Decoding CarMax's Options Activity: What's the Big Picture?

Financial giants have made a conspicuous bullish move on CarMax. Our analysis of options history for CarMax KMX revealed 11 unusual trades.

Delving into the details, we found 45% of traders were bullish, while 36% showed bearish tendencies. Out of all the trades we spotted, 8 were puts, with a value of $537,122, and 3 were calls, valued at $127,050.

Predicted Price Range

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $75.0 to $85.0 for CarMax over the last 3 months.

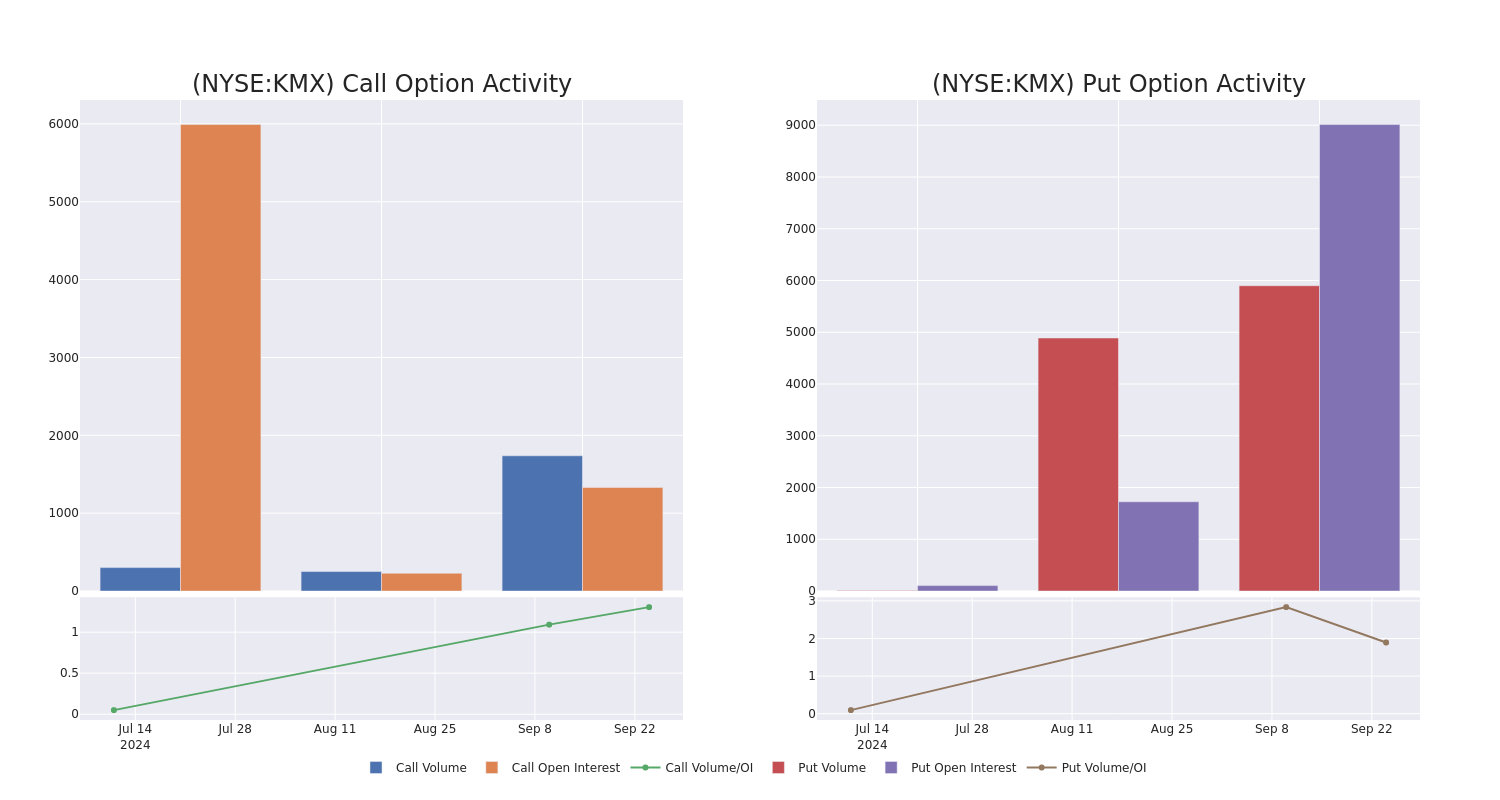

Volume & Open Interest Trends

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

This data can help you track the liquidity and interest for CarMax’s options for a given strike price.

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of CarMax’s whale activity within a strike price range from $75.0 to $85.0 in the last 30 days.

CarMax Option Activity Analysis: Last 30 Days

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| KMX | PUT | SWEEP | NEUTRAL | 10/18/24 | $8.1 | $7.8 | $7.95 | $82.50 | $190.0K | 2.7K | 1.4K |

| KMX | PUT | SWEEP | NEUTRAL | 10/18/24 | $4.9 | $4.6 | $4.75 | $77.50 | $113.5K | 3.4K | 1.7K |

| KMX | CALL | SWEEP | BULLISH | 10/18/24 | $2.6 | $2.55 | $2.55 | $80.00 | $53.5K | 699 | 274 |

| KMX | PUT | SWEEP | BULLISH | 10/18/24 | $4.7 | $4.6 | $4.6 | $77.50 | $46.0K | 3.4K | 114 |

| KMX | PUT | SWEEP | BEARISH | 01/17/25 | $10.4 | $10.2 | $10.4 | $82.50 | $40.5K | 467 | 39 |

About CarMax

CarMax sells, finances, and services used and new cars through a chain of around 250 used retail stores. It was formed in 1993 as a unit of Circuit City and spun off into an independent company in late 2002. Used-vehicle sales typically account for about 83% of revenue (79% in fiscal 2024 due to the chip shortage) and wholesale about 13% (19% in fiscal 2024), with the remaining portion composed of extended service plans and repair. In fiscal 2024, the company retailed and wholesaled 765,572, and 546,331 used vehicles, respectively. CarMax is the largest used-vehicle retailer in the US but still estimates that it had only about 3.7% US market share of vehicles 0-10 years old in 2023. It seeks over 5% share a few years from now. CarMax is based in Richmond, Virginia.

After a thorough review of the options trading surrounding CarMax, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Present Market Standing of CarMax

- With a trading volume of 2,442,796, the price of KMX is up by 0.07%, reaching $76.5.

- Current RSI values indicate that the stock is may be approaching oversold.

- Next earnings report is scheduled for 2 days from now.

What The Experts Say On CarMax

3 market experts have recently issued ratings for this stock, with a consensus target price of $78.33333333333333.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* An analyst from Wedbush has revised its rating downward to Outperform, adjusting the price target to $95.

* An analyst from JP Morgan persists with their Underweight rating on CarMax, maintaining a target price of $65.

* An analyst from Truist Securities persists with their Hold rating on CarMax, maintaining a target price of $75.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for CarMax with Benzinga Pro for real-time alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Leave a Reply