Billionaire Stan Druckenmiller Is Selling Nvidia, Apple, and Microsoft, and Buying These High-Yield Dividend Stocks Instead

Stan Druckenmiller saw the potential for the next wave of artificial intelligence fairly early. That led him to take a big position in Nvidia in the fourth quarter of 2022. He added Microsoft in the first quarter of 2023, after it upped its stake in generative AI leader OpenAI. At the start of this year, he started taking gains on his Nvidia investment and put some into Apple.

But Druckenmiller has quickly changed his tune on the three biggest companies in the world. He sold shares of Nvidia, Apple, and Microsoft during the second quarter, according to his latest 13F filing with the SEC. Instead, he’s focused on high-yield dividend stocks, which could all see their stock prices benefit from rate cuts by the Federal Reserve.

The Fed started this easing cycle on Sept. 18 with a 0.5-percentage-point cut to the federal funds rate. The market expects two 0.25-percentage-point cuts over the next three months and even further cuts in 2025. Here are the three stocks Druckenmiller is buying to take advantage.

1. Philip Morris

During the second quarter, Druckenmiller bought 889,355 shares of Philip Morris (NYSE: PM), in addition to call options giving him the right to buy an additional 963,000. Combined, the entire position was worth $187.7 million at the end of June.

Philip Morris is the world leader for an industry in decline. As the health risks of cigarettes are taught to new generations, fewer young consumers are buying cigarettes. But Philip Morris is committed to replacing cigarettes with smoke-free alternatives.

The tobacco company’s smoke-free product portfolio includes popular heat sticks brand Iqos and Zyn nicotine pouches. It now estimates 36.5 million active customers of those smoke-free products. The Iqos brand is set to launch in the U.S. in the fourth quarter, which could provide another boost to its sales.

Even as Philip Morris focuses on the future of nicotine products, it’s been able to maintain is cigarette sales through steady pricing power. Its market dominance, including brands like Marlboro and Parliament, give it strong pricing power, enabling it to offset declining unit sales.

The stock currently trades around 17.5 times forward earnings estimates and yields about 4.5%. That’s a fair price to pay for a company that should be able to consistently grow earnings and its dividend as it manages the current transition within its industry.

2. Kinder Morgan

Druckenmiller added 2,872,665 shares of Kinder Morgan (NYSE: KMI) to his portfolio during the second quarter. That follows an initial purchase of 3,880,500 shares in the first quarter. The total value of the billionaire’s position as of the end of the second quarter was $134.2 million.

Kinder Morgan is responsible for transporting approximately 40% of the natural gas consumed in the U.S. Its current growth driver, however, are liquefied natural gas (LNG) export facilities.

Management expects demand for natural gas to grow substantially between now and 2030. Liquefied natural gas exports could double during that period. On top of that, chairman Richard Kinder discussed the potential of AI to drive demand for energy during the company’s second-quarter earnings call.

As companies build more AI data centers, they’ll need to power them, and renewable energy isn’t at the point where it can keep up with demand. Training and running advanced AI models requires a lot of energy, even as chipmakers work to make their designs more power efficient.

The stock currently trades at an enterprise value of 12.2 times its earnings before interest, taxes, depreciation, and amortization (EBITDA) and yields about 5.3%. That valuation is near the high end of comparable companies, but it may be worth the price for a company in the dominant position of Kinder. Its steady free cash flow growth should support its dividend for years to come.

3. Mid-America Apartment Communities

Druckenmiller’s last big buy from the second quarter was Mid-America Apartment Communities (NYSE: MAA). He established a position of 644,190 shares of the real estate investment trust (REIT), worth $91.9 million at the end of June.

MAA focused on residential multifamily properties. It currently owns 103,600 apartment units across the Sunbelt region. MAA focuses on markets with strong job growth, expanding populations, and high household formation rates. The result is strong demand for housing, which enables MAA to grow rental rates faster than the market.

As a REIT, it can benefit from falling interest rates. That means a lower cost of debt while making the yield on shares look even more attractive relative to bond investments. But MAA isn’t waiting for rates to fall to invest in the future. It has $1 billion in its development pipeline.

The stock trades for about 17.4 times funds from operations (FFO) per share. That’s roughly in line with other residential real estate investment trusts. But with its investments in the future, it could see strong growth in rents and FFO. And, with the shares currently yielding about 3.6%, it may be worth a closer look for investors interested in diversifying their portfolio with a REIT.

Should you invest $1,000 in Philip Morris International right now?

Before you buy stock in Philip Morris International, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Philip Morris International wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $710,860!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 16, 2024

Adam Levy has positions in Apple and Microsoft. The Motley Fool has positions in and recommends Apple, Kinder Morgan, Microsoft, Mid-America Apartment Communities, and Nvidia. The Motley Fool recommends Philip Morris International and recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

Billionaire Stan Druckenmiller Is Selling Nvidia, Apple, and Microsoft, and Buying These High-Yield Dividend Stocks Instead was originally published by The Motley Fool

Adobe Dips 12.4% YTD: Can ADBE Stock Rebound on GenAI Strength?

Adobe ADBE, a titan in the Portable Document Format (PDF) technology, has been facing macroeconomic and competitive challenges this year, with its stock price plummeting 12.4% in the year-to-date period against the Zacks Computer-Software industry, the broader technology sector and the S&P 500 index’s returns of 14.8%, 22.2% and 19.6%, respectively.

Year-to-Date Price Performance

Image Source: Zacks Investment Research

This loss has left investors and analysts questioning the company’s future prospects. However, amid this downturn, Adobe’s strengthening Generative Artificial Intelligence (GenAI) drive is emerging as a potential catalyst for a much-needed recovery.

ADBE’s strong positioning in the digital content and marketing industry on the back of its robust cloud-enabled products and growing GenAI capabilities has been boosting its business prospects.

Expanding GenAI-Powered Solutions Drive ADBE’s Prospects

Adobe is constantly riding on the solid momentum in its family of creative, generative AI models, namely Firefly.

Its unveiling of the Firefly Image 2 Model, Firefly Vector Model and Firefly Design Model to mark a significant advancement in its creative generative AI model family, enhancing creative control, image quality and illustrator capabilities, is a major positive.

Adobe recently introduced the new Firefly Video model, which is marked as another positive.

With Firefly innovations and integrations, ADBE has exceeded 12 billion generations since the launch of Firefly. This is marked as an important milestone.

The company enhanced features of Acrobat AI Assistant to allow customers to ask questions, get insights, and create content from information across groups of PDFs and other document types, including Microsoft Word, Microsoft PowerPoint and text files. It also introduced enhanced meeting transcript capabilities in AI Assistant.

Adobe’s growing efforts to expand content creation in Adobe Acrobat are noteworthy. It integrated Adobe Firefly image generation into its Edit PDF workflows. It has optimized AI Assistant in Acrobat to generate content fit for presentations, emails and other forms of communication.

Adobe also offers Adobe Express Platform AI Assistant, which is capable of answering technical questions, automating tasks, simulating outcomes and generating audiences seamlessly.

The launch of Generative Remove in Adobe Lightroom, which is a powerful Firefly-backed tool that helps remove unwanted objects from any photo in a single click in a non-destructive manner, is a plus.

The introduction of Adobe Express for Enterprise, which is powered by Firefly Image Model 3, is driving the company’s momentum among various enterprises.

Strong Customer Base Drives ADBE’s Growth

A solid portfolio and differentiated approach to AI are attracting an expanding universe of customers across Adobe’s segments.

International Business Machines IBM is one of the notable customers leveraging Adobe Firefly.

Adobe’s other key customer wins include Johnson & Johnson, Mayo Clinic, Home Depot, Dentsu, TD Bank, Newell Brands, Alphabet’s Google, MediaMonks, Meta, U.S. Navy, PepsiCo, Estee Lauder, Disney, RedBull, Amazon, KPMG, U.S. Treasury Department and Charles Schwab.

ADBE’s Impressive Projections & Rising Estimates

Strong customer momentum, along with solid Firefly momentum, is expected to boost its near-term as well as long-term prospects.

For fourth-quarter fiscal 2024, Adobe projects total revenues between $5.50 billion and $5.55 billion. The Zacks Consensus Estimate for the same is pegged at $5.54 billion, indicating growth of 9.8% year over year.

Management expects non-GAAP earnings per share between $4.63 and $4.68. The consensus mark for the same is pinned at $4.66, indicating growth of 9.1%. The estimate has been revised upward by a penny over the past 30 days.

For fiscal 2024, the Zacks Consensus Estimate for revenues is pegged at $21.44 billion, indicating year-over-year growth of 10.5%.

The consensus mark for fiscal 2024 earnings is pegged at $18.26 per share, suggesting year-over-year growth of 13.6%. The estimate has been revised upward by 0.6% in the past 30 days.

Image Source: Zacks Investment Research

Macro Headwinds & Stiff Competition: Challenges for ADBE

However, a challenging macroeconomic environment, with high oil prices and elevated interest rates, remains a concern for Adobe. Fears of a looming U.S. recession are certainly major concerns. The ongoing Russia-Ukraine war also does not bode well for the company’s business.

Moreover, ADBE faces stiff competition in the AI software space from other tech giants and well-funded startups like Stability AI and Midjourney.

Intensifying competition might cause the returns from its AI push to take longer to materialize, which does not bode well for the stock.

ADBE Stock Overvalued

ADBE stock is not so cheap, as the Value Score of D suggests a stretched valuation at this moment.

In terms of the forward 12-month Price/Sales ratio, Adobe is trading at 9.92X, higher than the industry’s average of 7.84X.

Image Source: Zacks Investment Research

Conclusion

Adobe’s deepening GenAI focus and innovative GenAI-powered portfolio present a compelling opportunity for long-term investors. Its upward estimate revisions also bode well.

However, macro uncertainties and stiff AI competition are negatives for the stock. Also, its stretched valuation and Growth Score of C make it a risky bet at present.

ADBE currently has a Zacks Rank #3 (Hold), suggesting that it may be wise to wait for a more favorable entry point in the stock.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

US Services Growth Tops Estimate, Contraction In Manufacturing Worsens: 'Reacceleration Of Inflation'

Economic activity in the U.S. private sector grew at a slightly faster pace than anticipated in September, marking a stark contrast between the healthy services sector and the struggling manufacturing industry, according to the flash estimates from the Purchasing Managers’ Index (PMI) report released by S&P Global on Monday.

Despite better-than-expected readings for both the composite and services PMIs, two concerning trends emerged from September’s surveys.

First, the manufacturing sector’ deepened contraction’s contraction deepened, with output levels hitting their lowest level since December 2023. Second, inflationary pressures resurfaced, notably in the same month the Federal Reserve announced a 50-basis-point interest rate cut, with signals of further cuts ahead.

September Flash PMI Reports: Key Highlights

| Index | September 2024 | August 2024 | Forecast (September) |

|---|---|---|---|

| Composite PMI | 54.4 | 54.6 | 54.3 |

| Services PMI | 55.4 | 55.7 | 55.3 |

| Manufacturing PMI | 47.0 | 47.9 | 48.9 |

- Composite PMI: Eased from 54.6 in August to 54.4 but slightly outpaced the forecast of 54.3, as tracked by TradingEconomics.

- Services PMI: Slowed from 55.7 to 55.4, still above the expected 55.3, signaling ongoing expansion.

- Manufacturing PMI: Contracted more sharply, falling from 47.9 to 47, missing the expected improvement to 48.9.

- Manufacturing orders shrunk and business expectations for the year ahead hit a two-year low, primarily due to rising political uncertainty ahead of the upcoming presidential election. This uncertainty is leading companies to freeze hiring and cut jobs, with employment levels falling for the second consecutive month.

- Manufacturing payrolls were cut at the sharpest pace since June 2020, with factory job reductions at their steepest since January 2010 as firms grapple with weak demand.

- September saw a marked a worrisome increase in average prices for goods and services, with the fastest rise since March. This was the first acceleration in selling price inflation in four months, intensifying concerns about the new Federal Reserve’s monetary policy easing stance.

Economist Insights

“The early survey indicators for September point to an economy that continues to grow at a solid pace […]. A reacceleration of inflation is meanwhile also signalled, suggesting the Fed cannot totally shift its focus away from

its inflation target as it seeks to sustain the economic upturn,” said Chris Williamson, chief business economist at S&P Global Market Intelligence.

The survey aligns with a “healthy” third-quarter GDP growth estimate of 2.2% annualized, Williamson said, but emphasized the economy’s overreliance on the services sector and a drop in business confidence tied to political instability.

Regarding the price pressures increase, he advised the Fed to move cautiously in implementing further rate cuts.

Market Reactions

- U.S. Dollar Index (DXY): The dollar strengthened, with the Invesco DB USD Index Bullish Fund ETF UUP trading 0.3% higher in early New York trading.

- Treasury Yields: Both the 10-year yield and 30-year yield climbed by 5 basis points, sending the iShares 20+ Year Treasury Bond ETF TLT down by 0.8%.

- Stock Market: The S&P 500 – tracked by the SPDR S&P 500 ETF Trust SPY – edged up 0.4%, staying within striking distance of last week’s all-time highs.

Read Next:

Photo via Shutterstock.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Mark Cuban Says Trump's Lack Of Understanding Business Is 'Insane' — Slams 200% Tariff Threat On John Deere: 'Good Way To Destroy A Legendary American Company'

Ahead of the 2024 presidential election, former President Donald Trump has made headlines with his latest trade policy proposal, promising hefty tariffs on vehicles produced by alleged Chinese factories in Mexico.

What Happened: Billionaire entrepreneur Mark Cuban criticized former President Trump’s threat to impose a 200% tariff on John Deere, listed on the New York Stock Exchange as Deere & Co DE, for moving production to Mexico. In a post on X, Cuban called it a “good way to destroy a legendary American company.”

Cuban responded to Collin Rugg, owner of Trending Politics, who reported Trump’s comments made at a policy roundtable in Smithton, Pennsylvania. Trump warned John Deere of a 200% tariff if they proceed with plans to shift some production to Mexico.

“This Lack of Understanding of Business is insane,” Cuban wrote.

Trump’s comments were made while speaking to farmers, emphasizing his knowledge and love for John Deere. He stated, “If you do that, we’re putting a 200% tariff on everything that you want to sell into the United States,” highlighting his campaign’s focus on tariffs.

John Deere’s webpage details the company’s commitment to U.S. manufacturing and explains the necessity of moving less complex operations to other locations.

Why It Matters: Trump’s recent tariff threats are not isolated incidents. Last week, Trump vowed to impose 200% tariffs on Chinese-made cars produced in Mexico, warning of a potential collapse of the U.S. auto industry if Vice President Kamala Harris wins the 2024 election. He reiterated these claims during a town hall event in Flint, Michigan, despite the lack of evidence supporting the existence of such factories.

According to the Bureau of Labor Statistics, since President Joe Biden took over, auto and parts jobs have jumped by 13.6%, reaching 1.07 million by August. Car sales even ticked up by 2.4% in the first half of this year. The idea that the U.S. auto industry is on its last legs seems a stretch at the very least.

The U.S. has been strategically decoupling from China, a trend expected to continue regardless of the 2024 election outcome. Both Harris and Trump are likely to maintain this stance, impacting Chinese companies outsourcing to or investing in factories in Southeast Asia and Mexico.

Additionally, the Biden administration has proposed banning vehicles equipped with Chinese software, citing national security concerns. The U.S. Commerce Department aims to prevent nearly all Chinese cars from entering the U.S. market, further complicating the trade landscape.

Price Action: Deere & Co stock closed at $408.95 on Monday, up 0.75% for the day. In after-hours trading, the stock dipped 1.53%. Year to date, Deere & Co has risen by 2.01%, according to data from Benzinga Pro.

Read Next:

Image Via Shutterstock

This story was generated using Benzinga Neuro and edited by Kaustubh Bagalkote

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Invest in under-construction real estate in Bali from just $50. New product from Apato

Bali, Indonesia, Sept. 23, 2024 (GLOBE NEWSWIRE) — Apato, a real estate investment platform, has launched a new product allowing investors to buy fractions in under-construction properties starting at $50 and profit from the property’s value growth.

This product is ideal for private investors looking to diversify and earn on Bali’s fast-growing real estate market.

Apato’s new product lets investors make money in real estate without needing enough funds to buy an entire property. This opens up investment opportunities to a wider audience and changes the traditional approach to real estate investing.

Apato uses tokenization technology to make this possible. Tokenization splits the property into fractions represented as digital assets, offering high liquidity and transparency.

Key benefits: fully passive income, the ability to sell your share anytime, and quick online purchase in just a few minutes.

Currently, Apato offers shares in the Just Residence apartments, located five minutes from Bali’s popular Melasti beach. Construction began in October 2023, with completion expected by September 2025, but Apato plans to sell out within the next few months.

Dmitry Gollandtsev, CEO of Apato Estate, said, “We chose Bali for investments because it’s one of the fastest-growing regions with high demand from tourists and investors alike. We’ve already acquired several properties generating rental income for our investors, and now we’re expanding with under-construction investments.”

Apato makes real estate investing as simple and accessible as online shopping. The platform allows anyone to become an investor with minimal funds and earn income from real estate.

Contact:

Apato Estate

Dmitrii Gollandtsev

Email: info@apato.estate

Website: https://apato.estate

Bali, Indonesia

Dmitrii Gollandtsev info at apato.estate

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

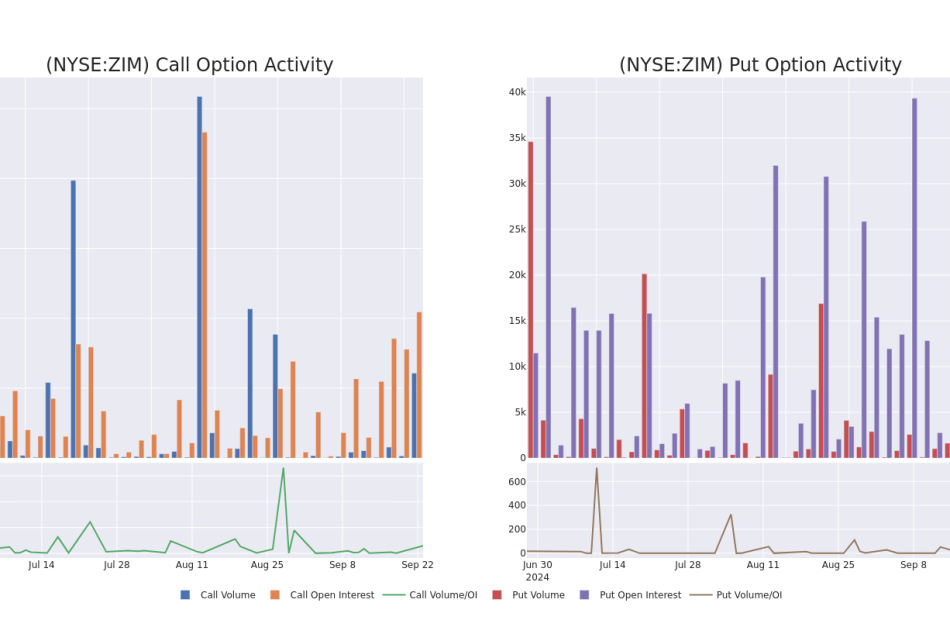

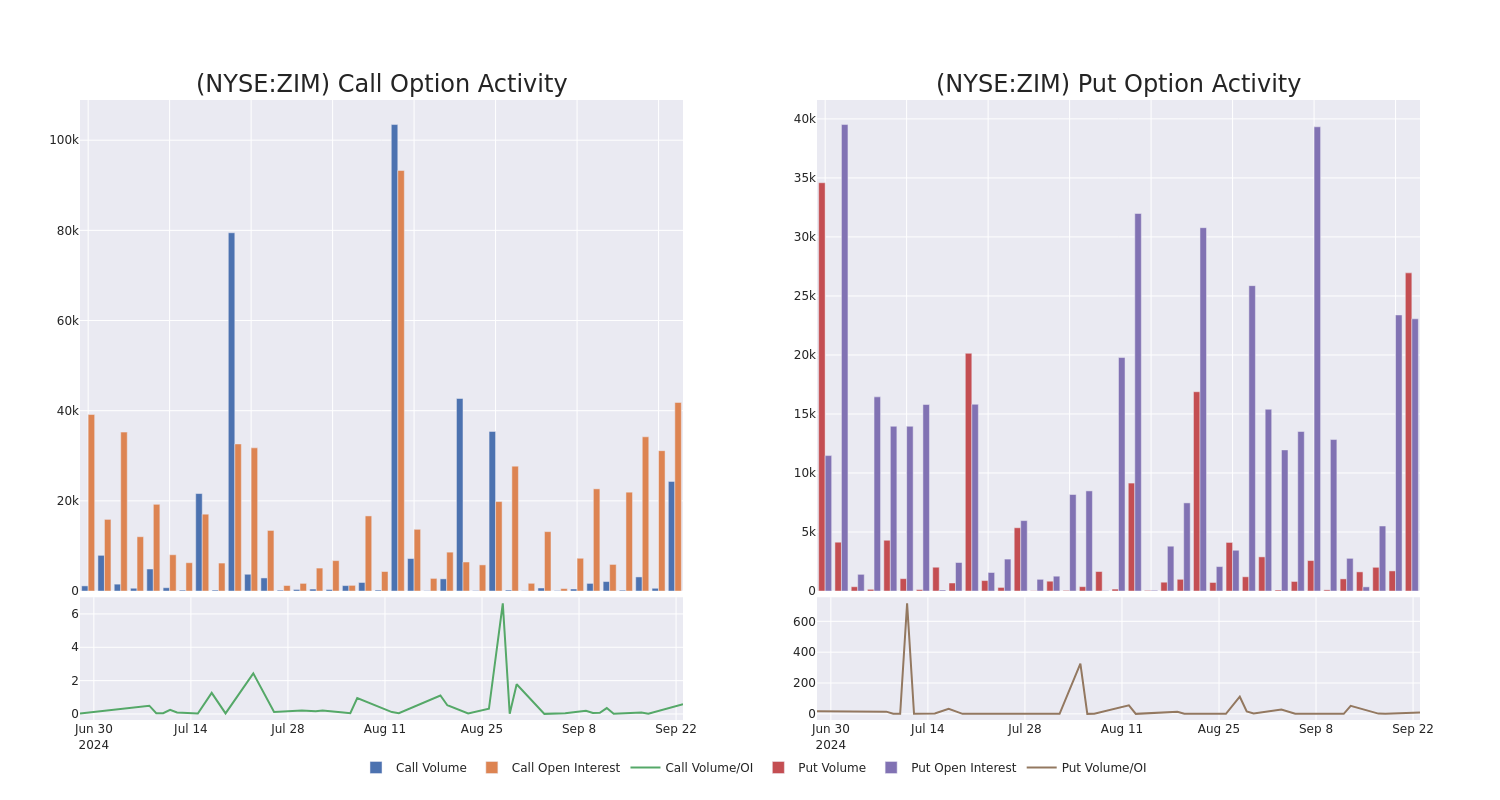

Market Whales and Their Recent Bets on ZIM Options

Investors with a lot of money to spend have taken a bullish stance on ZIM Integrated Shipping ZIM.

And retail traders should know.

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don’t know. But when something this big happens with ZIM, it often means somebody knows something is about to happen.

So how do we know what these investors just did?

Today, Benzinga‘s options scanner spotted 35 uncommon options trades for ZIM Integrated Shipping.

This isn’t normal.

The overall sentiment of these big-money traders is split between 48% bullish and 34%, bearish.

Out of all of the special options we uncovered, 16 are puts, for a total amount of $1,146,453, and 19 are calls, for a total amount of $1,120,580.

What’s The Price Target?

After evaluating the trading volumes and Open Interest, it’s evident that the major market movers are focusing on a price band between $15.0 and $25.0 for ZIM Integrated Shipping, spanning the last three months.

Volume & Open Interest Development

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for ZIM Integrated Shipping’s options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across ZIM Integrated Shipping’s significant trades, within a strike price range of $15.0 to $25.0, over the past month.

ZIM Integrated Shipping Option Activity Analysis: Last 30 Days

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| ZIM | PUT | TRADE | BULLISH | 01/17/25 | $6.55 | $6.3 | $6.34 | $25.00 | $253.6K | 1.8K | 423 |

| ZIM | CALL | SWEEP | BEARISH | 10/18/24 | $7.15 | $7.1 | $7.1 | $15.00 | $142.0K | 1.3K | 683 |

| ZIM | PUT | SWEEP | NEUTRAL | 01/17/25 | $3.3 | $2.95 | $2.95 | $20.00 | $118.0K | 13.2K | 514 |

| ZIM | CALL | TRADE | NEUTRAL | 10/18/24 | $7.15 | $6.95 | $7.05 | $15.00 | $105.7K | 1.3K | 233 |

| ZIM | CALL | SWEEP | BEARISH | 10/18/24 | $7.35 | $6.95 | $6.96 | $15.00 | $96.9K | 1.3K | 1.7K |

About ZIM Integrated Shipping

ZIM Integrated Shipping Services Ltd is an asset-light container liner shipping company. It offers tailored services, including land transportation and logistical services, specialized shipping solutions, including the transportation of out-of-gauge cargo, refrigerated cargo, and dangerous and hazardous cargo. Its services include Cargo Services, Digital Services, Schedules, and Shipping Trades and Lines. Geographically, it derives a majority of its revenue from the Pacific trade region.

Having examined the options trading patterns of ZIM Integrated Shipping, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Present Market Standing of ZIM Integrated Shipping

- Trading volume stands at 10,677,136, with ZIM’s price up by 10.47%, positioned at $22.16.

- RSI indicators show the stock to be may be approaching overbought.

- Earnings announcement expected in 51 days.

What The Experts Say On ZIM Integrated Shipping

In the last month, 2 experts released ratings on this stock with an average target price of $12.1.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* Consistent in their evaluation, an analyst from B of A Securities keeps a Underperform rating on ZIM Integrated Shipping with a target price of $13.

* Reflecting concerns, an analyst from JP Morgan lowers its rating to Underweight with a new price target of $10.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest ZIM Integrated Shipping options trades with real-time alerts from Benzinga Pro.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.