Hedge Funder John Paulson Says He'll Exit the Market if Kamala Harris Becomes President – Should Investors Be Worried?

Billionaire hedge fund manager John Paulson has shaken the financial world with a bold declaration. During an appearance on Fox Business’ “The Claman Countdown,” the founder of Paulson & Co. hinted at an exit strategy from U.S. markets if Vice President Kamala Harris wins the 2024 presidential election.

“If Harris is elected, I’d pull my money from the market,” Paulson stated. He explained his rationale: uncertainty. “I’d go into cash and I’d go into gold because I think the uncertainty regarding the plans they outlined would create a lot of turbulence in the markets and likely lower them.”

Don’t Miss:

It’s a bold statement from a man known for turning heads – and making billions by correctly predicting the 2007 housing crash.

Paulson, a key Trump donor, isn’t making idle threats. His concerns stem from Harris’s proposed policies, which include more government spending and what some critics call “centralized price controls.”

Economists have crunched the numbers and estimate that Harris’s plans could cost $1.7 trillion. Paulson worries that such policies could disrupt the economic machinery.

Trending: A billion-dollar investment strategy with minimums as low as $10 — you can become part of the next big real estate boom today.

“It depends very much on who is in the White House and who controls Congress,” Paulson warned. “If they go through with a 25% tax on unrealized gains, it would lead to massive selling across the board – stocks, bonds, real estate, art. It would trigger a market crash, and we’d look at a recession almost overnight.”

Known for his ability to spot trouble ahead, Paulson’s words will surely make investors uneasy. He has built a reputation for seeing through the smoke before others smell the fire. So when he says he’s ready to pull out of the U.S. market, people listen.

Trending: Groundbreaking trading app with a ‘Buy-Now-Pay-Later’ feature for stocks tackles the $644 billion margin lending market – here’s how to get equity in it with just $500

At the heart of Paulson’s concern is the middle class. During the conversation, he pointed out how much hinges on the upcoming election. “The middle class is key for this election. And it’s all about who will do better for them,” he said, adding that the average real wage increased by about 6.5% under Trump’s policies. In contrast, under Biden’s administration, real wages have declined due to inflation.

In contrast to Paulson’s fears, Harris has outlined a detailed plan aimed at boosting the middle class. One of her key initiatives includes expanding middle-class tax cuts to provide relief to millions of families.

Trending: Commercial real estate has historically outperformed the stock market, and this platform allows individuals to invest in commercial real estate with as little as $5,000 offering a 12% target yield with a bonus 1% return boost today!

Harris’s proposal aims to double the standard deduction and increase child tax credits, which she argues will ease financial pressure and promote spending. Additionally, she plans to reduce health care costs and make housing more affordable, policies that are central to her broader economic vision.

But Paulson isn’t alone in his critique. House Speaker Mike Johnson echoed his sentiments, warning that Harris’s economic agenda feels like a reality show giveaway.

“Candidate ‘Comrade Kamala,’ as President Donald Trump calls her, wants to take things to a whole new level,” Johnson quipped, adding that her plans for first-time homebuyers and grocery price controls would only deepen the country’s fiscal problems.

Johnson also laid out a stark contrast between the Republican vision and Harris’s. If the GOP regains control, Johnson promised to stick with the existing tax cuts and prioritize job creation. “We’ll ensure that our tax policy respects the dignity of work,” he added.

Read Next:

UNLOCKED: 5 NEW TRADES EVERY WEEK. Click now to get top trade ideas daily, plus unlimited access to cutting-edge tools and strategies to gain an edge in the markets.

Get the latest stock analysis from Benzinga?

This article Hedge Funder John Paulson Says He’ll Exit the Market if Kamala Harris Becomes President – Should Investors Be Worried? originally appeared on Benzinga.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Bitcoin, Ethereum, Dogecoin Trading Flat: 'Friday Is A Big Day For Bitcoin—Options Expiry Could Lead To Upside Volatility'

Cryptocurrency markets are trading sideways as BlackRock leads total U.S. Spot Bitcoin ETF net inflows.

| Cryptocurrency | Price | Gains +/- |

| Bitcoin BTC/USD | $63,252.75 | -0.8% |

| Ethereum ETH/USD | $2,579.65 | -2.2% |

| Solana SOL/USD | $150.04 | -1.9% |

| Dogecoin DOGE/USD | $0.1095 | +0.2% |

| Shiba Inu SHIB/USD | $0.00001548 | +5.3% |

Notable Statistics:

- IntoTheBlock data shows an increase of 11.5% in large transaction volume and a decrease of 5.1% in daily active addresses. Transactions greater than $100,000 are down from 8,444 to 8,367 in a single day. Exchanges netflows fell by 242.6%.

- Coinglass data reports 46,541 traders liquidated in the past 24 hours for $103.91 million. Bitcoin short liquidations stood at $3.17 million, the lowest since Sep.14.

- Crypto chart analyst Ali Martinez stated that Bitcoin whales sold more than 20,000 BTC, worth $1.28 billion, in the past 24 hours.

Notable Developments:

Top Gainers:

| Cryptocurrency | Price | Gains +/- |

| Worldcoin WLD/USD | $2.11 | +21.9% |

| Sei SEI/USD | $0.4544 | +17.3% |

| Popcat (SOL) POPCAT/USD | $1 | +9.7% |

Trader Notes: With Bitcoin prices trading relatively flat, crypto chart analyst Ali Martinez marked $63,300 as Bitcoin’s most important support level. If it holds, the crypto king can rise to $65,500, but if it doesn’t, it could dive to $60,365.

Stockmoney Lizards sees Bitcoin as “frontrunning the cycle.” The current levels are aligning with the previous cycle.

Looking ahead, Coin Bureau CEO and co-founder Nic predicts Friday as the big day for Bitcoin with $5.8 billion in options expiring with 21% “in the money”. He stated that the expiry could lead to upside volatility.

Nic added, “The “max pain” price is $58,000 which means dealers may be attempting to hold down spot prices to inflict max losses on buyers.”

Crypto Bully advises, “Let’s buy the dip on leverage, All-time high soon.”

What’s Next: The influence of Bitcoin as an institutional asset class is expected to be thoroughly explored at Benzinga’s upcoming Future of Digital Assets event on Nov. 19.

Read Next:

Image: Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

SEALSQ Announces Unaudited First Half 2024 Financial Results and Updates on Strategic Business Initiatives

Geneva, Switzerland, Sept. 25, 2024 (GLOBE NEWSWIRE) —

Schedules Conference Call and Webcast for Thursday, September 26 at 9:00 am ET (3:00 pm CET)

- Strategic initiatives include launch of Quantum-Resistant Secure Chips and partnerships to establish several OSAT Chip Design and Customization Centers.

- Despite temporary slowdown in H1 2024, SEALSQ expects an improved performance in H2 2024 and return to growth in 2025.

- Expected growth supported by $2.4 million investments made during H1 2024 in research and development initiatives.

- With a strong cash position of $18.9 million at June 30, 2024, SEALSQ is well-equipped to weather the current slowdown and continue funding its strategic initiatives.

- Release of engineering samples of SEALSQ’s QS7001 Quantum-Resistant Secure Chips is expected before the end of 2024.

- Robust pipeline of current and new business opportunities valued at $71 million as of September 20, 2024 is driven by the launch of the next generation of semiconductors, which SEALSQ expects to release in 2025.

SEALSQ Corp LAES (“SEALSQ” or “Company”), a company that focuses on developing and selling Semiconductors, PKI and Post-Quantum technology hardware and software products, today announces its unaudited financial results for the six month period ending June 30, 2024 (H1 2024) and provides updates on strategic business initiatives highlighting its continued commitment to innovation, including the launch of quantum-resistant secure chips set to position the Company for future growth in the cybersecurity industry.

H1 2024 FINANCIAL AND OPERATIONAL HIGHLIGHTS

As anticipated, 2024 has been a transitional year for SEALSQ. Revenue for H1 2024 was $4.8 million, reflecting the expected slowdown in traditional semiconductor demand, mainly due to two key factors: excess component inventories post-capacity shortage at legacy customers and a decrease in orders for legacy products from large customers as they await ordering availability for next-generation chips.

Despite this temporary downturn, SEALSQ expects improved financial and operational performance in H2 2024, subject to the finalization of previously announced projects and partnerships, and a return to growth in 2025. Of note, the Company’s robust pipeline of current and new business opportunities valued at $71 million as of September 20, 2024, is driven by the launch of the next generation of semiconductors, which SEALSQ expects to release in 2025 and with the first revenues anticipated in 2026.

Carlos Moreira, CEO of SEALSQ noted, “During the first half of the year, we took several steps to bolster our position in the markets we operate on a global scale. We invested $2.4 million in research and development initiatives, expanded our US-based sales team, made significant progress towards the establishment of several OSAT cybersecurity chip design and customization centers, secured global partnerships, and made advancements in the development of our post-quantum chips. Representative of this progress, we are now preparing to release engineering samples of our QS7001 Quantum-Resistant Secure Chips before the end of the year. With a strong cash position of $18.9 million at June 30, 2024, SEALSQ is well-equipped to weather the current slowdown and continue funding our strategic initiatives.”

Expectations are supported by several key growth factors including the expansion of Matter certification, global adoption of new IoT security standards such as the US Cyber Trust Mark or the EU Cyber Resilience Act, and SEALSQ’s strong value proposition on the PKI market for both IoT device makers segment and GSMA eUICC manufacturers and service providers. This has been reflected by new agreements signed in H1 2024, both with existing clients in the healthcare industry in the US and new customers in Asia (D-Link, HOSIDEN) and Europe (In Lite), mostly around smart home applications.

PROGRESS ON STRATEGIC INITIATIVES

Launch of Quantum-Resistant Secure Chips

SEALSQ remains on track to launch its range of Quantum-Resistant Secure Chips, including the QS7001 and QVault TPM, by Q4 2024. Engineering samples of the QS7001 are expected to be available for order by Q4 2024, with the TPM version ready by year-end. These chips are built on a RISC-V Quantum Resistant and CCEAL5+ hardware platform, designed for Kyber and Dilithium quantum-resistant algorithms. The QS7001 will allow customers to develop their own firmware, while the QVault TPM will feature a pre-provisioned, FIPS 140-3 and TCG-certified Trusted Platform Module stack.

Strategic Partnerships and Custom Solutions

SEALSQ is actively pursuing strategic partnerships with major electronics manufacturers to develop custom quantum-resistant chips based on the QS7001. These partnerships are key to SEALSQ’s broader industrial strategy and are expected to create new business opportunities and revenue streams. The Company’s efforts to establish Semiconductor Design and Personalization Centers will further support its customization activities.

In parallel, SEALSQ is developing a channel strategy by partnering with module and electronic board designers and manufacturers, like Hosiden in Japan and Bharat Pi in India. These companies have integrated SEALSQ VaultIC Secure Element into their semi-finished electronic products used by IoT device manufacturers to build consumer products like smart home appliances compatible with Matter standard. Each of these partnerships is expected to significantly contribute to generating new opportunities and accelerating growth in the coming months.

Global Expansion and OSAT Developments

SEALSQ is in final negotiations with the Spanish government to establish a Semiconductor Design and Personalization Center in Murcia. This collaboration supports Spain’s Strategic Project for Economic Recovery and Transformation of Microelectronics and Semiconductors (PERTE Chip), which aims to mobilize €12.25 billion by 2027.

In the United States, SEALSQ has incorporated SEALSQ USA Ltd as part of its plan to develop an Outsourced Semiconductor Assembly and Test (OSAT) facility. This facility would offer advanced testing and assembly services and would focus on post-quantum cryptography and artificial intelligence. SEALSQ is also exploring funding opportunities under government incentive schemes, including those provided by the US CHIPS Act of 2022.

Additionally, SEALSQ is in negotiations for two significant projects in the Middle East and Far East to establish Semiconductor Personalization Centers through Public-Private Partnerships (PPP).

Root Certificate Authority Approval and PKI Services

By leveraging the WISeKey Root Certificate Authority, which attained GSMA Root CI accreditation in Q1 2024, SEALSQ PKI can now enable eUICC and Subscription Management entities to identify and authenticate within the GSMA remote provisioning Consumer ecosystem, facilitating security and interoperability.

Of note, in 2023, SEALSQ’s Root Certificate Authority was approved by the CSA for Matter device attestation, positioning the Company as a Product Attestation Authority (PAA). SEALSQ offers Device Attestation Certificates (DACs) through its INeS managed “PKI as a Service” platform, enabling businesses to authenticate devices without investing in costly hardware infrastructure.

BALANCE SHEET HIGHLIGHTS

The balance sheet reflects a strong cash position of $18.9 million at June 30, 2024, enabling the Company to continue funding its operations for the foreseeable future. This strengthened cash position, up $12 million since December 31, 2023, is largely a result of $20 million of additional funds raised through Share Purchase Agreements (the “Agreements”) structured via three tranches, signed with a group of institutional investors (the “Investors”). The Company’s strong cash position also enabled it to pay down some of its debts to related parties leading to an overall $3.6 million reduction in debts to related parties.

As of June 30, 2024, through conversions into Ordinary Shares, the first tranche was fully repaid , while the second tranche was almost 90% repaid; subsequently, the remaining balance of the second tranche has now been fully repaid. The only balance remaining outstanding is that relating to the third tranche. Since the first and second tranches have been fully repaid, the Company intends to take action to deregister the remaining unsold securities on the Registration Statements on Form F-1 related to those tranches (Reg. Nos. 333- 273793 and 333-276877). Upon such deregistrations, the only resale registration statement remaining in effect would be relating to the third tranche (Reg. No. 333-278685).

The Company’s balance sheet is now in a much stronger position as a result of the reduction in the Company’s net debt position when considering the cash and cash equivalents held, offset by the Convertible Note liabilities and Indebtedness towards Related Parties.

The Company does note that the current price of its Ordinary Shares means that any conversions made by the Investors related to the outstanding balance of the third tranche, as per the terms and conditions of the Agreements, would be below the floor price. The Agreements set the floor price at $0.55 whilst stating that the floor price can be adjusted upon a mutual agreement between the Company and the Investors. Whilst the Company has not formally amended the floor price, it has done so previously, and the Company considers it would be inclined to agree to a reduction in the floor price should one be requested. Based upon the terms of the Agreements, the Company has calculated that the total number of shares registered under the third tranche registration statement would still exceed the number of shares likely to be issued if the entire remaining balance were to be converted today.

MOVING FORWARD

Market Outlook and Growth Projections

SEALSQ is well-positioned to capitalize on evolving cybersecurity requirements globally. The Company expects its post-quantum chips to play a crucial role in securing IoT devices, smart homes, autonomous vehicles, and industrial applications in the future.

Key growth areas for SEALSQ over the next five years include:

- VaultIC chip sales to Consumer IoT, Smart Grid and Automotive Charging device makers and operators.

- PKI and RoT Services: Recurring revenue is expected from device attestation and certificate lifecycle management services as well as from the GSMA eUICC manufacturers and service providers.

- Quantum-Resistant Semiconductor Sales: SEALSQ anticipates significant sales growth starting in 2025 as new chips enter full production.

- ASICS & custom solutions: Strategic partnerships for custom quantum-resistant chips will generate revenue through development contracts and licensing fees.

SEALSQ’s continued focus on innovation and security ensures it remains a leader in the cybersecurity and semiconductor industries, driving long-term growth and value for shareholders.

CONFERENCE CALL

The company will host a conference call to review its results on Thursday, September 26, at 9:00 am ET (3:00 pm CET). If you wish to join the conference call, please use the dial-in information below:

- Toll-Free Dial-In Number: 877-445-9755

- International Dial-In Number: 201-493-6744

A simultaneous webcast of the call may be accessed online via the Investors section of the company’s website, https://www.sealsq.com/investors/events.

The archived call will also be available on the Investors section of the company’s website, https://www.sealsq.com/investors/events.

FILING OF HALF YEAR REPORT ON FORM 6-K

SEALSQ filed its Condensed Consolidated Financial Statements in the Form 6-K for the six-month period ended June 30, 2024, with the U.S. Securities and Exchange Commission on September 25, 2024. The Form 6-K can be accessed by visiting the Company’s website at www.sealsq.com.

In addition, the Company’s stockholders may receive a hard copy of the Form 6-K, which includes complete unaudited financial statements, free of charge by contacting its Investor Relations Representative at lcati@equityny.com or +1 212 836-9611.

ADDITIONAL FINANCIAL & OPERATIONAL DATA

Consolidated Statements of Comprehensive Income/(Loss) [as reported]

| Unaudited 6 months ended June 30, | |||||

| USD’000, except earnings per share | 2024 | 2023 | |||

| Net sales | 4,828 | 14,751 | |||

| Cost of sales | (3,667 | ) | (6,760 | ) | |

| Depreciation of production assets | (228 | ) | (201 | ) | |

| Gross profit | 933 | 7,790 | |||

| Other operating income | – | 9 | |||

| Research & development expenses | (2,393 | ) | (1,492 | ) | |

| Selling & marketing expenses | (2,653 | ) | (2,441 | ) | |

| General & administrative expenses | (4,777 | ) | (4,145 | ) | |

| Total operating expenses | (9,823 | ) | (8,069 | ) | |

| Operating loss | (8,890 | ) | (279 | ) | |

| Non-operating income | 465 | 180 | |||

| Gain / (loss) on debt extinguishment | (100 | ) | – | ||

| Interest and amortization of debt discount | (557 | ) | (143 | ) | |

| Non-operating expenses | (372 | ) | (313 | ) | |

| Loss before income tax expense | (9,454 | ) | (555 | ) | |

| Income tax (expense) / income | (1,304 | ) | (320 | ) | |

| Net loss | (10,758 | ) | (875 | ) | |

| Earnings per ordinary share (USD) | |||||

| Basic | (0.37 | ) | (0.06 | ) | |

| Diluted | (0.37 | ) | (0.06 | ) | |

| Earnings per F share (USD) | |||||

| Basic | (1.87 | ) | (0.29 | ) | |

| Diluted | (1.87 | ) | (0.29 | ) | |

| Other comprehensive income / (loss), net of tax: | |||||

| Foreign currency translation adjustments | (8 | ) | (4 | ) | |

| Other comprehensive loss | (8 | ) | (4 | ) | |

| Comprehensive loss | (10,766 | ) | (879 | ) | |

The notes are an integral part of our consolidated financial statements.

Consolidated Balance Sheets [as reported]

| As at June 30, | As at December 31, | ||

| USD’000, except par value | 2024 (unaudited) | 2023 (unaudited) | |

| ASSETS | |||

| Current assets | |||

| Cash and cash equivalents | 18,858 | 6,895 | |

| Accounts receivable, net of allowance for credit losses | 1,565 | 5,053 | |

| Inventories | 2,772 | 5,231 | |

| Prepaid expenses | 471 | 605 | |

| Government assistance | 1,826 | 1,718 | |

| Other current assets | 625 | 765 | |

| Total current assets | 26,117 | 20,267 | |

| Noncurrent assets | |||

| Deferred income tax assets | 1,775 | 3,077 | |

| Deferred tax credits | 63 | – | |

| Property, plant and equipment, net of accumulated depreciation | 3,013 | 3,230 | |

| Intangible assets, net of accumulated amortization | – | – | |

| Operating lease right-of-use assets | 1,181 | 1,278 | |

| Other noncurrent assets | 85 | 83 | |

| Total noncurrent assets | 6,117 | 7,668 | |

| TOTAL ASSETS | 32,234 | 27,935 | |

| LIABILITIES | |||

| Current Liabilities | |||

| Accounts payable | 6,904 | 6,963 | |

| Indebtedness to related parties, current | – | 1,278 | |

| Deferred revenue, current | 2 | – | |

| Current portion of obligations under operating lease liabilities | 355 | 336 | |

| Income tax payable | – | 2 | |

| Other current liabilities | 34 | 138 | |

| Total current liabilities | 7,295 | 8,717 | |

| Noncurrent liabilities | |||

| Bonds, mortgages and other long-term debt | 1,734 | 1,654 | |

| Convertible note payable, noncurrent | 9,313 | 1,519 | |

| Indebtedness to related parties, noncurrent | 7,478 | 9,695 | |

| Operating lease liabilities, noncurrent | 754 | 893 | |

| Employee benefit plan obligation | 436 | 426 | |

| Total noncurrent liabilities | 19,715 | 14,187 | |

| TOTAL LIABILITIES | 27,010 | 22,904 |

| Commitments and contingent liabilities | |||||

| SHAREHOLDERS’ EQUITY | |||||

| Common stock – Ordinary Shares | 227 | 154 | |||

| Par value – USD 0.01 | |||||

| Authorized – 200,000,000 and 200,000,000 | |||||

| Issued and outstanding – 22,734,630 and 15,446,807 | |||||

| Common stock – F Shares | 75 | 75 | |||

| Par value – USD 0.05 | |||||

| Authorized – 10,000,000 and 10,000,000 | |||||

| Issued and outstanding – 1,499,700 and 1,499,700 | |||||

| Additional paid-in capital | 35,616 | 24,730 | |||

| Accumulated other comprehensive income / (loss) | 776 | 784 | |||

| Accumulated deficit | (31,470 | ) | (20,712 | ) | |

| Total shareholders’ equity | 5,224 | 5,031 | |||

| TOTAL LIABILITIES AND EQUITY | 32,234 | 27,935 | |||

The notes are an integral part of our consolidated financial statements.

About SEALSQ

SEALSQ focuses on selling integrated solutions based on Semiconductors, PKI and Provisioning services, while developing Post-Quantum technology hardware and software products. Our solutions can be used in a variety of applications, from Multi-Factor Authentication tokens, Smart Energy, Smart Home Appliances, Medical and Healthcare and IT Network Infrastructure, to Automotive, Industrial Automation and Control Systems.

Post-Quantum Cryptography (PQC) refers to cryptographic methods that are secure against an attack by a quantum computer. As quantum computers become more powerful, they may be able to break many of the cryptographic methods that are currently used to protect sensitive information, such as RSA and Elliptic Curve Cryptography (ECC). PQC aims to develop new cryptographic methods that are secure against quantum attacks. For more information, please visit www.sealsq.com.

Forward-Looking Statements

This communication expressly or implicitly contains certain forward-looking statements concerning SEALSQ Corp and its businesses. Forward-looking statements include statements regarding our business strategy, financial performance, results of operations, market data, events or developments that we expect or anticipates will occur in the future, as well as any other statements which are not historical facts. Although we believe that the expectations reflected in such forward-looking statements are reasonable, no assurance can be given that such expectations will prove to have been correct. These statements involve known and unknown risks and are based upon a number of assumptions and estimates which are inherently subject to significant uncertainties and contingencies, many of which are beyond our control. Actual results may differ materially from those expressed or implied by such forward-looking statements. Important factors that, in our view, could cause actual results to differ materially from those discussed in the forward-looking statements include the expected success of our technology strategy and solutions for IoMT Security for Medical and Healthcare sectors, SEALSQ’s ability to implement its growth strategies, SEALSQ’s ability to continue beneficial transactions with material parties, including a limited number of significant customers; market demand and semiconductor industry conditions; and the risks discussed in SEALSQ’s filings with the SEC. Risks and uncertainties are further described in reports filed by SEALSQ with the SEC.

SEALSQ Corp is providing this communication as of this date and does not undertake to update any forward-looking statements contained herein as a result of new information, future events or otherwise.

Press and Investor Contacts

| SEALSQ Corp. Carlos Moreira Chairman & CEO Tel: +41 22 594 3000 info@sealsq.com |

SEALSQ Investor Relations (US) The Equity Group Inc. Lena Cati Tel: +1 212 836-9611 / lcati@equityny.com Katie Murphy Tel: +212 836-9612 / kmurphy@equityny.com |

![]()

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Kamala Harris Strengthens Crypto Stance: The US Will 'Remain Dominant In AI And Quantum Computing, Blockchain, And Other Emerging Technologies'

Democratic presidential nominee Kamala Harris reaffirmed her support for emerging technologies like blockchain and artificial intelligence, days after mentioning cryptocurrencies for the first time on the campaign trail.

What happened: While outlining her economic proposals during a speech at The Economic Club of Pittsburgh, the vice president said, ” I will recommit the nation to global leadership in the sectors that will define the next century. We will invest in biomanufacturing and aerospace, remain dominant in AI and quantum computing, blockchain, and other emerging technologies.”

The support aligned with Harris’ goals of boosting America’s industrial might as it was tied to the nation’s overall economic strength.

Why It Matters: The latest mention came just a few days after Harris formally referenced cryptocurrencies for the first time as part of her campaign for the high-stakes November election.

The presidential hopeful promised to protect the interests of people involved in “innovative technologies like AI and digital assets.”

The ongoing election season has witnessed a considerable increase in emphasis on cryptocurrencies and blockchains, owing largely to former President Donald Trump’s promise to implement various cryptocurrency-friendly policies if elected.

But with Harris finally putting her cards on the table, the coming days could see a more aggressive bid by the two leaders to court the cryptocurrency demographic.

A report by CNBC indicated that Bitcoin BTC/USD had the potential to hit six figures irrespective of who emerged victorious in the November election.

Price Action: At the time of writing, Bitcoin was exchanging hands at $62,887.86, down 2.13% in the last 24 hours, according to data from Benzinga Pro.

Image via Shutterstock

Did You Know?

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

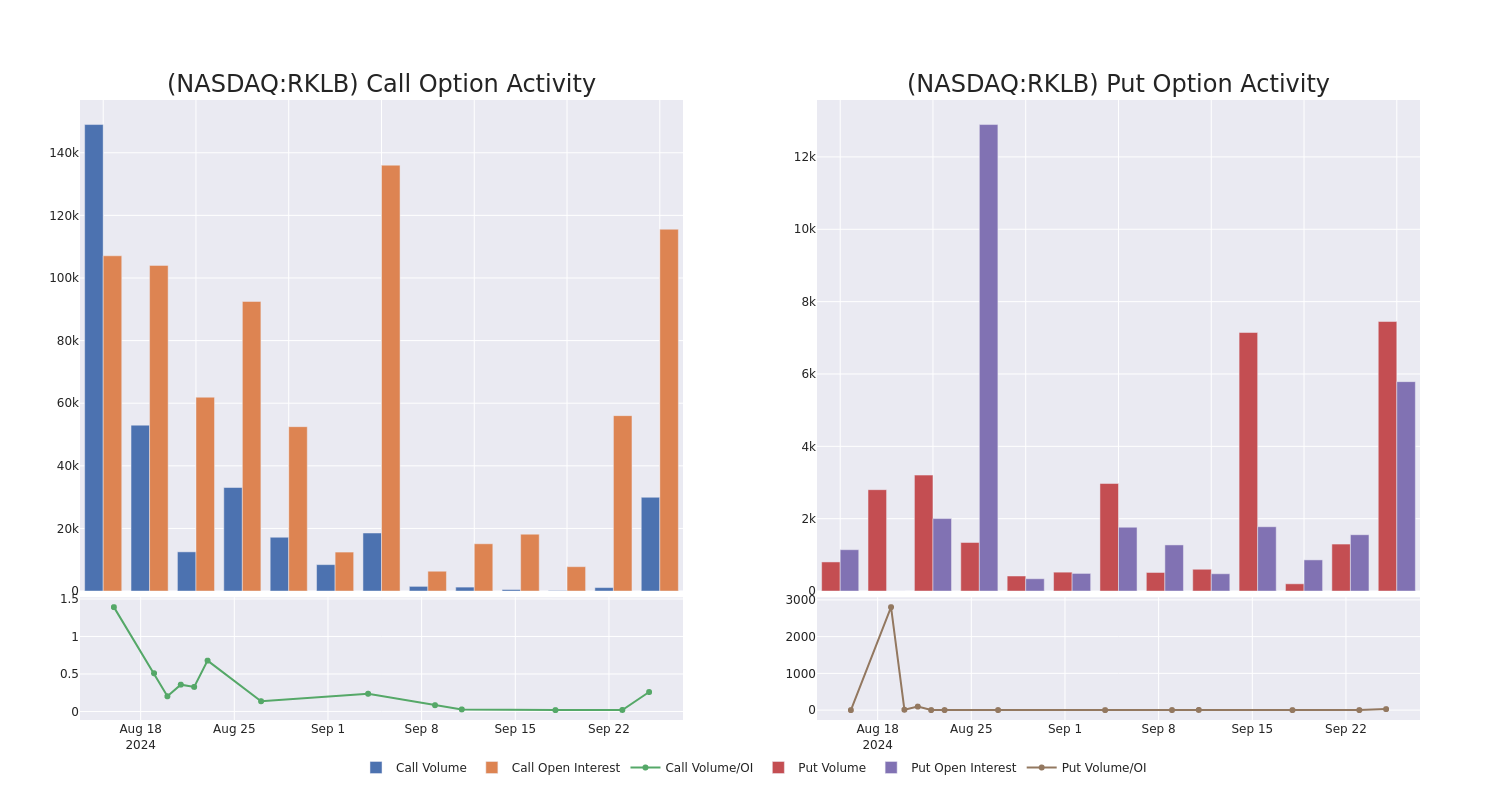

Rocket Lab USA's Options: A Look at What the Big Money is Thinking

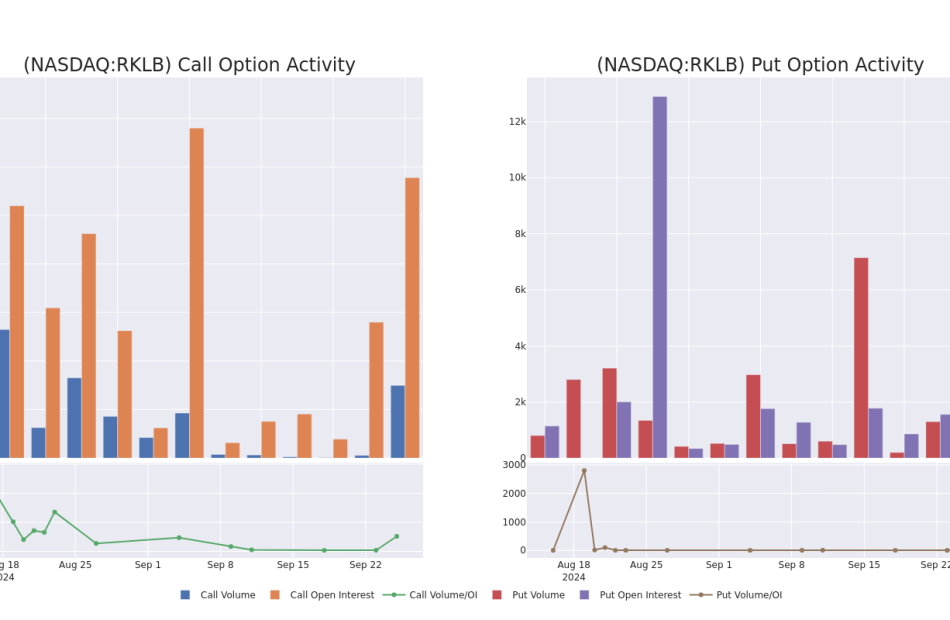

Financial giants have made a conspicuous bearish move on Rocket Lab USA. Our analysis of options history for Rocket Lab USA RKLB revealed 25 unusual trades.

Delving into the details, we found 40% of traders were bullish, while 56% showed bearish tendencies. Out of all the trades we spotted, 6 were puts, with a value of $367,295, and 19 were calls, valued at $995,434.

Expected Price Movements

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $5.0 to $15.0 for Rocket Lab USA over the last 3 months.

Insights into Volume & Open Interest

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Rocket Lab USA’s options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Rocket Lab USA’s whale trades within a strike price range from $5.0 to $15.0 in the last 30 days.

Rocket Lab USA Call and Put Volume: 30-Day Overview

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| RKLB | CALL | SWEEP | BEARISH | 01/15/27 | $4.0 | $3.7 | $3.7 | $10.00 | $240.5K | 146 | 946 |

| RKLB | PUT | SWEEP | BULLISH | 01/17/25 | $0.75 | $0.7 | $0.7 | $7.00 | $140.0K | 3.6K | 2.2K |

| RKLB | CALL | SWEEP | BULLISH | 10/18/24 | $0.5 | $0.45 | $0.5 | $9.00 | $100.9K | 3.2K | 2.4K |

| RKLB | PUT | TRADE | BULLISH | 12/18/26 | $4.6 | $4.3 | $4.4 | $10.00 | $88.0K | 149 | 0 |

| RKLB | CALL | SWEEP | BEARISH | 01/16/26 | $2.15 | $2.1 | $2.1 | $12.00 | $66.9K | 5.7K | 402 |

About Rocket Lab USA

Rocket Lab USA Inc is engaged in space, building rockets, and spacecraft. It provides end-to-end mission services that provide frequent and reliable access to space for civil, defense, and commercial markets. It designs and manufactures the Electron and Neutron launch vehicles and Photon satellite platform. Rocket Lab’s Electron launch vehicle has delivered multiple satellites to orbit for private and public sector organizations, enabling operations in national security, scientific research, space debris mitigation, Earth observation, climate monitoring, and communications. The business operates in two segments being Launch Services and Space systems. Geographically it serves Japan, Germany, rest of the world and earns key revenue from the United States.

After a thorough review of the options trading surrounding Rocket Lab USA, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Rocket Lab USA’s Current Market Status

- Currently trading with a volume of 29,021,043, the RKLB’s price is up by 13.57%, now at $8.62.

- RSI readings suggest the stock is currently may be overbought.

- Anticipated earnings release is in 42 days.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Rocket Lab USA, Benzinga Pro gives you real-time options trades alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Why Intel Stock Is Surging Today

Intel (NASDAQ: INTC) stock is gaining ground Wednesday following the unveiling of two new artificial intelligence (AI) products. The company’s share price was up 3.5% as of 12:30 p.m. ET. The semiconductor stock had been up as much as 5.5% earlier in the day.

Yesterday, Intel launched its Xeon 6 central processing unit (CPU) and its Gaudi 3 AI accelerator. The new chips are central to the next stages of the company’s strategy to gain ground in the data center AI space.

Intel debuts its next-generation AI solutions

Intel reports that its Xeon 6 processor delivers twice the performance of its predecessor and has been specifically tailored for artificial intelligence applications. Meanwhile, the company says that its Gaudi 3 AI accelerator offers a 20% throughput improvement and twice the performance on a price basis, compared to Nvidia‘s H100 for inference using Meta Platforms‘ LLaMA 2 70B large language model (LLM). The Gaudi 3 is still slower than Nvidia‘s H100 and H200, but its lower pricing and solid performance specs could help attract customers.

What comes next for Intel?

Thus far, Intel has struggled to score significant wins in the AI space. Nvidia’s advanced graphics processing units (GPUs) continue to be the go-to hardware for AI inference, and Advanced Micro Devices also has its own CPU and GPU offerings that add to the competitive pressures in the data center market.

Intel is also losing ground to AMD in the PC CPU market, and the recent launch of AI PCs hasn’t delivered the positive margin catalyst that many had previously anticipated. Further complicating matters, Intel is losing billions as it attempts to build up its chip fabrication business so that it can accommodate substantial business from third-party customers. While the company’s fab business has landed some significant contracts lately, competing with Taiwan Semiconductor Manufacturing in the space will be highly resource-intensive — and Intel’s financial footing has been looking shaky.

Some reports have emerged that the company could split its chip design and chip fabrication units into separate companies as a result of these challenges. Reports have also surfaced that Qualcomm is interested in buying some or all of Intel. While regulatory and valuation challenges make a full-on buyout unlikely, it’s possible that Intel could sell off some units or assets to improve its financial position.

Even with today’s pop, Intel stock is still down roughly 53% in 2024’s trading. The stock looks cheap by some metrics, but the business has been struggling lately — and there’s a high degree of uncertainty surrounding its path forward.

Should you invest $1,000 in Intel right now?

Before you buy stock in Intel, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Intel wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $740,704!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 23, 2024

Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Keith Noonan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Advanced Micro Devices, Meta Platforms, Nvidia, Qualcomm, and Taiwan Semiconductor Manufacturing. The Motley Fool recommends Intel and recommends the following options: short November 2024 $24 calls on Intel. The Motley Fool has a disclosure policy.

Why Intel Stock Is Surging Today was originally published by The Motley Fool

2 Unstoppable Dividend Stocks to Buy If There's a Stock Market Sell-Off

The stock market is going strong, with the S&P 500 index heading for a 19% gain so far in 2024, confirming its presence in a much-awaited bull market. These periods of market growth and optimism generally last longer than bear markets, so there still could be plenty of time for investors to benefit from this great momentum.

However, even in times of market strength, headwinds arise. That happened this summer when a stock market sell-off resulted in an 8% loss for the S&P 500 over a period of three weeks. At those times, which could happen even in a solid bull market, it’s a great idea to load up on stocks that may limit your losses during periods of trouble.

One of the best options is a dividend stock because it offers you annual passive income no matter what its stock price or the market is doing. Let’s check out two unstoppable players to buy if there’s another market sell-off.

Johnson & Johnson

Johnson & Johnson (NYSE: JNJ) is a Dividend King, meaning it’s raised its dividend for more than 50 consecutive years. In fact, J&J has lifted its dividend for more than 60 years.

Why is this important? Because it shows that rewarding shareholders is a priority for J&J, so it’s likely the company will continue with this policy.

Right now, the pharma giant pays an annual dividend of $4.96 a share, representing a dividend yield of 3%. This is considerably higher than the average S&P 500 dividend yield of 1.3%.

Another positive point is that J&J, with free cash flow of $19 billion, has what it takes financially to continue paying and raising its dividend. This offers you some confidence that even during difficult market times, you’ll collect passive income — and it’s likely to grow.

You’ll like J&J for more than its dividend, though. This pharma giant also offers you another reason to hold onto it through market downturns — and that’s the safety of its earnings.

J&J sells a wide variety of medicines and medical devices — and these are products patients and hospitals need during any economic environment. This is why pharma companies generally don’t see enormous fluctuations in revenue when the economy takes off or stalls.

But they still can boost their growth through portfolio expansion and strategic decisions — and this is what J&J did in recent years when it spun off its consumer health business to focus on its innovative medicines and medtech divisions. Both of these divisions are growing and helped the company report a 7% increase in sales, excluding acquisitions and divestitures, in the most recent quarter.

By investing in J&J, you’ll benefit from dividends and the promise of earnings strength over time.

Abbott Laboratories

Abbott Laboratories (NYSE: ABT) is another company you can count on for dividend growth. Like J&J, Abbott is a Dividend King, showing its commitment to sharing its successes with shareholders.

The company pays an annual dividend of $2.20 at a yield of 1.9%, surpassing the yield of the S&P 500. It’s increased its dividend for 52 straight years and just recently announced its 403rd consecutive quarterly dividend.

Like J&J, Abbott has the financial strength, with free cash flow of $5.6 billion, to continue along this path. Abbott has proven its ability to grow earnings over time, and I particularly like the diversification of its offerings across four segments — medical devices, diagnostics, nutrition, and established pharmaceuticals.

If one of its businesses faces headwinds, another may compensate. We’re seeing this today as the strength of the medical device business helps Abbott grow, even as a decline in COVID-19 testing weighs on the diagnostics business. And thanks to the medical device business’ revenue growth of more than 10% in the recent quarter and gains by nutrition and pharmaceuticals, the company raised its annual revenue guidance.

Abbott’s deep pipeline also keeps growth going, and that’s set to continue. Earlier this year, the company announced 10 new growth opportunities from the pipeline. This involves new approvals and expanded indications for already approved products.

All of this makes Abbott unstoppable. It could score a major win for your portfolio over time and pay you passive income while you wait.

Should you invest $1,000 in Johnson & Johnson right now?

Before you buy stock in Johnson & Johnson, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Johnson & Johnson wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $712,454!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 23, 2024

Adria Cimino has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Abbott Laboratories. The Motley Fool recommends Johnson & Johnson. The Motley Fool has a disclosure policy.

2 Unstoppable Dividend Stocks to Buy If There’s a Stock Market Sell-Off was originally published by The Motley Fool

What's In Store For Nike In Q1? Analyst Highlights China Vs. North America Trends

Goldman Sachs analyst Brooke Roach reiterated the Buy rating on Nike, Inc. NKE with a price forecast of $105.

According to the analyst, the company’s first-quarter results, set to be released on October 1, are expected to be healthy, with attention focused on trends in China versus North America.

That said, investors are cautious about the pace and timeline for the brand’s return to growth due to mixed signals from the Chinese market and uncertainty surrounding franchise management actions, including the extent and duration of rebalancing in the lifestyle category, Roach writes. Consequently, the analyst adds that there will likely be a heightened emphasis on the innovation pipeline and scaling initiatives, along with forward-looking insights related to the second quarter and second half of the fiscal year.

Also Read: Nike Executive’s Return To Become Top Leader Continues ‘Boomerang CEO’ Trend At Major Companies

China continues to be a significant topic of debate, especially given the volatile macro trends and partner performance indicating weak demand in the region during the summer.

With overall consumption under pressure, Nike will be scrutinizing inventory levels and the dynamics of sell-in versus sell-through, as well as the trends in “online vs. offline” demand.

According to the analyst, investors anticipate the company will lower its guidance to a level below the current FactSet consensus.

As Nike re-evaluates its plans for an investor day, the analyst is looking for additional insight on when the new CEO will outline his initial priorities for the business.

For the upcoming quarter, the analyst anticipates a year-over-year revenue decline of 10.5% and earnings per share (EPS) of $0.51. For the fiscal year 2025, the analyst projects a revenue decrease of 5.0% year-over-year, with gross margin expansion of 31 basis points, and an EPS of $3.24.

Price Action: NKE shares are trading higher by 0.55% to $87.94 at last check Wednesday.

Image via Shutterstock

Read Now:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

NexPoint Responds to United Development Funding IV's (UDF IV) Misleading Claims

Vote for NexPoint Nominees to Protect Your Interests and Maximize Value

DALLAS, Sept. 24, 2024 /PRNewswire/ — NexPoint Real Estate Opportunities, LLC (together with its affiliates “NexPoint”) announced today that it has sent a letter to fellow shareholders of United Development Funding IV (“UDF IV” or the “Company”), a real estate investment trust, ahead of the Company’s upcoming Annual Meeting of Shareholders, which must be held on or before December 31, 2024.

NexPoint’s letter addresses numerous misleading statements by UDF IV intended to distract shareholders from the Board of Trustees’ many failures. If elected, NexPoint’s nominees will implement a plan to maximize value for all shareholders. NexPoint urges shareholders to vote for much needed change at UDF IV by supporting its nominees: Paul S. Broaddus, Edward N. Constantino, John A. Good, and Julie Silcock, and rejecting UDF IV’s current Board, which has overseen criminal and fraudulent behavior and eroded shareholder value.

Shareholders can read the full letter HERE.

While UDF IV has not announced its Annual Meeting date, shareholders can vote TODAY using NexPoint’s GREEN proxy materials to enact long overdue change and elect Trustees who will work for all shareholders to maximize value at UDF IV.

NexPoint encourages shareholders to visit udfaccountability.com and complete the contact form to receive ongoing updates about the Company and the upcoming Annual Meeting.

Shareholders can also contact NexPoint via email at udfinvestors@nexpoint.com.

About NexPoint

NexPoint Real Estate Opportunities, LLC is a wholly owned subsidiary of NexPoint Diversified Real Estate Trust, Inc. NXDT, an affiliate of NexPoint Advisors, L.P.

NexPoint Advisors, L.P. is an SEC-registered adviser on the NexPoint alternative investment platform. It serves as the adviser to a suite of funds and investment vehicles, including a closed-end fund, interval fund, business development company, and various real estate vehicles. For more information visit www.nexpoint.com

IMPORTANT INFORMATION

NexPoint Real Estate Opportunities, LLC (“NexPoint”) intends to deliver a proxy statement with respect to its solicitation of proxies for nominees to be elected to the United Development Funding IV (“UDF IV”) Board of Trustees at the Annual Meeting of Shareholders of UDF IV. The date for the Annual Meeting has not yet been set and NexPoint is not soliciting proxies at this time. INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE NEXPOINT PROXY STATEMENT (INCLUDING ANY AMENDMENTS OR SUPPLEMENTS THERETO) WHEN AVAILABLE IN ITS ENTIRETY BECAUSE IT WILL CONTAIN IMPORTANT INFORMATION ABOUT ANY SOLICITATION. Copies of the documents will be made available free of charge from NexPoint by accessing the website www.udfaccountability.com.

NexPoint, its affiliates, their directors and executive officers and other members of management and employees may be participants (collectively “Participants”) in the solicitation of proxies by NexPoint. Information about NexPoint’s nominees to the UDF IV Board of Trustees and information regarding the direct or indirect interests in UDF IV, by security holdings or otherwise, of NexPoint, the other Participants and NexPoint’s nominees will be available in the proxy statement. NexPoint’s disclosure of any security holdings will be based on information made available to NexPoint by such Participants and nominees. UDF IV is no longer subject to the reporting requirements of the Securities Exchange Act of 1934, as amended. Consequently, NexPoint’s knowledge of significant security holders of UDF IV and as to UDF IV itself is limited.

CONTACT INFORMATION

UDF IV Investor Contacts

Chuck Garske / Jeremy Provost / Theo Caminiti (Okapi Partners):

Email: info@okapipartners.com

Phone: (212) 297-0720

For Additional Information/Updates on UDF IV

Website: www.udfaccountability.com

Email: udfinvestors@nexpoint.com

Media Contacts

Lucy Bannon (NexPoint): lbannon@nexpoint.com

Paul Caminiti/Pamela Greene (Reevemark): nexpointteam@reevemark.com

NexPoint Investor Relations

Kristen Thomas: ir@nexpoint.com

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/nexpoint-responds-to-united-development-funding-ivs-udf-iv-misleading-claims-302257747.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/nexpoint-responds-to-united-development-funding-ivs-udf-iv-misleading-claims-302257747.html

SOURCE NexPoint Advisors, L.P.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

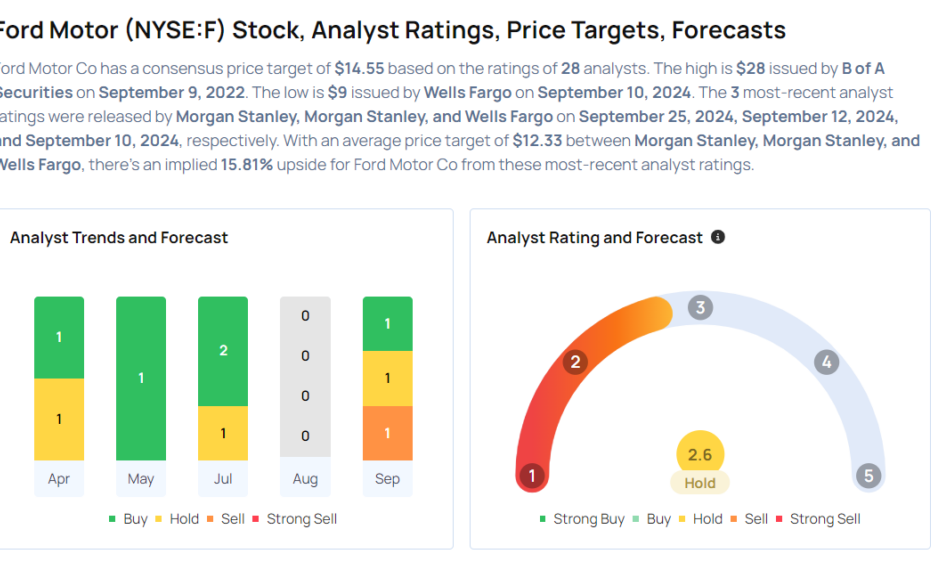

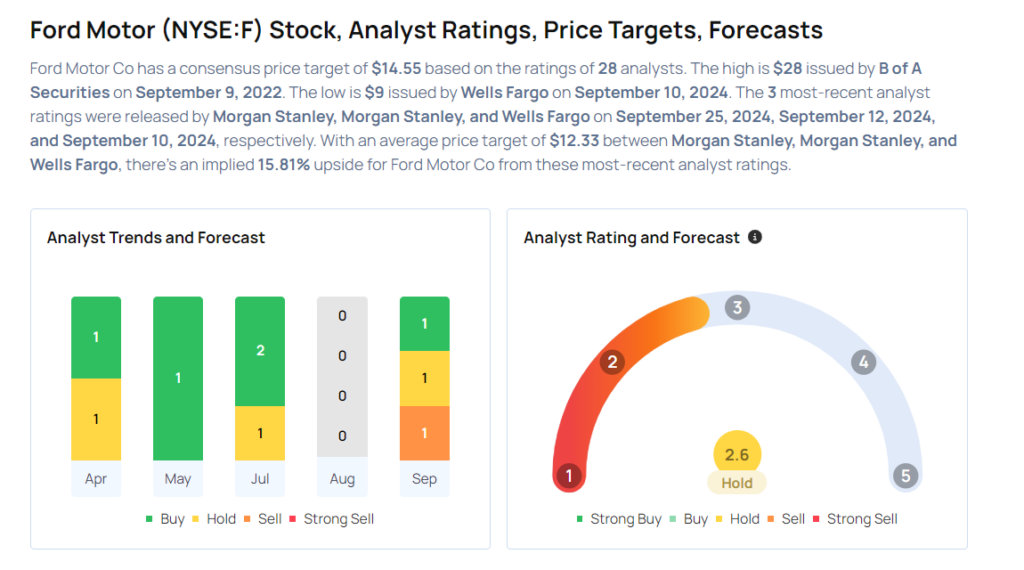

This Ford Analyst Is No Longer Bullish; Here Are Top 5 Downgrades For Wednesday

Top Wall Street analysts changed their outlook on these top names. For a complete view of all analyst rating changes, including upgrades and downgrades, please see our analyst ratings page.

- Needham analyst Scott Berg downgraded the rating for Smartsheet Inc. SMAR from Buy to Hold and maintained a price target of $57. Smartsheet shares gained 6.5% to close at $55.46 on Tuesday. See how other analysts view this stock.

- BTIG analyst Andrew Harte downgraded Global Payments Inc. GPN from Buy to Neutral. Global Payments shares fell 6.5% to close at $103.81 on Tuesday. See how other analysts view this stock.

- TD Cowen analyst Kevin Kopelman downgraded the rating for Expedia Group, Inc. EXPE from Buy to Hold and announced a price target of $150. Expedia shares gained 2.7% to close at $147.92 on Tuesday. See how other analysts view this stock.

- Evercore ISI Group analyst Jonathan Chappell downgraded Union Pacific Corporation UNP from Outperform to In-Line and slashed the price target from $254 to $247. Union Pacific shares gained 2% to close at $248.96 on Tuesday. See how other analysts view this stock.

- Morgan Stanley analyst Adam Jonas downgraded Ford Motor Company F from Overweight to Equal-Weight and cut the price target from $16 to $12. Ford shares fell 0.4% to close at $10.87 on Tuesday. See how other analysts view this stock.

Considering buying Ford stock? Here’s what analysts think:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.