General Motors To Lay Off About 1700 Employees Ahead Of Chevrolet Malibu Phase-Out And Re-Tooling For EV Production

Note: This story has been updated to add General Motors’ statement.

General Motors GM will lay off 1695 employees at its Fairfax Assembly and Stamping plant in Kansas City, according to a Worker Adjustment and Retraining Notification notice dated Sept. 19.

What Happened: The plant currently manufactures the Cadillac XT4 and the Chevrolet Malibu.

In May, GM said that the production of the Chevrolet Malibu would end in November. Production of the XT4 in Kansas will also be paused after January 2025.

The plant will then be retooled and will resume production in late 2025 with the next generation of Chevrolet Bolt EVs and the XT4, the company then said.

A General Motors spokesperson told Benzinga in a statement on Monday that the temporary layoff is aimed at facilitating the installation of new tooling at the plant until production resumes in mid-2025. GM will invest about $390 million for the retooling process, they added.

The initial layoffs, the spokesperson said, will take place in mid-November.

Why It Matters: The Chevrolet Bolt was GM’s best-selling electric vehicle until the company stopped production of its previous generation in December.

GM’s autonomous driving unit Cruise will also use the next-generation Bolt for its autonomous driving operations in the future, company CEO Mary Barra said in July.

It is unclear if the layoffs are temporary until the company resumes production later next year.

Check out more of Benzinga’s Future Of Mobility coverage by following this link.

Read More:

Photo via shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Should You Buy Super Micro Computer Stock Ahead of Its High-Profile 10-for-1 Stock Split? Here's What History Shows.

On Aug. 6, in conjunction with the results of its fiscal 2024 fourth quarter (ended June 30), Super Micro Computer (NASDAQ: SMCI), commonly called Supermicro, announced plans to initiate a 10-for-1 stock split. As a result of the split, shareholders will receive nine additional shares for each share of common stock they already own. The split will be conducted after the market closes on Monday, Sept. 30. The stock will begin trading on a split-adjusted basis on Tuesday, Oct. 1.

Stock splits tend to generate a lot of buzz among investors, and Supermicro is no different. Furthermore, the company’s robust performance over the past couple of years has fueled an eye-popping surge in the share price, as the stock has gained 433% since early last year (as of this writing).

After gains of that magnitude, investors are left to consider the question: Is Supermicro stock a buy ahead of its high-profile stock split? Let’s see what history has to say.

An object in motion tends to stay in motion

Market historians will note this is the first time Supermicro has initiated a stock split in its 17 year stint as a public company, so there’s no track record to review. Fortunately, there are other resources investors can use to provide insight into how Supermicro stock might perform post-split.

Research conducted by analysts from Bank of America revealed that companies that initiated stock splits generated returns of 25% in the 12 months after the stock split was announced, compared to returns of just 12% for the broader index, as represented by the S&P 500.

To be clear, the catalyst for the additional gains wasn’t the stock split itself but rather the strong business and financial results that precipitated the stock split.

Investors can learn valuable lessons from other fields of study, and one seems particularly fitting. Sir Isaac Newton’s first law of motion states that an object in motion tends to stay in motion unless acted upon by an outside force. In other words (and when applied to investing and stock splits), winners tend to keep winning.

By the numbers

While there is certainly the potential for short-term gains over the next year or so, long-term investors will still want to know whether Supermicro stock is a buy ahead of its high-profile stock split. A review of the company’s recent results can be instructional.

In its fiscal 2024 fourth quarter (ended June 30), Supermicro reported record revenue that soared 143% year over year to $5.31 billion while also increasing 38% quarter over quarter. This resulted in adjusted earnings per share (EPS) that jumped 78% to $6.25.

While results of that magnitude would normally be cause for celebration, investors were concerned about the company’s lower-than-expected profit margin.

In prepared remarks, CEO Charles Liang said this resulted from “the higher mix of hyperscale data center business and expedited costs of our direct liquid cooling (DLC) components in June and September quarters.”

He also noted a shortage of “key new components” that pushed $800 million in revenue into the following quarter. Finally, Liang said Supermicro’s “dominating position in DLC” and the production facility in Malaysia coming online later this year will be “instrumental in increasing our profitability.” This suggests any margin pressures will be short-lived.

For the company’s fiscal 2025 first quarter, management is guiding for revenue in a range of $6 billion to $7 billion, which would represent year-over-year growth of about 206%. The company is also forecasting adjusted EPS growth of 118% at the midpoint of its guidance.

Management clearly expects Supermicro’s growth spurt to continue.

I’d be remiss if I didn’t address the elephant in the room. The general weakness in artificial intelligence (AI) stocks of late, the aforementioned decline in its profit margin, and largely unfounded allegations by a short-seller have combined to weigh on Supermicro’s share price, currently down 63% from its peak. Investors abhor uncertainty, which explains the rampant selling. However, given the company’s continued strong performance, I’d respectfully submit the selling is overdone.

Is Supermicro a buy?

It’s still early innings for generative AI, which is the driving force behind Supermicro’s recent fortunes. According to Expert Market Research, the global AI market was estimated at $2.4 trillion in 2023 and is expected to soar more than 12-fold to $30.1 trillion by 2032, representing a compound annual growth rate of 32%.

If Supermicro continues to dominate the high-end server market, it will be well positioned to grab its share of the ongoing AI windfall. Furthermore, at just 22 times earnings and less than 2 times sales, Supermicro is attractively priced, particularly in light of the significant opportunity currently unfolding.

Given the available evidence, Super Micro Computer is a buy. And given the sizable opportunity and discounted price, I would submit that now is as good a time as any.

Should you invest $1,000 in Super Micro Computer right now?

Before you buy stock in Super Micro Computer, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Super Micro Computer wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $710,860!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 16, 2024

Bank of America is an advertising partner of The Ascent, a Motley Fool company. Danny Vena has positions in Super Micro Computer. The Motley Fool has positions in and recommends Bank of America. The Motley Fool has a disclosure policy.

Should You Buy Super Micro Computer Stock Ahead of Its High-Profile 10-for-1 Stock Split? Here’s What History Shows. was originally published by The Motley Fool

Bitcoin ETF Surge In Pre-Market As King Crypto Hits $63,500

The cryptocurrency market has seen a significant surge in pre-market activity after Bitcoin BTC/USD reached a new high of $63,500.

What Happened: Following Bitcoin’s 0.4% increase, several Bitcoin ETFs experienced a surge in pre-market activity on Monday. As per Benzinga Pro, Grayscale Bitcoin Trust GBTC rose by 1.46%, Bitwise Bitcoin ETF BITB by 1.31%, and ProShares Bitcoin Strategy ETF BITO by 1.21%. Other ETFs, including Fidelity Wise Origin Bitcoin Fund FBTC and ARK 21Shares Bitcoin ETF ARKB, also witnessed minor increases of 0.99% and 0.77%, respectively.

Reuters reported that Chris Weston, head of research at Pepperstone, attributed the surge to the “goldilocks macro backdrop,” which he believes is the primary driver of the current upward momentum. He also noted that Bitcoin’s rallies tend to be powerful, sparking significant FOMO (fear of missing out) among crypto investors.

See Also: Trump’s New Crypto Venture’s Legal Counsel Accused Of Attempting To Seize Control Of Rival Firm

Why It Matters: This surge in Bitcoin ETFs comes on the heels of a recent report by 10x Research, which suggested that Bitcoin’s correction phase may have ended. The report indicated a potential surge towards the $70,000 mark, with trading signals showing a favorable buying opportunity for Bitcoin and Ethereum.

Earlier in September, a viral story about a GameStop customer who turned a $33 trading card pack into a full Bitcoin worth over $60,000 also highlighted the growing influence of cryptocurrency in mainstream markets.

Read Next:

Photo courtesy: Unsplash

This story was generated using Benzinga Neuro and edited by Pooja Rajkumari

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Is It Too Late to Buy QuantumScape Stock?

QuantumScape (NYSE: QS) stock is up 6% over the past six months, but down 34% from its high-water mark over that span. This is a volatile stock, to put it mildly, noting that the shares have fallen around 95% from their all-time highs, reached in late 2020. Is it too late to invest in QuantumScape? Probably not. But this is not an investment for the faint of heart.

What does QuantumScape do?

A cynic would say that QuantumScape’s business is to spend money. That’s because, at this point in time, it doesn’t generate any revenue. Basically, the company is trying to build a solid-state lithium-metal battery that it can sell to customers. The key target right now is the electric vehicle (EV) niche of the automobile sector. But management hopes to spread beyond that in the future.

The only problem is that it doesn’t actually have a technology to sell just yet. It is still in development. That’s why research and development (R&D) is the first item you’ll see on the company’s income statement. It is a huge cost, too, totaling $97.7 million in the second quarter of 2024. With no revenue, that’s a big nut to crack every quarter.

That’s why it is so important that QuantumScape has $196 million in cash and $741 million in marketable securities on its balance sheet. That gives the company some breathing room to keep spending, but when you are burning through nearly $100 million per quarter on R&D, even $900 million doesn’t provide that long of a runway. And given how far QuantumScape stock has fallen from its all-time highs, you aren’t too late to buy. In fact, it might still be too early to buy.

QuantumScape adjusts its Volkswagen partnership

One of the big selling points for QuantumScape as it pitches its stock to investors is a partnership with Volkswagen. It is not exclusive, so QuantumScape is free to sell its technology to other companies, but it still provides a valuable partner on the production front and a potential long-term customer. That’s great news, but there’s still no product.

Given the cash burn, QuantumScape and Volkswagen recently reworked their partnership. There are small details here, but the big story is that the new agreement will lengthen the company’s cash runway into 2028, extending the company’s previous guidance by 18 months. From a glass-half-full perspective, that sounds really good, since there’s more time to develop QuantumScape’s solid-state lithium-metal battery.

From a glass-half-empty perspective, however, the company is warning investors that it will run out of money in 2028. If it doesn’t have a product to sell by that point, or find another way to raise cash, QuantumScape could be in big financial trouble. It’s little wonder that the stock has fallen so far from its all-time highs. Investors who buy the stock are basically making a bet that the company can develop and commercialize a novel battery technology and sell it into the fast-evolving EV space. That’s a tall order.

Making progress, but most investors should watch from the sidelines

QuantumScape appears to be progressing its technology, so it isn’t like management is just throwing money away. Still, the company doesn’t yet have a product and is likely to continue to lose money for at least several more years. Sure, the story here is exciting, but a lot of things have to go right for this to be a worthwhile investment. Most investors should probably wait for QuantumScape to hit a few more development milestones before investing. Right now, this is a stock that is only appropriate for aggressive investors. Even then, however, it looks like there’s still plenty of time to watch and learn before you actually buy the stock.

Should you invest $1,000 in QuantumScape right now?

Before you buy stock in QuantumScape, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and QuantumScape wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $710,860!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 16, 2024

Reuben Gregg Brewer has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Volkswagen. The Motley Fool recommends Volkswagen Ag. The Motley Fool has a disclosure policy.

Is It Too Late to Buy QuantumScape Stock? was originally published by The Motley Fool

Prediction: These 2 Artificial Intelligence (AI) Stocks Are About to See Massive Growth

Artificial intelligence (AI) stocks have roared higher in recent times — and for good reason. This exciting technology already is driving enormous revenue growth at companies making AI products and services — and customers are investing in these tools due to the promise of AI to revolutionize their businesses. For example, AI may accelerate the development of new and better drugs or make vehicles safer and easier to operate.

Investors, recognizing this promise, have piled into AI stocks, and these players have helped the S&P 500 index climb nearly 20% so far this year. Though companies in the field of AI have seen their shares soar, it’s not too late to get in on many compelling players. In fact, it’s a great time to invest in two in particular — my prediction is these AI companies are about to see massive growth. Let’s check them out.

1. Palantir Technologies

Palantir Technologies (NYSE: PLTR) helps its customers aggregate their complex web of data and put it to work — so they can integrate this data into their strategies and harness its power to make key decisions. For most of its history, the 20-year-old company counted on government contracts to drive revenue growth. But, in recent times, a new growth driver has emerged.

Palantir’s commercial business has taken off, helped by the company’s investment in AI. Last year, Palantir launched its Artificial Intelligence Platform (AIP), an AI-powered system that helps customers quickly zoom in on their data and discover how it can help advance their business goals. The company even has created a genius way of selling the platform to potential customers — by holding bootcamps that allow them to get a taste of its capabilities.

And this long-established company’s new bet is paying off. AIP is driving revenue in the government and commercial businesses — and commercial now is its highest-growth business. In the most recent quarter, U.S. commercial revenue advanced 55% compared with a 24% gain for U.S. government revenue. Palantir had only 14 commercial clients four years ago, and today it has nearly 300, illustrating the progress made in a short period of time.

AIP’s rather recent launch, the high demand for the platform, and the commercial numbers we’ve seen so far suggest that explosive growth for Palantir may be right around the corner. And that means the stock could have plenty of room to run — even after recent gains — over the long haul.

2. Super Micro Computer

Super Micro Computer (NASDAQ: SMCI) is a key behind-the-scenes player in the world of AI. The company makes the equipment crucial to the operations of AI data centers — from workstations to full-rack scale solutions. Supermicro isn’t the only equipment maker around, but it has managed to grow five times faster than the industry average over the past 12 months.

The reason for the company’s success? It works hand-in-hand with the world’s top chip designers — including market leader Nvidia — in order to immediately integrate their innovations into its products. Supermicro’s building blocks technology — with most products involving similar parts — also favors speed. So, customers know they can quickly get a product tailored to their data centers with the latest technology when they order from Supermicro.

This has driven major growth at the equipment company, with quarterly revenue this year soaring past the level of annual revenue as recently as 2021. In the most recent quarter, revenue came in at $5.3 billion, a gain of more than 140% year over year.

On top of this, a new wave of growth may be ahead. Supermicro is well positioned to solve one of the biggest problems facing AI data centers, and that’s the accumulation of heat. This is thanks to the company’s direct liquid cooling (DLC) technology. Supermicro says that over the coming 12 months, as much as 30% of new data centers will be equipped with DLC — and Supermicro will dominate that market.

So, my prediction is this equipment giant that already has delivered growth is heading for yet a new wave of lasting revenue gains — and that’s reason to be optimistic about its stock performance over the long term.

Should you invest $1,000 in Palantir Technologies right now?

Before you buy stock in Palantir Technologies, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Palantir Technologies wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $710,860!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 16, 2024

Adria Cimino has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Nvidia and Palantir Technologies. The Motley Fool has a disclosure policy.

Prediction: These 2 Artificial Intelligence (AI) Stocks Are About to See Massive Growth was originally published by The Motley Fool

Asian stocks climb after Wall Street closes its record-setting week mixed

HONG KONG (AP) — Global stocks were mixed on Monday following a series of key interest rate decisions last week by the U.S. Federal Reserve, Japan, China, and Britain.

The CAC 40 in Paris slipped 0.3% to 7,481.56 after the composite factory activity data for September fell below the 50 threshold that separates expansion from contraction, signaling the strong growth in the French economy seen in August has evaporated.

A similar update on Germany’s manufacturing sector, showed the HCOB Manufacturing PMI, or purchasing managers index, in September falling to 40.3, below expectations. Germany’s DAX added 0.4% to 18,796.33. In London, the FTSE 100 rose 0.4% to 8,258.47.

The futures for the S&P 500 and the Dow Jones Industrial Average were little changed.

Chinese stocks got a lift after the central bank lowered its 14-day reverse repurchase rate to 1.85% from 1.95% on Monday after opting to keep key lending rates unchanged last week. Markets had been anticipating a cut. Meanwhile, officials said People’s Bank of China Governor Pan Gongsheng would hold a news briefing to address support for the economy.

The Hang Seng in Hong Kong slipped 0.2% to 18,226.58 while the Shanghai Composite index added 0.4% to 2,748.92.

Markets in Japan were closed on Monday for a public holiday.

Japan’s monetary policy remained in the spotlight after the Bank of Japan announced on Friday that it would keep its benchmark rate unchanged at 0.25%.

That weakened the Japanese yen, which tumbled back from last week’s peak of around 140 to the U.S. dollar. The dollar was trading at 143.56 yen on Monday.

Elsewhere, Australia’s S&P/ASX 200 lost 0.7% to 8,152.90. The Reserve Bank of Australia begins a two-day policy meeting on Monday.

South Korea’s Kospi climbed 0.3% to close at 2,602.01.

On Friday, the S&P 500 slipped 0.2% from its record, closing at 5,702.55. The Nasdaq composite fell 0.4% 17,948.32. The Dow Jones Industrial Average, meanwhile, added 0.1% to close at another record high, at 42,063.36.

Last week the Fed cut its main interest rate for the first time in more than four years, with more likely to come, ending a long run where it kept that rate at a two-decade high in hopes of slowing the U.S. economy enough to stamp out high inflation. Inflation has subsided from its peak two summers ago and Chair Jerome Powell said the Fed can focus more on keeping the job market solid and the economy out of a recession.

The Fed is still under pressure because hiring has begun to slow under the weight of higher interest rates. Some critics say the central bank waited too long to cut rates and may have damaged the economy.

Critics also say the U.S. stock market may be running too hot on the belief the Federal Reserve will pull off what seemed nearly impossible earlier: getting inflation down to 2% without creating a recession.

Last week, also, the Bank of England kept its main interest rate on hold at 5% in the wake of the Fed’s move.

This week will bring preliminary reports on U.S. business activity, the final revision for how quickly the economy grew during the spring and an update on spending by U.S. consumers.

In other dealings early Monday, U.S. benchmark crude oil lost 12 cents to $70.88 per barrel. Brent crude, the international standard, gave up 8 cents to $74.41 per barrel.

The euro fell to $1.1096 from $1.1162.

Billionaire Ken Griffin Just Sold 9.3 Million Shares of Nvidia and Bought This Other Artificial Intelligence (AI) Stock That's Headed to the S&P 500 Instead

From sifting through investor presentations and corporate filings to listening to earnings calls and watching interviews, getting a firm gauge on an investment often requires a lot of work.

One thing that I like to do is analyze 13F filings. These are forms filed by investment firms managing over $100 million in stocks. One of the more high-profile hedge funds is Ken Griffin’s Citadel. Last quarter, Citadel reduced its stake in Nvidia (NASDAQ: NVDA) by 79% — dumping 9,282,018 shares. In addition, the firm increased its position by 1,140% in Palantir Technologies (NYSE: PLTR), scooping up 5,222,682 shares.

Let’s dig into what may have compelled Griffin and his portfolio managers to sell Nvidia and buy Palantir. Moreover, I’ll explore what catalysts could help fuel even more growth for Palantir — and why now could be a great time to follow Griffin’s lead.

Why sell Nvidia right now?

On the surface, selling Nvidia stock might look like a questionable move. After all, isn’t artificial intelligence (AI) the next big thing?

Well, even if AI ends up being the generational opportunity it’s being touted to be, that doesn’t mean a whole lot at face value. There are many components to the foundations of AI, and Nvidia’s expertise in the development of advanced chipsets called graphics processing units (GPU) is just one of many building blocks supporting artificial intelligence.

The biggest bear narrative surrounding Nvidia stems from rising competition. At present, products developed by Advanced Micro Devices and Intel are the most obvious alternatives to Nvidia. However, I see a bigger risk in the competitive landscape.

Namely, Nvidia’s big tech cohorts including Tesla, Meta Platforms, Microsoft, and Amazon are all investing heavily into their own hardware development. Considering that many of these companies are Nvidia’s own customers, I’m wary that the company’s current growth trajectory is sustainable in the long run.

When more GPUs come to market, there is a good chance this technology will be viewed as somewhat commoditized. Such a dynamic will likely lead to lower prices for Nvidia, which will subsequently bring decelerating revenue, margins, and profits.

All told, I don’t really blame Griffin for selling such a large portion of his Nvidia position. Despite the company’s success so far, its future prospects look potentially questionable.

Why buy Palantir right now?

In a different area of the AI landscape sits enterprise software company Palantir. It offers four data analytics platforms called Foundry, Gotham, Apollo, and AIP. The company’s software is used across a host of use cases throughout the U.S. military and private sector.

Investors can see that over the last couple of years, Palantir’s revenue accelerated on the backdrop of a bullish AI narrative. More importantly, the company’s operating leverage has improved dramatically in the form of margin expansion and consistent profitability.

Earlier this month, Palantir also achieved the notable milestone of inclusion in the S&P 500.

Should you buy Palantir stock right now?

I can’t say for certain why Griffin increased his stake in Palantir so much last quarter, but I do find the timing interesting for one particular reason. Palantir has been eligible for the S&P 500 before but was not initially chosen. Perhaps some thought Palantir’s newfound growth was purely an extension of demand for AI software and would not be sustainable in the long run.

Whatever the case, I think those who have followed Palantir for a long time understood that the company’s long-run prospects looked solid — regardless of the current AI narrative. Bearing that in mind, it was reasonable to think that the company would be included in the S&P 500 eventually.

This leads me to a broader point. Now that Palantir is in the S&P 500, there is a good chance more investment banks and research analysts will begin following the company more closely. In turn, this could lead to an increase in institutional investors buying the stock. Over time, this could strengthen Palantir’s brand and perception in the investment community and bring the stock to even higher prices.

I think there is a good chance Palantir will witness a rise in institutional ownership. The company is quickly emerging as a force in the AI software arena, and has even attracted the likes of Microsoft and Oracle — two relationships that I think will bring even further growth to the company.

I very much see even better days ahead for Palantir, and think now is a great time to buy shares. With so many catalysts fueling the company’s upside, I see Griffin swapping Nvidia for Palantir as a particularly savvy move.

Should you invest $1,000 in Palantir Technologies right now?

Before you buy stock in Palantir Technologies, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Palantir Technologies wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $710,860!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 16, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Adam Spatacco has positions in Amazon, Meta Platforms, Microsoft, Nvidia, Palantir Technologies, and Tesla. The Motley Fool has positions in and recommends Advanced Micro Devices, Amazon, Meta Platforms, Microsoft, Nvidia, Oracle, Palantir Technologies, and Tesla. The Motley Fool recommends Intel and recommends the following options: long January 2026 $395 calls on Microsoft, short January 2026 $405 calls on Microsoft, and short November 2024 $24 calls on Intel. The Motley Fool has a disclosure policy.

Billionaire Ken Griffin Just Sold 9.3 Million Shares of Nvidia and Bought This Other Artificial Intelligence (AI) Stock That’s Headed to the S&P 500 Instead was originally published by The Motley Fool

JD Vance says he's worried about a 'death spiral' in the US bond market. Here's what he's talking about.

-

JD Vance warned recently of a “death spiral” in the US bond market.

-

Vance’s concerns are tied to the US servicing its $35 trillion debt load.

-

“Do they try to take down the Trump presidency by spiking bond rates?” JD Vance asked.

Vice Presidential candidate JD Vance worries about soaring interest rates sparking a “death spiral” in the US bond market that could ultimately “take down the finances of this country.”

Vance made the comments in a recent interview with conservative political commentator Tucker Carlson, adding that if he and Trump win the November election, it won’t be “smooth sailing for four years” due to the risk of spiking interest rates.

“I really worry about, do the bond markets, do the international investors, the people who are getting rich off of globalization, the people who have gotten rich from shipping our manufacturing base to China, the people who’ve gotten rich from a lot of wars, do they try to take down the Trump presidency by spiking bond rates?” Vance asked.

Vance’s concern stems from the fact that America’s servicing of its $35 trillion debt pile was the federal government’s fourth largest expenditure in 2023 at $659 billion, up 38% from the $476 billion paid in 2022.

According to the Committee for a Responsible Federal Budget, a bipartisan policy think tank, government spending on net interest on the debt is on track to surpass government spending on defense and Medicare to become its second largest expense in 2024, just behind Social Security.

Vance worries that the spending could balloon even further if bond yields.

“We have call it $1.6 to $2 trillion in debt every single year in this country getting added to the national debt. And the only thing that really makes that serviceable is the interest rates are still pretty low. Right? They’re about 4.5% right now. If interest rates go to 8%, and you’re actually spending way more to service the debt than you are on actual goods, services and infrastructure for your country, like that can become a huge spiral,” Vance said.

As to how rates would spike to 8%, there has long been a fear that foreign countries could dump their holdings of US Treasurys all at once, sparking an imbalance in supply and demand and sending interest rates soaring (bond yields rise as prices fall).

Vance pointed to the 2022 resignation of former UK Prime Minister Liz Truss as an example of how this could play out.

“She came in, she had a plan, and the Bank of England I think made a lot of mistakes, maybe intentional, interest rates shot through the roof and it took down her government in a matter of days,” Vance said.

Interactive Brokers chief strategist Steve Sosnick notes that this fear is not new, and Vance is voicing concerns that have acted like a boogeyman for bond market investors for a long time.

“This has been a constant, underlying concern for bond investors for years,” Sosnick told Business Insider.

Sosnick said in his own recent conversations with bond investors, discussions “eventually pivoted to when long bond yields might reflect concerns about our ability to service the debt.”

He added: “The consensus was, someday maybe it could occur; but who knows when. Though if it does happen, it would likely be rather sudden.”

Sosnick said these same concerns had been raised in Japan for decades and they’ve yet to materialize.

As to the UK’s interest rate spike that hurt Liz Truss, that was “specific to the way that British pension funds handled their rate risks, not a flight from the overall credit worthiness of UK gilts,” Sosnick explained.

Ultimately, Vance’s concern about the US debt and potential for soaring interest rates “is not trivial,” Sosnick said, but when it’s coming from a politician of either party, investors should take it with a grain of salt.

“Comments like those, if made analytically, can and should be part of a responsible discussion about debt and deficits. But when a politician of either party raises problems without offering solutions it comes off more as scare mongering or blame shifting than a search for responsible policies,” Sosnick said.

As to where US interest rates seem to be going in the near future, the answer is lower.

Read the original article on Business Insider

This Stock Is Crushing Nvidia's Performance This Year: Is It Too Late to Buy?

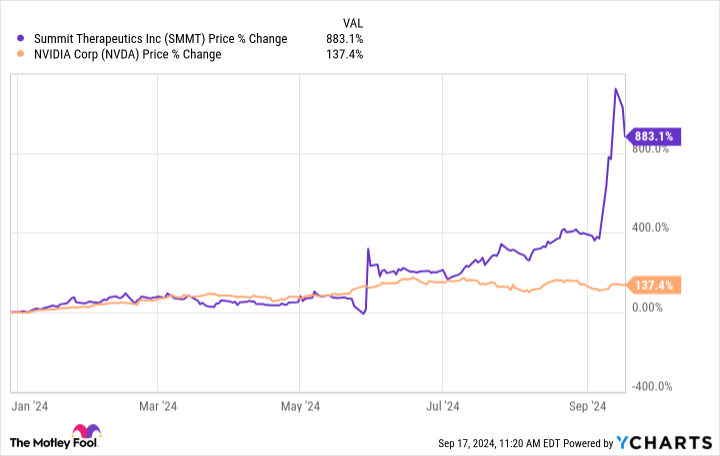

Few companies have attracted more attention this year than Nvidia. The chipmaker is on a roll thanks to the rapid rise of artificial intelligence, and its revenue, earnings, and stock price continue to grow incredibly fast. Nvidia’s shares are up by 137% this year.

Some companies have performed even better, including one many investors may never have heard about: Summit Therapeutics (NASDAQ: SMMT). The biotech’s performance this year makes Nvidia’s look mediocre: Summit’s shares are up by almost 900% year to date.

What exactly is driving this performance? Are Summit Therapeutics’ shares still attractive? Let’s find out.

Summit is taking on a giant

Summit focuses on developing cancer medicines. As is usually the case when a drugmaker rises this fast, it owes its recent run of form to excellent clinical progress related to its leading pipeline candidate, ivonescimab.

Originally developed by a China-based company called Akeso, Summit entered into an agreement with the former to license the drug in certain countries, including the U.S., in exchange for an up-front payment, potential development and sales milestones, and royalties. Ivonescimab is already approved in China for a particular variant of lung cancer.

It recently aced a phase 3 clinical trial in the country in treating another variant of non-small cell lung cancer (NSCLC). Ivonescimab was pitted against Merck‘s Keytruda, the standard of care in NSCLC and the best-selling drug in the world since last year, in this phase 3 study.

In the trial, ivonescimab led to a median progression-free survival of 11.14 months, compared to Keytruda’s 5.82 months. It also reduced the risk of disease progression or death by 49% compared to Keytruda and posted a similar safety profile.

According to Summit, ivonescimab is the first drug to post better clinical results than Keytruda in a phase 3 study in NSCLC.

Ivonescimab’s potential

Although Keytruda has earned dozens of indications worldwide, NSCLC is unquestionably one of its biggest growth drivers. According to the World Health Organization, lung cancer was the second most-common cancer in the world as of 2020. However, it was the leading cause of cancer death.

About 85% of lung cancer cases are of the NSCLC variety. In 2017, about 40% of Keytruda’s sales came from the various indications it has earned in treating NSCLC, although that has likely changed as the drug’s indications expanded.

But using this as a baseline, and considering that Keytruda generated $25 billion in sales last year, about $7 billion to $10 billion of it could have come from NSCLC indications. Ivonescimab, if approved in the U.S., Canada, Japan, and other countries where Summit owns the rights to license it, could capture much of that revenue and redirect it toward Summit’s financials.

The medicine is also being investigated in other indications, including colorectal cancer, the second leading cause of cancer death in the world.

Is Summit a buy?

There is no question that Summit has a winner in ivonescimab, a medicine that could become a “pipeline in a drug,” just like Keytruda. The problem for investors is that the market has already priced some of ivonescimab’s success into the shares. Despite not having a single drug on the market, the company is worth $17 billion. The stock could fall off a cliff at these levels if anything goes wrong with its leading pipeline candidate.

The good news is that funding likely won’t be an issue. Summit ended the second quarter with $325.8 million in cash and equivalents, which the company said could help it run its operations until the fourth quarter of 2025. Since then, it has raised even more money, taking advantage of ivonescimab’s recent success.

Summit Therapeutics does look a little risky, but ivonescimab’s potential makes it worth it for biotech investors who can stomach the risk. If the company can continue posting ivonescimab-related wins, the stock might be highly lucrative in the long run.

Should you invest $1,000 in Summit Therapeutics right now?

Before you buy stock in Summit Therapeutics, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Summit Therapeutics wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $710,860!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 16, 2024

Prosper Junior Bakiny has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Merck, Nvidia, and Summit Therapeutics. The Motley Fool has a disclosure policy.

This Stock Is Crushing Nvidia’s Performance This Year: Is It Too Late to Buy? was originally published by The Motley Fool

40-Year-Old Dividend Investor Earning $4,400 Per Month Shares His Portfolio Of Stocks and ETFs: Their Top 10 Picks

Benzinga and Yahoo Finance LLC may earn commission or revenue on some items through the links below.

The Federal Reserve’s 50bps rate cut has spooked many, as most Wall Street analysts were not expecting an aggressive policy easing from the central bank. Investors are now questioning the true state of the economy and weighing the likelihood of a potential recession.

One of the benefits of investing in reliable, long-term dividend stocks is that you are almost always well-positioned to survive any market downturn or recession and thrive during bull markets.

Trending Now:

About five months ago, a Redditor on r/Dividends shared his detailed income report and portfolio, saying he earns about $53,500 in annual dividend income and roughly $4,400 per month. The investor, who is 40 years old, has a goal of reaching $100,000 in annual dividend income.

The Redditor shared all his portfolio positions with details about the total number of shares and amount invested in each stock/ETF. Let’s look at some of the biggest positions in this high-dividend portfolio.

ConocoPhillips

ConocoPhillips (NYSE:COP) was the biggest position in the Redditor’s portfolio, earning $4,400 per month. The energy company has a dividend yield of about 3%. Earlier this year, ConocoPhillips said it would buy Marathon Oil for $22.5 billion.

Phillips 66

With 1450 shares, Phillips 66 (NYSE:PSX) was the second-biggest holding of the Redditor, who earned $4,400 per month in dividends. The energy manufacturing and logistics company has a dividend yield of 3.5% and has raised its dividends for more than 10 consecutive years.

NEOS Nasdaq-100 High Income ETF

NEOS Nasdaq-100 High Income ETF (NASDAQ:QQQI) exposes investors to Nasdaq 100 companies and generates income by selling covered call options on the index. It pays a monthly income and has a yield of about 15%. Over the past year, QQQI has been up 1.5%.

JPMorgan Nasdaq Equity Premium Income ETF

The Redditor, earning about $4,400 per month in dividends, said he had 1150 JEPQ shares in his portfolio. JPMorgan Nasdaq Equity Premium Income ETF (JEPQ) is a high-yield covered call ETF that distributes monthly dividend income. The ETF invests in Nasdaq companies and generates extra income by selling call options.

Schwab U.S. Dividend Equity ETF

Schwab U.S. Dividend Equity ETF (NYSE:SCHD) tracks the Dow Jones U.S. Dividend 100 Index and gives you exposure to some of the top dividend stocks trading in the U.S., including Home Depot, Coca-Cola, Verizon, Lockheed Martin, Pepsi, and AbbVie among others. SCHD’s holdings are mostly conservative dividend payers, making it suitable for investors close to retirement looking for consistent dividend income. The ETF yields about 3.4%.

Verizon Communications

With over 6% yield and 18 straight years of dividend growth, Verizon Communications Inc. (NYSE:VZ) is a popular dividend stock among income investors. The Redditor earning $4,400 in monthly dividends had 1300 VZ shares in his portfolio.

See More:

-

This billion-dollar fund has invested in the next big real estate boom, here’s how you can join for $10.

This is a paid advertisement. Carefully consider the investment objectives, risks, charges and expenses of the Fundrise Flagship Fund before investing. This and other information can be found in the Fund’s prospectus. Read them carefully before investing. -

Private markets have historically outperformed stocks in every downturn of the past 15 years — build your diversified portfolio.

Ares Capital

Business development and investment company Ares Capital Corporation (NASDAQ:ARCC) yields about 9.4% and has gained popularity among Redditors. Oppenheimer recently published a list of stock recommendations heading into the U.S. elections. The firm believes Ares Capital stands to benefit under both Republican and Democrat administrations.

iShares National Muni Bond ETF

iShares National Muni Bond ETF (MUB) is a municipal ETF that generates monthly income for shareholders. The biggest benefit of this ETF is that its gains are exempt from taxes. MUB tracks investment-grade U.S. municipal bonds and yields about 2.9%.

AT&T

AT&T Inc. (NYSE:T) yields about 5% and the stock has gained about 25% this year. UBS recently called AT&T its top pick in the cable, satellite, and telecom services sector. The firm believes AT&T can sustain its core profitability growth, low churn and fiber gains. The Redditor, earning about $4,400 per month in dividends, had 2,400 T shares in his portfolio.

Vanguard High Dividend Yield Index Fund ETF

Vanguard High Dividend Yield Index Fund ETF (NYSE:VYM) provides exposure to some of the most established and safe dividend stocks, including ExxonMobil, Coca-Cola, Walmart, and Home Depot. The ETF tracks the FTSE High Dividend Yield Index.

Interest Rates Are Falling, But These Yields Aren’t Going Anywhere

Lower interest rates mean some investments won’t yield what they did in months past, but you don’t have to give up those gains. Certain private market real estate investments are giving retail investors the opportunity to capitalize on these high-yield opportunities and Benzinga has identified some of the most attractive options for you to consider.

Arrived Homes, the Jeff Bezos-backed investment platform, offers a Private Credit Fund. This fund provides access to a pool of short-term loans backed by residential real estate with a target of 7% to 9% net annual yield paid to investors monthly. The best part? Unlike other private credit funds, this one has a minimum investment of only $100.

Don’t miss out on this opportunity to take advantage of high-yield investments while rates are high. Check out Benzinga’s favorite high-yield offerings.

This article 40-Year-Old Dividend Investor Earning $4,400 Per Month Shares His Portfolio Of Stocks and ETFs: Their Top 10 Picks originally appeared on Benzinga.com