Want $1,000 in Annual Dividend Income? Invest $9,550 in These 2 Ultra-High-Yield Stocks

If you’re concerned about having enough money during your retirement years, you’re not alone. A recent survey by the AARP found that 61% of Americans over 50 years old worry they won’t have enough to support themselves in retirement.

Acquiring real estate to rent out is a popular way to set yourself up with more passive income, but each new tenant presents significant risks. Plus, managing properties isn’t nearly as passive as most retirees want it to be.

If individual investors want to build a truly passive income stream, acquiring dividend-paying stocks is the way forward. Ares Capital (NASDAQ: ARCC) and PennantPark Floating Rate Capital (NYSE: PFLT) offer an average yield of 10.5% at recent prices. With yields this high, an investment of about $9,550 spread between them is enough to secure $1,000 in annual dividend payments.

Before you plow every penny you can find into these two stocks, it’s important to remember that an especially high yield means the market is worried the underlying business can’t continue meeting and raising its dividend commitment. Here’s why these two stocks could be far less risky than their ultra-high dividend yields suggest.

1. Ares Capital

Ares Capital is a business development company (BDC), which means it can legally avoid paying income taxes by distributing nearly all its profit to shareholders as a dividend. At recent prices, its dividend offers a 9.3% yield.

For decades now, American banks have been increasingly hesitant to lend money directly to midsize businesses. Since they’re starved for capital, mid-market companies are willing to accept interest rates that are way higher than this BDC’s cost of capital.

Individual borrowers with a job and a decent credit rating can get unsecured personal loans with lower interest rates than Ares receives from midmarket businesses, some of which record over $1 billion in annual sales. The average yield Ares received from its portfolio of debt securities was a healthy 12.2% in the second quarter.

Ares Capital isn’t just any BDC; it’s the largest one with shares that trade on a major stock exchange. With 525 companies already in its portfolio, its team of experienced underwriters receives heaps of new loan applications from businesses they’re already familiar with.

Selecting the best borrowers from a huge selection of applicants has led to industry loss rates. For example, about 1.07% of first-lien BDC loans defaulted over the past 20 years. For Ares Capital, though, less than 0.05% of its first lien loans resulted in a loss.

2. PennantPark Floating Rate Capital

As its name suggests, PennantPark Floating Rate Capital is a BDC that makes middle-market companies borrow at variable interest rates. At recent prices, it offers an 11.7% yield and monthly dividend payments.

PennantPark’s dividend yield is much higher than Ares Capital’s because its smaller portfolio is arguably riskier. While PennantPark is a smaller BDC, a portfolio with 151 different companies is large enough to produce economies of scale. The average yield on its debt securities was 12.1% at the end of June.

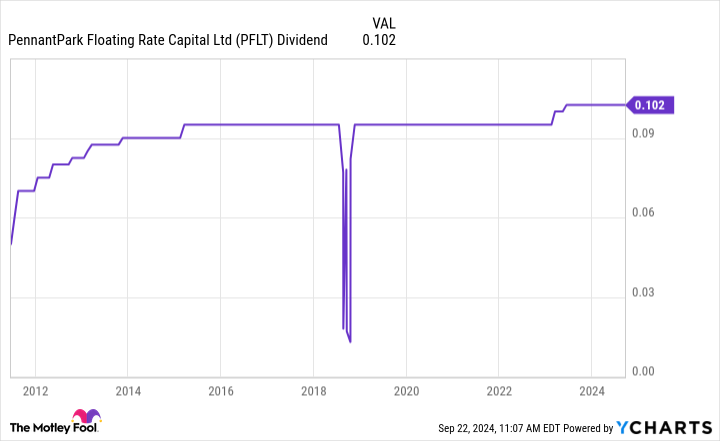

PennantPark Floating Rate Capital has been in operation since before the global financial crisis. It’s been able to maintain or raise its payout since beginning a dividend program in 2011, with a brief exception in 2018.

The average underwriter at PennantPark Floating Rate Capital has more than 26 years of experience, and it shows. The portfolio made it through the higher interest-rate environment we’ve been in since 2022 and hardly received a scratch. At the end of June, just 1.5% of the overall portfolio at cost was on nonaccrual status.

There are no guarantees, but this BDC’s successful track record suggests it can continue delivering heaps of dividend income for many years to come. Adding some shares to a diversified portfolio looks like a smart way to build up your income stream.

Should you invest $1,000 in Ares Capital right now?

Before you buy stock in Ares Capital, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Ares Capital wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $710,860!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 16, 2024

Cory Renauer has positions in Ares Capital. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

Want $1,000 in Annual Dividend Income? Invest $9,550 in These 2 Ultra-High-Yield Stocks was originally published by The Motley Fool

Leave a Reply