Market Whales and Their Recent Bets on HOOD Options

Financial giants have made a conspicuous bullish move on Robinhood Markets. Our analysis of options history for Robinhood Markets HOOD revealed 9 unusual trades.

Delving into the details, we found 55% of traders were bullish, while 44% showed bearish tendencies. Out of all the trades we spotted, 6 were puts, with a value of $545,046, and 3 were calls, valued at $622,402.

Projected Price Targets

After evaluating the trading volumes and Open Interest, it’s evident that the major market movers are focusing on a price band between $12.0 and $25.0 for Robinhood Markets, spanning the last three months.

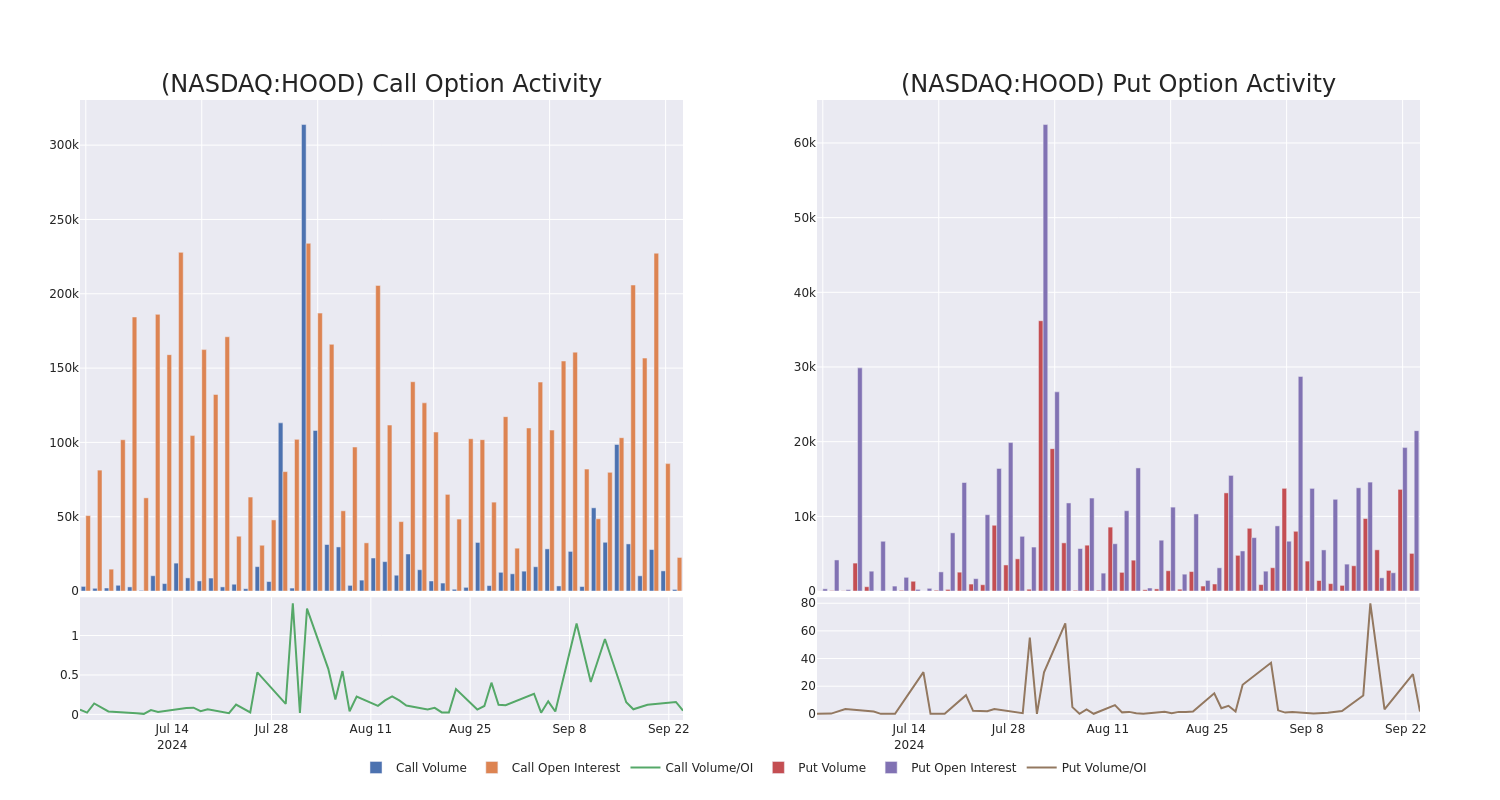

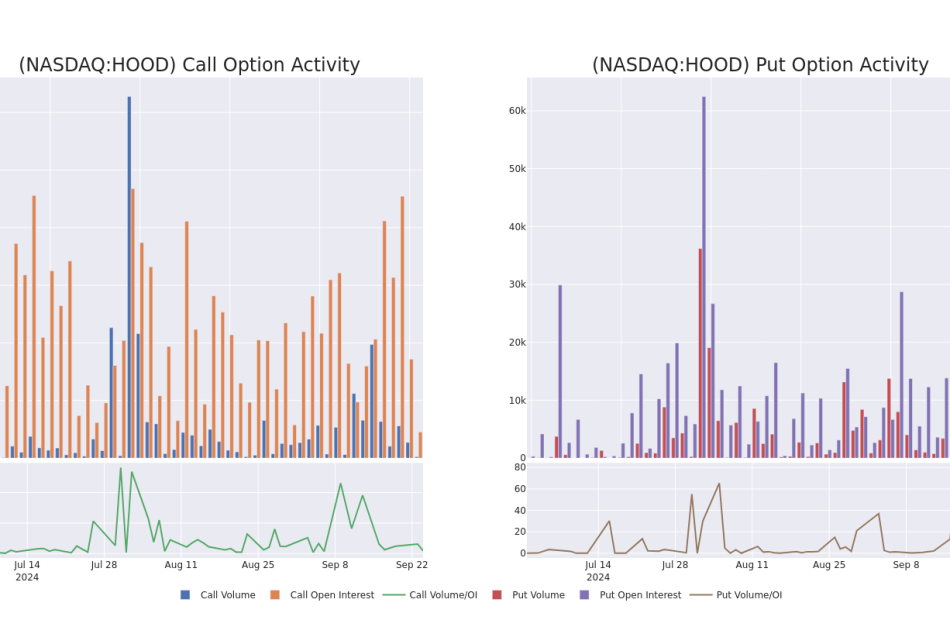

Analyzing Volume & Open Interest

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Robinhood Markets’s options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Robinhood Markets’s whale trades within a strike price range from $12.0 to $25.0 in the last 30 days.

Robinhood Markets Option Volume And Open Interest Over Last 30 Days

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| HOOD | CALL | TRADE | BULLISH | 01/17/25 | $11.1 | $10.9 | $11.02 | $12.00 | $551.0K | 17.3K | 507 |

| HOOD | PUT | SWEEP | BEARISH | 01/16/26 | $6.75 | $6.65 | $6.75 | $25.00 | $189.6K | 655 | 283 |

| HOOD | PUT | SWEEP | BEARISH | 01/16/26 | $6.75 | $6.65 | $6.75 | $25.00 | $147.8K | 655 | 283 |

| HOOD | PUT | TRADE | BULLISH | 01/17/25 | $0.32 | $0.3 | $0.3 | $15.00 | $113.2K | 10.1K | 3.7K |

| HOOD | CALL | SWEEP | BULLISH | 11/15/24 | $6.1 | $6.05 | $6.15 | $17.00 | $42.3K | 1.2K | 113 |

About Robinhood Markets

Robinhood Markets Inc is creating a modern financial services platform. It designs its own products and services and delivers them through a single, app-based cloud platform supported by proprietary technology. Its vertically integrated platform has enabled the introduction of new products and services such as cryptocurrency trading, dividend reinvestment, fractional shares, recurring investments, and IPO Access. It earns transaction-based revenues from routing user orders for options, equities, and cryptocurrencies to market makers when a routed order is executed.

After a thorough review of the options trading surrounding Robinhood Markets, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Current Position of Robinhood Markets

- With a volume of 7,383,875, the price of HOOD is up 0.31% at $22.77.

- RSI indicators hint that the underlying stock may be approaching overbought.

- Next earnings are expected to be released in 42 days.

What The Experts Say On Robinhood Markets

A total of 2 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $23.5.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* Maintaining their stance, an analyst from Piper Sandler continues to hold a Overweight rating for Robinhood Markets, targeting a price of $27.

* An analyst from Barclays has elevated its stance to Equal-Weight, setting a new price target at $20.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Robinhood Markets options trades with real-time alerts from Benzinga Pro.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Leave a Reply