Behind the Scenes of Iris Energy's Latest Options Trends

Financial giants have made a conspicuous bullish move on Iris Energy. Our analysis of options history for Iris Energy IREN revealed 9 unusual trades.

Delving into the details, we found 77% of traders were bullish, while 22% showed bearish tendencies. Out of all the trades we spotted, 2 were puts, with a value of $81,860, and 7 were calls, valued at $324,239.

Projected Price Targets

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $7.5 to $19.0 for Iris Energy over the last 3 months.

Insights into Volume & Open Interest

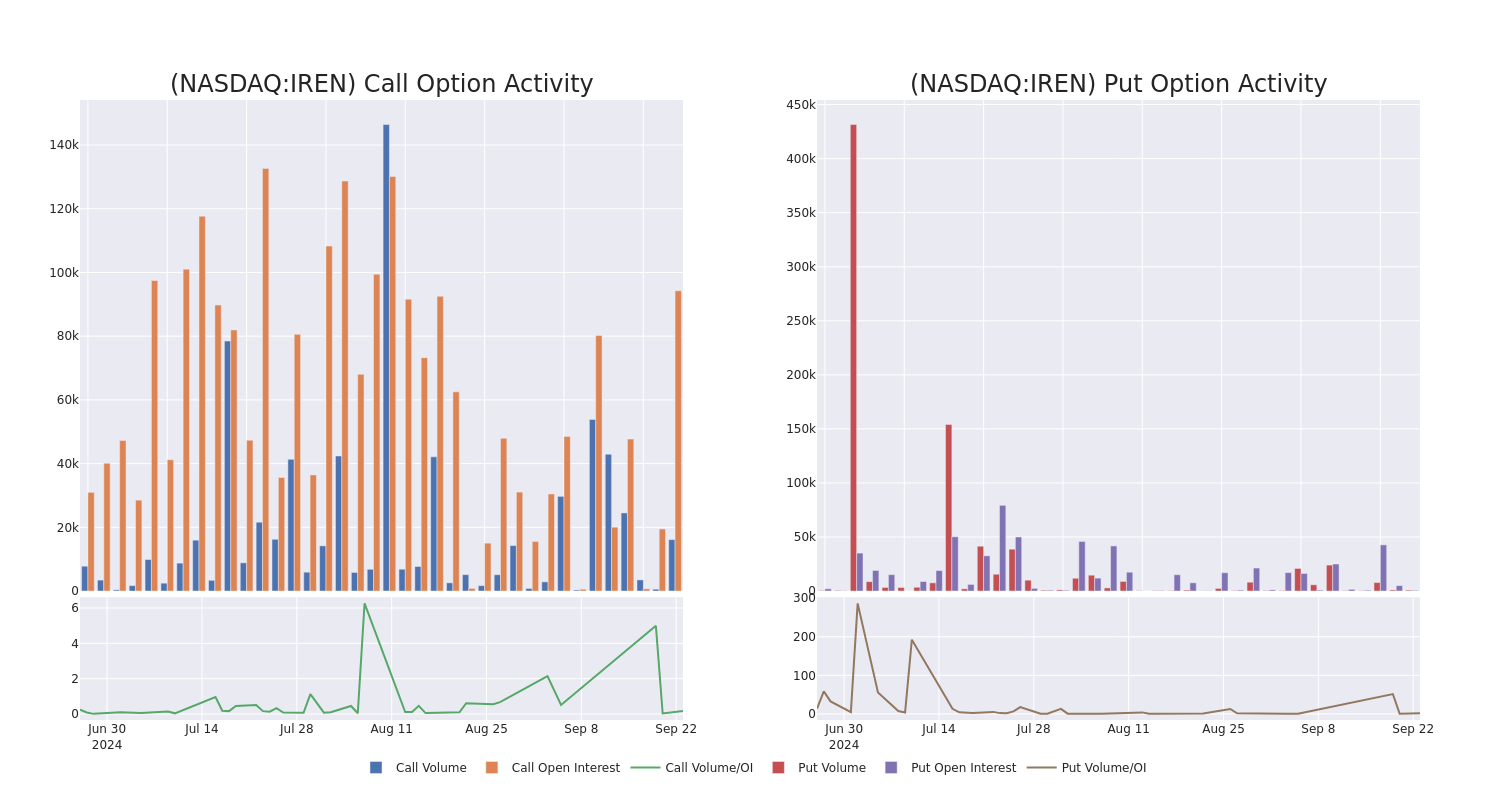

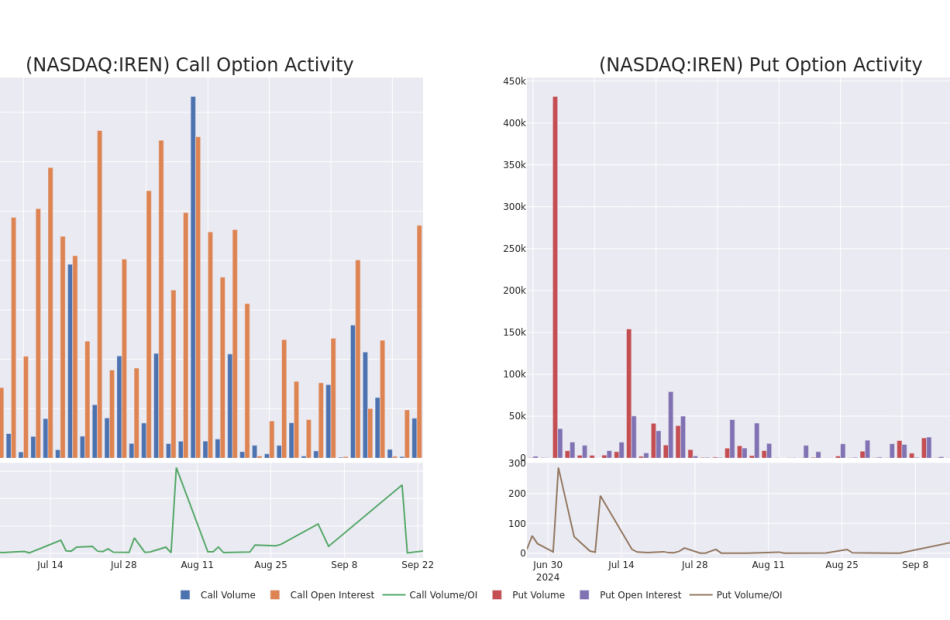

In terms of liquidity and interest, the mean open interest for Iris Energy options trades today is 13550.0 with a total volume of 16,946.00.

In the following chart, we are able to follow the development of volume and open interest of call and put options for Iris Energy’s big money trades within a strike price range of $7.5 to $19.0 over the last 30 days.

Iris Energy Call and Put Volume: 30-Day Overview

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| IREN | CALL | TRADE | BULLISH | 10/18/24 | $0.1 | $0.05 | $0.1 | $15.00 | $100.0K | 35.6K | 10.0K |

| IREN | CALL | TRADE | BULLISH | 11/15/24 | $0.3 | $0.25 | $0.3 | $15.00 | $54.0K | 17.5K | 3.0K |

| IREN | CALL | TRADE | BULLISH | 01/17/25 | $2.2 | $2.0 | $2.15 | $7.50 | $43.0K | 6.2K | 202 |

| IREN | PUT | TRADE | BEARISH | 09/27/24 | $2.05 | $1.95 | $2.05 | $10.00 | $40.9K | 605 | 505 |

| IREN | PUT | SWEEP | BEARISH | 09/27/24 | $2.05 | $2.0 | $2.04 | $10.00 | $40.8K | 605 | 305 |

About Iris Energy

Iris Energy Ltd is a Bitcoin mining company. It builds, owns, and operates data centers and electrical infrastructure for the mining of Bitcoin powered by renewable energy. The company’s mining operations generate revenue by earning Bitcoin through a combination of block rewards and transaction fees from the operation of its specialized computers called Application-specific Integrated Circuits and exchanging these Bitcoin for currencies such as USD or CAD on a daily basis.

Following our analysis of the options activities associated with Iris Energy, we pivot to a closer look at the company’s own performance.

Where Is Iris Energy Standing Right Now?

- Trading volume stands at 16,671,413, with IREN’s price up by 5.73%, positioned at $7.94.

- RSI indicators show the stock to be may be approaching overbought.

- Earnings announcement expected in 49 days.

Expert Opinions on Iris Energy

5 market experts have recently issued ratings for this stock, with a consensus target price of $13.9.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* An analyst from Compass Point persists with their Buy rating on Iris Energy, maintaining a target price of $16.

* An analyst from HC Wainwright & Co. has decided to maintain their Buy rating on Iris Energy, which currently sits at a price target of $13.

* Consistent in their evaluation, an analyst from Macquarie keeps a Outperform rating on Iris Energy with a target price of $13.

* Maintaining their stance, an analyst from B. Riley Securities continues to hold a Buy rating for Iris Energy, targeting a price of $12.

* Maintaining their stance, an analyst from Canaccord Genuity continues to hold a Buy rating for Iris Energy, targeting a price of $15.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Iris Energy with Benzinga Pro for real-time alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Leave a Reply