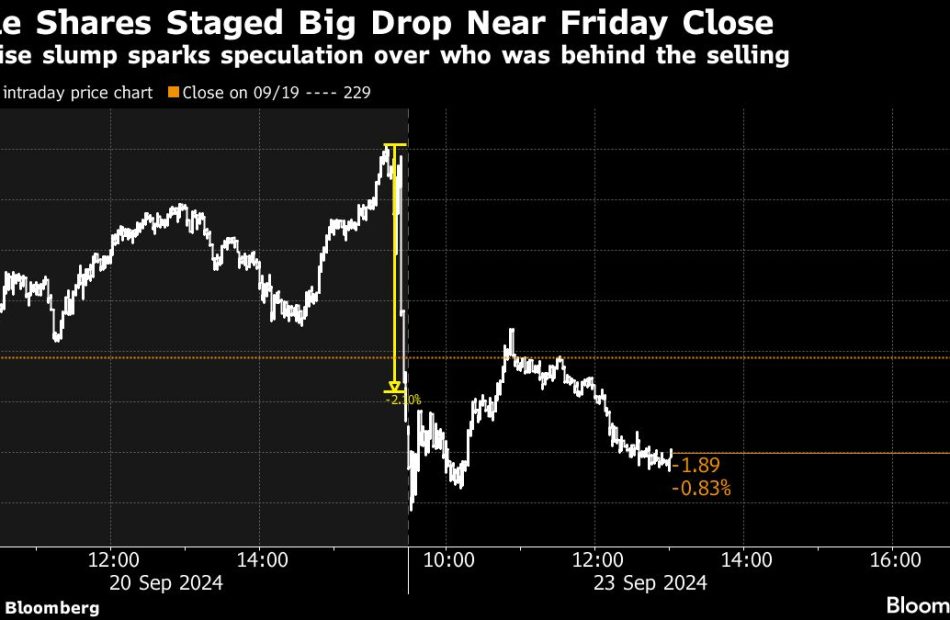

Apple’s Late-Day Plunge Stirs Speculation Over Who Was Selling

(Bloomberg) — Friday was supposed to be a good day for the shares of Apple Inc., with the iPhone maker set to be a big winner from the quarterly adjustment of major stock indexes. And for most of the session, that’s how it played out — until about 10 minutes before the closing bell.

Most Read from Bloomberg

By the time it rang, Apple had sunk more than 2% from its intraday high to close in the red, a surprise reversal that has left market watchers guessing who or what could have triggered it.

Market-on-close orders — those instructing a broker to buy or sell a stock at the closing price of a trading day — showed an unusually large imbalance at the time, indicating net disposals of 30 million shares. That’s more than half of Apple’s average full-day volume in the prior three months, all offloaded in the dying minutes of the Wall Street week.

The huge selling pressure was a surprise because funds tracking major equity benchmarks were expected to be big buyers of the stock on Friday after Warren Buffett sold a significant stake in Apple during the second quarter. That meant the company’s weighting was due to be significantly increased in many gauges.

One theory is that some actively managed funds may have capitalized on this predictable liquidity to trim their holdings.

“Maybe some investors wanted to take advantage of the rebalance to sell a sizable chunk of stock,” said Matt Maley, chief market strategist at Miller Tabak + Co. “They knew that a big piece of buying power was about to hit the market, so they knew it would be a great time for them to sell a chunk of stock without knocking down the stock very much.”

While Apple closed Friday down 0.3%, it was still 2.6% higher for the week overall. The shares slipped as much as 1% on Monday before paring the loss by half as of 12:45 p.m. in New York.

Another possibility is that arbitrage players may have snapped up Apple shares in advance of the rebalance event, which Piper Sandler & Co. estimated was set to create $35 billion of demand from passive funds. The stock rose for three straight sessions before Friday, jumping almost 6% in that time.

While it’s getting crowded, buying stocks whose representations in major indexes are rising and selling those with falling influence has been a reliable strategy for many in the hedge fund world.

“Arbitragers try to preposition themselves ahead of various index events because they think there is going to be movement at the close during rebalance days,” said Mohit Bajaj, director of ETFs at WallachBeth Capital. “Although it is getting tougher to do, it still does happen.”

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

Leave a Reply