Behind the Scenes of Celsius Holdings's Latest Options Trends

Financial giants have made a conspicuous bullish move on Celsius Holdings. Our analysis of options history for Celsius Holdings CELH revealed 18 unusual trades.

Delving into the details, we found 55% of traders were bullish, while 38% showed bearish tendencies. Out of all the trades we spotted, 13 were puts, with a value of $875,933, and 5 were calls, valued at $231,010.

What’s The Price Target?

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $22.5 to $50.0 for Celsius Holdings during the past quarter.

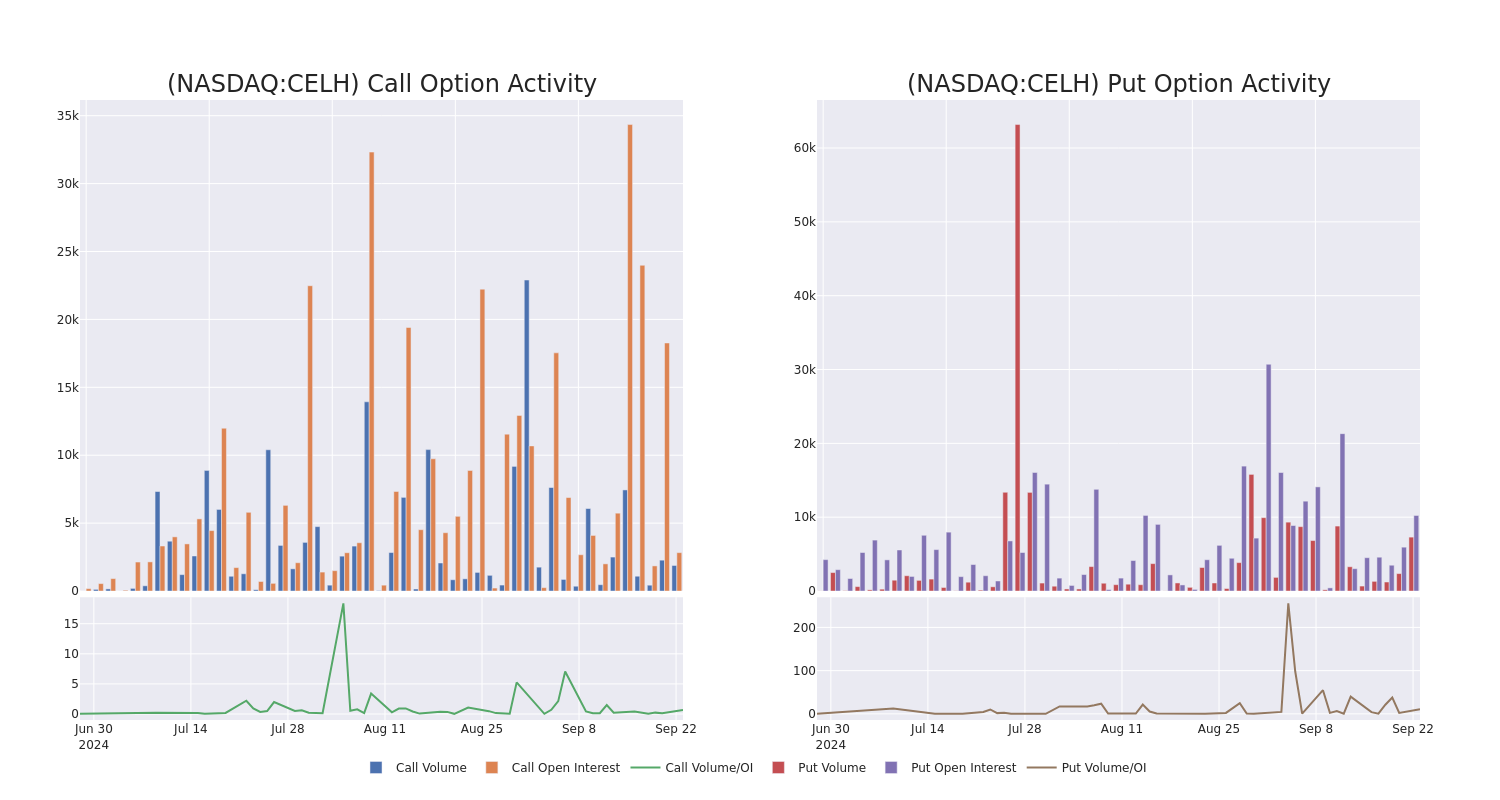

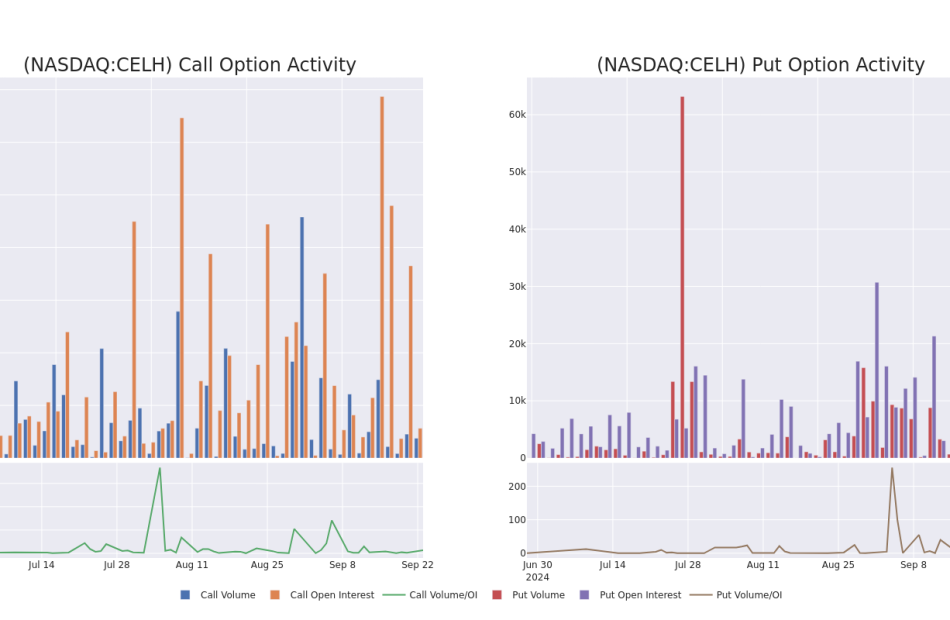

Volume & Open Interest Development

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Celsius Holdings’s options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Celsius Holdings’s whale trades within a strike price range from $22.5 to $50.0 in the last 30 days.

Celsius Holdings Option Volume And Open Interest Over Last 30 Days

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| CELH | PUT | SWEEP | BULLISH | 10/18/24 | $1.98 | $1.95 | $1.95 | $32.00 | $97.5K | 13 | 43 |

| CELH | PUT | SWEEP | BULLISH | 03/21/25 | $4.7 | $4.55 | $4.6 | $30.00 | $92.4K | 3.0K | 964 |

| CELH | PUT | SWEEP | BULLISH | 11/15/24 | $0.43 | $0.42 | $0.43 | $22.50 | $89.7K | 16.0K | 4.6K |

| CELH | PUT | SWEEP | BULLISH | 03/21/25 | $7.45 | $7.4 | $7.4 | $35.00 | $83.6K | 1.4K | 140 |

| CELH | PUT | SWEEP | BEARISH | 03/21/25 | $4.55 | $4.5 | $4.55 | $30.00 | $75.9K | 3.0K | 374 |

About Celsius Holdings

Celsius Holdings plays in the energy drink subsegment of the global nonalcoholic beverage market, with 96% of revenue concentrated in North America. Celsius’ products contain natural ingredients and a metabolism-enhancing formulation, appealing to fitness and active lifestyle enthusiasts. The firm’s portfolio includes its namesake Celsius Originals beverages (including those that are naturally caffeinated with stevia), Celsius Essentials line (containing aminos), and Celsius On-the-Go powder packets. Celsius dedicates its efforts to branding and innovation, while it utilizes third parties for the manufacturing, packaging, and distribution of its products. In 2022, Celsius forged a 20-year distribution agreement with PepsiCo, which holds an 8.5% stake in the business.

Following our analysis of the options activities associated with Celsius Holdings, we pivot to a closer look at the company’s own performance.

Current Position of Celsius Holdings

- With a trading volume of 7,693,574, the price of CELH is down by -3.35%, reaching $31.7.

- Current RSI values indicate that the stock is may be oversold.

- Next earnings report is scheduled for 42 days from now.

Expert Opinions on Celsius Holdings

5 market experts have recently issued ratings for this stock, with a consensus target price of $40.4.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* An analyst from Stifel persists with their Buy rating on Celsius Holdings, maintaining a target price of $51.

* Maintaining their stance, an analyst from Maxim Group continues to hold a Buy rating for Celsius Holdings, targeting a price of $50.

* An analyst from Roth MKM persists with their Buy rating on Celsius Holdings, maintaining a target price of $45.

* An analyst from Truist Securities has decided to maintain their Hold rating on Celsius Holdings, which currently sits at a price target of $30.

* An analyst from B of A Securities has decided to maintain their Underperform rating on Celsius Holdings, which currently sits at a price target of $26.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Celsius Holdings with Benzinga Pro for real-time alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Leave a Reply