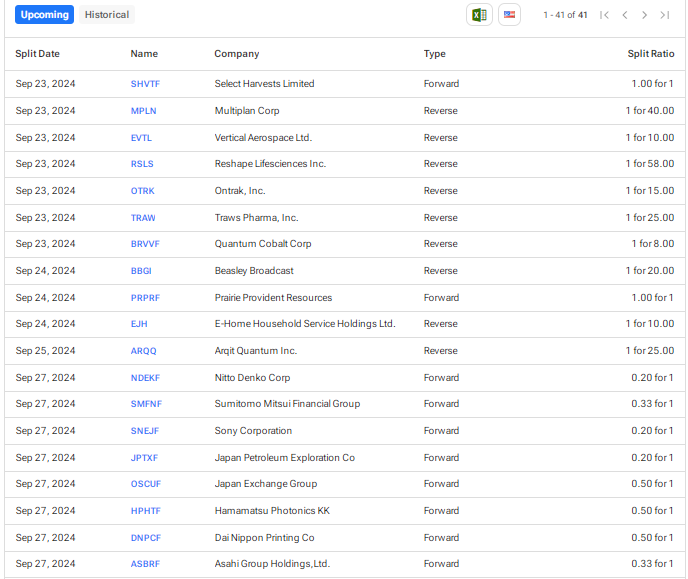

Upcoming Stock Splits This Week (September 23 to September 27) – Stay Invested

These are the upcoming stock splits for the week of September 23 to September 27, based on TipRanks’ Stock Splits Calendar. A stock split is a corporate action in which the company issues additional common shares to increase the number of outstanding shares. Accordingly, the stock price of the company’s shares decreases, which maintains the market capitalization before and after the split. In contrast, there are also reverse stock splits that reduce the number of outstanding shares (consolidate). In this case, too, the market cap is maintained as the share price increases following the reverse stock split.

Companies often undertake stock splits to improve the liquidity of the common shares and make them more affordable for retail investors. Let’s look quickly at the upcoming stock splits for the week.

Select Harvests Limited (SHVTF) – Australia-based Select Harvests is a major producer of almonds. The company recently announced a $80 million capital raise. This offer includes a fully underwritten institutional placement to selected institutional investors to raise about $30 million and a pro-rata accelerated non-renounceable entitlement offer to eligible shareholders to raise about $50 million.

The company stated that each new share issued under the placement and the entitlement offer will rank equally with existing shares on issue (a 1:1 offer). Shares will recommence trading on an ex-entitlement basis on September 23.

Multiplan Corp (MPLN) – MultiPlan provides technology and data-enabled cost management, payment, and revenue integrity solutions to the U.S. healthcare industry. Earlier this month, the company announced a 1-for-40 reverse stock split of its outstanding shares of Class A common stock to increase the per-share trading price in order to comply with the NYSE’s price criteria for continued listing. The stock split became effective after the market closed on September 20, 2024, and shares will start trading on a consolidated basis on September 23.

Vertical Aerospace (EVTL) – Vertical Aerospace specializes in electric aviation. Last week, the company announced a 1-for-10 reverse stock split to boost its share price and ensure compliance with the NYSE’s minimum share price requirement. Shares will begin trading on a reverse split-adjusted basis on September 23.

Reshape Lifesciences (RSLS) – Reshape Lifesciences offers weight-loss and metabolic health solutions. On September 19, the company announced a 1-for-58 reverse stock split, which will be effective for trading on September 23.

Ortrak, Inc. (OTRK) – Ontrak helps people with behavioral health conditions and chronic disease through AI-powered engagement and telehealth-enabled interventions. On September 19, the company announced a 1-for-15 reverse split of its common stock, effective September 23. The purpose of the stock split is to raise the bid price of the stock to regain compliance with Nasdaq’s $1.00 minimum bid price requirement for continued listing.

Traws Pharma, Inc. (TRAW) – Traws Pharma is a biopharma company focused on developing novel product candidates for respiratory viral diseases and cancer. Last week, the company announced that its board approved a 1-for-25 reverse stock split, effective September 20. Shares will commence trading on a consolidated basis on September 23.

This move will reduce the number of outstanding shares from about 45.7 million to about 1.8 million, boosting the stock’s marketability and ensuring compliance with Nasdaq’s listing requirements.

Quantum Cobalt (BRVVF) – Quantum Battery Metals (formerly Quantum Cobalt) announced a 1-for-8 reverse stock split of its shares that will reduce the total number of outstanding shares to from 52.2 million to about 6.53 million. Shares will start trading on a consolidated basis on September 24, instead of the previously announced date of September 23.

Beasley Broadcast (BBGI) – Beasley is a multi-platform media company that operates radio stations throughout the U.S. On September 19, the company announced that its board approved a 1-for-20 reverse stock split of its Class A and Class B common stocks to regain compliance with the $1.00 minimum bid price requirement for continued listing on the Nasdaq.

The reverse stock split will be implemented on September 23, and shares will start trading on a split-adjusted basis on September 24.

Prairie Provident Resources (PRPRF) – Calgary-based Prairie Provident is engaged in the exploration and development of oil and natural gas properties in Alberta. On September 13, the company announced a $13.2 million rights offering, which is supported by participation commitments of $11.6 million from its largest shareholder, PCEP Canadian Holdco, and $400K from directors and management.

Under the rights offering, each shareholder of Prairie Provident will receive one subscription right for each common share held at the close of business on September 24, 2024.

E-Home Household Service Holdings Ltd. (EJH) – E-Home is a China-based company that provides home appliance services and housekeeping services. The company recently disclosed that a 1-for-10 reverse stock split was approved at an extraordinary general meeting held on September 16, 2024. Shares will start trading on a post-consolidation basis on September 24, 2024. The reverse stock split will help the company to regain compliance with Nasdaq’s minimum bid price rule.

Arqit Quantum (ARQQ) – Arqit Quantum offers a unique encryption software service that makes the communication links of any networked device, cloud machine, or data secure against attacks on encryption. Last week, the company announced a 1-for-25 reverse stock split. Shares will start trading on a split-adjusted basis on September 25. Through this reverse stock split, Arqit intends to regain compliance with Nasdaq’s minimum $1.00 bid price per share requirement.

Nitto Denko Corp. (NDEKF) – Nitto Denko is a Japanese company that develops a range of products across businesses like electronics, automobiles, housing, infrastructure, environment, and medicine. In May, the company’s board decided to implement a 5-for-1 stock split to enhance the liquidity of its shares. Shares will start trading on a split-adjusted basis on September 27.

Sumitomo Mitsui Financial Group (SMFNF) – Sumitomo Mitsui Financial Group is a financial holding company that offers a wide range of financial services. The company announced a 3-for-1 stock split, with the aim of making its shares more accessible to a broader range of investors. Following the stock split (effective September 27), the ADR (American Depositary Receipt) ratio will change from 1 ADR:0.2 common share to 1 ADR:0.6 common share.

Sony Corporation (SNEJF) – Sony is a Japanese consumer electronics company. Earlier this year, the company announced a 5-for-1 stock split, stating that it intends to lower the amount per investment unit to make its shares more affordable and expand its investor base. Shares will begin trading on a split-adjusted basis on September 27.

Japan Petroleum Exploration (JPTXF) – Japan Petroleum is involved in the exploration, development, and production of oil and natural gas. At the board meeting held on May 14, 2024, the company decided to implement a 5-for-1 stock split to increase the liquidity of its shares and expand the investor base. The change in the price adjustment factor (PAF) for the stock on Nikkei 500 will be effective on September 27.

Japan Exchange Group (OSCUF) – Tokyo-based Japan Exchange operates financial instruments exchange markets to ensure that market participants have reliable venues for trading listed securities and derivative instruments. In May, the company announced a 2-for-1 stock split to reduce the minimum amount needed for investment in its stock and increase the liquidity of its stock.

Hamamatsu Photonics KK (HPHTF) – Hamamatsu manufactures high-performance devices like photomultiplier tubes, opto-semiconductors, light sources, and image processing and measurement equipment. The company announced a 2-for-1 stock split to increase the liquidity of its stock by lowering the amount per investment unit for the stock. The stock split will become effective on September 27.

Dai Nippon Printing Co. (DNPCF) – Dai Nippon is a Japanese printing company. In August, the company’s board approved a 2-for-1 stock split to enhance and make the stock accessible to more investors. Shares will start trading on a split-adjusted basis on September 27.

Asahi Group Holdings (ASBRF) – Asahi Group offers several brands across beer, alcohol, and non-alcohol beverage categories and food products. In early August, the company announced that it resolved to implement a 3-for-1 stock split to improve the liquidity of the stock. The split will be effective on September 27, 2024.

Yamaha Corporation (YAMCF) – Yamaha’s business is focused on musical instruments, audio equipment, industrial machinery, and components. At a board meeting held on July 31, 2024, the company’s board resolved to implement a 3-for-1 stock split to reduce per-share stock price and expand the investor base. Shares will begin trading on a split-adjusted basis on September 27.

OBIC Co. (OBIIF) – OBIC is a Japan-based information technology (IT) company that offers several services, including computer system integration, office automation, and system support. At the board of directors meeting held on July 24, 2024, the company resolved to implement a 5-for-1 stock split of its common shares. The stock split will become effective on September 27.

Nidec Corporation (NNDNF) – Nidec is a motor manufacturer that offers an expansive product line ranging from small precision motors to supersized motors. In July, the company’s board approved a 2-for-1 stock split to enhance liquidity. Shares will start trading on a split-adjusted basis on September 27.

Aisin Seiki Co. (ASEKF) – Aisin Seiki is a Japanese corporation that supplies automotive components globally. At a meeting held on June 27, 2024, the company’s board resolved to implement a 3-for-1 stock split to lower the per-share stock price and expand the investor base. Shares will start trading on a split-adjusted basis on September 27.

Secom Co. (SOMLF) – Japan-based Secom provides security services. The company announced a 2-for-1 stock split to increase the appeal of its shares by reducing the per-share price. Shares will start trading on a split-adjusted basis on September 27.

Nippon Building Fund (NBFJF) – Nippon Building is a Japanese REIT (real estate investment trust) focused on office properties. In August, the company announced a 5-for-1 stock split to boost the liquidity of its shares. The company said that through this stock split, the number of issued and outstanding investment units will increase from 1.7 million to over 8.5 million. Shares will start trading on a split-adjusted basis on September 27.

Shionogi & Co. (SGIOF) – Shionogi is a Japanese pharmaceutical company focused on developing novel medicines, mainly for infectious diseases. In late August, the company announced that its board approved a 3-for-1 stock split to expand its investor base by lowering the price per investment unit. Shares will commence training on a split-adjusted basis on September 27.

To find more information about historical and upcoming stock splits, visit the TipRanks Stock Splits Calendar.

Leave a Reply