Upstart Soars 71% in 3 Months: Is it Too Late to Buy the Stock?

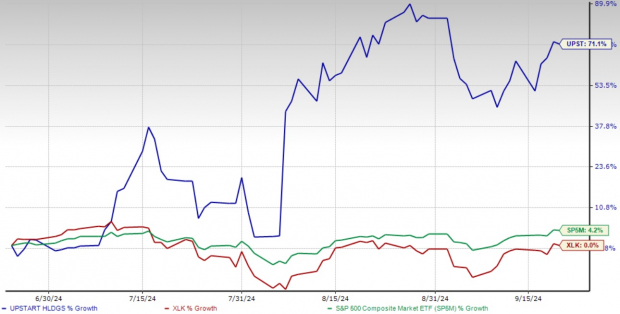

Upstart Holdings, Inc. UPST, the artificial intelligence-driven fintech, has surged by 71.1% in just three months, outpacing both the broader tech sector and the S&P 500. While the Technology Select Sector SPDR Fund ETF remained relatively flat, and the S&P 500 posted modest growth of 4.2%, Upstart’s surge has left many wondering: Have they missed the window of opportunity, or is there more room for the stock to climb?

3-Month Price Return Performance

Image Source: Zacks Investment Research

Why Upstart Shares Have Outperformed

The fintech world is buzzing with optimism, and much of Upstart’s recent success is tied to macroeconomic expectations around the U.S. Federal Reserve policy. Upstart’s business model is highly sensitive to interest rates because it primarily deals in personal and auto loans. When rates are high, borrowing becomes expensive, and demand shrinks. But when rates drop, loan affordability rises, and Upstart thrives.

Over the past few years, Upstart’s annual revenue run rate has halved from around $1 billion due to aggressive interest rate hikes by the Federal Reserve. These rate increases were designed to curb inflation, but they also hit Upstart’s loan origination business hard, reducing demand across the board.

However, the tide is turning. The Fed, which had been hiking rates, has been signaling a shift in policy over the past few months. This instilled investors’ optimism about the company’s turnaround in the near term. Going with market expectations, the central bank lowered the benchmark interest rate by 50 basis points to a 4.75%-5% range last week and indicated a further half-percentage point cut by the end of 2024. For UPST, this policy change is nothing short of a lifeline.

Upstart’s ability to grow its institutional funding base has been crucial in turning the company around. In the second quarter of 2024, Upstart locked in multiple long-term funding partnerships, which reduced the need for the company to fund loans using its balance sheet. During the second-quarter earnings call, CEO Dave Girouard highlighted that this internal progress — driven by improvements in AI models and operational efficiency — has set the stage for Upstart’s comeback.

Interest Rate Cuts: A Catalyst for UPST’s Growth

The recent 50-basis-point rate cut is a game-changer for Upstart. Its platform, which leverages AI to assess creditworthiness beyond the traditional Fair Issac Corporation (“FICO”) score, stands to gain immensely in an environment where interest rates are falling. Upstart’s model is designed to capture a wider range of borrower profiles by using unconventional data points like education and employment history to predict credit risk.

When rates are high, loan demand shrinks because borrowers either can’t afford or are hesitant to take on more debt. However, in a falling-rate environment, borrowing becomes cheaper and more attractive. This dynamic is critical for Upstart, which has been working to regain its loan origination volume after years of declines due to high interest rates. In the second quarter of 2024, Upstart’s revenues fell to $128 million, down from its previous highs. However, the Fed’s easing policies could help the company reclaim much of its lost business.

If the Fed continues to lower rates as expected, Upstart could experience a surge in loan originations, leading to revenue growth. As the company’s lending platform brings more borrowers into the fold —especially those previously priced out by high interest rates — Upstart’s market share is likely to expand further.

Upstart Stands Out on AI-Powered Innovation

Upstart’s success doesn’t just hinge on interest rate movements. Its core strength lies in its innovative use of AI to outperform traditional lenders like SoFi Technologies SOFI and LendingClub Corporation LC. Upstart has enhanced its AI models over the past few years, automating the vast majority of its loan approval process. As of the second quarter of 2024, 91% of Upstart’s loans were fully automated — no human intervention was required — a massive efficiency boost compared to its peers.

This level of automation allows Upstart to offer lower annual percentage rates (APRs) to riskier borrowers without compromising on credit performance. By contrast, competitors like SoFi and LendingClub still rely heavily on traditional credit assessment methods, which can be less effective at accurately predicting default risk in non-prime borrowers. While SoFi has diversified into areas like banking and investing to cushion the impact of interest rate fluctuations, it hasn’t made the same strides in loan approval efficiency as Upstart.

Upstart’s AI capabilities enable it to expand its loan portfolio across multiple product lines. Beyond personal loans, the company has also made substantial progress in auto loans, home equity lines of credit (HELOCs) and small-dollar relief loans. Upstart’s move into these new markets provides revenue streams and solidifies its position as a comprehensive lending platform.

Upstart’s Attractive Valuation: A Silver Lining

Despite the recent upswing, Upstart’s current valuation presents a compelling opportunity. The stock’s current forward 12-month price-to-sales (P/S) ratio indicates that it trades at a hefty discount to the Zacks Computers – IT Services industry average. Also, at the closing price of $39.74 as of Sept. 20, UPST shares have been trading way below its all-time high of $390, indicating a strong upside potential.

Image Source: Zacks Investment Research

The Zacks Consensus Estimate for Upstart has been projecting strong growth in the top and bottom lines over the coming years, reinforcing the fundamental case for the stock’s continued rise. In the short term, any further interest rate cuts by the Fed are likely to serve as additional catalysts for Upstart’s growth.

Image Source: Zacks Investment Research

Conclusion: Buy Upstart Stock Now

Upstart’s 71% rally might make it seem like the stock is already fully valued, but its unique positioning in the fintech space suggests otherwise. The interest rate environment is becoming more favorable, and Upstart’s AI-driven platform gives it a significant competitive edge over traditional lenders. As borrowing costs fall, the company’s loan originations are poised to increase, driving revenue growth and profitability.

For growth-oriented investors, Upstart offers a compelling opportunity. Its focus on innovation, automation and expanding access to credit positions it as a leader in the rapidly evolving fintech sector. With positive macroeconomic tailwinds and the company’s internal improvements, it’s clear that Upstart’s rally isn’t over yet. Now is the time to buy this Zacks Rank #2 (Buy) stock while it’s still riding the wave of momentum and before it potentially reaches new highs.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Leave a Reply