1 Brilliant Growth Stock to Buy Now. It Could Join Apple, Nvidia, and Amazon as a $1 Trillion Company by 2040.

Six publicly traded U.S. companies have market values of at least $1 trillion. From largest to smallest, that elite group includes Apple, Microsoft, Nvidia, Alphabet, Amazon, and Meta Platforms. But more companies will join the list as the global economy expands in the coming years.

For instance, Shopify (NYSE: SHOP) is currently worth $101 billion, but its market value could reach $1 trillion before 2040. If that happens, Shopify stock will return 890% over the next 15 years, which equates to 16.5% annually.

Here’s what investors should know about this brilliant growth stock.

Shopify is a leader in e-commerce and omnichannel software

Shopify is the market leader in e-commerce and omnichannel commerce software. What sets the company apart is its unique ability to simplify retail. Its platform lets merchants run their businesses across physical and digital channels from a single dashboard. It integrates with online marketplaces like Amazon and social media platforms like Meta’s Facebook and Instagram, and it helps merchants build direct-to-consumer websites.

Shopify also offers adjacent solutions for marketing, payments, and logistics and addresses back-office functions like tax compliance, bill payments, and fraud protection. Additionally, the company caters to larger brands with Shopify Plus and Commerce Components. The former is an enterprise-grade platform with more sophisticated features than Shopify’s standard software, and the latter lets enterprises build commerce platforms from scratch, using individual parts of Shopify’s technology stack.

Importantly, Shopify Plus and Commerce Components include solutions for business-to-business (B2B) e-commerce, also called wholesale. According to Grand View Research, this market is three times bigger and growing two times faster than retail e-commerce. In the second quarter, Forrester Research named Shopify a leader in B2B commerce tools, citing rapid product development and artificial intelligence features as key strengths.

Collectively, the wholesale and retail e-commerce markets are expected to grow at 18.9% annually through 2030. But Shopify’s sales growth should outpace the industry average. Its ability to simplify commerce is a compelling value proposition for businesses of all sizes, and the company has proven itself adept at deepening its relationship with merchants over time.

Shopify looked strong in the second quarter

Shopify reported strong financial results in the second quarter. Gross merchandise volume (GMV) jumped 22% to $67 billion, and revenue increased 21% to $2 billion. But revenue increased 25%, excluding the impact of the logistics business, which Shopify sold in the second quarter last year. Meanwhile, non-GAAP (generally accepted accounting principles) net income increased 85% to $0.26 per diluted share.

Management highlighted strong momentum in wholesale, physical retail, and international commerce, three growth vectors where the company has made a concerted effort to gain share. Specifically, wholesale GMV more than doubled, offline GMV increased by 27%, and the number of international merchants on the platform increased by 30% during the second quarter.

Looking ahead, Shopify still has plenty of room to grow its business. The company has captured less than 2% of its serviceable addressable market, which it values at $404 billion. Moreover, management believes that opportunity will reach $849 billion as the company expands into new geographies.

How Shopify can become a trillion-dollar company before 2040

Wall Street forecasts Shopify’s revenue will grow at 21% annually through 2027. That is plausible, given that global e-commerce sales are projected to increase at 18.9% annually through 2030. Assuming revenue growth decelerates gradually, Shopify’s top line could compound as quickly as 16% annually over the next 15 years.

In that scenario, the company’s trailing-12-month revenue would reach $71.9 billion after the quarter ending in June 2039. At that point, if shares trade at 14 times sales, a discount to the three-year average of 15.4 times sales, Shopify would be worth $1 trillion. That implies annual shareholder returns of 16.5% over the next 15 years.

However, the stock would still compound at 11.2% annually, even if Shopify was only worth $500 billion by 2039. Returns of 11%-plus would almost certainly beat the benchmark S&P 500. In other words, even if my $1 trillion prediction is 50% too high, Shopify shareholders could still see market-beating returns over the next 15 years.

Should you invest $1,000 in Shopify right now?

Before you buy stock in Shopify, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Shopify wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $710,860!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 16, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Trevor Jennewine has positions in Amazon, Nvidia, and Shopify. The Motley Fool has positions in and recommends Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia, and Shopify. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

1 Brilliant Growth Stock to Buy Now. It Could Join Apple, Nvidia, and Amazon as a $1 Trillion Company by 2040. was originally published by The Motley Fool

Stocks Gain on Chinese Stimulus Bets, Gold Climbs: Markets Wrap

(Bloomberg) — The euro slumped and German yields fell as weaker-than-expected data fueled concern the region’s economic recovery has hit a wall, spurring wagers on more aggressive rate cuts from the European Central Bank.

Most Read from Bloomberg

The common currency weakened 0.7% against the dollar, heading for its steepest daily decline since June. The gap between French and German benchmark yields climbed to the highest level since early August.

European stocks fluctuated, with so-called defensive plays in the food, telecoms, real estate and utilities sectors faring best. US futures pointed to a flat open on Wall Street with indexes hovering near record highs after the Federal Reserve’s jumbo rate cut last week.

Investors are increasingly wary of European assets as the region’s manufacturing downturn deepens and political turmoil in France continues. Weak PMI data for France and Germany on Monday was followed by numbers that showed the euro-area’s private-sector economy shrank for the first time since March.

“The market is almost demanding a more aggressive rate cut, especially after what we have seen the Fed has done,” Marija Veitmane, senior multi-asset strategist at State Street, said on Bloomberg TV. The ECB “is definitely behind the curve,” she said.

Investors will be watching for speeches from Fed officials on Monday for fresh insight on the pace and scope of easing. Further out, the Fed’s preferred price metric and data on US personal spending will be in focus on Friday.

In Europe, the composite Purchasing Managers’ Index by S&P Global dropped to 48.9 in September from 51 the previous month — below the 50 threshold separating growth from contraction. Analysts had expected the measure to slip only marginally, to 50.5.

The widening yield gap between France and Germany shows investors remain on edge over France’s political and fiscal challenges. French Prime Minister Michel Barnier said his new government could increase taxes for big business and the wealthiest as it seeks to repair runaway budget deficits.

The spread, a proxy for French risk, climbed to 80 basis points, the widest since Aug. 5. It’s been trading significantly wider since President Emmanuel Macron called a surprise election in June, spooking investors over the country’s ability to bring its large deficit under control long-term.

Elsewhere, Asian markets were lifted by speculation China is close to announcing fresh stimulus, after a cut to a short-term policy rate and a rare economic briefing scheduled for Tuesday.

“The start of the Fed easing cycle should lead to more stimulus from China, particularly as the 5% growth target seems difficult to achieve,” Mohit Kumar, chief strategist and economist for Europe at Jefferies International Ltd., wrote in a note. The “stimulus measures should also be beneficial for Europe.”

Gold touched a record high earlier before paring the move, as the worsening strife in the Middle East fueled wagers on further price gains in the metal due to its haven status.

Key events this week:

-

UK S&P Global Manufacturing PMI, S&P Global Services PMI, Monday

-

Australia rate decision, Tuesday

-

Japan Jibun Bank Manufacturing PMI, Services PMI, Tuesday

-

Mexico CPI, Tuesday

-

Bank of Canada Governor Tiff Macklem speaks, Tuesday

-

Australia CPI, Wednesday

-

China medium-term lending facility rate, Wednesday

-

Sweden rate decision, Wednesday

-

Switzerland rate decision, Thursday

-

ECB President Christine Lagarde speaks, Thursday

-

US jobless claims, durable goods, revised GDP, Thursday

-

Fed Chair Jerome Powell gives pre-recorded remarks to the 10th annual US Treasury Market Conference, Thursday

-

Mexico rate decision, Thursday

-

Japan Tokyo CPI, Friday

-

China industrial profits, Friday

-

Eurozone consumer confidence, Friday

-

US PCE, University of Michigan consumer sentiment, Friday

Some of the main moves in markets:

Stocks

-

The Stoxx Europe 600 rose 0.1% as of 10:14 a.m. London time

-

S&P 500 futures were little changed

-

Nasdaq 100 futures rose 0.1%

-

Futures on the Dow Jones Industrial Average were little changed

-

The MSCI Asia Pacific Index rose 0.2%

-

The MSCI Emerging Markets Index rose 0.2%

Currencies

-

The Bloomberg Dollar Spot Index rose 0.2%

-

The euro fell 0.6% to $1.1100

-

The Japanese yen was little changed at 143.71 per dollar

-

The offshore yuan fell 0.3% to 7.0609 per dollar

-

The British pound fell 0.3% to $1.3283

Cryptocurrencies

-

Bitcoin rose 0.5% to $63,513.33

-

Ether rose 2.9% to $2,648.52

Bonds

-

The yield on 10-year Treasuries was little changed at 3.74%

-

Germany’s 10-year yield declined five basis points to 2.16%

-

Britain’s 10-year yield was little changed at 3.90%

Commodities

-

Brent crude fell 0.1% to $74.39 a barrel

-

Spot gold fell 0.2% to $2,616.83 an ounce

This story was produced with the assistance of Bloomberg Automation.

–With assistance from Catherine Bosley.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

LULU Investor Alert: A Securities Fraud Class Action Lawsuit Has Been Filed Against lululemon athletica inc.

RADNOR, Pa., Sept. 22, 2024 (GLOBE NEWSWIRE) — The law firm of Kessler Topaz Meltzer & Check, LLP (www.ktmc.com) informs investors that a securities class action lawsuit has been filed in the United States District Court for the Southern District of New York against lululemon athletica inc. (“lululemon”) LULU on behalf of investors who purchased or otherwise acquired lululemon securities between December 7, 2023 and July 24, 2024, inclusive (the “Class Period”). The case is assigned to the Honorable Andrew Lamar Carter Jr. The lead plaintiff deadline is October 7, 2024.

CONTACT KESSLER TOPAZ MELTZER & CHECK, LLP:

If you suffered lululemon losses, you may CLICK HERE or go to: https://www.ktmc.com/new-cases/lululemon-athletica-inc?utm_source=PR&utm_medium=link&utm_campaign=lulu&mktm=r

Please CLICK HERE to view our video or copy and paste this link into your browser: https://youtu.be/5eEcTpJdRdc

You can also contact attorney Jonathan Naji, Esq. by calling (484) 270-1453 or by email at info@ktmc.com.

DEFENDANTS’ ALLEGED MISCONDUCT:

The complaint alleges that, throughout the Class Period, Defendants made materially false and/or misleading statements and/or failed to disclose that: (1) lululemon was struggling with inventory allocation issues and color palette execution issues; (2) the company’s Breezethrough product launch underperformed; (3) as a result, lululemon was experiencing stagnating sales in the Americas region; and (4) as a result of the foregoing, Defendants’ positive statements about the company’s business, operations, and prospects were materially misleading and/or lacked a reasonable basis.

THE LEAD PLAINTIFF PROCESS:

lululemon investors may, no later than October 7, 2024, seek to be appointed as a lead plaintiff representative of the class through Kessler Topaz Meltzer & Check, LLP or other counsel, or may choose to do nothing and remain an absent class member. A lead plaintiff is a representative party who acts on behalf of all class members in directing the litigation. The lead plaintiff is usually the investor or small group of investors who have the largest financial interest and who are also adequate and typical of the proposed class of investors. The lead plaintiff selects counsel to represent the lead plaintiff and the class and these attorneys, if approved by the court, are lead or class counsel. Your ability to share in any recovery is not affected by the decision of whether or not to serve as a lead plaintiff.

Kessler Topaz Meltzer & Check, LLP encourages lululemon investors who have suffered significant losses to contact the firm directly to acquire more information.

CLICK HERE TO SIGN UP FOR THE CASE OR GO TO: https://www.ktmc.com/new-cases/lululemon-athletica-inc?utm_source=PR&utm_medium=link&utm_campaign=lulu&mktm=r

ABOUT KESSLER TOPAZ MELTZER & CHECK, LLP:

Kessler Topaz Meltzer & Check, LLP prosecutes class actions in state and federal courts throughout the country and around the world. The firm has developed a global reputation for excellence and has recovered billions of dollars for victims of fraud and other corporate misconduct. All of our work is driven by a common goal: to protect investors, consumers, employees and others from fraud, abuse, misconduct and negligence by businesses and fiduciaries. The complaint in this action was not filed by Kessler Topaz Meltzer & Check, LLP. For more information about Kessler Topaz Meltzer & Check, LLP please visit www.ktmc.com.

CONTACT:

Kessler Topaz Meltzer & Check, LLP

Jonathan Naji, Esq.

(484) 270-1453

280 King of Prussia Road

Radnor, PA 19087

info@ktmc.com

May be considered attorney advertising in certain jurisdictions. Past results do not guarantee future outcomes.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Brookdale Honors 750 Residents this Centenarian's Day

Brookdale is celebrating the power of senior living for health and longevity

NASHVILLE, Tenn., Sept. 22, 2024 /PRNewswire/ — Brookdale Senior Living is proud to celebrate National Centenarians Day on September 22 by honoring approximately 750 remarkable residents across the country who have reached the incredible milestone of 100 years or older. As the nation’s largest senior living provider, Brookdale is privileged to care for hundreds of centenarians who embody the spirit of resilience, wisdom, and longevity.

“It is a profound honor to celebrate each of our incredible centenarian residents on this special day. Their longevity is a testament to the strength of the human spirit, and we are dedicated to helping them continue to live enriching, meaningful, and active lives,” Brookdale President and Chief Executive Officer Lucinda “Cindy” Baier said. “Each of their stories adds to the rich fabric of our community, and we are proud to serve them.”

Centenarian’s Day is a reminder that strong social connections are not only a source of joy but also a key contributor to longevity. A recent study demonstrates the health and wellness benefits for older adults who move into senior living, including increased longevity and better health outcomes.

As part of a commitment to lifelong wellness, Brookdale offers a person-centered approach aimed at supporting healthy aging, encouraging social connections, and enhancing the quality of life for all residents.

To learn more or to find a Brookdale community near you, click here.

Brookdale Senior Living Inc. is the nation’s premier operator of senior living communities. The Company is committed to its mission of enriching the lives of the people it serves with compassion, respect, excellence, and integrity. The Company, through its affiliates, operates independent living, assisted living, memory care, and continuing care retirement communities. Through its comprehensive network, Brookdale helps to provide seniors with care, connection, and services in an environment that feels like home. The Company’s expertise in healthcare, hospitality, and real estate provides residents with opportunities to improve wellness, pursue passions, make new friends, and stay connected with loved ones. Brookdale, through its affiliates, operates and manages 649 communities in 41 states as of June 30, 2024, with the ability to serve approximately 59,000 residents. Brookdale’s stock trades on the New York Stock Exchange under the ticker symbol BKD. For more information, visit brookdale.com or connect with Brookdale on Facebook or YouTube.

Contact: Media Relations, 615-564-8666, media.relations@brookdale.com

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/brookdale-honors-750-residents-this-centenarians-day-302254911.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/brookdale-honors-750-residents-this-centenarians-day-302254911.html

SOURCE Brookdale Senior Living

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Palantir and Dell are set to join the S&P 500 Monday

Key Takeaways

-

Dell and Palantir are set to join the S&P 500 on Monday as part of the index’s quarterly rebalancing.

-

Erie Indemnity also is joining the S&P 500. American Airlines Group, Etsy, and Bio-Rad Laboratories are being shifted to smaller indexes.

-

The exposure associated with inclusion in major indees, as well as buying from index funds tracking the benchmarks, can support companies’ stocks.

The S&P 500 gets three new members Monday, with Palantir Technologies (PLTR), Dell Technologies (DELL) and Erie Indemnity (ERIE) set to join the benchmark index.

The trio will replace American Airlines Group (AAL), Etsy (ETSY), and Bio-Rad Laboratories (BIO). American Airlines and Bio-Rad will be part of the S&P MidCap 400 index, while Etsy will join the S&P SmallCap 600 index.

S&P Global announced the moves, part of its quarterly rebalancing, two weeks ago. It periodically shifts companies between its indexes to ensure they are accurately represented in terms of their market capitalization.

Jakub Porzycki / NurPhoto via Getty Images

What S&P 500 Inclusion Can Mean

Companies often get a boost when their stock is added to a major index like the S&P 500, as the inclusion exposes them to a wider group of investors who could become aware of a company through an index.

The stock could also get a boost as its shares start to be included in index funds, which look to mirror the performance of a broader index by including shares of the companies included in it.

Shares of Dell closed Friday down 0.2%, while and Palantir rose 1%. Both shares have moved higher overall over the past two weeks since the announcement was made, as have shares of Erie, which fell 1% Friday.

Read the original article on Investopedia.

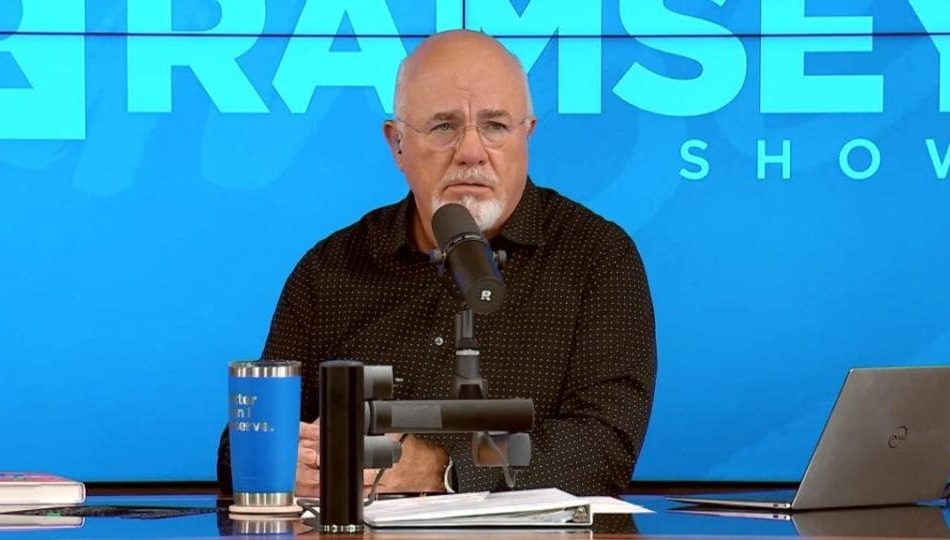

Dave Ramsey Tells 29-Year-Old $1M In Debt And Spending Like She's In Congress: 'I'm Getting Ready To Destroy Your Life As You Know It'

Many people in their 20s deal with credit card debt or student loans, sometimes thinking they’ll figure it out later. But what happens when that debt piles up to nearly a million dollars? That’s the reality a 29-year-old named Channing from Washington D.C. faced during an episode of The Dave Ramsey Show.

Don’t Miss:

Channing and her husband were grappling with nearly $1 million in debt, a number that had Ramsey quickly diving into tough-love mode. Sure, he’s seen scenarios where people are in over their heads with debt, but at just 29, this was particularly alarming to Ramsey.

Channing, who recently married, explained, “My husband and I have probably just under a million dollars in debt and we want to know how to get debt-free without filing for bankruptcy.” The breakdown included $335,000 in student loans, $136,000 in credit cards and $44,000 in personal loans. Their combined household income was about $230,000 a year.

Trending: Founder of Personal Capital and ex-CEO of PayPal re-engineers traditional banking with this new high-yield account — start saving better today.

Ramsey didn’t hold back. After calculating the staggering numbers, he addressed the couple’s situation bluntly. “You guys have been living at about 10x where you’re going to get to live for the next three years,” Ramsey said. “I’m getting ready to destroy your life as you know it.”

“You’ve gotten used to spending like you’re in Congress,” he scolded. He was clear that their lifestyle needed a complete overhaul. Ramsey emphasized that their financial habits would have to change drastically, stating, “You’re not gonna see the inside of a restaurant unless it’s your extra job or you’re waiting on someone you work with during the day.” He added, “You’re gonna be living on beans and rice, rice and beans.”

Ramsey went on to stress the emotional and spiritual challenges ahead. “Your friends are going to think you’ve lost your mind and your mother is going to think you need counseling,” he warned, adding that both Channing and her husband would need to stop caring what others think if they wanted to tackle their debt successfully.

He also shared a personal connection to their situation, saying, “This is exactly what I did in my 20s. I bought and purchased a lifestyle that was 5x to 10x what I had. It was all because of crap inside of me that caused me to do that.”

Trending: Elon Musk’s secret mansion in Austin revealed through court filings. Here’s how to invest in the city’s growth before prices go back up.

Ramsey’s advice wasn’t just about cutting expenses but about confronting the mindset that had led to their financial missteps. “The problem is what’s going on inside you guys,” Ramsey said. “You’re on a suicide mission right now.”

The tough conversation ended on a hopeful note, though. Ramsey assured Channing that while the journey would be difficult, it was possible. “You can do it, though,” he said. “I know. I’ll help you.”

Channing and her husband are now facing a major lifestyle change to climb out of their nearly $1 million debt, with Dave Ramsey’s guidance pointing them toward a more financially stable future. Sometimes debt happens, but at least they’re taking steps to address the issue and make changes before they’re left resorting to more extreme options such as bankruptcy.

Read Next:

UNLOCKED: 5 NEW TRADES EVERY WEEK. Click now to get top trade ideas daily, plus unlimited access to cutting-edge tools and strategies to gain an edge in the markets.

Get the latest stock analysis from Benzinga?

This article Dave Ramsey Tells 29-Year-Old $1M In Debt And Spending Like She’s In Congress: ‘I’m Getting Ready To Destroy Your Life As You Know It’ originally appeared on Benzinga.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Bitcoin jumps to one-month high and yen grinds even lower

SINGAPORE (Reuters) -Bitcoin was the notable mover as it reached for one-month highs on Monday, sustaining its rally after the Federal Reserve’s super-sized rate cut last week, while the yen extended its decline in markets thinned by a Japanese holiday.

The dollar strengthened against the yen last week after policy meetings in both the United States and Japan, hitting its highest level in two weeks at 144.50 yen. It was around 144.16 on Monday.

The Bank of Japan (BOJ) left interest rates unchanged last week and indicated it was not in a hurry to hike them again. That decision, coming just days after the Fed’s 50 basis points (bps) rate cut, put a pause to the yen’s sharp gains this month. The currency is up 1.4% in September.

With Japan closed for Autumnal Equinox Day, the main driver of trade was expectations around further Fed rate cuts and the gains those have spurred in equities, commodity currencies and other risk assets.

Bitcoin was up 1.8% at $63,954, hovering near one-month highs. Ether was 3% higher at 2,660.30, near its highest since late August.

Chris Weston, head of research at Pepperstone, said the ‘goldilocks macro backdrop’ is the key factor driving the solid upside momentum.

“For now, this is a rally that is there for chasing. As we’ve seen over the years, when Bitcoin goes on a run, the trends can be powerful and FOMO can really get the crypto players fired up”

The Australian dollar was 0.4% higher at $0.68355, digesting its rise of more than 3% in less than two weeks.

The U.S. dollar index, which measures the greenback against six major currencies, was at 100.75, continuing to stay above the one-year low it hit last week. Euro was flat at $1.1165.

The Fed’s rate cut “appears to have calmed market fears of a U.S. recession”, Goldman Sachs said in a note. “Our G10 FX team expect a slight rebound for the U.S. dollar over the next 3 months, before easing again on a 6- and 12-month view.”

Fed futures traders have priced in 75 bps in rate cuts by the end of this year, and nearly 200 bps in cuts by December 2025 that will take the Fed’s policy rate by the end of next year to 2.75%, according to CME FedWatch.

The U.S. Treasury yield curve has been steepening after the Fed’s rate cut, and investors added to bets favoring a second outsized rate cut after Fed Governor Christopher Waller said on Friday he was worried inflation may soon be running substantially below the central bank’s 2% target.

Meanwhile, the majority of economists polled by Reuters anticipate two more 25 bps rate cuts at the Fed’s final two meetings this year.

In weekend news, U.S. House Republicans unveiled a three-month stopgap bill to avert a government shutdown.

For the yen, an upcoming ruling party vote later this week to choose a new prime minister makes the BOJ’s job challenging in the coming months. A snap election is seen as likely in late October.

Liberal Democratic Party frontrunners to replace outgoing Prime Minister Fumio Kishida have presented diverse views on monetary policy.

Sanae Takaichi – who would become the nation’s first female premier – is a reflationist who has accused the Bank of Japan of raising rates too soon. Shigeru Ishiba has said the central bank is “on the right policy track”, while Shinjiro Koizumi, son of charismatic ex-premier Junichiro Koizumi, has so far only said he will respect the BOJ’s independence.

The selection presents two-way risks for yen, Barclays analysts wrote on the weekend. “The main risk here is if Abenomics advocate Takaichi wins, this could pose headwinds to the BOJ’s policy-normalization plan and raise concerns about fiscal discipline,” they said.

That could lead to a steeper Japanese bond curve and downside pressure on the yen as investors pare expectations for another rate rise, they said.

The Bank of England kept rates unchanged on Thursday, with its governor saying the central bank had to be “careful not to cut too fast or by too much.”

The pound was little changed at $1.3315, staying near highs it hit on Friday after the release of strong British retail sales data.

(Reporting by Vidya Ranganathan in Singapore; Editing by Jamie Freed and Kim Coghill)

Forget Rental Properties: Invest $10,000 Into These Dividend Growth Stocks With Ultra-High Yields for Passive Income

Passive income is a popular concept these days. Defined as money earned outside of a traditional job and requiring minimal time or effort, it is a tantalizing proposition for investors tired of the rat race.

Many people will pitch buying rental properties as the best form of passive income. But I think this is a misnomer. Managing a rental property may be profitable, but it requires a lot of time and effort to maintain. That is not “passive” income in the traditional sense.

The purest form of passive income comes from buying high-dividend-yield stocks, as they require zero upkeep to maintain your cash flow. Here are two ultra-high dividend-yielding stocks to buy with $10,000 over any rental property for your investment portfolio right now.

Legacy tobacco pricing power

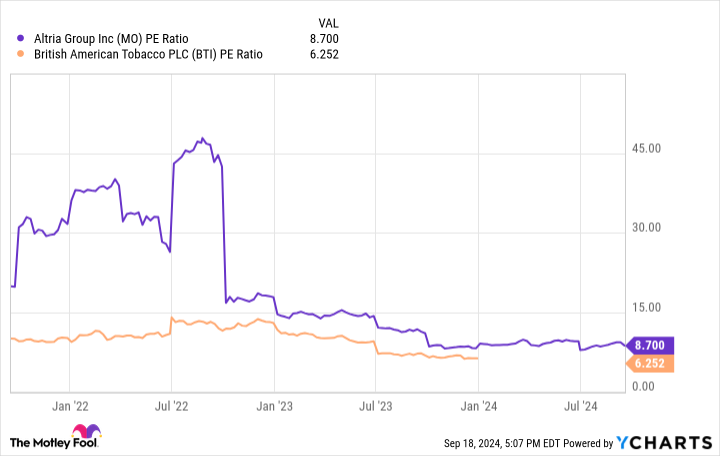

Many investors shy away from investing in tobacco companies. There is an idea that the sector is in terminal decline with fewer and fewer users of cigarettes around the world. While it is true that tobacco consumption is going down, there is still plenty of profit to be made for legacy brands such as Marlboro, owned by Altria Group (NYSE: MO). With so much skepticism pointed toward the industry, you can buy the stock at a cheap earnings multiple today. It currently has a price-to-earnings ratio (P/E) of 8.7.

Today, Altria Group has a dividend that yields 7.83%. If you invest $10,000 into Altria stock, the company will pay out $783 in dividends to you each year. For the last 10 years, Altria has consistently raised its dividend-per-share to stockholders, and the payout has climbed 100% in those 10 years.

The fuel to this dividend growth is the pricing power of its tobacco brands such as Marlboro. Even though cigarette usage — especially in the United States — is falling, Altria has the pricing power to counteract volume declines and grow cash flow (the lifeblood of dividend payments). Free cash flow per share has increased by 125.8% in the last 10 years despite massive declines in cigarette usage in the United States.

Cigarettes may not be around forever. But they will still generate healthy cash flows for many years. This makes Altria Group an easy dividend income stock that will likely generate heaps of passive income and help you grow your wealth without lifting a finger.

MO PE Ratio data by YCharts

International exposure and new-age products

Perhaps a more promising tobacco company is British American Tobacco (NYSE: BTI). It is the owner of legacy cigarette brands such as Newport and sports a higher dividend yield than Altria Group at 8.21%. That equates to $821 in annual passive income on a $10,000 investment.

Even better, British American Tobacco has been much more successful with new-age nicotine products that are stealing market share from cigarettes. These include electronic vaping cigarettes and nicotine pouches. This combined segment reached profitability for the company in 2023 and will be a significant contributor to earnings and cash flow growth in the coming years.

Despite seeing headwinds from foreign currency depreciation, British American Tobacco has grown its free cash flow per share by 35% since 2019. During this period, new-age products were a headwind to profitability as the company scaled up operations. Over the next five years, they are poised to be a tailwind to earnings growth.

As with Altria Group, there is plenty of room for British American Tobacco to keep growing its free cash flow per share over the next 10 years. With a sky-high dividend yield of over 8%, British American Tobacco is a great stock to own to add passive income to your portfolio.

Both of these stocks have dividend yields significantly higher than that of the S&P 500 index, which yields a measly 1.32% today. With the Federal Reserve lowering interest rates, it will be harder to earn a high interest rate with a savings account or Treasury bonds. For those who prioritize passive income, British American Tobacco and Altria Group look like attractive assets to hold in your portfolio right now.

Should you invest $1,000 in British American Tobacco right now?

Before you buy stock in British American Tobacco, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and British American Tobacco wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $710,860!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 16, 2024

Brett Schafer has no position in any of the stocks mentioned. The Motley Fool recommends British American Tobacco P.l.c. and recommends the following options: long January 2026 $40 calls on British American Tobacco and short January 2026 $40 puts on British American Tobacco. The Motley Fool has a disclosure policy.

Forget Rental Properties: Invest $10,000 Into These Dividend Growth Stocks With Ultra-High Yields for Passive Income was originally published by The Motley Fool

Bragar Eagel & Squire, P.C. Reminds Investors That Class Action Lawsuits Have Been Filed Against Sage, Outset Medical, Allarity, and Super Micro and Encourages Investors to Contact the Firm

NEW YORK, Sept. 22, 2024 (GLOBE NEWSWIRE) — Bragar Eagel & Squire, P.C., a nationally recognized shareholder rights law firm, reminds investors that class actions have been commenced on behalf of stockholders of Sage Therapeutics, Inc. SAGE, Outset Medical, Inc. OM, Allarity Therapeutics, Inc. ALLR, and Super Micro Computer, Inc. SMCI. Stockholders have until the deadlines below to petition the court to serve as lead plaintiff. Additional information about each case can be found at the link provided.

Sage Therapeutics, Inc. SAGE

Class Period: April 12, 2021 – July 23, 2024

Lead Plaintiff Deadline: October 28, 2024

The Complaint alleges that, throughout the Class Period, Defendants made materially false and misleading statements regarding the Company’s business, operations, and prospects. Specifically, Defendants made false and/or misleading statements and/or failed to disclose that: (1) zuranolone was less effective in treating MDD than Defendants had led investors to believe; (2) accordingly, the FDA was unlikely to approve the Zuranolone NDA for the treatment of MDD in its present form, and zuranolone’s clinical results for MDD, as well as its overall regulatory and commercial prospects, were overstated; (3) SAGE-718 was less effective in treating MCI due to PD than Defendants had led investors to believe; (4) accordingly, SAGE-718’s clinical, regulatory, and commercial prospects as a treatment for MCI due to PD were overstated; (5) SAGE-324 was less effective in treating ET than Defendants had led investors to believe; (6) accordingly, SAGE-324’s clinical, regulatory, and commercial prospects as a treatment for ET were overstated; and (7) as a result of all the foregoing, the Company’s public statements were materially false and misleading at all relevant times.

For more information on the Sage class action go to: https://bespc.com/cases/SAGE

Outset Medical, Inc. OM

Class Period: August 1, 2022 – August 7, 2024

Lead Plaintiff Deadline: October 28, 2024

According to the lawsuit, during the Class Period, defendants made false and/or misleading statements and/or failed to disclose that: (1) the Tablo products were marketed for continuous renal replacement therapy, which is not one of the indications approved by the United States Food and Drug Administration (“FDA”); (2) as a result, Outset Medical was reasonably likely to submit an additional 510(k) application for the Tablo products; (3) there was a substantial risk that Outset Medical would cease sales of the Tablo products pending FDA approval of additional indications; (4) Outset Medical lacked the sales team and process to execute on the ramp of Tablo sales; (5) as a result of the foregoing, Outset Medical’s revenue growth would be adversely impacted; and (6) as a result of the foregoing, defendants’ positive statements about Outset Medical’s business, operations, and prospects were materially misleading and/or lacked a reasonable basis. When the true details entered the market, the lawsuit claims that investors suffered damages.

For more information on the Outset Medical class action go to: https://bespc.com/cases/OM

Allarity Therapeutics, Inc. ALLR

Class Period: May 17, 2022 – July 19, 2024

Lead Plaintiff Deadline: November 12, 2024

The Complaint alleges that, throughout the Class Period, Defendants made materially false and misleading statements regarding the Company’s business, operations, and compliance policies. Specifically, the Complaint alleges that Defendants made false and/or misleading statements and/or failed to disclose that: (1) Defendants had overstated the Dovitinib NDA’s continued regulatory prospects; (2) Allarity and three of its former officers had engaged in illegal, illicit, and/or otherwise improper conduct in connection with the Dovitinib NDA and/or the Dovitinib-DRP PMA; (3) the foregoing misconduct subjected the Company to an increased risk of regulatory and/or governmental scrutiny and enforcement action, as well as significant legal, monetary, and reputational harm; (4) following Allarity’s announcement that it was, in fact, being investigated for wrongdoing in connection with the Dovitinib NDA and/or the Dovitinib-DRP PMA, the Company downplayed the substantial likelihood that an enforcement action would result from such investigation; and (5) as a result, the Company’s public statements were materially false and misleading at all relevant times.

For more information on the Allarity class action go to: https://bespc.com/cases/ALLR

Super Micro Computer, Inc. SMCI

Class Period: February 2, 2021 – August 26, 2024

Lead Plaintiff Deadline: October 29, 2024

According to the complaint, on August 27, 2024, Hindenburg Research unveiled a short report on SMCI. The short report detailed several allegations against the Company, including that Hindenburg “found glaring accounting red flags, evidence of undisclosed related party transactions, sanctions and control failures, and customer issues.”

Investors and analysts reacted immediately to these revelations. The price of SMCI’s common stock declined dramatically. From a closing market price of $562.51 per share on August 26, 2024, SMCI’s stock price fell to $443.49 per share on August 28, 2024, a decline of about 21.16% in the span of only two days.

For more information on the Super Micro class action go to: https://bespc.com/cases/SMCI

About Bragar Eagel & Squire, P.C.:

Bragar Eagel & Squire, P.C. is a nationally recognized law firm with offices in New York, California, and South Carolina. The firm represents individual and institutional investors in commercial, securities, derivative, and other complex litigation in state and federal courts across the country. For more information about the firm, please visit www.bespc.com. Attorney advertising. Prior results do not guarantee similar outcomes.

Contact Information:

Bragar Eagel & Squire, P.C.

Brandon Walker, Esq.

Marion Passmore, Esq.

(212) 355-4648

investigations@bespc.com

www.bespc.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Siemens Secures 6,500 SF at San Felasco Tech City in Alachua, Florida

ALACHUA, Fla., Sept. 20, 2024 /PRNewswire/ — Co-developers Mitch Glaeser and Rich Blaser of San Felasco Tech City (SFTC) are pleased to announce Siemens will establish a 6,500 square foot facility in Alachua, Florida. Siemens will occupy space in Phase III of the Tech City development and open their new location at SFTC in Q2 of 2025.

San Felasco Tech City is a premier business park that offers a unique blend of high-tech facilities, green spaces, residential, and a vibrant community environment. Designed to attract top-tier companies, Tech City provides Tenants and residents with access to world-class amenities. The new facility will support Siemens’ growing presence in the area, providing a state-of-the-art environment designed to facilitate advanced research, development and collaboration.

For 175 years, Siemens has shaped the world by transforming groundbreaking inventions into innovative technologies that address the challenges of each era, revolutionizing everyday life across the globe. From electrifying factories and digitally transforming entire industries to pioneering safer, more sustainable transportation and advancing medical imaging and diagnostics, Siemens has consistently led the way in building a sustainable future for generations to come.

“Gaining an international tenant like Siemens confirms our vision of building the most sustainable community in the world,” said Mitch Glaeser, co-developer of San Felasco Tech City. “Our mixed-use campus, completely run by onsite solar, was the leading reason that impressed them to choose us as a location for their regional facility. We’re beyond thrilled for them to call San Felasco Tech City home at this state-of-the-art campus.”

Siemens will be joining and serving over 60 innovative companies that call SFTC home. These companies include Vobile Inc., Okito America, Neurotronics, Anamar Environmental Consulting, Inc., IIA Engineering, Nextgen Biologics, Fracture, Novapproach Spine, Momentum Dance, Audiodrome, Daft Cow Brewery and Beaker & Flask just to name a few.

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/siemens-secures-6-500-sf-at-san-felasco-tech-city-in-alachua-florida-302254548.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/siemens-secures-6-500-sf-at-san-felasco-tech-city-in-alachua-florida-302254548.html

SOURCE San Felasco Tech City

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.