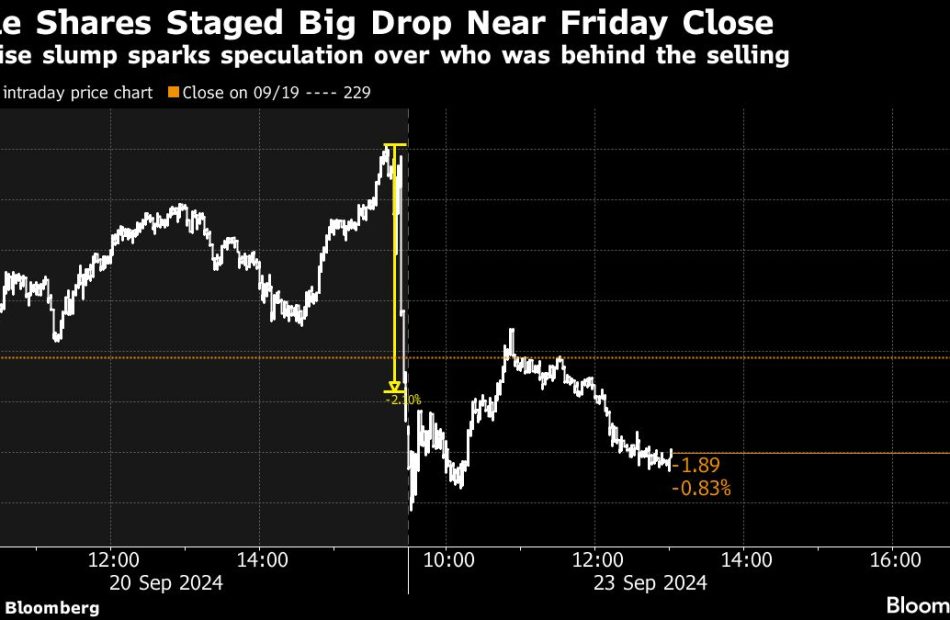

Apple’s Late-Day Plunge Stirs Speculation Over Who Was Selling

(Bloomberg) — Friday was supposed to be a good day for the shares of Apple Inc., with the iPhone maker set to be a big winner from the quarterly adjustment of major stock indexes. And for most of the session, that’s how it played out — until about 10 minutes before the closing bell.

Most Read from Bloomberg

By the time it rang, Apple had sunk more than 2% from its intraday high to close in the red, a surprise reversal that has left market watchers guessing who or what could have triggered it.

Market-on-close orders — those instructing a broker to buy or sell a stock at the closing price of a trading day — showed an unusually large imbalance at the time, indicating net disposals of 30 million shares. That’s more than half of Apple’s average full-day volume in the prior three months, all offloaded in the dying minutes of the Wall Street week.

The huge selling pressure was a surprise because funds tracking major equity benchmarks were expected to be big buyers of the stock on Friday after Warren Buffett sold a significant stake in Apple during the second quarter. That meant the company’s weighting was due to be significantly increased in many gauges.

One theory is that some actively managed funds may have capitalized on this predictable liquidity to trim their holdings.

“Maybe some investors wanted to take advantage of the rebalance to sell a sizable chunk of stock,” said Matt Maley, chief market strategist at Miller Tabak + Co. “They knew that a big piece of buying power was about to hit the market, so they knew it would be a great time for them to sell a chunk of stock without knocking down the stock very much.”

While Apple closed Friday down 0.3%, it was still 2.6% higher for the week overall. The shares slipped as much as 1% on Monday before paring the loss by half as of 12:45 p.m. in New York.

Another possibility is that arbitrage players may have snapped up Apple shares in advance of the rebalance event, which Piper Sandler & Co. estimated was set to create $35 billion of demand from passive funds. The stock rose for three straight sessions before Friday, jumping almost 6% in that time.

While it’s getting crowded, buying stocks whose representations in major indexes are rising and selling those with falling influence has been a reliable strategy for many in the hedge fund world.

“Arbitragers try to preposition themselves ahead of various index events because they think there is going to be movement at the close during rebalance days,” said Mohit Bajaj, director of ETFs at WallachBeth Capital. “Although it is getting tougher to do, it still does happen.”

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

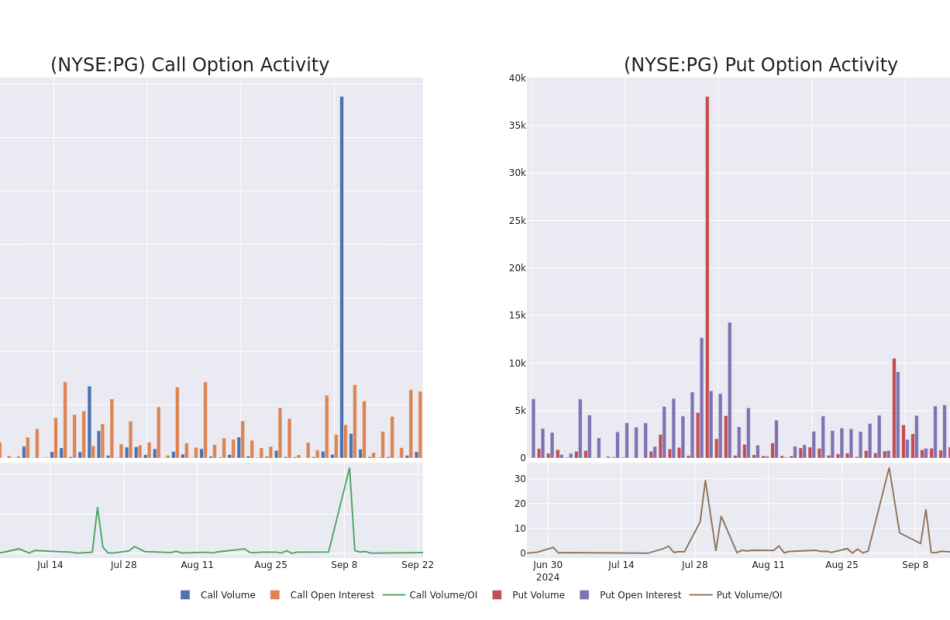

A Closer Look at Procter & Gamble's Options Market Dynamics

Whales with a lot of money to spend have taken a noticeably bullish stance on Procter & Gamble.

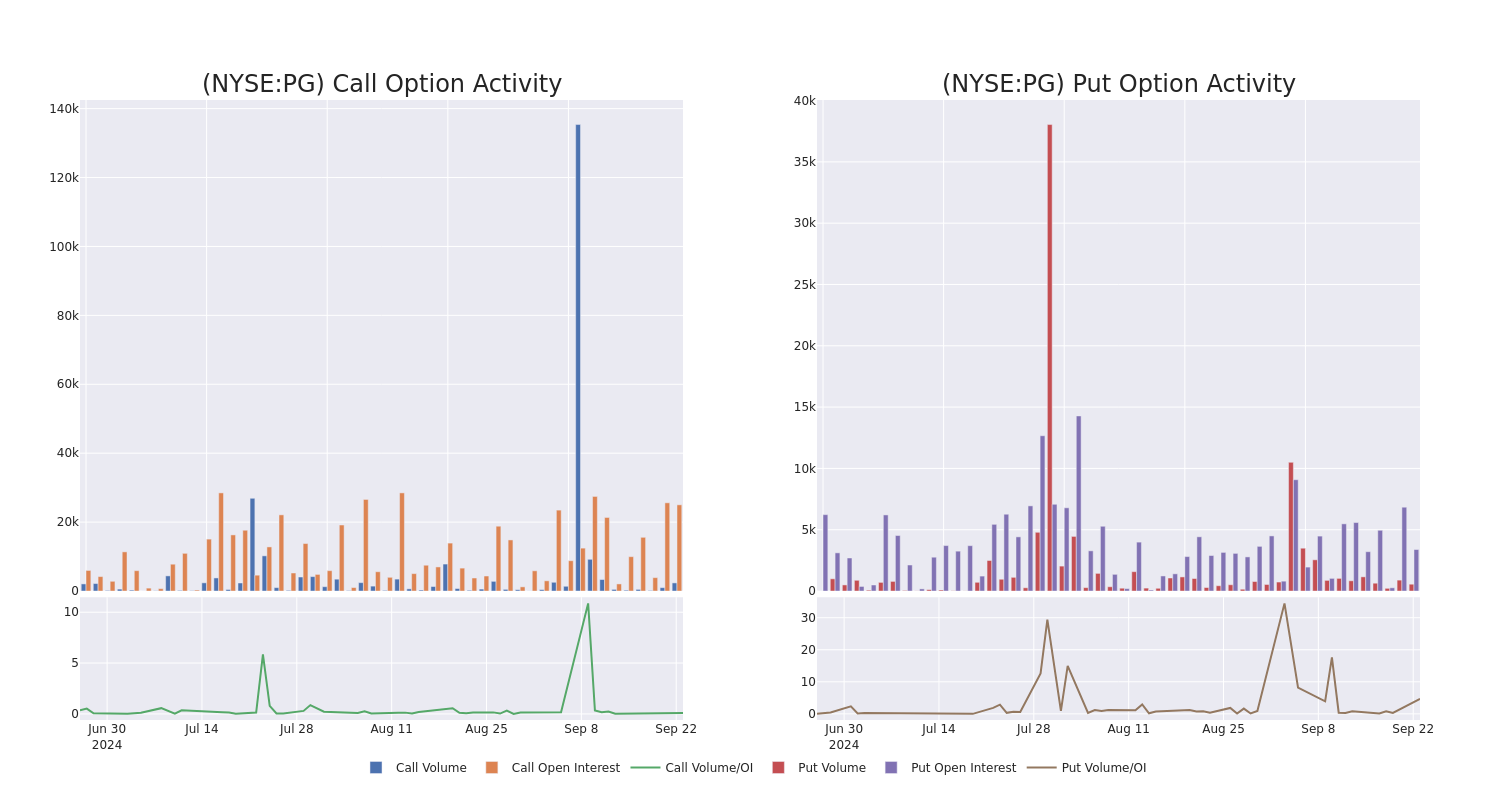

Looking at options history for Procter & Gamble PG we detected 8 trades.

If we consider the specifics of each trade, it is accurate to state that 50% of the investors opened trades with bullish expectations and 50% with bearish.

From the overall spotted trades, 2 are puts, for a total amount of $166,750 and 6, calls, for a total amount of $496,473.

Predicted Price Range

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $145.0 to $185.0 for Procter & Gamble over the recent three months.

Insights into Volume & Open Interest

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Procter & Gamble’s options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Procter & Gamble’s substantial trades, within a strike price spectrum from $145.0 to $185.0 over the preceding 30 days.

Procter & Gamble Option Activity Analysis: Last 30 Days

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| PG | CALL | SWEEP | BULLISH | 01/17/25 | $6.65 | $6.55 | $6.63 | $175.00 | $173.0K | 6.2K | 292 |

| PG | PUT | TRADE | BULLISH | 01/17/25 | $2.59 | $2.5 | $2.5 | $165.00 | $125.0K | 3.3K | 508 |

| PG | CALL | SWEEP | BULLISH | 09/27/24 | $2.68 | $2.5 | $2.5 | $172.50 | $118.7K | 1.1K | 666 |

| PG | CALL | SWEEP | BEARISH | 01/16/26 | $17.2 | $17.0 | $17.0 | $170.00 | $83.3K | 672 | 49 |

| PG | CALL | SWEEP | BEARISH | 12/20/24 | $1.78 | $1.71 | $1.71 | $185.00 | $69.2K | 1.6K | 635 |

About Procter & Gamble

Since its founding in 1837, Procter & Gamble has become one of the world’s largest consumer product manufacturers, generating more than $80 billion in annual sales. It operates with a lineup of leading brands, including more than 20 that generate north of $1 billion each in annual global sales, such as Tide laundry detergent, Charmin toilet paper, Pantene shampoo, and Pampers diapers. Sales outside its home turf represent more than half of the firm’s consolidated total.

Procter & Gamble’s Current Market Status

- Currently trading with a volume of 7,377,210, the PG’s price is down by -0.26%, now at $173.77.

- RSI readings suggest the stock is currently may be approaching overbought.

- Anticipated earnings release is in 25 days.

What Analysts Are Saying About Procter & Gamble

In the last month, 2 experts released ratings on this stock with an average target price of $188.0.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* In a positive move, an analyst from DZ Bank has upgraded their rating to Buy and adjusted the price target to $190.

* An analyst from JP Morgan persists with their Overweight rating on Procter & Gamble, maintaining a target price of $186.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Procter & Gamble options trades with real-time alerts from Benzinga Pro.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Sell Alert: Jack Reynolds Cashes Out $517K In Energy Servs of America Stock

Jack Reynolds, Director at Energy Servs of America ESOA, disclosed an insider sell on September 23, according to a recent SEC filing.

What Happened: A Form 4 filing from the U.S. Securities and Exchange Commission on Monday showed that Reynolds sold 50,000 shares of Energy Servs of America. The total transaction amounted to $517,500.

The latest market snapshot at Monday morning reveals Energy Servs of America shares down by 0.1%, trading at $10.15.

About Energy Servs of America

Energy Services of America Corporation is engaged in providing contracting services for energy-related companies. The company is predominantly engaged in the construction, replacement, and repair of natural gas pipelines and storage facilities for utility companies and private natural gas companies. It services the gas, petroleum, power, chemical, and automotive industries and does incidental work such as water and sewer projects. Energy Service’s other services include liquid pipeline construction, pump station construction, production facility construction, water and sewer pipeline installations, various maintenance and repair services, and other services related to pipeline construction.

Energy Servs of America’s Economic Impact: An Analysis

Revenue Growth: Energy Servs of America displayed positive results in 3 months. As of 30 June, 2024, the company achieved a solid revenue growth rate of approximately 0.46%. This indicates a notable increase in the company’s top-line earnings. As compared to its peers, the company achieved a growth rate higher than the average among peers in Energy sector.

Key Insights into Profitability Metrics:

-

Gross Margin: The company shows a low gross margin of 17.82%, suggesting potential challenges in cost control and profitability compared to its peers.

-

Earnings per Share (EPS): Energy Servs of America’s EPS is a standout, portraying a positive bottom-line trend that exceeds the industry average with a current EPS of 1.06.

Debt Management: Energy Servs of America’s debt-to-equity ratio stands notably higher than the industry average, reaching 0.66. This indicates a heavier reliance on borrowed funds, raising concerns about financial leverage.

Financial Valuation:

-

Price to Earnings (P/E) Ratio: The P/E ratio of 7.03 is lower than the industry average, implying a discounted valuation for Energy Servs of America’s stock.

-

Price to Sales (P/S) Ratio: With a lower-than-average P/S ratio of 0.48, the stock presents an attractive valuation, potentially signaling a buying opportunity for investors interested in sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): The company’s EV/EBITDA ratio of 4.27 trails industry averages, indicating a potential disparity in market valuation that could be advantageous for investors.

Market Capitalization Analysis: The company exhibits a lower market capitalization profile, positioning itself below industry averages. This suggests a smaller scale relative to peers.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

Exploring the Significance of Insider Trading

Insider transactions shouldn’t be used primarily to make an investing decision, however an insider transaction can be an important factor in the investing decision.

In the context of legal matters, the term “insider” refers to any officer, director, or beneficial owner holding more than ten percent of a company’s equity securities, as outlined by Section 12 of the Securities Exchange Act of 1934. This includes executives in the c-suite and significant hedge funds. Such insiders are obligated to report their transactions through a Form 4 filing, which must be completed within two business days of the transaction.

Pointing towards optimism, a company insider’s new purchase signals their positive anticipation for the stock to rise.

Despite insider sells not always signaling a bearish sentiment, they can be driven by various factors.

A Closer Look at Important Transaction Codes

In the domain of transactions, investors frequently turn their focus to those taking place in the open market, as meticulously outlined in Table I of the Form 4 filing. A P in Box 3 indicates a purchase, while S signifies a sale. Transaction code C signals the conversion of an option, and transaction code A denotes a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of Energy Servs of America’s Insider Trades.

Insider Buying Alert: Profit from C-Suite Moves

Benzinga Edge reveals every insider trade in real-time. Don’t miss the next big stock move driven by insider confidence. Unlock this ultimate sentiment indicator now. Click here for access.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

FTC set to greenlight Chevron's $53 billion buy of oil rival Hess, sources say

By Sabrina Valle

(Reuters) -The U.S. Federal Trade Commission is expected to greenlight U.S. oil producer Chevron’s purchase of Hess as soon as this week, two people familiar with the matter said, leaving Exxon Mobil’s challenge to the $53 billion deal as its final hurdle.

The proposed merger was first announced last October, and the FTC sent a second information request to Chevron two months later. Hess shares were up as much as 3% in after-hours trading on Monday following the news.

Uncertainty over the deal’s closing has knocked Chevron shares down 1% this year compared to a 6.5% increase in energy share fund XLE.

Exxon and CNOOC Ltd, Hess’s partners in a Guyana joint venture, are challenging the deal by claiming a right of first refusal to any sale of Hess’s Guyana assets, the prize in the proposed merger.

A three-judge arbitration panel is due to consider the case in May 2025. Chevron and Hess say a decision is expected by August, while Exxon expects it by September 2025.

The proposed all-stock acquisition is one of the largest in a consolidating U.S. oil and gas industry where several multi-billion dollar deals have been disclosed.

Chevron’s announcement of the Hess deal followed Exxon’s $60 billion purchase of U.S. shale giant Pioneer Natural Resources, which closed in May.

Two other mergers, Occidental Petroleum’s deal for CrownRock and Diamondback Energy’s bid for Endeavor Energy Resources, have closed even though they came after the Chevron-Hess combination.

The FTC required Exxon to withdraw its offer of a board seat to Pioneer Natural Resources CEO Scott Sheffield as a condition for its go-ahead. The FTC alleged he colluded with OPEC to reduce U.S. oil and gas output to potentially raise the price of oil.

Sheffield denied the allegations and has asked the FTC to vacate its ban on his taking an Exxon board seat.

A spokesperson for the FTC declined to comment on Monday.

EXXON ARBITRATION

The dispute over terms of the contract governing the Exxon-CNOOC-Hess partnership stalls any closing to the second half of 2025. The Guyana consortium controls one of the world’s fastest growing and lucrative oil provinces with more than 11.6 billion barrels of recoverable oil and gas discoveries since 2015.

Exxon operates all production in Guyana with a 45% stake in an offshore oil production consortium with Hess and China’s CNOOC, as minority partners. Combined earnings for the trio from Guyana last year were $6.33 billion on $11.25 billion in revenue.

The information was first reported by CTFN, a data and news provider to financial professionals.

(Reporting by Sabrina Valle and Jody Godoy; Writing by Gary McWilliams; Editing by Marguerita Choy and Stephen Coates)

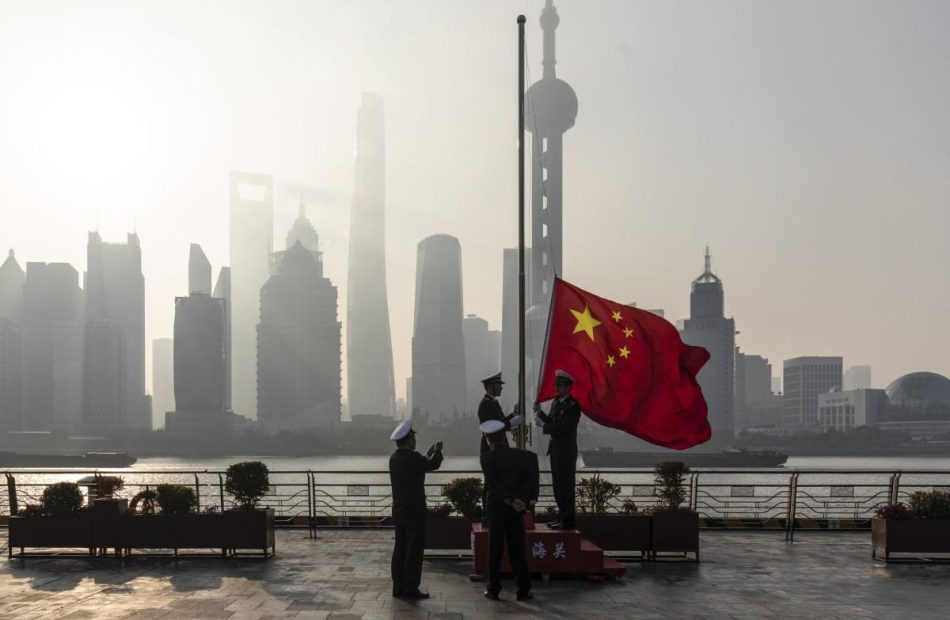

China Unleashes Stimulus Package to Revive Economy, Markets

(Bloomberg) — China’s central bank unveiled a broad package of monetary stimulus measures to revive the world’s second-largest economy, underscoring mounting alarm within Xi Jinping’s government over slowing growth and depressed investor confidence.

Most Read from Bloomberg

People’s Bank of China governor Pan Gongsheng cut a key short-term interest rate and announced plans to reduce the amount of money banks must hold in reserve to the lowest level since at least 2018, appearing at a rare briefing alongside two of the country’s other top financial regulators in Beijing. That marked the first time reductions to both measures were revealed on the same day since at least 2015.

Those moves were followed by a slew of other announcements that fueled gains in China’s beleaguered equity market. The central bank chief also unveiled a package to shore up the nation’s troubled property sector, including lowering borrowing costs on as much as $5.3 trillion in mortgages and easing rules for second-home purchases.

Subscribe to the Bloomberg Daybreak podcast on Apple, Spotify or anywhere you listen.

For the nation’s stocks, Pan said the central bank will provide at least 800 billion yuan ($113 billion) of liquidity support, adding that officials were studying setting up a market stabilization fund.

While several of the measures had been anticipated, the highly publicized rollout showed authorities are taking seriously warnings that China risks missing its growth target of around 5% this year. The policy barrage likely puts that goal back within reach, but doubts remain whether it was enough to break China’s longer-term deflationary pressure and entrenched real estate crisis.

Authorities have yet to unveil more forceful measures to boost demand among consumers, which some analysts view as a key missing ingredient for the economy.

“It’s hard to say what silver bullet can help resolve everything,” said Ken Wong, Asian equity portfolio specialist at Eastspring Investments Hong Kong Ltd. “While it’s good to have monetary easing measures that are accommodative, more needs to be done in order to help solidify fourth quarter growth.”

After a slow start, markets embraced the policy package. China’s benchmark CSI 300 Index of shares ended the session 4.3% higher, close to erasing losses for the year, though the gauge is still down more than 40% from its recent peak in 2021. Commodities markets gained and the yuan was little changed against the dollar. China’s 10-year bond yields rose 3 basis points to 2.06%, erasing an earlier decline to a record low.

Policymakers in Beijing have been trying to revive the economy without resorting to the bazooka stimulus China deployed in previous downturns, but piecemeal efforts have been ineffective. Growth recently slowed to its worst pace in five quarters — a deterioration that’s testing the leadership’s tolerance for missing its high-profile annual target for the second time in three years.

“The purpose of today’s briefing is to inject confidence into the market, judging by the fact that the authorities revealed measures in one go,” said Larry Hu, head of China economics at Macquarie Group Ltd. “The stimulus push will still need coordination from other policies — particularly follow-up policies from the fiscal side.”

The Federal Reserve’s bigger-than-expected half-percentage point slash has given central banks across Asia more room to move. But making money cheaper won’t lift the economy if Chinese consumers don’t want to spend because layoffs are looming amid sliding corporate profits and property prices are still falling. New home prices clocked their biggest decline last month from the previous period since 2014.

What Bloomberg Economics Says:

This will be a day to remember for China’s monetary policy. The People’s Bank of China unleashed a barrage of measures, from cuts to interest rates and reserve requirements to making central bank funding available for investors to purchase stocks.

Each individual step on its own is significant. Delivering them all at once is highly unusual and speaks to the urgency felt in Beijing to head off deflationary risks and get growth on track for this year’s 5% target … We estimate the boost to 2024 growth to be around 0.2 ppt, with most of the impact falling in 2025.

Chang Shu, Chief Asia economist

Read more here

Pan’s decisive display of ramped up monetary policy now sets the stage for the Finance Ministry to unveil its own bid to defend the growth target. A plunge in revenue from land sales has held back fiscal spending this year, crippling indebted local governments’ ability to invest in growth-boosting projects.

“It is too far from being a bazooka,” ANZ chief greater China economist Raymond Yeung said of the package. “We are not sure how much the mortgage rate cut will induce a property recovery.”

The central bank governor unveiled his big policy shift at his first high-profile press conference since March, appearing alongside securities regulator Wu Qing, and Li Yunze, head of the National Financial Regulatory Administration.

The trio kicked off their first joint public briefing at 9 a.m. before China trading began, ensuring their roll out of steps to salvage investor sentiment and stem a selloff in equities had maximum impact on markets. Government briefings typically start later in the morning.

Among their policies were new financial tools to expand liquidity for equities, which would help listed companies and major shareholders buy back shares and raise holdings.

Read this next: Xi Unleashes a Crisis for Millions of China’s Best-Paid Workers

The PBOC chief also effectively mapped out monetary policy for the rest of the year, exemplifying his more transparent approach. Pan used a similar briefing in January to announce a RRR cut two weeks before it was effective, as authorities tried to halt a stock-market rout.

The question now is whether this is all a prelude to more substantial measures to come, said Christopher Beddor, deputy China research director at Gavekal Dragonomics.

“If policymakers go back into wait-and-see mode,” he added, “the initial burst of market enthusiasm might fade.”

–With assistance from James Mayger, Ocean Hou, Alan Wong, Wenjin Lv, April Ma and Iris Ouyang.

(Updates with final stock prices, new analyst quote in last paragraph.)

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

Analyst Report: Quanta Services, Inc.

Summary

Quanta Services provides infrastructure solutions for the utility, renewable energy, communications, pipeline and energy industries. It operates through the following segments: Electric Power Infrastructure Solutions, Underground Utility and Infrastructure Solutions, and Renewable Energy Infrastructure Solutions. The Electric Power segment provides network solutions for customers in the electric power industry. The Underground Utility segment provides infrastructure solutions for the development, transportation, distribution, storage, and processing of natural gas, oil, and other p

Upgrade to begin using premium research reports and get so much more.

Exclusive reports, detailed company profiles, and best-in-class trade insights to take your portfolio to the next level

PNC Enters Into Agreement With Plaid to Boost Customer Data Security

The PNC Financial Services Group, Inc. PNC and Plaid, a fintech company specializing in data transfer networks, have entered into a bilateral data access agreement. This agreement intends to help PNC customers across the United States to securely and efficiently share their financial data with their preferred financial applications through Plaid.

PNC is utilizing Akoya as its Application Programming Interface service provider to facilitate the secure transfer of customer financial information to authorized data recipients. It is to be noted that the integration of Akoya Data Access Network into PNC Financial’s subsidiary, PNC Bank, was announced in 2021.

PNC Financial and Plaid are pleased to work together to help PNC clients maintain greater control over the tools they utilize to live a stable financial life.

PNC’s agreement with Plaid to enhance customer data security and efficiency comes at a time when other major banks like Wells Fargo & Company WFC and U.S. Bancorp USB are also enhancing their API technologies.

Last week, WFC expanded its APIs portfolio with the launch of specialized APIs for its Commercial Banking clients. This automated setup permits effortless data transfer among trading partners, reducing delays in sending and receiving information. In June, USB’s wholly-owned subsidiary, Elavon, launched the Elavon Cloud Payments Interface. This advanced API is intended to simplify managing digital and in-person payment experiences for hotels and other entities related to hospitality.

PNC’s Management Comments

Natalie Talpas, executive vice president of Digital and Payments at PNC, said, “PNC’s use of its Akoya-provided API allows for all data recipients, including Plaid, to get connected fast, while also enabling customers to reliably control what financial data they permissions without having to share their login credentials with third parties.”

“Through this new partnership with Plaid, PNC customers will be able to achieve greater data security, privacy, and control while using the third-party financial apps and services they enjoy” stated Talpas.

Final Words on PNC’s Latest Agreement

PNC’s data access agreement with Plaid highlights the bank’s commitment to enhance its digital banking while empowering customers with greater security and control over their financial data.

Such a strategic move to enhance customer data security will further solidify PNC’s customer loyalty and attract new clients seeking advanced secured digital solutions. This could lead to increased transaction volumes and higher revenue streams.

Over the past month, shares of PNC have gained 20.2% compared with the industry’s growth of 8.7%.

Image Source: Zacks Investment Research

PNC Financial currently carries a Zacks Rank #3 (Hold).

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

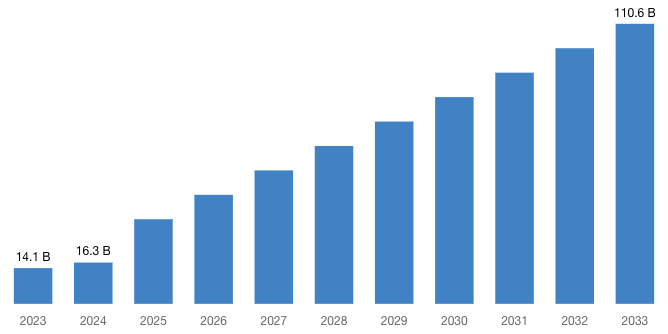

[Latest] Global Metaverse In E-commerce Market Size/Share Worth USD 110.6 Billion by 2033 at a 39.7% CAGR: Custom Market Insights (Analysis, Outlook, Leaders, Report, Trends, Forecast, Segmentation, Growth, Growth Rate, Value)

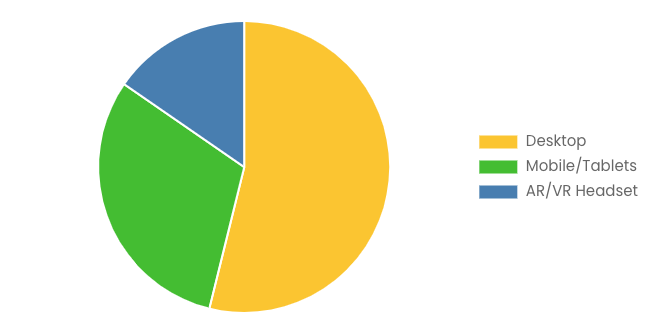

Austin, TX, USA, Sept. 24, 2024 (GLOBE NEWSWIRE) — Custom Market Insights has published a new research report titled “Metaverse In E-commerce Market Size, Trends and Insights By Platform (Desktop, Mobile/Tablets, AR/VR Headset), By Technology (Blockchain, Virtual Reality (VR) & Augmented Reality (AR), Edge Computing, Others), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033“ in its research database.

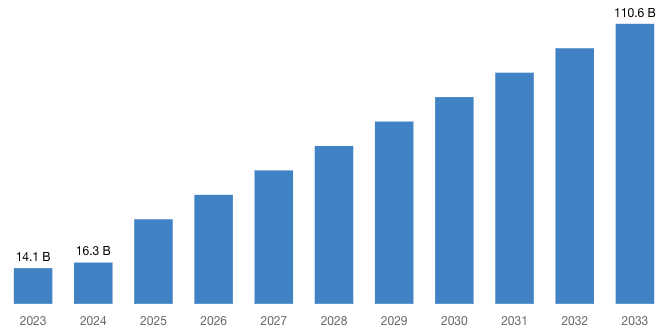

“According to the latest research study, the demand of global Metaverse In E-commerce Market size & share was valued at approximately USD 14.1 Billion in 2023 and is expected to reach USD 16.3 Billion in 2024 and is expected to reach a value of around USD 110.6 Billion by 2033, at a compound annual growth rate (CAGR) of about 39.7% during the forecast period 2024 to 2033.”

Click Here to Access a Free Sample Report of the Global Metaverse In E-commerce Market @ https://www.custommarketinsights.com/request-for-free-sample/?reportid=52227

Metaverse In E-commerce Market: Overview

The metaverse represents the convergence of various technological innovations, seamlessly blending the digital and physical worlds. From NFTs (non-fungible tokens) to social commerce, augmented reality (AR), and virtual reality (VR), the metaverse transcends traditional boundaries.

Metaverse in eCommerce has revolutionized how online transactions are conducted. For instance, the use of cryptocurrency and e-wallets has made it possible for sellers and buyers to conduct online businesses. By providing a bespoke virtual experience, customers can personalize their search by exploring the consumer avatar.

This allows them to try products that will boost their confidence and help them make informed decisions. Thus, for eCommerce businesses on the metaverse, implementing this top-notch personalization technique increases overall customer engagement and promotes loyalty.

AI algorithms analyze user behavior, preferences, and browsing history to offer personalized recommendations. Metaverse e-commerce platforms tailor product suggestions, advertisements, and pricing based on individual profiles.

Request a Customized Copy of the Metaverse In E-commerce Market Report @ https://www.custommarketinsights.com/inquire-for-discount/?reportid=52227

By platform, the AR/VR Headset segment held the highest market share in 2023 and is expected to keep its dominance during the forecast period 2024-2033. AR/VR headsets are transforming e-commerce by driving the development of the metaverse and creating immersive, interactive shopping experiences.

In the metaverse, consumers can enter virtual stores, interact with products, and receive personalized recommendations, enhancing the overall shopping experience.

By technology, the Virtual Reality (VR) & Augmented Reality (AR) segment held the highest market share in 2023 and is expected to keep its dominance during the forecast period 2024-2033. AR integrates virtual elements into the real world. It enables users to visualize products in their actual environment before purchase.

For instance, shoppers can see how furniture fits in their homes or how clothes look on them through AR apps. This reduces uncertainty and enhances decision-making, leading to higher conversion rates and fewer returns.

North American consumers appreciate these interactive features, driving metaverse adoption. The metaverse allows users to interact in shared virtual spaces. E-commerce platforms capitalize on this by integrating social features.

Nextech AR Solutions Corp focuses on creating 3D WebAR photorealistic models for the prime e-commerce marketplace, as well as other online retailers.

Report Scope

| Feature of the Report | Details |

| Market Size in 2024 | USD 16.3 Billion |

| Projected Market Size in 2033 | USD 110.6 Billion |

| Market Size in 2023 | USD 14.1 Billion |

| CAGR Growth Rate | 39.7% CAGR |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Key Segment | By Platform, Technology and Region |

| Report Coverage | Revenue Estimation and Forecast, Company Profile, Competitive Landscape, Growth Factors and Recent Trends |

| Regional Scope | North America, Europe, Asia Pacific, Middle East & Africa, and South & Central America |

| Buying Options | Request tailored purchasing options to fulfil your requirements for research. |

(A free sample of the Metaverse In E-commerce report is available upon request; please contact us for more information.)

Request a Customized Copy of the Metaverse In E-commerce Market Report @ https://www.custommarketinsights.com/report/metaverse-in-e-commerce-market/

Our Free Sample Report Consists of the following:

- Introduction, Overview, and in-depth industry analysis are all included in the 2024 updated report.

- The COVID-19 Pandemic Outbreak Impact Analysis is included in the package.

- About 220+ Pages Research Report (Including Recent Research)

- Provide detailed chapter-by-chapter guidance on the Request.

- Updated Regional Analysis with a Graphical Representation of Size, Share, and Trends for the Year 2024

- Includes Tables and figures have been updated.

- The most recent version of the report includes the Top Market Players, their Business Strategies, Sales Volume, and Revenue Analysis

- Custom Market Insights (CMI) research methodology

(Please note that the sample of the Metaverse In E-commerce report has been modified to include the COVID-19 impact study prior to delivery.)

Request a Customized Copy of the Metaverse In E-commerce Market Report @ https://www.custommarketinsights.com/report/metaverse-in-e-commerce-market/

CMI has comprehensively analyzed the Global Metaverse In E-commerce market. The driving forces, restraints, challenges, opportunities, and key trends have been explained in depth to depict the in-depth scenario of the market. Segment wise market size and market share during the forecast period are duly addressed to portray the probable picture of this Global Metaverse In E-commerce industry.

The competitive landscape includes key innovators, after market service providers, market giants as well as niche players are studied and analyzed extensively concerning their strengths, weaknesses as well as value addition prospects. In addition, this report covers key players profiling, market shares, mergers and acquisitions, consequent market fragmentation, new trends and dynamics in partnerships.

Key questions answered in this report:

- What is the size of the Metaverse In E-commerce market and what is its expected growth rate?

- What are the primary driving factors that push the Metaverse In E-commerce market forward?

- What are the Metaverse In E-commerce Industry’s top companies?

- What are the different categories that the Metaverse In E-commerce Market caters to?

- What will be the fastest-growing segment or region?

- In the value chain, what role do essential players play?

- What is the procedure for getting a free copy of the Metaverse In E-commerce market sample report and company profiles?

Key Offerings:

- Market Share, Size & Forecast by Revenue | 2024−2033

- Market Dynamics – Growth Drivers, Restraints, Investment Opportunities, and Leading Trends

- Market Segmentation – A detailed analysis by Types of Services, by End-User Services, and by regions

- Competitive Landscape – Top Key Vendors and Other Prominent Vendors

Buy this Premium Metaverse In E-commerce Research Report | Fast Delivery Available – [220+ Pages] @ https://www.custommarketinsights.com/report/metaverse-in-e-commerce-market/

Metaverse In E-commerce Market: Regional Analysis

By region, Metaverse In E-commerce market is segmented into North America, Europe, Asia-Pacific, Latin America, Middle East & Africa. North America dominated the global Metaverse In E-commerce market in 2023 with a market share of 39.1% and is expected to keep its dominance during the forecast period 2024-2033.

The integration of VR and AR technologies enhances user experiences within the metaverse. E-commerce platforms leverage these immersive technologies to offer realistic product interactions. Virtual try-on experiences, where customers virtually test products (from clothing to home decor), boost confidence and reduce returns.

North American consumers appreciate these interactive features, driving metaverse adoption. The metaverse allows users to interact in shared virtual spaces. E-commerce platforms capitalize on this by integrating social features.

Virtual shopping parties, collaborative wish lists, and decision-making enhance community engagement. North Americans value social connections, and these features mirror real-world interactions, making the e-commerce experience dynamic and engaging.

Request a Customized Copy of the Metaverse In E-commerce Market Report @ https://www.custommarketinsights.com/report/metaverse-in-e-commerce-market/

(We customized your report to meet your specific research requirements. Inquire with our sales team about customizing your report.)

Still, Looking for More Information? Do OR Want Data for Inclusion in magazines, case studies, research papers, or Media?

Email Directly Here with Detail Information: support@custommarketinsights.com

Browse the full “Metaverse In E-commerce Market Size, Trends and Insights By Platform (Desktop, Mobile/Tablets, AR/VR Headset), By Technology (Blockchain, Virtual Reality (VR) & Augmented Reality (AR), Edge Computing, Others), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

“ Report at https://www.custommarketinsights.com/report/metaverse-in-e-commerce-market/

List of the prominent players in the Metaverse In E-commerce Market:

- Amazon com Inc.

- Alibaba Group

- Meta Platform Inc.

- Tencent Holdings Ltd.

- Nvidia Corporation

- Epic Games Inc.

- Roblox Corporation

- Unity Technologies Inc.

- Nextech AR Solutions Corp.

- The Sandbox

- Decentraland

- Microsoft Corporation

- Antier Solutions Pvt. Ltd.

- Innowise Group

- Aetsoft Inc.

- Others

Click Here to Access a Free Sample Report of the Global Metaverse In E-commerce Market @ https://www.custommarketinsights.com/report/metaverse-in-e-commerce-market/

Spectacular Deals

- Comprehensive coverage

- Maximum number of market tables and figures

- The subscription-based option is offered.

- Best price guarantee

- Free 35% or 60 hours of customization.

- Free post-sale service assistance.

- 25% discount on your next purchase.

- Service guarantees are available.

- Personalized market brief by author.

Browse More Related Reports:

In-Flight Entertainment and Connectivity Market: In-Flight Entertainment and Connectivity Market Size, Trends and Insights By Component (Hardware, Non-portable, Portable, Connectivity, Wired, Wireless, Content, Stored, Streamed), By Aircraft Type (Narrow-Body Aircraft (NBA), Wide-Body Aircraft (WBA), Very Large Aircraft (VLA)), By Offering (In-flight Entertainment (IFE), In-flight Connectivity (IFC)), By End-user (Airlines, Aircraft OEMs), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

Active Optical Cable Market: Active Optical Cable Market Size, Trends and Insights By Data Rate (10 Gbps, 25 Gbps, 40 Gbps, 100 Gbps, Others), By Application (Data Centers, Consumer Electronics, High-Performance Computing (HPC), Telecommunications, Automotive, Others), By Protocol (Ethernet, InfiniBand, Fiber Channel, HDMI/DisplayPort, USB, Others), By Length (Short Range (up to 100 meters), Medium Range (100 meters to 300 meters), Long Range (above 300 meters)), By Connector Type (SFP (Small Form-factor Pluggable), QSFP (Quad Small Form-factor Pluggable), CXP (InfiniBand CXP), CFP (C Form-factor Pluggable), Others), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

Artificial General Intelligence Market: Artificial General Intelligence Market Size, Trends and Insights By Type (Software, Hardware), By Application (Transforming Customer Service, Predictive 3D Design, Personal Security, Data Security, Fraud Detection, Others), By Industry Vertical (Healthcare, Automotive, Manufacturing, Retail, BFSI, IT & Telecom, Education, Government & Defense, Energy, Transportation, Others), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

AI-Enabled Railway Market: AI-Enabled Railway Market Size, Trends and Insights By Component (Hardware, Sensors, Cameras, Communication equipment, Others, Software, Predictive maintenance software, Traffic management software, Security and surveillance software, Others), By Application (Predictive Maintenance, Safety and Security, Operations Management, Others), By Technology (Machine Learning, Computer Vision, Natural Language Processing (NLP), Others), By Type of Train (Passenger Trains, Freight Trains, High-Speed Trains, Urban Transit Trains, Others), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

Radiometric Dating Machine Market: Radiometric Dating Machine Market Size, Trends and Insights By Type (Alpha Counting, Beta Counting, Gamma Counting, Mass Spectrometry), By Method (Radiocarbon Dating, Potassium-Argon Dating, Uranium-Lead System), By End User (Archaeologists, Geologists, Environmental Scientists, Palaeontologists, Nuclear Scientists, Others), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

Composite AI Market: Composite AI Market Size, Trends and Insights By Component (Software, Hardware, Services), By Technique (Product Design and Development, Customer Service, Fraud Detection, Risk Management, Supply Chain Management), By Application (Banking and financial services, Healthcare, Retail, Manufacturing, Transportation and logistics, Others), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

AI Powered Content Creation Market: AI Powered Content Creation Market Size, Trends and Insights By Deployment Mode (Cloud, Premises), By Content Format (Textual, Graphical, Video, Audio, Others), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

Security Information and Event Management (SIEM) Market: Security Information and Event Management (SIEM) Market Size, Trends and Insights By Deployment (On-Premises, Cloud-Based), By Application (Small and Medium Enterprises, Large Enterprises), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

The Metaverse In E-commerce Market is segmented as follows:

By Platform

- Desktop

- Mobile/Tablets

- AR/VR Headset

By Technology

- Blockchain

- Virtual Reality (VR) & Augmented Reality (AR)

- Edge Computing

- Others

By Application

- Virtual Stores

- Virtual Events

Click Here to Get a Free Sample Report of the Global Metaverse In E-commerce Market @ https://www.custommarketinsights.com/report/metaverse-in-e-commerce-market/

Regional Coverage:

North America

- U.S.

- Canada

- Mexico

- Rest of North America

Europe

- Germany

- France

- U.K.

- Russia

- Italy

- Spain

- Netherlands

- Rest of Europe

Asia Pacific

- China

- Japan

- India

- New Zealand

- Australia

- South Korea

- Taiwan

- Rest of Asia Pacific

The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

Latin America

- Brazil

- Argentina

- Rest of Latin America

This Metaverse In E-commerce Market Research/Analysis Report Contains Answers to the following Questions.

- What Developments Are Going On in That Technology? Which Trends Are Causing These Developments?

- Who Are the Global Key Players in This Metaverse In E-commerce Market? What are Their Company Profile, Product Information, and Contact Information?

- What Was the Global Market Status of the Metaverse In E-commerce Market? What Was the Capacity, Production Value, Cost and PROFIT of the Metaverse In E-commerce Market?

- What Is the Current Market Status of the Metaverse In E-commerce Industry? What’s Market Competition in This Industry, Both Company and Country Wise? What’s Market Analysis of Metaverse In E-commerce Market by Considering Applications and Types?

- What Are Projections of the Global Metaverse In E-commerce Industry Considering Capacity, Production and Production Value? What Will Be the Estimation of Cost and Profit? What Will Be Market Share, Supply and Consumption? What about imports and exports?

- What Is Metaverse In E-commerce Market Chain Analysis by Upstream Raw Materials and Downstream Industry?

- What Is the Economic Impact On Metaverse In E-commerce Industry? What are Global Macroeconomic Environment Analysis Results? What Are Global Macroeconomic Environment Development Trends?

- What Are Market Dynamics of Metaverse In E-commerce Market? What Are Challenges and Opportunities?

- What Should Be Entry Strategies, Countermeasures to Economic Impact, and Marketing Channels for Metaverse In E-commerce Industry?

Click Here to Access a Free Sample Report of the Global Metaverse In E-commerce Market @ https://www.custommarketinsights.com/report/metaverse-in-e-commerce-market/

Reasons to Purchase Metaverse In E-commerce Market Report

- Metaverse In E-commerce Market Report provides qualitative and quantitative analysis of the market based on segmentation involving economic and non-economic factors.

- Metaverse In E-commerce Market report outlines market value (USD) data for each segment and sub-segment.

- This report indicates the region and segment expected to witness the fastest growth and dominate the market.

- Metaverse In E-commerce Market Analysis by geography highlights the consumption of the product/service in the region and indicates the factors affecting the market within each region.

- The competitive landscape incorporates the market ranking of the major players, along with new service/product launches, partnerships, business expansions, and acquisitions in the past five years of companies profiled.

- Extensive company profiles comprising company overview, company insights, product benchmarking, and SWOT analysis for the major market players.

- The Industry’s current and future market outlook concerning recent developments (which involve growth opportunities and drivers as well as challenges and restraints of both emerging and developed regions.

- Metaverse In E-commerce Market Includes in-depth market analysis from various perspectives through Porter’s five forces analysis and provides insight into the market through Value Chain.

Reasons for the Research Report

- The study provides a thorough overview of the global Metaverse In E-commerce market. Compare your performance to that of the market as a whole.

- Aim to maintain competitiveness while innovations from established key players fuel market growth.

Buy this Premium Metaverse In E-commerce Research Report | Fast Delivery Available – [220+ Pages] @ https://www.custommarketinsights.com/report/metaverse-in-e-commerce-market/

What does the report include?

- Drivers, restrictions, and opportunities are among the qualitative elements covered in the worldwide Metaverse In E-commerce market analysis.

- The competitive environment of current and potential participants in the Metaverse In E-commerce market is covered in the report, as well as those companies’ strategic product development ambitions.

- According to the component, application, and industry vertical, this study analyzes the market qualitatively and quantitatively. Additionally, the report offers comparable data for the important regions.

- For each segment mentioned above, actual market sizes and forecasts have been given.

Who should buy this report?

- Participants and stakeholders worldwide Metaverse In E-commerce market should find this report useful. The research will be useful to all market participants in the Metaverse In E-commerce industry.

- Managers in the Metaverse In E-commerce sector are interested in publishing up-to-date and projected data about the worldwide Metaverse In E-commerce market.

- Governmental agencies, regulatory bodies, decision-makers, and organizations want to invest in Metaverse In E-commerce products’ market trends.

- Market insights are sought for by analysts, researchers, educators, strategy managers, and government organizations to develop plans.

Request a Customized Copy of the Metaverse In E-commerce Market Report @ https://www.custommarketinsights.com/report/metaverse-in-e-commerce-market/

About Custom Market Insights:

Custom Market Insights is a market research and advisory company delivering business insights and market research reports to large, small, and medium-scale enterprises. We assist clients with strategies and business policies and regularly work towards achieving sustainable growth in their respective domains.

CMI provides a one-stop solution for data collection to investment advice. The expert analysis of our company digs out essential factors that help to understand the significance and impact of market dynamics. The professional experts apply clients inside on the aspects such as strategies for future estimation fall, forecasting or opportunity to grow, and consumer survey.

Follow Us: LinkedIn | Twitter | Facebook | YouTube

Contact Us:

Joel John

CMI Consulting LLC

1333, 701 Tillery Street Unit 12,

Austin, TX, Travis, US, 78702

USA: +1 801-639-9061

India: +91 20 46022736

Email: support@custommarketinsights.com

Web: https://www.custommarketinsights.com/

Blog: https://www.techyounme.com/

Blog: https://atozresearch.com/

Blog: https://www.technowalla.com/

Blog: https://marketresearchtrade.com/

Buy this Premium Metaverse In E-commerce Research Report | Fast Delivery Available – [220+ Pages] @ https://www.custommarketinsights.com/report/metaverse-in-e-commerce-market/

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Companies Run To Bond Markets After Last Week's Fed Rate Cut

Online furniture retailer Wayfair Inc. W said on Monday that it is offering $700 million in secured notes to repay some of its debt, joining other companies’ run to the debt markets less than a week after the Federal Reserve cut interest rates for the first time in four years.

The Fed lowered its key interest rate on Wednesday by an unexpected 50 basis points to a range between 4.75% and 5%, setting in motion an expected gradual decrease in rates on bonds, car loans, mortgages and anything else with an interest rate.

Wayfair said the proceeds from the notes, which will mature in 2029, go towards paying back certain convertible senior notes and general corporate purposes.

Read Also: Fed Rate Cut Fuels Market Rally Amidst Valuation Fears

Wayfair is not alone in its dash for debt as 10 high-grade issuers — including TMobile US, Inc. TMUS — are looking to raise money from borrowing in the junk-bond market, a flurry that could result in $20 billion to $25 billion in deals this week, Bloomberg reported.

The average yield in the U.S. investment-grade and high-yield bond markets fell after the Fed rate cut, enticing issuers into the market.

Cigarette-filter maker Cerdia Holdings issued $800 million in debt to refinance notes due 2027 and pay for a shareholder distribution.

Australian coal miner Coronado Global Resources CODQL launched a $400 million offer to redeem its 2026 notes, while U.S.-based telecommunications company Windstream Holdings, Inc. put together a $1.3 billion debt package through the loan and bond markets to refinance loans.

Price Action: Investment banks that underwrite corporate bonds saw gains and losses on Monday.

- Charles Schwab Corporation SCHW declined 0.7% to close at $64.93

- JPMorgan & Chase Co. JPM rose 0.17% to close at $211.44

- Goldman Sachs Group Inc. GS slipped 0.2% to close at $497.41

Read Now:

Photo: Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

V2X Upgraded to Buy: Here's What You Should Know

V2X VVX appears an attractive pick, as it has been recently upgraded to a Zacks Rank #2 (Buy). This rating change essentially reflects an upward trend in earnings estimates — one of the most powerful forces impacting stock prices.

The sole determinant of the Zacks rating is a company’s changing earnings picture. The Zacks Consensus Estimate — the consensus of EPS estimates from the sell-side analysts covering the stock — for the current and following years is tracked by the system.

The power of a changing earnings picture in determining near-term stock price movements makes the Zacks rating system highly useful for individual investors, since it can be difficult to make decisions based on rating upgrades by Wall Street analysts. These are mostly driven by subjective factors that are hard to see and measure in real time.

Therefore, the Zacks rating upgrade for V2X basically reflects positivity about its earnings outlook that could translate into buying pressure and an increase in its stock price.

Most Powerful Force Impacting Stock Prices

The change in a company’s future earnings potential, as reflected in earnings estimate revisions, has proven to be strongly correlated with the near-term price movement of its stock. The influence of institutional investors has a partial contribution to this relationship, as these big professionals use earnings and earnings estimates to calculate the fair value of a company’s shares. An increase or decrease in earnings estimates in their valuation models simply results in higher or lower fair value for a stock, and institutional investors typically buy or sell it. Their bulk investment action then leads to price movement for the stock.

For V2X, rising earnings estimates and the consequent rating upgrade fundamentally mean an improvement in the company’s underlying business. And investors’ appreciation of this improving business trend should push the stock higher.

Harnessing the Power of Earnings Estimate Revisions

Empirical research shows a strong correlation between trends in earnings estimate revisions and near-term stock movements, so it could be truly rewarding if such revisions are tracked for making an investment decision. Here is where the tried-and-tested Zacks Rank stock-rating system plays an important role, as it effectively harnesses the power of earnings estimate revisions.

The Zacks Rank stock-rating system, which uses four factors related to earnings estimates to classify stocks into five groups, ranging from Zacks Rank #1 (Strong Buy) to Zacks Rank #5 (Strong Sell), has an impressive externally-audited track record, with Zacks Rank #1 stocks generating an average annual return of +25% since 1988.

Earnings Estimate Revisions for V2X

For the fiscal year ending December 2024, this government services company is expected to earn $4.11 per share, which is a change of 9.9% from the year-ago reported number.

Analysts have been steadily raising their estimates for V2X. Over the past three months, the Zacks Consensus Estimate for the company has increased 0.6%.

Bottom Line

Unlike the overly optimistic Wall Street analysts whose rating systems tend to be weighted toward favorable recommendations, the Zacks rating system maintains an equal proportion of ‘buy’ and ‘sell’ ratings for its entire universe of more than 4000 stocks at any point in time. Irrespective of market conditions, only the top 5% of the Zacks-covered stocks get a ‘Strong Buy’ rating and the next 15% get a ‘Buy’ rating. So, the placement of a stock in the top 20% of the Zacks-covered stocks indicates its superior earnings estimate revision feature, making it a solid candidate for producing market-beating returns in the near term.

The upgrade of V2X to a Zacks Rank #2 positions it in the top 20% of the Zacks-covered stocks in terms of estimate revisions, implying that the stock might move higher in the near term.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.