Century Complete Announces New Community Now Selling in Ocala, FL

Starting from the mid $200s, West Oak offering single-family floor plans from the national leader in online homebuying

OCALA, Fla., Sept. 23, 2024 /PRNewswire/ — Century Communities, Inc. CCS—a top national homebuilder, industry leader in online home sales, and featured on America’s Most Trustworthy Companies and World’s Most Trustworthy Companies by Newsweek—announced that its Century Complete brand is now selling at West Oak, a new community in Ocala featuring quality single-family floor plans, affordably priced from the mid $200s.

Marking the company’s second community in Ocala, West Oak features a prime location that backs up to the Ocala Wetland Recharge Park—a 60-acre nature site with two walking loops throughout a wetland ecosystem. Homebuyers can choose from a versatile selection of single- and two-story floor plans, with included features like Kohler® bath fixtures, Whirlpool® stainless-steel appliances and granite countertops. Planned community amenities include a pool, clubhouse and fitness center. The community will also offer paired floor plans in the future.

In the greater Ocala area and nearby Silver Springs, Century Complete offers an additional three exceptional communities priced from the mid $200s: Bennah Oaks, Marion Oaks, and Silver Springs Shores.

Learn more and explore available homes at www.CenturyCommunities.com/WestOak.

“We’re very excited to bring an even greater selection of quality and affordable new homes to Ocala,” said Dave Roberts, EVP of Field Operations. “With an exceptional lineup of floor plans, incredible amenities and a beautiful location, homebuyers should act fast to find their best fit.”

MORE ABOUT WEST OAK

Now selling from the mid $200s

- 100 single-family homesites

- Single- and two-story floor plans

- Up to 4 bedrooms, 2 bathrooms, and up to 1,934 square feet

- 2-bay garages

- Open-concept layouts with Kohler® bath fixtures, Whirlpool® stainless-steel appliances, granite countertops and more

- Community amenities like a clubhouse, fitness center, and pool

- Backs up to the Ocala Wetland Recharge Park

- Convenient access to I-75, Highway 27, and Highway 301

NW 21st Street,

Ocala, FL 34475

352.678.6630

VISIT OUR NEARBY MODEL HOME AT MARION OAKS!

319 Marion Oaks Boulevard

Ocala, FL 34473

352.678.6630

THE FREEDOM OF ONLINE HOMEBUYING

Century Complete is proud to feature its industry-first online homebuying experience on all available homes in Florida, allowing homebuyers to easily find their best fit and purchase when they’re ready—all while continuing to work with their local real estate agent of choice. Homebuyers can further streamline the homebuying process by financing online with Century Complete’s affiliate lender, Inspire Home Loans®.

How it works:

- Shop homes at CenturyCommunities.com

- Click “Buy Now” on any available home

- Fill out a quick Buy Online form

- Electronically submit an initial earnest money deposit

- Electronically sign a purchase contract via DocuSign®

Learn more about the Buy Online experience at www.CenturyCommunities.com/online-homebuying.

About Century Communities

Century Communities, Inc. CCS is one of the nation’s largest homebuilders, an industry leader in online home sales, and the highest-ranked homebuilder on Newsweek’s list of America’s Most Trustworthy Companies 2024—consecutively awarded for a second year—and Newsweek’s list of the World’s Most Trustworthy Companies 2024. Through its Century Communities and Century Complete brands, Century’s mission is to build attractive, high-quality homes at affordable prices to provide its valued customers with A HOME FOR EVERY DREAM®. Century is engaged in all aspects of homebuilding — including the acquisition, entitlement and development of land, along with the construction, innovative marketing and sale of quality homes designed to appeal to a wide range of homebuyers. The Company operates in 18 states and over 45 markets across the U.S., and also offers title, insurance and lending services in select markets through its Parkway Title, IHL Home Insurance Agency, and Inspire Home Loans subsidiaries. To learn more about Century Communities, please visit www.centurycommunities.com.

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/century-complete-announces-new-community-now-selling-in-ocala-fl-302255938.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/century-complete-announces-new-community-now-selling-in-ocala-fl-302255938.html

SOURCE Century Communities, Inc.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Red Cat Holdings Reports Financial Results for Fiscal First Quarter 2025 and Provides Corporate Update

SAN JUAN, Puerto Rico, Sept. 23, 2024 (GLOBE NEWSWIRE) — Red Cat Holdings, Inc. RCAT (“Red Cat” or “Company”), a drone technology company integrating robotic hardware and software for military, government, and commercial operations, reports its financial results for the fiscal first quarter ended July 31, 2024 and provides a corporate update.

Recent Operational Highlights:

- Presented drone solutions to high-level officials, at multiple Defense Conferences, including the U.S Marine Corps (Modern Day Marine), domestic and international Special Operations Forces (SOF Week), and European Union and NATO forces at Eurosatory 2024 in Paris, France.

- Announced development of a new Family of Small ISR and Precision Strike Systems at Eurosatory 2024.

- Recently closed FlightWave asset purchase agreement.

- Launched Robotics and Autonomous Systems Industry Consortium called Red Cat Futures Initiative.

First Quarter 2025 Financial Highlights:

- Quarterly revenue of $2.8 million, representing 59% year-over-year growth.

- Ended the quarter with cash of $7.7 million.

- Guidance of $50-$55 million for calendar year 2025 exclusive of government or NATO programs of record.

- Record backlog of $13 million.

“Red Cat continues to see significant global demand and year-over-year growth with a strong pipeline and backlog,” said Jeff Thompson, Red Cat Chairman and Chief Executive Officer. “This is being driven by strong domestic and international adoption and sales across our entire Family of Systems, which now includes the Edge 130 Blue. Our guidance for the upcoming 2025 calendar year of $50 – $55 million will continue our growth trend as we await news around the U.S. Army’s Short-Range Reconnaissance Program of Record and prepare to scale up production capacity.”

“We are reporting 59% year-over-year growth and $13 million in backlog for the first quarter of fiscal 2025,” stated Leah Lunger, Chief Financial Officer. “Having officially closed the acquisition of FlightWave Aerospace System, we look forward to integrating the Edge 130 Blue into our Family of Systems, which will open new revenue streams and partnership opportunities with companies in our Futures Initiative. We also have significant market potential for NDAA compliant FPV precision strike drones within our innovation roadmap.”

Conference Call Today

CEO Jeff Thompson and CFO Leah Lunger will host an earnings conference call at 4:30 p.m. ET on Tuesday, September 23, 2024 to review financial results and provide an update on corporate developments. Following management’s formal remarks, there will be a question-and-answer session.

Interested parties can listen to the conference call by dialing 1-844-413-3977 (within the U.S.) or 1-412-317-1803 (international). Callers should dial in approximately ten minutes prior to the start time and ask to be connected to the Red Cat conference call. Participants can also pre-register for the call using the following link: https://dpregister.com/sreg/10192508/fd6e5cff60

The conference call will also be available through a live webcast that can be accessed at:

https://event.choruscall.com/mediaframe/webcast.html?webcastid=TD6F4UVA

A replay of the webcast will be available until December 22, 2024 and can be accessed through the above link or at www.redcatholdings.com. A telephonic replay will be available until October 7, 2024 by calling 1-877-344-7529 (domestic) or 1-412-317-0088 (international) and using access code 2058195.

About Red Cat, Inc.

Red Cat RCAT is a drone technology company integrating robotic hardware and software for military, government, and commercial operations. Through two wholly owned subsidiaries, Teal Drones and FlightWave Aerospace, Red Cat has developed a bleeding-edge Family of ISR and Precision Strike Systems including the Teal 2, a small unmanned system offering the highest-resolution thermal imaging in its class, the Edge 130 Blue Tricopter for extended endurance and range, and FANG™, the industry’s first line of NDAA compliant FPV drones optimized for military operations with precision strike capabilities. Learn more at www.redcat.red.

Forward Looking Statements

This press release contains “forward-looking statements” that are subject to substantial risks and uncertainties. All statements, other than statements of historical fact, contained in this press release are forward-looking statements. Forward-looking statements contained in this press release may be identified by the use of words such as “anticipate,” “believe,” “contemplate,” “could,” “estimate,” “expect,” “intend,” “seek,” “may,” “might,” “plan,” “potential,” “predict,” “project,” “target,” “aim,” “should,” “will” “would,” or the negative of these words or other similar expressions, although not all forward-looking statements contain these words. Forward-looking statements are based on Red Cat Holdings, Inc.’s current expectations and are subject to inherent uncertainties, risks and assumptions that are difficult to predict. Further, certain forward-looking statements are based on assumptions as to future events that may not prove to be accurate. These and other risks and uncertainties are described more fully in the section titled “Risk Factors” in the Form 10-K filed with the Securities and Exchange Commission on July 27, 2023. Forward-looking statements contained in this announcement are made as of this date, and Red Cat Holdings, Inc. undertakes no duty to update such information except as required under applicable law.

Contact:

INVESTORS:

E-mail: Investors@redcat.red

NEWS MEDIA:

Phone: (347) 880-2895

Email: peter@indicatemedia.com

| RED CAT HOLDINGS | |||||||||||

| Condensed Consolidated Balance Sheets | |||||||||||

| July 31, | April 30, | ||||||||||

| 2024 | 2024 | ||||||||||

| ASSETS | |||||||||||

| Cash and marketable securities | $ | 7,732,763 | $ | 6,067,169 | |||||||

| Accounts receivable, net | 681,775 | 4,361,090 | |||||||||

| Inventory, including deposits | 10,667,676 | 8,610,125 | |||||||||

| Intangible assets including goodwill, net | 12,612,560 | 12,882,939 | |||||||||

| Other | 6,260,457 | 7,473,789 | |||||||||

| Equity method investee | — | 5,142,500 | |||||||||

| Note receivable | — | 4,000,000 | |||||||||

| TOTAL ASSETS | $ | 37,955,231 | $ | 48,537,612 | |||||||

| LIABILITIES AND STOCKHOLDERS’ EQUITY | |||||||||||

| Accounts payable and accrued expenses | $ | 3,428,538 | $ | 2,703,922 | |||||||

| Debt obligations | 599,570 | 751,570 | |||||||||

| Operating lease liabilities | 1,471,589 | 1,517,590 | |||||||||

| Total liabilities | 5,499,697 | 4,973,082 | |||||||||

| Stockholders’ capital | 126,002,642 | 124,690,641 | |||||||||

| Accumulated deficit/comprehensive loss | (93,547,108 | ) | (81,126,111 | ) | |||||||

| Total stockholders’ equity | 32,455,534 | 43,564,530 | |||||||||

| TOTAL LIABILITIES AND STOCKHOLDERS’ EQUITY | $ | 37,955,231 | $ | 48,537,612 | |||||||

| Condensed Consolidated Statements of Operations | ||||||||

| Three months ended | ||||||||

| July 31, | ||||||||

| 2024 | 2023 | |||||||

| Revenues | $ | 2,776,535 | $ | 1,748,129 | ||||

| Cost of goods sold | 3,259,926 | 1,573,464 | ||||||

| Gross (loss) profit | (483,391 | ) | 174,665 | |||||

| Operating Expenses | ||||||||

| Research and development | 1,626,440 | 1,353,551 | ||||||

| Sales and marketing | 2,041,511 | 1,288,760 | ||||||

| General and administrative | 3,483,095 | 2,863,758 | ||||||

| Impairment loss | 93,050 | — | ||||||

| Total operating expenses | 7,244,096 | 5,506,069 | ||||||

| Operating loss | (7,727,487 | ) | (5,331,404 | ) | ||||

| Other expense | 4,688,889 | 262,891 | ||||||

| Net loss from continuing operations | (12,416,376 | ) | (5,594,295 | ) | ||||

| Loss from discontinued operations | — | (242,573 | ) | |||||

| Net loss | $ | (12,416,376 | ) | $ | (5,836,868 | ) | ||

| Loss per share – basic and diluted | $ | (0.17 | ) | $ | (0.11 | ) | ||

| Weighted average shares outstanding – basic and diluted | 74,500,480 | 54,935,339 | ||||||

| Condensed Consolidated Statements of Cash Flows | ||||||||

| Three months ended July 31, | ||||||||

| 2024 | 2023 | |||||||

| Cash Flows from Operating Activities | ||||||||

| Net loss from continuing operations | $ | (12,416,376 | ) | $ | (5,594,295 | ) | ||

| Non-cash expenses | 6,755,639 | 1,522,611 | ||||||

| Changes in operating assets and liabilities | 3,312,325 | (2,854,385 | ) | |||||

| Net cash used in operating activities | (2,348,412 | ) | (6,926,069 | ) | ||||

| Cash Flows from Investing Activities | ||||||||

| Proceeds from sale of equity method investment and note receivable | 4,400,000 | — | ||||||

| Proceeds from sale of marketable securities | — | 4,888,399 | ||||||

| Other | (99,957 | ) | (5,054 | ) | ||||

| Net cash provided by investing activities | 4,300,043 | 4,883,345 | ||||||

| Cash Flows from Financing Activities | ||||||||

| Payments of debt obligations, net | (152,000 | ) | (137,989 | ) | ||||

| Payments related to employee equity transactions | (134,037 | ) | (8,520 | ) | ||||

| Net cash used in financing activities | (286,037 | ) | (146,509 | ) | ||||

| Net cash used in discontinued operations | — | (118,295 | ) | |||||

| Net increase (decrease) in Cash | 1,665,594 | (2,307,528 | ) | |||||

| Cash, beginning of period | 6,067,169 | 3,260,305 | ||||||

| Cash, end of period | 7,732,763 | 952,777 | ||||||

| Less: Cash of discontinued operations | — | (15,021 | ) | |||||

| Cash of continuing operations, end of period | 7,732,763 | 937,756 | ||||||

| Marketable securities | — | 7,922,392 | ||||||

| Cash of continuing operations and marketable securities | $ | 7,732,763 | $ | 8,860,148 | ||||

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Automotive Piezoelectric Sensor Market exhibiting a CAGR of 6% during the forecast period | Exactitude Consultancy

Luton, Bedfordshire, United Kingdom, Sept. 23, 2024 (GLOBE NEWSWIRE) — Exactitude Consultancy, the market research and consulting wing of Ameliorate Digital Consultancy Private Limited has completed and published the final copy of the detailed research report on the Global Automotive Piezoelectric Sensor Market which have been slid into a multipage report of over two hundred pages with ample data available for business strategists to take proper informed decisions targeted at achieving cloud efficiency that takes care of changing competitive dynamics across geography.

The global automotive piezoelectric sensor market size is projected to grow from USD 2.0 billion in 2023 to USD 3.01 billion by 2030, exhibiting a CAGR of 6% during the forecast period. This growth means Compound Annual Growth Rate (CAGR) of 6% during the forecast period of 2024 to 2030.

Click Here to get more information: https://exactitudeconsultancy.com/reports/36820/automotive-piezoelectric-sensor-market/

The Latest News about Advanced Process Control Market

October 9, 2024: Bosch came up with the road hazard service that is very useful to cars, including trucks. This cloud-based system is planned to be implemented for passenger car from June 2024 and for Mercedes-Benz Trucks from December 2024. It also provides alerts concerning adverse road conditions such as; Frozen surface of the road, foggy conditions, Accidents scenes and vehicles on the wrong side of the divide. As per Dr. Markus Heyn this traffic predictive service not only makes the potential motorists informed about the probable ghastly occurrence beforehand which in turn minimizes the chances of occurrence and in addition assists the drivers largely in re-routing the ‘commercial’ car.

September 17, 2024: STMicroelectronics announced that the STSAFE-TPM trusted platform modules are now FIPS 1403 compliant, offering higher levels of cryptographic security for computers, servers and other embedded systems. The above TPMs are for protecting CSs, and they are very secure that comes with different support like IoT devices and medical ones. According to Laurent Degauque this certification prepares their TPMs for new designs for boot assurance as well as for remote trustworthy attestation in conjunction with the enhanced crypt Asset protection. Therefore, the STSAFE-TPM devices are now ready for high secure applications to spread in vastly different areas in the future.

September 17, 2024: Infineon Technologies launched the SECORA Pay Bio which is a biometric payment card that enables secure contact less payments. This card that measures 85. However, plan that was launched in 2000s was maize helping the client reach its goal of selling its products in new markets through increasing elements a long-term strategic plan that was put in place in the 2000′. 5 mm x 54 mm x 0. 82mm, complies with Visa & master card form factor and with Infineon SLC39B secure element having a built-in fingerprint scanner enables payments to be made via fingerprints. In turn, Tolgahan Yildiz stresses on the scalability and efficiency of the offered solution as well as on the forecasted high growth of the market of biometric cards, in particular, 113. It had predicted that within the next six to seven years, that is by the year 2028, it will be in a position to sell as many as 3 million units. The new technology provides improved security against frisk as well as ease in the production process while at the same time making the cards more reliable.

Click Here to get more information: https://exactitudeconsultancy.com/reports/36820/automotive-piezoelectric-sensor-market/#request-a-sample

Automotive piezoelectric sensor market can be considered as an essential category of the automotive sector, which deals with the sensors that convert the mechanical stress and vibrations into electrical signals. As for this technology, it helps to enhance vehicle performance, safety and efficiency, offering significant data for a range of uses. At present the market is growing at a rapid pace due to higher demand for enhancing vehicle dynamics and safety rules and regulations. Other key applications of Piezoelectric sensors include Engine management, air bag control and Suspension systems to give real time information improving the general performance and safety of the vehicle.

The market today is further strengthened by the increasing use of electric automobiles, and enhanced driving assist system where these sensors are indispensable for enhancing energy consumption efficiency and lowering exhaust emissions. towards the future, automotive piezoelectric sensor market is envisaged to experience considerable growth given the projections on the impacts of technology integration and adoption of smart sensor systems into automobiles. Some of the factors driving this market are; growing consciousness of vehicle safety, increasing demand for better fuel economy, and the increasing interest in electric vehicles that use advanced sensor systems for efficient functioning. In the ever-changing auto industry, piezoelectric sensors shall continue playing a vital role in creating new solutions that satisfy ever high expectations of drivers and changing regulations.

Sustained expansion is expected in the next years as sensing technologies are advancing every time further and more attention is being paid to environmentally friendly vehicles and vehicle safety. Altogether, the automotive piezoelectric sensor market is all set to become one of the key drivers that defines the future of mobility through innovations that are focused towards developing safer, efficient, and eco-friendly automobiles.

Click Here to get more information: https://exactitudeconsultancy.com/reports/36820/automotive-piezoelectric-sensor-market/

Key Players

- Robert Bosch GmbH

- Honeywell International Inc.

- TE Connectivity Ltd.

- Siemens AG

- Continental AG

- STMicroelectronics N.V.

- Analog Devices, Inc.

- Infineon Technologies AG

- Kistler Group

- Ametek, Inc.

- Omron Corporation

- Murata Manufacturing Co., Ltd.

- Eaton Corporation

- Bourns, Inc.

- NXP Semiconductors N.V.

- Vishay Intertechnology, Inc.

- MTS Systems Corporation

- First Sensor AG

- PCB Piezotronics, Inc.

- Cypress Semiconductor Corporation

Market Dynamics

The Power of Safety-Driven innovation in automotive Technology – Let Loose

A tremendous interest in improving safety and new requirements from buyers and regulatory authorities have been observed over the recent years in specifically the automotive industry. This developing concern for security is driving the new technologies application, such as piezoelectric sensors. These innovative devices are useful for detecting vital parameters like vibration, pressure and acceleration and necessary for collecting data for example in the airbag systems or the ADAS. Used extensively in a wide range of automotive applications to improve safety, the manufacturers are incorporating these sensors into vehicles to guarantee safety, which will propel the growth of the piezoelectric sensor market.

Facing the Problems of Single and Multiple Component Inventory Management

The automotive piezoelectric sensor market has tremendous opportunities, which, at the same time, are challenged by flawed stock management systems. A frequent challenge that many manufactures face is the ability to strike the right balance on their inventory stock which they use in their production processes and if they get it wrong, they end up facing losses through time delayed production times and low operational effectiveness. Lack of proper inventory control delays the procurement of certain parts needed in building automobiles with state-of-art sensors, and in the deployment of such vehicles. Furthermore, this will complicate logistics since different sensors have their strengths in different platforms, adding to the problem of managing different types of sensors. Solving these problems of inventory management is critical for manufacturers who would like to improve the supply chain and maximize the potential of automotive piezoelectric sensors market.

Optimizing the Era of Electric and Self-driving Technology to Drive the Sensor Innovation

The rising trends of electric and self-driving cars are expected to be a huge plus for the growth of the automotive piezoelectric sensor market. Given that these developments are progressing steadily and turning more and more into intelligent vehicles for optimal performance and safety, piezoelectric sensors may function as effective means of tracking vital indicators, from the battery state to the external climate. The lightweight and small size of these devices makes their incorporation into next generation vehicle systems favorable.

Click Here to get more information: https://exactitudeconsultancy.com/reports/36820/automotive-piezoelectric-sensor-market/#request-a-sample

Market Segmentation of Automotive Piezoelectric Sensor Market

- Automotive Piezoelectric Sensor Market by Type, 2020-2030, (USD Billion) (Thousand Units)

- Piezoelectric Accelerometers

- Piezoelectric Pressure Sensor

- Piezoelectric Force Sensors

- Others

- Automotive Piezoelectric Sensor Market by Application, 2020-2030, (USD Billion) (Thousand Units)

- Automotive Piezoelectric Sensor Market by Region, 2020-2030, (USD Billion) (Thousand Units)

- North America

- Europe

- Asia Pacific

- South America

- Middle East and Africa

Regional Analysis

The demand for the piezoelectric sensor in the Asia Pacific is dominating the global automotive piezoelectric sensor market due to the growth of automotive industries and the widespread implementation of automation. The major countries that dominate this market include China, Japan, South Korea and India that cumulatively make up a large portion of the market. This leadership is as a result of increasing in industrial automated systems and new safety measures that governments of these nations have put forth. North America is also involved especially the US through stressing on the facet of safety of vehicles through policy frameworks. These regulations spur the use of smart sensing technologies hence increasing demand for piezoelectric sensors for vehicle stability systems.

Particularly, this commitment to safety assists consumer and has the effect of increasing the overall standard of industrial practices. The result of these changes is considerable in both areas. In Asia-Pacific, the growth of the automotive industry requires many vehicle parts, piezoelectric sensors, as well as automation systems. With this it accelerates investment in new technologies and enhances the status of the region as the manufacturing powerhouse. In North American region, precautionary measures are promoted to higher standards making companies to come up with enhanced sensing technologies that enhances the performance of the vehicles. In future, the market of piezoelectric sensor in automotive seems promising particularly in Asia-Pacific region. There are efforts by the emerging economies to come up with new laws that are calling for the inclusion of electronic vehicle stability system which is expected to fuel the market expansion. That is why both regions are expected to experience consistent demand and developments in this important area as regulations on safety increase constantly.

Find More Research:

ATV & Side by Side Sales Market – https://exactitudeconsultancy.com/reports/24626/atv-side-by-side-sales-market/

The global ATV & side by side sales market size is expected to grow at more than 5.92% CAGR from 2023 to 2029. It is expected to reach above USD 3.07 billion by 2029 from a little above USD 5.16 billion in 2020.

Automotive OE Bumper Cover Market – https://exactitudeconsultancy.com/reports/24582/automotive-oe-bumper-cover-market/

The automotive OE bumper cover market is expected to grow at 8.5% CAGR from 2023 to 2029. It is expected to reach above USD 87.94 billion by 2029 from USD 42.20 billion in 2022.

Global Automotive Flex Fuel Engines Sales Market – https://exactitudeconsultancy.com/reports/24561/automotive-flex-fuel-engines-sales-market/

The global Automotive Flex Fuel Engines sales market size is expected to grow at more than 5.83% CAGR from 2020 to 2029. It is expected to reach above USD 82.27 billion by 2029 from a little above USD 49.40 billion in 2020.

Scale-Out NAS Market – https://exactitudeconsultancy.com/reports/24512/scale-out-nas-market/

The scale-out NAS market is expected to grow at 21.05 % CAGR from 2022 to 2029. It is expected to reach above USD 124.53 billion by 2029 from USD 22.31 billion in 2020.

Global Electric Power Steering System (EPS) Market – https://exactitudeconsultancy.com/reports/24472/global-electric-power-steering-system-eps-market/ The global electric power steering system (EPS) market is expected to grow at 6% CAGR from 2022 to 2029. It is expected to reach above USD 46.76 billion by 2029 from USD 31.1 billion in 2022.

Automotive Navigation System Market – https://exactitudeconsultancy.com/reports/24450/automotive-navigation-system-market/

The automotive navigation system market is expected to grow at 6.8 % CAGR from 2022 to 2029. It is expected to reach above USD 38.87 USD billion by 2029 from USD 22.5 billion in 2021.

Automotive Disc Brakes Market – https://exactitudeconsultancy.com/reports/24441/automotive-disc-brakes-market/

The automotive disc brakes market is expected to grow at 5.4% CAGR from 2022 to 2029. It is expected to reach above USD 69.45 billion by 2029 from USD 43.26 billion in 2020.

Automotive Daytime Running Lights Market – https://exactitudeconsultancy.com/reports/24223/automotive-daytime-running-lights-market/

The automotive daytime running lights market is expected to grow at 7% CAGR from 2022 to 2029. It is expected to reach above USD 2.57 billion by 2029 from USD 1.5 billion in 2020.

Automotive Instrument Cluster and Head-Up Display (HUD) Market- https://exactitudeconsultancy.com/reports/24216/automotive-instrument-cluster-and-head-up-display-hud-market/

The global automotive instrument cluster and head-up display (HUD) market size was valued at USD 9.43 billion in 2020 and is projected to reach USD 24.86 billion by 2029, with a CAGR of 11.37% from 2022 to 2029.

Global Ignition Interlock Devices Market – https://exactitudeconsultancy.com/reports/24139/ignition-interlock-devices-market/

The global ignition interlock devices market is expected to grow at 3.90 % CAGR from 2020 to 2029. It is expected to reach above USD 956.69 Million by 2029 from USD 678.00 Million in 2020.

Transfer Case Market – https://exactitudeconsultancy.com/reports/24114/transfer-case-market/

The global Transfer Case market is expected to grow at an 11.2% CAGR from 2022 to 2029, It is reach USD 28.08 Billion in 2029.

Electric Vehicle Battery Current Sensor Market – https://exactitudeconsultancy.com/reports/24069/electric-vehicle-battery-current-sensor-market/

The global electric vehicle battery current sensor market size was valued at USD 80.49 billion in 2020, and projected to reach USD 265.70 billion by 2029, with a CAGR of 14.19% from 2022 to 2029.

Vehicle Surveillance Market – https://exactitudeconsultancy.com/reports/24090/vehicle-surveillance-market/

The vehicle surveillance market is expected to grow at 10.7% CAGR from 2022 to 2029. It is expected to reach above USD 97.67 billion by 2029 from USD 39.12 billion in 2020.

Robotic Welding Market – https://exactitudeconsultancy.com/reports/23866/robotic-welding-market/

The robotic welding market is expected to grow at 8.5% CAGR from 2020 to 2029. It is expected to reach above USD 9.8 billion by 2029 from USD 4.7 billion in 2020.

Molded Interconnect Device (MID) Market – https://exactitudeconsultancy.com/reports/23847/molded-interconnect-device-mid-market/

The global molded interconnect device (MID) market size is expected to grow at more than 13.42% CAGR from 2020 to 2029. It is expected to reach above USD 3.63 billion by 2029 from a little above USD 1.17 billion in 2020.

Robotic Drilling Market – https://exactitudeconsultancy.com/reports/23852/robotic-drilling-market/

The robotic drilling market is expected to grow at 7.7% CAGR from 2022 to 2029. It is expected to reach above USD 1208.74 million by 2029 from USD 667.74 million in 2021.

Electric Traction Motor Market – https://exactitudeconsultancy.com/reports/23411/electric-traction-motor-market/

The electric traction motor market is expected to grow at 23.04 % CAGR from 2022 to 2029. It is expected to reach above USD 95.63 billion by 2029 from USD 14.8 billion in 2020.

Diesel Particulate Filter Market – https://exactitudeconsultancy.com/reports/23399/diesel-particulate-filter-market/

The diesel particulate filter market is expected to grow at an 11.3% CAGR between 2022 and 2029. It is expected to be worth more than USD 39.14 billion by 2029, up from USD 18.50 billion in 2022.

Digital Instrument Cluster Market – https://exactitudeconsultancy.com/reports/23382/digital-instrument-cluster-market/

The global Digital Instrument Cluster Market is expected to grow at a 19.1% CAGR from 2022 to 2029, from USD 2.18 billion in 2022.

Automotive Front End Module Market – https://exactitudeconsultancy.com/reports/23291/automotive-front-end-module-market/

Automotive front-end module market is expected to grow at 5.45% CAGR from 2022 to 2029. It was valued 117.59 billion at 2020. It is expected to reach above USD 189.58 billion by 2029.

Irfan Tamboli (Head of Sales) – Exactitude consultancy Phone: + 1704 266 3234 sales@exactitudeconsultancy.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

‘Short corn’ could replace the towering cornfields steamrolled by a changing climate

WYOMING, Iowa (AP) — Taking a late-summer country drive in the Midwest means venturing into the corn zone, snaking between 12-foot-tall green, leafy walls that seem to block out nearly everything other than the sun and an occasional water tower.

The skyscraper-like corn is a part of rural America as much as cavernous red barns and placid cows.

But soon, that towering corn might become a miniature of its former self, replaced by stalks only half as tall as the green giants that have dominated fields for so long.

“As you drive across the Midwest, maybe in the next seven, eight, 10 years, you’re going to see a lot of this out there,” said Cameron Sorgenfrey, an eastern Iowa farmer who has been growing newly developed short corn for several years, sometimes prompting puzzled looks from neighboring farmers. “I think this is going to change agriculture in the Midwest.”

The short corn developed by Bayer Crop Science is being tested on about 30,000 acres (12,141 hectares) in the Midwest with the promise of offering farmers a variety that can withstand powerful windstorms that could become more frequent due to climate change. The corn’s smaller stature and sturdier base enable it to withstand winds of up to 50 mph — researchers hover over fields with a helicopter to see how the plants handle the wind.

The smaller plants also let farmers plant at greater density, so they can grow more corn on the same amount of land, increasing their profits. That is especially helpful as farmers have endured several years of low prices that are forecast to continue.

The smaller stalks could also lead to less water use at a time of growing drought concerns.

U.S. farmers grow corn on about 90 million acres (36 million hectares) each year, usually making it the nation’s largest crop, so it’s hard to overstate the importance of a potential large-scale shift to smaller-stature corn, said Dior Kelley, an assistant professor at Iowa State University who is researching different paths for growing shorter corn. Last year, U.S. farmers grew more than 400 tons (363 metric tonnes) of corn, most of which was used for animal feed, the fuel additive ethanol, or exported to other countries.

“It is huge. It’s a big, fundamental shift,” Kelley said.

Researchers have long focused on developing plants that could grow the most corn but recently there has been equal emphasis on other traits, such as making the plant more drought-tolerant or able to withstand high temperatures. Although there already were efforts to grow shorter corn, the demand for innovations by private companies such as Bayer and academic scientists soared after an intense windstorm — called a derecho — plowed through the Midwest in August 2020.

The storm killed four people and caused $11 billion in damage, with the greatest destruction in a wide strip of eastern Iowa, where winds exceeded 100 mph. In cities such as Cedar Rapids, the wind toppled thousands of trees but the damage to a corn crop only weeks from harvest was especially stunning.

“It looked like someone had come through with a machete and cut all of our corn down,” Kelley said.

Or as Sorgenfrey, the Iowa farmer who endured the derecho put it, “Most of my corn looked like it had been steamrolled.”

Although Kelley is excited about the potential of short corn, she said farmers need to be aware that cobs that grow closer to the soil could be more vulnerable to diseases or mold. Short plants also could be susceptible to a problem called lodging, when the corn tilts over after something like a heavy rain and then grows along the ground, Kelley said.

Brian Leake, a Bayer spokesman, said the company has been developing short corn for more than 20 years. Other companies such as Stine Seed and Corteva also have been working for a decade or longer to offer short-corn varieties.

While the big goal has been developing corn that can withstand high winds, researchers also note that a shorter stalk makes it easier for farmers to get into fields with equipment for tasks such as spreading fungicide or seeding the ground with a future cover crop.

Bayer expects to ramp up its production in 2027, and Leake said he hopes that by later in this decade, farmers will be growing short corn everywhere.

“We see the opportunity of this being the new normal across both the U.S. and other parts of the world,” he said.

Block Surges 47.9% in a Year: Should SQ Stock be in Your Portfolio?

Buoyed by a holistic growth model, Block SQ has gained 47.9% over the past year, outperforming the Zacks Business-Services sector’s rally of 26.9% and the S&P 500’s return of 31.1%.

However, the company has underperformed its industry’s rise of 62.9% in the same time frame.

Block’s strong positioning in the digital payments industry on the back of its robust payment and point-of-sale (POS) solutions, which include both hardware and software to accept payments, streamline operations, and analyze business information, is a major positive.

SQ’s comprehensive commerce ecosystem, which enables sellers to combine software, hardware and payment services to accept payments from customers, helps it sustain solid momentum across sellers. Strength Square ecosystem is a plus.

One-Year Price Performance

Image Source: Zacks Investment Research

Despite this positive scenario, market uncertainties, high inflation, unfavorable foreign exchange fluctuations and sluggish trends in consumer spending are concerning for the company. The normalization trend in the post-pandemic era is negative.

The combination of both risks and rewards is prompting investors to question how they should play the SQ stock.

Block Rides on Portfolio Strength

Block has been gaining solid momentum among several sellers across various industries, such as food, retail and services, and geographies, including the United States, Japan, Australia and Canada. The primary factor behind this remains its robust product portfolio, which, in turn, is increasing its Gross Payment Volume (GPV). In the second quarter of 2024, the company processed $61.94 billion of GPV, up 5% year over year.

SQ’s omnichannel offerings, which help sellers create differentiated customer experiences on the back of customer insights by managing orders from POS and eliminating manual aggregation of online and in-person orders, are adding strength to its seller base.

Growing momentum across the Square ecosystem and CashApp ecosystem, which enables the company to provide peer-to-peer payment and digital commercial transaction facilities, is another positive.

Block leverages artificial Intelligence to deliver an enhanced seller experience. Square Online’s Themes and Square for Retail’s AI-generated product descriptions help sellers enhance their customer engagement and automate sales.

Square offers generative AI features to sellers, enabling them to automate operations, speed up workflows and save time.

Block is constantly gaining momentum in the cryptocurrency market on the back of CashApp, which allows users to buy, sell, send and receive bitcoins.

Its decentralized TBD platform, which enables developers to build decentralized finance applications that run on programmable blockchains, is noteworthy.

Block’s self-custody bitcoin wallet, Bitkey, is also boosting its presence in the cryptocurrency space. The company offers Bitkey in more than 95 countries across six continents, allowing users to easily and safely own and manage their bitcoins.

Strong Partner Base Aids SQ’s BNPL Prospects

Block’s Afterpay division and strong partner base are boosting its prospects in the ‘buy now, pay later’ (BNPL) market.

Afterpay’s partnership with several brands, including Curology, Helzberg Diamonds, Journeys, Rawlings Sporting Goods and Zenni Optical, is noteworthy. These partnerships help Afterpay to deliver an enhanced shopping experience to U.S. customers.

Afterpay also collaborated with various merchants, including Diane von Furstenberg, Diggs, For Eyes and Kendra Scott, to offer installment payments for purchases from these merchants.

Afterpay’s partnership with Rokt in a bid to boost the online shopping experience for customers is another positive. This partnership enables Afterpay and its retail partners to provide relevant advertising experiences to targeted customers during the checkout process using Rokt’s e-commerce solution.

SQ’s Rising Estimates

Block’s near-term as well as long-term prospects are expected to benefit from compelling products and solutions, a comprehensive payment ecosystem, and a strong position in the digital payment industry.

For the third quarter of 2024, the Zacks Consensus Estimate for revenues is pegged at $6.17 billion, implying year-over-year growth of 9.8%.

The consensus mark for earnings is pegged at 88 cents per share, suggesting a year-over-year rise of 60%. The estimate has been revised 14.3% upward in the past 60 days.

For 2024, the Zacks Consensus Estimate for revenues is pegged at $24.52 billion, implying year-over-year growth of 11.9%.

The consensus mark for earnings is pegged at $3.60 per share, suggesting a year-over-year rise of 100%. The estimate has been revised 0.6% upward in the past 30 days.

Image Source: Zacks Investment Research

Attractive Valuation: A Silver Lining For SQ

Block offers an attractive valuation at current levels.

SQ is trading at a discount, with a forward 12-month Price/Sales of 1.58X compared with the industry’s 6.33X. This reflects a good opportunity for the investors.

Image Source: Zacks Investment Research

Challenges Being Faced by Block

Block has been grappling with weakening transaction activities on Cash App and softness in consumer spending trends in food and drink and retail discretionary verticals.

Broader market volatility is acting as a headwind.

Specific challenges associated with the security of payments and money transfer in the digital payments industry, and regulatory uncertainties in the cryptocurrency space are other concerns for SQ.

Increasing pricing pressure due to rising competition from the likes of PayPal PYPL in the peer-to-peer payments space does not bode well. SQ also faces stiff competition from Affirm AFRM in the booming buy now, pay later (BNPL) market.

Conclusion

Block’s strong solutions portfolio, rising earnings estimates, strong position in the digital payments industry and attractive valuation present a compelling investment opportunity.

However, macroeconomic uncertainties and unfavorable changes in the consumer spending pattern, which surround Block’s prospects at present, do not bode well.

With a Zacks Rank #3 (Hold), Block appears to be treading in the middle of the road, and investors could be better off if they trade with caution.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Americold Realty Trust Upgraded to Buy: What Does It Mean for the Stock?

Americold Realty Trust Inc. COLD could be a solid addition to your portfolio given its recent upgrade to a Zacks Rank #2 (Buy). This rating change essentially reflects an upward trend in earnings estimates — one of the most powerful forces impacting stock prices.

A company’s changing earnings picture is at the core of the Zacks rating. The system tracks the Zacks Consensus Estimate — the consensus measure of EPS estimates from the sell-side analysts covering the stock — for the current and following years.

Individual investors often find it hard to make decisions based on rating upgrades by Wall Street analysts, since these are mostly driven by subjective factors that are hard to see and measure in real time. In these situations, the Zacks rating system comes in handy because of the power of a changing earnings picture in determining near-term stock price movements.

As such, the Zacks rating upgrade for Americold Realty Trust is essentially a positive comment on its earnings outlook that could have a favorable impact on its stock price.

Most Powerful Force Impacting Stock Prices

The change in a company’s future earnings potential, as reflected in earnings estimate revisions, has proven to be strongly correlated with the near-term price movement of its stock. The influence of institutional investors has a partial contribution to this relationship, as these big professionals use earnings and earnings estimates to calculate the fair value of a company’s shares. An increase or decrease in earnings estimates in their valuation models simply results in higher or lower fair value for a stock, and institutional investors typically buy or sell it. Their bulk investment action then leads to price movement for the stock.

Fundamentally speaking, rising earnings estimates and the consequent rating upgrade for Americold Realty Trust imply an improvement in the company’s underlying business. Investors should show their appreciation for this improving business trend by pushing the stock higher.

Harnessing the Power of Earnings Estimate Revisions

Empirical research shows a strong correlation between trends in earnings estimate revisions and near-term stock movements, so it could be truly rewarding if such revisions are tracked for making an investment decision. Here is where the tried-and-tested Zacks Rank stock-rating system plays an important role, as it effectively harnesses the power of earnings estimate revisions.

The Zacks Rank stock-rating system, which uses four factors related to earnings estimates to classify stocks into five groups, ranging from Zacks Rank #1 (Strong Buy) to Zacks Rank #5 (Strong Sell), has an impressive externally-audited track record, with Zacks Rank #1 stocks generating an average annual return of +25% since 1988.

Earnings Estimate Revisions for Americold Realty Trust

For the fiscal year ending December 2024, this company is expected to earn $1.48 per share, which is a change of 16.5% from the year-ago reported number.

Analysts have been steadily raising their estimates for Americold Realty Trust. Over the past three months, the Zacks Consensus Estimate for the company has increased 3.1%.

Bottom Line

Unlike the overly optimistic Wall Street analysts whose rating systems tend to be weighted toward favorable recommendations, the Zacks rating system maintains an equal proportion of ‘buy’ and ‘sell’ ratings for its entire universe of more than 4000 stocks at any point in time. Irrespective of market conditions, only the top 5% of the Zacks-covered stocks get a ‘Strong Buy’ rating and the next 15% get a ‘Buy’ rating. So, the placement of a stock in the top 20% of the Zacks-covered stocks indicates its superior earnings estimate revision feature, making it a solid candidate for producing market-beating returns in the near term.

The upgrade of Americold Realty Trust to a Zacks Rank #2 positions it in the top 20% of the Zacks-covered stocks in terms of estimate revisions, implying that the stock might move higher in the near term.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

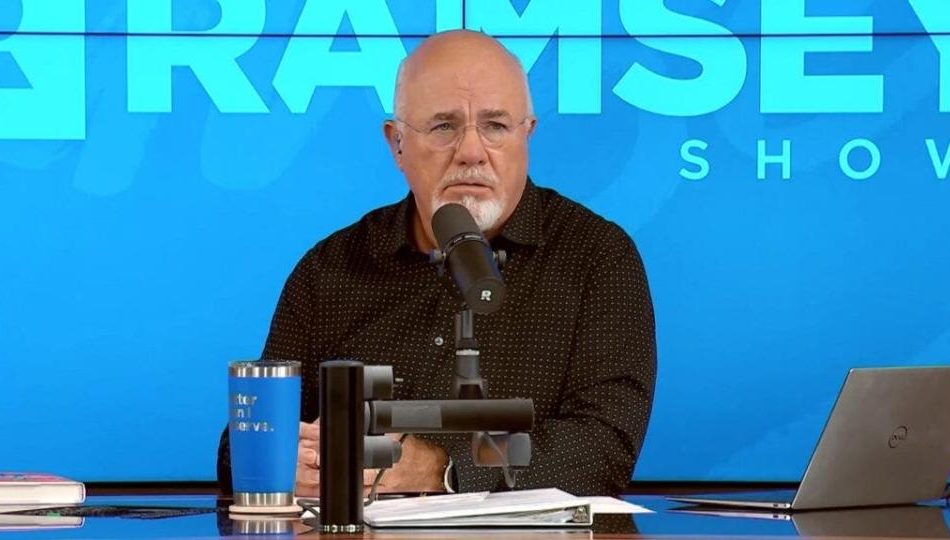

Dave Ramsey Tells 29-Year-Old $1 Million In Debt And Spending Like She's In Congress: 'I'm Getting Ready To Destroy Your Life As You Know It'

Many people in their 20s deal with credit card debt or student loans, sometimes thinking they’ll figure it out later. But what happens when that debt piles up to nearly a million dollars? That’s the reality a 29-year-old named Channing from Washington D.C. faced during an episode of The Dave Ramsey Show.

Don’t Miss:

Channing and her husband were grappling with nearly $1 million in debt, a number that had Ramsey quickly diving into tough-love mode. Sure, he’s seen scenarios where people are in over their heads with debt, but at just 29, this was particularly alarming to Ramsey.

Channing, who recently married, explained, “My husband and I have probably just under a million dollars in debt and we want to know how to get debt-free without filing for bankruptcy.” The breakdown included $335,000 in student loans, $136,000 in credit cards and $44,000 in personal loans. Their combined household income was about $230,000 a year.

Trending: Founder of Personal Capital and ex-CEO of PayPal re-engineers traditional banking with this new high-yield account — start saving better today.

Ramsey didn’t hold back. After calculating the staggering numbers, he addressed the couple’s situation bluntly. “You guys have been living at about 10x where you’re going to get to live for the next three years,” Ramsey said. “I’m getting ready to destroy your life as you know it.”

“You’ve gotten used to spending like you’re in Congress,” he scolded. He was clear that their lifestyle needed a complete overhaul. Ramsey emphasized that their financial habits would have to change drastically, stating, “You’re not gonna see the inside of a restaurant unless it’s your extra job or you’re waiting on someone you work with during the day.” He added, “You’re gonna be living on beans and rice, rice and beans.”

Ramsey went on to stress the emotional and spiritual challenges ahead. “Your friends are going to think you’ve lost your mind and your mother is going to think you need counseling,” he warned, adding that both Channing and her husband would need to stop caring what others think if they wanted to tackle their debt successfully.

He also shared a personal connection to their situation, saying, “This is exactly what I did in my 20s. I bought and purchased a lifestyle that was 5x to 10x what I had. It was all because of crap inside of me that caused me to do that.”

Trending: Elon Musk’s secret mansion in Austin revealed through court filings. Here’s how to invest in the city’s growth before prices go back up.

Ramsey’s advice wasn’t just about cutting expenses but about confronting the mindset that had led to their financial missteps. “The problem is what’s going on inside you guys,” Ramsey said. “You’re on a suicide mission right now.”

The tough conversation ended on a hopeful note, though. Ramsey assured Channing that while the journey would be difficult, it was possible. “You can do it, though,” he said. “I know. I’ll help you.”

Channing and her husband are now facing a major lifestyle change to climb out of their nearly $1 million debt, with Dave Ramsey’s guidance pointing them toward a more financially stable future. Sometimes debt happens, but at least they’re taking steps to address the issue and make changes before they’re left resorting to more extreme options such as bankruptcy.

Read Next:

UNLOCKED: 5 NEW TRADES EVERY WEEK. Click now to get top trade ideas daily, plus unlimited access to cutting-edge tools and strategies to gain an edge in the markets.

Get the latest stock analysis from Benzinga?

This article Dave Ramsey Tells 29-Year-Old $1 Million In Debt And Spending Like She’s In Congress: ‘I’m Getting Ready To Destroy Your Life As You Know It’ originally appeared on Benzinga.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Yardeni Says Fed Cut Raises Odds of ‘Outright Melt-Up’ in Stocks

(Bloomberg) — US stocks can soar to fresh highs thanks to the Federal Reserve’s aggressive half-point interest rate cut last week, but it also could cause inflation to resurface if central bankers don’t tread carefully, according to Wall Street strategist Ed Yardeni.

Most Read from Bloomberg

The latest policy decision lifted the odds of an “outright melt-up” in equity prices — like during the dot-com bubble when the S&P 500 Index roared 220% from 1995 to the end of the century — to 30% from 20%. He placed the chances of a bull market at 80%, while reserving a 20% probability for a 1970s-like scenario, when stock markets around the world were gripped by volatility due to inflation and geopolitical tensions.

But there’s a broader risk if things start running too hot.

“If they overheat the economy and create a bubble in the stock market, they’re creating some issues,” the founder of eponymous firm Yardeni Research Inc. said in an interview with Bloomberg Television Monday. He added that the Fed is ignoring the upcoming US presidential election, in which both candidates are proposing policies that could trigger inflation.

The remarks come as policymakers reiterate confidence in their decision to deliver an outsized cut to kick off the easing cycle. Minneapolis Fed President Neel Kashkari on Monday said he supported the half-point reduction but that he expects smaller quarter-point moves at the November and December meetings. Meanwhile, his Atlanta counterpart Raphael Bostic said last week’s large move will help bring interest rates closer to neutral levels as the risks of managing inflation and employment become more balanced.

Stocks had a tough start to the month, with the S&P 500 Index dropping more than 4% in the first week. But since then, investor confidence that officials can engineer a soft landing has grown, putting the broad equities benchmark on pace for its best September — historically the index’s worst month of the year — since 2019.

Yardeni again leaned into his idea that markets are in a new “Roaring ’20s” period, marked by productivity, growth and substantial equity returns. However, he said his odds of such a scenario fell to 50% from 60% previously.

The soothsayer, typically among the most bullish forecasters on Wall Street, has an S&P 500 target of 5,800, according to the latest Bloomberg survey of strategists. That once eye-popping forecast now looks in line with many of his optimistic peers, who’ve steadily lifted their outlooks to keep up with the S&P 500’s 20% rally this year.

BMO Capital Markets has the highest call for the US stock benchmark at 6,100, while Evercore ISI sees the gauge closing at 6,000 by year end. On the other end of the spectrum, Barry Bannister, chief equity strategist at Stifel Nicolaus & Co., warned last week that the market is in a dot-com-bubble “Groundhog Day,” and said stocks could plunge by up to 13% by the fourth quarter.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

Iran's President Says 'We Don't Want To Fight' But Israel 'Wants To Drag Everyone Into War And Destabilize The Region' — Willing To Put Our Weapons Aside If They Do The Same

In a recent development, Masoud Pezeshkian, the President of Iran, has pointed fingers at Israel for escalating the ongoing conflict in the Middle East.

What Happened: Pezeshkian, in his address to the media on Monday, alleged that Israel is creating “traps” to instigate Iran into a wider conflict. He voiced Iran’s unwillingness to see the current Gaza war and Israeli-Lebanon border airstrikes escalate, reported AP News.

“We don’t want to fight,” Pezeshkian declared. “It’s Israel that wants to drag everyone into war and destabilize the region. … They are dragging us to a point where we do not wish to go.”

The Iranian leader, who recently took office after a presidential runoff in July, made these comments during his first appearance at the U.N. General Assembly. His comments come as Israel intensifies its attacks on Iranian-backed Hezbollah militants in Lebanon.

Pezeshkian criticized Israel’s actions, citing the recent deadly explosions in Lebanon and the assassination of Hamas’ political leader in Tehran, both of which he attributed to Israel.

Despite Israel’s claims of not wanting a wider war, Pezeshkian argued that their actions suggest otherwise. He reiterated Iran’s commitment to peace, stating, “We are willing to put all our weapons aside so long as Israel is willing to do the same.”

Why It Matters: The recent escalation of violence between Israel and Hezbollah has been a cause for international concern. Israeli airstrikes on Hezbollah targets in southern Lebanon resulted in approximately 274 casualties on Monday. The conflict has been intensifying since Israel’s war with Hamas began last October.

Despite the escalating conflict, oil prices fell by more than 1% on Monday due to concerns over weakened global demand. The conflict has not significantly affected energy supplies, with investors focusing more on the macroeconomic picture of slowing global consumption.

The U.S. has also warned Israel against escalating hostilities with Hezbollah, emphasizing the potential risks of a full-scale land war. The U.S. has urged Israel to seek diplomatic solutions to ensure the safety of Israeli citizens.

Check This Out:

This story was generated using Benzinga Neuro and edited by Shivdeep Dhaliwal

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

RCN Capital Announces Expansion of Charlotte Office

Grand Re-Opening Marks Increased Efforts to Grow Company’s North Carolina-Based Workforce

SOUTH WINDSOR, Conn., Sept. 23, 2024 /PRNewswire/ — RCN Capital, the leading nationwide private lender specializing in providing financing for real estate investors, announced the official reopening of its newly expanded office in Charlotte, North Carolina. This significant expansion reflects the company’s rapid growth and commitment to enhancing its presence in the region. Post renovation, the office can now accommodate up to 45 employees, up from 25 employees. In addition to the Charlotte office, RCN Capital has a corporate headquarters in South Windsor, CT, and an additional office in Los Angeles, CA.

“We are thrilled to announce the official re-opening and expansion of our Charlotte office. This expansion is a testament to the sizable impact our Charlotte employees have had on RCN’s growth and success,” said Justin Parker, RCN Capital’s Chief Financial Officer. “We’re ecstatic for the new job opportunities this brings to the Charlotte area, and look forward to better servicing our clients while leveraging this region’s incredible talent pool.”

2024 continues to be a strong year for RCN Capital as the company is currently looking to originate $1.85 billion annually. The company also recently reached the impressive milestone of originating over 30,000 loans since inception for nearly $7B.

About RCN Capital

RCN Capital is a South Windsor, CT based national, direct, private lender. Established in 2010, RCN provides commercial loans for the purchase or refinance of non-owner occupied residential and commercial properties. The company specializes in new construction financing, short-term fix & flip and bridge financing and long-term rental financing for real estate investors. For more information on RCN Capital and RCN’s loan programs, visit www.RCNCapital.com.

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/rcn-capital-announces-expansion-of-charlotte-office-302254564.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/rcn-capital-announces-expansion-of-charlotte-office-302254564.html

SOURCE RCN Capital

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.