Snowflake's CFO Just Said 16 Words That Should Be Music to Every Shareholder's Ears

If you’re an informed investor, you likely read the quarterly reports from the companies you’ve invested in. If you’re looking for even deeper insight, you might listen to management’s commentary on quarterly earnings calls. But if you still have extra time, listening to presentations at investor conferences can provide even more insight.

On Sept. 12, data company Snowflake (NYSE: SNOW) made a presentation at the Goldman Sachs Communacopia + Technology Conference. In his remarks, CFO Mike Scarpelli said 16 words that are extremely important for investors. They even have me rethinking the stock as a potential investment.

Snowflake is making a big change

The artificial intelligence (AI) trend is undeniable, and Snowflake is swept up in it. For evidence, just look at its press releases. Its report for its fiscal Q2 2022 started with simply calling itself “The Data Cloud company.” But in its report for its fiscal Q2 2025, it called itself “The AI Data Cloud company.”

From my perspective, almost all tech companies are trying to convince investors that they’ve been leaders in the AI space for years. But in reality, most are investing aggressively in AI, desperately trying to just keep up. I’d lump Snowflake in this bunch. Indeed, the company has been buying graphics processing units (GPUs) to have what it needs to power AI workloads.

The problem is that GPUs are expensive, and it’s hurt Snowflake’s profit margins — more on that in a moment. Management has been saying that the investment in AI is ongoing. But Scarpelli’s tone sounded much different during his recent conference presentation.

While talking about the expensive price tags of GPUs, Scarpelli surprisingly said: “I’m not going to buy any more GPUs until I see the revenue to support it.” Those 16 words were both shocking, and, for me, a rare breath of fresh air.

Why it matters

During my investing career, I’ve seen stocks richly valued at more than 100 times sales, and I’ve seen companies with enormous market caps above $100 billion. But I’ve rarely seen both, as was the case with Snowflake stock shortly after it went public.

Investors were willing to make Snowflake stock one of the most expensive I’ve ever seen because it had a phenomenal growth rate and enviable profit margins. The general consensus was that the business would grow at such an impressive rate that it would be worth far more than $100 billion in short order.

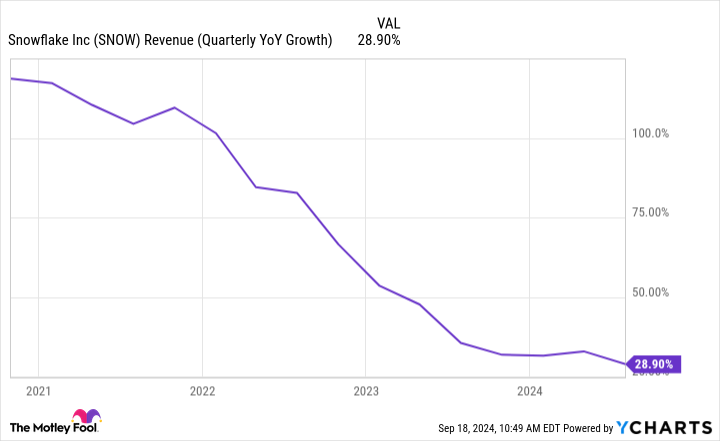

AI was also believed to be a catalyst for Snowflake. After all, it’s a data company, and AI doesn’t work without data. But AI hasn’t been the catalyst that many expected. The company’s growth rate is still strong, but it’s plunged steadily nonetheless. Investments in AI infrastructure also motivated management to lower its outlook for profits.

To put specific numbers here, Snowflake started fiscal 2025 expecting 22% growth for its product revenue, as well as a 6% operating margin and a 29% adjusted free cash flow margin. But as of Q2, it expects 26% growth, a 3% operating margin, and a 26% margin for free cash flow.

Snowflake’s outlook for revenue is up, yes. But don’t be quick to attribute this to AI. As Scarpelli said regarding AI: “The reality is that very few are using it en masse today.” Therefore, it seems AI is not boosting revenue. But AI is boosting expenses because the company is buying GPUs — this might be why Warren Buffett’s company recently sold Snowflake stock.

Generally speaking, it can be dangerous to invest in a company with rising expenses and without a boost for revenue. That’s why I find Scarpelli’s comments refreshing. He’s not buying any more GPUs unless it actually starts contributing to the growth of the business.

Is it time to rethink Snowflake stock?

When companies indiscriminately spend money on the latest “big thing,” it can be money forever wasted. But when businesses scrutinize spending and demand to see a financial benefit, good things can happen for shareholders. Meta Platforms is a good recent example. After dubbing 2023 its “year of efficiency,” the company’s profits soared without sacrificing growth.

For perspective, Meta Platforms stock has quadrupled since the start of 2023. In short, as it focused on justifying its spending, its profits skyrocketed, which lifted the stock to new highs.

Could something similar be in the works for Snowflake stock? It’s too early to say. But the company’s CFO demands to see a return on investment when it comes to AI. That’s the right mindset to have, and it could lead to better efficiency for Snowflake.

At 11 times sales, Snowflake stock has never been cheaper. And if it keeps growing at its current pace while keeping expenses under control, I believe better days could be ahead.

Should you invest $1,000 in Snowflake right now?

Before you buy stock in Snowflake, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Snowflake wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $710,860!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 16, 2024

Jon Quast has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Goldman Sachs Group and Snowflake. The Motley Fool has a disclosure policy.

Snowflake’s CFO Just Said 16 Words That Should Be Music to Every Shareholder’s Ears was originally published by The Motley Fool

Leave a Reply