Can You Guess How Much Money Warren Buffett Saved Up By The Time He Was 15? Hint: It's Much, Much More Than Your Son Or Nephew Has

When you think of Warren Buffett, you probably imagine him as one of the richest men in the world, with billions in his bank account. But have you ever wondered what he was like as a kid? Well, even at a very young age, he was thinking like a mini-mogul and had accumulated an incredible $2,000 by the time he was 15 years old! That may not seem like much now, but back in 1945, it was a small fortune.

Don’t Miss:

To put it in perspective, that $2,000 would be worth almost $35,000 in today’s money! That’s more than many people have saved up in their savings accounts and it’s certainly a lot more than most teenagers carry around.

Warren Buffett stood apart from most teenagers. Even at that delicate age, he was already a smart business owner who considered investments, profits and optimizing his early business ventures.

Trending: Elon Musk and Jeff Bezos are bullish on one city that could dethrone New York and become the new financial capital of the US. Investing in its booming real estate market has never been more accessible.

So, what made young Warren succeed? His family was certainly well-off, but he still hustled in somewhat surprising ways, at least by today’s standards.

He sold chewing gum and Coca-Cola door-to-door in his neighborhood, delivered newspapers before school and even set up his business to sell used golf balls and stamps.

His biggest success came from turning a plain teenage job – delivering newspapers – into something more significant and a foundation for greater things. He found ways to be more efficient, deliver faster and even sell extra subscriptions and calendars on the side.

Trending: Founder of Personal Capital and ex-CEO of PayPal re-engineers traditional banking with this new high-yield account — start saving better today.

With the proceeds of this venture, Buffett was able to buy a 40-acre farm in Nebraska for $1,200, which he rented out for a steady income.

Buffett, who just turned 94, has an estimated net worth of around $143.7 billion. He’s averaged around $4.18 million every day of his life! Of course, he didn’t make that much every day from the start – most of his wealth came later. But it’s still an incredible way to think about how much he’s achieved over the years.

Despite all that, his definition of success goes beyond money or fame. In a 2019 interview, he explained that if you’re 65 or 70 and the people you care about truly love you back, then you’re successful. He’s seen incredibly wealthy people who are still miserable because no one loves them.

Trending: Warren Buffett once said, “If you don’t find a way to make money while you sleep, you will work until you die.” These high-yield real estate notes that pay 7.5% – 9% make earning passive income easier than ever.

He lives modestly and has pledged 99% of his wealth to charity, showing that success is about much more than a bank account – it’s about investing in yourself, your relationships and living a meaningful life.

But when it comes to his children, he believes in tough love. His daughter Susie once asked him for a $41,000 loan to renovate her kitchen and his response suggested she “go to the bank like everyone else.”

Despite his often frugal behavior, Susie never felt he was stingy and appreciated his philosophy. Once, she said, “I actually agree with his philosophy of not dumping a bunch of money on your kids.” She agrees it’s wiser not to leave them billions, as it would be “crazy” to do so.

Read Next:

Up Next: Transform your trading with Benzinga Edge’s one-of-a-kind market trade ideas and tools. Click now to access unique insights that can set you ahead in today’s competitive market.

Get the latest stock analysis from Benzinga?

This article Can You Guess How Much Money Warren Buffett Saved Up By The Time He Was 15? Hint: It’s Much, Much More Than Your Son Or Nephew Has originally appeared on Benzinga.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Cresset Real Estate Partners Announces Largest Speculative Industrial Lease in Houston Area's History

1.2 million-square-foot facility was built in partnership with Lovett Industrial and leased to BroadRange Logistics

CHICAGO, Sept. 24, 2024 /PRNewswire/ — Cresset Real Estate Partners, in partnership with Lovett Industrial, announced today they have agreed to a lease with BroadRange Logistics on a 1,224,498 square-foot facility within Northport Logistics Center in Conroe, Texas. About 40 miles north of Houston, the lease marks the largest speculatively-built warehouse ever leased within the Houston area.

By signing the lease, BroadRange Logistics, a fast-growing third-party logistics firm, will occupy the state-of-the-art Northport Logistics Center, which was designed to the highest specifications. This includes the 40-foot clear-height building with truck courts measuring 190 feet deep, 273 trailer parking stalls, 224 loading dock doors and 8-inch slab-on-grade foundation.

The facility, which broke ground in September 2022, is located within the larger Conroe Business Park, a 1,655-acre location, allows convenient service to Houston, Dallas, Austin and San Antonio. More than 30 companies and over 3,000 employees already populate Conroe Business Park, which boasts four-lane roads, municipal utilities and quick access to I-45 through three convenient interchanges.

“We’re proud to be a part of the largest speculatively-built industrial lease ever signed in the Houston area, which has become a key target market for the Cresset Partners team and specifically our logistics fund,” said Dominic DeRose, Managing Director of Cresset Real Estate Partners. “We were thrilled to begin development on Northport Logistics Park two years ago with Lovett Industrial, and we’re excited to have BroadRange Logistics add their commitment to the space. We hope the facility serves to continue the amazing trajectory of the booming Houston area.”

Added Charlie Meyer, President & CEO of Lovett Industrial: “When we began construction of Northport Logistics Center within Conroe Business Park, we believed that if we could build a large scale, modern, high quality logistics facility here, then it would generate substantial tenant interest due to the fantastic business environment in Conroe, unparalleled regional connectivity and access to high quality labor. We are gratified to see our strategy play out successfully and equally excited to build this relationship with BroadRange Logistics, whom we hope to serve in more locations around the U.S. as they continue their steep growth trajectory.”

The lease marks the latest milestone within Cresset Real Estate Partners’ Logistics Fund I (“Fund I”). To date, the firm’s Logistics Funds have raised more than $380 million, and resulting projects from these investments have covered more than 10 million square feet across the country.

With its Logistics Funds, Cresset Real Estate Partners seeks to find unique and attractive investment opportunities in an evolving domestic supply chain, with Houston’s active port and large population growth serving as an example of that strategy.

“We’re thrilled about our expansion in the Lone Star State with this state-of-the-art facility in Conroe,” said Ari Milstein, CEO of BroadRange Logistics. “They say everything’s bigger in Texas, and this new warehouse – twice the size of our previous Houston location – certainly proves that point. With this addition, we’ve tripled our footprint in Texas, a move our customers have long encouraged. We’re seeing significant tailwinds in our industry, including the trend toward reshoring, and this expansion allows us to capitalize on these opportunities while meeting the growing demand for flexible warehousing and distribution. The scale and capabilities of Northport Logistics Center align perfectly with our commitment to providing cutting-edge solutions for our clients’ evolving needs.”

Northport Logistics Center was represented by Nathan Wynne Jason Dillee and Ed Frantz of CBRE in its successful marketing and leasing efforts, while BroadRange Logistics was represented by JR Wright and Russell Hofstetter of Atlanta-based Strategic Real Estate Partners, LLC.

About Cresset Partners

Cresset Partners is a private investment firm focused on providing its investors with direct access to opportunities in real estate, private credit, private equity, and venture capital. We focus on building outstanding, lasting partnerships by investing long-term capital, resources, and an experienced team to create sustainable value. We believe that long-term investing creates better alignment and reduces risk and inefficiencies, leading to better outcomes for all stakeholders. Cresset Partners was founded in 2018 and has more than $3.7 billion in committed capital as of September 1, 2024. Learn more at https://cressetpartners.com.

About Lovett Industrial

Founded in 2020 and based in Houston, Texas, Lovett Industrial is a privately held vertically integrated logistics real estate investment platform that seeks to develop and acquire industrial real estate assets that are differentiated by their quality, location, and functionality. Currently active in 15 markets across the United States, Lovett Industrial’s portfolio consists of approximately 19 million square feet of completed, acquired, and under construction warehouses and in excess of 10 million square feet of warehouses planned for future development. Lovett Industrial’s founders have combined over 60+ years of experience in the commercial and industrial real estate sectors. For more information, please see our website at https://lovettindustrial.com/.

About BroadRange Logistics

BroadRange is a transformative force in warehousing and logistics solutions—offering solar manufacturers, retailers, leading brands, and other logistics providers unprecedented flexibility and a strategic network of distribution centers. Committed to propelling the growth and success of its clients’ businesses, the company provides a comprehensive range of logistics services, including adaptable space licensing agreements, advanced inventory management, and cash flow solutions. With more than 20 years in the industry and recently recognized as the 163rd fastest-growing company and the No. 6 logistics firm in America by Inc. Magazine, BroadRange manages 10.5 million square feet of Class A warehouse space across the U.S.

Media Contact:

Water & Wall

Mike Persak

Mike@waterandwall.com

616-826-2449

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/cresset-real-estate-partners-announces-largest-speculative-industrial-lease-in-houston-areas-history-302256299.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/cresset-real-estate-partners-announces-largest-speculative-industrial-lease-in-houston-areas-history-302256299.html

SOURCE Cresset Partners

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Case-Shiller Home Prices Tick in Lower Than Expectations

If you’re looking at this morning’s pre-market indexes and experiencing deja vu, you’re not the only one. Just as Monday morning we saw early trading in the red blossom into the green as the regular trading day started — on the way to new all-time closing highs on the Dow and S&P 500 — we have done the same so far Tuesday: the Dow is +5 points, the S&P +62 and the Nasdaq +36 points at this hour.

Case-Shiller Home Prices Increase, but Miss Estimates

The definitive measure on home prices is the Case-Shiller index, reported a month in arrears from most other housing data (in this case, July). Overall, we see +5% growth in home price data for mid-summer, but this is lower than the +6% analysts had been expecting, and below the downwardly revised +5.5% the previous month.

Breaking the findings down into the two separate indexes, the 10-city survey saw home prices up +6.8% for July, +5.9% on the 20-city. Among region leaders, New York led the way that month: +8.8%, followed by Las Vegas at +8.2%.

Of course, this data is still well within the high mortgage rate environment that we see coming down rather rapidly, looking ahead. With a lowering Fed funds rate, this will establish lower mortgage rates over time. Considering pent-up demand over the past couple years of high mortgage rates, we may also expect to see more activity in the Existing Home Sales space, which may put pressure on new homebuilders.

AutoZone Mixed on Q4 Report

Zacks Rank #4 (Sell)-rated AutoZone AZO posted a substantial miss on its bottom line for fiscal Q4 earnings today, with a reported $48.11 per share short of the $53.31 expected, for a negative earnings surprise of -9.75%. Revenues, however, outperformed slightly, by +0.37% to $6.21 billion in the quarter (and a nice boost from the $5.69 billion posted a year ago).

AutoZone shares are trading down -3.7% on the news, crimping the company’s gains of +17.9% year to date. Even still, the stock is underperforming the S&P 500’s strong growth of +19.9% so far this year.

What to Expect for Tuesday in the Stock Market

A half hour after the opening bell, Consumer Confidence for September will be released. Analysts expect a slight uptick to 104 from 103.3 reported a month ago. Especially now with a loosening Fed funds rate cycle underway, we may begin to see the clouds part before consumers surveyed here.

After the closing bell, two notable stocks will be reporting earnings: KB Home KBH, the Los Angeles-based homebuilder which specializes in single-family homes first-time homebuyers, and Stitch Fix SFIX, a 21st century online custom apparel store.

KB Home is expected to have grown by +13.3% on earnings in Q3 and +8.8% on revenues, and is working on a six-straight string of quarterly earnings beats. Fiscal Q4 results for Stitch Fix are expected to be flat on earnings for the quarter, but -15.5% on revenues.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

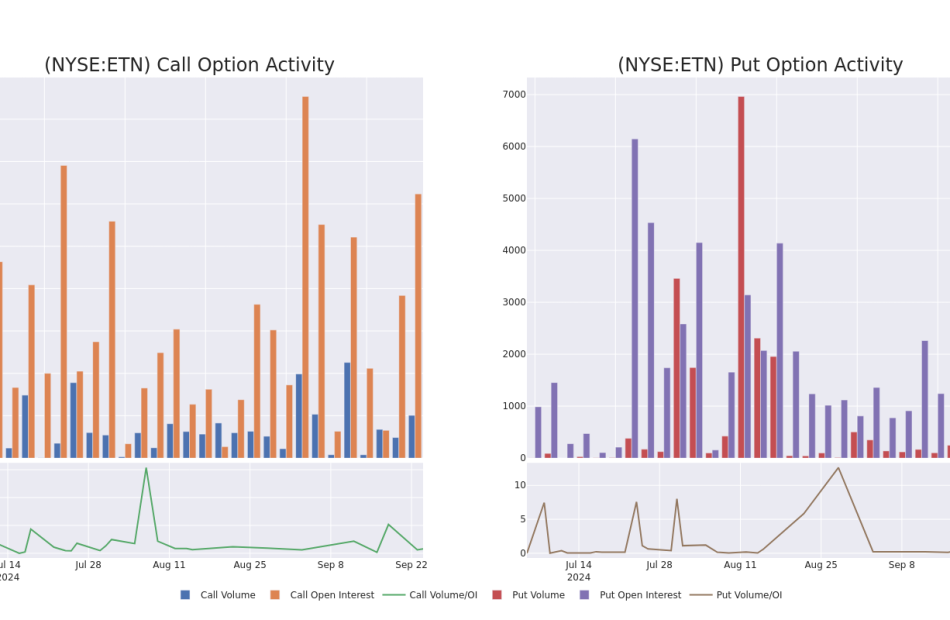

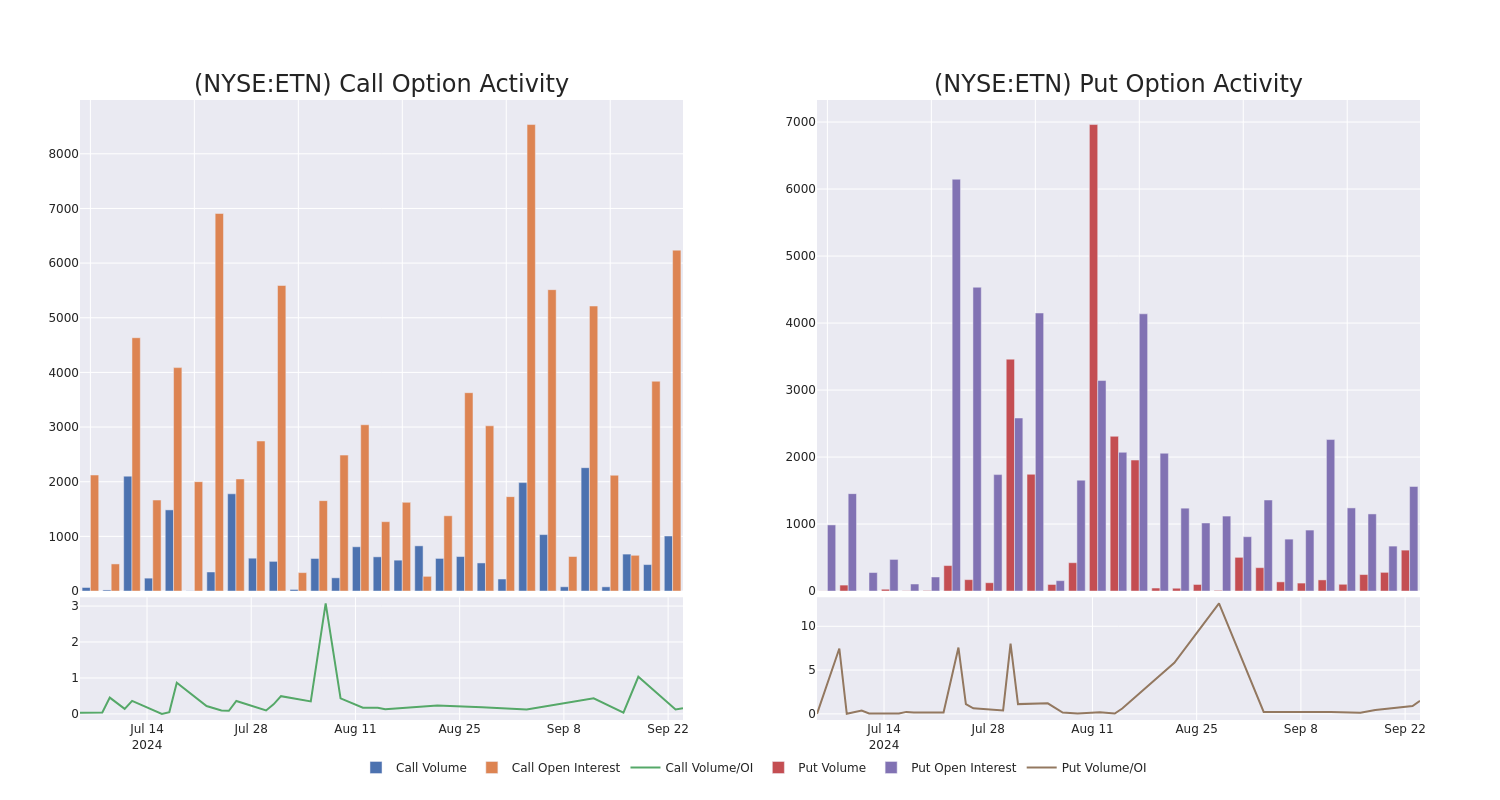

Smart Money Is Betting Big In ETN Options

Investors with a lot of money to spend have taken a bearish stance on Eaton Corp ETN.

And retail traders should know.

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don’t know. But when something this big happens with ETN, it often means somebody knows something is about to happen.

So how do we know what these investors just did?

Today, Benzinga‘s options scanner spotted 12 uncommon options trades for Eaton Corp.

This isn’t normal.

The overall sentiment of these big-money traders is split between 33% bullish and 50%, bearish.

Out of all of the special options we uncovered, 4 are puts, for a total amount of $181,040, and 8 are calls, for a total amount of $519,776.

What’s The Price Target?

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $300.0 to $370.0 for Eaton Corp during the past quarter.

Volume & Open Interest Development

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Eaton Corp’s options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Eaton Corp’s whale trades within a strike price range from $300.0 to $370.0 in the last 30 days.

Eaton Corp Call and Put Volume: 30-Day Overview

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| ETN | CALL | SWEEP | BULLISH | 01/17/25 | $13.3 | $12.8 | $13.12 | $350.00 | $112.0K | 1.4K | 90 |

| ETN | CALL | SWEEP | BULLISH | 01/17/25 | $22.3 | $21.8 | $22.12 | $330.00 | $110.9K | 1.0K | 94 |

| ETN | CALL | TRADE | BEARISH | 10/18/24 | $4.4 | $4.2 | $4.2 | $340.00 | $105.0K | 1.4K | 614 |

| ETN | PUT | TRADE | BEARISH | 11/15/24 | $4.9 | $4.6 | $4.9 | $300.00 | $85.2K | 755 | 245 |

| ETN | CALL | SWEEP | NEUTRAL | 10/18/24 | $14.3 | $14.0 | $14.15 | $320.00 | $55.2K | 1.4K | 44 |

About Eaton Corp

Founded in 1911 by Joseph Eaton, the eponymous company began by selling truck axles in New Jersey. Eaton has since become an industrial powerhouse largely through acquisitions in various end markets. Eaton’s portfolio can broadly be divided into two parts: its electrical and industrial businesses. Its electrical portfolio (representing around 70% of company revenue) sells components within data centers, utilities, and commercial and residential buildings, while its industrial business (30% of revenue) sells components within commercial and passenger vehicles and aircraft. Eaton receives favorable tax treatment as a domiciliary of Ireland, but it generates over half of its revenue within the US.

After a thorough review of the options trading surrounding Eaton Corp, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Current Position of Eaton Corp

- With a volume of 1,963,327, the price of ETN is down -0.73% at $327.39.

- RSI indicators hint that the underlying stock may be approaching overbought.

- Next earnings are expected to be released in 35 days.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Eaton Corp with Benzinga Pro for real-time alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Consumer Confidence Tumbles As Concerns Over Labor Market Grow, Odds Rise For 50-Basis-Point Interest Rate Cut In November

U.S. consumer confidence experienced a sharp and unexpected decline in September due to mounting concerns over the labor market, increasing speculation that the Federal Reserve might implement a consecutive 50-basis-point rate cut at its November meeting.

The index measured by The Conference Board fell from an upwardly revised 105.6 in August to 98.7 in September, missing expectations of 103.8.

“Consumer confidence dropped in September to near the bottom of the narrow range that has prevailed over the past two years,” said Dana M. Peterson, chief economist at the Conference Board, commented, adding that the monthly decline was the largest since August 2021.

Consumer Confidence Worsens As Labor Market, Inflation Conditions Turn Bleaker

Peterson highlighted that all five components of the index deteriorated, reflecting consumers’ negative assessments of both current business conditions and the labor market.

Consumers expressed more pessimism about future job availability and income prospects, with those aged 35 to 54 showing the sharpest decline in confidence. Among income groups, the largest drop occurred in households earning under $50,000 annually.

In terms of labor market views, 30.9% of consumers reported jobs as “plentiful” in September, down from 32.7% in August.

Those saying jobs were “hard to get” rose to 18.3%, up from 16.8%. Looking forward, 18.5% of consumers expected business conditions to improve, down from 19.1%, while 18.3% anticipated fewer job openings, up from 17%.

Inflation expectations also crept higher in September, with consumers expecting a 5.2% inflation rate over the next year, up from the prior month, though still well below the 7.9% peak in March 2022. Despite some declines in goods prices, mentions of inflation remained the top issue affecting consumers’ economic outlook.

Economist Reactions

Harris Financial Group managing partner Jamie Cox expressed concerns: “It’s never good to see consumer confidence fall this much. Consumers are clearly worried about global conflicts, the upcoming elections, and stubbornly high costs for food and credit.”

He added that another larger rate cut by Federal Reserve might be necessary. “A 50-basis-point cut seems more appropriate in light of these data.

Gina Bolvin, president of Bolvin Wealth Management Group, highlighted that consumer confidence plays a critical role in driving the economy, which relies heavily on consumer spending. “Confidence coming in lower than expected could trigger more market volatility, which typically spikes in late September,” Bolvin said.

She also explained that lower confidence may result in softer demand, which could help cool inflation. “In the long term, this could ease inflationary pressures, which is a positive for the consumer.”

Market Reactions Have Been Swift

The U.S. dollar index (DXY) dipped 0.3% at 11:00 a.m. in New York, and Treasury yields fell as investors raised their bets on a Federal Reserve rate cut.

The probability of a 50-basis-point rate cut in November rose to 58.1%, up from 53% a day earlier, according to the CME FedWatch tool.

The SPDR S&P 500 ETF Trust SPY stalled after hitting record highs on Thursday. Gold prices, tracked by the SPDR Gold Trust GLD, continued their ascent, propelled by fresh stimulus measures in China.

Now Read:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Insider Move: GREGORY ROBERTS Exercises Options, Realizing $493K At A-Mark Precious Metals

A large exercise of company stock options by GREGORY ROBERTS, Chief Executive Officer at A-Mark Precious Metals AMRK was disclosed in a new SEC filing on September 23, as part of an insider exercise.

What Happened: Disclosed in a Form 4 filing on Monday with the U.S. Securities and Exchange Commission, ROBERTS, Chief Executive Officer at A-Mark Precious Metals, executed a strategic derivative sale. This involved exercising stock options for 14,320 shares of AMRK, resulting in a transaction value of $493,610.

The Tuesday morning update indicates A-Mark Precious Metals shares down by 0.0%, currently priced at $42.87. At this value, ROBERTS’s 14,320 shares are worth $493,610.

Get to Know A-Mark Precious Metals Better

A-Mark Precious Metals Inc is a precious metal trading company. It is principally engaged in the wholesale of gold, silver, platinum, copper, and palladium bullion and related products in the form of bars, wafers, coins, and grains. The company’s operating segment includes Wholesale Sales and Ancillary Services; Secured Lending and Direct-to-Consumer. It generates maximum revenue from the Wholesale Trading and Ancillary Services segment. The Wholesale Trading and Ancillary Services segment comprises business units such as Industrial, Coin and Bar, Trading and Finance, Storage, Logistics, and Mint. Geographically, it derives a majority of its revenue from the United States and the rest from Europe, Asia Pacific, Australia, Africa, and other regions.

Unraveling the Financial Story of A-Mark Precious Metals

Revenue Challenges: A-Mark Precious Metals’s revenue growth over 3 months faced difficulties. As of 30 June, 2024, the company experienced a decline of approximately -19.06%. This indicates a decrease in top-line earnings. In comparison to its industry peers, the company trails behind with a growth rate lower than the average among peers in the Consumer Discretionary sector.

Navigating Financial Profits:

-

Gross Margin: The company faces challenges with a low gross margin of 1.7%, suggesting potential difficulties in cost control and profitability compared to its peers.

-

Earnings per Share (EPS): A-Mark Precious Metals’s EPS reflects a decline, falling below the industry average with a current EPS of 1.34.

Debt Management: A-Mark Precious Metals’s debt-to-equity ratio stands notably higher than the industry average, reaching 1.28. This indicates a heavier reliance on borrowed funds, raising concerns about financial leverage.

Valuation Analysis:

-

Price to Earnings (P/E) Ratio: The P/E ratio of 15.1 is lower than the industry average, implying a discounted valuation for A-Mark Precious Metals’s stock.

-

Price to Sales (P/S) Ratio: The Price to Sales ratio is 0.11, which is lower than the industry average. This suggests a possible undervaluation based on sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): With an impressive EV/EBITDA ratio of 12.79, A-Mark Precious Metals demonstrates exemplary market valuation, surpassing industry averages.

Market Capitalization Analysis: Falling below industry benchmarks, the company’s market capitalization reflects a reduced size compared to peers. This positioning may be influenced by factors such as growth expectations or operational capacity.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

The Relevance of Insider Transactions

Insider transactions, although significant, should be considered within the larger context of market analysis and trends.

From a legal standpoint, the term “insider” pertains to any officer, director, or beneficial owner holding more than ten percent of a company’s equity securities as outlined in Section 12 of the Securities Exchange Act of 1934. This encompasses executives in the c-suite and significant hedge funds. These insiders are mandated to inform the public of their transactions through a Form 4 filing, to be submitted within two business days of the transaction.

A company insider’s new purchase is a indicator of their positive anticipation for a rise in the stock.

While insider sells may not necessarily reflect a bearish view and can be motivated by various factors.

Unlocking the Meaning of Transaction Codes

For investors, a primary focus lies on transactions occurring in the open market, as indicated in Table I of the Form 4 filing. A P in Box 3 denotes a purchase, while S signifies a sale. Transaction code C signals the conversion of an option, and transaction code A denotes a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of A-Mark Precious Metals’s Insider Trades.

Insider Buying Alert: Profit from C-Suite Moves

Benzinga Edge reveals every insider trade in real-time. Don’t miss the next big stock move driven by insider confidence. Unlock this ultimate sentiment indicator now. Click here for access.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Stitch Fix Stock Falls After Q4 Results: Here's Why (CORRECTION)

Editor’s Note: A correction was made to the fourth quarter revenue.

Stitch Fix, Inc. SFIX shares are trading lower after the company reported its fourth-quarter financial results after Tuesday’s closing bell. Here’s a look at the details from the report.

The Details: Stitch Fix reported quarterly losses of 29 cents per share, which missed the analyst consensus estimate for losses of 19 cents. Quarterly revenue of $319.6 million beat the analyst consensus estimate of $318.5 million and is a 12.4% decrease year-over-year.

“We are executing our transformation strategy with discipline and, during the fourth quarter, we delivered results at the high end of our guidance on both the top and bottom line,” said Matt Baer, CEO of Stitch Fix.

“I am proud of the Stitch Fix team’s efforts this past fiscal year and encouraged by the progress we have already made to strengthen the foundation of our business and reimagine our client experience. While there is a lot of work still to do, I am confident we are on the right path to continue to improve the trajectory of our business which includes returning to revenue growth by the end of FY26,” Baer added.

Read Next: What’s Going On With Intel Stock?

Outlook: Stitch Fix sees first-quarter revenue in a range of $303 million to $310 million and fiscal year 2025 revenue in a range of $1.11 billion to $1.16 billion.

SFIX Price Action: According to Benzinga Pro, Stitch Fix shares are down 19.15% after-hours at $3.07 at the time of publication Tuesday.

Read Also:

Photo: Courtesy of Stitch Fix, Inc.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

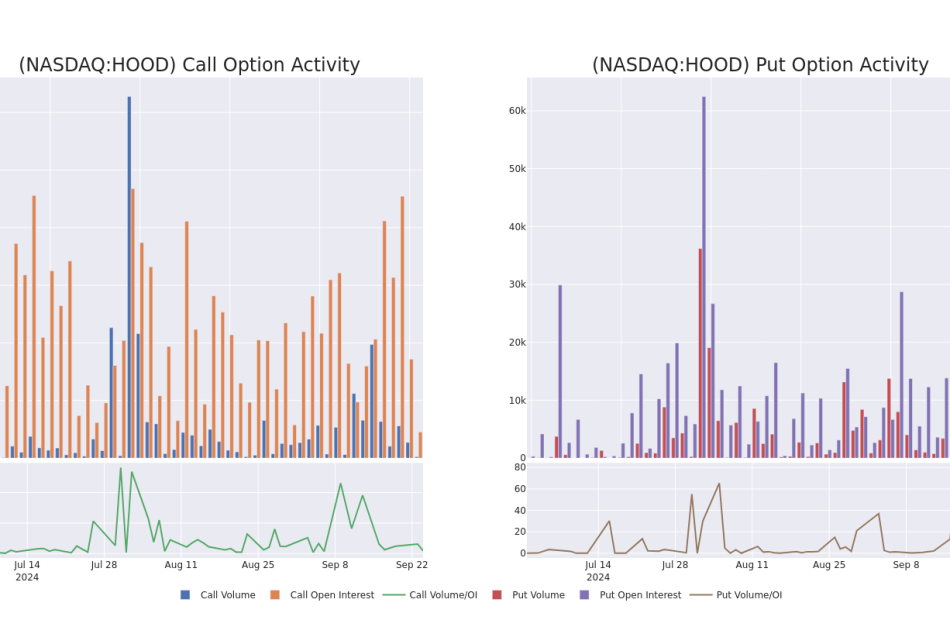

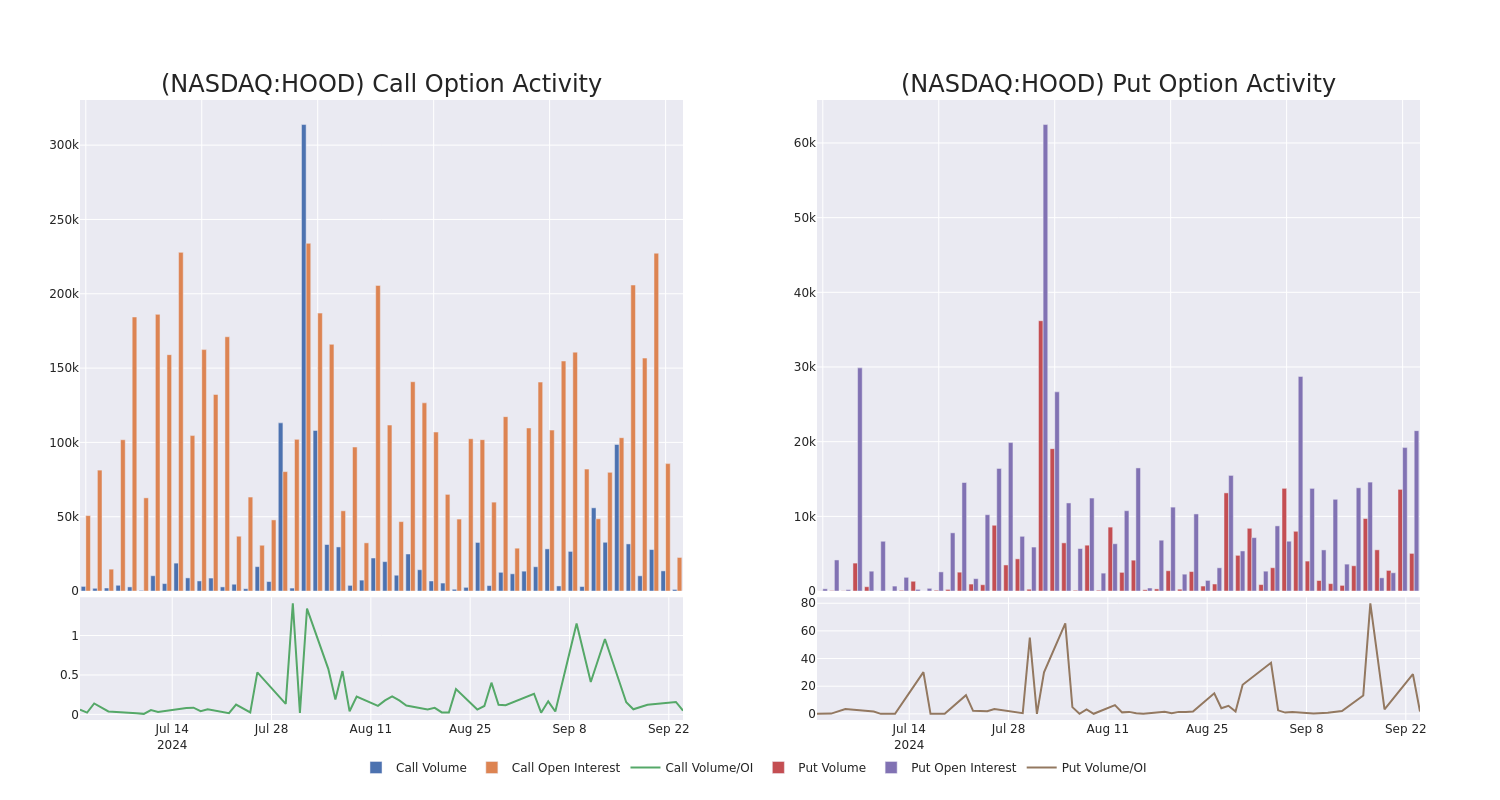

Market Whales and Their Recent Bets on HOOD Options

Financial giants have made a conspicuous bullish move on Robinhood Markets. Our analysis of options history for Robinhood Markets HOOD revealed 9 unusual trades.

Delving into the details, we found 55% of traders were bullish, while 44% showed bearish tendencies. Out of all the trades we spotted, 6 were puts, with a value of $545,046, and 3 were calls, valued at $622,402.

Projected Price Targets

After evaluating the trading volumes and Open Interest, it’s evident that the major market movers are focusing on a price band between $12.0 and $25.0 for Robinhood Markets, spanning the last three months.

Analyzing Volume & Open Interest

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Robinhood Markets’s options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Robinhood Markets’s whale trades within a strike price range from $12.0 to $25.0 in the last 30 days.

Robinhood Markets Option Volume And Open Interest Over Last 30 Days

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| HOOD | CALL | TRADE | BULLISH | 01/17/25 | $11.1 | $10.9 | $11.02 | $12.00 | $551.0K | 17.3K | 507 |

| HOOD | PUT | SWEEP | BEARISH | 01/16/26 | $6.75 | $6.65 | $6.75 | $25.00 | $189.6K | 655 | 283 |

| HOOD | PUT | SWEEP | BEARISH | 01/16/26 | $6.75 | $6.65 | $6.75 | $25.00 | $147.8K | 655 | 283 |

| HOOD | PUT | TRADE | BULLISH | 01/17/25 | $0.32 | $0.3 | $0.3 | $15.00 | $113.2K | 10.1K | 3.7K |

| HOOD | CALL | SWEEP | BULLISH | 11/15/24 | $6.1 | $6.05 | $6.15 | $17.00 | $42.3K | 1.2K | 113 |

About Robinhood Markets

Robinhood Markets Inc is creating a modern financial services platform. It designs its own products and services and delivers them through a single, app-based cloud platform supported by proprietary technology. Its vertically integrated platform has enabled the introduction of new products and services such as cryptocurrency trading, dividend reinvestment, fractional shares, recurring investments, and IPO Access. It earns transaction-based revenues from routing user orders for options, equities, and cryptocurrencies to market makers when a routed order is executed.

After a thorough review of the options trading surrounding Robinhood Markets, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Current Position of Robinhood Markets

- With a volume of 7,383,875, the price of HOOD is up 0.31% at $22.77.

- RSI indicators hint that the underlying stock may be approaching overbought.

- Next earnings are expected to be released in 42 days.

What The Experts Say On Robinhood Markets

A total of 2 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $23.5.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* Maintaining their stance, an analyst from Piper Sandler continues to hold a Overweight rating for Robinhood Markets, targeting a price of $27.

* An analyst from Barclays has elevated its stance to Equal-Weight, setting a new price target at $20.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Robinhood Markets options trades with real-time alerts from Benzinga Pro.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

DOJ goes after payment giant Visa with new antitrust suit

The US Justice Department went after Visa (V) on Tuesday in a federal antitrust lawsuit alleging that the company illegally used the scale of its vast card processing network to block competition.

Visa owns and controls the largest debit card processing network in the US, which processes more than 60% of the nation’s debit card transactions.

According to the DOJ, Visa leveraged its ecosystem of consumers, banks, and merchants to penalize merchants for choosing an alternate debit network.

“Collectively … Visa’s systematic efforts to limit competition for debit transactions have resulted in significant additional fees imposed on American consumers and businesses and slowed innovation in the debit payments ecosystem,” the complaint said.

According to the DOJ, Visa fashioned a “web of contracts” with major banks and merchants that required merchants to choose Visa’s network or pay higher fees to Visa for sales transactions.

In 2022, Visa debit processing fees drove $7 billion in revenue for the company. Visa stock dropped more than 5% Tuesday.

US Attorney General Merrick Garland said Visa’s illegal conduct discouraged potential rivals, particularly fintech companies like Square’s CashApp, from entering the debit processing market.

“While Visa is the first name many debit card users see when they take out their card to make a purchase, they do not see the role that Visa plays behind the scenes,” Garland said.

“There, it controls a complex network of merchants, financial institutions, and consumers … It is charging a hidden toll on each of trillions of transactions, adding up to billions of dollars of fees imposed annually on American consumers and businesses.”

Specifically, the DOJ said Visa illegally held on to monopolies in two markets: the debit network services market, which is used to withdraw funds directly out of a consumer’s bank account, and the card-not-present debit network services market.

The latter is a narrower market within the broader services market that includes traditional debit card transactions, as well as fintech transactions.

Visa’s general counsel, Julie Rottenberg, responded to the lawsuit by saying that it ignored Visa’s “many competitors” in the growing debit space.

“Anyone who has bought something online, or checked out at a store, knows there is an ever-expanding universe of companies offering new ways to pay for goods and services,” Rottenberg said.

Alden Abbott, a Mercatus Center research fellow and former general counsel for the US Federal Trade Commission, said the Visa case is unique for an antitrust case in that the Dodd-Frank Act set a cap on debit card fees.

Any antitrust analysis of Visa’s arrangements should take the law’s impact into account, Abbott said, because it may have discouraged rivals from entering the market, weakened then-existing rivals, and led to fewer poorer Americans having debit cards.

“It is certainly possible that Visa’s growing debit card market share is due to this statutory price cap, rather than anti-competitive actions by Visa,” Abbott said.

The DOJ is asking for the federal district court in Manhattan to block Visa from using the allegedly harmful contracts and to block it from bundling credit services or credit incentives with debit network services.

It also asked for the court to stop Visa from imposing pricing incentives for use of its network.

Alexis Keenan is a legal reporter for Yahoo Finance. Follow Alexis on X @alexiskweed.

Click here for in-depth analysis of the latest stock market news and events moving stock prices

Read the latest financial and business news from Yahoo Finance

'It Takes A Village…To Build Generational Wealth': NBA's Al Harrington On His Full Circle Moment And Opening NJ Cannabis Dispensary

“It takes a village to do anything great in life,” says NBA star turned cannabis entrepreneur Al Harrington in an exclusive interview with Benzinga Cannabis, repeating a mantra that has guided him throughout his career. As he reflects on the recent opening of Village Dispensary in Hoboken, New Jersey, the significance of this moment is not lost on him. It’s a return home for Harrington, a personal victory tied to a broader mission: redefining the cannabis landscape, particularly for communities of color that have been disproportionately affected by the War on Drugs.

The Hoboken dispensary, Village Brands’ first East Coast location is more than just another store in the company’s growing portfolio. It marks a full-circle moment for Harrington, who recalls when the streets of New Jersey were hostile to young men like him. “I’m really happy that we finally got something here in my own state,” Harrington says, referencing the years of anticipation that led to this launch. “People for years have been asking, ‘When are we gonna be able to get some product?’ Now I can say, go to 516 Washington and buy as much as you can.”

A ‘Full Circle’ Moment

The Village Dispensary opened its doors in a location where Harrington was once stopped and frisked as a teenager. The shop’s presence in that same neighborhood is symbolic. “It’s a full circle moment to open a dispensary in the state where I was stopped and frisked as a kid who had never even touched flower,” Harrington said. He acknowledged the irony of not only opening a legal cannabis store but doing so with local government support, including the mayor and city officials.

Village Brands, founded in 2019 by Harrington and his business partner Dan Pettigrew aims to expand its cannabis footprint beyond Viola, their first brand, which was inspired and named after Harrington’s grandmother who found relief from glaucoma through cannabis. Viola became a symbol of the healing potential of the plant. Village Brands is the next step in their mission to make cannabis accessible and de-stigmatized. “When we started Viola, it was about changing the stigma. We saw how cannabis helped my grandmother, and we thought, why not use that story? It resonated with people,” Harrington told Benzinga.

Bridging Community And Business

For Harrington, opening a shop in New Jersey is not just about expanding his business, but righting historical wrongs and offering communities – particularly those hardest hit by prohibition – a chance to reclaim something that was used to oppress them. “This is a way for us to get generational wealth,” Harrington said, emphasizing the need to provide opportunities for people of color to thrive in the cannabis industry. His advocacy for inclusion taps into a deeper desire for justice and representation in a space that has long excluded those most impacted by the war on drugs.

The new dispensary is meant to be a pillar of the community, providing more than just cannabis products. Harrington views it as a place where people from all walks of life can come together and feel a sense of ownership. “We want people from our community to feel like they can take ownership of our dispensaries,” he says, highlighting Village Brands’ mission to create spaces that are not just commercial but communal.

A New Chapter For New Jersey: ‘Things Happen In God’s Time‘

For Harrington, this store opening is a powerful statement, especially in a state with a long history of criminalizing cannabis use, particularly among communities of color. The fact that a Black entrepreneur like Harrington is now leading a legal cannabis venture in the same neighborhoods where he once faced discrimination feels deeply significant. But as Harrington is quick to remind, this is just the beginning.

The journey has had its challenges. “We were ready three years ago,” said Harrington, referring to delays caused by local jurisdictions taking their time to opt into NJ’s cannabis program. Though frustrating, Harrington believes the timing ultimately worked out for the best. “If you ask me, things happen in God’s time.”

The dispensary’s grand opening featured a ribbon-cutting ceremony with city officials, followed by a celebratory block party. “We threw a little mini block party to let everybody know that we’re here,” he says with pride. “We hope that we don’t rub anybody the wrong way because we did see a lot of people come through.”

Harrington’s focus remains on creating deeper experiences for his customers. His personal touch extends to the dispensary’s loyalty program, designed to offer unique rewards. “We have a loyalty program that’s gonna be very aggressive around winning different experiences, maybe even going with me to a Nets game.”

Harrington’s deep connection to his home state of New Jersey and his determination to right historical wrongs, fuel his drive to build something meaningful. “We’ve been bringing people together for the last 13 years through this magnificent opportunity to work with the cannabis plant, and it takes a village to do anything great,” Harrington said.

For Harrington, it’s also about ensuring that the cannabis industry includes those who have been marginalized. “We don’t forget the people that were mostly harmed and negatively affected by it,” Harrington notes. His focus is on ensuring that the billions of dollars being generated in cannabis include opportunities for generational wealth in communities that need it the most.

As Village Dispensary becomes a beacon for cannabis reform and community empowerment, Harrington remains steadfast in his mission to make this new chapter in New Jersey not just a business venture but part of a much larger movement. “The strategy is always to find something that can be impactful first and make money second,” Harrington says, ensuring that the foundation of Village Brands is one of purpose, not just profit.

The success of Village Dispensary marks the beginning of many more chapters for Al Harrington and his ever-expanding cannabis empire.

Stay tuned for parts 2 and 3 of this 3-story series with Al Harrington.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.