I'm Getting Divorced at 55 With $800k in My 401(k). How Can I Safeguard My Finances?

SmartAsset and Yahoo Finance LLC may earn commission or revenue through links in the content below.

Like all family and property law, divorce is a highly state-specific process. How you will handle a divorce and protect your assets, and what constitutes individual vs. shared assets, will depend entirely on your jurisdiction. As a result, how retirement accounts are treated during divorce proceeds can vary widely from state to state.

If you need financial advice during or after a divorce, consider connecting with a fiduciary financial advisor today.

The first step is typically to separate personal from marital assets. In most cases, you retain assets and debts that predated the marriage, and you split assets and debts that you acquired while you were married. This is far more complicated than it sounds, as it’s very easy for assets to comingle and share accrued value during the course of a marriage.

For example, say that you are 55 years old with $800,000 in a 401(k). The most important part of this will be where you live and how much of the account was earned during the marriage. From there, a divorce court will typically divide up the 401(k) based on your household’s overall assets and, in particular, any other retirement accounts held by you or your spouse.

While a complete discussion of this issue is far beyond the scope of a single article, we’ll explore some of the most important factors to consider below.

Retirement Accounts and Divorce

Divorce courts typically do not give special status to a couple’s tax-advantaged retirement accounts. A judge will treat these portfolios as a standard financial asset, splitting up each account based on the overall distribution of assets, the parties’ relative financial status and an account’s marital vs. personal status, among other factors.

There is no tax penalty for taking early withdrawals in order to transfer retirement assets between divorcing spouses. This is typically done through a “Qualified Domestic Relations Order” or a “Transfer Incident to Divorce” depending on the nature of the account.

You can move these funds directly into another qualifying pre-tax account without triggering income taxes or an early withdrawal penalty.

For example, say that you have $800,000 in a 401(k), of which you had $300,000 in the account when you got married. Typically, you will keep that $300,000. The remaining $500,000 might be considered a marital asset and be distributed between you and your spouse. You might then agree to split that money 50/50, and draft a QDRO to remove $250,000 worth of assets from your 401(k) and move them to an account of your spouse’s choosing.

Retirement accounts may be distributed directly, with one spouse receiving the assets or their cash equivalent at the time of divorce. Assets can also be shared in retirement, with each spouse taking income or distributions according to the terms of their divorce. This is most common with a more structured retirement asset, like an annuity or a pension, which can be difficult to split apart.

Whether you’re just starting the divorce proceedings or have completed them, a financial advisor can help you set and plan for new financial goals given this major life change.

Community vs. Equity States

There are two main ways that states deal with divorce assets: community or equity.

Community property has become increasingly disfavored, so relatively few states (nine in total) still practice it. Under this scheme, a court will order marital assets split evenly between the spouses upon divorce, with each spouse taking half. Here, for example, under a community property scheme a court would simply give each spouse 50% of the marital component of the 401(k).

Equity, or “equitable distribution,” is increasingly the standard model. Under this approach, courts will attempt to distribute divorce assets equitably, not necessarily evenly. The court will consider several factors including (but not limited to) length of the marriage, child custody arrangements, work and careers, financial and personal contributions to the marriage, earnings potential, and in some cases, fault and bad actions.

In the case of a retirement fund, a court might also consider issues like age of spouses (who has more time to save up), future Social Security benefits of each spouse, and other retirement assets held by each spouse. For example, if you are 55 and your spouse is 45, the court might give you more of the 401(k)’s assets since you have less time remaining until retirement. On the other hand, if you hold $800,000 in your 401(k) and your spouse has $750,000 in theirs, a court might transfer few (if any) assets between two similarly-situated parties.

Whether you live in a community property or equitable distribution state, a financial advisor can help you consolidate the assets you receive in a divorce and construct a comprehensive financial plan around them.

Protecting Your Assets and Tax Status

The truth is, there are few legitimate ways to protect your marital assets from divorce proceedings. Much advice on this subject shades on illegality, since trying to hide your assets or obscure their marital history may constitute fraud. As a result, most advice to move your assets or change their tax status is at best unhelpful, at worst legally suspect.

Some advice recommends that you stop contributing to a 401(k) during divorce proceedings. While this will (modestly) reduce the gains that your spouse can claim, it will equivalently reduce your own gains, and will not change the distribution of the underlying cash.

While a financial advisor can be a valuable resource during a divorce, there are a few basic steps you can take:

1. Establish Your Own Bank Accounts

First, once divorce begins, establish your own bank accounts. Cash flow will be critical. You will need to pay legal bills, establish your own household, begin building a separate credit history and more. You also may want to buy your spouse out of their share of the retirement portfolio. For example, say that you hold an $800,000 401(k) based on stock options from your employer. You might want to keep those assets invested. In that case, you might want to accrue cash so that you can pay your spouse the equivalent value for their share of the 401(k), trading the cash for the more-valuable portfolio assets.

Although your spouse may choose to decline your offer if they also prefer the long-term value assets.

2. Prevent Your Spouse from Cashing Out 401(k)

You’ll also want to immediately speak with your divorce attorney and 401(k) plan administrator. It is not uncommon in divorce proceedings for spouses to attempt to sell, move or spend assets. In some cases, this is an effort to disrupt the proceedings, for example by converting identifiable securities into obscure personal property. In other cases, it is simply an attempt to destroy or devalue shared assets out of spite.

Regardless of the purpose, you want to address this up front. It’s far easier to prevent your spouse from cashing out the 401(k) than to try and claw that money back.

3. Collect and Create Explicit Records

You want know exactly what you own and where. Clearly document any financial transactions that you make and pay attention to any conducted by your spouse. This paperwork includes addressing the beneficiaries on all policies, like your 401(k) and life insurance. You don’t want your spouse to retain authority or rights under those accounts, regardless of how they’re divided up.

4. Be Mindful of the Tax Status of Assets

Finally, pay attention to the tax status of your settled assets. For example, say that you have an $800,000 Roth IRA in addition to your $800,000 401(k). Don’t accept a divorce settlement that treats those as equivalently valuable assets, because the Roth account likely has far more value than the other. Make sure that you and your lawyer insist on treating your 401(k) as the pre-tax asset it is, and not the $800,000 asset it appears to be.

Bottom Line

Protecting your assets during a divorce is difficult, because as far as the law is concerned they aren’t your assets. They belong equally to your spouse. But you can put yourself in a better position by remembering to track your money and valuing it for its long-term, after-tax value.

Financial Tips for Divorce

-

Getting a divorce is stressful and painful, especially since it involves some of the most complex financial transactions any household will conduct. While it’s important to have legal and financial professionals there to help you through the process, you should also understand exactly what goes into it.

-

Finding a financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to three vetted financial advisors who serve your area, and you can have a free introductory call with your advisor matches to decide which one you feel is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

-

Keep an emergency fund on hand in case you run into unexpected expenses. An emergency fund should be liquid — in an account that isn’t at risk of significant fluctuation like the stock market. The tradeoff is that the value of liquid cash can be eroded by inflation. But a high-interest account allows you to earn compound interest. Compare savings accounts from these banks.

-

Are you a financial advisor looking to grow your business? SmartAsset AMP helps advisors connect with leads and offers marketing automation solutions so you can spend more time making conversions. Learn more about SmartAsset AMP.

Photo credit: ©iStock.com/Jacob Wackerhausen, ©iStock.com/Vimvertigo, ©iStock.com/Rawf8

The post I’m Getting Divorced This Year at 55 With $800k in a 401(k). How Do I Protect My Finances? appeared first on SmartReads by SmartAsset.

Dividend Investor Who Saved For Years Working '3 Jobs, 7 Days A Week' Reached $5,500 Monthly Income Portfolio Shares His Stock Picks And Secrets

Benzinga and Yahoo Finance LLC may earn commission or revenue on some items through the links below.

Dividend investing isn’t easy. It takes research, time, discipline and perseverance to reach a monthly dividend income significant enough to pay your bills. But there’s no shortage of inspiring success stories that show it can be done.

A dividend investor on Reddit shared their detailed income report about a month ago on r/Dividends, saying he reached his goal of making $5,500 per month in dividend income. He urged fellow investors to be patient and work hard to reach their financial goals.

Trending Now:

“I had three jobs for the longest time, working seven days for many years in my 20s and most of 30s. While I only started stock investments about three years ago as I was heavy in real estate investments, it took me years to save a chunk of money to use as seed money,” he said.

Asked what jobs he worked, the Redditor said he worked simultaneously as a full-time nurse, weekend nurse and weekend restaurant waiter for several years. The investor was repeatedly asked for tips and secrets for a successful dividend investing journey. They said:

“First, you gotta work, discipline yourself not to spend and save all you can. That’s the first step. Disciplining yourself to save is just as important as investing.”

The investor was also asked if they got burned out because of three jobs. Here is the response:

“I didn’t have time to think or feel ‘burned out’ because I was that hungry, desperate and determined to get myself and my family out of poverty.”

The Redditor shared their detailed portfolio with fellow investors. It had 45 positions and a total value of about $1.1 million. Let’s look at some of the highest-yielding dividend stocks in the portfolio.

Enterprise Products Partners

Midstream energy company Enterprise Products Partners LP (NYSE:EPD) has a dividend yield of about 7% and 26 consecutive years of dividend increases. The stock has gained about 10% so far this year. The Redditor, earning about $5,500 per month in dividends, had about $153,700 invested in the company. EPD was the biggest position in the portfolio.

JPMorgan Equity Premium Income ETF

The Redditor, earning $5,500 per month in dividends, had about $152,300 invested in JPMorgan Equity Premium Income ETF, which is gaining popularity among income investors. JPMorgan Equity Premium Income ETF (NYSE:JEPI) makes money by investing in large-cap U.S. stocks and selling call options. JEPI is suitable for investors looking to gain exposure to defensive stocks. It usually underperforms during bull markets and protects investors against huge losses during bear markets since most of its portfolio consists of large, defensive equities like Trane Technologies PLC (NYSE:TT), Southern Co (NYSE:SO), Progressive Corp (NYSE:PGR) and others.

Ares Capital

Business development and investment company Ares Capital Corporation (NASDAQ:ARCC) was the third biggest holding of the Redditor, who said he was earning $5,500 per month in dividend income. Oppenheimer recently recommended Ares Capital Corporation (NASDAQ:ARCC), believing the stock is positioned to gain in both Republican and Democratic governments.

Altria Group

The investor earning $5,500 per month in dividends had invested about $80,000 in Altria Group (NYSE:MO), a stock with a dividend yield of about 8%. The tobacco products company has increased its payouts for 55 years. While the tobacco industry’s troubles amid declining use of traditional tobacco products have made Altria Group (NYSE:MO) investors uneasy, they are hopeful about the company’s transition toward e-vapors and nicotine pouches.

Blackstone Secured Lending

Blackstone Secured Lending (NYSE:BXSL) is a business development company that mainly invests in private U.S. companies’ first-lien senior secured debt. The company has a dividend yield of about 11% and over 95% of its investments are first-lien senior secured, which means its loans are safe and have assurances for repayments even if borrowers default.

Don’t Miss:

Realty Income

It’s rare to see a high-income dividend portfolio shared on Reddit without Realty Income Corp (NYSE:O). The REIT’s stock yields about 5.2% and has upped its payouts for 30 consecutive years. Analysts believe Realty Income Corp (NYSE:O) has better days ahead as its tenants include retailers who will see more foot traffic amid a decline in inflation and interest rate cuts.

Schwab U.S. Dividend Equity ETF

Schwab U.S. Dividend Equity ETF (NYSE:SCHD) is gaining popularity among young income investors. The fund tracks the Dow Jones U.S. Dividend 100 Index and includes some of the safest dividend stocks like Home Depot, Coca-Cola, Verizon, Lockheed Martin, Pepsi and AbbVie. Portfolio details shared by the Redditor showed he had about $32,000 worth of SCHD shares.

Arbor Realty Trust

Arbor Realty Trust Inc. (NYSE:ABR) is a mortgage REIT with a dividend yield of over 11%. During the second quarter, Arbor’s distributable EPS came in at $0.45, beating Wall Street estimates of $0.42. Net interest income was $88 million, missing the market’s estimate of $97 million.

Medical Properties Trust

Medical Properties Trust Inc. (NYSE:MPW) is a healthcare-focused REIT that acquires and develops net-leased hospital facilities. The company has a dividend yield of about 5.5%. The Redditor owned about $30,900 of company shares.

Enbridge

Canada-based pipeline company Enbridge Inc. (NYSE:ENB) has a dividend yield of over 6% and has increased its payouts for 29 straight years. The stock is up about 12% this year. According to portfolio screenshots he shared publicly, the Redditor had a stake worth about $29,800 in Enbridge Inc. (NYSE:ENB).

Lock In High Rates Now With A Short-Term Commitment

Leaving your cash where it is earning nothing is like wasting money. There are ways you can take advantage of the current high interest rate environment through private market real estate investments.

EquityMultiple’s Basecamp Alpine Notes is the perfect solution for first-time investors. It offers a target APY of 9% with a term of only three months, making it a powerful short-term cash management tool with incredible flexibility. EquityMultiple has issued 61 Alpine Notes Series and has met all payment and funding obligations with no missed or late interest payments. With a minimum investment of $5,000, Basecamp Alpine Notes makes it easier than ever to start building a high-yield portfolio.

Don’t miss out on this opportunity to take advantage of high-yield investments while rates are high. Check out Benzinga’s favorite high-yield offerings.

Wondering if your investments can get you to a $5,000,000 nest egg? Speak to a financial advisor today. SmartAsset’s free tool matches you up with up to three vetted financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you.

This article Dividend Investor Who Saved For Years Working ‘3 Jobs, 7 Days A Week’ Reached $5,500 Monthly Income Portfolio Shares His Stock Picks And Secrets originally appeared on Benzinga.com

Nancy Pelosi's Husband Bets Big On San Francisco Office Real Estate, Is A Turnaround Coming?

Benzinga and Yahoo Finance LLC may earn commission or revenue on some items through the links below.

In recent months, San Francisco’s office real estate has been struggling. It led the country with a 37% vacancy rate in the second quarter of 2024, but one famous investor thinks now is the time to strike.

Financial disclosures of the portfolio of politician Nancy Pelosi and her husband, Paul, revealed that Paul Pelosi invested between $250,000 and $500,000 in REOF XXVI, LLC, an entity responsible for acquiring and managing a commercial office property at 631 Howard St. in the South of Market or SoMa area of San Francisco. The investment took place on Aug. 13 and was reported on Sept. 11.

Check it Out:

The five-story Class B office building was purchased for $36.4 million by a partnership between business owner Greg Flynn and real estate firm Ellis Partners. That was around 42% less than what Invesco paid for the property in 2014. The five-story building was built in 1929. “Our basic bet is that the market will greatly improve over the next five to 10 years,” said Flynn at the time of the purchase.

The San Francisco Standard also reported in previous disclosures that the Pelosis invested in several other Flynn entities, including REOF XX LLC, which has invested in hotels around the United States and REOF XXV, which is updating and restoring a luxury hotel in San Francisco. Flynn and a group of investors bought the Huntington Hotel on Nob Hill out of foreclosure in March 2023. The hotel had closed during the pandemic and had a $56.2 million loan against it.

The Pelosis have multiple homes in the San Francisco area. This could be seen as a wealthy local investing in the town she lives in and represents, but it also hints at the power of real estate to expand and grow net worth. Pelosi’s stock market trades have been well-followed. She has invested in Nvidia, Broadcom and other high-profile technology stocks. Several ETFs are dedicated to tracking her moves and following her investing style. Paul Pelosi is a venture capitalist who understands the risks and rewards of investing in various asset types.

Trending: A billion-dollar investment strategy with minimums as low as $10 — you can become part of the next big real estate boom today.

This is a paid advertisement. Carefully consider the investment objectives, risks, charges and expenses of the Fundrise Flagship Fund before investing. This and other information can be found in the Fund’s prospectus. Read them carefully before investing.

Many family offices and ultra-high-net-worth individuals have these investments in their portfolios for various reasons. Investing in commercial real estate assets not only provides diversification from stocks and bonds, it can also come with tax breaks. For projects such as the Huntington Hotel, which is being redeveloped and not generating cash flow, the Pelosis may be able to use any potential temporary losses to offset capital gains taxes in other parts of their portfolio.

You don’t have to have Pelosi’s level of wealth to invest in these types of opportunities. One company that is leading the way in the real estate investment space is EquityMultiple. EquityMultiple offers individual property investments, such as an industrial facility near Orlando, FL and funds backed by commercial real estate assets. The Ascent Income Fund from EquityMultiple targets stable income from senior commercial real estate debt positions and has a historical distribution yield of 12.1% backed by real assets. With payment priority and flexible liquidity options, the Ascent Income Fund is a cornerstone investment vehicle for income-focused investors. First-time investors with EquityMultiple can now invest in the Ascent Income Fund with a reduced minimum of just $5,000.

The fact that the Pelosis are making this type of investment in the San Francisco market indicates several things. The first is that right now there are substantial opportunities for investors with ready cash in the market. The second is the value of patience. As long-term investors, even though they are in their 80s, the Pelosis see the value of real estate as a way to potentially earn significant returns by investing in the potential for the San Francisco rebound.

Wondering if your investments can get you to a $5,000,000 nest egg? Speak to a financial advisor today. SmartAsset’s free tool matches you up with up to three vetted financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you.

Keep Reading:

This article Nancy Pelosi’s Husband Bets Big On San Francisco Office Real Estate, Is A Turnaround Coming? originally appeared on Benzinga.com

Oil Falls, Energy Stocks Flat As Fears Of Demand Drop Eclipse Israel-Hezbollah Conflict Escalation

Oil prices slid by more than 1% on Monday, reflecting persistent concerns over weakened global demand despite the escalating conflict between Israel and Hezbollah in the Middle East. Investors appeared more focused on the macroeconomic picture of slowing global consumption rather than the immediate geopolitical risks that could disrupt energy supplies.

U.S. energy stocks, tracked by the Energy Select Sector SPDR Fund XLE, remained mostly flat during the final hour of New York trading.

Israel-Hezbollah Conflict Intensifies: 650 Air Strikes In 24 Hours

On Monday, Israel launched its most extensive air campaign yet against Hezbollah targets in southern Lebanon. The Israeli military carried out 650 air strikes in the past 24 hours, hitting over 1,100 targets with more than 1,400 munitions, as reported by Reuters.

The attacks targeted Hezbollah’s military infrastructure, including rocket launchers and underground weapon storage facilities.

Tens of thousands of civilians in southern Lebanon have begun fleeing towards the north, leading to severe traffic congestion on key roads as the population seeks safety. The conflict, which has simmered for nearly a year, is showing signs of spiraling into a larger regional crisis.

“Essentially, we are targeting combat infrastructure that Hezbollah has been building for the past 20 years. This is very significant. We are striking targets and preparing for the next phases,” Israeli Prime Minister Benjamin Netanyahu said in a statement.

The international response to the intensifying conflict has been swift. The Pentagon announced plans to send additional troops to the Middle East as a precautionary measure amid the growing instability. Both Vice President Kamala Harris and President Joe Biden are scheduled to hold separate meetings with UAE President Sheikh Mohamed bin Zayed Al Nahyan to discuss the ceasefire deal in Gaza.

Stéphane Dujarric, spokesperson for U.N. Secretary-General Antonio Guterres, expressed concern over the growing number of civilian casualties reported by Lebanese authorities. “The Secretary-General is deeply worried about the rising toll on civilian lives and the broader implications for regional stability,” Dujarric stated.

Reactions from other regional players in Middle East were largely critical of Israel’s actions. Turkey’s Foreign Ministry condemned Israel’s air strikes, calling them “a new phase in its efforts to drag the entire region into chaos.”

Iranian President Masoud Pezeshkian, speaking to journalists upon his arrival in New York for the United Nations General Assembly, accused Israel of provoking a wider conflict. “Israel wants to drag the Middle East into a full-blown war by provoking Iran to join the nearly year-old conflict between Israel and Tehran-backed Hezbollah in Lebanon,” Pezeshkian said.

Read Next:

Photo: Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

‘He forced me to take Social Security at 62’: My husband inherited millions, but never gave me a penny. If I divorce him, would I get any of it?

Dear Quentin,

I am thinking about divorce. My husband inherited a few million dollars from his father when he passed away. Am I entitled to any of that should I choose to divorce? I live in Texas. He doesn’t share his information on his bank accounts so I have no idea what I would be entitled to.

He forced me to take Social Security at 62. I am 65 now and have been collecting Social Security since I was 62½. I claimed my benefits early because my husband never would give me money to put in my account.

Most Read from MarketWatch

Also, we have five rental properties. Two of them were inherited, but the rent goes into a joint checking account. Would I still get half of the rental money every month if I filed for divorce? It’s time for a new beginning.

Wife in Texas

Dear Wife,

If you file joint tax returns, you may be able to

If the rental income from these properties was going into a joint account, you probably had considerable cash at your disposal. I suspect that your reluctance to access that money ultimately led you to take Social Security at 62. Sometimes, strings are invisible, and if you felt forced or coerced into retirement, you could have felt that you were living under your husband’s rules. Accessing those benefits gave you independence, even if it did so at a price.

If this is the case, I’m sorry. I’m sorry that you did not feel you had the same right to community property as your husband. I’m sorry that you lived a more modest lifestyle because your husband maintained a tight — or controlling — hold on the purse strings. And most of all, I’m sorry that this has chipped away at your self-confidence and happiness over the years and affected how you feel about both your marriage and your place in the world.

That said, you made a decision and, hopefully, it has given you the freedom and power to make other decisions, leading you to the place you are now. If taking Social Security at 62, even if that meant getting lower payments, has helped you discover what you, at 65, want for the rest of your life, it was worth it. Only you can decide, but financial control is a form of domestic abuse, and if you raised your kids and were a stay-at-home mom, it’s all the more egregious.

To answer two of your financial and legal questions bluntly: No, you are not entitled to a share of your husband’s inheritance in the event that you divorce, unless that money went into a joint bank account and the funds were commingled. And rental income from separate property — that is, properties that your husband purchased prior to your marriage — does not commingle those properties. The money in the joint account belongs to both of you, so talk to an attorney.

Claiming Social Security at 62

You get 100% of your Social Security benefit at full retirement age, which is 67 for anyone born in 1960 or after, and you receive a lesser amount if you claim at any time from the age of 62 until full retirement age. If you wait until age 70, you receive roughly 8% more per year. Some advisers say it can work out roughly the same whether you start taking your benefits at 62 or at 70 — it all depends on how long you live. You, however, had other, more immediate considerations.

The financial argument suggests people should delay their Social Security benefits as long as possible, especially if they are in good health. Virtually all American workers age 45 to 62 should wait until beyond age 65 to collect Social Security, according to this working paper from researchers at Boston University and the Federal Reserve Bank of Atlanta. More than 90% of people should wait until they reach the age of 70, yet only 10.2% appear to do so, they said.

To put that in context for your retirement: Claiming Social Security early reduces household lifetime discretionary spending by $182,370 for the median worker who is near retirement, the paper concluded. “Optimizing would produce a 10.4% increase in typical workers’ lifetime spending,” the researchers wrote. “For one in four, the lifetime spending gain exceeds 17%. For one in 10, the gain exceeds 26%.”

Your situation is not unique. Nearly half of workers (47%) retire early, and many cite reasons more serious than yours, according to a report by the Employee Benefit Research Institute, a nonprofit based in Washington. Nearly a third cited a financial hardship, such as a health problem or disability not related to COVID-19, while nearly a quarter said they retired due to changes at their company. Some 38% said they could afford to retire early.

Godspeed on your new life, however you choose to pursue it.

More columns from Quentin Fottrell:

Most Read from MarketWatch

Upstart Soars 71% in 3 Months: Is it Too Late to Buy the Stock?

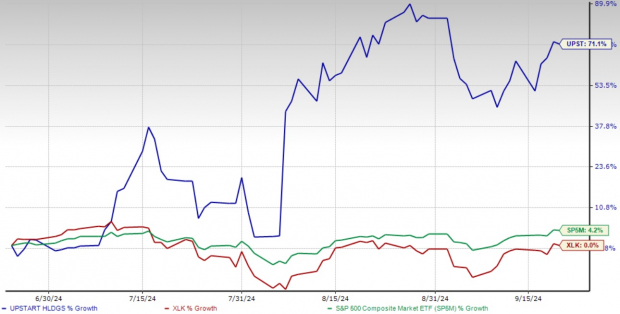

Upstart Holdings, Inc. UPST, the artificial intelligence-driven fintech, has surged by 71.1% in just three months, outpacing both the broader tech sector and the S&P 500. While the Technology Select Sector SPDR Fund ETF remained relatively flat, and the S&P 500 posted modest growth of 4.2%, Upstart’s surge has left many wondering: Have they missed the window of opportunity, or is there more room for the stock to climb?

3-Month Price Return Performance

Image Source: Zacks Investment Research

Why Upstart Shares Have Outperformed

The fintech world is buzzing with optimism, and much of Upstart’s recent success is tied to macroeconomic expectations around the U.S. Federal Reserve policy. Upstart’s business model is highly sensitive to interest rates because it primarily deals in personal and auto loans. When rates are high, borrowing becomes expensive, and demand shrinks. But when rates drop, loan affordability rises, and Upstart thrives.

Over the past few years, Upstart’s annual revenue run rate has halved from around $1 billion due to aggressive interest rate hikes by the Federal Reserve. These rate increases were designed to curb inflation, but they also hit Upstart’s loan origination business hard, reducing demand across the board.

However, the tide is turning. The Fed, which had been hiking rates, has been signaling a shift in policy over the past few months. This instilled investors’ optimism about the company’s turnaround in the near term. Going with market expectations, the central bank lowered the benchmark interest rate by 50 basis points to a 4.75%-5% range last week and indicated a further half-percentage point cut by the end of 2024. For UPST, this policy change is nothing short of a lifeline.

Upstart’s ability to grow its institutional funding base has been crucial in turning the company around. In the second quarter of 2024, Upstart locked in multiple long-term funding partnerships, which reduced the need for the company to fund loans using its balance sheet. During the second-quarter earnings call, CEO Dave Girouard highlighted that this internal progress — driven by improvements in AI models and operational efficiency — has set the stage for Upstart’s comeback.

Interest Rate Cuts: A Catalyst for UPST’s Growth

The recent 50-basis-point rate cut is a game-changer for Upstart. Its platform, which leverages AI to assess creditworthiness beyond the traditional Fair Issac Corporation (“FICO”) score, stands to gain immensely in an environment where interest rates are falling. Upstart’s model is designed to capture a wider range of borrower profiles by using unconventional data points like education and employment history to predict credit risk.

When rates are high, loan demand shrinks because borrowers either can’t afford or are hesitant to take on more debt. However, in a falling-rate environment, borrowing becomes cheaper and more attractive. This dynamic is critical for Upstart, which has been working to regain its loan origination volume after years of declines due to high interest rates. In the second quarter of 2024, Upstart’s revenues fell to $128 million, down from its previous highs. However, the Fed’s easing policies could help the company reclaim much of its lost business.

If the Fed continues to lower rates as expected, Upstart could experience a surge in loan originations, leading to revenue growth. As the company’s lending platform brings more borrowers into the fold —especially those previously priced out by high interest rates — Upstart’s market share is likely to expand further.

Upstart Stands Out on AI-Powered Innovation

Upstart’s success doesn’t just hinge on interest rate movements. Its core strength lies in its innovative use of AI to outperform traditional lenders like SoFi Technologies SOFI and LendingClub Corporation LC. Upstart has enhanced its AI models over the past few years, automating the vast majority of its loan approval process. As of the second quarter of 2024, 91% of Upstart’s loans were fully automated — no human intervention was required — a massive efficiency boost compared to its peers.

This level of automation allows Upstart to offer lower annual percentage rates (APRs) to riskier borrowers without compromising on credit performance. By contrast, competitors like SoFi and LendingClub still rely heavily on traditional credit assessment methods, which can be less effective at accurately predicting default risk in non-prime borrowers. While SoFi has diversified into areas like banking and investing to cushion the impact of interest rate fluctuations, it hasn’t made the same strides in loan approval efficiency as Upstart.

Upstart’s AI capabilities enable it to expand its loan portfolio across multiple product lines. Beyond personal loans, the company has also made substantial progress in auto loans, home equity lines of credit (HELOCs) and small-dollar relief loans. Upstart’s move into these new markets provides revenue streams and solidifies its position as a comprehensive lending platform.

Upstart’s Attractive Valuation: A Silver Lining

Despite the recent upswing, Upstart’s current valuation presents a compelling opportunity. The stock’s current forward 12-month price-to-sales (P/S) ratio indicates that it trades at a hefty discount to the Zacks Computers – IT Services industry average. Also, at the closing price of $39.74 as of Sept. 20, UPST shares have been trading way below its all-time high of $390, indicating a strong upside potential.

Image Source: Zacks Investment Research

The Zacks Consensus Estimate for Upstart has been projecting strong growth in the top and bottom lines over the coming years, reinforcing the fundamental case for the stock’s continued rise. In the short term, any further interest rate cuts by the Fed are likely to serve as additional catalysts for Upstart’s growth.

Image Source: Zacks Investment Research

Conclusion: Buy Upstart Stock Now

Upstart’s 71% rally might make it seem like the stock is already fully valued, but its unique positioning in the fintech space suggests otherwise. The interest rate environment is becoming more favorable, and Upstart’s AI-driven platform gives it a significant competitive edge over traditional lenders. As borrowing costs fall, the company’s loan originations are poised to increase, driving revenue growth and profitability.

For growth-oriented investors, Upstart offers a compelling opportunity. Its focus on innovation, automation and expanding access to credit positions it as a leader in the rapidly evolving fintech sector. With positive macroeconomic tailwinds and the company’s internal improvements, it’s clear that Upstart’s rally isn’t over yet. Now is the time to buy this Zacks Rank #2 (Buy) stock while it’s still riding the wave of momentum and before it potentially reaches new highs.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

AMD Chief Predicts Custom Chips Will Outperform GPUs, Sees Shift in AI Chip Demand: Report

Advanced Micro Devices, Inc. (NASDAQ:AMD) chief Lisa Su shared insight into the prospects of graphics processing units (GPUs) in the near term, almost to the extent of taking a dig at rival Nvidia Corp (NASDAQ:NVDA) and hyperscalers like Amazon.com Inc (NASDAQ:AMZN) and Alphabet Inc (NASDAQ:GOOG) (NASDAQ:GOOGL) Google.

As AI models become more standardized, there’s potential to create custom chips that offer greater energy efficiency, smaller sizes, and lower costs.

According to the WSJ report, Su highlighted this opportunity, noting that while GPUs remain the top choice for large language models due to their efficiency in parallel processing, the future will likely see a shift toward a broader range of chip architectures.

Also Read: Nvidia, AMD, and Broadcom Stocks Jump, Fed Rate Cut Boosts AI Chip Sector

Recent reports indicated AMD focusing on the mainstream and mid-range GPUs, ditching the premium gaming GPU market led by Nvidia.

Nvidia GPUs, designed for gaming graphics, have been instrumental in helping the company reach a trillion-dollar valuation and counting.

Tech investor James Anderson expects Nvidia to reach a market cap of $50 trillion within the next decade. JPMorgan analyst Harlan Sur expects AMD’s revenue from data center GPUs to grow by $5 billion in the current fiscal.

Su emphasizes that the future of AI computing will involve a combination of different chip types, including GPUs and new specialized chips.

For context, large cloud providers like Amazon and Google have developed their custom AI chips for internal use.

Rival hyperscalers, including Oracle Corp (NYSE:ORCL) and Amazon, have been collaborating lately, which BofA Securities analyst Justin Post expects to unlock demand for infrastructure and applications, implying higher demand for AI chips.

AMD stock gained over 60% in the last 12 months versus Nvidia’s 175%.

Investors can gain exposure to the semiconductor sector through First Trust Nasdaq Semiconductor ETF (NASDAQ:FTXL) and Columbia Semiconductor and Technology ETF (NYSE:SEMI).

Price Actions: AMD stock is up 0.28% at $156.39 premarket at the last check Monday.

Photo courtesy of AMD

Up Next: Transform your trading with Benzinga Edge’s one-of-a-kind market trade ideas and tools. Click now to access unique insights that can set you ahead in today’s competitive market.

Get the latest stock analysis from Benzinga?

This article AMD Chief Predicts Custom Chips Will Outperform GPUs, Sees Shift in AI Chip Demand: Report originally appeared on Benzinga.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

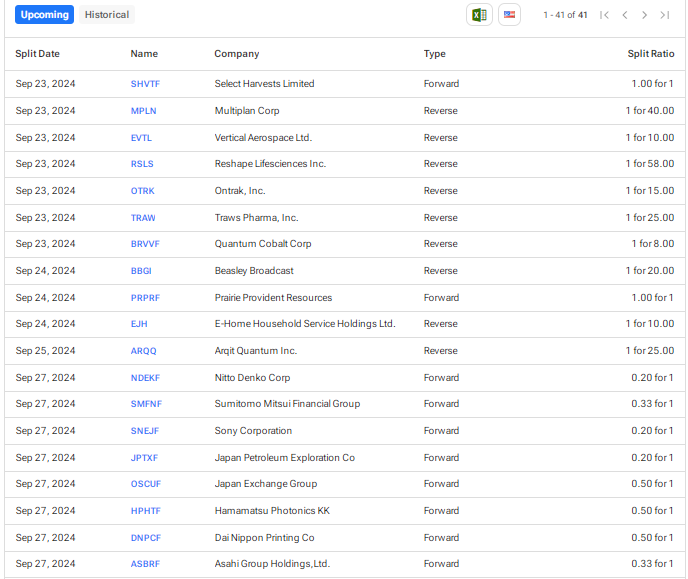

Upcoming Stock Splits This Week (September 23 to September 27) – Stay Invested

These are the upcoming stock splits for the week of September 23 to September 27, based on TipRanks’ Stock Splits Calendar. A stock split is a corporate action in which the company issues additional common shares to increase the number of outstanding shares. Accordingly, the stock price of the company’s shares decreases, which maintains the market capitalization before and after the split. In contrast, there are also reverse stock splits that reduce the number of outstanding shares (consolidate). In this case, too, the market cap is maintained as the share price increases following the reverse stock split.

Companies often undertake stock splits to improve the liquidity of the common shares and make them more affordable for retail investors. Let’s look quickly at the upcoming stock splits for the week.

Select Harvests Limited (SHVTF) – Australia-based Select Harvests is a major producer of almonds. The company recently announced a $80 million capital raise. This offer includes a fully underwritten institutional placement to selected institutional investors to raise about $30 million and a pro-rata accelerated non-renounceable entitlement offer to eligible shareholders to raise about $50 million.

The company stated that each new share issued under the placement and the entitlement offer will rank equally with existing shares on issue (a 1:1 offer). Shares will recommence trading on an ex-entitlement basis on September 23.

Multiplan Corp (MPLN) – MultiPlan provides technology and data-enabled cost management, payment, and revenue integrity solutions to the U.S. healthcare industry. Earlier this month, the company announced a 1-for-40 reverse stock split of its outstanding shares of Class A common stock to increase the per-share trading price in order to comply with the NYSE’s price criteria for continued listing. The stock split became effective after the market closed on September 20, 2024, and shares will start trading on a consolidated basis on September 23.

Vertical Aerospace (EVTL) – Vertical Aerospace specializes in electric aviation. Last week, the company announced a 1-for-10 reverse stock split to boost its share price and ensure compliance with the NYSE’s minimum share price requirement. Shares will begin trading on a reverse split-adjusted basis on September 23.

Reshape Lifesciences (RSLS) – Reshape Lifesciences offers weight-loss and metabolic health solutions. On September 19, the company announced a 1-for-58 reverse stock split, which will be effective for trading on September 23.

Ortrak, Inc. (OTRK) – Ontrak helps people with behavioral health conditions and chronic disease through AI-powered engagement and telehealth-enabled interventions. On September 19, the company announced a 1-for-15 reverse split of its common stock, effective September 23. The purpose of the stock split is to raise the bid price of the stock to regain compliance with Nasdaq’s $1.00 minimum bid price requirement for continued listing.

Traws Pharma, Inc. (TRAW) – Traws Pharma is a biopharma company focused on developing novel product candidates for respiratory viral diseases and cancer. Last week, the company announced that its board approved a 1-for-25 reverse stock split, effective September 20. Shares will commence trading on a consolidated basis on September 23.

This move will reduce the number of outstanding shares from about 45.7 million to about 1.8 million, boosting the stock’s marketability and ensuring compliance with Nasdaq’s listing requirements.

Quantum Cobalt (BRVVF) – Quantum Battery Metals (formerly Quantum Cobalt) announced a 1-for-8 reverse stock split of its shares that will reduce the total number of outstanding shares to from 52.2 million to about 6.53 million. Shares will start trading on a consolidated basis on September 24, instead of the previously announced date of September 23.

Beasley Broadcast (BBGI) – Beasley is a multi-platform media company that operates radio stations throughout the U.S. On September 19, the company announced that its board approved a 1-for-20 reverse stock split of its Class A and Class B common stocks to regain compliance with the $1.00 minimum bid price requirement for continued listing on the Nasdaq.

The reverse stock split will be implemented on September 23, and shares will start trading on a split-adjusted basis on September 24.

Prairie Provident Resources (PRPRF) – Calgary-based Prairie Provident is engaged in the exploration and development of oil and natural gas properties in Alberta. On September 13, the company announced a $13.2 million rights offering, which is supported by participation commitments of $11.6 million from its largest shareholder, PCEP Canadian Holdco, and $400K from directors and management.

Under the rights offering, each shareholder of Prairie Provident will receive one subscription right for each common share held at the close of business on September 24, 2024.

E-Home Household Service Holdings Ltd. (EJH) – E-Home is a China-based company that provides home appliance services and housekeeping services. The company recently disclosed that a 1-for-10 reverse stock split was approved at an extraordinary general meeting held on September 16, 2024. Shares will start trading on a post-consolidation basis on September 24, 2024. The reverse stock split will help the company to regain compliance with Nasdaq’s minimum bid price rule.

Arqit Quantum (ARQQ) – Arqit Quantum offers a unique encryption software service that makes the communication links of any networked device, cloud machine, or data secure against attacks on encryption. Last week, the company announced a 1-for-25 reverse stock split. Shares will start trading on a split-adjusted basis on September 25. Through this reverse stock split, Arqit intends to regain compliance with Nasdaq’s minimum $1.00 bid price per share requirement.

Nitto Denko Corp. (NDEKF) – Nitto Denko is a Japanese company that develops a range of products across businesses like electronics, automobiles, housing, infrastructure, environment, and medicine. In May, the company’s board decided to implement a 5-for-1 stock split to enhance the liquidity of its shares. Shares will start trading on a split-adjusted basis on September 27.

Sumitomo Mitsui Financial Group (SMFNF) – Sumitomo Mitsui Financial Group is a financial holding company that offers a wide range of financial services. The company announced a 3-for-1 stock split, with the aim of making its shares more accessible to a broader range of investors. Following the stock split (effective September 27), the ADR (American Depositary Receipt) ratio will change from 1 ADR:0.2 common share to 1 ADR:0.6 common share.

Sony Corporation (SNEJF) – Sony is a Japanese consumer electronics company. Earlier this year, the company announced a 5-for-1 stock split, stating that it intends to lower the amount per investment unit to make its shares more affordable and expand its investor base. Shares will begin trading on a split-adjusted basis on September 27.

Japan Petroleum Exploration (JPTXF) – Japan Petroleum is involved in the exploration, development, and production of oil and natural gas. At the board meeting held on May 14, 2024, the company decided to implement a 5-for-1 stock split to increase the liquidity of its shares and expand the investor base. The change in the price adjustment factor (PAF) for the stock on Nikkei 500 will be effective on September 27.

Japan Exchange Group (OSCUF) – Tokyo-based Japan Exchange operates financial instruments exchange markets to ensure that market participants have reliable venues for trading listed securities and derivative instruments. In May, the company announced a 2-for-1 stock split to reduce the minimum amount needed for investment in its stock and increase the liquidity of its stock.

Hamamatsu Photonics KK (HPHTF) – Hamamatsu manufactures high-performance devices like photomultiplier tubes, opto-semiconductors, light sources, and image processing and measurement equipment. The company announced a 2-for-1 stock split to increase the liquidity of its stock by lowering the amount per investment unit for the stock. The stock split will become effective on September 27.

Dai Nippon Printing Co. (DNPCF) – Dai Nippon is a Japanese printing company. In August, the company’s board approved a 2-for-1 stock split to enhance and make the stock accessible to more investors. Shares will start trading on a split-adjusted basis on September 27.

Asahi Group Holdings (ASBRF) – Asahi Group offers several brands across beer, alcohol, and non-alcohol beverage categories and food products. In early August, the company announced that it resolved to implement a 3-for-1 stock split to improve the liquidity of the stock. The split will be effective on September 27, 2024.

Yamaha Corporation (YAMCF) – Yamaha’s business is focused on musical instruments, audio equipment, industrial machinery, and components. At a board meeting held on July 31, 2024, the company’s board resolved to implement a 3-for-1 stock split to reduce per-share stock price and expand the investor base. Shares will begin trading on a split-adjusted basis on September 27.

OBIC Co. (OBIIF) – OBIC is a Japan-based information technology (IT) company that offers several services, including computer system integration, office automation, and system support. At the board of directors meeting held on July 24, 2024, the company resolved to implement a 5-for-1 stock split of its common shares. The stock split will become effective on September 27.

Nidec Corporation (NNDNF) – Nidec is a motor manufacturer that offers an expansive product line ranging from small precision motors to supersized motors. In July, the company’s board approved a 2-for-1 stock split to enhance liquidity. Shares will start trading on a split-adjusted basis on September 27.

Aisin Seiki Co. (ASEKF) – Aisin Seiki is a Japanese corporation that supplies automotive components globally. At a meeting held on June 27, 2024, the company’s board resolved to implement a 3-for-1 stock split to lower the per-share stock price and expand the investor base. Shares will start trading on a split-adjusted basis on September 27.

Secom Co. (SOMLF) – Japan-based Secom provides security services. The company announced a 2-for-1 stock split to increase the appeal of its shares by reducing the per-share price. Shares will start trading on a split-adjusted basis on September 27.

Nippon Building Fund (NBFJF) – Nippon Building is a Japanese REIT (real estate investment trust) focused on office properties. In August, the company announced a 5-for-1 stock split to boost the liquidity of its shares. The company said that through this stock split, the number of issued and outstanding investment units will increase from 1.7 million to over 8.5 million. Shares will start trading on a split-adjusted basis on September 27.

Shionogi & Co. (SGIOF) – Shionogi is a Japanese pharmaceutical company focused on developing novel medicines, mainly for infectious diseases. In late August, the company announced that its board approved a 3-for-1 stock split to expand its investor base by lowering the price per investment unit. Shares will commence training on a split-adjusted basis on September 27.

To find more information about historical and upcoming stock splits, visit the TipRanks Stock Splits Calendar.

Oil Falls After Iran Says It’s Prepared to Ease Israel Tensions

(Bloomberg) — Oil fell on a weak outlook for fuel demand and the potential for the conflict between Iran and Israel to de-escalate after its recent flare-up.

Most Read from Bloomberg

West Texas Intermediate slipped almost 1% to settle below $71 a barrel while Brent retreated to settle below $74 a barrel. WTI had gained 4.8% last week in its biggest weekly jump since February.

After days of Israel and Iran-backed Hezbollah trading rocket fire, Iranian President Masoud Pezeshkian said on Monday that his country is prepared to de-escalate tensions as long as it sees the same level of commitment on the other side. The overture is easing some concerns that the conflict will worsen, threatening oil output in a region that supplies about a third of the world’s barrels.

Crude is also down this quarter on concerns that demand from China and the US will weaken at the same time that output from non-OPEC nations rises, creating an oversupplied market. The outlook for fuel demand is worsening, turning hedge funds the most bearish on diesel on record. Technical factors also are providing headwinds after crude rallied about 10% from its 2024 lows reached earlier this month.

“Sentiment among energy investors has turned decisively bearish as OPEC+ now plans to add barrels into a surplus oil market,” Bank of America Corp. analysts including Francisco Blanch wrote in a note.

In China, the world’s top oil importer, authorities announced plans for financial regulators to provide a rare briefing on the economy as the country cut a short-term policy rate. That fueled speculation officials are preparing more efforts to revive growth.

Increased stimulus from China could improve demand for crude, said Robert Yawger, director of the energy futures division at Mizuho Securities USA.

It’s “tough for crude oil to rally for size without China demand growth,” Yawger said.

Meanwhile, from Mississippi to the Florida Panhandle, the US Gulf Coast is at risk of a hurricane strike by the end of the week as a patch of turbulent weather in the Atlantic becomes more organized. Ahead of the storm, Shell Plc has curtailed production at the Appomattox project and the Stones oil field in the Gulf, according to a company statement.

To get Bloomberg’s Energy Daily newsletter in your inbox, click here.

–With assistance from Alex Longley.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

Dundee Corporation Announces Acquisition of Shares of Maritime Resources Corp.

TORONTO, Sept. 23, 2024 (GLOBE NEWSWIRE) — In accordance with regulatory requirements, Dundee Corporation DC (“Dundee”) announces that its wholly owned subsidiary, Dundee Resources Limited, has acquired by private agreement 47,000,000 common shares of Maritime Resources Corp. (TSXV – MAE) (the “Issuer”) at a price of $0.034 per share for aggregate consideration of C$1,598,000.

Immediately prior to the acquisition of securities described in this news release, Dundee and its affiliates owned 312,967,123 common shares and 53,961,033 warrants of the Issuer representing an approximate 37.66% interest in the Issuer on an undiluted basis and a 41.46% interest in the Issuer on a partially diluted basis. Immediately following the transaction that triggered the requirement to file this news release, Dundee and its affiliates own or control an aggregate of 359,967,123 common shares and 53,961,033 warrants, representing an approximate 43.32% interest in the Issuer on an undiluted basis and a 46.77% interest in the Issuer on a partially diluted basis.

Dundee acquired the securities of the Issuer for investment purposes only. Dundee intends to review, on a continuous basis, various factors related to its investment, including (but not limited to) the price and availability of the securities of the Issuer, subsequent developments affecting the Issuer or its business, and the general market and economic conditions. Based upon these and other factors, Dundee may decide to purchase additional securities of the Issuer or may decide in the future to sell all or part of its investment.

This news release is being issued in accordance with National Instrument 62-103 – The Early Warning System and Related Take-Over Bid and Insider Reporting Issues in connection with the filing of an early warning report. The early warning report respecting the acquisition will be filed on the System for Electronic Document Analysis and Retrieval (“SEDAR”) at www.sedar.com under the Issuer’s profile. To obtain a copy of the early warning report filed by Dundee, please contact:

Dundee Corporation

Legal Department

80 Richmond Street West, Suite 2000

Toronto, Ontario M5H 2A4

Tel: (416) 365-5172

ABOUT DUNDEE CORPORATION

Dundee Corporation is a public Canadian independent holding company, listed on the Toronto Stock Exchange under the symbol “DC.A”. Through its operating subsidiaries, Dundee Corporation is an active investor focused on delivering long-term, sustainable value as a trusted partner in the mining sector with more than 30 years of experience making accretive mining investments.

FOR FURTHER INFORMATION PLEASE CONTACT:

Investor and Media Relations

T: (416) 864-3584

E: ir@dundeecorporation.com

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.