Assurant or Old Republic: Which Multiline Insurer Has an Edge?

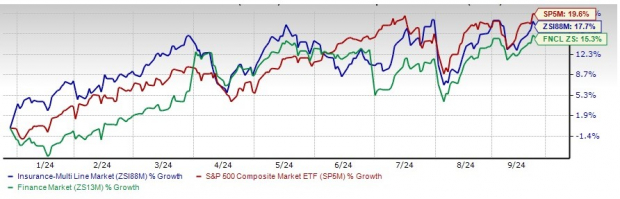

Better pricing, prudent underwriting, increased exposure and faster economic recovery should help Multiline insurers to grow. The industry has returned 17.7% year to date compared with the Finance sector’s growth of 15.3%. The Zacks S&P 500 composite has witnessed an increase of 19.6% in the said time frame. Product diversification helps insurance industry players lower concentration risk and improve retention ratio.

YTD Performance

Image Source: Zacks Investment Research

Accelerated digitalization will help the industry function smoothly. An improving rate environment should drive investment income higher as insurers are beneficiaries of a better rate environment.

Here we focus on two multiline insurers, namely Assurant, Inc. AIZ and Old Republic International Corporation ORI.

Assurant, with a market capitalization of $10.26 billion, provides business services that support, protect and connect consumer purchases in North America, Latin America, Europe and the Asia Pacific. Old Republic International, with a market capitalization of $9.21 billion, through its subsidiaries, engages in the insurance underwriting and related services business primarily in the United States and Canada. AIZ and ORI carry a Zacks Rank #2 (Buy) each at present.

Multiline insurers benefit from a diversified portfolio that lowers concentration risk. While higher demand for protection products benefits sales and premiums of life insurance operations, better pricing and increased exposure to intangibles and cyber threats support premium growth of non-life insurance operations.

Also, per Deloitte Insights, the transition to green energy and related insurance products, as well as exposure to intangible assets, offers growth opportunities. Per a report in Carrier Management, AM Best expects profitable commercial lines and improving personal lines in 2024. Swiss Re estimates high single-digit premium growth in 2024.

Insurers are direct beneficiaries of a rising rate environment. They invest a portion of their premiums. Long-tail insurers tend to gain more from rising rates as they have more time to invest their premiums and earn a higher rate of return. With a lower rate of return, investment income will suffer. In the FOMC meeting, the Federal Reserve announced cutting the interest rate by 50 basis points. This is the first time in four years that the central bank has taken such an action. The interest rate is now 4.75-5%, down from a more than two-decade high of 5.25-5.5%.

Multiline insurers are investing heavily in technology to improve scale and efficiencies. This should help them generate higher margins and improve profitability.

These positives together help insurers build solid policyholders’ surplus that helps the industry absorb losses. The solid capital level of the multiline insurers will fuel merger and acquisition activities to ramp up growth and aid these insurers to engage in shareholder-friendly moves.

Let’s delve deeper into specific parameters to ascertain which multi-line insurer is better-positioned at the moment.

Price Performance

Shares of Old Republic have climbed 21.3% year to date, outperforming the industry’s growth of 17.8% and Assurant’s rise of 17.6%.

Image Source: Zacks Investment Research

Return on Equity (ROE)

Assurant, with a ROE of 19.6%, exceeds Old Republic’s ROE of 12.5% and the industry average of 16%.

Image Source: Zacks Investment Research

Debt-to-Capital

Old Republic’s debt-to-capital ratio of 24.8 is lower than the industry average of 31.8 and Assurant’s reading of 29.3. Therefore, ORI has an advantage over AIZ on this front.

Image Source: Zacks Investment Research

Earnings Surprise History

AIZ outpaced expectations in each of the last seven reported quarters. ORI surpassed estimates in six of the last seven reported quarters.

Dividend Yield

Old Republic’s dividend yield of 2.97% is better than Assurant’s dividend yield of 1.45%. Thus, ORI has an advantage over AIZ on this front.

Image Source: Zacks Investment Research

Valuation

The price-to-book value is the best multiple used for valuing insurers. Compared with Assurant’s P/B ratio of 2.06, Old Republic is cheaper, with a reading of 1.53. The multi-line insurance industry’s P/B ratio is 2.70.

Image Source: Zacks Investment Research

Growth Projection

The Zacks Consensus Estimate for 2024 earnings indicates 7.6% growth from the year-ago reported figure for Old Republic, while the same for Assurant implies an increase of 6.7%.

Earnings Estimates

For 2024, the Zacks Consensus Estimate for AIZ has moved 2.9% north to $16.54 in the past 60 days, while the same for ORI has been revised 4.4% north to $2.83. Therefore, AIZ is in an advantageous position over ORI on this front.

Net Margin

Old Republic’s net margin for the trailing 12 months was 8.59%, higher than Assurant’s reading of 6.9%.

To Conclude

Our comparative analysis shows that Old Republic is better positioned than Assurant with respect to price, valuation, growth projection, dividend yield, leverage and net margin. AIZ outpaces ORI in terms of return on equity, earnings estimates and earnings surprise history. With the scale majorly tilted toward Old Republic, the stock appears to be better poised.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Leave a Reply