S&P Settles At Fresh Record High: Investor Sentiment Improves, But Fear Index Remains In 'Greed' Zone

The CNN Money Fear and Greed index showed some improvement in the overall market sentiment, while the index remained in the “Greed” zone on Monday.

U.S. stocks settled higher on Monday, with the S&P 500 jumping to a new closing high.

All three major indices recorded weekly gains, with the S&P 500 gaining around 1.4% and adding more than 19% in 2024. The Dow gained around 1.6% last week, while the tech-heavy Nasdaq jumped around 1.5% during the week.

On the economic data front, the S&P Global manufacturing PMI declined to 47 in September from 47.9 in the prior month, versus market estimates of 48.5. The S&P Global flash composite PMI slipped to 54.4 in September compared to 54.6 in August and versus market estimates of 54.3.

Most sectors on the S&P 500 closed on a positive note, with energy, consumer discretionary, and real estate stocks recording the biggest gains on Monday. However, healthcare and communication services stocks bucked the overall market trend, closing the session lower.

The Dow Jones closed higher by around 61 points to 42,124.65 on Monday. The S&P 500 rose 0.28% to 5,718.57, while the Nasdaq Composite gained 0.14% at 17,974.27 during Monday’s session.

Investors are awaiting earnings results from AAR Corp. AIR and Red Cat Holdings, Inc. RCAT today.

What is CNN Business Fear & Greed Index?

At a current reading of 64.4, the index remained in the “Greed” zone on Monday, versus a prior reading of 63.9.

The Fear & Greed Index is a measure of the current market sentiment. It is based on the premise that higher fear exerts pressure on stock prices, while higher greed has the opposite effect. The index is calculated based on seven equal-weighted indicators. The index ranges from 0 to 100, where 0 represents maximum fear and 100 signals maximum greediness.

Read Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

DJT stock falls another 10%. Could Trump Media’s plunge finally spell the end for SPACs?

As the threat of insider sales continues to hang over investors, shares of Trump Media (Nasdaq:DJT) once again tumbled to new lows on Friday, falling another 10% Monday to hit $12.15 a share, its lowest point as a public company.

Most Read from Fast Company

While the parent company of Donald Trump’s Truth Social platform does not appear to have made any filings with the Securities and Exchange Commission (SEC), informing regulators of any significant sales by shareholders who were recently restricted by lockup agreements, Trump Media has been falling steadily for more than a week. Shares of DJT stock have now lost roughly 30% of their value in just the past five days.

It was only six months ago that Trump Media had a valuation of $10 billion. Today, that stands at about $2.5 billion. The share price, meanwhile, has fallen more than 80% since its public debut via a special purpose acquisition company (SPAC).

Trump Media is occupying much of the media spotlight lately, due to its ties with the presidential candidate and the possibility that early investors including ARC Global, which sponsored the blank-check firm that took Trump Media public, and United Atlantic Ventures, an entity controlled by two former contestants on The Apprentice, could sell their holdings. (Trump, who owns 60% of the company, has also seen his lockup period expire but has said he does not plan to sell DJT stock.) But Trump Media is hardly the first SPAC to give investors heartburn.

The SPAC implosion

Several well-known companies that utilized a SPAC to go public have run into problems. In 2021, DNA-testing service 23andMe merged with a SPAC to go public, with shares topping $16 that year. Shares now trade for 34 cents, having lost 97% of their value—and last week, the entirety of the company’s board resigned, saying the founder/CEO had failed to produce an “actionable” plan to take the company private after it struggled to make a profit.

BuzzFeed, which joined the Nasdaq in 2021 via a SPAC, is another example. Shares of the SPAC hovered near $40 up until the weeks before the merger with the media company was made official. Today, the stock trades for less than $3—and that number would be a lot worse if not for a 1-for-4 reverse stock split earlier this year that was necessary to prevent BuzzFeed from being delisted.

And, in the past week, BurgerFi, which went public via SPAC in 2020, announced plans to close 19 locations of its titular restaurants as well as Anthony’s Coal Fired Pizza. The company’s stock was delisted and no longer trades on the Nasdaq.

Other notable SPACs that have seen their value vanish include WeWork and Virgin Orbit. In 2023, at least 21 companies that went public via SPAC filed for bankruptcy.

Is this the end of SPACs?

The steady decline of Trump Media’s DJT stock has put SPACs back in an uncomfortable spotlight. While they were wildly popular in 2020 and 2021, they’ve lost a lot of momentum due to high-profile bankruptcies and investors realizing the accompanying risks from a lack of due diligence typical of this alternate method of going public. Quite often, they don’t outweigh the reward, certainly in the long-term.

Earlier this year, the SEC adopted new rules that put more legal liability on both blank-check companies and their acquisition targets to disclose more about their projected earnings.

Despite that extra scrutiny, though, SPACs are not yet totally dead. Some 39% of the total IPOs in 2024 (34 of 88) were via SPACs. That’s well off the pace of the early 2020s—in 2021, for example, 613 of 968 IPOs were via SPACs—but still a considerable percentage.

The SEC is hoping the new rules will protect both those investors and people who see a bandwagon and hop on.

“Just because a company uses an alternative method to go public does not mean that its investors are any less deserving of time-tested investor protections,” said SEC Chair Gary Gensler when the new rules were adopted. “[These changes] will help ensure that the rules for SPACs are substantially aligned with those of traditional IPOs, enhancing investor protection through three areas: disclosure, use of projections, and issuer obligations. Taken together, these steps will help protect investors.”

This post originally appeared at fastcompany.com

Subscribe to get the Fast Company newsletter: http://fastcompany.com/newsletters

Insiders Snap Up These 2 ‘Strong Buy’ Stocks

Let’s talk about insider trading. Not the illegal kind, but the perfectly normal – and fully legal – trading by top-level corporate officers. These are the C-suite residents and the members of the Boards, company officers who know what’s going on behind the scenes and are responsible to shareholders for bringing in profits. They typically hold shares in their own companies and make trades based on the knowledge they have from behind the scenes.

To keep the playing field level, federal regulators require that company insiders publish these transactions – and investors can benefit from seeing just which stocks the corporate officers are buying. There’s one thing to remember: company brass will sell their shares for a multitude of reasons, but they’ll only buy big when they believe the stock is on the way up.

So, let’s take a look at some recent insider trades. Using the Insiders’ Hot Stocks tool from TipRanks, we’ve pulled up the recent data on two stocks that have recently seen multi-million dollar buys from Board members. In each case, this is the first such purchase from the insider. With the significant outlay of the buy, that points to increased confidence in the company’s prospects for the near- to mid-term.

In addition to the recent high-value insider purchases, the TipRanks data shows us that both stocks feature Strong Buy ratings from the Street and solid upside potential for the coming year. Here’s a closer look at them.

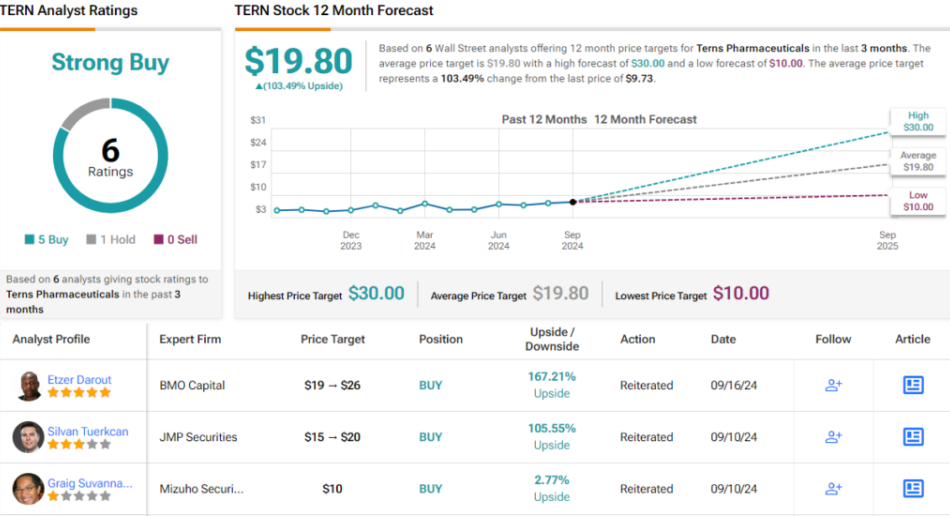

Terns Pharmaceuticals (TERN)

First up is Terns Pharmaceuticals, a biopharmaceutical research firm working at both the early development and the clinical trials stages. The company has set its sights on the fields of oncology and metabolic disease, and has a clinical program underway in each of these areas, targeting chronic myeloid leukemia (CML) in the first and obesity, a major health issue, in the second. The company’s pipeline is composed of novel small molecule compounds, with clinically validated modes of action.

That’s a mouthful, but it comes down to a pipeline that features two Phase 1 clinical trials. The first of these features TERN-701, an allosteric BCR-ABL tyrosine kinase inhibitor, or TKI, designed to treat CML. This cancer starts in the bone marrow, where blood cells are formed, and is considered a chronic, life-long and life-threatening disease that frequently requires changes in therapies. Terns’ drug candidate, TERN-701, is undergoing the Phase 1 CARDINAL trial, a two-part study to evaluate the safety, pharmacokinetics, and efficacy of the drug. Interim data from the first cohorts of the dose escalation part of the study is expected for release this coming December.

Also of note on the clinical trial side is TERN-601, which has just completed a Phase 1 trial. This drug is an orally dosed, glucagon-like peptide-1 (GLP-1) receptor agonist, under investigation as an obesity treatment. The company released positive trial results from that study earlier this month, showing that TERN-601 produced a statistically significant weight loss in trial participants over a 28-day period. The drug was considered well-tolerated, and the company plans to initiate a Phase 2 trial next year.

Also on the obesity track, Terns has recently reported positive pre-clinical data from another drug candidate, TERN-501. This pre-clinical data supports using TERN-501 in combination with a GLP-1 receptor agonist as a treatment for obesity. The data showed that TERN-501, in the combo therapy, resulted in greater weight loss and a better retention of lean mass.

These clinical programs don’t come cheap, and Terns recently conducted a public stock offering to raise capital. The company offering, which saw more than 14 million shares made available, closed on September 12. Terns raised approximately $172.7 million in gross proceeds from the sale.

With that in mind, we can turn to the insider trades – and we see that Board of Directors member Lu Hongbo purchased 476,190 shares on the day the public offering closed. Hongbo paid nealy $5 million for this stock purchase.

This stock has also caught the attention of BMO analyst Etzer Darout, who likes the multiple catalysts lined up for it.

“With the obesity data from TERN-601 (oral GLP-1 agonist), TERN has delivered on a once-daily and clinically competitive drug profile for two of its three clinical programs (TERN-501, TERN-601) which gives us more confidence ahead of Phase 1 CML dose escalation data with TERN-701 (BCR-ABL allosteric) in December. With two partially de-risked clinical programs and another de-risking event upcoming, we continue to like the risk-reward for TERN and its setup for value creation in oncology and metabolic diseases,” Darout opined.

These comments back up Darout’s Outperform (i.e. Buy) rating on TERN shares, and his $26 price target points toward a potential one-year gain of 159%. (To watch Darout’s track record, click here)

Overall, this stock’s Strong Buy consensus rating is based on 6 recent analyst reviews that split 5 to 1 in favor of Buy over Hold. The shares are currently trading at $9.73, and the average target price, $19.80, implies a 103% upside in the next 12 months. (See TERN stock forecast)

Permian Resources (PR)

For the second stock on our list, we’ll shift gears and look at the energy sector. Permian Resources is an independent oil and gas exploration and production firm operating in the rich oil fields of Texas. The company’s name gives away its game – Permian’s assets are located in the richest parts of the Permian Basin of Texas-New Mexico. The company’s land holdings total more than 400,000 net leasehold acres, which includes more than 68,000 net royalty acres. These holdings are focused in the Midland and Delaware Basins of the larger Permian formation, and some 45% of the production on these landholdings is crude oil.

This makes Permian one of the region’s largest pure-play hydrocarbon E&P firms, and on September 17 the company announced the closing of a bolt-on acquisition to its Delaware Basin assets. The acquisition, a deal with Occidental, added ~29,500 net acres and ~9,900 net royalty acres, along with a significant amount of midstream infrastructure, to Permian’s existing Reeves County, Texas positions.

In another update that should interest investors, Permian announced on September 3 a large increase to its regular base dividend. The dividend payment, formerly at 6 cents per common share, has been increased by 150% and is now set at 15 cents per share to be paid out starting in 3Q24. The new annualized rate of 60 cents per share will give a forward yield of 4.3% based on the current share value.

Permian attracted a recent large buy from an insider, company director William Quinn. Quinn made two purchases, on September 10 and 11, that totaled 312,429 shares – and cost more than $3.99 million.

Turning to the analysts’ view of the stock, we’ll check in with Truist’s energy sector expert Neal Dingmann, who sees Permian as one of the best stocks that he covers, with plenty of capital return and effective merger activities. In a note earlier this month, Dingmann wrote, “We believe PR operations continue to be among the best in our coverage with improving well results and lowering of unit costs while now adding an equally stable financial plan that will include notable share buybacks. Further, the high share overhang has been eliminated with existing private equity likely selling fewer shares going forward. The company also continues to have one of the more effective M&A strategies that will not change going forward with a focus on accretive additions in core areas. As such, we believe there remains notable share price upside potential with the current valuation not reflective of continued operational and financial success.”

For Dingmann, PR shares get a Buy rating with a $22 price target that implies an upside of 55% on the one-year horizon. (To watch Dingmann’s track record, click here)

All in all, PR’s Strong Buy consensus rating is based on 16 reviews that include 14 Buys against just 2 Holds. With a trading price of $14.18 and an average target price of $19.43, Permian’s stock has a 37% upside this coming year. (See PR stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.

Elon Musk Cries Foul Over Governments' Preferential Treatment For Rival Companies: 'Success Of SpaceX/Tesla Is In Spite Of Competitor Subsidies'

Elon Musk, who has been very vocal about governments’ unfair treatment meted out to his business ventures, vented out his frustration yet again on Monday.

What Happened: The trigger for another outburst by Musk came in the form of a post by a Tesla influencer from Canada, who noted that federal and provincial governments have reiterated support for Canadian satellite telecom company Telesat’s Lightspeed satellite network project.

The project was touted as a source of 967 additional jobs in Canada and Quebec and involved an investment of C$2.62 billion. This would translate to a public subsidy of just under C$3 million per job for a project that will cost a total of more than C$6 billion and aims to connect all Canadians to high-speed Internet by 2030,” the social-media user said on X. He contrasted that with Musk’s Starlink, which did not receive any subsidies but already had over 400,000 satisfied users in Canada.

Starlink is owned by SpaceX and it provides low-latency broadband internet service.

The Tesla influencer said Starlink could “provide all Canadians in rural and remote locations with reliable high-speed internet *today* and for a fraction of that cost.”

Musk jumped in and said competitors receive vastly more subsidies than SpaceX or Tesla. “The success of SpaceX/Tesla is in spite of competitor subsidies!” he said.

He also referred to the U.S. government’s giveaway for a North American Supercharger network to compete against Tesla, adding that it still failed. The billionaire could have referred to Charge Enterprises, which partnered with Stellantis and General Motors, filing for Chapter 11 bankruptcy earlier this year.

Despite massive subsidies to Starlink competitors for American rural broadband they failed, Musk said.

See Also: How To Invest In SpaceX

Why It’s Important: The Tesla CEO clarified the same in an exchange with Sun Microsystems co-founder and venture capitalist Vinod Khosla over the weekend.

When the latter questioned how much government money SpaceX gets and whether Tesla could have survived without EV subsidies, Musk retorted sharply. “Do some research before you display your utter ignorance,” he said, adding that SpaceX gets no subsidies and received half as much as Boeing for astronaut transport, but did 100% of the work. He also clarified that government subsidies make up only a minor portion of his electric-vehicle manufacturing company Tesla’s revenue.

Musk’s SpaceX is already on a warpath with the Federal Aviation Administration (FAA) over regulatory delays and safety concerns, particularly regarding its Starship development program. The regulator has maintained that its accent is on safety and environmental protection but Musk has been rooting for a more agile and forward-thinking regulatory approach that aligns with SpaceX’s fast-paced innovation agenda.

Recently Rep. Kevin Kiley (R-Calif.) applauded Musk’s SpaceX for its Polaris Dawn mission in a speech and also voiced concerns regarding the regulatory clampdown on the company. “We continue to be stuck in the reality where it takes longer to do the government paperwork to license a rocket launch than it does to design and build the actual hardware,” Kiley said.

Read Next:

Image via Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

BioVie Inc. Announces Pricing of Public Offering

CARSON CITY, Nev., Sept. 23, 2024 (GLOBE NEWSWIRE) — BioVie Inc. BIVI, (“BioVie” or the “Company”), a clinical-stage company developing innovative drug therapies to treat chronic debilitating conditions including liver disease and neurological and neuro-degenerative disorders, today announced the pricing of a best efforts public offering of 1,960,800 shares of its common stock (or pre-funded warrants (“Pre-funded Warrants”) in lieu thereof) and warrants to purchase up to 1,960,800 shares of common stock at a combined offering price of $1.53 per share (or Pre-funded Warrant) and associated warrant. The warrants will have an exercise price of $1.53 per share and will be immediately exercisable upon issuance for a period of five years following the date of issuance. The gross proceeds to the Company from the offering are expected to be approximately $3,000,000, before deducting placement agent fees and offering expenses. The Company intends to use the net proceeds from the offering primarily for working capital and general corporate purposes. All of the shares of common stock (or Pre-funded Warrants) and associated warrants are being offered by the Company. The offering is expected to close on September 25, 2024, subject to satisfaction of customary closing conditions.

ThinkEquity is acting as sole placement agent for the offering.

The securities were offered and will be sold pursuant to a shelf registration statement on Form S-3 (File No. 333-274083), including a base prospectus, filed with the U.S. Securities and Exchange Commission (the “SEC”) on August 18, 2023 and declared effective on August 28, 2023. The offering will be made only by means of a written prospectus. A final prospectus supplement and accompanying prospectus describing the terms of the offering will be filed with the SEC and will be available on its website at www.sec.gov. Copies of the final prospectus supplement and the accompanying prospectus relating to the offering may also be obtained, when available, from the offices of ThinkEquity, 17 State Street, 41st Floor, New York, New York 10004.

This press release shall not constitute an offer to sell or a solicitation of an offer to buy, nor shall there be any sale of these securities in any state or jurisdiction in which such an offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such state or jurisdiction.

About BioVie Inc.

BioVie Inc. BIVI is a clinical-stage company developing innovative drug therapies for the treatment of neurological and neurodegenerative disorders and advanced liver disease. In neurodegenerative disease, the Company’s drug candidate NE3107 inhibits inflammatory activation of ERK and NFkB (e.g., TNF signaling) that leads to neuroinflammation and insulin resistance, but not their homeostatic functions (e.g., insulin signaling and neuron growth and survival). Both are drivers of Alzheimer’s and Parkinson’s diseases. The Company conducted and reported efficacy data on its randomized, double-blind, placebo-controlled, parallel-group, multicenter study to evaluate NE3107 in patients who have mild to moderate Alzheimer’s disease (NCT04669028). Results of a Phase 2 investigator-initiated trial (NCT05227820) showing NE3107-treated patients experienced improved cognition and biomarker levels were presented at the Clinical Trial in Alzheimer’s Disease annual conference in December 2022. An estimated six million Americans suffer from Alzheimer’s. A Phase 2 study of NE3107 in Parkinson’s disease (NCT05083260) has completed, and data presented at the International Conference on Alzheimer’s and Parkinson’s Disease and Related Neurological Disorders conference in Gothenburg, Sweden in March 2023 showed significant improvements in “morning on” symptoms and clinically meaningful improvement in motor control in patients treated with a combination of NE3107 and levodopa vs. patients treated with levodopa alone, and no drug-related adverse events. In liver disease, the Company’s Orphan drug candidate BIV201 (continuous infusion terlipressin), with U.S Food and Drug Administration (“FDA”) Fast Track status, is being evaluated and discussed with guidance received from the FDA regarding the design of Phase 3 clinical testing of BIV201 for the treatment of ascites due to chronic liver cirrhosis. The active agent is approved in the U.S. and in about 40 countries for related complications of advanced liver cirrhosis. For more information, visit http://www.bioviepharma.com/.

Forward-Looking Statements

This press release contains forward-looking statements, which may be identified by words such as “expect,” “look forward to,” “anticipate” “intend,” “plan,” “believe,” “seek,” “estimate,” “will,” “project” or words of similar meaning. Although BioVie Inc. believes such forward-looking statements are based on reasonable assumptions, it can give no assurance that its expectations will be attained. Actual results may vary materially from those expressed or implied by the statements herein due to the Company’s ability to successfully raise sufficient capital on reasonable terms or at all, available cash on hand and contractual and statutory limitations that could impair our ability to pay future dividends, our ability to complete our pre-clinical or clinical studies and to obtain approval for our product candidates, our ability to successfully defend potential future litigation, changes in local or national economic conditions as well as various additional risks, many of which are now unknown and generally out of the Company’s control, and which are detailed from time to time in reports filed by the Company with the SEC, including quarterly reports on Form 10-Q, reports on Form 8-K and annual reports on Form 10-K. BioVie Inc. does not undertake any duty to update any statements contained herein (including any forward-looking statements), except as required by law.

For Investor Relations Inquiries:

Bruce Mackle

Managing Director, LifeSci Advisors, LLC

bmackle@lifesciadvisors.com

For Media Relations Inquiries:

Melyssa Weible

Managing Partner, Elixir Health Public Relations

mweible@elixirhealthpr.com

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

The Ontario Home Builders' Association Acquires EnerQuality to Develop External Training Hub for the Industry

NIAGARA FALLS, Ontario, Sept. 23, 2024 (GLOBE NEWSWIRE) — The Ontario Home Builders’ Association (OHBA) is pleased to announce that it has acquired full ownership of EnerQuality Corporation, a leading energy efficiency certification company in Ontario.

For the last 25 years, OHBA has been a proud shareholder of EnerQuality, which it founded with the Canadian Energy Efficient Association (CEEA) in pursuit of improving building and energy efficiency standards in the home building industry.

EnerQuality has developed a highly successful third-party certification business, certifying over 120,000 homes in Ontario since its founding in 1999. These programs include the ENERGY STAR® designation for residential properties, Net Zero for builders, and the EnerGuide Rating System.

With full ownership of EnerQuality, OHBA will leverage this strategic acquisition to create an external training hub, expanding its offerings to deliver industry-wide training for the home construction and renovation sector in Ontario. While EnerQuality will continue to work closely with OHBA and home builders on certification, this new division within the company will address the full training needs of the industry through direct delivery of training and service agreements with existing providers.

This investment in EnerQuality highlights OHBA CEO, Scott Andison’s, growth strategy for the organization, focused on advocacy and expanding benefits and services for members.

“EnerQuality has been a staple in the home building sector in Ontario for over two decades,” said Andison, “This investment signals our confidence in the company’s ability to integrate into our existing plans for expanding training services in key areas for the industry.”

Since joining OHBA in April, Andison’s vision for the organization has taken shape, partnering with government on advocacy goals for the home building sector and repositioning OHBA to expand its member services. The EnerQuality acquisition represents another step forward for OHBA as it works towards its new growth objectives.

About OHBA

The Ontario Home Builders’ Association is the voice of the building, land development and professional renovation industry in Ontario, representing 4,000 member companies organized into 28 local associations across the province. OHBA collects, analyzes and distributes information to its members and the general public, advocates on behalf of the industry to the key stakeholders, promotes innovation, professionalism, and affordability within the industry and provides group benefit plans and other membership services.

Since 2007, OHBA members have built more than 700,000 homes in more than 500 Ontario communities. The residential construction industry employs more than 500,000 people across the province and contributes more than $66.6 billion dollars to Ontario’s economy.

Contact:

Andres F. Ibarguen

Senior Manager, Communications

aibarguen@ohba.ca

(647) 217-6790

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Jim Cramer Says This Utilities Stock Is A Buy: 'We Need Cheap Power'

Benzinga and Yahoo Finance LLC may earn commission or revenue on some items through the links below.

On CNBC’s “Mad Money Lightning Round,” Jim Cramer said Dominion Energy, Inc. (NYSE:D) is a buy. “We need cheap power,” he noted.

On Sept. 19, Jefferies analyst Paul Zimbardo initiated coverage on Dominion Energy with a Hold rating and announced a price target of $58.

Cramer said he likes Dutch Bros Inc. (NYSE:BROS). “I’m glad that they slowed their expansion,” he added.

Check It Out:

On Sept. 12, TD Cowen analyst Andrew Charles reiterated Dutch Bros with a Buy and maintained a $47 price target.

When asked about Super Micro Computer (NASDAQ:SMCI), he said, “I need to see the financials filed.”

On Sept. 20, Super Micro Computer announced the receipt of non-compliance letter from the Nasdaq.

LyondellBasell Industries N.V. (NYSE:LYB) is not a stock that he is recommending, Cramer said.

Trending: This billion-dollar fund has invested in the next big real estate boom, here’s how you can join for $10.

This is a paid advertisement. Carefully consider the investment objectives, risks, charges and expenses of the Fundrise Flagship Fund before investing. This and other information can be found in the Fund’s prospectus. Read them carefully before investing.

On Sept. 13, JPMorgan analyst Jeffrey Zekauskas maintained LyondellBasell Industries with an Overweight rating and lowered the price target from $113 to $110.

On Aug. 2, LyondellBasell reported second-quarter fiscal 2024 revenues of $10.55 billion, up from $10.306 billion a year ago, beating the consensus of $10.44 billion. Adjusted EBITDA stood at $1.37 billion (-5.3% Y/Y), and the margin contracted by 107 bps to 13%. Adjusted EPS stood at $2.24, beating the consensus of $2.23.

Price Action:

-

Dominion Energy shares gained 0.8% to settle at $57.93 on Friday.

-

Dutch Bros shares gained 0.2% to close at $34.92 during the session.

-

Super Micro Computer shares gained 4.6% to close at $457.27 during Friday’s session.

-

LyondellBasell shares fell 2.1% to settle at $94.04 on Friday.

Wondering if your investments can get you to a $5,000,000 nest egg? Speak to a financial advisor today. SmartAsset’s free tool matches you up with up to three vetted financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you.

Keep Reading:

This article Jim Cramer Says This Utilities Stock Is A Buy: ‘We Need Cheap Power’ originally appeared on Benzinga.com

Top 4 Industrials Stocks Which Could Rescue Your Portfolio This Quarter

The most oversold stocks in the industrials sector presents an opportunity to buy into undervalued companies.

The RSI is a momentum indicator, which compares a stock’s strength on days when prices go up to its strength on days when prices go down. When compared to a stock’s price action, it can give traders a better sense of how a stock may perform in the short term. An asset is typically considered oversold when the RSI is below 30, according to Benzinga Pro.

Here’s the latest list of major oversold players in this sector, having an RSI near or below 30.

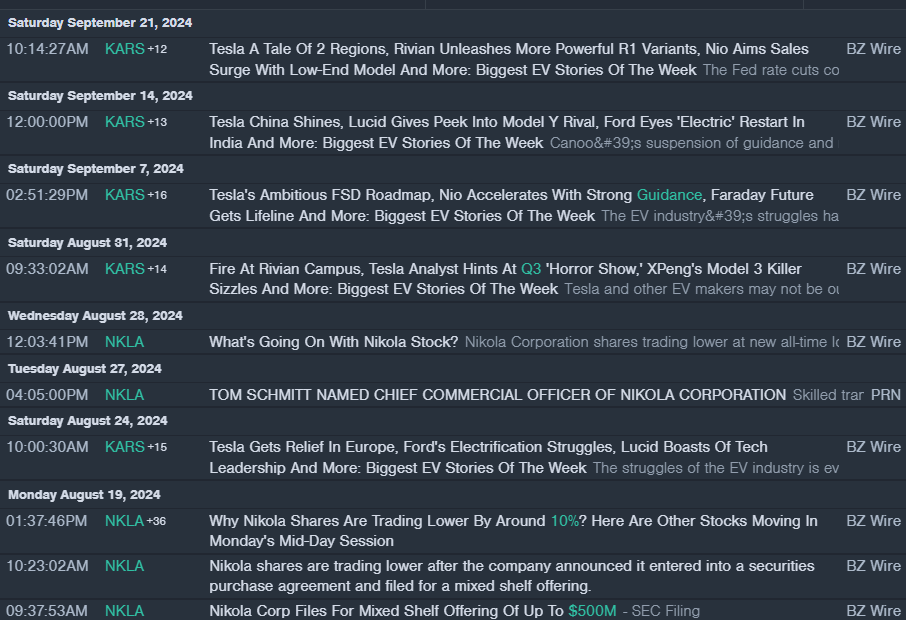

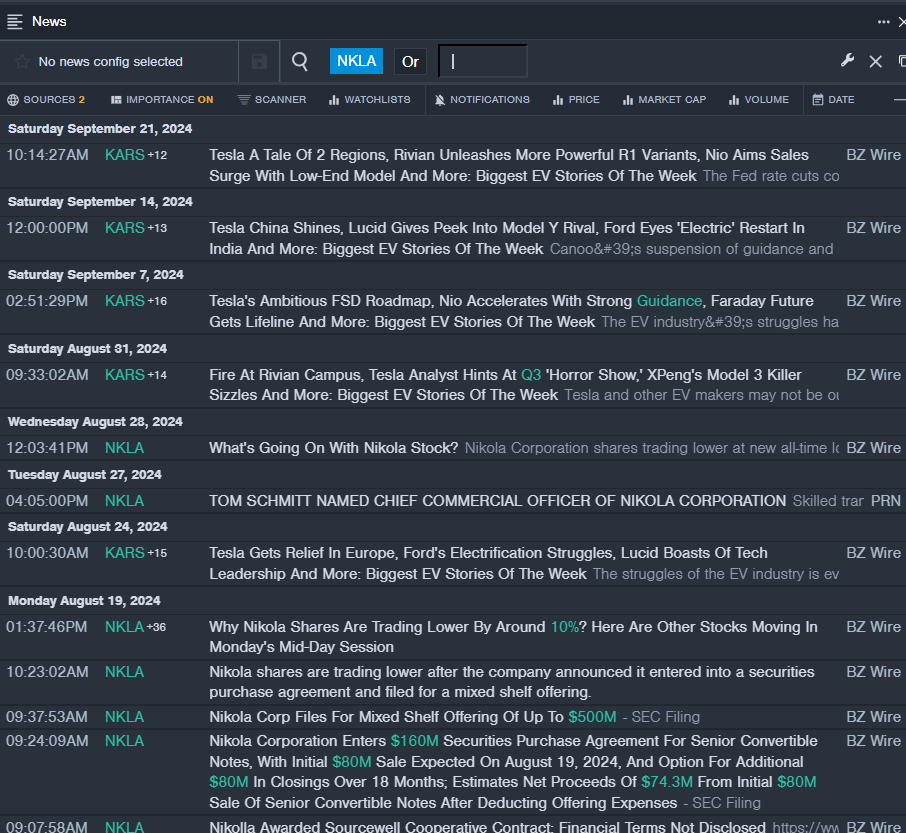

Nikola Corp NKLA

- On Aug. 19, Nikola announced it entered into a securities purchase agreement and filed for a mixed shelf offering. The company’s stock fell around 35% over the past month and has a 52-week low of $4.78.

- RSI Value: 26.27

- NKLA Price Action: Shares of Nikola fell 5% to close at $4.78 on Monday.

- Benzinga Pro’s real-time newsfeed alerted to latest NKLA news.

SES AI Corp SES

- On Sept. 17, SES AI announced a collaboration with NVIDIA, Crusoe and Supermicro on AI for scientific initiative to accelerate material discovery in electric transportation. “AI is changing everything. Our AI for Manufacturing, AI for Safety, and AI for Science models are accelerating the commercialization, time to revenue, and profitability of Li-Metal for EV and UAM,” said Qichao Hu, CEO of SES AI. The company’s stock fell around 48% over the past five days. It has a 52-week low of $0.66.

- RSI Value: 21.33

- SES Price Action: Shares of SES fell 13.4% to close at $0.66 on Monday.

- Benzinga Pro’s charting tool helped identify the trend in SES stock.

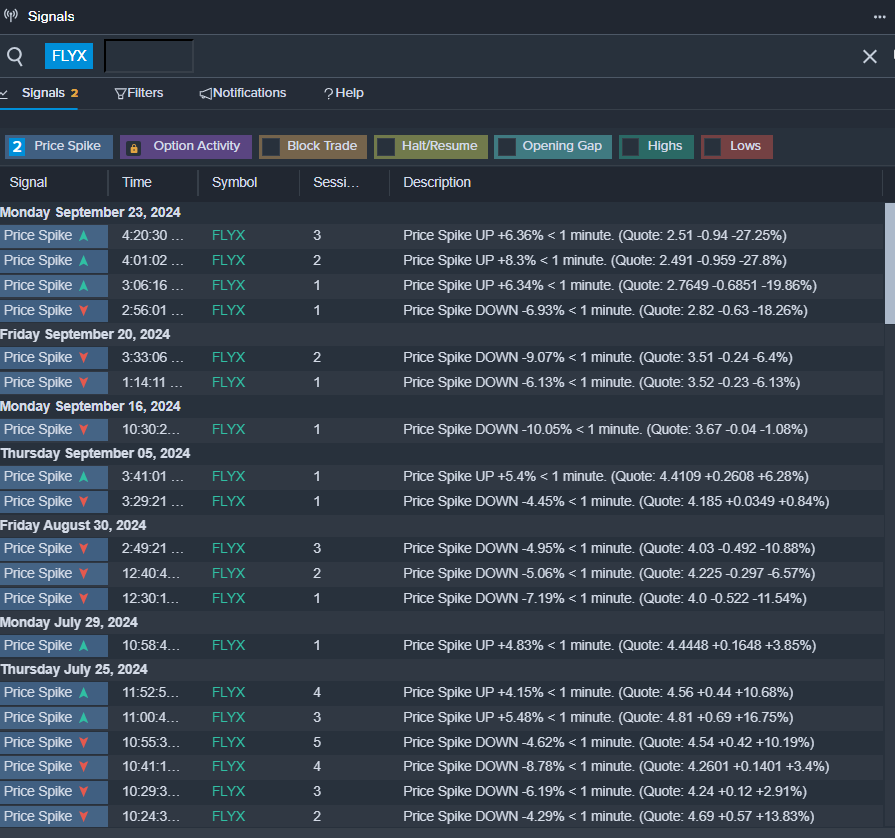

Flyexclusive Inc FLYX

- On Sept. 4, Volato Group, Inc. SOAR disclosed an agreement with flyExclusive, Inc. to transition the management of its fleet operations to flyExclusive.. The company’s shares fell around 41% over the past five days and has a 52-week low of $2.29.

- RSI Value: 18.61

- FLYX Price Action: Shares of Flyexclusive fell 33.6% to close at $2.29 on Monday.

- Benzinga Pro’s signals feature notified of a potential breakout in FLYX shares.

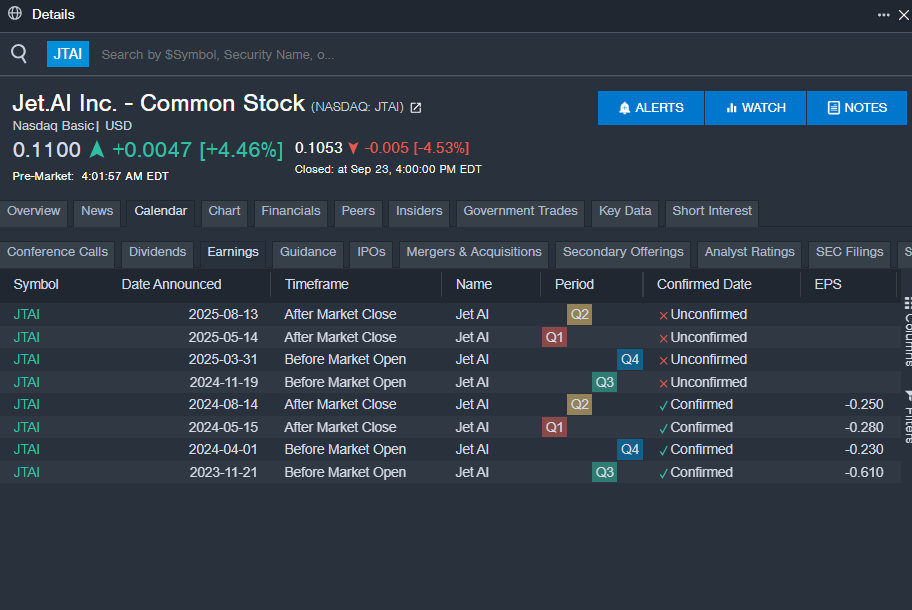

Jet.AI Inc JTAI

- On Aug. 19, Jet.AI disclosed that Executive Chairman and Interim CEO Michael Winston Exchanged 4,076,288 Merger Consideration Warrants For 4,130,503 Shares Of Common Stock.. The company’s shares lost around 45% over the past month. The company’s 52-week low is $0.10.

- RSI Value: 24.74

- JTAI Price Action: Shares of Jet.AI fell 4.5% to close at $0.11 on Monday.

- Benzinga Pro’s earnings calendar was used to track upcoming JTAI earnings reports.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Microsoft stock receives rare downgrade as analyst says it's 'beholden' to Nvidia

Microsoft (MSFT) received a rare Wall Street downgrade on Monday over concerns the tech giant’s artificial intelligence lead is diminishing and that it has become too reliant on Nvidia (NVDA) for its AI infrastructure.

Analysts at D.A. Davidson downgraded the stock to Neutral from Buy, keeping their price target unchanged at $475, which still implies around an 8% upside from current levels.

The firm noted that Microsoft’s early investments and commercial product rollouts initially gave the company an advantage over Amazon (AMZN) and Google (GOOGL, GOOG), who it said were both “caught flat-footed.”

Since then, Amazon and Google “have invested in catching up to Microsoft, and we think you can start telling that they’ve caught up,” Gil Luria, managing director at D.A. Davidson, told Yahoo Finance on Monday (video above).

“Going forward, we think AWS [Amazon Web Services] and GCP [Google Cloud Platform] actually have an advantage over [Microsoft] Azure because they have the capability to deploy their own chips into their data centers, which are a fraction of the cost of an Nvidia GPU — something Microsoft has yet to do with its own chips.”

Citing their own hyperscaler semiconductor data, the analysts at D.A Davidson said Microsoft is “beholden” to Nvidia, its supplier of AI chips.

“Microsoft is so reliant on Nvidia that it’s almost transferring wealth from its own shareholders to Nvidia shareholders,” Luria said.

As Yahoo Finance’s Dan Howley recently reported, Microsoft has embarked on a broad push to infuse its vast portfolio of business software products with AI capabilities as it seeks to outpace rivals in the space and monetize its enormous investments in AI technology.

The company has been plowing cash into building out its AI data centers, with its latest quarterly capital expenditures topping out at $19 billion, up 35% from the prior quarter.

Microsoft pointed to a number of bright spots in its AI business, noting that AI contributed 8 percentage points of growth to its cloud Azure revenue, up from 7 percentage points in the third quarter and 1 percentage point in the fourth quarter last year.

Despite Monday’s downgrade, Microsoft shares were trading mostly flat. The stock, which topped in July, is up roughly 15% year to date.

Ines Ferre is a senior business reporter for Yahoo Finance. Follow her on X at @ines_ferre.

Click here for the latest stock market news and in-depth analysis, including events that move stocks

Read the latest financial and business news from Yahoo Finance

Nasdaq, S&P 500 Futures Firm, China's Economic Stimulus Fuels Commodities, Bitcoin Steady: Here's What Traders Should Be Watching Tuesday

After the market ended at a fresh record on Monday, traders have positioned themselves for more gains. The index futures are modestly higher early Tuesday. China, the second largest economy in the world, decided to go bold, with the nation’s central bank announcing a series of stimulatory measures. This has sent commodities soaring, given China is a commodity-guzzling country. China’s growth has a bearing on the rest of the global economy as it is often called the world’s factory.

In the domestic market, traders may look ahead to a speech by a Federal Reserve official, a consumer confidence reading and a couple of house prices data. Momentum suggests additional gains but the overbought levels may introduce caution, especially ahead of key inflation data due this week and more labor market data that would roll out next week.

| Futures | Performance (+/-) |

| Nasdaq 100 | +0.32% |

| S&P 500 | +0.19% |

| Dow | +0.17% |

| R2K | +0.44% |

In premarket trading on Tuesday, the SPDR S&P 500 ETF Trust SPY rose 0.23% to $570.96 and the Invesco QQQ ETF QQQ climbed 0.35% to $484.74, according to Benzinga Pro data.

Cues From Last Session:

U.S. stocks closed Monday’s session modestly higher although trading was marked by some degree of volatility. The major indices opened higher, as they digested comments from Fed officials, and reacted to S&P Global private sector activity readings, which showed the manufacturing sector contracted more than expected. Minneapolis Fed President Neel Kashkari said in an interview with CNBC’s Squawk Box that he favored a slowdown in rate cuts.

The indices traded on a nervous note, with the Dow Industrials and the Nasdaq Composite dipping below the unchanged line in the mid-session before making a comeback. The Dow hit new intraday and closing highs, while the S&P 500 Index, despite the mid-session volatility, traded in the green throughout the session and ended at a fresh high.

Among S&P 500 sectors, real estate, utility, material, energy and consumer discretionary stocks advanced solidly. On the other hand, communication services, healthcare and IT stocks experienced modest weakness.

| Index | Performance (+/) | Value |

| Nasdaq Composite | +0.14% | 17,974.27 |

| S&P 500 Index | +0.28% | 5,718.57 |

| Dow Industrials | +0.15% | 42,124.65 |

| Russell 2000 | -0.34% | 2,220.28 |

Insights From Analysts:

The Fed delivered in line with expectations and it is now time to move to neutral on defensives vs. cyclicals, said Morgan Stanley’s U.S. Equity Strategist Mike Wilson. The valuation of defensives has reached extended levels and “we await more clarity on the labor data,” the strategist said.

“Historically, defensives see fairly persistent outperformance 3-12 months following the Fed’s first cut, but can

see initial, modest underperformance in the 1 month following the initial rate reduction,” Wilson said. The strategist recommended taking profits on the recent outperformance of defensives makes sense in the absence of knowing the outcome of the next labor report.

Wilson said he continued to have conviction in his recommendation of large caps over small caps and also his bias for high-quality names.

WisdomTree Senior Economist and Wharton Professor Emeritus Jeremy Siegel said valuations across many sectors appear stretched by historical standards, particularly in the technology sector and AI-driven companies. “This reflects a broader market anticipation of substantial growth driven by technological advancements,” he said.

“As AI continues to evolve, it will be crucial to differentiate between companies that are genuinely creating value through innovative AI applications and those whose valuations are inflated by speculative interest.”

Siegel sees big rate cuts supporting small-cap companies that borrow at short-term borrowing rates as these companies have been the most impacted by the Fed’s aggressive rate hikes and they have some relatively cheap valuations in the U.S. market.

See Also: How To Trade Futures

Upcoming Economic Data:

- Federal Reserve Governor Michelle Bowman is scheduled to speak at 9 a.m. EDT.

- The S&P/Case-Shiller and Federal House Finance Agency are due to announce the results of their separate house price surveys for July at 9 a.m. EDT.

- The Conference Board will announce its consumer confidence index for September at 10 a.m. EDT, with economists, on average, expecting the index to rise from 103.3 in August to 104 currently.

- The Treasury is set to auction two-year notes at 1 p.m. EDT.

Stocks In Focus:

- Liberty Broadband Corporation LBRDA shares soared over 18% in premarket trading after the company announced that it communicated a counterproposal to the Special Committee of the Board of Directors of Charter Communications, Inc. CHTR regarding its proposed acquisition by the latter.

- Snowflake Inc. SNOW dropped over 3% following the company’s announcement concerning a convertible note offering.

- Hawaiian Electric Industries, Inc. HE plunged over 11.50% after the company announced a commons stock offering.

- AutoZone, Inc. AZO and THOR Industries, Inc. THO are among the companies due to announce their quarterly results before the market opens.

- Those reporting after the close include KB Home KBH, Progress Software Corporation PRGS, Stitch Fix, Inc. SFIX and Worthington Enterprises, Inc. WOR.

Commodities, Bonds And Global Equity Markets:

Oil and gold futures climbed, with the latter trading in record territory amid stimulus measures announced by China’s central bank, and Bitcoin BTC/USD is little changed at $63.5K level. The 10-year Treasury note climbed 5.5 points to 3.793%.

Asian stocks, though ending mixed, saw spectacular performances by the Chinese market. The Shanghai Composite Index soared over 4% on stimulus hopes, and this positivity seeped into the Hong Kong market. The Chinese stock market gauge’s performance marked the biggest one-day gain in over four years.

The People’s Bank of China announced a slew of measures to kickstart domestic growth, which has been constrained by an ailing property sector. In a new conference in Beijing, central bank chief Pan Gongsheng said, “The reserve requirement ratio will be cut by 0.5 percentage points in the near future,” while he also hinted at reducing the policy interest rate and driving down the market benchmark interest rate to reinvigorate growth.

‘The Taiwanese and South Korean markets also recorded decent gains. The Australian market retreated amid a pause decision by the central bank.

The European markets firmed up early Tuesday.

Read Next:

- S&P 500 Outpaces Wall Street Projections As Year-End Nears: Will The Rally Hold?

Image Via Shutterstock

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.