development company.” Bloomberg reported last month that Saylor himself owns about $1 billion worth of Bitcoins.

Based on Bitcoin’s recent price of $55,000, a $13 million target represents an astronomical 23,000% return if you buy today and hold for the next two decades. Obviously, a lot has to happen for that to become a reality. Let’s take a closer look.

Bitcoin’s long-run performance

Yes, seeing a $13 million price tag for Bitcoin can induce a fair amount of sticker shock. But if you dig into the numbers, the math actually starts to make sense. And a lot of that has to do with the compounding power of money. If any asset is allowed to compound in value for a long period of time, the results have the potential to shock.

In the case of Bitcoin, it would require a compound annual growth rate (CAGR) of 30% for the magic to happen and it to jump from $55,000 now to $13 million in 2045. In other words, if Bitcoin can increase in value by 30% per year, for the next 21 years, an upfront investment of $55,000 would turn into $13 million.

And, while it may be unlikely, a CAGR of 30% for Bitcoin is not out of the question. From 2011 to 2021, Bitcoin delivered annualized returns of 230% per year. And Bitcoin returned approximately 150% in 2023. Already this year, Bitcoin is up more than 30%. Over the past five years, the only blemish was 2022, when Bitcoin fell nearly 65%.

So what can investors realistically expect? In an interview this month with CNBC, Saylor predicted that during the next two decades, Bitcoin’s annual return would steadily fall over time, from about 44% a year to 40% to 35% to 30% to 25% to… well, you get the idea. The final long-run number for Bitcoin, says Saylor, would be the annual return of the S&P 500 plus an extra 8% to compensate investors for the extra risk.

At some point, of course, it’s worth taking a moment to ponder what a price tag of $13 million really means for Bitcoin. Based on its current circulating coin supply of 20 million, that implies a future market cap of $260 trillion. That dwarfs the value of any tech stock today, and in fact, it dwarfs the value of the entire S&P 500, which today sits at around $45 trillion.

Even if we assume that U.S. stocks will grow at a rate of 10% per year over the next 20 years, a price tag of $13 million still implies that Bitcoin would represent an astonishing amount of the world’s wealth in the year 2045. For that reason alone, it’s worth having a healthy dose of skepticism about Bitcoin’s future price trajectory.

Bitcoin as an asset class

For much of its history, Bitcoin has been uncorrelated with any major asset class, and that has made it very unique from a risk diversification perspective. Quite simply, Bitcoin can zig when other assets zag.

Thus, Bitcoin is growing in favor with billionaire hedge fund managers, who increasingly view it as a way to hedge risk. In some cases, that risk might be economic, such as the risk of inflation. In other cases, that risk might be geopolitical. In the CNBC interview, Saylor uses the example of missile strikes to illustrate this point. What do you do as an investor if you wake up one morning and hear that there have been missile strikes somewhere in the world?

Until recently, the answer to that question might have been: Buy gold. But there is growing popularity in the notion that Bitcoin is “digital gold.” Some investors are buying Bitcoin, and not gold, as a hedge against worst-case scenarios popping off around the world. It sounds surprising, but Bitcoin might actually be a safe haven asset.

All of which is to say: The more that Bitcoin can cement its status as a valuable, stand-alone asset class, the more likely it is that its price could skyrocket during the next two decades. That’s because investors will be willing to allocate a greater and greater share of their portfolio to it.

Risk factors

Of course, there are several factors that could derail Bitcoin during the next two decades. For example, if Bitcoin’s annual returns decline significantly for an extended period of time, investors might just decide that they can get the same type of return, while taking on much less risk, simply by buying hot tech stocks.

Or, even worse, the U.S. political and regulatory establishment might shift against Bitcoin. For example, there might be a crackdown on Bitcoin mining, given the concerns over its environmental impact. Or, regulators in the U.S. might decide to ban Bitcoin entirely, as they’ve done in China and other nations. At the very least, the government could make things difficult for Bitcoin owners simply by making a few quick changes to the U.S. tax code.

That said, I remain bullish on Bitcoin’s long-term prospects. As long as it continues to deliver anywhere close to the type of performance that it has delivered over the past decade, investors are likely to be very pleased at Bitcoin’s valuation 20 years from now, even if it’s nowhere close to the astronomically high valuation predicted by Michael Saylor of MicroStrategy.

Should you invest $1,000 in Bitcoin right now?

Before you buy stock in Bitcoin, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Bitcoin wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $710,860!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 16, 2024

Dominic Basulto has positions in Bitcoin. The Motley Fool has positions in and recommends Bitcoin. The Motley Fool has a disclosure policy.

This Cryptocurrency Could Soar by 23,000% Over the Next 2 Decades, According to MicroStrategy’s Michael Saylor was originally published by The Motley Fool

Gold Rises to Record High Before US Data That May Give Fed Clues

(Bloomberg) — Gold climbed to a fresh all-time high ahead of US economic data that may offer clues on the path forward for further rate cuts by the Federal Reserve.

Most Read from Bloomberg

Bullion was little changed after earlier rising as much as 0.4% to a record $2,631.40 an ounce, beating the previous all-time high posted on Friday. Gold has advanced since the Fed lowered its benchmark interest rate by half a percentage point last week, building on what was already a record-setting year for the precious metal.

Traders will scrutinize comments from Fed speakers including Raphael Bostic and Austan Goolsbee later Monday, before turning their attention to US personal consumption data and jobless claims later in the week. Those could inform the central bank’s thinking on future rate cuts, which are often seen as positive for non-interest bearing gold.

“The market looks increasingly in need of consolidation, but at this point, a deep one is needed to rattle hedge funds holding the largest bet on higher prices since 2020,” according to a report from Saxo Bank A/S.

Fed Governor Christopher Waller said Friday he’d likely back quarter-point cuts at each of the next two central bank policy meetings in November and December, if the economy evolves as he expects.

Bullion’s 27% rally this year has also been supported by robust purchasing by central banks and haven demand amid ongoing conflicts in the Middle East and Ukraine.

Spot gold was steady at $2,622.49 an ounce by 11:33 a.m. in London. The Bloomberg Dollar Spot Index rose 0.1%, while the US 10-year Treasury yield was little changed. Palladium, platinum and silver all fell.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

China's Central Bank Follows Fed's Dovish Move, Cuts Key Short-Term Rates, Injects Over $10B To Boost Economy

China’s central bank has taken significant steps to support the economy by reducing a key short-term interest rate and injecting substantial liquidity into the financial system.

What Happened: The People’s Bank of China cut the 14-day reverse repurchase interest rate by 10 basis points to 1.85% and injected 74.5 billion yuan ($10.6 billion) of liquidity via this policy tool, according to its website.

Additionally, the central bank injected 160.1 billion yuan ( $10.6 billion) through 7-day reverse repo agreements, maintaining the interest rate at 1.7%, the bank stated on Monday.

Last week, the PBOC unexpectedly kept its benchmark lending rates steady, despite rising expectations for easing following the U.S. Federal Reserve’s rate cut.

Why It Matters: The recent actions by the People’s Bank of China come amid a global trend of monetary policy adjustments. On Thursday, the Bank of Japan opted to maintain its benchmark interest rate at 0.25%, diverging from the U.S. Federal Reserve’s 50 basis point cut.

On Friday, a portfolio manager noted that the Federal Reserve’s rate cut could drive investors away from money market funds and into longer duration bonds.

Additionally, Federal Reserve Governor Michelle W. Bowman defended her decision to support a smaller 25-basis-point rate cut, citing ongoing inflation concerns. This marked a historic moment as it was the first time since 2005 that a Fed governor openly disagreed with a rate decision.

Read Next:

Image Via Shutterstock

This story was generated using Benzinga Neuro and edited by Kaustubh Bagalkote

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

AAR, ShiftPixy And 3 Stocks To Watch Heading Into Monday

With U.S. stock futures trading higher this morning on Monday, some of the stocks that may grab investor focus today are as follows:

- Wall Street expects AAR Corp. AIR to report quarterly earnings at 82 cents per share on revenue of $645.50 million after the closing bell, according to data from Benzinga Pro. AAR shares edged lower to $69.26 in after-hours trading.

- ShiftPixy, Inc. PIXY announced a 1-for-15 reverse stock split. ShiftPixy shares gained 0.8% to $1.21 in the after-hours trading session.

- Analysts expect Red Cat Holdings, Inc. RCAT to post a quarterly loss at 8 cents per share on revenue of $3.85 million after the closing bell. Red Cat shares gained 0.3% to $3.14 in the after-hours trading session.

Check out our premarket coverage here

- iBio, Inc. IBIO posted a consolidated net loss of $24.9 million for the fiscal year ended June 30, versus a year-ago loss of $65.01 million. Its revenue jumped 100% to around $0.2 million. iBio shares fell 0.5% to $1.96 in the after-hours trading session.

- Before the markets open, Uxin Limited UXIN is projected to report earnings results for the first quarter. Uxin shares fell 1.6% to $1.56 in the after-hours trading session.

Check This Out:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.