Accenture Gears Up For Q4 Print; Here Are The Recent Forecast Changes From Wall Street's Most Accurate Analysts

Accenture plc ACN will release earnings results for its fourth quarter, before the opening bell on Thursday, Sept. 26.

Analysts expect the Dublin, Ireland-based company to report quarterly earnings at $2.78 per share, up from $2.71 per share in the year-ago period. Accenture projects to report revenue of $16.38 billion for the quarter, compared to $15.99 billion a year earlier, according to data from Benzinga Pro.

On Sept. 16, Accenture Federal Services won a $190M million U.S. Department of State Data and Systems Engineering contract.

Accenture shares gained 0.1% to close at $339.62 on Tuesday.

Benzinga readers can access the latest analyst ratings on the Analyst Stock Ratings page. Readers can sort by stock ticker, company name, analyst firm, rating change or other variables.

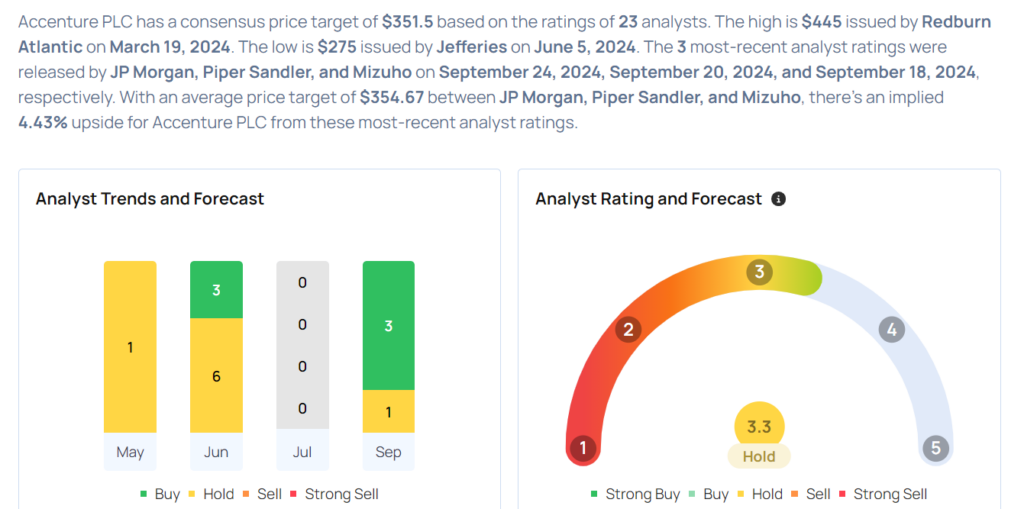

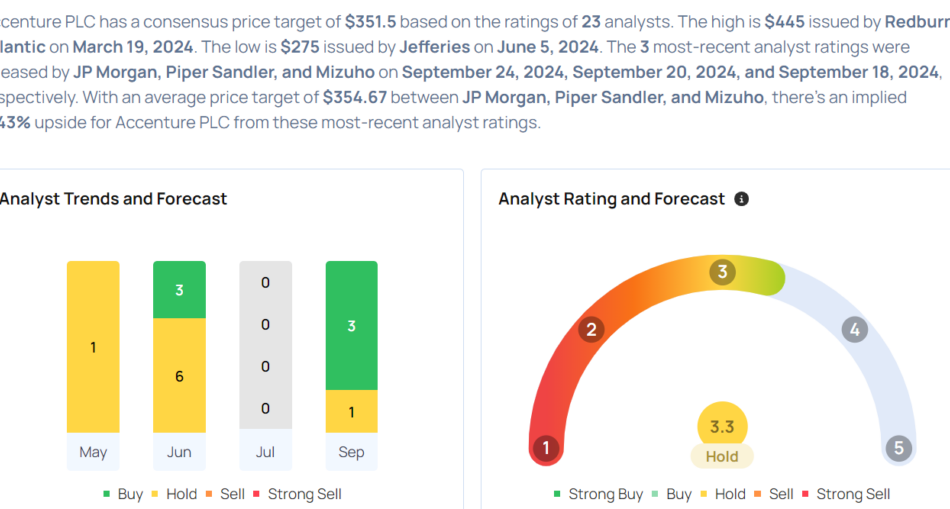

Let’s have a look at how Benzinga’s most-accurate analysts have rated the company in the recent period.

- JP Morgan analyst Tien-Tsin Huang maintained an Overweight rating and cut the price target from $376 to $370 on Sept. 24. This analyst has an accuracy rate of 61%.

- Mizuho analyst Dan Doelev maintained an Outperform rating and boosted the price target from $352 to $365 on Sept. 18. This analyst has an accuracy rate of 63%.

- Citigroup analyst Ashwin Shirvaikar maintained a Buy rating and raised the price target from $350 to $405 on Sept. 17. This analyst has an accuracy rate of 72%.

- TD Cowen analyst Bryan Bergin maintained a Hold rating and raised the price target from $293 to $321 on Sept. 12. This analyst has an accuracy rate of 62%.

- Morgan Stanley analyst James Faucette downgraded the stock from Overweight to Equal-Weight rating and slashed the price target from $382 to $300 on June 26. This analyst has an accuracy rate of 65%.

Considering buying ACN stock? Here’s what analysts think:

Read This Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Leave a Reply