Bank of Japan Governor Takes Cautious Stance On Interest Rates, Awaiting Key Economic Data Amid Global Uncertainty

Bank of Japan Governor Kazuo Ueda indicated on Tuesday that the central bank is in no hurry to raise interest rates further.

What Happened: Ueda mentioned that the BOJ will closely monitor financial markets and global economic conditions before making any decisions, Reuters reported.

He emphasized the importance of analyzing October’s service-price data, which will be available in November, to determine if underlying inflation is moving towards the BOJ’s 2% target.

During a news conference in Osaka, Ueda highlighted the need to scrutinize actual data before making any rate hike decisions, suggesting that the BOJ will wait until at least December.

The next policy meeting is scheduled for Oct. 30-31, where a quarterly review of growth and inflation forecasts will also take place.

“We must conduct policy in a timely, appropriate fashion without having any pre-set schedule in mind, taking into account various uncertainties,” said Ueda.

Ueda reiterated that the BOJ would raise rates if underlying inflation accelerates towards the 2% target. However, he warned of risks such as volatile financial markets and uncertainty about the U.S. economy’s ability to achieve a soft landing.

He noted that the yen’s recent stabilization has reduced the risk of inflation overshooting due to rising import prices. Ueda stressed the importance of monitoring market developments and overseas economic conditions in setting monetary policy.

Ueda’s remarks reflect a shift in the BOJ’s focus from inflationary risks to concerns about slowing global growth and the impact of yen fluctuations on Japan’s export-driven economy, according to the report.

Why It Matters: The Bank of Japan has been a significant outlier in the global monetary landscape, maintaining its interest rate at 0.25% while other major central banks have been cutting rates to counteract slowing inflation.

On Thursday, the BOJ decided to keep its benchmark rate unchanged, diverging from the Federal Reserve’s 50 basis point cut.

This decision aligns with predictions from a Reuters poll, where economists anticipated another rate hike by the end of the year.

Meanwhile, other global central banks, including the People’s Bank of China, have been cutting rates and injecting liquidity to support their economies. China’s central bank recently reduced a key short-term interest rate and injected over $10 billion into the financial system to boost economic growth.

Read Next:

Image Via Shutterstock

This story was generated using Benzinga Neuro and edited by Kaustubh Bagalkote

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Lyft Partners with Smartcar to Ease EV Drivers' Range Anxiety

On Tuesday, Smartcar, the API platform for mobility businesses partnered with ride-hailing company Lyft, Inc LYFT to tackle range anxiety and help electric vehicle drivers confidently accept rides.

Lyft’s ‘Rides in Range,’ which ensures EV drivers only receive ride requests within their current battery range, is now available for EV drivers on the platform with a 20-mile buffer on an EV’s battery range to accommodate different driving styles or route obstacles.

Range anxiety is the top concern for EV drivers on the platform.

Also Read: Lyft And Payfare Team Up To Transform Driver Earnings: Details

Accurate and automated ride assignments, combined with EV battery data retrieved via Smartcar, help Lyft drivers take on more trips with confidence, boost ratings, and increase customer tips.

Lyft reported second-quarter topline growth of 41%, reaching $1.44 billion, beating the analyst estimate of $1.39 billion. Lyft’s rides grew by 15% to 205 million.

The ride-hailing company remains invested in restructuring activities to unlock value, including laying off 1% of its employees and disposing of assets related to its bike and scooter operations to contain operating costs. The stock is up over 34% in the last 12 months.

Meanwhile, Uber Technologies, Inc UBER stock has increased 71% in the last 12 months, backed by its diversified offering, which includes food delivery, freight, and same-day delivery services.

Price Action: LYFT stock is up 3.81% at $13.21 at the last check on Tuesday.

Photo via Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Iris® Powered by Generali Launches Total Title Protection

A comprehensive monitoring and protection plan, Total Title Protection, is designed to help protect consumers from real estate fraud, which cost them more than $145M in 2023.

WASHINGTON, Sept. 24, 2024 /PRNewswire/ — Iris® Powered by Generali (“Iris”), provider of a proprietary identity and cyber protection platform, today announced the launch of Total Title Protection, a comprehensive protection package that combines key products and services to help protect homebuyers against home title theft, scams, cyberattacks, and identity fraud.

Paige Schaffer, CEO of Iris, commented on the launch, “As providers of industry-leading identity protection, we are constantly looking out for new fraud trends or changes to the identity theft landscape. While these real estate-related scams & identity theft issues aren’t new, we launched Total Title Protection in response to the worrying increase of this type of fraud, which the FBI reported cost consumers more than $145M in 2023 alone. A package that protects against scams, proactively monitors for any changes or filings made to a customer’s title, and even provides expert resolution in case of fraud or cyberattacks is unlike any other product out there. This solution gives real estate professionals, lenders, insurance carriers, and builders an edge over their competition by providing their clients protection well beyond the closing date.”

Data reported by HousingWire showed that nearly 52% of loans had at least one wire and title fraud risk issue in Q4 of 2023, which was an all-time high. Some key tactics deployed by real estate fraudsters include forging of deeds, fraudulently refinancing a home, and fraudulently applying for a reverse mortgage or home equity line of credit. Some of the offerings unique to Total Title Protection include:

- Home Title Monitoring & Alerts – Professionals involved in the home buying process can protect their customers against title fraud by providing continuous monitoring of their property title(s). Customers receive alerts of changes or filings made against their title that could indicate fraud.

- $2M Reimbursement for Home Title ID Theft Expenses** – Clients are protected against the costly financial expenses associated with the resolution and restoration of a stolen identity and home title theft. Total Title Protection plan users can receive up to $2 million home title identity theft expense reimbursement.

- Caller ID Monitoring and Alerts – Customers are protected against phone impersonation fraud through instant alerts sent when suspicious, masked, inbound, and outbound call attempts occur. These threats include vishing and spoofing.

These offerings are paired with other high-value Iris tools and services, such as high-risk transaction monitoring and alerts, ScamAssist®, personal cyber protection, 24/7 award-winning resolution assistance, and a monthly risk report.

Michele Krisanda, Senior VP of Global Product Development, added, “Iris is going beyond your standard title monitoring or this concept of a “home title lock,” which is a misnomer we’ve seen among many of the products on the market that look to address real estate fraud currently. Since titles get recorded all throughout the country in local courthouses, there’s no centralized database that can be “locked” like there is with credit. Our home title solution monitors home title changes from thousands of county recorders offices across the country and sends alerts when we detect activity that could indicate fraud. In addition, our package includes a comprehensive suite of services to help protect the homeowner and resolve issues related to identity theft, scams, and cyberattacks, along with up to $2M expense coverage for identity theft or home title theft incidents.”

Over the past year, Iris has continued to enhance its current offerings and roll out new ones, including ScamAssist, which is part of Total Title Protection. Iris plans to continue monitoring trends in identity theft and scams to develop comprehensive solutions, like Total Title Protection, so that consumers are protected both before an incident happens and after one occurs, with the assistance of expert support to rectify it in the event they are scammed, or their identity is stolen.

**DISCLAIMER: The Home Title Theft Expense Reimbursement is underwritten and administered by American Bankers Insurance Company of Florida, an Assurant company, under group or blanket policies issued to Generali Global Assistance, Inc., dba Iris® Powered by Generali for the benefit of its Members. Please refer to the actual policies for terms, conditions, and exclusions of coverage. Coverage may not be available in all jurisdictions. Review the Summary of Benefits for more details.

About Iris® Powered by Generali

Iris® Powered by Generali is a B2B2C global identity and cyber protection company owned by the 190-year-old multinational insurance company, Generali, that is passionate about not just developing effective identity protection solutions but also integrating them into people’s lives in a meaningful and impactful way. Today, we partner with some of the world’s most well-known brands, protecting their people how they want to be protected, no matter where they are.

To learn more about Iris’ offerings, please visit https://www.irisidentityprotection.com/.

Iris Media Contact

M Group Strategic Communications

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/iris-powered-by-generali-launches-total-title-protection-302256494.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/iris-powered-by-generali-launches-total-title-protection-302256494.html

SOURCE Iris powered by Generali

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

This Tech Stock Just Raised Its Dividend by 35%, and Analysts Are Raising Their Price Targets

While investors may love their dividends, stocks with high yields often come with risks or very limited growth prospects.

But if one can find a stock with a decent yield that can grow a lot into the future, that’s a ticket for superior payouts looking out five, 10, or 20 years or longer.

The best growth today is found in the tech sector, but most tech companies don’t pay a lot in dividends. However, one winning company just announced a massive 35% increase in its payout following its Analyst Day, and analysts see even better things ahead.

T-Mobile is becoming a dividend growth monster

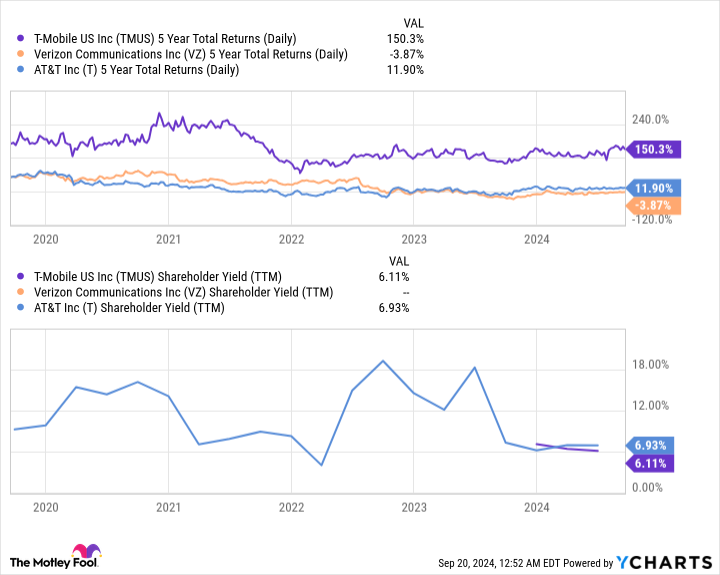

Following its Capital Markets Day on Wednesday, T-Mobile (NASDAQ: TMUS) announced a whopping 35% increase to its dividend. T-Mobile just introduced a dividend to shareholders last year for the first time, and started rather small compared with peers Verizon (NYSE: VZ) and AT&T (NYSE: T). T-Mobile’s dividend yield amounted to 1.32% at today’s price, but the big increase will bring that to 1.76%. That’s still a far cry from Verizon’s 6.2% yield or AT&T’s 5.1%. However, as one can see, there is much more to a stock’s return than its dividend yield:

T-Mobile has achieved a massive 150% gain over the past five years, including dividends. Meanwhile, AT&T has returned only 12% and Verizon shareholders have actually seen a 4% decline, even including dividends.

Moreover, T-Mobile has returned much more to shareholders recently in the form of share repurchases. T-Mobile’s shareholder yield, which incorporates dividends and repurchases, totaled 6.11% over the past 12 months, almost as high as AT&T’s 6.9% yield.

T-Mobile is best grower of the telecom bunch

The difference in shareholder returns is attributable to the fact that T-Mobile has outgrown its peers, largely because of its transformation as the industry transitioned to 5G. T-Mobile had formerly been a discount brand that thrived on lower prices, but with an inferior network. However, the acquisition of Sprint in 2020 along with some savvy spectrum purchases actually gave T-Mobile a network advantage as the industry flipped from 4G to 5G.

And more growth lies ahead

T-Mobile also presented its Capital Markets Day on Wednesday, where it outlined its strategy for continued growth. These include:

-

Maintaining its network leadership: It’s doing so by investing in an AI-powered network, through a collaboration with Nvidia, Ericsson and Nokia.

-

Continuing to take market share: It’s focusing on places where it’s still underpenetrated, including small and rural towns, business accounts, and roughly 30 of the top 100 metro markets where it’s not already the leader.

-

Increasing broadband growth: T-Mobile rolled out its 5G wireless broadband offering just a few years ago, but has already achieved 5.6 million broadband customers to date. By 2028, it sees that growth going to 12 million and then between 12 million and 15 million by 2030. That will be achieved both through wireless and fiber-to-the-home, which is a new initiative for the company.

-

Collaborating on customer service with OpenAI: T-Mobile is partnering with OpenAI on IntentCX, which is an AI-powered predictive platform to better serve customers, anticipate their needs, and solve problems, all while reducing pressure on T-Mobile’s customer service. The company hopes the initiative will lower churn even further while also lowering costs.

T-Mobile forecasts that these growth initiatives should lead to 5% service revenue growth, 7% EBITDA growth, and 8% free cash flow growth between 2023 and 2027.

That would lead the telecom industry, supporting continued dividend growth beyond even the recent increase.

Analysts raise their targets

In the wake of Analyst Day, analysts at Evercore raised their price target on T-Mobile to $220, up from $210. The analysts called T-Mobile the most attractive story in the cable and telco industries, raising the target based on a valuation based of 13.4 times 2027 free cash flow.

That’s a premium to the rest of the sector, but T-Mobile’s growth as well as the prospect of lower interest rates make its story much more appealing. In addition, T-Mobile said it plans to return another $50 billion to shareholders between 2023 and 2027, even while it reserves another $30 billion for acquisitions and other optionality. Even the newly raised dividend payout would only equate to about $4.1 billion per year in dividends. Therefore, that leaves ample room for more share repurchases and dividend growth well into the future.

Should you invest $1,000 in T-Mobile US right now?

Before you buy stock in T-Mobile US, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and T-Mobile US wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $710,860!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 16, 2024

Billy Duberstein and/or his clients have positions in T-Mobile US. The Motley Fool has positions in and recommends Nvidia. The Motley Fool recommends T-Mobile US and Verizon Communications. The Motley Fool has a disclosure policy.

This Tech Stock Just Raised Its Dividend by 35%, and Analysts Are Raising Their Price Targets was originally published by The Motley Fool

AutoZone, Thor Industries And 3 Stocks To Watch Heading Into Tuesday

With U.S. stock futures trading mixed this morning on Tuesday, some of the stocks that may grab investor focus today are as follows:

- Wall Street expects AutoZone, Inc. AZO to report quarterly earnings at $53.53 per share on revenue of $6.22 billion before the opening bell, according to data from Benzinga Pro. AutoZone shares fell 0.7% to $3,027 in after-hours trading.

- AAR Corp. AIR posted better-than-expected results for its first quarter on Monday. The company reported quarterly earnings of 85 cents which beat the analyst consensus estimate of 82 cents per share. AAR shares gained 3.4% to $71.44 in the after-hours trading session.

- Analysts expect THOR Industries, Inc. THO to post quarterly earnings at $1.30 per share on revenue of $2.47 million before the opening bell. THOR Industries shares gained 1.6% to $104.83 in the after-hours trading session.

Check out our premarket coverage here

- Snowflake Inc. SNOW announced a $2 billion private placement of senior convertible notes. Snowflake shares fell 3.1% to $109.71 in the after-hours trading session.

- Analysts are expecting KB Home KBH to post quarterly earnings at $2.06 per share on revenue of $1.73 billion. The company will release earnings after the closing bell. KB Home shares gained 1.1% to close at $88.20 on Monday.

Check This Out:

Photo courtesy: Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Selvita reports growing sales in Q2 and Q3, and projects increased profitability in H2 2024

KRAKÓW, Poland, Sept. 24, 2024 /PRNewswire/ — Selvita S.A. SLV, one of the leading preclinical contract research organizations in Europe, has published its financial results for Q2 2024, earnings estimates for Q3 204 and backlog for 2024 and 2025.

Financial and Operational Highlights

- Selvita reports revenue growth in each subsequent quarter of 2024. In Q2 2024, commercial revenues were 6% higher than in Q1. Published estimates for Q3 suggest the rebound will continue, with the company expecting to generate between EUR 20.2 million and EUR 20.6 million in organic revenue. This implies 9-12% q/q and 7-10% y/y growth. The Group’s EBITDA(1) margin for Q3 is projected to reach 15-18%, representing an improvement of 5-8 p.p. from the previous quarter.

- The contracting level for H2 2024 is 12% higher compared to the same period in the previous year(2). Meanwhile, the backlog for next year is 32% higher than it was in September 2023.

- Selvita has observed a gradual improvement in global biotech sector financing. Over the past six months, it reported four significant cooperation agreements, compared to two during all of 2023. At the same time, contracting for 2024 from big pharma(3) companies stands currently at EUR 17.9 million, 28% higher than the revenue generated by this group of customers in the entirety of 2023.

- In Q2 2024, the Company completed transactions related to the launch of a new site in Wroclaw, dedicated to biological drug discovery and development, as well as the acquisition of PozLab, a CDMO offering services for small molecule drug development. The integration of these new sites is progressing as planned and is at its final stage.

“After a challenging first half of the year, we believe to have returned to solid organic revenue growth in the second quarter, which is expected to further accelerate in the third quarter, and beyond, as indicated by the strong backlog for the second half of the year and further on in 2025. Acquisitions made in the first half of the year and sizable staff and infrastructure reserves create a solid base for continued strong revenue growth and increasing profitability. We also expect to be supported by the improving macroeconomic situation for the sector, where in case of our biotech sector, a significant driver can be, for instance, the first interest rate cuts in four years in the key markets.” – comments Bogusław Sieczkowski, Co-Founder and Chief Executive Officer of Selvita.

Selvita on the path for growth

Selvita’s revenues are increasing in each consecutive quarter of 2024. The Group estimates that Q3 revenues will be11-13% higher organically than those in Q1 and 7-9% higher than in Q2. The Group’s contracting for H2 2024 indicates 12% y/y growth (organic 10%). The expansion of the business will optimize resource utilization, especially those resources related to the launch of its own laboratory space, driving significant profitability growth.

Financial Insights

Selvita Group’s commercial revenues in Q2 2024 amounted to EUR 18.5 million, compared to EUR 17.3 million in Q1. The Group generated EUR 1.8 million in EBITDA, impacted by approximately EUR 1.9 million due to foreign exchange differences compared to 2023, temporarily underutilized resources and one-time events. In Q2 2023, EBITDA amounted to EUR 4.7 million.

According to the published earnings estimates, Selvita expects EUR 19.3-19.7 million in organic commercial revenues (up 7-9% q/q) in Q3 2024 and EBIDTA profitability in the range of 17-20% (up 3-6 p.p. q/q profitability). Organic backlog for 2024 indicates a 10% y/y contracting growth rate in H2 2024.

Revenues of the drug discovery segment, which accounted for 78% of the Group’s sales in H1 2024, increased by 10% q/q in Q2 2024. The contracted status for H2 2024 indicates that the drug discovery segment grew by 4% y/y, and the drug development segment by 30% y/y.

Selvita continues to consistently grow its sales to big pharma customers. Organic revenues from big pharma companies amounted to EUR 8.5 million in H1 2024, up 17% y/y. The contracted status for the full year 2024 indicates at least 27% y/y growth in sales to this type of customer.

The backlog for the next year amounts to EUR 19.3 million, indicating a 32% increase when compared to the previous year. As a result, Selvita achieved a record cost coverage ratio for the next year as of September, historically achieved by the Group two months later.

Notes:

(1) The results do not include non-cash costs of the non-dilutive employee incentive program.

(2) Backlog as of 20/09/2024 and 25/09/2023.

(3) Big Pharma defined as global pharmaceutical companies reporting revenues in excess of $5 billion in 2022.

All % calculated from PLN

All values are calculated from PLN using an average exchange rate for a respective reporting period

About Selvita (SLV)

Selvita is a leading provider of integrated drug discovery and development services, dedicated to advancing pharmaceutical and biopharmaceutical innovations through a holistic approach. Company delivers comprehensive solutions that span the entire drug development lifecycle, from early discovery to final product delivery.

The drug discovery department offers a comprehensive scope of services bridging the gap between early drug discovery and the clinical stage of drug development. The department specializes in a variety of therapeutic areas, including infectious diseases, inflammation, fibrosis, and oncology, offering both stand-alone and fully integrated services tailored to your needs.

The drug development division provides extensive drug development and regulatory support, including analytical support for both small and large molecules, microbiology, formulation, and clinical trial batch manufacturing, adheres to the highest quality standards under GMP and GLP regulations.

Selvita, established in 2007, operates globally with over 950 highly qualified employees, of which over 35% hold a PhD degree. With state-of-the-art facilities in Krakow, Poznan, Wroclaw, and Zagreb, and international offices in Cambridge, MA, the San Francisco Bay Area, and Cambridge, UK, Selvita offers a global network of expertise and resources.

Selvita is listed on the Warsaw Stock Exchange SLV. For more information, please see www.selvita.com.

![]() View original content:https://www.prnewswire.com/news-releases/selvita-reports-growing-sales-in-q2-and-q3-and-projects-increased-profitability-in-h2-2024-302256647.html

View original content:https://www.prnewswire.com/news-releases/selvita-reports-growing-sales-in-q2-and-q3-and-projects-increased-profitability-in-h2-2024-302256647.html

SOURCE Selvita S.A.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Mackenzie Investments Announces September 2024 Distributions for its Exchange Traded Funds

TORONTO, Sept. 24, 2024 /CNW/ – Mackenzie Investments today announced the September 2024 monthly cash distributions for its Exchange Traded Funds (“ETFs”) listed below that trade on the Toronto Stock Exchange (TSX) and Cboe Canada. Unitholders of record on October 1, 2024 will receive cash distributions payable on October 8, 2024.

Details of the per-unit distribution amounts are as follows:

|

Mackenzie ETF |

Ticker |

Distribution |

CUSIP |

ISIN |

Payment |

Exchange |

|

Mackenzie Core Plus |

MGB |

$ 0.06263 |

55452P101 |

CA55452P1018 |

Monthly |

TSX |

|

Mackenzie Unconstrained |

MUB |

$ 0.08080 |

55454N104 |

CA55454N1042 |

Monthly |

TSX |

|

Mackenzie Floating Rate |

MFT |

$ 0.14033 |

55453X103 |

CA55453X1033 |

Monthly |

TSX |

|

Mackenzie Core Plus |

MKB |

$ 0.05995 |

55452R107 |

CA55452R1073 |

Monthly |

TSX |

|

Mackenzie Canadian Short |

MCSB |

$ 0.05526 |

55452Q109 |

CA55452Q1090 |

Monthly |

TSX |

|

Mackenzie Canadian |

QBB |

$ 0.31346 |

55452S105 |

CA55452S1056 |

Monthly |

TSX |

|

Mackenzie Canadian Short- |

QSB |

$ 0.32776 |

55453K101 |

CA55453K1012 |

Monthly |

TSX |

|

Mackenzie US Investment |

QUIG |

$ 0.30105 |

55455H106 |

CA55455H1064 |

Monthly |

TSX |

|

Mackenzie US High Yield |

QHY |

$ 1.12159 |

55455K109 |

CA55455K1093 |

Monthly |

TSX |

|

Mackenzie Emerging |

QEBL |

$ 0.29052 |

55455J102 |

CA55455J1021 |

Monthly |

TSX |

|

Mackenzie Emerging |

QEBH |

$ 0.29696 |

55454J103 |

CA55455J1030 |

Monthly |

TSX |

|

Mackenzie Developed ex- |

QDXB |

$ 0.15965 |

55454P109 |

CA55454P1099 |

Monthly |

TSX |

|

Mackenzie U.S. Aggregate |

QUB |

$ 0.21843 |

554557108 |

CA5545571088 |

Monthly |

TSX |

|

Mackenzie Global Fixed |

MGAB |

$ 0.04936 |

554552208 |

CA5545522081 |

Monthly |

TSX |

|

Mackenzie Canadian Ultra |

QASH |

$ 0.17322 |

554564104

|

CA5545641048 |

Monthly |

TSX |

|

Mackenzie US Government |

QTLT |

$ 0.25638 |

55454Q107

|

CA55454Q1072 |

Monthly |

TSX |

|

Mackenzie Canadian |

QLB |

$ 0.31138 |

55455N103

|

CA55455N1033 |

Monthly |

TSX |

|

Mackenzie Global High |

MHYB |

$ 0.08484 |

55454M106 |

CA55454M1068 |

Monthly |

Cboe |

|

Mackenzie Canadian All |

QCB |

$ 0.32933 |

55454A102 |

CA55454A1021 |

Monthly |

Cboe |

|

Mackenzie US TIPS Index |

QTIP |

$ 0.20517 |

55456B108 |

CA55456B1085 |

Monthly |

Cboe |

|

Mackenzie Global |

MGSB |

$ 0.05812 |

554565101 |

CA5545651013 |

Monthly |

Cboe |

|

Wealthsimple North |

WSGB |

$ 0.05474 |

94702B109 |

CA94702B1094 |

Monthly |

Cboe |

Further information about Mackenzie ETFs can be found at mackenzieinvestments.com.

Commissions, management fees, brokerage fees and expenses all may be associated with Exchange Traded Funds. Please read the prospectus before investing. Exchange Traded Funds are not guaranteed, their values change frequently and past performance may not be repeated.

The payment of distributions is not guaranteed and may fluctuate. The payment of distributions should not be confused with an Exchange Traded Fund’s performance, rate of return or yield. If distributions paid by the Exchange Traded Fund are greater than the performance of the Exchange Traded Fund, your original investment will shrink. Distributions paid as a result of capital gains realized by an Exchange Traded Fund, and income and dividends earned by an Exchange Traded Fund are taxable in your hands in the year they are paid. Your adjusted cost base will be reduced by the amount of any returns of capital. If your adjusted cost base goes below zero, you will have to pay capital gains tax on the amount below zero.

About Mackenzie Investments

Mackenzie Investments (“Mackenzie”) is a leading investment management firm with $208.6 billion in assets under management as of August 31, 2024. Mackenzie provides investment solutions and related services to more than one million retail and institutional clients through multiple distribution channels. Founded in 1967, Mackenzie is a global asset manager with offices across Canada as well as in Boston, Dublin, London, Hong Kong and Beijing. Mackenzie is a member of IGM Financial Inc. IGM, one of Canada’s premier financial services companies with approximately $260 billion in total assets under management and advisement as of August 31, 2024. For more information, visit mackenzieinvestments.com

SOURCE Mackenzie Financial Corporation

![]() View original content to download multimedia: http://www.newswire.ca/en/releases/archive/September2024/24/c7333.html

View original content to download multimedia: http://www.newswire.ca/en/releases/archive/September2024/24/c7333.html

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Who Funded Melania Trump's Six-Figure LGBT+ Speaking Engagement? The Source Remains Shrouded In Mystery

Former First Lady Melania Trump has reportedly been receiving hefty payments for her appearances at political events this year. This unusual practice was unearthed in former President Donald Trump’s recent financial disclosure form.

What Happened: For a speaking engagement at an event organized by the LGBT+ organization Log Cabin Republicans in April, Melania Trump received a payment of $237,500 for a “speaking engagement,” reported CNN. However, the source of this payment remains a mystery. Charles Moran, the president of the Log Cabin Republicans, refuted claims that the group was responsible for her speaking fee.

Another instance of a similar payment request was made on behalf of Melania Trump for a fundraiser in July. However, it has not been confirmed whether she received payment for this event. The request was put forth by Ric Grenell, the former ambassador to Germany and a Trump ally.

These payments have reportedly raised eyebrows among experts in campaign finance and government ethics, who deem them not only unusual but also ethically dubious. They argue that the source of the payment should have been disclosed transparently to avoid potential conflicts of interest.

The report indicates that Melania Trump also received $250,000 for a Log Cabin Republican event in December 2022 and $155,000 from a Trump-aligned super PAC for a speech in December 2021. These payments were disclosed in Donald Trump’s previous year’s financial disclosure form.

While a spokesperson for Melania Trump declined to comment on the matter to CNN, sources supportive of her defended her right to decide how to spend her time and to get paid for it.

See Also: A Military Coup If Trump Wins? Tucker Carlson Voices Concerns To JD Vance

Why It Matters: These revelations come at a time when Melania Trump has been increasingly visible in the political sphere. She has been questioning the circumstances surrounding an assassination attempt on her husband and promoting her upcoming memoir.

However, her absence from key events linked to Donald Trump’s legal challenges and her portrayal in Hillary Clinton’s latest book have also drawn attention.

Photo Courtesy: Evan El-Amin On Shutterstock.com

Check This Out:

This story was generated using Benzinga Neuro and edited by Shivdeep Dhaliwal

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Max Keiser Says El Salvador 'Needs To Step It Up' As Bhutan's Bitcoin Adoption Astonishes Crypto Market

While debate around the U.S. government’s Bitcoin BTC/USD holdings continues and El Salvador’s pioneering embrace hogs headlines, a small Himalayan nation nestled between India and China was quietly adding the top cryptocurrency to its reserves.

What happened: According to a report by Firstpost America, the landlocked South Asian held about 13,011 Bitcoin in its coffers, worth $821 million as of this writing. This made it the fourth-largest government holder of the apex digital currency behind the U.S., China, and UK, and surprisingly, above El Salvador.

With an estimated GDP of $3.11 billion as per Statista, Bitcoin holdings represented nearly one-third of Bhutan’s economy.

However, unlike other nations, Bhutan’s holdings didn’t come from law enforcement seizures, but from indigenously developed mining capability, backed by its abundant hydropower resources.

The report added that Bhutan’s state-owned investment firm, Druk Holdings, maintains custody of all Bitcoins.

These findings were amplified on X by none other than Michael Saylor, a well-known proponent of Bitcoin who, via his company MicroStrategy, has spearheaded the corporate adoption of the world’s largest cryptocurrency.

“Bhutan is leading the way in global Bitcoin adoption,” Saylor wrote.

Furthermore, Max Keiser, senior Bitcoin adviser to El Salvador President Nayib Bukele, expressed astonishment at Bhutan surpassing the Central American nation in Bitcoin holdings, saying, “We need to STEP IT UP!!!”

Why It Matters: Recent months have seen a surge in discussions on the topic of holding Bitcoin in national reserves, with former President Donald Trump pitching in favor of the idea during his campaign.

The narrative was strengthened when pro-cryptocurrency Senator Cynthia Lummis (R-Wyo.) proposed a bill to establish a U.S. strategic Bitcoin reserve.

Price Action: At the time of writing, Bitcoin was exchanging hands at $63,122.89, down 1.06% in the last 24 hours, according to data from Benzinga Pro.

Read Next:

Photo courtesy: Flickr

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Mark Cuban's Black Amex Card Was Declined Trying To Buy A $140,000 Bottle Of Champagne After His NBA Team Won Championship

Mark Cuban once famously gave memorable financial advice: “Don’t use credit cards. If you use a credit card, you don’t want to be rich.”

He often shares this mantra on his blog and during interviews with financial gurus like Dave Ramsey. It reflects his belief in living within one’s means, a solid principle for anyone looking to build wealth.

Ironically, Cuban was in a predicament involving a credit card while celebrating his team’s 2011 NBA championship victory.

Don’t Miss:

From selling garbage bags door-to-door as a kid to building a tech empire, Cuban became a household name through his hard work and savvy investments. His big break came in the 1990s with the sale of Broadcast.com to Yahoo for $5.7 billion, followed by his purchase of the Mavericks for $285 million in 2000. Under his ownership, the team transformed from perennial underperformers to NBA champions, capturing their first title in 2011.

After the championship win, Cuban and his team headed to LIV nightclub in Miami to celebrate in style. He treated himself to an extravagant 15-liter bottle of Armand de Brignac Champagne, often called “Ace of Spades.” Priced at $140,000 (or $90,000 according to some sources), it was the perfect way to commemorate the moment. Cuban confidently reached for his American Express Centurion Card – an exclusive credit card for high-net-worth individuals.

Trending: Warren Buffett once said, “If you don’t find a way to make money while you sleep, you will work until you die.” These high-yield real estate notes that pay 7.5% – 9% make earning passive income easier than ever.

To his surprise, the transaction was declined. Cuban recounted the experience during a 2018 interview on Fox Sports 1’s “Fair Game,” revealing how he had to call American Express into the back office. “I’m on the phone with them, and they say, ‘Uh, sir, this hasn’t been authorized. It’s a new card,'” he said, laughing at the absurdity of the situation. “I asked to speak to a supervisor. I was like, ‘Did you see the NBA game tonight? Are you a basketball fan?'”

His humorous approach shone through as he navigated the layers of customer service, eventually reaching someone who understood the context of his extravagant request. “This is Mark Cuban. We just won the championship. Can I please spend some money?” he quipped.

Trending: Founder of Personal Capital and ex-CEO of PayPal re-engineers traditional banking with this new high-yield account – start saving better today.

David Grutman, the owner of LIV, chimed in, recalling the chaotic scene: “We were in the back because his credit card was denied.”

Cuban often emphasizes that learning to avoid credit cards was one of his toughest financial lessons, but he acknowledges that they can be OK – if used responsibly.

In a 2017 Money.com interview, he noted, “Over time, what I’ve learned is using a credit card is OK if you pay it off at the end of the month.” He added, “Just recognize that the 18% or 20% or 30% you’re paying in credit card debt is going to cost you a lot more than you could ever earn anywhere else.” While Cuban may not be a fan of credit cards, he knows the right way to handle them when necessary.

Trending: Amid the ongoing EV revolution, previously overlooked low-income communities now harbor a huge investment opportunity at just $500.

Cuban’s ventures have continued to evolve in the years following the championship. In late 2023, he sold his majority stake in the Mavericks for $3.5 billion but retained a minority share and control over basketball operations.

Even billionaires occasionally whip out the plastic for a celebratory splurge, but Cuban’s message is simple: if you use credit cards, pay them off fast to dodge interest charges. While most people won’t be charging $140,000 bottles of Champagne, his Amex Black Card mishap proves that financial wisdom and indulgence can coexist, even for the ultrawealthy.

Read Next:

Up Next: Transform your trading with Benzinga Edge’s one-of-a-kind market trade ideas and tools. Click now to access unique insights that can set you ahead in today’s competitive market.

Get the latest stock analysis from Benzinga?

This article Mark Cuban’s Black Amex Card Was Declined Trying To Buy A $140,000 Bottle Of Champagne After His NBA Team Won Championship originally appeared on Benzinga.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.