KBC Group Upgraded to Buy: Here's What You Should Know

KBC Group SA KBCSY appears an attractive pick, as it has been recently upgraded to a Zacks Rank #2 (Buy). An upward trend in earnings estimates — one of the most powerful forces impacting stock prices — has triggered this rating change.

The sole determinant of the Zacks rating is a company’s changing earnings picture. The Zacks Consensus Estimate — the consensus of EPS estimates from the sell-side analysts covering the stock — for the current and following years is tracked by the system.

Individual investors often find it hard to make decisions based on rating upgrades by Wall Street analysts, since these are mostly driven by subjective factors that are hard to see and measure in real time. In these situations, the Zacks rating system comes in handy because of the power of a changing earnings picture in determining near-term stock price movements.

As such, the Zacks rating upgrade for KBC Group is essentially a positive comment on its earnings outlook that could have a favorable impact on its stock price.

Most Powerful Force Impacting Stock Prices

The change in a company’s future earnings potential, as reflected in earnings estimate revisions, and the near-term price movement of its stock are proven to be strongly correlated. That’s partly because of the influence of institutional investors that use earnings and earnings estimates for calculating the fair value of a company’s shares. An increase or decrease in earnings estimates in their valuation models simply results in higher or lower fair value for a stock, and institutional investors typically buy or sell it. Their transaction of large amounts of shares then leads to price movement for the stock.

For KBC Group, rising earnings estimates and the consequent rating upgrade fundamentally mean an improvement in the company’s underlying business. And investors’ appreciation of this improving business trend should push the stock higher.

Harnessing the Power of Earnings Estimate Revisions

As empirical research shows a strong correlation between trends in earnings estimate revisions and near-term stock movements, tracking such revisions for making an investment decision could be truly rewarding. Here is where the tried-and-tested Zacks Rank stock-rating system plays an important role, as it effectively harnesses the power of earnings estimate revisions.

The Zacks Rank stock-rating system, which uses four factors related to earnings estimates to classify stocks into five groups, ranging from Zacks Rank #1 (Strong Buy) to Zacks Rank #5 (Strong Sell), has an impressive externally-audited track record, with Zacks Rank #1 stocks generating an average annual return of +25% since 1988.

Earnings Estimate Revisions for KBC Group

This company is expected to earn $5.93 per share for the fiscal year ending December 2024, which represents a year-over-year change of 36.3%.

Analysts have been steadily raising their estimates for KBC Group. Over the past three months, the Zacks Consensus Estimate for the company has increased 4%.

Bottom Line

Unlike the overly optimistic Wall Street analysts whose rating systems tend to be weighted toward favorable recommendations, the Zacks rating system maintains an equal proportion of ‘buy’ and ‘sell’ ratings for its entire universe of more than 4000 stocks at any point in time. Irrespective of market conditions, only the top 5% of the Zacks-covered stocks get a ‘Strong Buy’ rating and the next 15% get a ‘Buy’ rating. So, the placement of a stock in the top 20% of the Zacks-covered stocks indicates its superior earnings estimate revision feature, making it a solid candidate for producing market-beating returns in the near term.

The upgrade of KBC Group to a Zacks Rank #2 positions it in the top 20% of the Zacks-covered stocks in terms of estimate revisions, implying that the stock might move higher in the near term.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Minto Apartment REIT Releases 2023 ESG Report

OTTAWA, ON, Sept. 23, 2024 /CNW/ – Minto Apartment Real Estate Investment Trust MI (the “REIT”) today announced the publication of its 2023 Environmental, Social and Governance (“ESG”) Report (the “Report”). The Report highlighted the REIT’s continued progress in addressing the issues that are important to its investors, employees and communities.

“Our commitment to ESG is reflected across our operating footprint. From the way we treat our employees to doing the right thing for our residents, the environment, and the future of our business, we have integrated ESG into every aspect of what we do,” said Jonathan Li, President and Chief Executive Officer of Minto Apartment REIT. “We’re building a resilient business through governance structures that incorporate strong ESG dimensions to inform our business practices; we’re making a positive impact on the communities we serve by fostering meaningful connections with them and the employees that help us carry out our mission; and we’re taking steps towards championing environmental responsibility, including consuming fewer natural resources and reducing greenhouse gas emissions.”

“Underlining our commitment to ESG, the REIT participates in the GRESB real estate assessment, which independently provides actionable and transparent environmental, social and governance data to financial market participants,” added Mr. Li. “In 2023, we scored 96 in the GRESB Public Disclosure evaluation, earning a Level A designation. In the Real Estate Assessment we scored 78, earning a Green Star designation and 3-star rating. These scores reflect our commitment to transparency and excellence.”

Other 2023 ESG highlights included:

Diversity and Inclusion

- The REIT’s 2nd annual DEI Survey scored 76%, which is 9% above the industry average, with 46% of respondents identifying as People of Colour; and

- The REIT increased female representation on its Board of Trustees from 29% in 2021 to 43% in 2023.

Community Engagement

- The REIT launched Mentorship @ Minto, with 12 mentors and 13 mentees joining in the first month;

- The BRAVO! recognition program received 3,532 nominations, demonstrating strong company culture; and

- The REIT ran hundreds of events to bring residents together and create a sense of belonging in communities across the country.

Environmental Stewardship

- The REIT has reduced rental property energy consumption by 17% since 2019;

- Rental property carbon emissions have been reduced by 16% since that time, as the REIT refines and evolves its roadmap toward a net zero carbon future; this includes the deep retrofit at Minto Yorkville, where the REIT aims to reduce energy use by 50% and greenhouse gas emissions by 80%; and

- The REIT has invested $7.4 million in environmental improvements across its property portfolio over the past five years.

The Report adheres to the reporting standards of the Global Reporting Initiative and the Sustainability Accounting Standards Board. It can be found by visiting the REIT’s website at www.mintoapartmentreit.com/about/environmental-social-and-governance.

About Minto Apartment Real Estate Investment Trust

Minto Apartment Real Estate Investment Trust is an unincorporated, open-ended real estate investment trust established pursuant to a declaration of trust under the laws of the Province of Ontario to own, develop and operate income-producing multi-residential properties located in urban markets in Canada. The REIT owns a portfolio of high-quality income-producing multi-residential rental properties located in Toronto, Montreal, Ottawa and Calgary. For more information on Minto Apartment REIT, please visit the REIT’s website at: www.mintoapartmentreit.com.

Forward-Looking Information

This news release may contain forward-looking information within the meaning of applicable securities legislation, which reflects the REIT’s current expectations regarding future events and in some cases can be identified by such terms as “will” and “expected”. Forward-looking information is based on a number of assumptions and is subject to a number of risks and uncertainties, many of which are beyond the REIT’s control that could cause actual results and events to differ materially from those that are disclosed in or implied by such forward-looking information. These risks and uncertainties are more fully described in regulatory filings that can be obtained on SEDAR+ at www.sedarplus.com.

SOURCE Minto Apartment Real Estate Investment Trust

![]() View original content to download multimedia: http://www.newswire.ca/en/releases/archive/September2024/23/c7525.html

View original content to download multimedia: http://www.newswire.ca/en/releases/archive/September2024/23/c7525.html

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Want $1,000 in Annual Dividend Income? Invest $9,550 in These 2 Ultra-High-Yield Stocks

If you’re concerned about having enough money during your retirement years, you’re not alone. A recent survey by the AARP found that 61% of Americans over 50 years old worry they won’t have enough to support themselves in retirement.

Acquiring real estate to rent out is a popular way to set yourself up with more passive income, but each new tenant presents significant risks. Plus, managing properties isn’t nearly as passive as most retirees want it to be.

If individual investors want to build a truly passive income stream, acquiring dividend-paying stocks is the way forward. Ares Capital (NASDAQ: ARCC) and PennantPark Floating Rate Capital (NYSE: PFLT) offer an average yield of 10.5% at recent prices. With yields this high, an investment of about $9,550 spread between them is enough to secure $1,000 in annual dividend payments.

Before you plow every penny you can find into these two stocks, it’s important to remember that an especially high yield means the market is worried the underlying business can’t continue meeting and raising its dividend commitment. Here’s why these two stocks could be far less risky than their ultra-high dividend yields suggest.

1. Ares Capital

Ares Capital is a business development company (BDC), which means it can legally avoid paying income taxes by distributing nearly all its profit to shareholders as a dividend. At recent prices, its dividend offers a 9.3% yield.

For decades now, American banks have been increasingly hesitant to lend money directly to midsize businesses. Since they’re starved for capital, mid-market companies are willing to accept interest rates that are way higher than this BDC’s cost of capital.

Individual borrowers with a job and a decent credit rating can get unsecured personal loans with lower interest rates than Ares receives from midmarket businesses, some of which record over $1 billion in annual sales. The average yield Ares received from its portfolio of debt securities was a healthy 12.2% in the second quarter.

Ares Capital isn’t just any BDC; it’s the largest one with shares that trade on a major stock exchange. With 525 companies already in its portfolio, its team of experienced underwriters receives heaps of new loan applications from businesses they’re already familiar with.

Selecting the best borrowers from a huge selection of applicants has led to industry loss rates. For example, about 1.07% of first-lien BDC loans defaulted over the past 20 years. For Ares Capital, though, less than 0.05% of its first lien loans resulted in a loss.

2. PennantPark Floating Rate Capital

As its name suggests, PennantPark Floating Rate Capital is a BDC that makes middle-market companies borrow at variable interest rates. At recent prices, it offers an 11.7% yield and monthly dividend payments.

PennantPark’s dividend yield is much higher than Ares Capital’s because its smaller portfolio is arguably riskier. While PennantPark is a smaller BDC, a portfolio with 151 different companies is large enough to produce economies of scale. The average yield on its debt securities was 12.1% at the end of June.

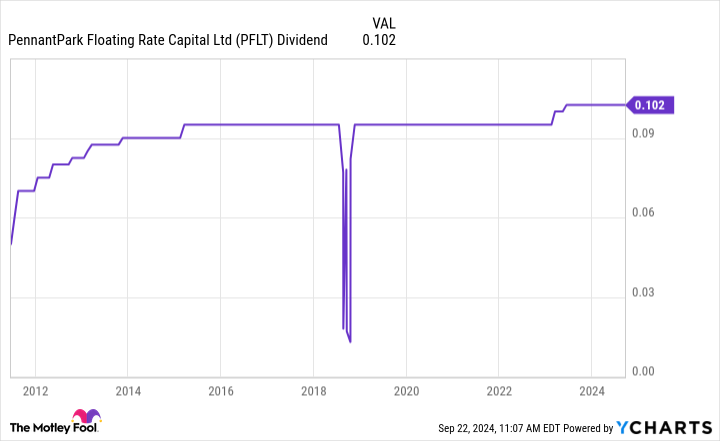

PennantPark Floating Rate Capital has been in operation since before the global financial crisis. It’s been able to maintain or raise its payout since beginning a dividend program in 2011, with a brief exception in 2018.

The average underwriter at PennantPark Floating Rate Capital has more than 26 years of experience, and it shows. The portfolio made it through the higher interest-rate environment we’ve been in since 2022 and hardly received a scratch. At the end of June, just 1.5% of the overall portfolio at cost was on nonaccrual status.

There are no guarantees, but this BDC’s successful track record suggests it can continue delivering heaps of dividend income for many years to come. Adding some shares to a diversified portfolio looks like a smart way to build up your income stream.

Should you invest $1,000 in Ares Capital right now?

Before you buy stock in Ares Capital, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Ares Capital wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $710,860!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 16, 2024

Cory Renauer has positions in Ares Capital. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

Want $1,000 in Annual Dividend Income? Invest $9,550 in These 2 Ultra-High-Yield Stocks was originally published by The Motley Fool

Tradepulse Power Inflow Alert: Booking Holdings Inc. Climbs Over 40 Points After Signal

STOCK CLOSES NEAR HIGH OF THE DAY

Today, TradePulse’s latest Power Inflow alert indicated institutional volume is coming into Booking Holdings Inc. BKNG, signaling a shift from net selling to buying. This shift is a key indicator of rising investor confidence and the potential for an uptrend in BKNG’s stock.

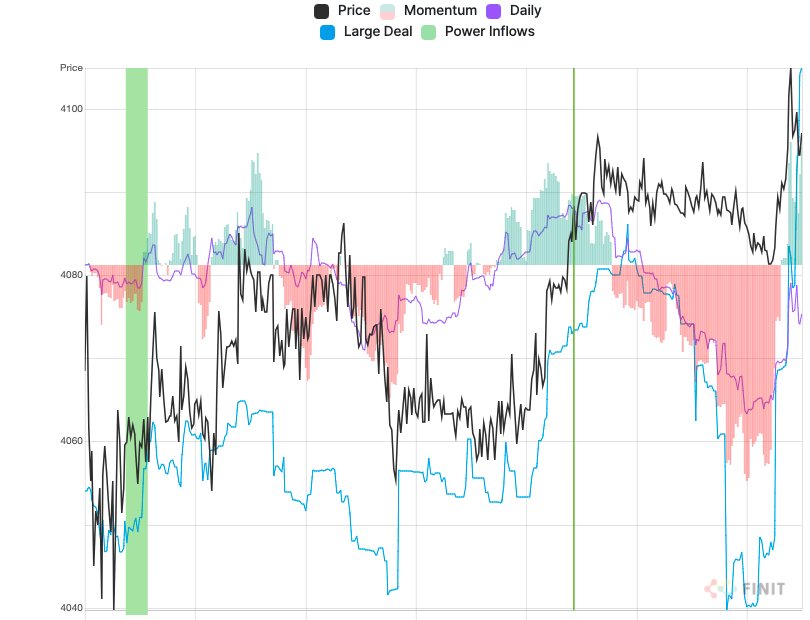

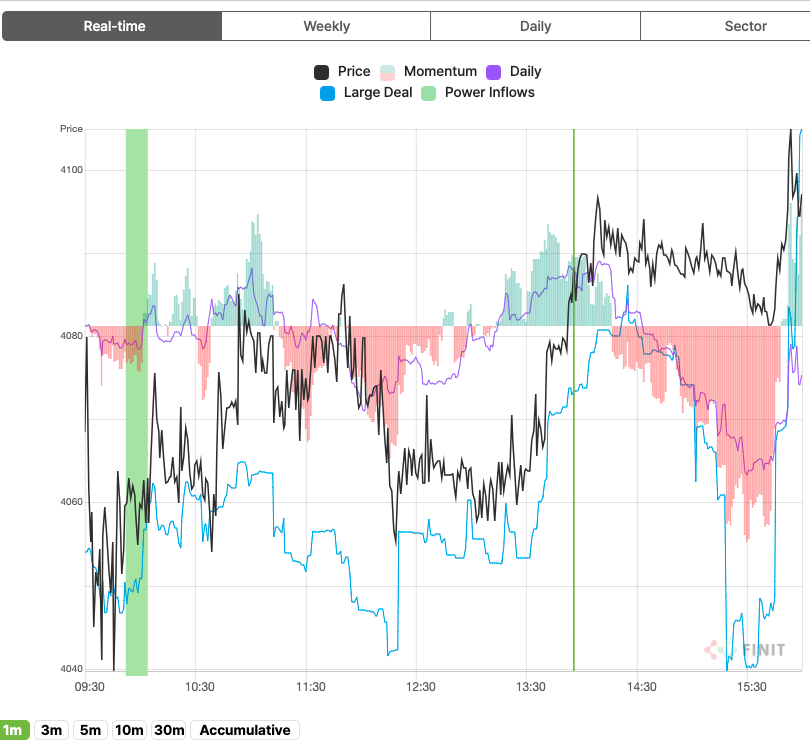

At 10:02 AM ET on September 23rd BKNG registered a Power Inflow at a price of $4062.73. Following this signal, the stock reached its high point at 3:55 EDT, climbing over 40 points ($4104.87) during the day, translating to an approximate increase of 1.0%. This alert is crucial for investors relying on order flow analytics, suggesting the beginning of an uptrend and presenting a valuable opportunity for those anticipating higher prices. Observers are now closely monitoring BKNG for sustained positive momentum, viewing this as a bullish sign.

Understanding Power Inflow:

A Power Inflow is identified by a surge in buy orders over sell orders, typically occurring within the first one or two hours after the market opens. This phenomenon is observed in ten to twenty stocks daily, reflecting the initial strategies and reactions of large institutional investors. Analyzing the size, timing, and price of these transactions helps signal shifts in market sentiment and potential price changes. For those interested in monitoring more stocks exhibiting Power Inflows, visiting the TradePulse website provides comprehensive insights and updates on daily occurrences.

Importance of Power Inflow:

Power Inflows are crucial as they offer early indications of potential uptrends, enabling traders to act even before the market fully adjusts. Such a change is commonly viewed as a sign of larger inflows than retail is capable of producing, indicating institutional interest and a short-term uptrend in the stock. Although not always marking the lowest point, stocks tend to rise following a Power Inflow. This makes these signals especially valuable for identifying strategic entry points and planning short-term investments, as they provide an opportunity to capitalize on upward momentum ahead of wider market recognition.

Strategic Actions Following a Power Inflow:

After detecting a Power Inflow, traders should view it as a potential entry buying point but also confirm the trend with TradePulse’s additional indicators such as Momentum, Daily, and Large Deal flows to ensure its strength and viability. Prompt action, combined with strategic stop-loss settings, can maximize returns and minimize risks. This comprehensive approach allows traders to make more informed decisions, optimizing their trading strategies in alignment with real-time market dynamics.

If you want to stay updated on the latest options trades for Booking Holdings Inc., Benzinga Pro gives you real-time options trade alerts.

Market News and Data are brought to you by Benzinga APIs and include firms, like Finit USA, responsible for parts of the data within this article.

After Market Close UPDATE:

The price at the time of the Power Inflow was $4062.73. The returns on the High price ($4104.87) and Close price ($4097.08) after the Power Inflow were respectively 1.0% and 0.8%. That is why it is important to have a trading plan that includes Profit Targets and Stop Losses that reflect your risk appetite. In this case the high of the day and close were very close but that is not always the case

Past Performance is Not Indicative of Future Results

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Global digital radiography market: $1.6B in 2024 to $1.9B by 2029, CAGR 3.5% | MarketsandMarkets™

Delray Beach, FL, Sept. 23, 2024 (GLOBE NEWSWIRE) — Digital radiography market forecasted to transform from $1.6 billion in 2024 to $1.9 billion by 2029, driven by a CAGR of 3.5%. The key factors driving the growth of the digital radiography market include the rising prevalence of musculoskeletal disorders and sports-related injuries, particularly among the elderly and athletes. This, along with continuous technological advancements, the increasing demand for early diagnosis, and a shift toward non-invasive procedures, is expected to drive the market for digital radiography. The hospitals segment, especially in emerging economies, is positively influencing market expansion due to rising healthcare investments. Additionally, supportive government initiatives, such as healthcare reforms and subsidies for advanced medical equipment, are expected to further propel market growth during the forecast period.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=51436065

Browse in-depth TOC on “ Digital Radiography Market“

204 – Tables

54 – Figures

222 – Pages

Based on product, the digital radiography market is segmented into fixed digital radiography system (floor-to-ceiling-mounted systems and ceiling-mounted systems) and portable digital radiography systems (mobile systems and handheld systems). The fixed digital radiography system segment to hold the largest share of the market in 2023.

Digital radiography technology allows the acquisition and processing of images immediately, thus obviating development time of films and shortening patients’ waiting times. It enhances workflow and patients’ passage in heavy clinical settings. Besides, the images that result from digital radiography system are quite well stored, retrieved, and shared in an electronic format, and so can easily fit into the systems of electronic health records for remote consultation and collaboration among different health professionals.

Based on type, the digital radiography market is segmented into retrofit digital systems and new digital systems. The retrofit digital system segment to hold the largest share of the market in 2023. The retrofit digital systems segment has gained so much ground in the digital radiography market. This is because retrofitting of the already existing system, analog or CR, becomes relatively very cheap in relation to buying the completely new electronic radiography system. Such a feature is very significant for institutions with low budgets.

Based on application, the digital radiography market is segmented into chest imaging, pediatric imaging, cardiovascular imaging, orthopedic imaging, and other application. The chest imaging application segment is expected to dominate this market during the forecast period and is estimated to grow at a CAGR of 4.4% during the forecast period.

Growth in this market can be attributed technology such as high image resolution, rapid image acquisition, and the ability to easily share images for remote consultations, making it well-suited for diagnosing chest conditions efficiently and effectively.

Based on end user, the digital radiography market is segmented into hospitals, diagnostic imaging centers, orthopedic clinic, and other end users. Hospitals are expected to dominate the market during the forecast period.

The growing demand for more efficient and higher-version diagnostic imaging technologies leads many hospitals and imaging centers to invest in digital radiography systems to build more capabilities in the diagnosis, treatment planning, and monitoring of patients.

By region, the digital radiography market is further divided into five main geographies: North America, Europe, the Asia Pacific, Latin America, and Middle East & Africa. North America accounted for the largest share of the digital radiography market in the year 2023. Europe and Asia-Pacific held the second and third largest shares of the digital radiography market, respectively.

This region offers a greater environment for digital radiography systems due to the well-established healthcare infrastructure and high technology adoption rates. Moreover, increasing burden of chronic diseases and rising aging population in North America results in an increasing demand for diagnostic imaging in the process of disease management and treatment. Such factors help drive the market for digital imaging systems in the Asia Pacific and draw foreign investments. It can also be attributed to the high healthcare spending in the region, rising prevalence of target diseases, increasing research activities, growing number of cancer surgeries, and technological advancements in orthopedic care braces.

Request for FREE Sample Pages: https://www.marketsandmarkets.com/requestsampleNew.asp?id=51436065

The top players in the digital radiography market utilize some of the key strategies that help them stay ahead in the competition. Continuing research and development allows companies to come up with new, innovative, and technologically advanced digital radiography systems and improve their product lineups. Strategic partnerships and collaborations with healthcare providers and institutions are also done to get greater market share and increase their reach. The key players focus on customer-oriented strategies that involve a full range of training, support, and maintenance services to enhance user experience and satisfaction. Siemens Healthineers, (Germany), accounted for the leading position in the Digital radiography market in the year 2023, followed by Philips Healthcare, Netherlands, GE Healthcare, (US), Canon, Inc., (Japan), and FUJIFILM Holdings Corporation, (Japan).

SIEMENS HEALTHINEERS (GERMANY)

Siemens Healthineers is one of the global leaders in medical technologies, including digital radiography systems. Their digital radiography systems unite ultra-modern technologies with sophisticated imaging possibilities for generating first-class diagnostic images while keeping a sharp eye on patient safety and comfort. Siemens Healthineers’ digital radiography systems provide healthcare facilities with as much diversity in requirements as possible. Equipped with versatile configurations, the systems accommodate a wide range of clinical applications, from routine diagnostic imaging to specialized procedures. These machines are equipped with user-friendly graphical interfaces and workflow optimization tools, enabling the whole process of imaging to be streamlined for healthcare professionals to effectively acquire and interpret images. Siemens Healthineers is working relentlessly to evolve this digital radiography technology, focusing on innovation and continuous improvement. With modern challenges and demands shifting in healthcare, every effort combines to make patients better and to deliver advanced services in diagnostic imaging worldwide.

PHILIPS HEALTHCARE. (NETHERLANDS)

Philips is among the top four players in the digital radiography market. The company believes in research & development activities to maintain its leading position in the | digital radiography market. The company spends over 10% of its annual turnover on R&D activities and product development that has helped the company to launch innovative products continuously in the market. For instance, CombiDiagnost R90, Digital Diagnost C90, and ProxiDiagnost N90 are some of the products launched by the company in the last three years. The company also focuses on teleradiology services and has launched SHINEFLY in collaboration with Digital China Health of China for the Chinese market. Philips also follows inorganic growth strategies in the form of partnerships, collaborations, and acquisitions. The strong product portfolio of the company, its geographical presence, and ongoing partnerships and agreements are well complemented by frequent launches, which have further strengthened this position in the market.

For More information, Inquire Now.

Related Reports:

Medical Equipment Maintenance Market

Ultrasound Market

Diagnostic Imaging Market

Diagnostic Imaging Services Market

Nuclear Imaging Equipment Market

Get access to the latest updates on Digital Radiography Market Companies and Digital Radiography Market Size

About MarketsandMarkets™ MarketsandMarkets™ has been recognized as one of America's best management consulting firms by Forbes, as per their recent report. MarketsandMarkets™ is a blue ocean alternative in growth consulting and program management, leveraging a man-machine offering to drive supernormal growth for progressive organizations in the B2B space. We have the widest lens on emerging technologies, making us proficient in co-creating supernormal growth for clients. Earlier this year, we made a formal transformation into one of America's best management consulting firms as per a survey conducted by Forbes. The B2B economy is witnessing the emergence of $25 trillion of new revenue streams that are substituting existing revenue streams in this decade alone. We work with clients on growth programs, helping them monetize this $25 trillion opportunity through our service lines - TAM Expansion, Go-to-Market (GTM) Strategy to Execution, Market Share Gain, Account Enablement, and Thought Leadership Marketing. Built on the 'GIVE Growth' principle, we work with several Forbes Global 2000 B2B companies - helping them stay relevant in a disruptive ecosystem. Our insights and strategies are molded by our industry experts, cutting-edge AI-powered Market Intelligence Cloud, and years of research. The KnowledgeStore™ (our Market Intelligence Cloud) integrates our research, facilitates an analysis of interconnections through a set of applications, helping clients look at the entire ecosystem and understand the revenue shifts happening in their industry. To find out more, visit www.MarketsandMarkets™.com or follow us on Twitter, LinkedIn and Facebook. Contact: Mr. Rohan Salgarkar MarketsandMarkets Inc. 1615 South Congress Ave. Suite 103, Delray Beach, FL 33445 USA : 1-888-600-6441 UK +44-800-368-9399 Email: sales@marketsandmarkets.com Visit Our Website: https://www.marketsandmarkets.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

China Raises Retirement Age For The First Time In Decades: What It Means For Global Pension Systems

China, a country with one of the lowest retirement ages in the world, will raise its retirement age starting in January 2025. At that time, China will gradually increase its retirement age over the next 15 years.

Currently, the retirement ages in China are 60 for men and 50 for women in blue-collar jobs and 55 for women in white-collar jobs. The increase will put the retirement age for men at 63 and for women, it will be 55 for blue-collar workers and 58 for white-collar workers.

Don’t Miss:

Why is China Raising Its Retirement Age?

China’s current retirement ages were set in the 1950s when life expectancy was much lower. Back then, people lived to be around 40 years old. Now, the average life expectancy in China is about 77 years old. With a larger aging population, the country is facing a problem as there are fewer people to fund China’s pension system.

By 2035, about 400 million people in China will be over 60. China’s pension system is dependent on contributions from current workers. However, with fewer people in younger generations, the workforce is smaller than the aging population. Experts have even warned that the public pension fund could run out of money by 2035 if no changes are made.

A Global Issue

China isn’t the only country facing this problem. The United States and other countries in Europe and Asia struggle to determine the best ways to support their aging populations. If some real change isn’t made, the U.S. Social Security system won’t be able to pay full benefits to its beneficiaries starting in 2033.

Like China, the U.S. depends on payroll taxes from current workers to fund retirement benefits. As the number of retirees grows and the number of younger workers shrinks, pension systems are feeling the strain.

Trending: Mark Cuban believes “the next wave of revenue generation is around real estate and entertainment” — this new real estate fund allows you to get started with just $100.

Short-Term Pain, Long-Term Gain

China’s decision to raise the retirement age will help stabilize its pension system, but the change won’t be easy. The country already faces high unemployment among young people, and older workers staying longer could worsen this problem. However, most experts agree that this change is necessary to protect the future of China’s pension fund.

“This is happening everywhere,” said Yanzhong Huang, a senior fellow at the Council on Foreign Relations. “But in China, with its large elderly population, the challenge is much larger.”

Trending: Founder of Personal Capital and ex-CEO of PayPal re-engineers traditional banking with this new high-yield account — start saving better today.

Global Implications

China’s move could influence other countries to reexamine their pension systems. As life expectancy continues to rise and birthrates fall, many countries will have to raise their retirement age or risk running out of funds for retirees. Japan, Germany and France have made similar changes in recent years to help keep their pension systems afloat.

China’s policy change might serve as a wake-up call for the U.S. and other nations. Governments must find creative ways to adjust their pension systems to avoid long-term financial problems.

Read Next:

UNLOCKED: 5 NEW TRADES EVERY WEEK. Click now to get top trade ideas daily, plus unlimited access to cutting-edge tools and strategies to gain an edge in the markets.

Get the latest stock analysis from Benzinga?

This article China Raises Retirement Age For The First Time In Decades: What It Means For Global Pension Systems originally appeared on Benzinga.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Obama Era Treasury Secretary Slams Trumponomics, Warns It Could Unanchor Long-Term Inflation Expectations And Lead To 'Higher Wages And Prices'

Ahead of the 2024 presidential election, former Treasury Secretary Lawrence Summers has raised concerns about the economic policies proposed by Donald Trump, warning they could destabilize long-term inflation expectations.

What Happened: Summers, a notable economist and former Treasury Secretary under 44th U.S. President Barack Obama, criticized Trumponomics in a post on X on Monday. According to Summers, the economic policies proposed by Trump could destabilize long-term inflation expectations.

Summers expressed concerns that political interference with the central bank might lead to higher wages and prices. He stated, “Long term inflation expectations are anchored by the judgment that a politically independent central bank will impose restrictive policy if inflation becomes excessive.”

Summers cited an article by the Financial Times discussing Trumponomics and its potential impact on the economy. The article highlighted that Trump’s proposed tariffs could damage the economy and increase global tensions.

Summers also criticized Trump’s plan to cap credit card interest rates, calling it a “far more egregious price control than anything Democrats have suggested.” He added that such measures could constrain credit costs significantly away from market levels.

See Also: Oil Falls, Energy Stocks Flat As Fears Of Demand Drop Eclipse Israel-Hezbollah Conflict Escalation

Why It Matters: The economic policies proposed by Trump have been a focal point of debate, especially as the 2024 presidential election approaches.

Recent surveys indicate a shift in voter sentiment, with Vice President Kamala Harris gaining ground over Trump. According to a recent survey, Harris has moved from a 13-point deficit to a 7-point lead over Trump among fund managers, strategists, and economists.

Trump’s economic proposals, including tax cuts, tariffs, and mass deportations, have drawn significant scrutiny. Economists warn that these measures could trigger skyrocketing inflation. Trump’s stance on tariffs, in particular, has been criticized for potentially exacerbating inflationary pressures.

Moreover, Trump’s dissatisfaction with the Federal Reserve’s recent decision to cut interest rates by 50 basis points has added another layer of complexity to the economic discourse. Trump suggested that the rate cut might indicate a faltering U.S. economy or be a politically motivated action.

Read Next:

Image Via Shutterstock

This story was generated using Benzinga Neuro and edited by Kaustubh Bagalkote

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Behind the Scenes of Iris Energy's Latest Options Trends

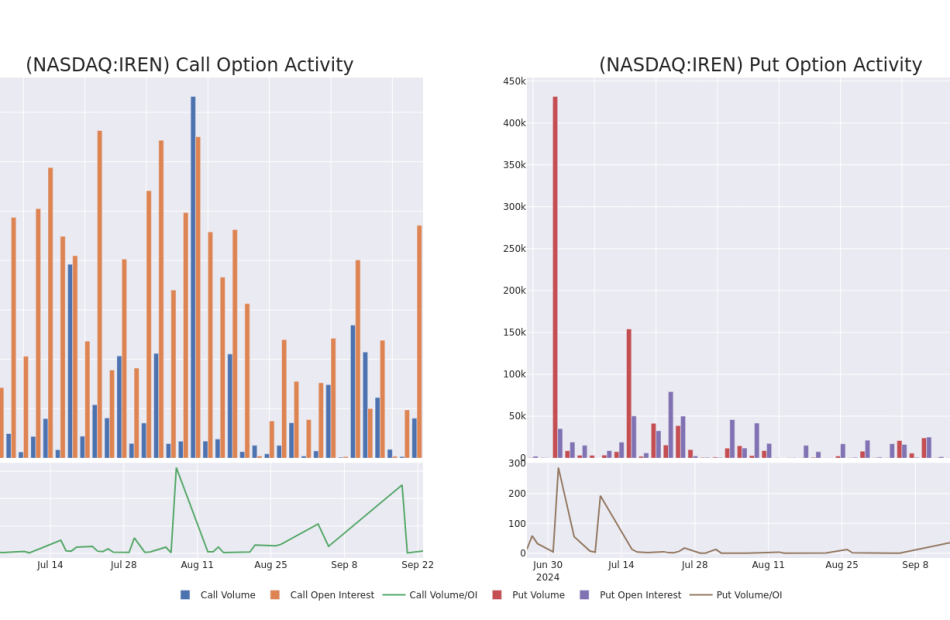

Financial giants have made a conspicuous bullish move on Iris Energy. Our analysis of options history for Iris Energy IREN revealed 9 unusual trades.

Delving into the details, we found 77% of traders were bullish, while 22% showed bearish tendencies. Out of all the trades we spotted, 2 were puts, with a value of $81,860, and 7 were calls, valued at $324,239.

Projected Price Targets

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $7.5 to $19.0 for Iris Energy over the last 3 months.

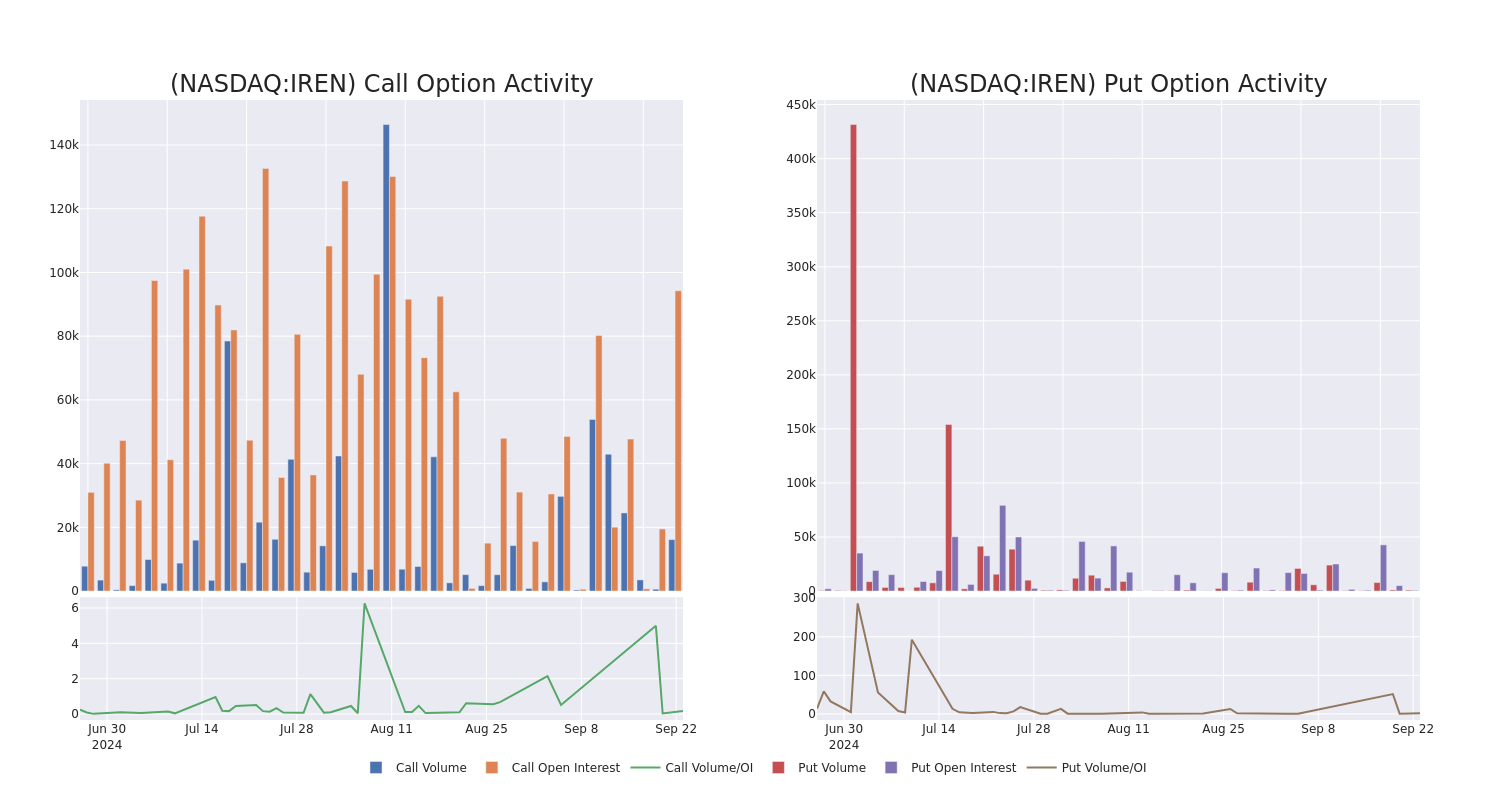

Insights into Volume & Open Interest

In terms of liquidity and interest, the mean open interest for Iris Energy options trades today is 13550.0 with a total volume of 16,946.00.

In the following chart, we are able to follow the development of volume and open interest of call and put options for Iris Energy’s big money trades within a strike price range of $7.5 to $19.0 over the last 30 days.

Iris Energy Call and Put Volume: 30-Day Overview

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| IREN | CALL | TRADE | BULLISH | 10/18/24 | $0.1 | $0.05 | $0.1 | $15.00 | $100.0K | 35.6K | 10.0K |

| IREN | CALL | TRADE | BULLISH | 11/15/24 | $0.3 | $0.25 | $0.3 | $15.00 | $54.0K | 17.5K | 3.0K |

| IREN | CALL | TRADE | BULLISH | 01/17/25 | $2.2 | $2.0 | $2.15 | $7.50 | $43.0K | 6.2K | 202 |

| IREN | PUT | TRADE | BEARISH | 09/27/24 | $2.05 | $1.95 | $2.05 | $10.00 | $40.9K | 605 | 505 |

| IREN | PUT | SWEEP | BEARISH | 09/27/24 | $2.05 | $2.0 | $2.04 | $10.00 | $40.8K | 605 | 305 |

About Iris Energy

Iris Energy Ltd is a Bitcoin mining company. It builds, owns, and operates data centers and electrical infrastructure for the mining of Bitcoin powered by renewable energy. The company’s mining operations generate revenue by earning Bitcoin through a combination of block rewards and transaction fees from the operation of its specialized computers called Application-specific Integrated Circuits and exchanging these Bitcoin for currencies such as USD or CAD on a daily basis.

Following our analysis of the options activities associated with Iris Energy, we pivot to a closer look at the company’s own performance.

Where Is Iris Energy Standing Right Now?

- Trading volume stands at 16,671,413, with IREN’s price up by 5.73%, positioned at $7.94.

- RSI indicators show the stock to be may be approaching overbought.

- Earnings announcement expected in 49 days.

Expert Opinions on Iris Energy

5 market experts have recently issued ratings for this stock, with a consensus target price of $13.9.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* An analyst from Compass Point persists with their Buy rating on Iris Energy, maintaining a target price of $16.

* An analyst from HC Wainwright & Co. has decided to maintain their Buy rating on Iris Energy, which currently sits at a price target of $13.

* Consistent in their evaluation, an analyst from Macquarie keeps a Outperform rating on Iris Energy with a target price of $13.

* Maintaining their stance, an analyst from B. Riley Securities continues to hold a Buy rating for Iris Energy, targeting a price of $12.

* Maintaining their stance, an analyst from Canaccord Genuity continues to hold a Buy rating for Iris Energy, targeting a price of $15.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Iris Energy with Benzinga Pro for real-time alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Cryogenic Equipment Market Size Expected to Targets $16.6 Billion, at a 6.9% CAGR by 2028 – Report by MarketsandMarkets™

Delray Beach, FL, Sept. 23, 2024 (GLOBE NEWSWIRE) — Cryogenic Equipment Market size is projected to grow from USD 11.9 billion in 2023 to USD 16.6 billion by 2028, at a CAGR of 6.9% according to a new report by MarketsandMarkets™. The cryogenic equipment market is heavily dependent on the consumption of industrial gases that are liquefied for high-volume storage purposes. oxygen, nitrogen, argon, and hydrogen, wherein oxygen and nitrogen are such major industrial gases used across end-user industries for numerous applications. The increasing use of these industrial gases in industries such as energy & power, metallurgy, electronics, chemicals, and transportation is likely to propel the demand for cryogenic equipment. Moreover, growing popularity of liquefied natural gas as source of clean and efficient energy, will boost the demand for cryogenic equipment for the transportation and storage at LNG liquefaction and regasification terminals.

Browse in-depth TOC on “Cryogenic Equipment Market”

273 – Tables

64 – Figures

307– Pages

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=735

Scope of the Report

| Report Metric | Details |

| Cryogenic Equipment Market Size Values |

|

| Base Year | 2022 |

| Forecast Period | 2023–2028 |

| Forecast Unit | Value (USD Billion) |

| Segments Covered | Cryogenic Equipment Market by Equipment, Cryogen, End-user Industry, System Type, Application, and Region. |

| Geographic Regions Covered | Asia Pacific, North America, Europe, South America, Middle East and Africa. |

| Companies Covered | Linde plc (Ireland); Air Liquide (France); Air Products and Chemicals, Inc. (US); Chart Industries (US); Parker Hannifin Corp. (US); Flowserve Corporation (US); Nikkiso Co., Ltd. (Japan); INOX India Limited (India); SHI Cryogenics Group (Japan); Emerson Electric Co. (US); Sulzer Ltd (Switzerland); Taylor-Wharton (US); Wessington Cryogenics (UK); PHPK Technologies (US); Acme Cryo (US); Five SAS (France); HEROSE GMBH (Germany); Shell-N-Tube (India); CRYOFAB (US); Cryostar (France) |

by equipment Segment

Valves are expected to hold the second-largest market share in the Cryogenic Equipment Market during the forecast period. Cryogenic valves are essential for handling liquefied gases, particularly in LNG, LPG, and other cryogenic processes. These valves are vital for maintaining leak-free operations during heating and cooling cycles. There is a variety of cryogenic valve types, including manual and actuated globe valves, gate valves, emergency shut-off gate valves, manual and actuated ball valves, safety relief valves, needle valves, check valves, and control valves. They have diverse applications in industries such as solar panel manufacturing, specialty gases, metallurgy, rubber production, food processing, healthcare, automotive, chemicals, transportation, and electronics.

by Cryogen Segment

Based on the cryogen, the Cryogenic Equipment Market is segmented into nitrogen, argon, oxygen, liquified natural gas (LNG), hydrogen, and other cryogens. The LNG segment is expected to grow at the highest rate during the forecast period due to increasing investments in LNG infrastructure LNG is a globally traded commodity, with its demand as a cleaner energy source surging worldwide. This has led to the expansion of LNG infrastructure to support international trade and the increasing need for LNG across different regions. LNG’s ease of transport has unlocked previously unprofitable natural gas reserves that were once considered economically unviable due to the high costs associated with pipeline infrastructure. To address the surging LNG demand, countries are making significant investments in LNG storage and regasification infrastructure.

By Application

The Cryogenic Equipment Market is segmented into CASU and non-CASU. The non-CASU segment is expected to be the fastest growing market during the forecast period. The market for non-CASU includes the demand for cryogenic equipment across various applications, such as rail & road transport, bulk carrier ships, LNG liquefaction & regasification terminals, and other minor applications. By expanding the ecosystem for air separation technology, the non-cryogenic air separation units (ASUs) can indirectly support the rising demand for cryogenic equipment. Non-cryogenic ASUs work at room temperature and do not directly involve cryogenic processes. Non-cryogenic units have advantages over cryogenic ones for industries and applications that do not need high-purity gases produced by cryogenic ASUs. As industries grow and their need for higher purity gases increases, cryogenic equipment and air separation technologies are likely to become more essential.

Request Sample Pages: https://www.marketsandmarkets.com/requestsampleNew.asp?id=735

Asia Pacific is expected to be the largest region in the Cryogenic Equipment Industry.

Asia Pacific is expected to be the largest Cryogenic Equipment Market during the forecast period. The Asia Pacific region comprises major economies such as China, India, Australia, Japan, Malaysia, and Rest of Asia Pacific. Rest of Asia Pacific primarily includes Thailand, the Philippines, Singapore, Indonesia, and Myanmar. The high growth rate and market share of the Asia Pacific region can be attributed to constant LNG infrastructure developments in China, investments in the aerospace industry in India, and increasing investments in gas production and LNG imports in Australia and Japan, respectively. The significant demand for cryogenic equipment in the region is witnessed by end-user industries such as healthcare, metallurgy, energy & power, and electronics.

Key Market Players

Due to their strong supply network, a few global and regional players hold a strong foothold in the Cryogenic Equipment Companies. Linde plc (Ireland); Air Liquide (France); Air Products and Chemicals, Inc. (US); Chart Industries (US); Parker Hannifin Corp. (US); Flowserve Corporation (US); Nikkiso Co., Ltd. (Japan); and INOX India Limited (India) are the market leaders in the global Cryogenic Equipment Market. These companies have adopted strategies such as partnerships, contracts, agreements, acquisitions, and expansions to increase their market share.

Make an Inquiry: https://www.marketsandmarkets.com/Enquiry_Before_BuyingNew.asp?id=735

Browse Related Reports:

Cryogenic Pump Market – Global Forecast to 2027

Hydrogen Generation Market – Global Forecast to 2028

Hydrogen Market – Global Forecast to 2030

About MarketsandMarkets™ MarketsandMarkets™ has been recognized as one of America's best management consulting firms by Forbes, as per their recent report. MarketsandMarkets™ is a blue ocean alternative in growth consulting and program management, leveraging a man-machine offering to drive supernormal growth for progressive organizations in the B2B space. We have the widest lens on emerging technologies, making us proficient in co-creating supernormal growth for clients. Earlier this year, we made a formal transformation into one of America's best management consulting firms as per a survey conducted by Forbes. The B2B economy is witnessing the emergence of $25 trillion of new revenue streams that are substituting existing revenue streams in this decade alone. We work with clients on growth programs, helping them monetize this $25 trillion opportunity through our service lines - TAM Expansion, Go-to-Market (GTM) Strategy to Execution, Market Share Gain, Account Enablement, and Thought Leadership Marketing. Built on the 'GIVE Growth' principle, we work with several Forbes Global 2000 B2B companies - helping them stay relevant in a disruptive ecosystem. Our insights and strategies are molded by our industry experts, cutting-edge AI-powered Market Intelligence Cloud, and years of research. The KnowledgeStore™ (our Market Intelligence Cloud) integrates our research, facilitates an analysis of interconnections through a set of applications, helping clients look at the entire ecosystem and understand the revenue shifts happening in their industry. To find out more, visit www.MarketsandMarkets™.com or follow us on Twitter, LinkedIn and Facebook. Contact: Mr. Rohan Salgarkar MarketsandMarkets™ INC. 1615 South Congress Ave. Suite 103, Delray Beach, FL 33445 USA: +1-888-600-6441 Email: sales@marketsandmarkets.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.