Red Cat Holdings Q1 Earnings: Revenue, EPS Miss Estimates, Company Highlights 'Significant Global Demand'

Red Cat Holdings Inc RCAT reported first-quarter financial results for fiscal year 2025 after the market close on Monday. Here’s a look at the key highlights from the quarter.

Q1 Earnings: Red Cat reported first-quarter revenue of $2.78 million, missing analyst estimates of $3.85 million. The drone technology company reported a first-quarter loss of 17 cents per share, missing analyst estimates for a loss of 8 cents per share, according to Benzinga Pro.

Total revenue was up 59% on a year-over-year basis. Red Cat said it had a record backlog of $13 million at the quarter’s end. The company ended the quarter with $7.7 million in cash.

“Red Cat continues to see significant global demand and year-over-year growth with a strong pipeline and backlog. This is being driven by strong domestic and international adoption and sales across our entire Family of Systems, which now includes the Edge 130 Blue,” said Jeff Thompson, chairman and CEO of Red Cat.

“Our guidance for the upcoming 2025 calendar year of $50-$55 million will continue our growth trend as we await news around the U.S. Army’s Short-Range Reconnaissance Program of Record and prepare to scale up production capacity.”

Key highlights from the quarter include drone solutions presentations at multiple Defense conferences, the announced development of a new family of small ISR and precision strike systems, the closing of the company’s FlightWave asset purchase agreement and the launch of the Red Cat futures initiative.

Looking ahead, Red Cat said it anticipates revenue of $50 million to $55 million in calendar year 2025, exclusive of government or NATO programs of record.

Management will hold a conference call to discuss these results at 4:30 p.m. ET.

See Also: Meta Connect 2024 Preview: Cheaper VR Expected, Analysts See Augmented Reality And AI As Major Focus

RCAT Price Action: Red Cat Holdings shares were down after-hours 11.39%, trading at $2.80 at the time of publication Monday, according to Benzinga Pro.

Photo: Unsplash.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Ask an Advisor: I Inherited My Late Wife's 401(k). She Wasn't 72 Yet. When Do I Have to Take RMDs?

SmartAsset and Yahoo Finance LLC may earn commission or revenue through links in the content below.

I am 74 years old (I was born Feb 2, 1948). My wife and I both worked for Aetna, but have retired and have 401(k)s from work that are with Vanguard. I received her 401(k) as a spousal inheritance and maintain it in a separate account. I plan to take RMDs on her account but I’m not sure if I have the option to take the RMDs based upon her age or my age. She had not begun taking RMDs on her account because she was not 72. Can you confirm which age (hers or mine) I should use for the first RMD withdrawal, and by what date does that RMD need to be taken? I believe there is a provision in the law that indicates that with spousal inheritance you don’t have to begin taking RMDs from an inherited account for a year after the year of death.

– Gary

The date and amount of that first required minimum distribution (RMD) depend on what you decide to do with the inherited 401(k). The answer will vary based on whether you roll the funds into your own 401(k) or IRA; transfer the account to an inherited IRA and take RMDs from it; transfer the money into an inherited IRA and follow what’s called the 10-year rule; or do a Roth conversion. Here’s a closer look at those options and what they mean for RMDs. (And if you need more help planning for RMDs or taxes in retirement, speak with a financial advisor.)

Option #1: Roll Into Your Own 401(k) or IRA

As a surviving spouse, you have the option of rolling the inherited 401(k) into your own 401(k) or IRA. You could roll it into an existing account open open a new IRA to receive the rollover.

If you go this route, the money will be treated as yours and become subject to the same RMD requirements as if you had held it in your account all along. Since you are 74 and no longer working, you would need to take an RMD by Dec. 31 and the amount would be calculated using your age and the Uniform Lifetime Table. (But if you need more help calculating your RMDs, consider matching with a financial advisor.)

Option #2: Transfer Into an Inherited IRA and Take RMDs

Instead of rolling it into your own IRA, you could instead transfer it into an inherited IRA. This has the benefit of allowing you to delay RMDs until the later of two deadlines:

In your case, it sounds like this would allow you to wait a couple of years before taking RMDs. As long as you take your first RMD by Dec. 31 of the year your wife would have turned 73, you should avoid penalties.

At that point, however, RMDs would still be calculated based on your age. You would not be able to use your wife’s age to reduce the RMD amount. (A financial advisor may be able to help you manage inherited retirement accounts and other assets.)

Option #3: Transfer Into an Inherited IRA and Follow the 10-Year Rule

Since RMDs had not already started, you could choose not to take RMDs at all as long as the entire account is distributed by Dec. 31 of the 10th year after your wife’s passing.

This would save you the hassle of calculating RMDs during those first nine years, and it would save you taxes in those years as well. However, it could lead to a much bigger tax bill in that 10th year, and the entire balance would have to be distributed much earlier than if you were taking RMDs according to the Uniform Lifetime Table. (And if you need help finding a financial advisor to guide you through this process, this tool can pair you with up to three advisors who serve your area.)

Option #4: Convert to a Roth IRA

Another option would be to convert some or all of the inherited 401(k) balance to a Roth IRA. This would eliminate the need for RMDs for the amount that’s converted since Roth IRAs aren’t subject to RMDs.

It would, however, subject the conversion amount to taxes during that year. That could benefit you if you’re likely to be in a higher tax bracket later in retirement. Otherwise, it may not be worth the cost.

Bottom Line

You’ll likely be best off with either the first or second option since they both allow you to spread those distributions out over your lifetime. The primary difference is when those RMDs have to begin. If you transfer the assets into your own account, they will be part of your RMD calculation for this year. If you keep the assets in an inherited IRA, you can wait until the year in which your spouse would have turned 73 before taking RMDs. The required distribution amounts will still be based on your age, but those extra tax-deferred years could be beneficial.

Tips for Finding a Financial Advisor

-

Finding a financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to three vetted financial advisors who serve your area, and you can have a free introductory call with your advisor matches to decide which one you feel is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

-

Consider a few advisors before settling on one. It’s important to make sure you find someone you trust to manage your money. As you consider your options, these are the questions you should ask an advisor to ensure you make the right choice.

-

Keep an emergency fund on hand in case you run into unexpected expenses. An emergency fund should be liquid — in an account that isn’t at risk of significant fluctuation like the stock market. The tradeoff is that the value of liquid cash can be eroded by inflation. But a high-interest account allows you to earn compound interest. Compare savings accounts from these banks.

-

Are you a financial advisor looking to grow your business? SmartAsset AMP helps advisors connect with leads and offers marketing automation solutions so you can spend more time making conversions. Learn more about SmartAsset AMP.

Matt Becker, CFP®, is a SmartAsset financial planning columnist and answers reader questions on personal finance and tax topics. Got a question you’d like answered? Email AskAnAdvisor@smartasset.com and your question may be answered in a future column.

Please note that Matt is not a participant in the SmartAsset AMP platform, nor is he an employee of SmartAsset, and he has been compensated for this article.

Photo credit: ©iStock.com/designer491, ©iStock.com/Cecilie_Arcurs

The post Ask an Advisor: When Do I Have to Take RMDs from the 401(k) That I Inherited from My Wife? She Hasn’t Turned 72 appeared first on SmartReads by SmartAsset.

All You Need to Know About Amphenol Rating Upgrade to Buy

Amphenol APH appears an attractive pick, as it has been recently upgraded to a Zacks Rank #2 (Buy). This upgrade is essentially a reflection of an upward trend in earnings estimates — one of the most powerful forces impacting stock prices.

A company’s changing earnings picture is at the core of the Zacks rating. The system tracks the Zacks Consensus Estimate — the consensus measure of EPS estimates from the sell-side analysts covering the stock — for the current and following years.

The power of a changing earnings picture in determining near-term stock price movements makes the Zacks rating system highly useful for individual investors, since it can be difficult to make decisions based on rating upgrades by Wall Street analysts. These are mostly driven by subjective factors that are hard to see and measure in real time.

As such, the Zacks rating upgrade for Amphenol is essentially a positive comment on its earnings outlook that could have a favorable impact on its stock price.

Most Powerful Force Impacting Stock Prices

The change in a company’s future earnings potential, as reflected in earnings estimate revisions, has proven to be strongly correlated with the near-term price movement of its stock. The influence of institutional investors has a partial contribution to this relationship, as these big professionals use earnings and earnings estimates to calculate the fair value of a company’s shares. An increase or decrease in earnings estimates in their valuation models simply results in higher or lower fair value for a stock, and institutional investors typically buy or sell it. Their transaction of large amounts of shares then leads to price movement for the stock.

Fundamentally speaking, rising earnings estimates and the consequent rating upgrade for Amphenol imply an improvement in the company’s underlying business. Investors should show their appreciation for this improving business trend by pushing the stock higher.

Harnessing the Power of Earnings Estimate Revisions

As empirical research shows a strong correlation between trends in earnings estimate revisions and near-term stock movements, tracking such revisions for making an investment decision could be truly rewarding. Here is where the tried-and-tested Zacks Rank stock-rating system plays an important role, as it effectively harnesses the power of earnings estimate revisions.

The Zacks Rank stock-rating system, which uses four factors related to earnings estimates to classify stocks into five groups, ranging from Zacks Rank #1 (Strong Buy) to Zacks Rank #5 (Strong Sell), has an impressive externally-audited track record, with Zacks Rank #1 stocks generating an average annual return of +25% since 1988.

Earnings Estimate Revisions for Amphenol

For the fiscal year ending December 2024, this maker of fiber-optic products is expected to earn $1.76 per share, which is a change of 16.6% from the year-ago reported number.

Analysts have been steadily raising their estimates for Amphenol. Over the past three months, the Zacks Consensus Estimate for the company has increased 4%.

Bottom Line

Unlike the overly optimistic Wall Street analysts whose rating systems tend to be weighted toward favorable recommendations, the Zacks rating system maintains an equal proportion of ‘buy’ and ‘sell’ ratings for its entire universe of more than 4000 stocks at any point in time. Irrespective of market conditions, only the top 5% of the Zacks-covered stocks get a ‘Strong Buy’ rating and the next 15% get a ‘Buy’ rating. So, the placement of a stock in the top 20% of the Zacks-covered stocks indicates its superior earnings estimate revision feature, making it a solid candidate for producing market-beating returns in the near term.

The upgrade of Amphenol to a Zacks Rank #2 positions it in the top 20% of the Zacks-covered stocks in terms of estimate revisions, implying that the stock might move higher in the near term.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Smart Money Is Betting Big In WULF Options

Investors with a lot of money to spend have taken a bullish stance on TeraWulf WULF.

And retail traders should know.

We noticed this today when the positions showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don’t know. But when something this big happens with WULF, it often means somebody knows something is about to happen.

Today, Benzinga’s options scanner spotted 15 options trades for TeraWulf.

This isn’t normal.

The overall sentiment of these big-money traders is split between 86% bullish and 6%, bearish.

Out of all of the options we uncovered, there was 1 put, for a total amount of $100,000, and 14, calls, for a total amount of $1,988,991.

What’s The Price Target?

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $2.0 to $10.0 for TeraWulf over the recent three months.

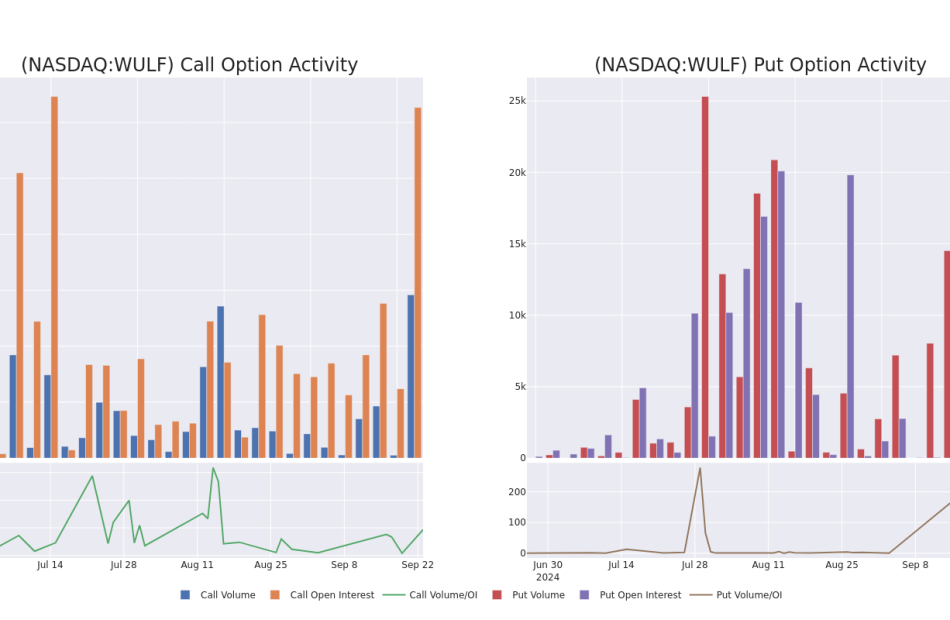

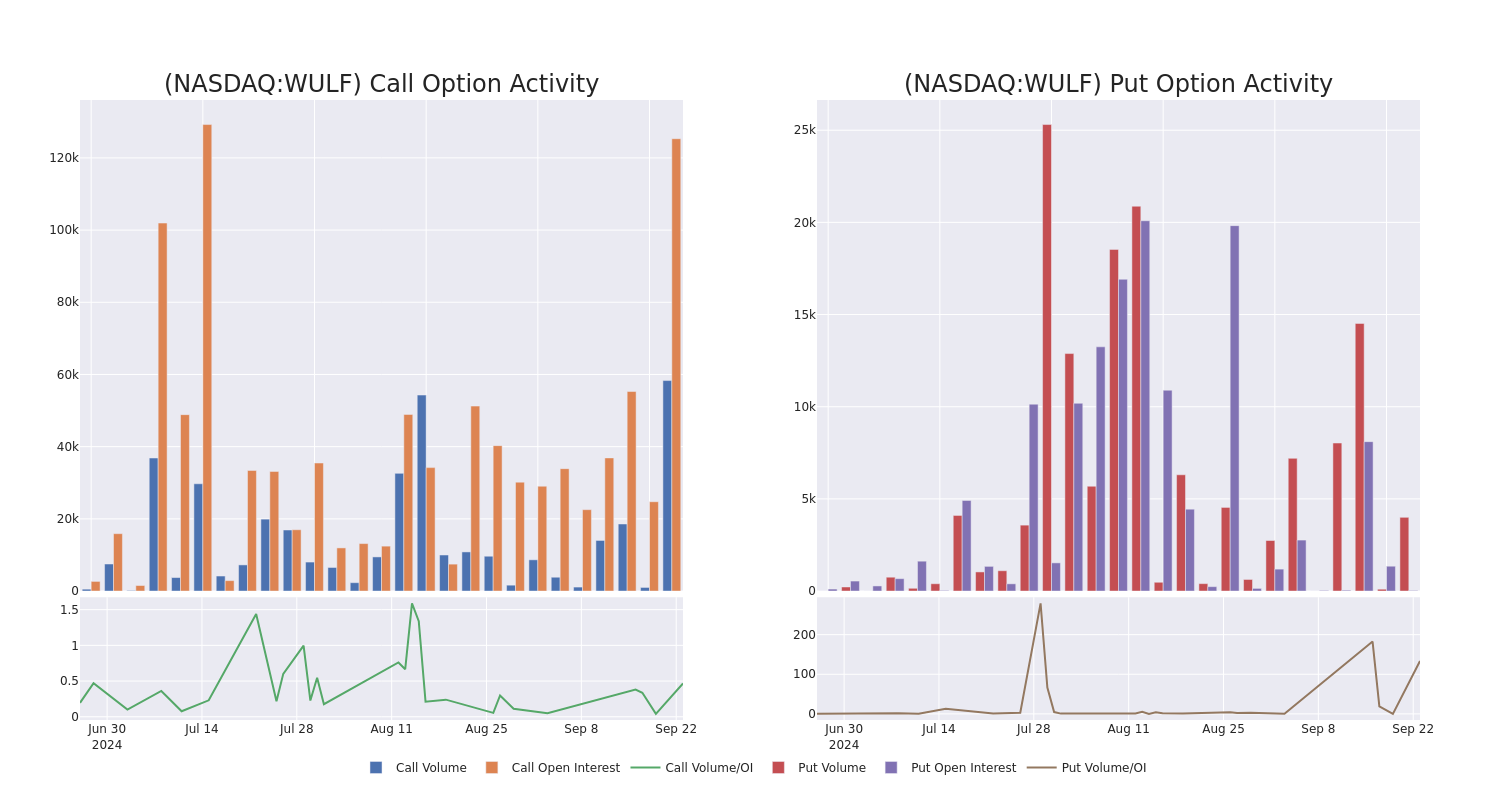

Insights into Volume & Open Interest

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for TeraWulf’s options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across TeraWulf’s significant trades, within a strike price range of $2.0 to $10.0, over the past month.

TeraWulf Call and Put Volume: 30-Day Overview

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| WULF | CALL | TRADE | BEARISH | 01/17/25 | $1.7 | $1.6 | $1.61 | $4.00 | $700.3K | 24.6K | 4.5K |

| WULF | CALL | SWEEP | BULLISH | 01/17/25 | $0.35 | $0.3 | $0.35 | $10.00 | $255.2K | 8.1K | 12.1K |

| WULF | CALL | SWEEP | BULLISH | 10/18/24 | $1.1 | $1.0 | $1.08 | $4.00 | $216.0K | 1.5K | 2.1K |

| WULF | CALL | SWEEP | BULLISH | 01/17/25 | $0.35 | $0.3 | $0.35 | $10.00 | $168.3K | 8.1K | 4.8K |

| WULF | CALL | TRADE | NEUTRAL | 10/18/24 | $0.25 | $0.15 | $0.2 | $6.00 | $151.9K | 12.1K | 10.2K |

About TeraWulf

TeraWulf Inc is a digital asset technology company that is engaged in digital infrastructure and sustainable energy development. The company’s primary focus is supporting environmentally conscious bitcoin mining operations by developing and operating facilities within the United States. The company’s bitcoin mining facilities are powered by clean, affordable, and reliable energy sources. The company’s primary source of revenue stems from the mining of bitcoin conducted at the company’s mining facility sites. Additionally, the company occasionally generates revenue through the provision of miner hosting services to third-party entities.

Having examined the options trading patterns of TeraWulf, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Where Is TeraWulf Standing Right Now?

- With a volume of 23,817,927, the price of WULF is up 8.44% at $4.88.

- RSI indicators hint that the underlying stock may be approaching overbought.

- Next earnings are expected to be released in 49 days.

What The Experts Say On TeraWulf

Over the past month, 3 industry analysts have shared their insights on this stock, proposing an average target price of $7.333333333333333.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* An analyst from B. Riley Securities has decided to maintain their Buy rating on TeraWulf, which currently sits at a price target of $6.

* An analyst from Cantor Fitzgerald downgraded its action to Overweight with a price target of $10.

* In a cautious move, an analyst from Needham downgraded its rating to Buy, setting a price target of $6.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest TeraWulf options trades with real-time alerts from Benzinga Pro.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Wall Street's Most Anticipated Stock Split of the 4th Quarter May Be Announced This Week

For much of the last two years, Wall Street and investors have been fixated on the artificial intelligence (AI) revolution. But what they might not realize is how important stock-split euphoria has been for pushing Wall Street’s major indexes higher in 2024.

A stock split is a tool public companies have at their disposal that allows them to superficially adjust their share price and outstanding share count by the same factor. Splits are surface-scratching in the sense that they don’t alter a company’s market cap or in any way affect its underlying operating performance.

Splits come in two varieties, one of which is undeniably favored by investors. Reverse-stock splits aim to increase a company’s share price, often with the purpose of maintaining minimum listing standards for a major stock exchange. Since this is the type of split conducted by struggling businesses, it’s one that investors usually avoid.

On the other hand, forward-stock splits get investors excited. A forward split reduces a company’s share price to make it more nominally affordable for everyday investors who lack access to fractional-share purchases through their broker. This type of split is almost always conducted by companies with a rich history of outperforming their peers.

A little over a dozen high-profile stock splits have been announced or completed in 2024, all but one of which is a forward split.

Wall Street has flocked to AI stock-split stocks

With AI stocks in the spotlight, it’s no surprise to find that three of Wall Street’s most-prominent splits of the year are attached to this highly touted trend:

-

Nvidia (NASDAQ: NVDA) completed a historic 10-for-1 forward split in June.

-

Broadcom (NASDAQ: AVGO) closed a 10-for-1 split (its first ever) in mid-July.

-

Super Micro Computer (NASDAQ: SMCI) will effect a 10-for-1 split after the close of trading on Sept. 30.

Nvidia has been the flagship of the rise of AI and is, arguably, the most-decorated of all stock-split stocks in 2024. Shares of the company have catapulted higher by more than 675% since the start of 2023 due to the dominance of its graphics processing units (GPUs) in AI-accelerated data centers — an estimated 98% share of GPUs shipped to data centers in 2022 and 2023, according to TechInsights. Demand for its H100 GPU is backlogged, leading to exceptional pricing power and a sizable uptick in the company’s gross margin.

Broadcom has quickly slid in as the preferred choice in networking solutions for high-compute data centers. Its solutions are responsible for reducing tail latency and maximizing the computing capacity of GPUs in enterprise data centers training large language models, running generative AI solutions, and making split-second decisions. Although Broadcom is much more than an AI stock, AI is the source of excitement surrounding the company right now.

As for Super Micro Computer, it’s become one of the leading infrastructure providers of the AI revolution. Super Micro’s customizable rack servers, which incorporate Nvidia’s H100 GPUs, are in high demand — net sales for the company jumped 110% last year — as businesses look to establish first-mover advantages.

But while AI stocks have been the bee’s knees on Wall Street throughout much of 2024, another brand-name company is perfectly positioned to announce a stock split and steal the spotlight in the fourth quarter.

This may be the most-anticipated stock split of the fourth quarter

The stock in question that could set Wall Street abuzz if it announces a forward split later this week is none other than warehouse club Costco Wholesale (NASDAQ: COST).

Costco is set to report its fiscal fourth-quarter operating results after the closing bell on Sept. 26, which would be the perfect time to also announce a stock split.

As of the closing bell on Sept. 18, a single share of Costco was tipping the scales at north of $892. More importantly, the company has conducted only three splits since going public, the last of which occurred all the way back in January 2000. In other words, it looks to be long overdue to make shares more affordable for retail investors and its employees who want to participate in the company’s employee stock purchase plan.

The only logical reason Costco has likely avoided a split for so long — aside from a greater prevalence of fractional-share purchase capabilities through most online brokers — is the fact that roughly 72% of its shares are held by institutional investors that aren’t concerned about a high nominal share price. But at some point, a near-$900 share price becomes burdensome to its employees and/or everyday investors. I believe we’ve reached that point with Costco.

Furthermore, Costco’s valuation is historically rich. It’s currently trading at a multiple of 50 (yes, 50!) times forward-year earnings per share, which is pretty much unheard of for a retailer. The company is going to need some serious buzz if it’s to grow into its current valuation, and the first stock split in 24 years might just be what the doctor ordered.

Unmasking Costco’s recipe for success

While the stage is undeniably set for Costco Wholesale to wow Wall Street with a stock split, the company’s underlying operations continue to fire on all cylinders.

Costco’s recipe for success begins with the advantage it possesses from its sheer size. Being able to purchase products in bulk helps to lower the per-unit cost of each item. Ultimately, this allows the company to undercut local shops and national grocery chains on price and provide a value proposition to consumers that keeps them coming back.

Costco is also a consumer staples stock. This is to say that it sells a variety of basic need goods that consumers are going to buy regardless of how well or poorly the U.S. economy is performing, such as food, beverages, and household cleaning/sanitary products. It has a lure to drive traffic into its stores in any economic climate.

Another key ingredient to Costco’s success story is its membership-based operating model. The $65 and $130 annual fees Costco collects from its members is high margin and flows straight to its bottom line. These fees provide an even firmer margin buffer that allows the company to undercut its peers on price to drive membership growth.

Last but not least, paying for an annual membership tends to incent loyalty in shoppers. Consumers will want to get the most out of their membership and are, therefore, more likely to head to Costco for their big-dollar purchases. Getting consumers into its stores is half the battle — and it’s one that Costco has been winning for decades.

Should you invest $1,000 in Costco Wholesale right now?

Before you buy stock in Costco Wholesale, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Costco Wholesale wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $710,860!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 16, 2024

Sean Williams has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Costco Wholesale and Nvidia. The Motley Fool recommends Broadcom. The Motley Fool has a disclosure policy.

Wall Street’s Most Anticipated Stock Split of the 4th Quarter May Be Announced This Week was originally published by The Motley Fool

All You Need to Know About Applied Therapeutics Rating Upgrade to Buy

Applied Therapeutics Inc. APLT appears an attractive pick, as it has been recently upgraded to a Zacks Rank #2 (Buy). This upgrade is essentially a reflection of an upward trend in earnings estimates — one of the most powerful forces impacting stock prices.

A company’s changing earnings picture is at the core of the Zacks rating. The system tracks the Zacks Consensus Estimate — the consensus measure of EPS estimates from the sell-side analysts covering the stock — for the current and following years.

The power of a changing earnings picture in determining near-term stock price movements makes the Zacks rating system highly useful for individual investors, since it can be difficult to make decisions based on rating upgrades by Wall Street analysts. These are mostly driven by subjective factors that are hard to see and measure in real time.

As such, the Zacks rating upgrade for Applied Therapeutics is essentially a positive comment on its earnings outlook that could have a favorable impact on its stock price.

Most Powerful Force Impacting Stock Prices

The change in a company’s future earnings potential, as reflected in earnings estimate revisions, has proven to be strongly correlated with the near-term price movement of its stock. The influence of institutional investors has a partial contribution to this relationship, as these big professionals use earnings and earnings estimates to calculate the fair value of a company’s shares. An increase or decrease in earnings estimates in their valuation models simply results in higher or lower fair value for a stock, and institutional investors typically buy or sell it. Their transaction of large amounts of shares then leads to price movement for the stock.

Fundamentally speaking, rising earnings estimates and the consequent rating upgrade for Applied Therapeutics imply an improvement in the company’s underlying business. Investors should show their appreciation for this improving business trend by pushing the stock higher.

Harnessing the Power of Earnings Estimate Revisions

As empirical research shows a strong correlation between trends in earnings estimate revisions and near-term stock movements, tracking such revisions for making an investment decision could be truly rewarding. Here is where the tried-and-tested Zacks Rank stock-rating system plays an important role, as it effectively harnesses the power of earnings estimate revisions.

The Zacks Rank stock-rating system, which uses four factors related to earnings estimates to classify stocks into five groups, ranging from Zacks Rank #1 (Strong Buy) to Zacks Rank #5 (Strong Sell), has an impressive externally-audited track record, with Zacks Rank #1 stocks generating an average annual return of +25% since 1988.

Earnings Estimate Revisions for Applied Therapeutics

For the fiscal year ending December 2024, this company is expected to earn -$0.84 per share, which is a change of 40.9% from the year-ago reported number.

Analysts have been steadily raising their estimates for Applied Therapeutics. Over the past three months, the Zacks Consensus Estimate for the company has increased 18.6%.

Bottom Line

Unlike the overly optimistic Wall Street analysts whose rating systems tend to be weighted toward favorable recommendations, the Zacks rating system maintains an equal proportion of ‘buy’ and ‘sell’ ratings for its entire universe of more than 4000 stocks at any point in time. Irrespective of market conditions, only the top 5% of the Zacks-covered stocks get a ‘Strong Buy’ rating and the next 15% get a ‘Buy’ rating. So, the placement of a stock in the top 20% of the Zacks-covered stocks indicates its superior earnings estimate revision feature, making it a solid candidate for producing market-beating returns in the near term.

The upgrade of Applied Therapeutics to a Zacks Rank #2 positions it in the top 20% of the Zacks-covered stocks in terms of estimate revisions, implying that the stock might move higher in the near term.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Ocular Drug Delivery Technology Market Size to Reach a Valuation of USD 30.2 billion by 2034, advancing at an 5.7% CAGR | Exclusive Report by Transparency Market Research

Wilmington, Delaware, United States, Transparency Market Research, Inc. , Sept. 23, 2024 (GLOBE NEWSWIRE) — The ocular drug delivery technology industry (Industrie für Augenarzneimittelverabreichungstechnologie) globally generated US$ 16.3 billion in revenue by 2023. A CAGR of 5.7% is expected between 2024 and 2034, resulting in US$ 30.2 billion by 2034.

Drug delivery technologies for treating ocular diseases have significantly advanced in recent years. A variety of advanced technologies have improved the efficacy and compliance of ocular drug delivery, including nanocarriers, implants, and MEMS devices

Research and development are being conducted to improve drug efficacy, improve patient compliance, and develop non-invasive methods for ocular drug delivery. Hydrogels combining nanotechnology with hydrogels and microneedles are expected to be designed with nanocoatings derived from biomimetic structures.

Devices made up of MEMS are currently in development as treatments for chronic and refractory eye conditions. These devices enable drug therapy to be continued without the need for repeated surgical procedures for an extended time.

After a single administration, drug delivery systems can maintain maximum levels of active medications longer, resulting in more effective treatment. Side effects may be reduced, such as cataract development and elevation of intraocular pressure.

Request Your Sample PDF and Stay Ahead with Our Insightful Report! https://www.transparencymarketresearch.com/ocular-drug-delivery-technologies.html

Key Findings of the Market Report

- Based on technology, the ocular insert segment will generate demand for ocular drug delivery in the near future.

- In terms of formulation type, the solution segment is expected to create new markets for drug delivery techniques.

- Rising glaucoma conditions have significantly increased the demand for ocular drug delivery technology.

- Ophthalmic clinics are likely to increase demand for ocular drug delivery technology.

Global Ocular Drug Delivery Technology Market: Growth Drivers

- The rising prevalence of eye conditions like diabetic retinopathy, glaucoma, and age-related macular degeneration (AMD) is becoming more prevalent as the world’s population ages and lifestyles change.

- Continuing research and development has resulted in safer and more effective medication formulations. The demand for advanced ocular delivery systems has increased due to innovations such as sustained-release formulations, nanoparticle drug delivery, and biodegradable implants.

- Patients prefer non-invasive drug delivery methods that minimize discomfort and inconvenience associated with traditional eye drops or injections. Ocular drug delivery technologies such as punctal plugs, inserts, and contact lenses offer convenient and comfortable alternatives, driving the market growth.

- Improved access to ocular drug delivery technologies has resulted from increased investments in healthcare infrastructure. This expansion of healthcare facilities boosts market demand for innovative ocular drug delivery solutions.

- A favorable regulatory environment and accelerated approval processes encourage manufacturers to invest in research and development. Support from regulations fosters innovation in creating novel ocular medication delivery systems and increases market competitiveness.

- Precision and targeted drug delivery platforms can now be created using nanotechnology, microfabrication, and advanced imaging systems. Enhancing medication bioavailability and tissue targeting through technical advancements propels market expansion.

Global Ocular Drug Delivery Technology Market: Regional Landscape

- Numerous eye conditions, such as age-related macular degeneration (AMD), diabetic retinopathy, glaucoma, and dry eye syndrome, impact a sizable portion of the population in North America. The rising frequency of these disorders is a result of the aging population and lifestyle variables, including prolonged screen time, which is pushing the need for efficient ocular drug delivery systems.

- Global leaders in biomedical research and innovation are found in North America, especially the United States. Reputable universities, research centers, and pharmaceutical firms create an atmosphere favorable to advancing cutting-edge ocular drug delivery technology. Government, business, and academia partnerships encourage innovation and expand the market.

- The regulation of the approval and commercialization of ocular drug delivery products is largely under the control of the US Food and Drug Administration (FDA). Due to a strong regulatory environment, patients and healthcare providers can feel confident knowing that products are safe, effective, and compliant with quality standards.

- Innovative ocular drug delivery technologies can enter the market more quickly with prompt approvals and clear regulatory procedures. Reimbursement policies and healthcare service accessibility both contribute to the region’s market expansion.

Global Ocular Drug Delivery Technology Market: Competitive Landscape

New technologies are being introduced by leading companies in the global market for ocular drug delivery technologies.

Key Players Profiled

- Ocular Therapeutix Inc.

- Alimera Sciences Inc.

- Allergan (an AbbVie company)

- Bausch Health Companies Inc.

- EyeGate Pharmaceuticals Inc.

- Envisia Therapeutics Inc.

- Clearside Biomedical Inc.

- Graybug Vision Inc.

- Santen Pharmaceutical Co. Ltd.

- Taiwan Liposome Company Ltd.

Key Developments

- In May 2023, Alimera Sciences acquired the right to commercialize Yutiq 0.18 mg in the United States from EyePoint Pharmaceuticals. In 2024, the company will pay EyePoint Pharmaceuticals $7.5m in equal quarterly payments based on the $75m cash payment made on closing the deal.

- In September 2023, Bausch + Lomb Corporation, a global eye health leader committed to improving people’s eyesight to live better, acquired XIIDRA (lifitegrast ophthalmic solution) 5%, an eye drop approved for the treatment of dry eye disease (DED) and inflammation associated with dry eye disease.

Elevate Your Business Strategy! Purchase the Report for Market-Driven Insights: https://www.transparencymarketresearch.com/checkout.php?rep_id=2869<ype=S

Global Ocular Drug Delivery Technology Market: Segmentation

By Technology

- Iontophoresis

- Intraocular Implant

- Biodegradable

- Non-biodegradable

- In Situ Gel & Punctal Plug

- Others

By Formulation Type

- Solution

- Suspension

- Emulsion

- Liposome & Nanoparticle

- Ointment

By Disease Type

- Glaucoma

- Macular Degeneration

- Diabetic Retinopathy

- Cataract

- Diabetic Macular Edema

- Dry Eye Syndrome

- Others

By End User

- Hospitals

- Ambulatory Surgical Centers

- Ophthalmic Clinics

- Homecare Settings

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Have a Look at Related Research Reports of Pharmaceutical

- Vaccines Market – The global vaccines market (Impfstoffmarkt ) was estimated at a value of US$ 119.1 billion in 2022. It is anticipated to register a 4.2% CAGR from 2022 to 2031 and by 2031, the market is likely to attain US$ 99.3 billion by 2031.

- Empty Capsules Market – The global empty capsules market (Markt für leere Kapseln) was valued at US$ 2.1 Bn in 2021 and is projected to expand at a CAGR of 7.6% from 2022 to 2031.

- Allergy Treatment Market – The global allergy treatment market Markt für Allergiebehandlungen) is estimated to grow at a CAGR of 5.8% from 2024 to 2034.

- Bioengineered Protein Drugs Market – The global bioengineered protein drugs market (Markt für biotechnologisch hergestellte Proteinmedikamente) is estimated to grow at a CAGR of 6.2% from 2024 to 2034.

About Transparency Market Research

Transparency Market Research, a global market research company registered at Wilmington, Delaware, United States, provides custom research and consulting services. Our exclusive blend of quantitative forecasting and trends analysis provides forward-looking insights for thousands of decision makers. Our experienced team of Analysts, Researchers, and Consultants use proprietary data sources and various tools & techniques to gather and analyses information.

Our data repository is continuously updated and revised by a team of research experts, so that it always reflects the latest trends and information. With a broad research and analysis capability, Transparency Market Research employs rigorous primary and secondary research techniques in developing distinctive data sets and research material for business reports.

Contact:

Transparency Market Research Inc.

CORPORATE HEADQUARTER DOWNTOWN,

1000 N. West Street,

Suite 1200, Wilmington, Delaware 19801 USA

Tel: +1-518-618-1030

USA – Canada Toll Free: 866-552-3453

Website: https://www.transparencymarketresearch.com

Email: sales@transparencymarketresearch.com

Follow Us: LinkedIn| Twitter| Blog | YouTube

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

DJT stock plummets to new lows after lockup period expires

Shares of Trump Media & Technology Group (DJT) dropped more than 10% on Monday to trade at their lowest level since the social media company went public in March. The moves come after DJT’s lockup period officially expired last week.

Stakeholders, including former President Donald Trump, were subject to a six-month lockup period before being able to sell or transfer shares. That lockup period expired last Thursday, although Trump has said he would not sell his stake.

“I have absolutely no intention of selling,” the former president told reporters at a press conference prior to the lockup period expiration. “I love it. I use it as a method of getting out my word.”

As Yahoo Finance’s Ben Werschkul detailed, the purpose of a lockup period is to protect a newly public company’s interests and allow it to preserve stability before its founders can cash out.

“If I sell, it wouldn’t be the same, and I can understand that,” Trump said at the time, adding that he knows his stake has been “whittled down” in recent months.

Shares are down about 20% since Thursday and remain far off their record high of just over $79 a share.

Trump maintains a roughly 60% interest in DJT. At current levels, Trump Media boasts a market cap of about $2.5 billion, giving the former president a stake worth around $1.5 billion. Right after the company’s public debut, Trump’s stake was worth just over $4.5 billion.

Trump Media went public on the Nasdaq in late March after merging with special purpose acquisition company Digital World Acquisition Corp. But the stock has been on a bumpy ride since, with shares oscillating between highs and lows as the moves have typically been tied to a volatile news cycle.

In June, the stock popped (then fell) after current commander in chief Joe Biden stumbled in his first presidential debate of 2024 with Trump. Biden dropped out of the presidential race one month later.

Since Biden’s announcement, shares have remained under pressure as Vice President Kamala Harris, the Democratic presidential nominee, tracks ahead of Trump in the latest polling.

In May, Trump was found guilty on all 34 counts of falsifying business records intended to influence the 2016 presidential campaign — a verdict that sent shares down 5% the day after the conviction. His sentencing was recently delayed until Nov. 26.

Shares have fallen about 65% since the company’s public debut.

Trump founded Truth Social after he was kicked off major social media apps like Facebook (META) and Twitter, the platform now known as X, following the Jan. 6, 2021, Capitol riots. Trump has since been reinstated on those platforms. He officially returned to X in mid-August after about a year’s hiatus.

But as Truth Social attempts to take on the social media incumbents, the fundamentals of the company have long been in question.

Last month, DJT reported second quarter results that revealed a net loss of $16.4 million, about half of which was tied to expenses related to the company’s SPAC deal. The company also reported revenue of just under $837,000 for the quarter ending June 30, a 30% year-over-year drop.

Alexandra Canal is a Senior Reporter at Yahoo Finance. Follow her on X @allie_canal, LinkedIn, and email her at alexandra.canal@yahoofinance.com.

Click here for the latest stock market news and in-depth analysis, including events that move stocks

Read the latest financial and business news from Yahoo Finance.

Are You Looking for a Top Momentum Pick? Why Canadian Imperial Bank is a Great Choice

Momentum investing is all about the idea of following a stock’s recent trend, which can be in either direction. In the ‘long’ context, investors will essentially be “buying high, but hoping to sell even higher.” And for investors following this methodology, taking advantage of trends in a stock’s price is key; once a stock establishes a course, it is more than likely to continue moving in that direction. The goal is that once a stock heads down a fixed path, it will lead to timely and profitable trades.

Even though momentum is a popular stock characteristic, it can be tough to define. Debate surrounding which are the best and worst metrics to focus on is lengthy, but the Zacks Momentum Style Score, part of the Zacks Style Scores, helps address this issue for us.

Below, we take a look at Canadian Imperial Bank CM, a company that currently holds a Momentum Style Score of B. We also talk about price change and earnings estimate revisions, two of the main aspects of the Momentum Style Score.

It’s also important to note that Style Scores work as a complement to the Zacks Rank, our stock rating system that has an impressive track record of outperformance. Canadian Imperial Bank currently has a Zacks Rank of #2 (Buy). Our research shows that stocks rated Zacks Rank #1 (Strong Buy) and #2 (Buy) and Style Scores of A or B outperform the market over the following one-month period.

Set to Beat the Market?

Let’s discuss some of the components of the Momentum Style Score for CM that show why this bank and financial services company shows promise as a solid momentum pick.

Looking at a stock’s short-term price activity is a great way to gauge if it has momentum, since this can reflect both the current interest in a stock and if buyers or sellers have the upper hand at the moment. It’s also helpful to compare a security to its industry; this can show investors the best companies in a particular area.

For CM, shares are up 0.37% over the past week while the Zacks Banks – Foreign industry is up 1.99% over the same time period. Shares are looking quite well from a longer time frame too, as the monthly price change of 13.34% compares favorably with the industry’s 1.97% performance as well.

While any stock can see a spike in price, it takes a real winner to consistently outperform the market. Over the past quarter, shares of Canadian Imperial Bank have risen 29.74%, and are up 53.89% in the last year. On the other hand, the S&P 500 has only moved 4.57% and 31.09%, respectively.

Investors should also take note of CM’s average 20-day trading volume. Volume is a useful item in many ways, and the 20-day average establishes a good price-to-volume baseline; a rising stock with above average volume is generally a bullish sign, whereas a declining stock on above average volume is typically bearish. Right now, CM is averaging 1,548,275 shares for the last 20 days.

Earnings Outlook

The Zacks Momentum Style Score also takes into account trends in estimate revisions, in addition to price changes. Please note that estimate revision trends remain at the core of Zacks Rank as well. A nice path here can help show promise, and we have recently been seeing that with CM.

Over the past two months, 6 earnings estimates moved higher compared to none lower for the full year. These revisions helped boost CM’s consensus estimate, increasing from $5.05 to $5.36 in the past 60 days. Looking at the next fiscal year, 6 estimates have moved upwards while there have been no downward revisions in the same time period.

Bottom Line

Taking into account all of these elements, it should come as no surprise that CM is a #2 (Buy) stock with a Momentum Score of B. If you’ve been searching for a fresh pick that’s set to rise in the near-term, make sure to keep Canadian Imperial Bank on your short list.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Bullish Sentiment Across The Cannabis Space – Check Full Movers For September 23, 2024

GAINERS:

LOSERS:

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Click on the image for more info.

Cannabis rescheduling seems to be right around the corner

Want to understand what this means for the future of the industry?

Hear directly for top executives, investors and policymakers at the Benzinga Cannabis Capital Conference, coming to Chicago this Oct. 8-9.

Get your tickets now before prices surge by following this link.